Market

Brazil Explores AI Regulation, and More

BeInCrypto comprehensive Latam Crypto Roundup brings Latin America’s most important news and trends. With reporters in Brazil, Mexico, Argentina, and more, we cover the latest updates and insights from the region’s crypto scene.

This week’s roundup includes stories on Brazil’s efforts to regulate AI, a surge in interest in the Argentine Football Association fan token as the Copa América final approaches, and more.

BBVA: 9 out of 10 Argentines Use Digital Wallets

BBVA Bank recently reported that nine out of every ten Argentines under 40 now use digital wallets. This is a huge increase from 2020 when only 4% paid using QR codes. According to Argentina’s National Institute of Statistics and Census (Indec), 89% of Argentines use smartphones and 88% have internet access, helping modernize financial services.

“The outlook is for growth: the greater adoption of digital wallets among young people allows us to think that their use will be increasingly widespread,” said Joaquín Molina from the consulting firm Taquion.

Popular digital wallets in Argentina that are not crypto-based include Mercado Pago, Ualá, Brubank, MODO, Cuenta DNI, and Tarjeta Naranja. MODO is the only one that integrates services from several banks like BBVA, Santander, Macro, Galicia, Nación, ICBC, and Ciudad.

Read more: 16 Best Web3 Wallets In 2024

Data from Taquion also shows that 55% of Argentines use digital wallets for shopping at local stores, 38% for supermarket purchases, and 30% for buying shoes. Additionally, four out of ten users prefer this payment method for the rewards offered.

In March, Argentina drafted a law to regulate cryptocurrency exchanges and wallets, working closely with the private sector. This move follows the guidelines of the Financial Action Task Force (FATF).

The new set of rules requires Argentine lawyers, banks, and finance companies to report any client operations that seem illegal. This is part of President Javier Milei’s effort to regulate wallet use.

Venezuelan Authorities Warn of Alleged Cryptocurrency Ponzi Using PDVSA Name

In May and June, Venezuela faced controversies over alleged cryptocurrency Ponzi schemes. As July progresses, the issue persists with a new scheme reportedly using the name of Petroleos de Venezuela (PDVSA). The initial alert came from X (former Twitter) user RoamingVzla, known for exposing dubious operations of companies like BTR, HyperAI, and Solesbot.

“Since some major Ponzi schemes collapsed, new ones keep emerging weekly. Some last longer than others. The latest one, supposedly launched on July 2, is called PDVSA_Mall,” tweeted RoamingVzla.

The platform solicits investments in TRON (TRX) or USDT, promising benefits “valid for 40 days.” It also claims that forming a large team can significantly increase earnings.

“Whenever you top up through the registration link, you will receive additional USDT rewards. For instance, depositing 1000 USDT through the link grants an additional 160 USDT rebate,” stated the PDVSA-VIP team.

Read more: 15 Most Common Crypto Scams To Look Out For

The cryptocurrency ecosystem in Venezuela has seen multiple scams, causing significant losses. Previous schemes like Solesbot, HyperAI, and BTR have left Venezuelan investors wary.

The use of PDVSA’s name raises serious concerns, especially without official endorsement. The platform claims to operate under the Central Bank of Venezuela (BCV) and the Bank of Venezuela (BDV) regulations.

The PDVSA crypto scandal, marked by massive corruption within Petroleos de Venezuela, serves as a stark fraud warning. Former Petroleum Minister Tareck El Aissami was arrested for allegedly siphoning billions from oil sales through cryptocurrencies and Venezuela’s National Superintendence of Cryptoassets (SUNACRIP). Estimates suggest up to $23 billion was embezzled, severely impacting Venezuela’s economy.

Brazilian Senate Postpones Vote on AI Regulation Bill

The Brazilian Senate has delayed voting on Bill 2338/23, which aims to regulate artificial intelligence (AI) tools. The bill will undergo further debate, with a vote expected only after the municipal elections. Opposition senator Marcos Rogério proposed the postponement, citing concerns about the bill’s potential impact on the tech sector.

“The bill aims to regulate AI to prevent misuse in elections and establish privacy rules. However, it imposes excessive restrictions on a nascent sector,” he stated.

Rogério warned that the bill’s bureaucracy could hinder technological development, requiring rigorous documentation and state analysis for all systems. Alan Nicolas, founder of the Lendár.IA Community and an AI expert, echoed these concerns. He said the need for legislation to protect against AI misuse but cautioned against stifling innovation.

Read more: How To Invest in Artificial Intelligence (AI) Cryptocurrencies

The push for AI regulation stems from its disruptive potential, especially in elections, where false information can spread rapidly. The Superior Electoral Court (TSE) has mandated AI-created content identification and banned deepfakes for the 2024 elections.

This concern extends beyond Brazil. Tech giants like Google and OpenAI have restricted their AI tools from discussing elections. OpenAI’s terms of service prohibit tools like ChatGPT from creating political content. With elections in Brazil and the US in 2024, it remains to be seen how AI will influence the outcomes, marking the first time elections will occur after AI tools have become widespread.

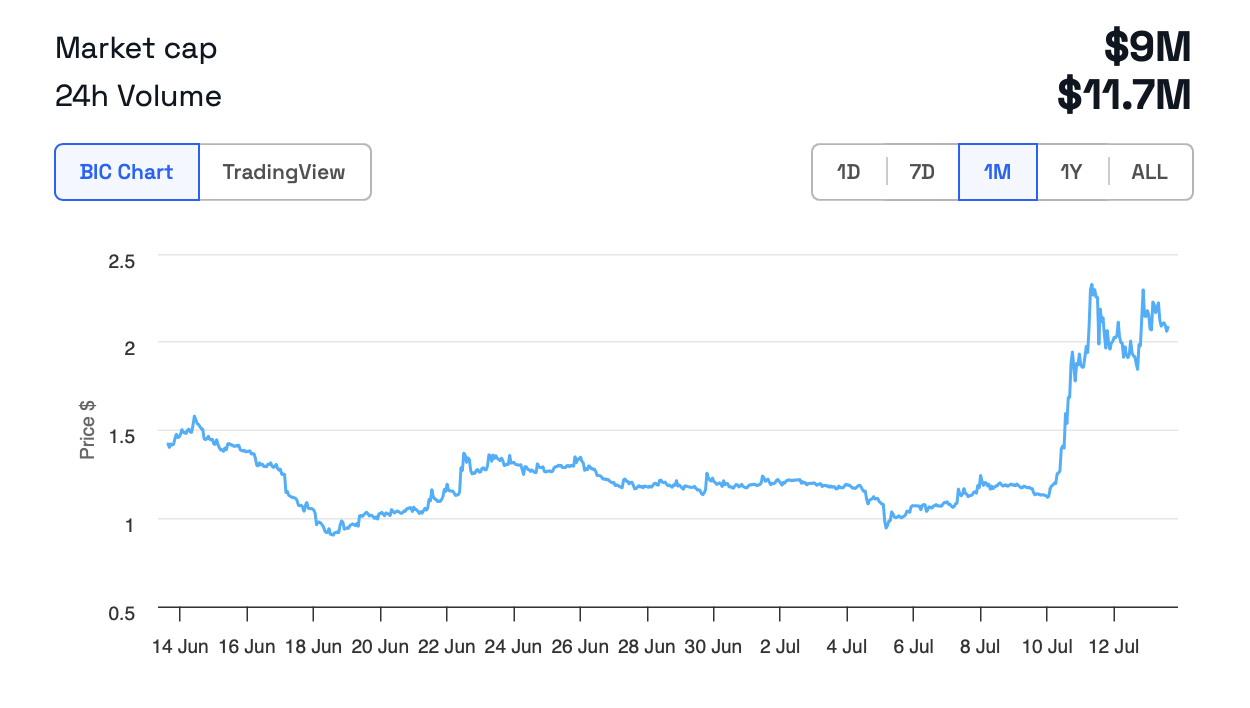

Copa América Final: Argentina Fan Token Surges

Argentina, the reigning world champions, will play Colombia in the Copa América final on July 14. Argentina is favored to win their 15th continental title.

Soccer fans have enjoyed this major event for a month, but cryptocurrencies have also taken the spotlight. Amid this excitement, the Argentine Football Association Fan Token (ARG) is surging, now trading at $2.09.

Read more: What is Sorare? Where Blockchain Meets Fantasy Football

The rise in fan token prices correlates with the teams’ performances in the tournaments. However, other factors, like the overall volatility of the cryptocurrency market, also play a role. It’s important to note that fan tokens are a new and uncertain asset, involving several investment risks.

After the celebrity meme coin frenzy, hackers have shifted their focus to sports stars, using their accounts to push dubious projects. The latest victims are Lionel Messi and Ronaldinho Gaúcho.

Messi’s Instagram account was hacked on Monday, leading to a 193% surge in the WATER meme coin value. Hackers posted a story featuring an image of Messi with a link to promote WATER.

A similar incident occurred on Tuesday with Ronaldinho Gaúcho’s account. The post remained visible on his profile, with no explanation provided.

Read more: How to Buy Solana Meme Coins: A Step-By-Step Guide

The meme coin promotion reached a significant portion of the combined 577 million followers of the two soccer legends. This exposure created a spike in interest in WATER.

WATER was launched on June 24, 2024 on Solana, valued at approximately $0.00264353. It experienced a sharp decline, hitting a low of $0.00028329 by Monday morning.

The hack on Messi’s account caused WATER’s value to rise exponentially, reaching $0.00123181. However, the price fell again. Another slight surge occurred on Tuesday morning following the post on Ronaldinho’s account, but it failed to sustain the meme coin’s value, which has continued to decline.

As the Latam crypto scene grows, these stories highlight the region’s increasing influence in the global market. Stay tuned for more updates and insights in next week’s roundup.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

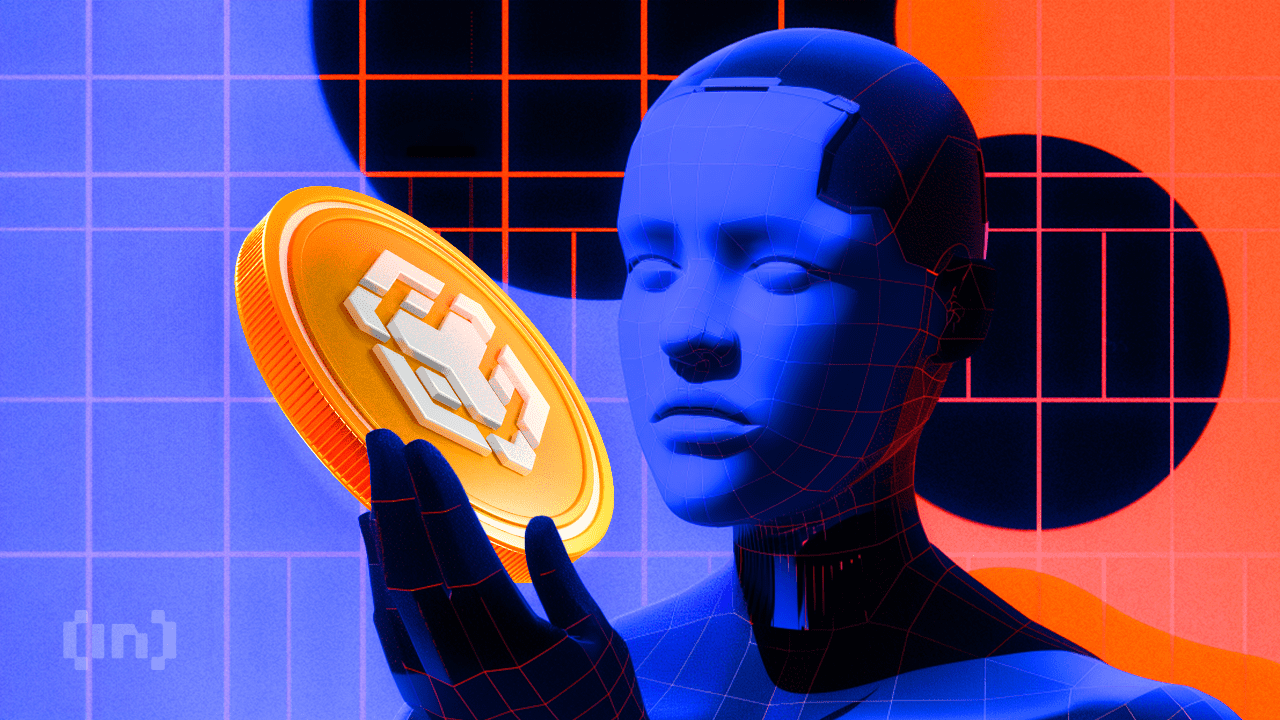

VanEck Sets Stage for BNB ETF with Official Trust Filing

Global investment management firm VanEck has officially registered a statutory trust in Delaware for Binance’s BNB (BNB) exchange-traded fund (ETF).

This move marks the first attempt to launch a spot BNB ETF in the United States. It could potentially open new avenues for institutional and retail investors to gain exposure to the asset through a regulated investment vehicle.

VanEck Moves Forward with BNB ETF

The trust was registered on March 31 under the name “VanEck BNB ETF” with filing number 10148820. It was recorded on Delaware’s official state website.

The proposed BNB ETF would track the price of BNB. It is the native cryptocurrency of the BNB Chain ecosystem, developed by the cryptocurrency exchange Binance.

As per the latest data, BNB ranks as the fifth-largest cryptocurrency by market capitalization at $87.1 billion. Despite its significant market position, both BNB’s price and the broader cryptocurrency market have faced some challenges recently.

Over the past month, the altcoin’s value has declined 2.2%. At the time of writing, BNB was trading at $598. This represented a 1.7% dip in the last 24 hours, according to data from BeInCrypto.

While the trust filing hasn’t yet led to a price uptick, the community remains optimistic about the prospects of BNB, especially with this new development.

“Send BNB to the moon now,” an analyst posted on X (formerly Twitter).

The filing comes just weeks after VanEck made a similar move for Avalanche (AVAX). On March 10, VanEck registered a trust for an AVAX-focused ETF.

This was quickly followed by the filing of an S-1 registration statement with the US Securities and Exchange Commission (SEC). Given this precedent, a similar S-1 filing for a BNB ETF could follow soon.

“A big step toward bringing BNB to US institutional investors!” another analyst wrote.

Meanwhile, the industry has seen an influx of crypto fund applications at the SEC following the election of a pro-crypto administration. In fact, a recent survey revealed that 71% of ETF investors are bullish on crypto and plan to increase their allocations to cryptocurrency ETFs in the next 12 months.

“Three-quarters of allocators expect to increase their investment in cryptocurrency-focused ETFs over the next 12 months, with demand highest in Asia (80%), and the US (76%), in contrast to Europe (59%),” the survey revealed.

This growing interest in crypto ETFs could drive further demand for assets like BNB, making the VanEck BNB ETF a potentially significant product in the market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Recovery Stalls—Are Bears Still In Control?

XRP price started a fresh decline from the $2.20 zone. The price is now consolidating and might face hurdles near the $2.120 level.

- XRP price started a fresh decline after it failed to clear the $2.20 resistance zone.

- The price is now trading below $2.150 and the 100-hourly Simple Moving Average.

- There is a connecting bearish trend line forming with resistance at $2.120 on the hourly chart of the XRP/USD pair (data source from Kraken).

- The pair might extend losses if it fails to clear the $2.20 resistance zone.

XRP Price Faces Rejection

XRP price failed to continue higher above the $2.20 resistance zone and reacted to the downside, like Bitcoin and Ethereum. The price declined below the $2.150 and $2.120 levels.

The bears were able to push the price below the 50% Fib retracement level of the recovery wave from the $2.023 swing low to the $2.199 high. There is also a connecting bearish trend line forming with resistance at $2.120 on the hourly chart of the XRP/USD pair.

The price is now trading below $2.150 and the 100-hourly Simple Moving Average. However, the bulls are now active near the $2.10 support level. They are protecting the 61.8% Fib retracement level of the recovery wave from the $2.023 swing low to the $2.199 high.

On the upside, the price might face resistance near the $2.120 level and the trend line zone. The first major resistance is near the $2.150 level. The next resistance is $2.20. A clear move above the $2.20 resistance might send the price toward the $2.240 resistance. Any more gains might send the price toward the $2.2650 resistance or even $2.2880 in the near term. The next major hurdle for the bulls might be $2.320.

Another Decline?

If XRP fails to clear the $2.150 resistance zone, it could start another decline. Initial support on the downside is near the $2.10 level. The next major support is near the $2.0650 level.

If there is a downside break and a close below the $2.0650 level, the price might continue to decline toward the $2.020 support. The next major support sits near the $2.00 zone.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now below the 50 level.

Major Support Levels – $2.10 and $2.050.

Major Resistance Levels – $2.120 and $2.20.

Market

Experts Raise Red Flags Over Finances

Circle’s initial public offering (IPO) filing has raised concerns among industry experts, who are sounding alarms over the company’s financial health, distribution costs, and valuation.

While the move marks a significant step toward mainstream financial integration, experts’ skepticism casts doubt on the company’s long-term prospects.

Analysts Highlight Red Flags With Circle IPO

On April 1, BeInCrypto reported that Circle had filed for an IPO. The company plans to list its Class A common stock on the New York Stock Exchange (NYSE) under “CRCL.”

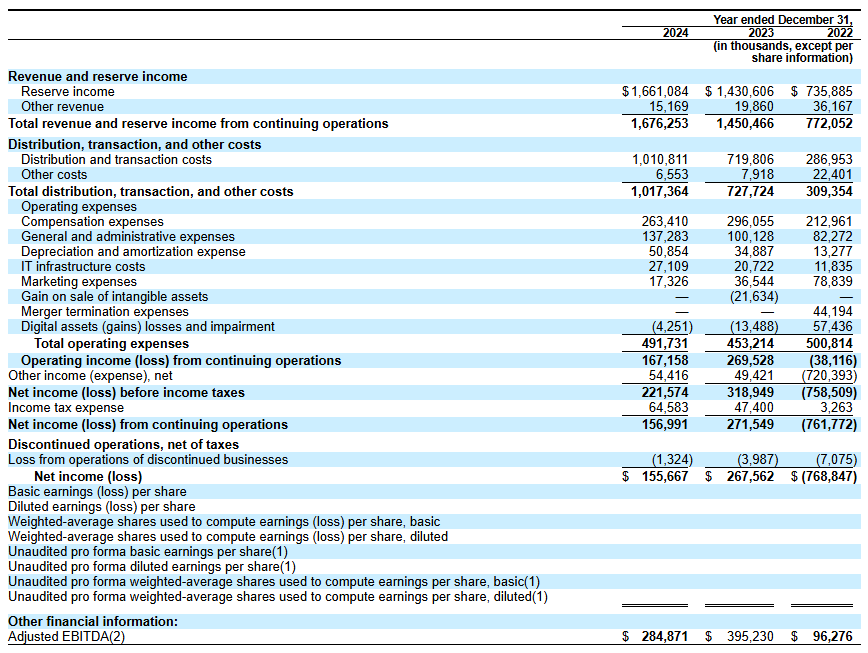

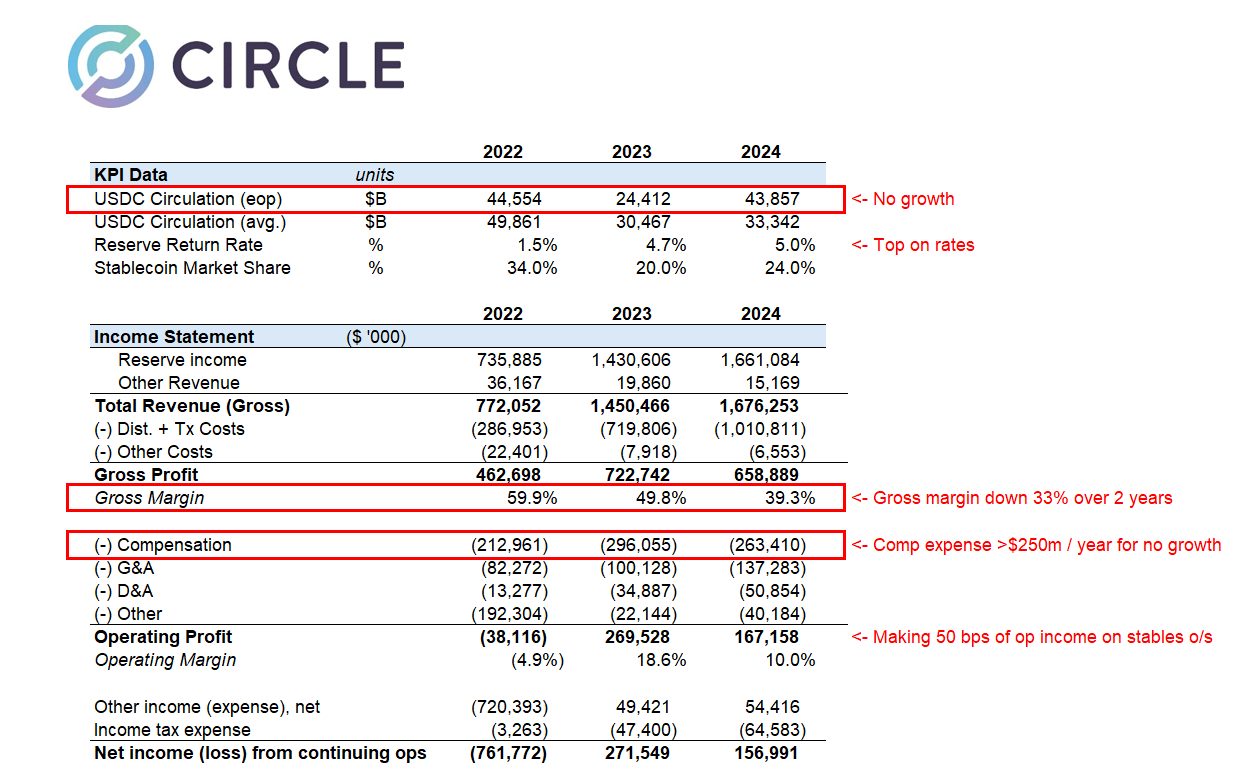

Circle’s IPO filing reveals revenue of $1.67 billion in 2024, a notable increase from previous years. However, a closer examination of the company’s financials has uncovered some challenges.

Matthew Sigel, Head of Digital Assets Research at VanEck, noted that revenue increased 16% year over year. Yet, at the same time, the company reported a 29% decrease in EBITDA year over year, indicating a decline in operational profitability. Additionally, net income fell by 42%, reflecting a significant drop in overall profitability.

Sigel pointed out four factors contributing to the decline in these financial metrics. He explained that the company’s rapid expansion and new service integrations negatively impacted net income.

Furthermore, the discontinuation of services like Circle Yield reduced other revenue streams. This, in turn, exacerbated the decline in profitability.

“Costs related to restructuring, legal settlements, and acquisition-related expenses also played a role in the decline in EBITDA and net income, despite overall revenue growth,” Sigel added.

Importantly, he focused on Circle’s increased distribution and transaction costs. Sigel revealed that the cost rose due to higher fees paid to partners like Coinbase and Binance.

A related post by Farside Investors on X (formerly Twitter) shed further light on these expenses.

“In 2024, the company spent over $1 billion on “distribution and transaction costs,” probably much higher than Tether as a % of revenue,” the post read.

This prompts speculation that Circle may be overspending to maintain its market share in the competitive stablecoin sector. The company’s historical performance further fuels skepticism.

Farside Investors added that in 2022, Circle recorded a staggering $720 million loss. Notably, the year was marked by significant turmoil in the crypto industry, including the high-profile collapses of FTX and Three Arrows Capital (3AC).

This suggests that Circle may be vulnerable to market shocks. Thus, it calls into question the company’s risk management capabilities—especially in the inherently volatile crypto market.

“The gross creation and redemption numbers are a lot higher than we would have thought for USDC. Gross creations in a year are many multiples higher than the outstanding balance,” Farside Investors remarked.

In addition, analyst Omar expressed doubts about Circle’s $5 billion valuation.

“Nothing to love in the Circle IPO filing and no idea how it prices at $5 billion,” he questioned.

He drew attention to several concerns, including the company’s gross margins being severely impacted by high distribution costs. The analyst also pointed out that the deregulation of the US market is poised to disrupt Circle’s position.

Additionally, Omar stressed that Circle spends over $250 million annually on compensation and another $140 million on general and administrative costs, raising questions about its financial efficiency. He also noted that interest rates—core income drivers for Circle—will likely decline, presenting additional challenges.

“32x ’24 earnings for a business that just lost its mini-monopoly and facing several headwinds is expensive when growth structurally challenged,” Omar said.

Ultimately, the analyst concluded that the IPO filing was a desperate attempt to secure liquidity before facing serious market difficulties.

Meanwhile, Wyatt Lonergan, General Partner at VanEck, shared his predictions for Circle’s IPO, outlining four potential scenarios. In the base case, he forecasted that Circle would capitalize on the stablecoin narrative and secure key partnerships to drive growth.

In a bear case, Lonergan speculated that poor market conditions might lead to a Coinbase buyout.

“Circle IPOs, the market continues to tank, Circle stock goes with it. Poor business fundamentals cited. Coinbase swoops in to buy at a discount to the IPO price. USDC is all theirs at long last. Coinbase acquires Circle for something close to the IPO price, and they never go public,” Lonergan claimed.

Lastly, he outlined a probable scenario where Ripple bids up Circle’s valuation to a staggering $15 to $20 billion and acquires the company.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoBitcoin Price Battles Key Hurdles—Is a Breakout Still Possible?

-

Bitcoin20 hours ago

Bitcoin20 hours ago$500 Trillion Bitcoin? Saylor’s Bold Prediction Shakes the Market!

-

Bitcoin21 hours ago

Bitcoin21 hours agoBig Bitcoin Buy Coming? Saylor Drops a Hint as Strategy Shifts

-

Market20 hours ago

Market20 hours agoCoinbase Stock Plunges 30% in Worst Quarter Since FTX Collapse

-

Altcoin19 hours ago

Altcoin19 hours agoWill XRP, SOL, ADA Make the List?

-

Altcoin18 hours ago

Altcoin18 hours agoBTC, ETH, XRP, DOGE Fall Following Weak PMI, JOLTS Data

-

Altcoin17 hours ago

Altcoin17 hours agoBinance Update Sparks 50% Decline For Solana Meme Coin ACT: Details

-

Market22 hours ago

Market22 hours agoXRP Price Struggles as Whale Selling Rises To $2.3 Billion