Market

German Bitcoin Sales, US CPI Data, and More

This week, the German government’s continued Bitcoin (BTC) sell-offs significantly impacted the crypto market. The release of the US Consumer Price Index (CPI) data also introduced further complexity to the economic scenario.

Meanwhile, a security breach on Compound Finance’s website has raised alarms in the decentralized finance (DeFi) community, highlighting security concerns. These developments have sent ripples through the market, marking another volatile week.

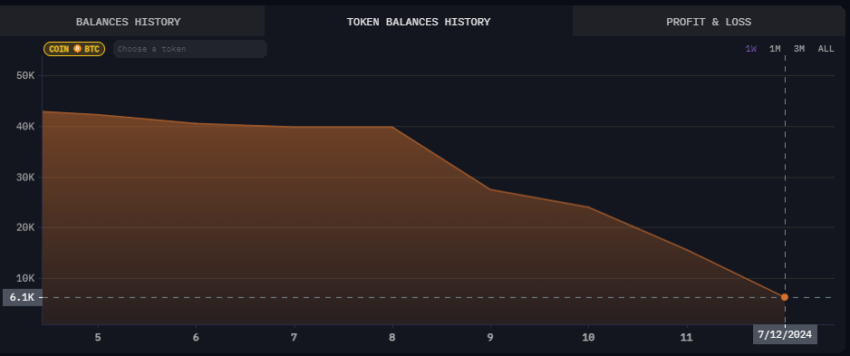

Experts Weigh In on the Future Impact of German Bitcoin Sales

This week, the German government continued its Bitcoin sell-offs, significantly affecting the crypto market. Data from Arkham Intelligence revealed that Germany’s Bitcoin holdings dropped from 42,000 BTC on July 5 to 6,000 BTC currently.

The government wallet, now holding approximately $349.17 million worth of BTC, has transferred Bitcoins to various addresses. These transactions include crypto exchanges like Kraken, Coinbase, Bitstamp and market makers such as Cumberland and Flow Traders.

Read more: Who Owns the Most Bitcoin in 2024?

The persistent sell-offs have undeniably stirred the market, with Bitcoin’s price reflecting the ongoing sales spree. When Germany began these transfers on June 19, Bitcoin traded around $65,000. As of now, it has dropped to $57,000.

However, industry experts believe that as the wallet balance decreases, the sales will end. Consequently, the impact on Bitcoin’s price will gradually diminish.

US CPI Data Provides a Glimmer of Hope for Inflation

Bitcoin experienced a notable price jump, reaching $59,313, immediately after the Bureau of Labor Statistics (BLS) released the June US Consumer Price Index (CPI) data. Inflation in the US dropped to 3% year-over-year, slightly below market expectations of 3.1% and down from May’s 3.3%. This data suggests a 0.1% month-over-month decline.

Federal Reserve Chair Jerome Powell’s recent testimony before Congress highlighted that the Fed is not yet ready to cut interest rates. Powell emphasized that the inflation rate must show sustained progress towards the 2% target before any rate cuts can be considered. This cautious approach aligns with the latest CPI figures.

Lower-than-expected inflation is generally positive for the crypto market. Cryptocurrencies, often considered risk-on assets, tend to react bullishly to favorable economic indicators like low inflation. Jag Kooner, Head of Derivatives at Bitfinex, shared his perspective on the recent CPI data release with BeInCrypto.

“The lower-than-expected CPI reading today signals a more significant slowdown in inflation. This could reinforce the market’s expectation of a rate cut in September, boosting both equities and cryptocurrencies by increasing liquidity and risk appetite,” Kooner explained.

Cardano’s Chang Hard Fork Nears Completion

In a live Ask Me Anything (AMA) session on YouTube, Cardano founder Charles Hoskinson confirmed that the Chang hard fork is practically finished and will roll out next week. He also celebrated the completion of all elements of the Cardano Improvement Proposal (CIP) 1694, which is essential for advancing Cardano’s infrastructure.

The Chang fork will introduce Delegates (DReps) elected by Cardano token (ADA) holders. These representatives will draft the Cardano constitution, establishing the network’s supreme law.

Recently released Node 9.0 supports the initial phase of CIP-1694 in production environments but does not yet include DRep voting and all governance activities. These will be available in Node 10.0.

Named in honor of Cardano enthusiast Phil Chang, who passed away two years ago, the Chang hard fork aims to alter the ownership structure of the Cardano blockchain, initiating the Voltaire era and fully decentralizing network management.

Cardanoscan data shows that exchanges and stake pools are not yet ready for the hard fork despite this update. However, the Cardano community remains optimistic about the network’s imminent changes.

Binance Delists Four Altcoins, Prices Plummet

On Monday, Binance, the world’s largest crypto exchange by trading volume, announced it would no longer support four altcoins: BarnBridge (BOND), Dock (DOCK), Mdex (MDX), and Polkastarter (POLS). This delisting will take effect on July 22 at 03:00 UTC.

Following the announcement, the affected tokens saw significant price declines. DOCK plummeted nearly 30%, MDX dropped by 23.65%, and BOND and POLS both experienced over 17% losses. However, prices have slightly recovered since the initial drop.

DNS Attack Targets Multiple DeFi Platforms

On Thursday, Compound Labs, the team behind Compound Finance, announced that its website had been compromised. Around three hours later, Celer Network issued a similar warning, indicating a potential DNS domain attack affecting multiple projects simultaneously.

Blockchain security experts, including 0xngmi, founder of DefiLlama, and Samczsun, a researcher at Paradigm, suspect vulnerabilities in Squarespace, the website registrar, may be linked to the breaches. 0xngmi pointed out that around 65 other DeFi platform domains connected to Squarespace might be at risk, urging the community to avoid these websites for now.

Web3 security firm Blockaid shared its analysis, indicating that attackers hijack DNS records of projects hosted on Squarespace. The Pendle team also commented on this incident, ensuring that their domain and funds are secure. Despite these security breaches, the team claimed that Pendle protocol and smart contracts remain unaffected.

This week also saw developments in the celebrity meme coins. Daddy Tate (DADDY), a Solana-based meme coin related to controversial influencer Andrew Tate, reached more than 55,000 holders. DEX Screener data shows that DADDY is currently trading at $0.1380, with a market capitalization of $82.7 million.

Read more: 11 Top Solana Meme Coins to Watch in July 2024

Additionally, the crypto market buzzed with Argentine soccer player Lionel Messi joining the list of celebrities promoting meme coins through social media. However, some believe Messi’s Instagram account was hacked to promote WATER, another Solana meme coin.

Despite speculation, the publication had not been removed, and Messi had not reported his Instagram account as compromised. This has led to disappointment among fans and further speculation within the crypto community.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana (SOL) Holds Steady After Decline—Breakout or More Downside?

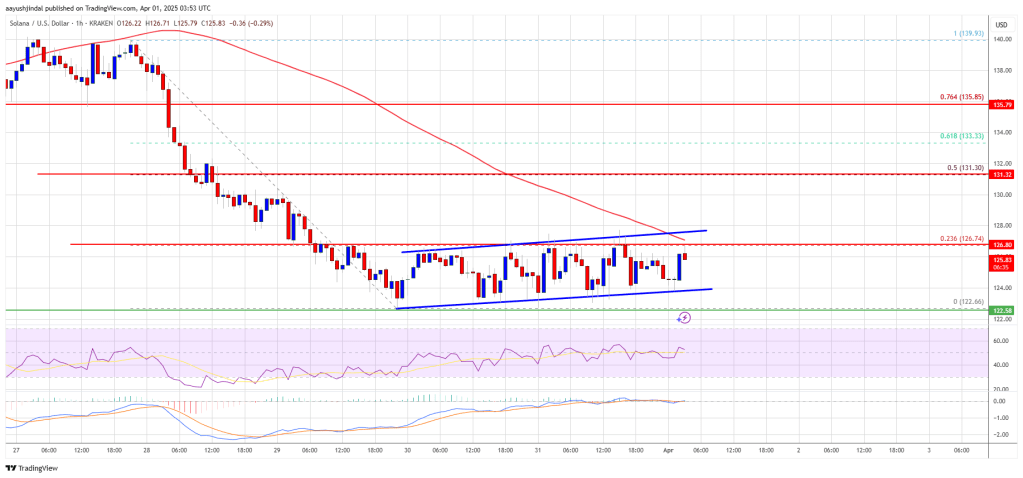

Solana started a fresh decline below the $132 support zone. SOL price is now consolidating and might struggle to recover above the $126 resistance.

- SOL price started a recovery wave from the $122 support zone against the US Dollar.

- The price is now trading below $130 and the 100-hourly simple moving average.

- There is a key rising channel forming with support at $124 on the hourly chart of the SOL/USD pair (data source from Kraken).

- The pair could start a fresh increase if the bulls clear the $126 zone.

Solana Price Faces Resistance

Solana price started a fresh decline below the $135 and $132 levels, like Bitcoin and Ethereum. SOL even declined below the $125 support level before the bulls appeared.

A low was formed at $122.64 and the price recently started a consolidation phase. There was a minor increase above the $125 level. The price tested the 23.6% Fib retracement level of the downward move from the $140 swing high to the $122 low.

Solana is now trading below $126 and the 100-hourly simple moving average. There is also a key rising channel forming with support at $124 on the hourly chart of the SOL/USD pair.

On the upside, the price is facing resistance near the $126 level. The next major resistance is near the $128 level. The main resistance could be $132 or the 50% Fib retracement level of the downward move from the $140 swing high to the $122 low.

A successful close above the $132 resistance zone could set the pace for another steady increase. The next key resistance is $136. Any more gains might send the price toward the $142 level.

Another Decline in SOL?

If SOL fails to rise above the $128 resistance, it could start another decline. Initial support on the downside is near the $124 zone. The first major support is near the $122 level.

A break below the $122 level might send the price toward the $115 zone. If there is a close below the $115 support, the price could decline toward the $102 support in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is losing pace in the bearish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is above the 50 level.

Major Support Levels – $124 and $122.

Major Resistance Levels – $128 and $132.

Market

Ethereum Price Faces a Tough Test—Can It Clear the Hurdle?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price started another decline and traded below the $1,850 level. ETH is now consolidating and facing key hurdles near the $1,850 level.

- Ethereum struggled to continue higher above the $1,980 resistance level.

- The price is trading below $1,860 and the 100-hourly Simple Moving Average.

- There was a break above a connecting bearish trend line with resistance at $1,810 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair must clear the $1,850 and $1,880 resistance levels to start a decent increase.

Ethereum Price Attempts Recovery

Ethereum price failed to continue higher above $2,050 and started another decline, like Bitcoin. ETH declined below the $1,880 and $1,850 support levels.

It tested the $1,765 zone. A low was formed at $1,767 and the price recently started a short-term recovery wave. The price climbed above the $1,800 resistance. There was a move above the 23.6% Fib retracement level of the downward move from the $2,033 swing high to the $1,767 low.

There was also a break above a connecting bearish trend line with resistance at $1,810 on the hourly chart of ETH/USD. Ethereum price is now trading below $1,860 and the 100-hourly Simple Moving Average.

On the upside, the price seems to be facing hurdles near the $1,850 level. The next key resistance is near the $1,860 level. The first major resistance is near the $1,900 level and the 50% Fib retracement level of the downward move from the $2,033 swing high to the $1,767 low.

A clear move above the $1,900 resistance might send the price toward the $2,000 resistance. An upside break above the $2,000 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,050 resistance zone or even $2,120 in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $1,850 resistance, it could start another decline. Initial support on the downside is near the $1,800 level. The first major support sits near the $1,780 zone.

A clear move below the $1,780 support might push the price toward the $1,765 support. Any more losses might send the price toward the $1,710 support level in the near term. The next key support sits at $1,665.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $1,800

Major Resistance Level – $1,850

Market

Top 3 Made in USA Coins to Watch In April

Made in USA coins continue to try a rebound, with Solana (SOL), RENDER, and Jupiter (JUP) standing out as key names to watch in April. Despite recent price corrections, each of these tokens plays a major role in high-growth areas like DeFi, AI, and blockchain infrastructure.

Solana has seen its price dip, but ecosystem activity remains strong; RENDER is riding the wave of AI demand despite market turbulence; and Jupiter is showing solid usage metrics even as its token struggles. Here’s a closer look at the technical and fundamental setups for each of these standout U.S.-based projects.

Solana (SOL)

Solana has faced a notable price correction over the past week, with its value dropping nearly 13%. If this bearish momentum continues, the token could be on track to retest the critical support level at $120.

A breakdown below that could see SOL sliding further toward the $112 mark.

Despite the recent downturn, Solana remains one of the most relevant Made in USA coins and continues to show impressive usage metrics. PumpFun, for example, generated nearly $9 million in revenue over the past 24 hours, second only to Tether.

After a short period when BNB led the DEX volume race, Solana seems to be regaining traction—its decentralized exchange volume has surged by 128% in just seven days, reaching $18 billion and surpassing both Ethereum and BNB.

If this recovery in momentum persists, SOL could target a move toward the $131 resistance level. A successful breakout there could open the door to further gains toward $136 and potentially $147.

RENDER

RENDER, one of the most prominent U.S.-based cryptocurrencies with a focus on artificial intelligence, has seen its price decline nearly 11% over the past seven days.

This drop reflects the broader correction that has impacted many AI-related tokens in recent months.

However, new developments in the AI infrastructure space may provide a catalyst for a potential rebound, especially as the limitations of centralized systems become clear.

If bullish momentum returns to the AI sector, RENDER could look to challenge the resistance at $3.47, and a successful breakout might open the door for a rally toward $4.21.

However, if the current correction deepens, the token could fall to test the $3.14 support level. A breakdown there may trigger further losses, potentially dragging RENDER down to $2.83 or even $2.52—its lowest level in recent weeks.

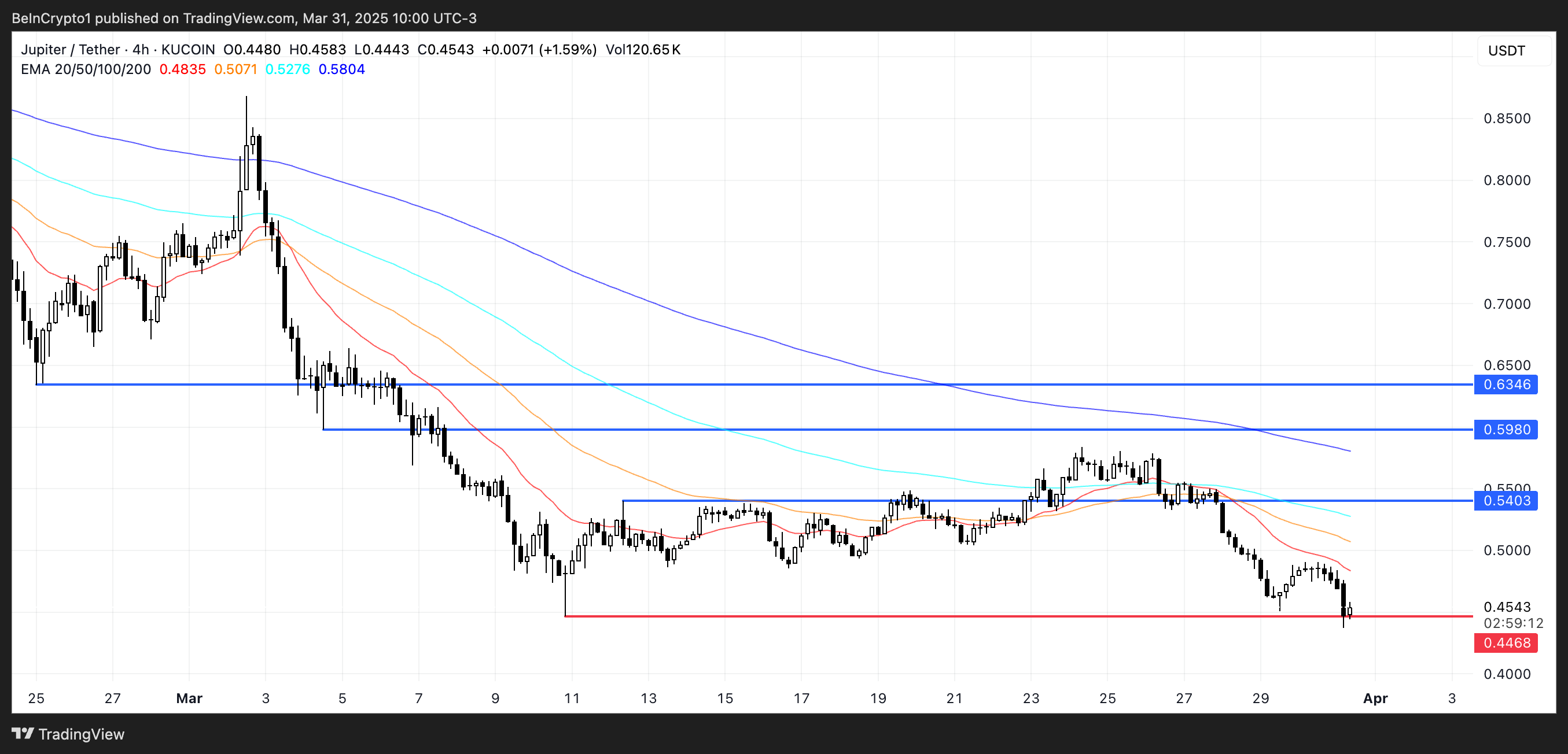

Jupiter (JUP)

Despite Solana’s recent struggles, Jupiter—its leading DEX aggregator—is demonstrating impressive strength in terms of activity.

In the last 24 hours, Jupiter ranked as the fourth-highest protocol in crypto by fee generation, collecting nearly $2.5 million.

Only Tether, PumpFun, and Circle managed to outperform it, highlighting the platform’s growing relevance within the Solana ecosystem even during periods of broader market weakness.

However, JUP, Jupiter’s native token, hasn’t mirrored this positive momentum. Its price has dropped over 21% in the past week, being one of the worst performers among the biggest Made in USA coins. It has remained below the $0.65 mark for three consecutive weeks.

With JUP now hovering dangerously close to a key support at $0.44, a breakdown could see the token dip below $0.40 for the first time ever.

Still, if market sentiment shifts and momentum returns, JUP could begin climbing again—first testing resistance at $0.54, then potentially moving toward $0.598 and even $0.63 if bullish pressure intensifies.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market20 hours ago

Market20 hours agoDon’t Fall for These Common Crypto Scams

-

Bitcoin13 hours ago

Bitcoin13 hours agoStrategy Adds 22,048 BTC for Nearly $2 Billion

-

Market12 hours ago

Market12 hours agoTrump Family Gets Most WLFI Revenue, Causing Corruption Fears

-

Altcoin16 hours ago

Altcoin16 hours ago$33 Million Inflows Signal Market Bounce

-

Market22 hours ago

Market22 hours agoBitcoin Price Nears $80,000; Fuels Death Cross Potential

-

Market15 hours ago

Market15 hours agoBitcoin Mining Faces Tariff Challenges as Hashrate Hits New ATH

-

Ethereum13 hours ago

Ethereum13 hours agoEthereum Price Confirms Breakout From Ascending Triangle, Target Set At $7,800

-

Bitcoin18 hours ago

Bitcoin18 hours agoMarathon Digital to Sell $2 Billion in Stock to Buy Bitcoin