Altcoin

Maker Whales Accumulate $6 Million MKR Amid 6% Price Jump

The cryptocurrency market is witnessing a notable surge in Maker (MKR) token prices, accompanied by significant accumulation from whale investors. As the governance token of the MakerDAO protocol, MKR has captured attention with its impressive 11% price rally over the past week.

This upward trend coincides with strategic moves by large-scale investors, who have collectively acquired over $5.63 million worth of MKR tokens. The recent whale activity, coupled with MKR’s price performance, offers a compelling glimpse into the dynamics of investor sentiment and market movements within the decentralized finance (DeFi) sector.

Maker (MKR) Price Surge & Whale Accumulation Details

The recent accumulation of MKR tokens by whale investors provides a compelling narrative of strategic positioning within the cryptocurrency market. Two prominent whale addresses have been identified as key players in this accumulation phase, collectively acquiring a total of 2,242 MKR tokens, valued at more than $5.63 million. This significant investment demonstrates a strong belief in the long-term potential of the MakerDAO protocol and its governance token.

The first whale, identified by the address starting with 0x3737, has shown particular interest in MKR, purchasing 1,465 tokens (worth approximately $3.63 million) since June 27, at an average price of $2,476. This investor’s track record is noteworthy, having previously profited about $468,000 from a well-timed MKR trade.

Additionally, this same whale has demonstrated diversified interests within the crypto space, reportedly earning over $30 million from an investment in the meme coin PEPE. This diverse portfolio and successful trading history suggest a sophisticated approach to cryptocurrency investment, lending credibility to their bullish stance on MKR.

The second whale, with an address beginning with 0xCf9b, has also made a significant move, buying 777 MKR tokens for 2 million USDT at a price of $2,587 just 9 hours prior to the report. This investor, too, has a history of profitable trading in MKR, having previously made about $321,000 from a prior position.

The actions of these whales provide valuable insights into the strategies of large-scale cryptocurrency investors. Their willingness to commit substantial capital to MKR tokens suggests confidence in the token’s fundamentals, the MakerDAO protocol’s future, or potentially upcoming governance decisions that could impact the token’s value.

Also Read: Riot Platform’s Exec Highlights Decentralized Antagonism on Bitcoin Security

MKR Current Market Statistics

As of the latest available data, Maker (MKR) price is trading at $2,616.16, representing a significant increase from its recent lows. The token has experienced a 5.16% increase in the last 24 hours and an impressive 11.70% rise over the past week, outperforming many other cryptocurrencies during this period. This price action is supported by a robust 24-hour trading volume of $145.7 million, indicating strong market interest and liquidity.

A particularly noteworthy statistic is the surge in open interest for Maker (MKR), which has increased by 16.10% to reach a current valuation of $117.1 million. With a circulating supply of 930,000 MKR, the project currently boasts a market capitalization of $2.4 billion. This places MKR among the top cryptocurrencies by market value, reflecting its importance within the DeFi ecosystem.

The combination of increased whale activity, price surge, and growing open interest comes at a time when the broader cryptocurrency market is showing signs of recovery. This confluence of factors potentially signals growing confidence in MakerDAO and its native token among both large investors and the wider crypto community.

Also Read: Why Chainlink (LINK) Price Is Struggling Despite Big Whales Interactions?

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Analyst Reveals Why The XRP Price Can Hit ATH In The Next 90 To 120 Days

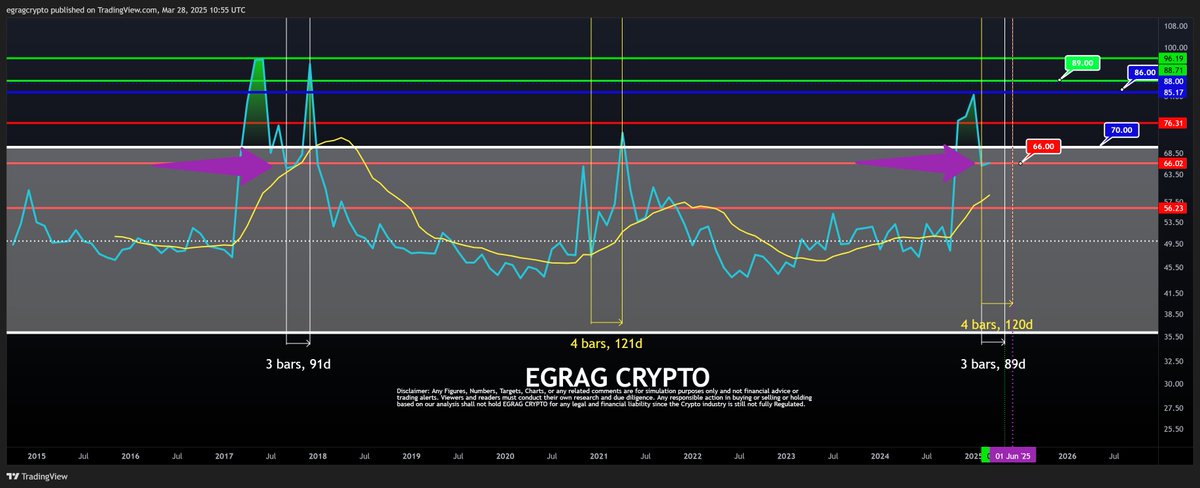

Crypto analyst Egrag Crypto has again provided a bullish outlook for the XRP price. This time, he alluded to historical trends to explain why the altcoin can hit a new all-time high (ATH) in 90 to 120 days.

Why The XRP Price Can Hit ATH In 90 To 120 Days

In an X post, Egrag Crypto alluded to historical patterns to explain why the XRP price can hit a new ATH in the next 90 to 120 days. He noted that the RSI chart shows important historical patterns and stated that the altcoin usually has two peaks during its bull runs.

The crypto analyst further revealed that in 2021, the second peak occurred after 90 days, while in 2017, it occurred after 120 days. Based on this, Egrag Crypto affirmed that this historical timeframe provides market participants with a potential for a “great opportunity,” hinting at the altcoin hitting a new ATH.

In another post, he raised the possibility of the XRP price reaching a new ATH of $3.9 by May. This came as he identified an Inverse Head and Shoulder pattern, which was forming for the altcoin. The crypto analyst stated that the measured move is $3.7 to $3.9.

For now, an XRP analysis has shown that the altcoin is struggling at $2.15 amid regulatory uncertainty over SEC Chair nominee Paul Atkins. In his update on this Inverse Head and Shoulder pattern, Egrag Crypto remarked that a close above $2.24, the Fib 0.888, is the next minor target. He affirmed that the pattern is still unfolding as anticipated.

Ripple’s Native Token Could Still Drop Below $2

Crypto analyst Dark Defender has predicted that the XRP price could still drop below $2 before the next leg up. In an X post, he stated that Ripple’s native token is in the 4th Wave of the Monthly Elliott Wave structure.

His accompanying chart showed that XRP could drop to as low as $1.88 on this Wave 4 corrective move. Once that is done, the altcoin will witness its next leg up, rallying to as high as $5.8, which would mark a new ATH.

Dark Defender assured that Wave 4 will end soon and that XRP will continue to reach its targets. The crypto analyst recently affirmed that the altcoin is the “one” and explained why it would dominate Bitcoin and Ethereum.

Crypto analyst CasiTrades also suggested that XRP could further decline before its next leg to the upside. She noted that after the drop to $2.27, the altcoin showed no bullish RSI divergence, which signaled that the drop wasn’t quite done yet.

She added that the coin is now likely heading down to test the 0.618 golden retracement at $2.17, or possibly the golden pocket at $2.15 for a final low before “lift-off.” However, CasiTrades also mentioned that RSI is starting to build the bullish divergence and that the selling pressure is exhausting.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Gemini Crypto Exchange Announces Rewards For XRP Users, Here’s How To Get In

Gemini, the crypto exchange founded by the Winklevoss twins, is promoting its previously launched XRP cashback program, which offers crypto rewards to users. This initiative allows eligible participants to earn rewards on their XRP transactions. Here’s a look at the program details and the steps required to join.

Gemini Founder Unveils XRP Cashback Rewards

On March 27, Tyler Winklevoss reminded the XRP community and Ripple army on X (formerly Twitter) that they can earn rewards in the token whenever they use the Gemini Credit Card for purchases. The Gemini credit card, launched in partnership with Mastercard in 2021, allows users to choose cryptocurrencies from Bitcoin, Ethereum, XRP, and over 50 other digital assets for cashback.

Since adding XRP to its long portfolio of crypto cashback offerings in August 2023, Gemini has continued to support the third-largest cryptocurrency as an option for crypto enthusiasts. The Credit Card reward information announced by Winklevoss was well received by the XRP community.

He explained that the Gemini Credit Card allows users to earn crypto back each time they spend fiat. He clarified that this feature is only available to residents in the United States (US) currently. The Gemini founder also revealed that he has been using the Credit Card for years and has had a great experience accumulating significant crypto rewards from the cashback program.

Gemini’s Credit Card offers tiered cashback rates depending on the purchase categories. A 4% XRP cashback is offered on gas and EV charging, with up to $200 monthly. A 1% XRP cashback is available for fuel and EV charging after exceeding the monthly limit. Finally, a 3%, 2%, and 1% XRP cashback is provided for dining, groceries, and other purchases, respectively.

As XRP continues to push for widespread adoption, this Gemini cashback reward program strengthens its utility and encourages greater usability and investments.

Notably, Gemini isn’t the only crypto exchange embracing XRP in its rewards programs. Platforms like WhiteBIT and Bit2Me have also introduced similar programs. By offering an XRP cashback, Gemini and other crypto exchanges can make crypto more accessible, encourage faster adoption, and reinforce XRP’s role as a digital payment solution.

How To Participate In Gemini’s XRP Cashback

Gemini has specified that users interested in earning XRP rewards from Gemini’s cashback program must first qualify for the exchange’s Credit Card, which depends on their credit score. Approved applicants must secure their cards by June 30, 2025, to participate in the promotional offer.

The crypto exchange also stated that new cardholders could earn up to $200 in XRP cashback if they spend at least $3,000 within the first 90 days. Once earned, the XRP reward will be automatically deposited into their trading accounts on Gemini, enabling users to hold, trade, or sell whenever they wish. The Credit Card also comes with no extra annual, exchange, or foreign transaction fees, allowing crypto users to grow their portfolios continually.

Featured image from SCMP, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Altcoin

Ethereum Price Falls Below $1900 As Expert Blames Decline On Network Stagnation

Ethereum price has tumbled below $1,900 in a correction driven by a slew of factors. Outside of the technicals, one expert is pinning the blame on Ethereum’s failure to lead and innovate in the Web 3 space.

Ethereum Price Continues Its Steep Decline

According to CoinMarketCap data, technicals for Ethereum’s price are grim, with the second-largest cryptocurrency slipping below $1,900. At press time, Ethereum (ETH) is trading at $1,828 and shows no signs of reversing the grim trend.

A look at Ethereum’s chart does not indicate any signs of an uptrend or a short bounce to stoke embers of optimism. According to pseudonymous analyst Gum, Ethereum signals “relentless downward price action” that could see the asset fall below $1,800.

Over the last day, Ethereum has fallen by nearly 4% while its seven-day chart indicates a decline of nearly 8%. The decline of Ethereum price follows a broader market correction with the global crypto market capitalization losing nearly 3% of its valuation.

On the fundamentals side, things are equally grim for the Ethereum price. Unconfirmed reports of a potential Binance delisting ETH threaten to send Ethereum price to $1,500. Standard Chartered has slashed its ETH prediction for 2025 by 60%, projecting $4,000 as a potential price point by the end of the year.

Expert Says Network Has Itself To Blame

Ryan Watkins, co-founder at Syncracy Capital has taken swipes at Ethereum over its failure to keep pace with its peers. Watkins notes that a failure to capitalize on previous momentum during the last two market cycles is haunting Ethereum’s price.

Ethereum has fallen down the pecking order to new blockchains with Solana and Bitcoin tipped to have the upper hand over the network. An inflow of bridged funds from Ethereum to Solana is accentuating the network’s worrying metrics.

“No one wants to own a growth stage product that’s falling behind technologically superior competitors and bleeding market share,” said Watkins.

Watkins says the only for Ethereum to pull itself from the rut is to “deliver generational leadership and growth.” However, with the Pectra upgrade around the corner, enthusiasts are optimistic that Ethereum can reach $10,000. Hardcore community members are poking holes in Solana’s rise, attributing it a memecoin craze compared to Ethereum’s neck-deep foray into decentralized finance (DeFi).

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Altcoin22 hours ago

Altcoin22 hours agoPepe Coin Whale Sells 150 Billion Tokens, Price Fall Ahead?

-

Market21 hours ago

Market21 hours agoXRP Falls 12% in a Week as Network Activity Declines

-

Altcoin21 hours ago

Altcoin21 hours agoIs Burger King Teasing Crypto Launch? Decoding Their X Post

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Bulls Disappointed As Recovery Attempt Fails At $2,160 Resistance

-

Market23 hours ago

Market23 hours agoGRASS Jumps 30% in a Week, More Gains Ahead?

-

Market22 hours ago

Market22 hours agoONDO Whales Retreat as Price Risks Dropping Below $0.70

-

Bitcoin23 hours ago

Bitcoin23 hours ago8,000 Dormant Bitcoin Suddenly Move: What’s Next For The Market?

-

Ethereum17 hours ago

Ethereum17 hours agoEthereum Monthly RSI At 2018 Market Low — What Happened Last Time?

✓ Share: