Bitcoin

Spot Bitcoin ETFs Issuer Holdings Surge Past 900,000 BTC Amid Massive July Accumulation

Spot Bitcoin ETFs have achieved yet another milestone, recording a total of 900,000 BTC since its launch. This historic milestone occurs amidst the substantial wave of BTC accumulation in July.

Spot Bitcoin ETFs Holdings Surpass 900,000 BTC

Spot Bitcoin ETFs have accomplished an unprecedented feat, as the United States BTC ETF holdings have now surpassed a staggering 900,000 BTC valued at more than $60 billion. Nate Geraci, President of the ETF Store revealed in a recent X (formerly Twitter) post that the US Spot Bitcoin ETFs recent 900,000 BTC milestone represents about 4.3% of BTC’S total supply of 21 million BTC in the market. Additionally, this massive BTC holding accounts for 82% of the nearly 1.1 million BTC held by global BTC ETFs.

According to market data from Farside Investors, a London-based investment management company, Spot Bitcoin ETFs have witnessed a major increase in inflows, reflecting a surge in demand for the digital asset. In less than two weeks, Spot Bitcoin ETFs witnessed approximately $2.38 billion in net inflows. This substantial increase has effectively propelled its total net inflows to $17 billion since its launch on January 11, 2024.

Farside Investors data also revealed that Spot Bitcoin ETFs have seen 11 days of consecutive inflows. The highest inflow recorded within this time frame was about $383.6 million on July 19. At the time, BlackRock’s iShares Bitcoin Trust (IBIT) led with an impressive inflow of $116.2 million. Over the past two weeks, BlackRock has also attracted the highest amount of inflows, followed by Fidelity Wise Origin Bitcoin Fund (FBTC).

As a key contributor to the 900,000 BTC milestone achieved by the US Spot Bitcoin ETFs, the Assets Under Management (AuM) of BlackRock’s IBIT now manages approximately 325,449 BTC, valued at about $21 billion. This significant BTC holding highlights BlackRock’s rapid success, with its Spot BTC ETF achieving a multi-billion dollar status in less than six months.

BTC Accumulation Grows In July

Amidst the 900,000 surge in the US Spot Bitcoin ETFs holdings, BTC has seen a significant spike in accumulation. This growth is likely driven by the recent shift in BTC’S bearish trend, possibly sparking an increase in investors’ demand for the cryptocurrency. According to reports from a crypto analyst identified as ‘Crypto Capex,’ on X, BTC accumulation into Spot Bitcoin ETFs has intensified significantly in July, while the availability of BTC on exchanges continues to dwindle.

Glassnode has also disclosed a notable increase in the BTC accumulation trend, which surged from 0.05 on June 1 to 0.44 by July 10. Based on the data, the number of BTC whales holding at least 1,000 BTC rose from 1,640 on July 1 to 1,643 on July 10. This move highlights the growing demand for BTC in July.

Featured image created with Dall.E, chart from Tradingview.com

Bitcoin

Strategy Adds 22,048 BTC for Nearly $2 Billion

Michael Saylor announced that Strategy purchased nearly $2 billion worth of Bitcoin. This is a massive leap over last week’s purchase, which was already quite substantial.

Nonetheless, the firm was only able to make this acquisition thanks to major stock offerings. Bitcoin’s price has been sinking over the last few weeks, and this could mature into a potential liquidation crisis.

Strategy Maintains Bitcoin Purchases

Since Strategy (formerly MicroStrategy) began acquiring Bitcoin, it’s become one of the world’s largest BTC holders. This plan has totally reoriented the company around its massive acquisitions, inspiring other firms to take up the same plan.

Today, the firm’s Chair, Michael Saylor, announced another purchase, much larger than the last few.

“Strategy has acquired 22,048 BTC for ~$1.92 billion at ~$86,969 per bitcoin and has achieved BTC Yield of 11.0% YTD 2025. As of 3/30/2025, Strategy holds 528,185 BTC acquired for ~$35.63 billion at ~$67,458 per bitcoin,” Saylor claimed via social media.

Strategy’s latest Bitcoin acquisition, worth just shy of $2 billion, is a major commitment. In February, the firm made a similar $2 billion purchase, and it was followed by a tiny $10 million buy and a $500 million one. The $500 million purchase, which took place on March 24, only happened thanks to a huge new stock offering. This move further cements Strategy’s faith in BTC.

By making these billion-dollar buys, Strategy is able to buttress the entire market’s confidence in Bitcoin. However, investors should be aware of a few potential cracks.

First of all, Bitcoin’s performance is a little subpar at the moment. Despite hitting an all-time high recently, Bitcoin is having its worst quarter since 2019, and there is not much forward momentum.

This could cause a unique problem for the company. Since Strategy is a cornerstone of market confidence, it is unable to offload its assets without jeopardizing Bitcoin’s price.

The firm’s debts are growing at a fast rate, and this could have dangerous implications if Bitcoin keeps falling. Strategy could be forced to liquidate, even if that seems unlikely now.

Still, it’s important to remember that these are only possible scenarios. Strategy has maintained its consistent Bitcoin investments for nearly five years, and it’s paid off tremendously well. However, if it keeps taking on billions in fresh debt obligations, this faith will turn into a gamble with very high stakes.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

BTC Price Rebound Likely as Long-Term Holders Reenter Market

Bitcoin (BTC) is on track to end Q1 with its worst performance since 2019. Without an unexpected recovery, BTC could close the quarter with a 25% decline from its all-time high (ATH).

Some analysts have noted that experienced Bitcoin holders are shifting into an accumulation phase, signaling potential price growth in the medium term.

Signs That Veteran Investors Are Accumulating Again

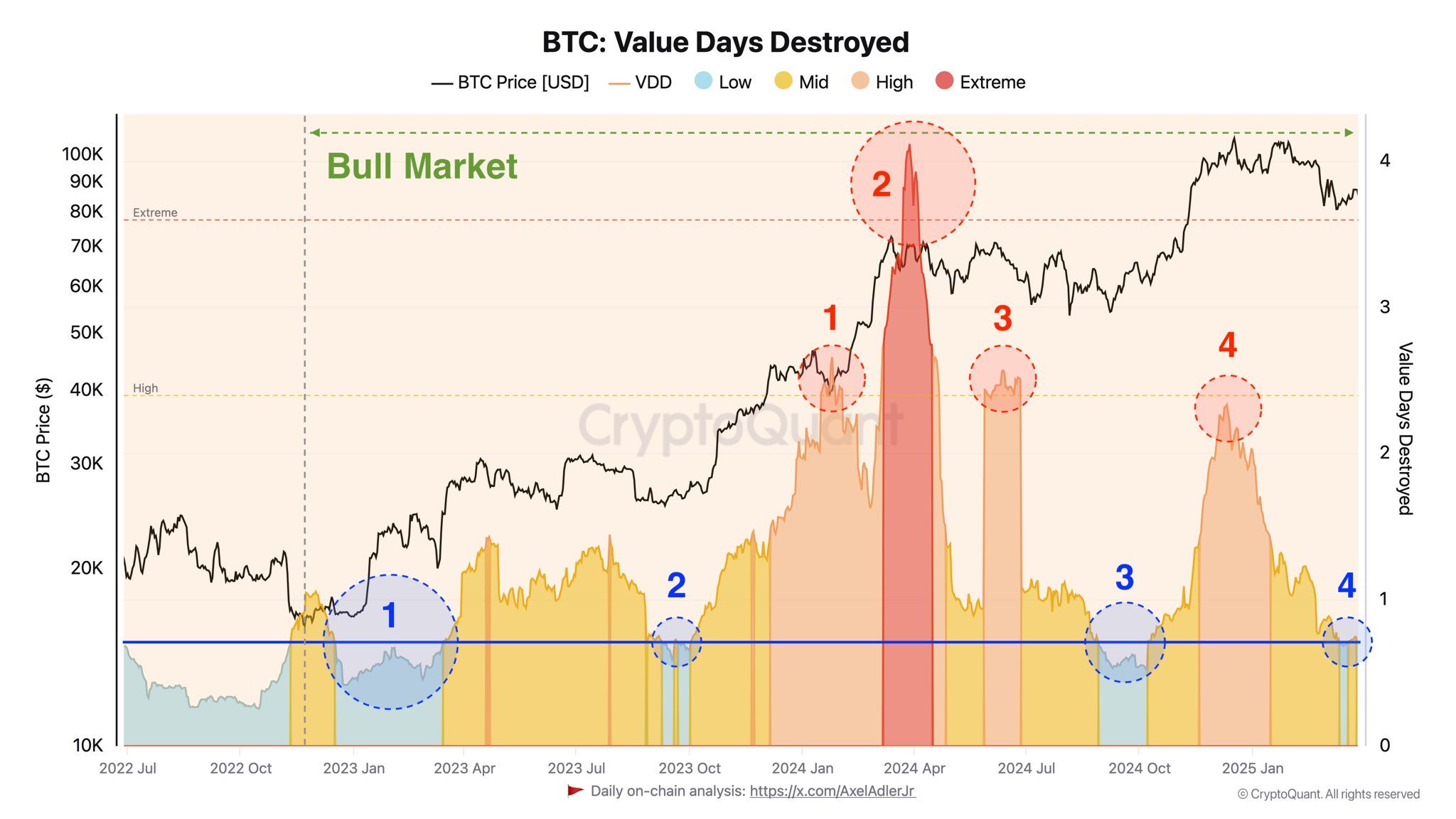

According to AxelAdlerJr, March 2025 marks a transition period where veteran investors move from selling to holding and accumulating. This shift is reflected in the Value Days Destroyed (VDD) metric, which remains low.

VDD is an on-chain indicator that tracks investor behavior by measuring the number of days Bitcoin remains unmoved before being transacted.

A high VDD suggests that older Bitcoin is being moved, which may indicate selling pressure from whales or long-term holders. A low VDD suggests that most transactions involve short-term holders, who have a smaller impact on the market.

Historically, low VDD periods often precede strong price rallies. These phases suggest that investors are accumulating Bitcoin with expectations of future price increases. AxelAdlerJr concludes that this shift signals Bitcoin’s potential for medium-term growth.

“The transition of experienced players into a holding (accumulation) phase signals the potential for further BTC growth in the medium term,” AxelAdlerJr predicted.

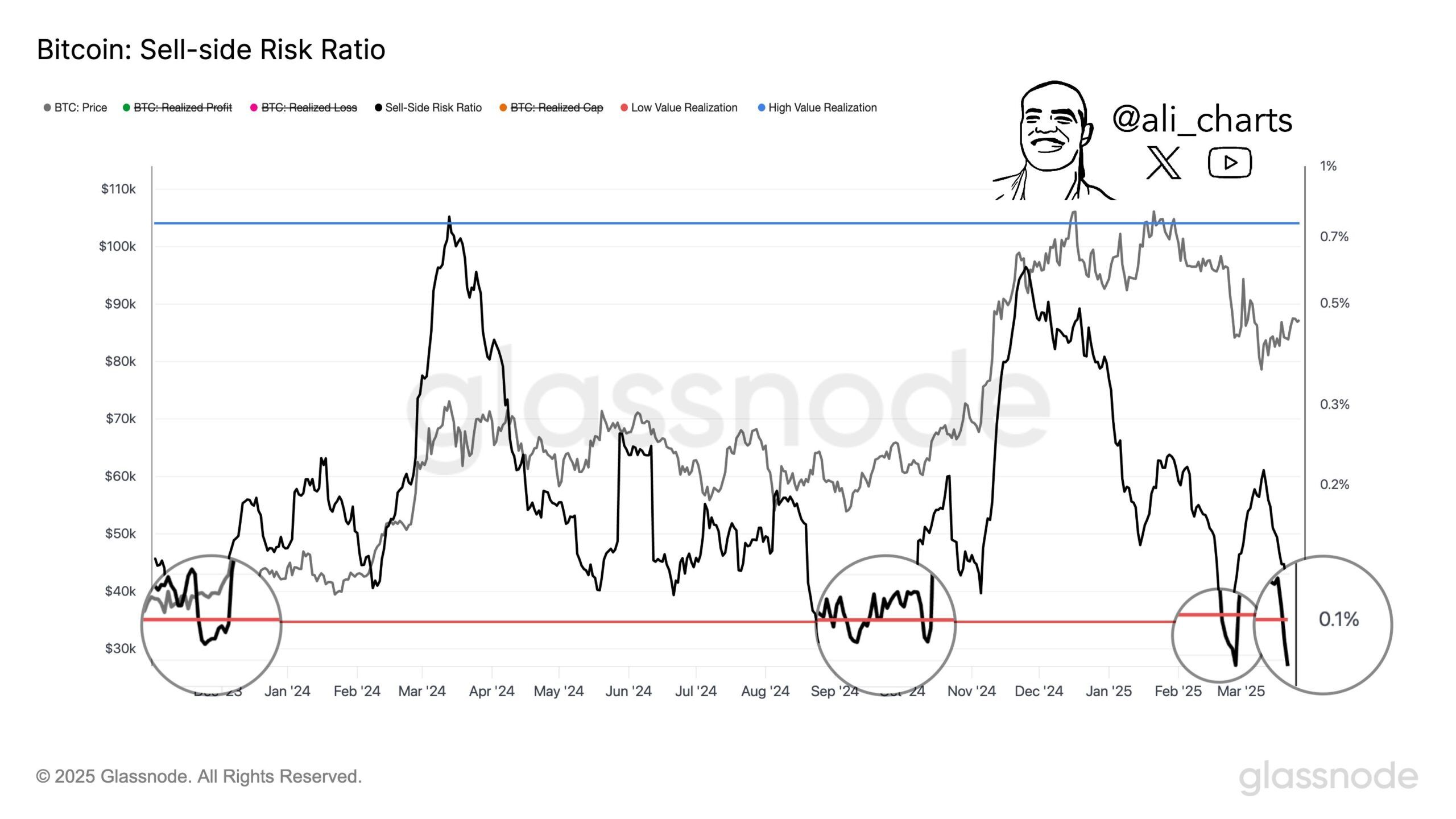

Bitcoin’s Sell-Side Risk Ratio Hits Low

At the same time, analyst Ali highlighted another bullish indicator: Bitcoin’s sell-side risk ratio had dropped to 0.086%.

According to Ali, over the past two years, every time this ratio fell below 0.1%, Bitcoin experienced a strong price rebound. For example, in January 2024, Bitcoin surged to a then-all-time high of $73,800 after the sell-side risk ratio dipped below 0.1%.

Similarly, in September 2024, Bitcoin hit a new peak after this metric reached a low level.

The combination of veteran investors accumulating Bitcoin and a sharp decline in the sell-side risk ratio are positive signals for the market. However, a recent analysis from BeInCrypto warns of concerning technical patterns, with a death cross beginning to form.

Additionally, investors remain cautious about potential market volatility in early April. The uncertainty stems from President Trump’s upcoming announcement regarding a major retaliatory tariff.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Marathon Digital to Sell $2 Billion in Stock to Buy Bitcoin

Marathon Digital Holdings, one of the largest Bitcoin mining companies in the US, made headlines with its announcement of a $2 billion stock offering to increase its Bitcoin holdings.

This strategic move, detailed in recent SEC filings, shows Marathon’s aggressive approach to capitalize on the growing crypto market.

Marathon’s $2 Billion Stock Offering: Key Details

On March 30, 2025, Marathon Digital Holdings announced a $2 billion at-the-market (ATM) stock offering to fund its strategy of acquiring more Bitcoin. The company filed a Form 8-K with the SEC, outlining its plan to raise capital through the sale of shares, with the proceeds primarily aimed at increasing its Bitcoin holdings.

According to the SEC filing (Form 424B5), Marathon intends to use the funds for “general corporate purposes,” which include purchasing additional Bitcoin and supporting operational needs.

Marathon holds 46,376 BTC, making it the second-largest publicly traded company in Bitcoin ownership, behind MicroStrategy. The company’s Bitcoin holdings have grown significantly in recent years, from 13,726 BTC in early 2024 to the current figure.

“We believe we are the second largest holder of bitcoin among publicly traded companies. From time to time, we enter into forward or option contracts and/or lend bitcoin to increase yield on our Bitcoin holdings.” Marathon confirmed

This $2 billion stock offering continues Marathon’s strategy to bolster its balance sheet with Bitcoin, a move that aligns with its long-term vision of leveraging cryptocurrency as a store of value.

Marathon’s strategy mirrors that of MicroStrategy. MicroStrategy’s stock price has soared with Bitcoin’s value, providing a blueprint for companies like Marathon to follow. By increasing its Bitcoin holdings, Marathon aims to position itself as a leader in the crypto mining sector while diversifying its revenue streams beyond traditional mining operations.

Marathon Digital CEO Fred Thiel advises investing small amounts in Bitcoin monthly, citing its consistent long-term growth potential.

The issuance of new shares to raise $2 billion could dilute the ownership of existing shareholders, potentially impacting the company’s stock price (MARA). As of March 31, 2025, MARA stock has experienced volatility, trading at around $12.47 per share, down from a 52-week high of $24, according to data from Yahoo Finance.

Moreover, Marathon’s heavy reliance on Bitcoin exposes it to the cryptocurrency’s price fluctuations. If Bitcoin’s price were to decline significantly, the value of Marathon’s holdings would decrease, potentially straining its financial position.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.