Altcoin

Why Crypto Is About To Skyrocket?

The crypto is about to skyrocket regardless of macroeconomic and other factors that have until now kept Bitcoin and altcoins prices under the radar. With multiple developments happening in parallel bolstering the bullish outlook for the crypto market, experts pointed out reasons why the market could see the biggest short squeeze in human history.

Reasons Why Bitcoin and Crypto Market About To Explode?

Brian Dixon, CEO at Off the Chain Capital, explained why the crypto is near a massive breakout or about to explode. He mentions many reasons that are helping bulls to dominate and strengthen their position in the market.

1. Donald Trump’s Lead in Presidential Race

Bitcoin price is more resilient after a failed assassination attempt on Donald Trump. The Republican presidential nominee Trump’s stance on crypto has picked up in recent months. He also announced crypto donations to his campaign earlier and amassed over $3 million in donations from crypto.

Brian Dixon said digital assets will pick pace, bringing more allocations to Bitcoin and other crypto, following the assassination attempt on Trump. Moreover, he also announced pro-Bitcoin J.D. Vance as Vice President pick.

JD Vance holds $100-$250k in Bitcoin and hates bad crypto regulation. Vance is against Gary Gensler and his inclusion of politics in securities regulation. He has raised serious concerns over Gensler’s approach to regulating blockchain and crypto. The SEC is killing the industry and pushing innovation outside the U.S. not realizing the utilities of various crypto tokens.

Donald Trump confirmed that he will make a presence and give speech at the Bitcoin Conference, which will be held in Nashville, Tennessee on July 25-27. It will be a historic moment for the crypto industry.

2. Spot Ethereum ETF Approval

Spot Ethereum ETFs have received preliminary approval from the U.S. SEC. Some Ether ETFs are expected to start trading on Tuesday, July 23. Bloomberg ETF analysts also posted on X platform about the potential increase in buying activity in the market.

Brian Dixon believes spot Ethereum ETFs will also witness demand similar to spot Bitcoin ETFs. The Ethereum ETFs listing and trading will create an easier on-ramp to ETH trading and with time it will drive price. Moreover, he believes it is also a positive development for additional ETFs for other crypto assets such as XRP and Solana.

3. TradeFi Investments in Bitcoin

The mainstream adoption of Bitcoin and other crypto assets is gradually picking pace as TradFi invested in spot Bitcoin ETFs. As a retail investor, one can now invest in Bitcoin through spot Bitcoin ETFs by using traditional brokerage accounts or apps, creating more adoption of other digital assets. Dixon added that the adoption will continue to grow with time.

Apollo Sats data revealed that 154 entities have submitted the 13F filing to the U.S. SEC. Almost 80% of institutions have increased their holdings in these Bitcoin ETFs. Whilst, only 12.5% have decreased their spot Bitcoin ETF exposure.

4. Solana And Other Crypto ETFs

Historically, the SEC had been extremely restrictive in approving ETFs and these products. But the industry saw a complete shift in the SEC as they reached out to Ether ETF issuers to complete the approval processes. Solana ETFs are anticipated to see approval processes in 2025.

Brian Dixon explained that crypto ETFs will see much larger allocations from sovereign wealth funds, pension funds, and endowments. They have a very long due diligence timeline of 12-18 months before they can start pouring money into the Bitcoin ETFs.

Meanwhile, XRP ETF is also on the cards as Ripple CEO Brad Garlinghouse pointed out after CME and CF Benchmarks announced the launch of new reference rates and real-time indices for XRP. Notably, the price has skyrocketed over 40% in a week.

5. Fed Interest Rate Cuts

The global crypto market witnessed renewed buying sentiment amid growing spot Bitcoin ETF inflow, more buying from institutional and retail investors, and strong technical and on-chain charts. The global crypto market cap is at 2.38 trillion, with BTC price trading near $65,000.

With Fed officials including Chair Jerome Powell’s dovish outlook on rate cuts this year after cooling inflation and slowing labor market, traders eye rate cuts in September. Wall Street giants also predicted a first rate cut in September. Crypto research firms including Matrixport also reported that upside momentum will continue for longer.

Also Read: Ripple XRP Case Update — Ex-SEC On Secret Meeting; XRP Breakout To $1 Next?

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Solana Price Drops 15% Amid $46M Whale Dump, Will SOL Recover Anytime Soon?

Solana price has extended weekly losses to 14% amid heightened selling pressure for the cryptocurrency. Whale data on Friday revealed that roughly $46M worth of SOL was unstaked and offloaded to exchanges in recent days. The outcome? Crypto market traders and investors are speculating if a recovery is even possible ahead as the broader market faces turmoil amid Trump’s reciprocal tariff announcement.

Solana Price Takes Bearish Turn Amid Rising Whale Dumps, What’s Happening?

As of press time, Solana price traded at $115.91, down slightly over 3% in the past 24 hours. The weekly chart for the crypto showcases a 14% decline, further accompanied by a monthly drop of over 18%. This waning action falls in line with the recent broader market trends and heightened selling pressure for the cryptocurrency.

Data from the tracker Lookonchain suggested that crypto whales are on a SOL dumping spree in tandem with the coin’s slumping action. Notably, 4 wallet addresses collectively unstaked and offloaded $46 million worth of coins in the past 24 hours, per whale data.

Here Are The Addresses & Amounts of SOL Dumped

- ‘HUJBzd’ – $30.3 million worth of coins.

- ‘BnwZvG’ – $9.47 million worth of coins.

- ‘8rWuQ5’ – $3.53 million worth of coins.

- 2UhUo1′ – $3 million worth of coins.

For context, usual market sentiments reflect bearishness in light of such massive dumps as the selling pressure for a crypto increases. Solana’s waning price action has contributed to investors’ cautious outlook toward the coin amid negative market dynamics.

SOL Price Faces Pressure Amid Broader Trends

It’s worth pointing out that SOL is currently facing immense heat due to broader macro trends presenting risk assets with uncertainty. CoinGape recently reported that Bitcoin price saw an offsetting movement with Donald Trump’s reciprocal tariffs commencement. In turn, even the altcoin market mimicked a bearish movement lately.

Another report revealed that BTC price is expected to follow the stock market action in light of the new reciprocal tariffs. Matrixport strongly asserted that the broader crypto market could potentially sustain volatility in the short run as BTC price is expected to mimic stock market movements.

Analyst Forecasts Bullish Outlook Despite Downtrend

However, a crypto market analyst named ‘Brandon Hong’ has conversely highlighted a bullish outlook for Solana price regardless of the broader turmoil. The analyst recently posted on X, stating, “SOL is about to have its biggest breakout ever.”

This bullish anticipation rides the back of the coin about to break its 400-day range. “Buy now or regret later,” the analyst concluded, sparking contrary speculations. Crypto market participants continue to extensively eye the token for price action shifts amid uncertain dynamics.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Cardano Price Can Clinch $1 As It Eyes Bounce From New Support Zone

While predictions for Cardano to $1 may seem like a far cry, a cryptocurrency expert has injected new life into the claims. Cardano’s price is headed below 50 cents in search of a new support zone that can serve as a springboard to reach new highs.

Cardano Price Can Still Clinch $1 Despite Price Slump

Market technician Jonathan Carter in an analysis on X predicts that Cardano’s price can reclaim the $1 price point in the coming months. According to Carter, the recent ADA correction will not be a hindrance for Cardano’s price to reach $1.

ADA has lost a jarring 13% over the last week and trades at $0.64 in an unremarkable week for the cryptocurrency. On the daily charts, prices have generally moved sideways, underscoring a lack of investor enthusiasm.

For Carter, Cardano’s recent decline has seen it fail to stay above the $0.65 support level. The analyst opined that a downtrend is the offing for the Cardano price that could see a new support zone of $0.59. Carter says the new $0.59 support zone will hurl Cardano price to reach $1.

“Despite the long correction, the price still has a chance to bounce off this support and rise towards $1,” said Carter. “Otherwise, we will fall to the lower border of the broadening wedge.”

While some investors are eyeing an ADA bounce to $0.70, a plausible play will be a slump below $0.60 before the start of a rally.

A Slew Of Positives For ADA

Despite the pervading negative sentiment around ADA price, the cryptocurrency has a wave of positive fundamentals going for it. Cardano price spiked following Charles Hoskinson’s confirmation of Ripple’s RLUSD on ADA.

Furthermore, Charles Hoskinson reveals that Cardano will play a major role in Bitcoin decentralized finance (DeFi) application. In more positive technicals, Cardano price is forming a cyclical pattern from 2024 that can send prices to astronomical proportions in May.

While the prediction pegged prices at $2.5, optimists say ADA price to $10 is not a crazy hypothesis. The report cites present solid fundamentals and ADA’s over 1,000% spike to set its all-time high back in 2021 as pointers for the seismic rally to $10.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Expert Reveals XRP Price Could Drop To $1.90 Before Rally To New Highs

Crypto analyst CasiTrades has provided a roadmap for the XRP price, revealing what could happen before the altcoin reaches a new all-time high (ATH). Based on her analysis, XRP could still witness a price decline before it potentially rallies past its current ATH of $3.4.

XRP Price Could Drop To $1.9 Before Rally To New Highs

In an X post, CasiTrades stated that in the event of a deeper flush, the XRP price could wick down to $1.90, suggesting that the altcoin could visit this low before it rallies to new highs. She believes XRP will ideally hold above this $1.90 and avoid dropping to new lows.

The crypto expert noted that the next move is critical. She claimed that if XRP gets that flush with bullish RSI divergence, it could mark the bottom before the altcoin rockets into Wave 3. However, CasiTrades warned that a break below $1.90 could force a reset of the entire new trend count.

Meanwhile, there is still the possibility that the XRP price might not drop to as low as $1.90. CasiTrades stated that $1.95 is the prime target, with subwaves heavily aligning there and a drop to $1.90 only likely to occur in the event of a deeper flush.

It is worth mentioning that US President Donald Trump recently announced reciprocal tariffs on all countries, a move which is set to ignite a global trade war and is bearish for XRP and the broader crypto market. As such, this development could be what sparks the deeper flush and send the altcoin to as low as $1.90.

A Drop To $1.4 Is Also The Cards

In an X post, crypto analyst Brandon asserted that the XRP price is about to have a massive breakout, to the downside. His accompanying chart showed that XRP could drop to as low as $1.4.

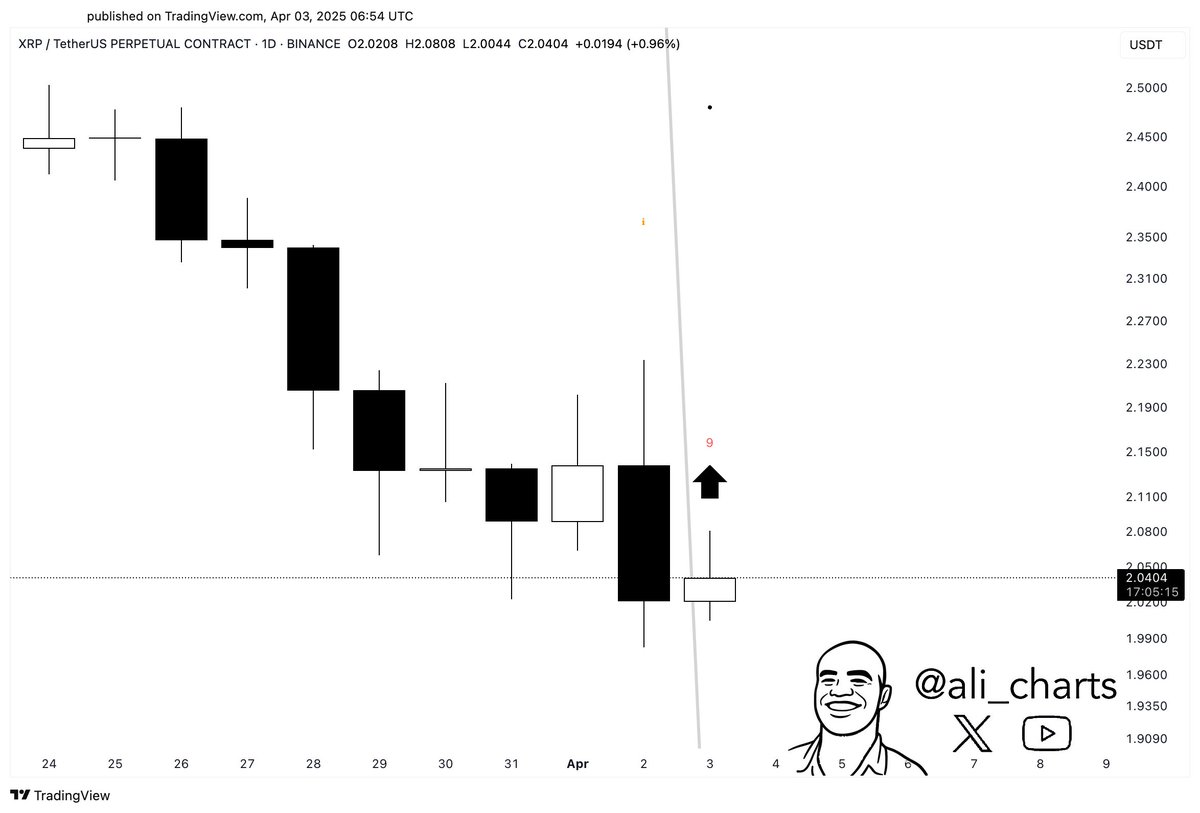

On the other hand, crypto analysts such as Ali Martinez have provided a bullish outlook for the XRP price. In an X post, he stated that XRP could be setting up for a rebound. The analyst further remarked that the altcoin is holding above $2 while the TD Sequential flashes a buy signal.

Crypto analyst Javon Marks also recently predicted that Ripple’s coin could surge 44x and reach as high as $99. He alluded to the 2017 bull run as the reason why he is confident that the altcoin could record such a parabolic rally.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market23 hours ago

Market23 hours agoIP Token Price Surges, but Weak Demand Hints at Reversal

-

Market19 hours ago

Market19 hours agoBitcoin’s Future After Trump Tariffs

-

Altcoin23 hours ago

Altcoin23 hours agoMovimiento millonario de Solana, SOLX es la mejor opción

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum Trading In ‘No Man’s Land’, Breakout A ‘Matter Of Time’?

-

Bitcoin23 hours ago

Bitcoin23 hours agoBlackRock Approved by FCA to Operate as UK Crypto Asset Firm

-

Market22 hours ago

Market22 hours agoHBAR Foundation Eyes TikTok, Price Rally To $0.20 Possible

-

Altcoin22 hours ago

Altcoin22 hours agoJohn Squire Says XRP Could Spark A Wave of Early Retirements

-

Market21 hours ago

Market21 hours ago10 Altcoins at Risk of Binance Delisting

✓ Share: