Market

Paraguay Fights Illegal Miners, and More

BeInCrypto comprehensive Latam Crypto Roundup brings Latin America’s most important news and trends. With reporters in Brazil, Mexico, Argentina, and more, we cover the latest updates and insights from the region’s crypto scene.

This week’s roundup includes stories about Paraguay’s intensified efforts against illegal Bitcoin miners, the growth of cryptocurrency users in Mexico, and more.

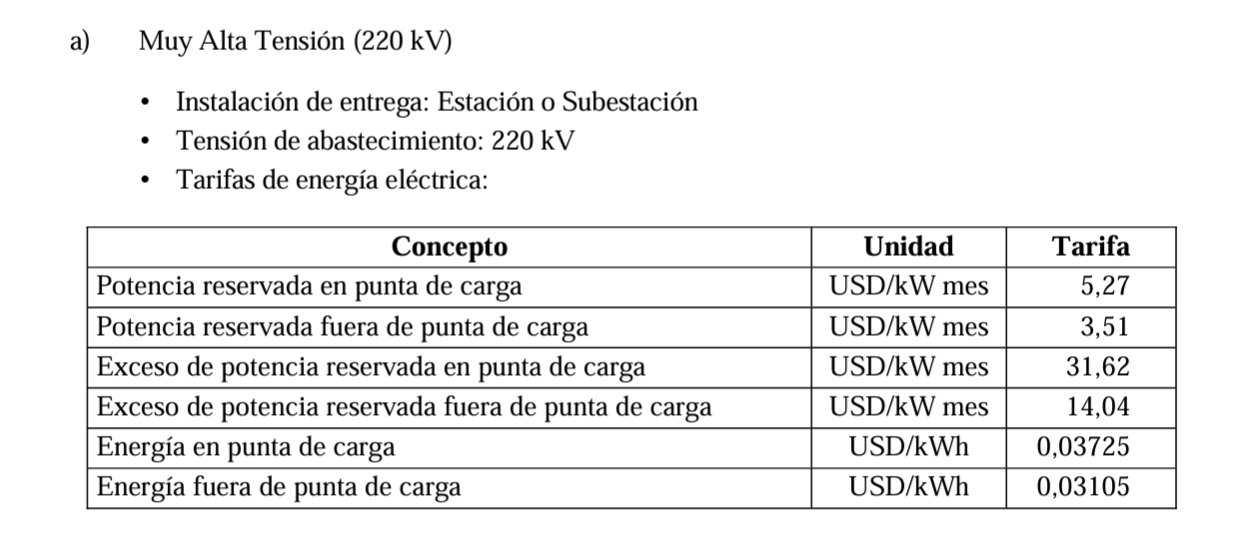

Paraguay Raises Electricity Rates for Bitcoin Miners

Paraguay’s National Electricity Administration (ANDE) has increased electricity rates for cryptocurrency mining companies by 9 to 16 percent. This measure aims to curb losses from illegal mining activities, estimated to cost the country up to 14 billion guaraníes (over $185,000).

On June 26, ANDE issued Resolution 49238, updating electricity tariffs. Hugo Fernández, ANDE’s commercial manager, informed the newspaper Última Hora about intensified efforts against illegal cryptocurrency mining. He revealed that 72,823 KVA (kilovolt-ampere) have been intervened this year. Most energy thefts affect the electrical system.

“The intervention represented a monthly loss of G. 14,720,458,825 for the institution, in terms of unregistered active energy, which added to the intervention costs and fine, must be paid by the person responsible for the theft of electric energy. This fact damages the proper functioning of the electric system”, Fernández explained.

Read more: Is Crypto Mining Profitable in 2024?

In early June, national deputy María Constancia Benítez de Benítez presented a bill titled “That regulates cryptomining in the Republic of Paraguay,” aiming to regulate Bitcoin mining. She acknowledged that mining presents an opportunity for the country’s economic development.

BeInCrypto CEO Alena Afanaseva Will Speak at Blockchain Rio 2024

The highly anticipated Blockchain Rio 2024 will take place from July 24 to 25 at EXPOMAG in Rio de Janeiro. This year’s event will feature more than 300 experts from the new economy, including BeInCrypto CEO Alena Afanaseva. She will discuss global trends in the new economy and the educational role of media outlets.

Other confirmed participants include Ariel Scaliter, co-founder and CTO of Agrotoken, and Daniela Barbosa, director of the Hyperledger Foundation. João Aragão Pereira, technology and innovation specialist at Microsoft, and pro-crypto Senator Carlos Portinho will also attend. They will present their expertise in different areas, from digital finance to energy and agriculture.

Read more: Top Crypto Events in 2024

Agrotoken, Microsoft, and Hyperledger have joined the Drex pilot platform consortium to highlight the importance of advanced blockchain applications. Blockchain Rio 2024 will also feature workshops, hackathons, knowledge trails, networking areas, Rio Digital Arts gallery, and immersive experiences. The business fair will provide a platform for companies to showcase their solutions, making new connections and potential collaborations among attendees.

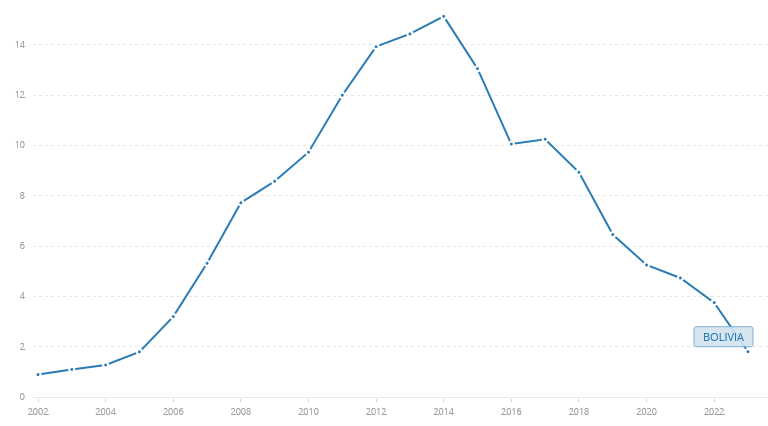

Bolivian President Lifts Cryptocurrency Ban Amid Dollar Shortage

In response to an economic crisis marked by a shortage of dollars and fuel, Bolivia has lifted its ban on using cryptocurrencies as a means of payment. President Luis Arce announced this decision to mitigate the impact of dwindling foreign currency reserves caused by a decline in gas exports, the country’s primary income source until 2021. Arce believes this move could significantly benefit the Bolivian economy by attracting foreign capital and modernizing its financial system.

From a macroeconomic perspective, allowing cryptocurrencies could attract foreign investment, as these digital assets enable fast and secure global transactions. This potential for seamless international trade might encourage both individual and corporate investors to diversify their assets in emerging markets like Bolivia, bypassing traditional currency restrictions.

Bolivia, which receives substantial remittances from citizens abroad, stands to gain from this policy shift. Cryptocurrencies provide a quicker and cheaper method for transferring money, reducing transaction costs and increasing the inflow of dollars into the country.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

The adoption of cryptocurrencies could also boost e-commerce by enabling local businesses to sell products and services internationally without traditional banking barriers. This expansion would help diversify Bolivia’s revenue sources beyond gas exports.

Overall, Bolivia’s decision to embrace cryptocurrencies could mark a shift in addressing its economic challenges, offering new opportunities for investment, commerce, and financial stability.

3.1 Million Mexicans Now Own Crypto, Report Reveals

A recent report from Sherlock Communications reveals that cryptocurrency adoption is on the rise in Mexico, with over 3.1 million holders, equivalent to 2.5% of the population. Previously, the consultancy identified Brazil and Argentina as the regional leaders.

The growth potential for crypto adoption in Mexico is significant, partly due to the $63 billion remittance market with the United States. A single exchange, Bitso, processed $4.3 billion last year.

“Legislators and authorities have been silent on the tax status of cryptocurrencies, and so far, no tax regulation in Mexico makes reference on the subject. Certain interpretations apply tax provisions and make applicable income tax rates of 30% to 35%, 16% VAT on each transfer within the country (but 0% if the buyer is outside Mexico) and 10% capital gains,” Sherlock Communications stated.

Read more: Who Owns the Most Bitcoin in 2024?

In addition, the report noted some companies have been instrumental in increasing the adoption of cryptocurrencies in Mexico. Among them, the following stand out: Bitso, Volabit, Coinbase, Ripple, Banco Azteca, Banxico, Telefónica, Helium, Etherfuse, investment firms Exponent Capital, Lvna Capital and GBM, ConsenSys Academy and BIVA.

Sherlock Communications argues that there are factors driving the use of cryptoassets in Mexico, such as the central bank’s digital currency (CBDC) working the country, 40% of companies in the country seek to use blockchain technology, the Fintech Law, and even, crypto sympathy from legislators in Mexico.

“Blockchain enjoys an excellent reputation in Latin America. Latin Americans see the technology as having positive consequences in areas beyond the business field and financial sectors. In the region, 61% of respondents in this sample agree that blockchain technology can transform the way governments keep records,” the report read.

As the Latam crypto scene grows, these stories highlight the region’s increasing influence in the global market. From Bolivia’s recent efforts to rising adoption of digital assets in Mexico, Latin America is positioning itself as a key player in the tech world. Stay tuned for more updates and insights in next week’s roundup.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance Faces Community Backlash and Boycott Calls

Controversies surrounding token listings, the depegging of the FDUSD stablecoin, and allegations of unethical behavior have raised a crucial question: Is Binance losing its credibility?

These issues threaten to erode trust and challenge Binance’s standing in the crypto industry.

Binance Struggles to Meet the Standard

One of Binance‘s most pressing issues is the poor performance of the tokens listed on the exchange. As BeInCrypto reported earlier, 89% of the tokens listed on the platform in 2025 recorded negative returns.

Even more concerning, another report reveals that most of the tokens listed in 2024 also experienced negative performance.

Listing on Binance was once considered a “launchpad” for new projects. However, it no longer guarantees success.

A prime example is the ACT token, a meme coin listed on the exchange that quickly plummeted. Earlier this week, Wintermute—a major market maker—dumped a large amount of ACT, exerting strong downward pressure on its price and raising concerns about the transparency of Binance’s listing process.

Such criticism has led the community to believe Binance prioritizes listing fees over users’ interests.

Connection to FDUSD

The FDUSD stablecoin has also become a focal point of controversy, with Binance at its center. FDUSD lost its peg, dropping to $0.89 after reports surfaced that its issuing company had gone bankrupt.

Wintermute, one of the largest FDUSD holders outside of Binance, withdrew 31.36 million FDUSD from the exchange at 11:15 AM UTC. This move is believed to have exacerbated the depegging situation, sparking panic in the market.

More concerning, a community member claimed that some Binance employees leaked internal information about the FDUSD incident so they could select whale chat groups.

If true, this would severely damage Binance’s reputation and raise major questions about the platform’s transparency and ethics.

Overall, the community’s dissatisfaction is growing, with many users calling for a boycott of the exchange. Such negative reactions are shaking user confidence in the platform, which was once considered a symbol of credibility in the crypto space.

“Binance today caused massive liquidations on alts listed on their exchange. I warned you all yesterday about their very dirty tactics, specifically GUN. I refuse to use Binance #BoycottBinance,” wrote popular crypto YouTuber Jesus Martinez.

These accusations stem from a central issue that Binance prioritizes profits over user interests. Over the past few months, the community has constantly criticized its listing strategy, arguing that the exchange focuses on “shitcoins” to collect high listing fees without considering project quality.

Although the exchange recently introduced a community voting mechanism to decide on listings, this might not be enough to silence the criticism.

As a Tier-1 exchange, the company is evaluated based on trading volume, security, regulatory compliance, and community trust. However, recent events suggest that the exchange is struggling to maintain these standards.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Stellar (XLM) Falls 5% as Bearish Signals Strengthen

Stellar (XLM) is down more than 5% on Thursday, with its market capitalization dropping to $8 billion. XLM technical indicators are flashing strong bearish signals, suggesting continued downward momentum that could test critical support levels around $0.22.

While a reversal scenario remains possible with resistance targets at $0.27, $0.29, and $0.30, such an upside move would require a substantial shift in market sentiment.

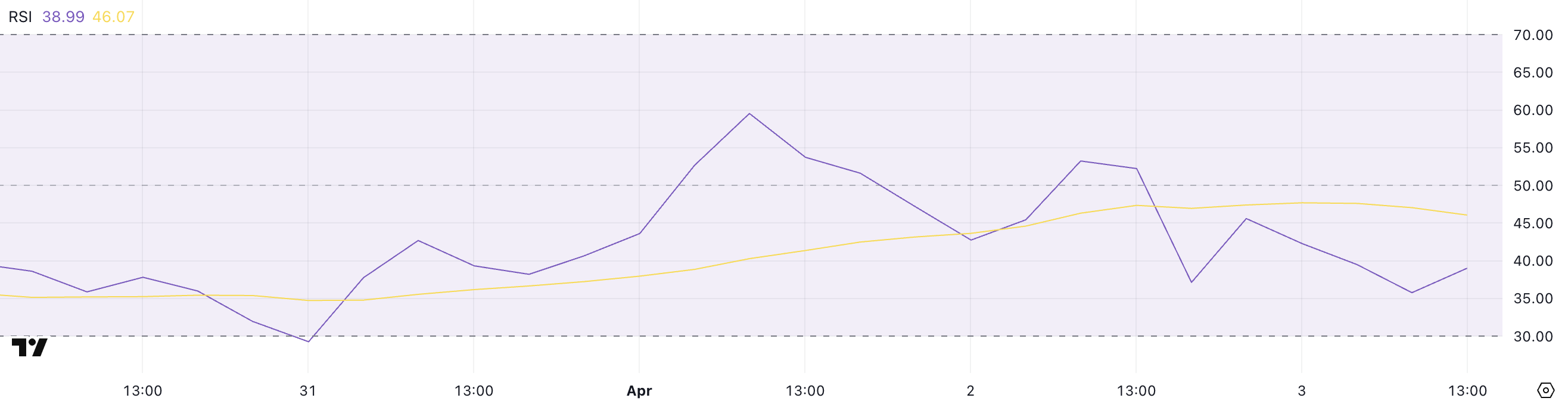

XLM RSI Shows Sellers Are In Control

Stellar’s Relative Strength Index (RSI) has dropped sharply to 38.99, down from 59.54 just two days ago—signaling a notable shift in momentum.

The RSI is a widely used momentum oscillator that measures the speed and magnitude of recent price changes, typically ranging between 0 and 100.

Readings above 70 suggest overbought conditions, while levels below 30 indicate oversold territory. A reading between 30 and 50 often reflects bearish momentum but is not yet extreme enough to trigger an immediate reversal.

With Stellar’s RSI now below the key midpoint of 50 and approaching the oversold threshold, the current reading of 38.99 suggests that sellers are gaining control.

While it’s not yet in oversold territory, it does signal weakening buying pressure and increasing downside risk.

If the RSI continues to fall, XLM could face further price declines unless buyers step in soon to stabilize the trend and prevent a slide into more deeply oversold levels.

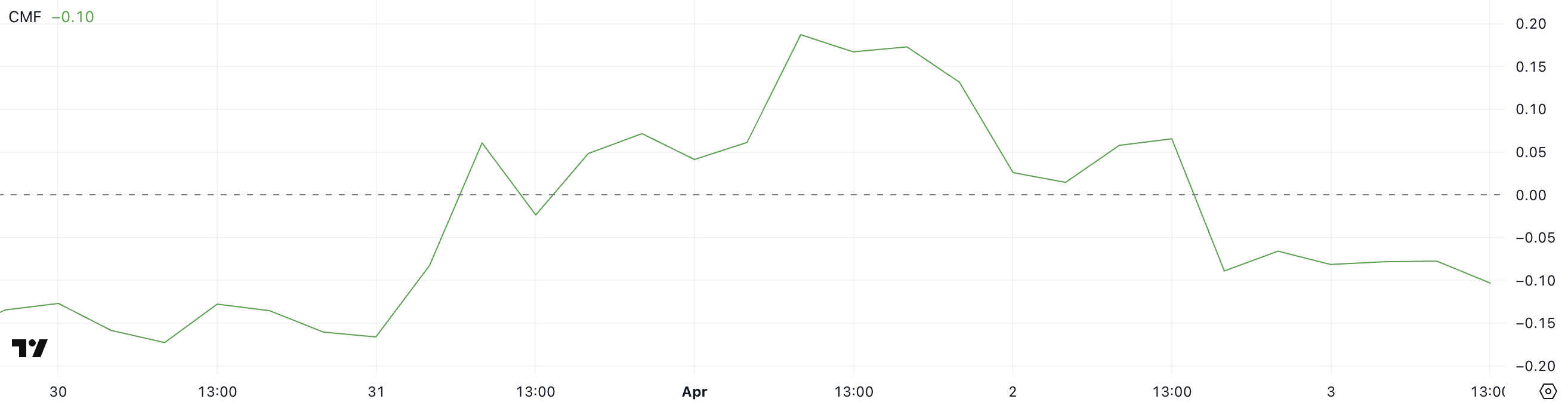

Stellar CMF Heavily Dropped Since April 1

Stellar’s Chaikin Money Flow (CMF) has plunged to -10, a sharp decline from 0.19 just two days ago, signaling a significant shift in capital flow dynamics.

The CMF is an indicator that measures the volume-weighted average of accumulation and distribution over a set period—essentially tracking whether money is flowing into or out of an asset.

Positive values suggest buying pressure and accumulation, while negative values point to selling pressure and capital outflow.

With XLM’s CMF now deep in negative territory at -10, it indicates that sellers are firmly in control and substantial capital is leaving the asset.

This level of negative flow can put downward pressure on price, especially if it aligns with other bearish technical signals. Unless buying volume returns to offset this outflow, XLM could continue to weaken in the near term.

Will Stellar Fall To Five-Month Lows?

Stellar price action presents concerning signals as EMA indicators point to a strong bearish trend with significant downside potential.

Technical analysis suggests this downward momentum could push XLM to test critical support around $0.22. It could breach this level and fall below the psychologically important $0.20 threshold—a price not seen since November 2024.

This technical deterioration warrants caution from traders and investors as selling pressure appears to be intensifying.

Conversely, a trend reversal scenario would require a substantial shift in market sentiment. Should bulls regain control, XLM could challenge the immediate resistance at $0.27, with further upside targets at $0.29 and the key $0.30 level.

However, this optimistic outlook faces considerable obstacles, as only a dramatic sentiment shift coupled with the emergence of a powerful uptrend would enable such a recovery.

Until clearer bullish signals manifest, the prevailing technical structure continues to favor the bearish case.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

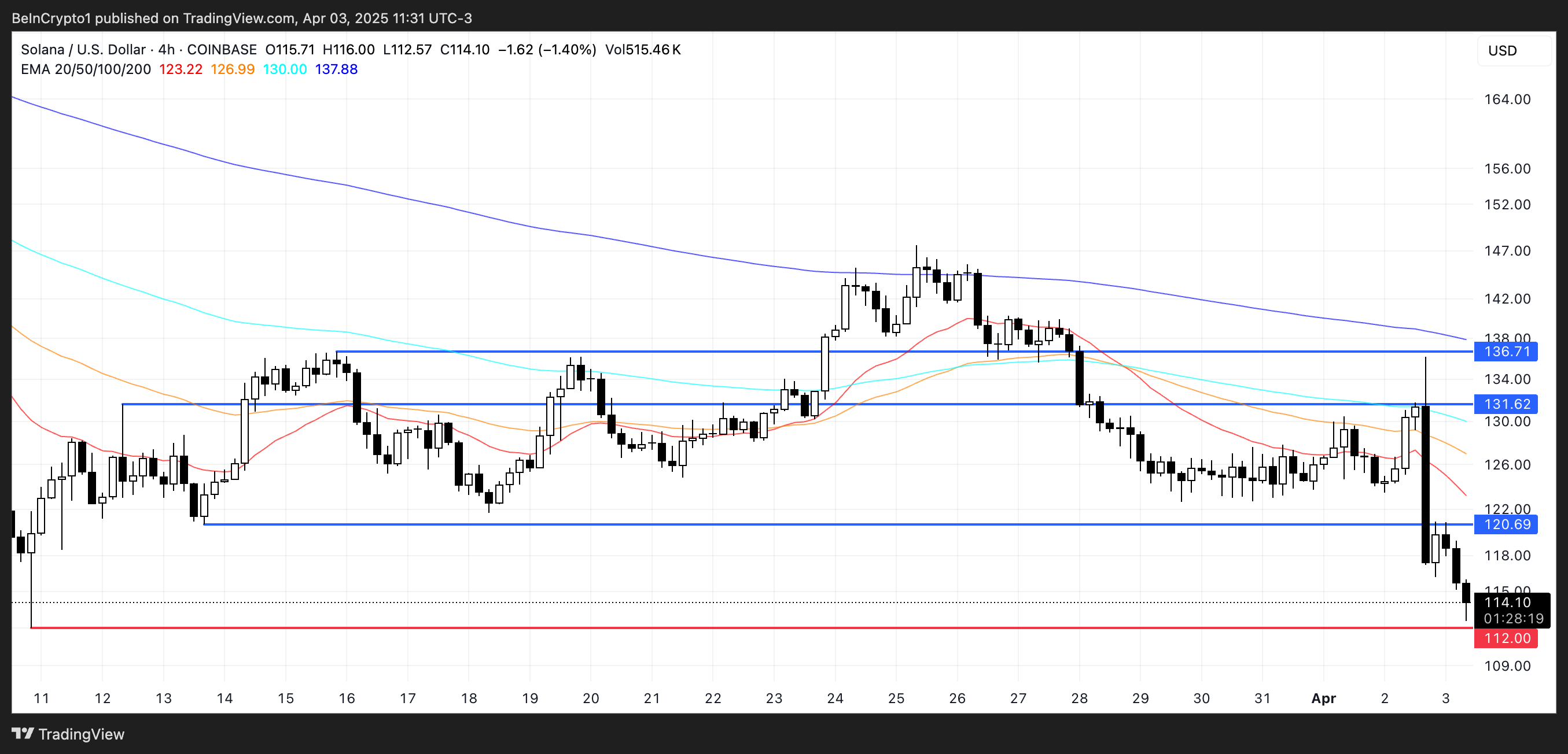

Solana (SOL) Crashes 11%—Is More Pain Ahead?

Solana (SOL) is under heavy pressure, with its price down more than 10% in the last 24 hours as bearish momentum intensifies across key indicators. The Ichimoku Cloud, BBTrend, and price structure all point to continued downside risk, with SOL now hovering dangerously close to critical support levels.

Technical signals show sellers firmly in control, while the widening gap from resistance zones makes a near-term recovery increasingly difficult.

Solana’s Ichimoku Cloud chart is currently flashing strong bearish signals. The price has sharply broken below both the Tenkan-sen (blue line) and Kijun-sen (red line), confirming a clear rejection of short-term support levels.

Both of these lines are now angled downward, reinforcing the view that bearish momentum is gaining strength.

The sharp distance between the latest candles and the cloud further suggests that any recovery would face significant resistance ahead.

Looking at the Kumo (cloud) itself, the red cloud projected forward is thick and sloping downward, indicating that bearish pressure is expected to persist in the coming sessions.

The price is well below the cloud, which typically means the asset is in a strong downtrend.

For Solana to reverse this trend, it would need to reclaim the Tenkan-sen and Kijun-sen and push decisively through the entire cloud structure—an outcome that looks unlikely in the short term, given the current momentum and cloud formation.

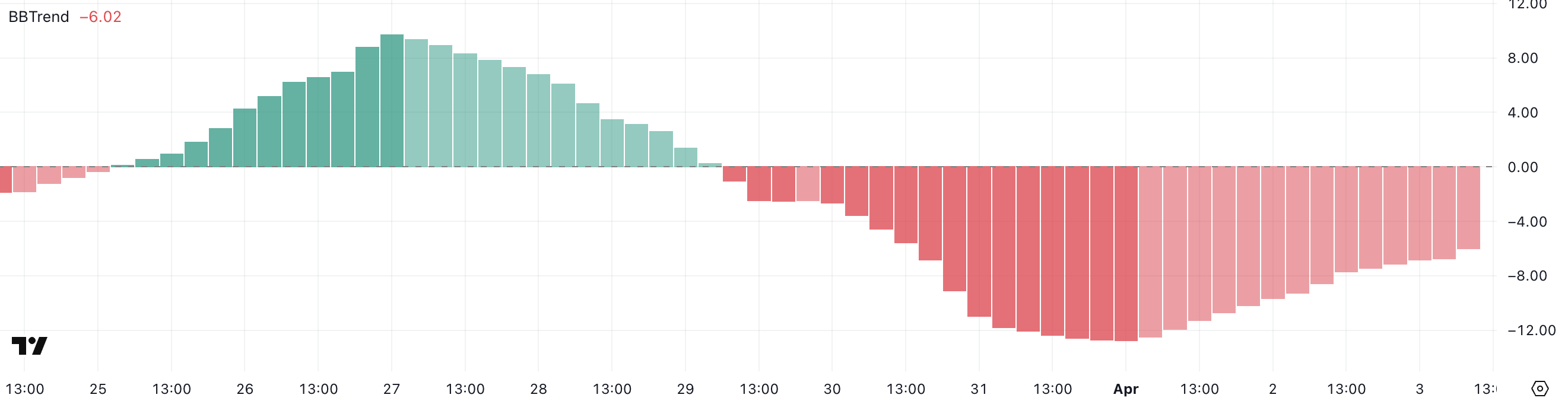

Solana’s BBTrend Signals Prolonged Bearish Momentum

Solana’s BBTrend indicator currently sits at -6, having remained in negative territory for over five consecutive days. Just two days ago, it hit a bearish peak of -12.72, showing the strength of the recent downtrend.

Although it has slightly recovered from that low, the sustained negative reading signals that selling pressure remains firmly in control and that the bearish momentum hasn’t yet been reversed.

The BBTrend (Bollinger Band Trend) measures the strength and direction of a trend using Bollinger Bands. Positive values suggest bullish conditions and upward momentum, while negative values indicate bearish trends.

Generally, values beyond 5 are considered strong trend signals. With Solana’s BBTrend still well below -5, it implies that downside risk remains elevated.

Unless a sharp shift in momentum occurs, this persistent bearish reading may continue to weigh on SOL’s price in the near term.

Solana Eyes $112 Support as Bears Test February Lows

Solana’s price has broken below the key $115 level, and the next major support lies around $112. A confirmed move below this threshold could trigger further downside. That could potentially push the price under $110 for the first time since February 2024.

The recent momentum and strong bearish indicators suggest sellers remain in control, increasing the likelihood of testing these lower support levels in the near term.

However, if Solana manages to stabilize and reverse its current trajectory, a rebound toward the $120 resistance level could follow.

Breaking above that would be the first sign of recovery, and if bullish momentum accelerates, SOL price could aim for higher targets at $131 and $136.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin24 hours ago

Altcoin24 hours agoBinance Sidelines Pi Network Again In Vote To List Initiative, Here’s All

-

Altcoin21 hours ago

Altcoin21 hours agoAnalyst Forecasts 250% Dogecoin Price Rally If This Level Holds

-

Market20 hours ago

Market20 hours agoCardano (ADA) Downtrend Deepens—Is a Rebound Possible?

-

Market24 hours ago

Market24 hours agoXRP Price Reversal Toward $3.5 In The Works With Short And Long-Term Targets Revealed

-

Market21 hours ago

Market21 hours agoXRP Price Under Pressure—New Lows Signal More Trouble Ahead

-

Market16 hours ago

Market16 hours agoIP Token Price Surges, but Weak Demand Hints at Reversal

-

Market19 hours ago

Market19 hours agoEthereum Price Recovery Stalls—Bears Keep Price Below $2K

-

Altcoin18 hours ago

Altcoin18 hours agoVanEck Seeks BNB ETF Approval—Big Win For Binance?