Market

Animoca Brands Launches MOCA Coin, Eyes IPO in 2025

Animoca Brands launched its own token, MOCA Coin, on Thursday. The launch turns heads, given the rarity of public companies in crypto making such a move.

The GameFi and metaverse giant is planning to go public in early 2025 in Hong Kong or the Middle East. The two regions are famous for their favorable stance towards cryptocurrency.

MOCA Coin Soars to $141 Million Market Cap

Following its launch, MOCA Coin skyrocketed by over 90%, with CoinGecko data showing a market capitalization above $141 million. Serving as a utility token in Animoca’s ecosystem of Web3 games and applications, it will help expand Animoca Brands’ network and boost the conglomerate’s growth.

“Mocaverse and MOCA Coin represent cultural capital that today may appear objectified (like most NFTs). However, it will become more social and symbolic in meaning and purpose. This is as Mocaverse’s reputation layer grows and increasingly rewards and incentivizes the creation of cultural capital,” Animoca Brands co-founder and executive chair Yat Siu wrote in a Medium post.

Read more: 7 Best Cloud Gaming Services in 2024

The surge in market capitalization is unsurprising given Animoca Brands’ heft as a leading force in the cryptocurrency gaming and metaverse sectors. However, the token launch stirred debate, given the company’s plans to go public early next year.

In hindsight, the Australian Securities Exchange (ASX) delisted Animoca Brands in 2020 for owning token-issuing entities like The Sandbox (SAND). The regulator cited questionable governance and the use of simple agreements for future equity (SAFEs) in its subsidiaries. Despite submitting a 39-page report to address these concerns, the ASX delisted the company.

SAFEs provide a straightforward and efficient way for startups to raise capital, avoiding complexities associated with traditional equity financing instruments. They allow investors to invest in early-stage companies and participate in their growth potential while mitigating some risks typically associated with early-stage investments.

Amid regulatory uncertainty, public companies remain skeptical about issuing their own tokens. Coinbase, for example, has not launched a token despite going public on the Nasdaq three years ago.

Skepticism for firms doing business in the US comes amid tough regulation from the US Securities and Exchange Commission (SEC). According to the regulator, companies deceptively use Initial Coin Offerings (ICOs) to raise capital from investors without clear disclosures, as the law requires.

The regulator sued multiple firms for raising funds through unregistered ICOs. Among them are smart contract-auditing firm Quantstamp, Token Metrics CEO Ian Balina, and Loci Inc. and its chief executive, John Wise. The regulator also investigated Binance and Ripple on ICO-related claims.

Animoca Brands CEO on Token Launch

According to Yat Siu, the token launch does not compromise its oncoming initial product offering (IPO) because it is not equity. Speaking to a news site, the Animoca Brands executive said it is a utility token with “no profit sharing and no claim to profit.” This means MOCA Coin holders will not receive earnings per share against their holdings.

It is worth noting, however, that Animoca Brands does not do business in the US, unlike Coinbase. This puts the firm and its executive chair outside the purview of the US SEC, led by chair Gary Gensler.

Read more: Who Is Gary Gensler? Everything To Know About the SEC Chairman

In late June, the SEC chair highlighted compliance issues within the crypto industry. He noted that securities laws are established to safeguard investors and maintain fair, orderly, and efficient markets. Gensler added that when tokens and platforms fail to provide necessary disclosures to investors, this lack of compliance poses risks to the public.

“And we have a set of pretty clear rules. There’s nothing inconsistent about crypto securities and the securities laws,” he stated.

Furthermore, Gensler warned that moving operations abroad would not excuse crypto companies from following US securities laws. The regulator’s stance reflects the challenges of complying with regulatory restrictions in the US.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

WisdomTree Europe Launches XRP ETP

ETF issuer WisdomTree’s European division just announced a new ETP based on XRP. This product is currently available in four EU countries, which has led XRP’s price to jump slightly.

ETPs are a common issuer strategy to earn revenue without ETF approval, but Europe will not necessarily approve one even if the US does so.

WisdomTree’s XRP ETP

WisdomTree, one of the Bitcoin ETF issuers in the US, announced that its European branch is offering an exchange-traded product (ETP) based on XRP. This new product is currently available in Germany, Switzerland, France, and the Netherlands. A growing number of issuers have filed for an XRP ETF, but WisdomTree is taking a slightly different tack.

“The WisdomTree Physical XRP ETP offers a simple, secure, and low-cost way to gain exposure to XRP, one of the largest cryptocurrencies by market capitalization. Backed 100% by XRP, XRPW is the lowest-priced XRP ETP in Europe, providing direct spot price exposure,” the announcement claimed.

The possibility of an official XRP ETF is growing with the current bull market, and Ripple CEO Brad Garlinghouse considers it “inevitable.” Still, it hasn’t happened yet, and ETP offerings allow issuers to somewhat address customers’ requirements. BitWise, which has also filed for an XRP ETF in the US, recently acquired a European ETP issuer to enter the same market.

WisdomTree, however, is no stranger to this market strategy. In May this year, it won approval to offer ETPs based on Bitcoin and Ethereum to British investors.

The UK has not yet approved a full ETF for either of these assets, but WisdomTree still gained market access. Even a fraction of the XRP market could also prove lucrative; the asset’s value spiked today.

WisdomTree Europe’s strategy page does not describe any further actions upon full approval. Even if the US approves an XRP ETF under the SEC’s new leadership, that won’t necessarily benefit WisdomTree’s European branch. For now, these ETPs built on XRP will have to suffice for this market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Rallies 10% and Targets More Upside

Ethereum price started a fresh increase above the $3,220 zone. ETH is rising and aiming for more gains above the $3,350 resistance.

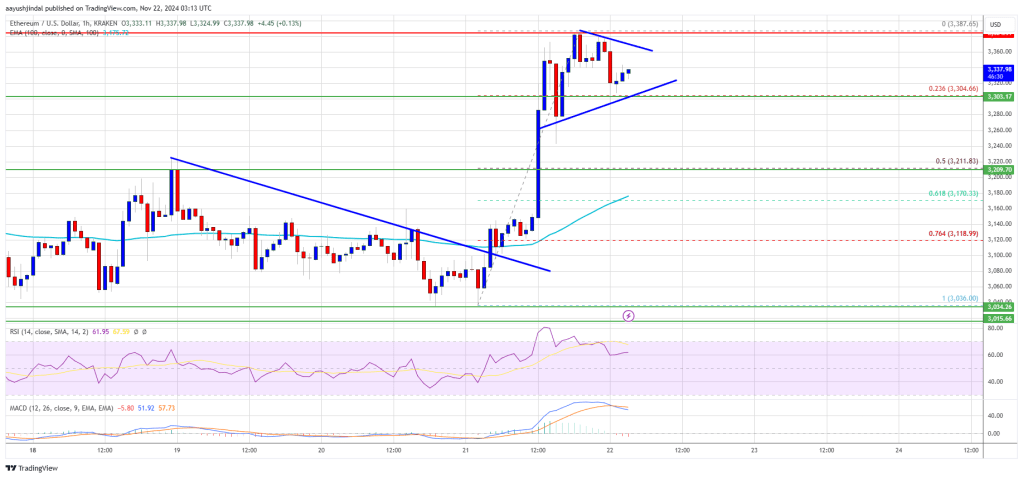

- Ethereum started a fresh increase above the $3,220 and $3,300 levels.

- The price is trading above $3,250 and the 100-hourly Simple Moving Average.

- There is a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could gain bullish momentum if it clears the $3,385 resistance zone.

Ethereum Price Regains Traction

Ethereum price remained supported above $3,000 and started a fresh increase like Bitcoin. ETH gained pace for a move above the $3,150 and $3,220 resistance levels.

The bulls pumped the price above the $3,300 level. It gained over 10% and traded as high as $3,387. It is now consolidating gains above the 23.6% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high.

Ethereum price is now trading above $3,220 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,350 level. There is also a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD.

The first major resistance is near the $3,385 level. The main resistance is now forming near $3,420. A clear move above the $3,420 resistance might send the price toward the $3,550 resistance. An upside break above the $3,550 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,650 resistance zone or even $3,880.

Another Decline In ETH?

If Ethereum fails to clear the $3,350 resistance, it could start another decline. Initial support on the downside is near the $3,300 level. The first major support sits near the $3,250 zone.

A clear move below the $3,250 support might push the price toward $3,220 or the 50% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high. Any more losses might send the price toward the $3,150 support level in the near term. The next key support sits at $3,050.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,250

Major Resistance Level – $3,385

Market

Rallies 10% and Targets More Upside

Ethereum price started a fresh increase above the $3,220 zone. ETH is rising and aiming for more gains above the $3,350 resistance.

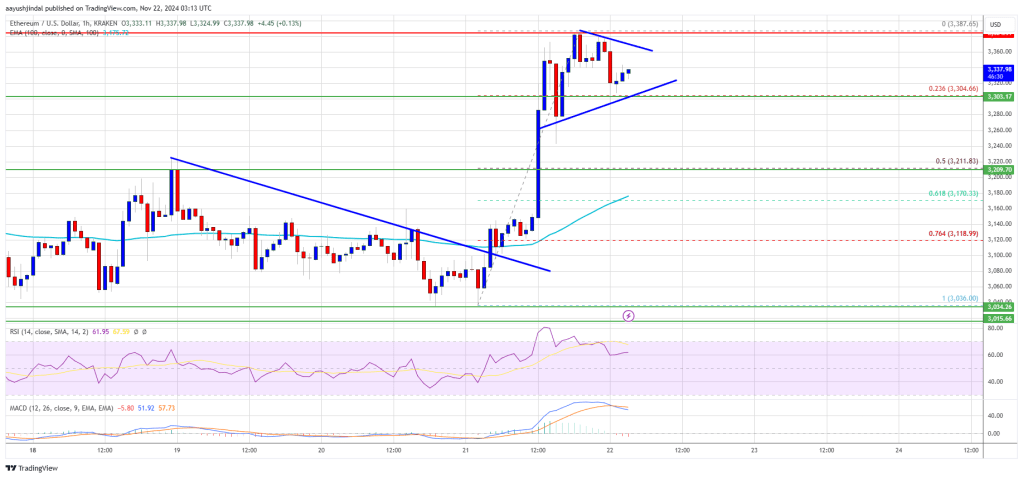

- Ethereum started a fresh increase above the $3,220 and $3,300 levels.

- The price is trading above $3,250 and the 100-hourly Simple Moving Average.

- There is a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could gain bullish momentum if it clears the $3,385 resistance zone.

Ethereum Price Regains Traction

Ethereum price remained supported above $3,000 and started a fresh increase like Bitcoin. ETH gained pace for a move above the $3,150 and $3,220 resistance levels.

The bulls pumped the price above the $3,300 level. It gained over 10% and traded as high as $3,387. It is now consolidating gains above the 23.6% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high.

Ethereum price is now trading above $3,220 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,350 level. There is also a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD.

The first major resistance is near the $3,385 level. The main resistance is now forming near $3,420. A clear move above the $3,420 resistance might send the price toward the $3,550 resistance. An upside break above the $3,550 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,650 resistance zone or even $3,880.

Another Decline In ETH?

If Ethereum fails to clear the $3,350 resistance, it could start another decline. Initial support on the downside is near the $3,300 level. The first major support sits near the $3,250 zone.

A clear move below the $3,250 support might push the price toward $3,220 or the 50% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high. Any more losses might send the price toward the $3,150 support level in the near term. The next key support sits at $3,050.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,250

Major Resistance Level – $3,385

-

Ethereum23 hours ago

Ethereum23 hours agoFundraising platform JustGiving accepts over 60 cryptocurrencies including Bitcoin, Ethereum

-

Market19 hours ago

Market19 hours agoSouth Korea Unveils North Korea’s Role in Upbit Hack

-

Market23 hours ago

Market23 hours agoCardano’s Hoskinson Wants Brian Armstrong for US Crypto-Czar

-

Altcoin17 hours ago

Altcoin17 hours agoSui Network Back Online After 2-Hour Outage, Price Slips

-

Market22 hours ago

Market22 hours agoLitecoin (LTC) at a Crossroads: Can It Rebound and Rally?

-

Altcoin16 hours ago

Altcoin16 hours agoDogecoin Whale Accumulation Sparks Optimism, DOGE To Rally 9000% Ahead?

-

Altcoin21 hours ago

Altcoin21 hours agoWhy FLOKI Price Hits 6-Month Peak With 5% Surge?

-

Bitcoin14 hours ago

Bitcoin14 hours agoMarathon Digital Raises $1B to Expand Bitcoin Holdings