Market

XRP Bulls Face Continued Pressure: Key Challenges Ahead

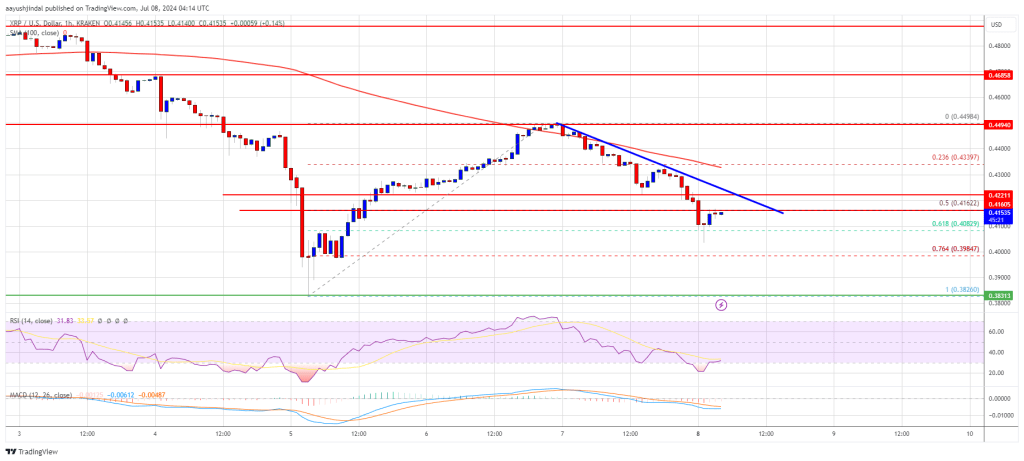

XRP price is struggling below the $0.4250 support zone. The price is consolidating losses and might struggle to recover above the $0.450 resistance.

- XRP price struggled to recover above $0.450 and started another decline.

- The price is now trading below $0.4250 and the 100-hourly Simple Moving Average.

- There is a connecting bearish trend line forming with resistance at $0.420 on the hourly chart of the XRP/USD pair (data source from Kraken).

- The pair might recover, but the upsides might be limited above $0.4350 and $0.450.

XRP Price Moves In The Red Zone

XRP price struggled to clear the $0.450 resistance and started a fresh decline, like Bitcoin and Ethereum. The bears took control and pushed the price below the $0.4320 support.

The pair even declined heavily below the $0.4250 support level. There was a drop below the 50% Fib retracement level of the upward move from the $0.3826 swing low to the $0.4498 high. The bulls are now trying to protect the $0.4050 support zone.

It is now trading below $0.4250 and the 100-hourly Simple Moving Average. On the upside, the price is facing resistance near the $0.4160 level. The first major resistance is near the $0.420 level.

There is also a connecting bearish trend line forming with resistance at $0.420 on the hourly chart of the XRP/USD pair. The next key resistance could be $0.4220. A clear move above the $0.4220 resistance might send the price toward the $0.4380 resistance. The next major resistance is near the $0.450 level. Any more gains might send the price toward the $0.4650 resistance.

More Losses?

If XRP fails to clear the $0.420 resistance zone, it could start another decline. Initial support on the downside is near the $0.4050 level or the 61.8% Fib retracement level of the upward move from the $0.3826 swing low to the $0.4498 high.

The next major support is at $0.40. If there is a downside break and a close below the $0.40 level, the price might continue to decline toward the $0.3750 support in the near term.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now below the 50 level.

Major Support Levels – $0.4050 and $0.400.

Major Resistance Levels – $0.420 and $0.4380.

Market

Solana (SOL) Bulls Stay in Control: Rally Far From Over?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

Ethereum Price Poised for Gains: $3,600 Within Reach?

Ethereum price started a fresh increase above the $3,320 zone. ETH is rising and aiming for more gains above the $3,500 resistance.

- Ethereum started a fresh increase above the $3,300 and $3,320 levels.

- The price is trading above $3,300 and the 100-hourly Simple Moving Average.

- There is a short-term bearish trend line forming with resistance at $3,350 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could gain bullish momentum if it clears the $3,420 resistance zone.

Ethereum Price Eyes More Gains

Ethereum price remained supported above $3,120 and started a fresh increase like Bitcoin. ETH gained pace for a move above the $3,220 and $3,300 resistance levels.

The bulls pumped the price above the $3,400 level. It gained over 10% and traded as high as $3,499. Recently, there was a downside correction below $3,400. The price dipped below $3,320 and tested $3,280. A low was formed at $3,288 and the price is now consolidating above the 23.6% Fib retracement level of the recent decline from the $3,499 swing high to the $3,288 low.

Ethereum price is now trading above $3,300 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,350 level. There is also a short-term bearish trend line forming with resistance at $3,350 on the hourly chart of ETH/USD.

The first major resistance is near the $3,400 level. The main resistance is now forming near $3,420 or the 61.8% Fib retracement level of the recent decline from the $3,499 swing high to the $3,288 low.

A clear move above the $3,420 resistance might send the price toward the $3,500 resistance. An upside break above the $3,500 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,600 resistance zone or even $3,620.

Downsides Limited In ETH?

If Ethereum fails to clear the $3,350 resistance, it could start another decline. Initial support on the downside is near the $3,320 level. The first major support sits near the $3,285 zone.

A clear move below the $3,285 support might push the price toward $3,220. Any more losses might send the price toward the $3,120 support level in the near term. The next key support sits at $3,040.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,300

Major Resistance Level – $3,350

Market

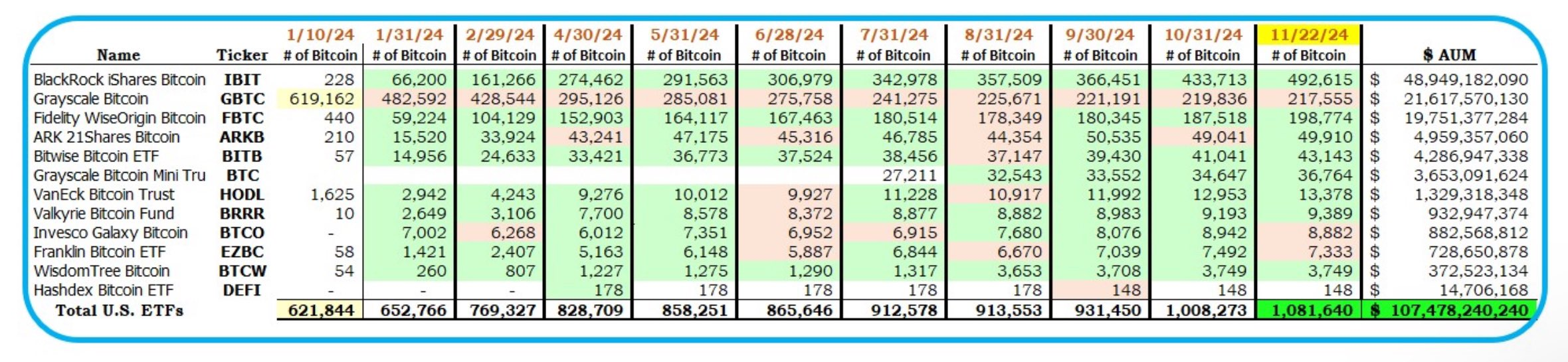

Bitcoin ETFs Could Overtake Gold ETFs by End of The Year

Spot Bitcoin exchange-traded funds (ETFs) in the US are nearing a major milestone. They are set to become the biggest BTC holders in the world, even surpassing the amount held by Bitcoin’s creator, Satoshi Nakamoto.

Additionally, they are catching up to gold ETFs in total net assets.

Bitcoin ETFs on The Verge of Surpassing Satoshi Nakamoto’s BTC Stash

Since their launch in January, US spot Bitcoin ETFs have grown significantly. According to crypto analyst HODL15Capital, these funds now hold about 1.081 million Bitcoin, just below Nakamoto’s estimated 1.1 million.

Satoshi Nakamoto, the anonymous creator of Bitcoin, is believed to own approximately 5.68% of the total Bitcoin supply. These holdings, valued at over $100 billion, place Nakamoto among the world’s wealthiest individuals — if they are alive and a single person.

However, Bloomberg’s Senior ETF Analyst, Eric Balchunas, pointed out that ETFs are now 98% of the way to overtaking Nakamoto. He predicted that if the current pace of inflows continues, this could happen by Thanksgiving.

“US spot ETFs now 98% of way there to passing Satoshi as world’s biggest holder. My over/under date of Thanksgiving looking good. If next 3 days are like the past 3 days flow-wise it’s a done deal,” Balchunas stated.

SoSoValue data shows inflows into these ETFs grew by around 97% week-on-week to $3.3 billion over the last five trading days, with BlackRock’s iShares Bitcoin Trust (IBIT) contributing $2 billion. This surge coincides with the introduction of options trading for these products, which many believe is attracting more institutional investors.

Meanwhile, Bitcoin ETFs are also narrowing the gap with gold ETFs, which currently hold $120 billion in assets under management (AUM). According to Balchunas, Bitcoin ETFs manage $107 billion and could overtake gold ETFs by Christmas.

These bullish predictions reflect Bitcoin’s exceptional performance in 2024. The top cryptocurrency has surged nearly 160% since January, trading near the $100,000 landmark. In addition, its $1.91 trillion market capitalization now exceeds that of silver and major corporations like the state-owned oil company Saudi Aramco.

However, BTC still lags behind gold, which remains the world’s largest asset with a market capitalization of more than $18 billion.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin23 hours ago

Altcoin23 hours agoBTC Continues To Soar, Ripple’s XRP Bullish

-

Bitcoin18 hours ago

Bitcoin18 hours agoBitcoin Price Is Decoupling From Gold Again — What’s Happening?

-

Market21 hours ago

Market21 hours agoWhy a New Solana All-Time High May Be Near

-

Market18 hours ago

Market18 hours agoWinklevoss Urges Scrutiny of FTX and SBF Political Donations

-

Bitcoin17 hours ago

Bitcoin17 hours agoBitcoin Correction Looms As Analyst Predicts Fall To $85,600

-

Bitcoin16 hours ago

Bitcoin16 hours agoAI Company Invests $10 Million In BTC Treasury

-

Market15 hours ago

Market15 hours agoIs the XRP Price Decline Going To Continue?

-

Market14 hours ago

Market14 hours agoToken Unlocks to Watch Next Week: AVAX, ADA and More