Altcoin

Anthony Pompliano Shifts Focus To Solana From Ethereum, Here’s Why

Anthony Pompliano, a prominent crypto market expert, has recently shifted his focus from Ethereum to Solana. In a CNBC interview, he revealed that he sold all his Ethereum holdings last year to buy Solana. Although he doesn’t consider himself a Solana maximalist, the crypto market expert provided a flurry of compelling reasons behind the shift in his focus.

Anthony Pompliano Shifts Focus To Solana

Anthony Pompliano emphasized that he will continue holding Bitcoin, but he sees Solana as a leading altcoin worth maintaining a position in. He highlighted that Solana is cheaper and faster compared to Ethereum. Besides, he believes that Solana is “likely going to receive more flows” due to its efficiency and lower transaction costs.

Meanwhile, he pointed out that decentralized exchange (DEX) volumes show Solana is capturing market share from Ethereum. This shift indicates Solana’s growing influence in the crypto market. With a smaller market cap than Ethereum, the expert expressed optimism about Solana’s potential for significant momentum and growth.

In addition, Pompliano’s analysis during his CNBC interview suggests that Solana’s lower costs and faster transaction speeds make it an attractive option for investors looking for alternatives to Ethereum. His strategic move reflects confidence in Solana’s ability to outperform Ethereum due to its scalability and growing user base.

Also Read: WLD Price Slips 7% Ahead Of Massive Token Unlock

Ethereum ETF Hype

During his CNBC appearance, Anthony Pompliano also shared his views on Ethereum ETFs. He noted that while Bitcoin ETFs have garnered massive inflows and media attention, the same excitement hasn’t been seen for Ethereum ETFs.

According to the expert, the narrative around Ethereum isn’t as clear-cut as Bitcoin’s “digital gold” story. He sees Ethereum as a technology platform facing stiff competition. Besides, he believes Ethereum ETFs will likely be used for diversification from Bitcoin ETFs.

He predicts a 70/30 split in favor of Bitcoin, as investors seek to hold more than one asset. However, he has concerns about the staking process, which won’t be available to ETF investors. Staking is one of Ethereum’s most appealing features, and its absence in ETFs could limit inflows compared to Bitcoin.

Despite these concerns, the expert thinks the approval of Spot Ethereum ETFs signals a broader acceptance of cryptocurrencies on Wall Street. He believes more regulatory clarity is needed, but eventually, many altcoins will enter the mainstream financial markets.

Anthony Pompliano’s decision to sell all his Ethereum holdings and invest in Solana underscores his belief in Solana’s superior performance prospects. He sees Solana as a more attractive investment due to its lower price, faster transaction speeds, and potential for higher inflows.

However, during writing, SOL price was down 2% to $176.9, with its trading volume declining 21% to $3.02 billion. On the other hand, Ethereum price traded in the green but stayed near the flatline at $3,460, with a 9% increase in its trading volume from yesterday.

Also Read: Coinbase Receives Buy Rating Ahead Q2 Earnings Release, What’s Next?

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Dogecoin Fractal Points To A Potential Breakout, Can It Reach A New ATH?

The Dogecoin price has entered another stage of bullish momentum that has reignited inflows from traders. Notably, the DOGE price has surged by about 16.3% over the past 24 hours. This surge has brought into focus the possibility of the DOGE price reaching a new all-time high this year.

Interestingly, a crypto analyst on the social media platform X has highlighted a bullish fractal that could push the Dogecoin price on a parabolic run.

Dogecoin Fractal Points To New ATH

Master Kenobi shared his analysis of the Dogecoin price action on X. In his post, Kenobi outlined a fractal setup, suggesting that DOGE is on the verge of a significant breakout. Kenobi attributed the fractal formation to the consolidation that began after the DOGE price reached $0.43

A bullish fractal is a pattern that suggests an upward reversal in price. This pattern, which occurs during price consolidations, is characterized by a middle bar that has the lowest low, flanked by higher lows on each side.

Kenobi’s analysis was accompanied by a DOGE chart on the four-hour candlestick timeframe. The chart revealed that a similar fractal had occurred during the first week of November. At that time, Dogecoin was consolidating after an initial surge past the $0.20 mark. This consolidation phase, much like the current one, was marked by low volatility and steady accumulation. However, the November fractal ultimately resolved with an explosive 115% rally over six days.

Drawing parallels with the November setup, Kenobi predicted that the Dogecoin price could replicate this outcome and create a new all-time high in the next three days. In terms of a price target, a breakout would see the DOGE price reaching the $0.74 mark, which would put it above its current all-time high of $0.7316.

What’s Next For The Dogecoin Price?

The prospect of a new all-time high for the Dogecoin price is gaining ground with each passing day, especially with the price action in the past 24 hours. At the time of the analysis, the DOGE price was trading at $0.41. Interestingly, the Dogecoin price has surged to $0.46 at the time of writing, which indicates that the bullish fractal breakout has happened.

DOGE, which started November at $0.1616, is already up by about 230% in the past 30 days. Many on-chain data and price patterns point to a continued price increase, at least in the next few days and weeks. Ali Martinez, a popular crypto analyst, suggested that the Dogecoin price is in the middle of a bullish breakout to $0.82. If the price target is achieved, this would represent a further 78% gain from the current price.

Featured image created with Dall.E, chart from Tradingview.com

Altcoin

BTC Continues To Soar, Ripple’s XRP Bullish

The crypto universe has concluded yet another week, primarily with riveting developments unfolding across the broader sector. Bitcoin (BTC) continues to pump, hitting a new ATH this week. Simultaneously, Ripple’s XRP garnered significant market attention, recording considerable gains. The broader market continues to leverage investor optimism post-U.S. elections that saw Donald Trump reelected as the president.

Here’s a brief collection of some of the top cryptocurrency market headlines that have significantly impacted investor sentiment over the past seven days.

BTC Hits New ATH Amid Bull Crypto Market

BTC price hit a new ATH near the $100K level this week, echoing a buzz across the broader sector. Notably, the flagship coin gained roughly 10% over the past week to hit an ATH of $99,655. Attributable to this bullish movement post-U.S. elections, Rich Dad Poor Dad author Robert Kiyosaki shared a bold prediction for the coin, anticipating its price to hit $13 million.

Simultaneously, the crypto also saw heightened institutional interest amid its bullish movement, underscoring the potential for further gains. Aligning with this heightened market interest, biopharmaceutical firm Hoth Therapeutics forged ahead with BTC buying plans, sparking additional optimism surrounding the crypto.

Meanwhile, Bitcoin miner MARA completed its $1 billion private offering this week, with some of the proceeds set to be used to buy more BTC. Overall, the flagship coin leveraged significant buying pressure this week, paving a bullish path for future movements.

Ripple’s XRP Steals Attention

On the other hand, XRP’s price witnessed gains worth 40% over the past week, cementing investor optimism amid a bullish digital asset sector. Notably, XRP whales accumulated nearly $526M worth of the token this week, indicating that the Ripple-backed coin could pump higher. Veteran trader Peter Brandt predicted amid this bullish movement that a parabolic rally for the crypto also lies ahead.

Further, Ripple CEO Brad Garlinghouse conveyed bullish sentiments on XRP and a possible end to the SEC lawsuit, primarily attributable to the newly appointed U.S. Treasury Secretary Scott Bessent. Simultaneously, the Ripple vs. SEC lawsuit saw the regulator and FINRA trying to bring “digital asset securities” claims. This mover comes against the backdrop of XRP’s rally to $1, with speculations of a looming $2 target on SEC Chair Garu Gensler’s exit.

Overall, these market updates have sparked significant investor enthusiasm over the crypto realm’s future action, with market watchers being optimistic.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

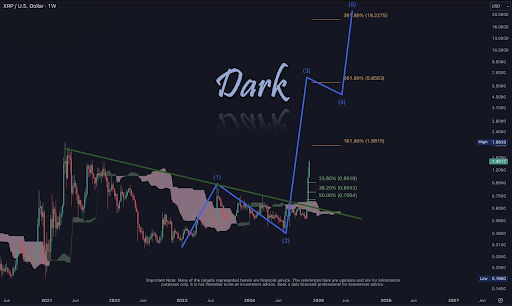

XRP Price To $28: Wave Analysis Reveals When It Will Reach Double-Digits

Crypto analyst Behdark has predicted that the XRP price can reach $28. This prediction follows his Elliot Wave theory analysis, which also showed when the crypto will reach this double-digit price target.

When XRP Price Will Reach Double Digits

In a TradingView post, Behdark’s Elliot Wave theory analysis showed that the XRP price can reach double digits by 2026. The analyst’s accompanying chart showed that the first double digits target for XRP will be $15, after which the crypto could eventually rally to $28. Behdark also provided more insights into XRP’s current price action and why this rally could happen.

First, the analyst mentioned that the XRP price looks to be currently within a running triangle. In line with this, Behdark remarked that wave D might complete its movement by hunting the all-time high (ATH) at $3.84. He mentioned that there could be a price correction for wave E afterward.

Once that XRP price correction happens, Behdrak predicts the next move will be the post-pattern movement targeting a level above $15. This is where the price target of $28 comes into the picture, as the analyst’s accompanying chart shows it is a feasible target for the crypto, although it might not happen in this market cycle.

An XRP price rally to $28 would mean that the crypto would have a market cap of $2.8 trillion. However, Behdrak suggested that this was still feasible. He noted that his focus was on chart analysis and not fundamentals, even though fundamentals are reflected in the chart itself.

Meanwhile, the analyst told market participants that if a clear and identifiable pattern emerges when the XRP price reaches wave E of the triangle, they could position themselves for the main move to double digits.

A Confirmation Of This Double Digit Target

Crypto analyst Dark Defender also recently shared an Elliot Wave theory analysis, which showed that the XRP price could indeed reach double digits. Specifically, the analyst’s accompanying chart showed that XRP could rally as high as $18 when the wave 5 impulsive move occurs.

Interestingly, unlike Behdark’s chart, which showed that the rally to double digits would happen in 2026, Dark Defender’s chart showed that the rally to $18 could happen as early as mid-2025. Meanwhile, the analyst said that the XRP price is currently in the third wave, with the crypto expected to rally to $5 when this next impulsive move occurs.

Afterward, the XRP price is expected to witness a corrective move that will cause it to drop to as low as $4. The next impulsive move after this could send XRP to the $18 target.

At the time of writing, the XRP price is trading at around $1.55, up over 10% in the last 24 hours, according to data from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com

-

Altcoin22 hours ago

Altcoin22 hours agoBTC Continues To Soar, Ripple’s XRP Bullish

-

Bitcoin16 hours ago

Bitcoin16 hours agoBitcoin Price Is Decoupling From Gold Again — What’s Happening?

-

Market19 hours ago

Market19 hours agoWhy a New Solana All-Time High May Be Near

-

Market16 hours ago

Market16 hours agoWinklevoss Urges Scrutiny of FTX and SBF Political Donations

-

Bitcoin15 hours ago

Bitcoin15 hours agoBitcoin Correction Looms As Analyst Predicts Fall To $85,600

-

Bitcoin14 hours ago

Bitcoin14 hours agoAI Company Invests $10 Million In BTC Treasury

-

Market14 hours ago

Market14 hours agoIs the XRP Price Decline Going To Continue?

-

Market13 hours ago

Market13 hours agoToken Unlocks to Watch Next Week: AVAX, ADA and More

✓ Share: