Market

TRON to Launch Gas-Free Stablecoin Transfers in Q4 2024

TRON founder Justin Sun announced that his team is developing a stablecoin solution to increase institutional adoption of such assets.

On July 6, Sun revealed that a gas-free stablecoin solution will launch on the TRON network in the fourth quarter of this year.

Gas-Free Stablecoin Solution

Sun explained that this innovation means users will not need to pay a gas fee for stablecoin transactions. Instead, the stablecoins will cover the fees themselves. This solution will initially be available on the TRON Network before expanding to Ethereum and other Ethereum Virtual Machine (EVM)-compatible public chains.

“Our team is developing a new solution that enables gas-free stablecoin transfers. In other words, transfers can be made without paying any gas tokens, with the fees being entirely covered by the stablecoins themselves,” Sun stated.

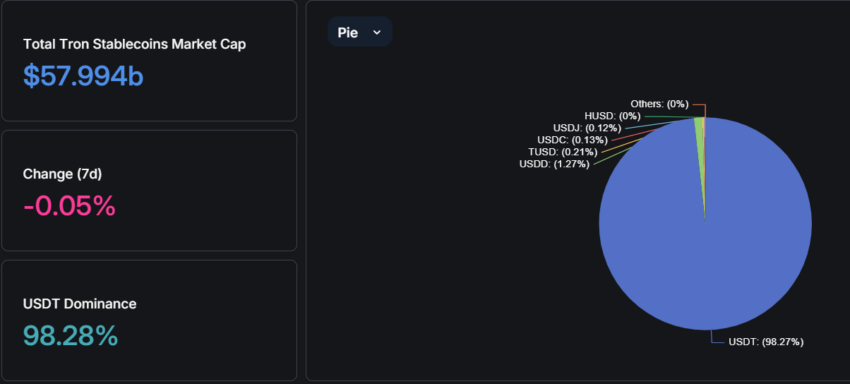

Sun added that this development could help TRON become the first blockchain to surpass one billion addresses. TRON gained prominence by offering affordable stablecoin access, making it the second-largest network for such assets after Ethereum. TRON controls around 36% of the stablecoin market, with Tether dominating 99% of its $58 billion stablecoin supply.

Read more: A Guide to the Best Stablecoins in 2024

Despite facing regulatory challenges and allegations of misuse by fraudsters, Sun believes this solution will further drive institutional stablecoin adoption. Over the years, stablecoins have become one of the most successful real-world applications in the emerging industry, especially after payment giants like PayPal launched theirs.

Stablecoins, typically pegged to the US dollar, offer a stable alternative to volatile digital assets like Bitcoin. In emerging markets, crypto users use these assets to hedge against depreciating national currencies and as a payment method for goods and services.

Read more: 10 Platforms That Provide the Best Interest Rate on Stablecoins

Market experts predict that demand for these assets will continue to grow. Visa notes that this growth is helping it catch up with established settlement networks. Due to this, regulatory efforts in various countries, including the United States, aim to bring these assets into compliance due to their high adoption rate.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cardano Whales Accumulation Hits $55 Million: $1 Target Soon?

On November 20, crypto whales offloaded significant amounts of Cardano (ADA), disrupting its bullish momentum. However, the narrative shifted today as the Cardano whales’ accumulation has taken center stage.

This renewed buying activity suggests that ADA’s price might regain its bullish momentum toward $1. But does the data support this bullish outlook?

Cardano Key Investors Change Their Stance

According to IntoTheBlock, Cardano’s large holders’ netflow has surged to 67.51 million ADA, signaling a significant shift in sentiment among crypto whales. The netflow represents the difference between the amount of ADA purchased and sold by large holders over a specific period.

When netflow increases, it indicates that whales are buying more than they are selling. Typically, this is a bullish signal. Conversely, a drop in netflow suggests more selling by whales, which is generally regarded as bearish.

In this case, the recent netflow increase, valued at approximately $55 million, aligns with ADA’s 11% price surge over the last 24 hours. Thus, this Cardano whales accumulation suggests that ADA may be poised for further gains, with the recent uptick serving as a potential foundation for a higher value.

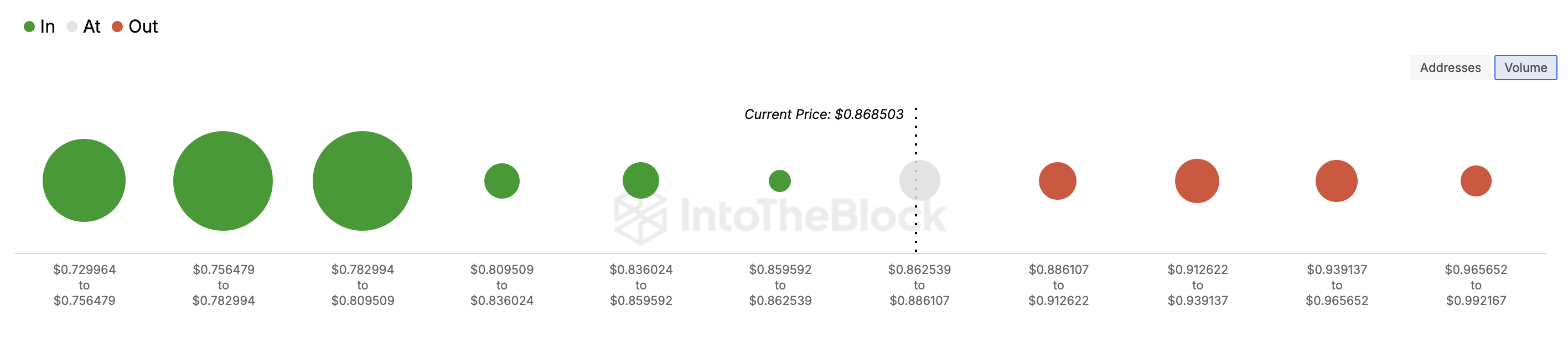

Furthermore, the In/Out of Money Around Price (IOMAP) indicator provides further support for this bullish outlook. For context, the IOMAP analyzes token clusters based on three groups: holders who purchased below the current price (in the money), above the current price (out of the money), and those at breakeven.

This metric is essential for identifying potential support and resistance zones. Specifically, if there is a higher number of tokens “in the money, ” it signifies solid support, as many holders are at a profit and less likely to sell, potentially driving the price higher.

On the other hand, a higher “out of the money,” volume points to resistance, as holders might sell to recover losses, putting downward pressure on the price.

Currently, ADA’s IOMAP shows strong support levels outweighing resistance zones, reinforcing the potential for its price to climb further.

ADA Price Prediction: Move Toward $1 Almost Valid

On the daily chart, ADA’s price has risen above the key Exponential Moving Averages (EMAs). Specifically, the 20-day EMA (blue) and 50 EMA (yellow) are below Cardano’s price. When the price is above the indicator, the trend is bullish.

On the other hand, if the price is below the indicator, the trend is bearish. Therefore, it appears that, with the current trend, ADA could rise higher than $0.87. If this happens, the altcoin might rally toward the $1 mark.

However, if Cardano whales decide to sell and book profits, this prediction might not come to pass. Instead, the price could drop to $0.68.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Approaches $100K: The Countdown Is On

Bitcoin price is rising steadily above the $95,000 zone. BTC is showing positive signs and might soon hit the $100,000 milestone level.

- Bitcoin started a fresh increase above the $95,000 zone.

- The price is trading above $95,000 and the 100 hourly Simple moving average.

- There is a key bullish trend line forming with support at $95,200 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could continue to rise if it clears the $100,000 resistance zone.

Bitcoin Price Sets Another ATH

Bitcoin price remained supported above the $92,000 level. BTC formed a base and started a fresh increase above the $95,000 level. It cleared the $96,500 level and traded to a new high at $98,999 before there was a pullback.

There was a move below the $98,000 level. However, the price remained stable above the 23.6% Fib retracement level of the upward move from the $91,500 swing low to the $98,990 high. There is also a key bullish trend line forming with support at $95,200 on the hourly chart of the BTC/USD pair.

The trend line is close to the 50% Fib retracement level of the upward move from the $91,500 swing low to the $98,990 high. Bitcoin price is now trading above $96,000 and the 100 hourly Simple moving average.

On the upside, the price could face resistance near the $98,880 level. The first key resistance is near the $99,000 level. A clear move above the $99,000 resistance might send the price higher. The next key resistance could be $100,000.

A close above the $100,000 resistance might initiate more gains. In the stated case, the price could rise and test the $102,000 resistance level. Any more gains might send the price toward the $104,500 resistance level.

Downside Correction In BTC?

If Bitcoin fails to rise above the $100,000 resistance zone, it could start a downside correction. Immediate support on the downside is near the $98,000 level.

The first major support is near the $96,800 level. The next support is now near the $95,500 zone and the trend line. Any more losses might send the price toward the $92,000 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $96,800, followed by $95,500.

Major Resistance Levels – $99,000, and $100,000.

Market

This Is Why XRP Price Rallied By 25% and Could Soon Hit $2

Ripple’s (XRP) price rallied by 25% in the last 24 hours following Gary Gensler’s announcement that he would resign as the US Securities and Exchange Commission (SEC) chair on January 20, 2025.

This development comes as a relief to the popular “XRP Army,” which has had to deal with suppressed price action due to the Gensler-led SEC’s nonstop petitions against Ripple. But that is not all that happened.

Ripple Bears Face Notable Liquidation Following Gensler’s Notification

Gensler’s announcement appears to be a positive development for the broader crypto market. But XRP holders seemed to benefit the most. This was particularly significant given the unresolved Ripple-SEC legal issues that have persisted throughout the SEC Chair’s tenure.

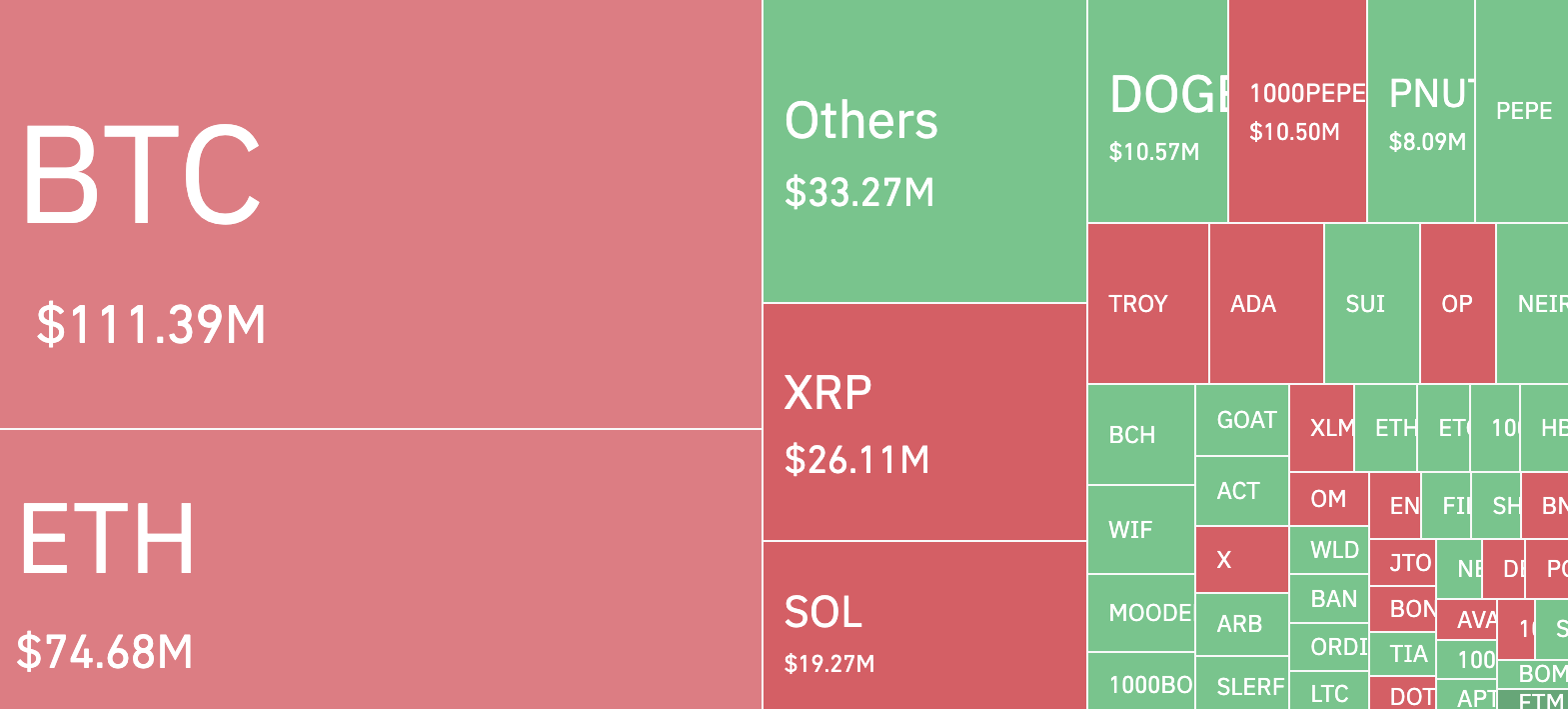

As a result, it came as no surprise that XRP price rallied and outpaced those of any other cryptocurrency in the top 10. Furthermore, the development triggered liquidations totaling $26.11 million over the last 24 hours.

Liquidation occurs when a trader fails to meet the margin requirements for a leveraged position. This forces the exchange to sell off their assets to prevent further losses. In XRP’s case, the liquidation primarily resulted in a short squeeze.

A short squeeze happens when a large number of short positions (traders betting on price declines) are forced to close, driving the price higher as they rush back to buy back the asset.

At press time, XRP trades at $1.40 and currently has a market cap of $80.64 billion. With Gensler almost gone, crypto lawyer John Deaton noted that XRP price gains could be higher, and the market cap could climb to $100 billion.

“XRP soon will achieve a $100B market cap. Times are changing,” Deaton wrote on X.

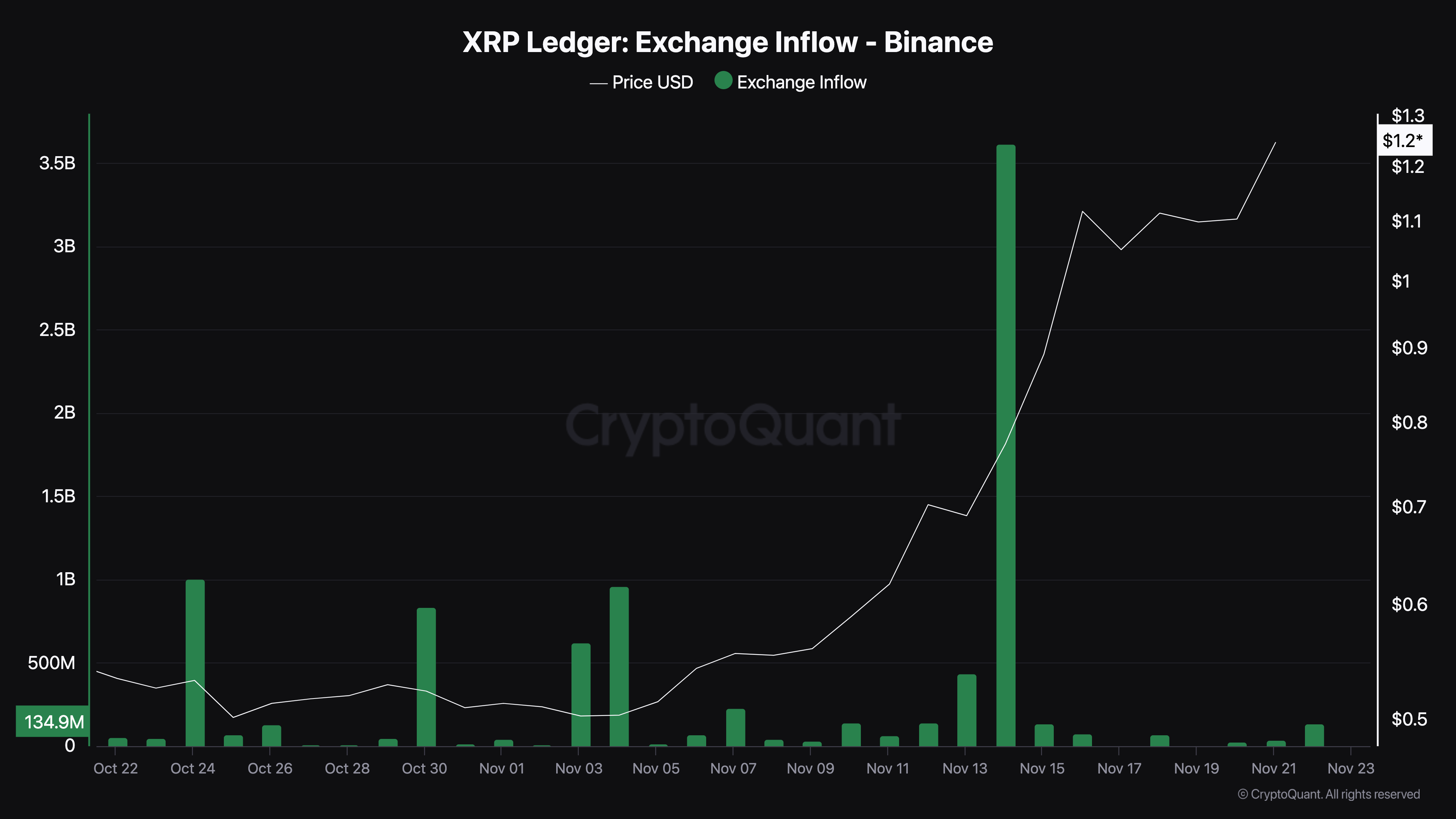

Meanwhile, CryptoQuant data shows that the total number of XRP sent into exchange has significantly decreased. Typically, high values indicate increased selling pressure in the spot market. This is because it suggests that more assets are being offloaded, potentially driving prices lower.

However, since it is low, XRP holders are refraining from selling. If this remains the case, the token’s value could rise higher than $1.40.

XRP Price Prediction: $2 Coming?

According to the 4-hour chart, XRP has been trading within a range of $1.04 to $1.17 since November 18. This sideways movement has resulted in the formation of a bull flag — a bullish chart pattern that signals potential upward momentum.

The bull flag begins with a sharp price surge, forming the flagpole, driven by significant buying pressure that outpaces sellers. This is followed by a consolidation phase, where the price retraces slightly and moves within parallel trendlines, creating the flag structure.

Yesterday, XRP broke out of this pattern, signaling that bulls have seized control of the market. If this momentum persists, XRP’s price could surpass $1.50, potentially approaching the $2 threshold.

However, this bullish scenario hinges on market behavior. If holders decide to secure profits, selling pressure could push XRP’s price below $1, erasing recent gains.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin23 hours ago

Altcoin23 hours agoSui Network Back Online After 2-Hour Outage, Price Slips

-

Altcoin22 hours ago

Altcoin22 hours agoDogecoin Whale Accumulation Sparks Optimism, DOGE To Rally 9000% Ahead?

-

Bitcoin20 hours ago

Bitcoin20 hours agoMarathon Digital Raises $1B to Expand Bitcoin Holdings

-

Regulation14 hours ago

Regulation14 hours agoUK to unveil crypto and stablecoin regulatory framework early next year

-

Market20 hours ago

Market20 hours agoETH/BTC Ratio Plummets to 42-Month Low Amid Bitcoin Surge

-

Regulation17 hours ago

Regulation17 hours agoGary Gensler To Step Down As US SEC Chair In January

-

Ethereum17 hours ago

Ethereum17 hours agoAnalyst Reveals When The Ethereum Price Will Reach A New ATH, It’s Closer Than You Think

-

Market17 hours ago

Market17 hours agoWhy SUI Network Outage Did Not Cause a Price Crash