Market

UFC Star Khamzat Chimaev Accused of Crypto Insider Trading

UFC star Khamzat Chimaev, known for his formidable presence in the ring, recently ventured into cryptocurrency, intending to capitalize on his popularity.

However, he faces allegations of insider trading related to his newly launched meme coin. He also has drawn the ire of the crypto community and raised serious questions about his financial activities.

Chimaev’s SMASH Coin Crashes After Initial Hype

Initially, Chimaev engaged his followers on X (formerly Twitter) by asking which cryptocurrency he should invest in. The very next day, Chimaev introduced his SMASH meme coin on the Solana (SOL) blockchain. He encouraged his fans to buy the SMASH meme coin, leveraging his famous catchphrase, “Smash ’em all.”

Read more: Crypto Scam Projects: How To Spot Fake Tokens

Despite initial hype and promotional efforts on his social media, the asset’s price fell to zero soon after its release. The crypto community quickly accused Chimaev of orchestrating a pump-and-dump scheme. In the crypto market, a pump-and-dump scheme involves artificially inflating an asset’s price before selling off at a peak, leaving later buyers with devalued investments.

Data from GeckoTerminal revealed a staggering 72% drop in SMASH’s value within 24 hours, with a temporary plunge exceeding 96%. The meme coin’s market capitalization now stands at only $82,000. Moreover, its trading volume barely surpasses $116,000.

Moreover, all related tweets had been deleted at the time of writing. These add more suspicion surrounding the meme coin.

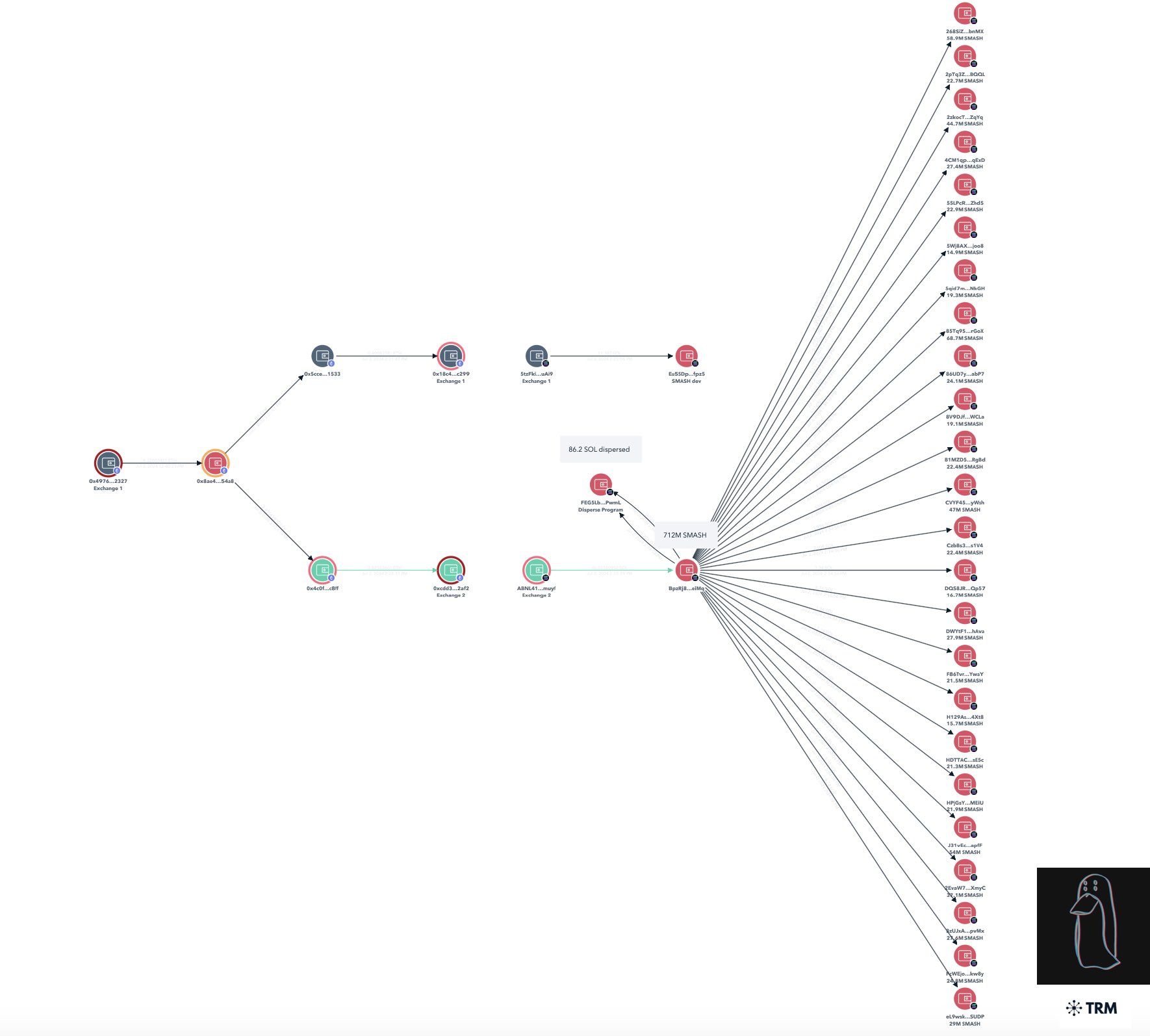

Prominent on-chain sleuth ZachXBT uncovered evidence suggesting insider trading on SMASH. He pointed out that insiders and wallets linked to the developers purchased up to 78% of the SMASH volume.

“Why do all of you instantly nuke your reputation with meme coin scams?” ZachXBT called out.

Furthermore, ZachXBT’s findings indicate that at least 71% of the coin’s supply has a direct connection with insider wallets funded from the same Ethereum address as the developer’s wallet on Solana. A total of 24 addresses collectively received 86.2 SOL, valued at around $11,500.

This amount was subsequently utilized to acquire 712 million SMASH tokens, representing 71.2% of the total available supply of SMASH tokens. These assets were dispersed among smaller addresses, further complicating the traceability of the transactions.

The incident with Chimaev’s SMASH coin is not an isolated case. The crypto market has witnessed a surge in meme coins launched by celebrities, often leading to similar controversies.

For instance, former Olympic athlete and Kardashian-Jenner family member Caitlyn Jenner faced accusations of fraud after launching her own coin. Similarly, confusion and deceit marred singer Iggy Azalea’s token release, as an unauthorized asset appeared on the market just before her official launch.

Read more: 15 Most Common Crypto Scams To Look Out For

Earlier in June, Ethereum co-founder Vitalik Buterin has criticized celebrity meme coins. Buterin emphasized that digital assets should serve meaningful purposes rather than simply enriching insiders.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Market

Solana (SOL) Bulls Stay in Control: Rally Far From Over?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

Ethereum Price Poised for Gains: $3,600 Within Reach?

Ethereum price started a fresh increase above the $3,320 zone. ETH is rising and aiming for more gains above the $3,500 resistance.

- Ethereum started a fresh increase above the $3,300 and $3,320 levels.

- The price is trading above $3,300 and the 100-hourly Simple Moving Average.

- There is a short-term bearish trend line forming with resistance at $3,350 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could gain bullish momentum if it clears the $3,420 resistance zone.

Ethereum Price Eyes More Gains

Ethereum price remained supported above $3,120 and started a fresh increase like Bitcoin. ETH gained pace for a move above the $3,220 and $3,300 resistance levels.

The bulls pumped the price above the $3,400 level. It gained over 10% and traded as high as $3,499. Recently, there was a downside correction below $3,400. The price dipped below $3,320 and tested $3,280. A low was formed at $3,288 and the price is now consolidating above the 23.6% Fib retracement level of the recent decline from the $3,499 swing high to the $3,288 low.

Ethereum price is now trading above $3,300 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,350 level. There is also a short-term bearish trend line forming with resistance at $3,350 on the hourly chart of ETH/USD.

The first major resistance is near the $3,400 level. The main resistance is now forming near $3,420 or the 61.8% Fib retracement level of the recent decline from the $3,499 swing high to the $3,288 low.

A clear move above the $3,420 resistance might send the price toward the $3,500 resistance. An upside break above the $3,500 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,600 resistance zone or even $3,620.

Downsides Limited In ETH?

If Ethereum fails to clear the $3,350 resistance, it could start another decline. Initial support on the downside is near the $3,320 level. The first major support sits near the $3,285 zone.

A clear move below the $3,285 support might push the price toward $3,220. Any more losses might send the price toward the $3,120 support level in the near term. The next key support sits at $3,040.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,300

Major Resistance Level – $3,350

Market

Bitcoin ETFs Could Overtake Gold ETFs by End of The Year

Spot Bitcoin exchange-traded funds (ETFs) in the US are nearing a major milestone. They are set to become the biggest BTC holders in the world, even surpassing the amount held by Bitcoin’s creator, Satoshi Nakamoto.

Additionally, they are catching up to gold ETFs in total net assets.

Bitcoin ETFs on The Verge of Surpassing Satoshi Nakamoto’s BTC Stash

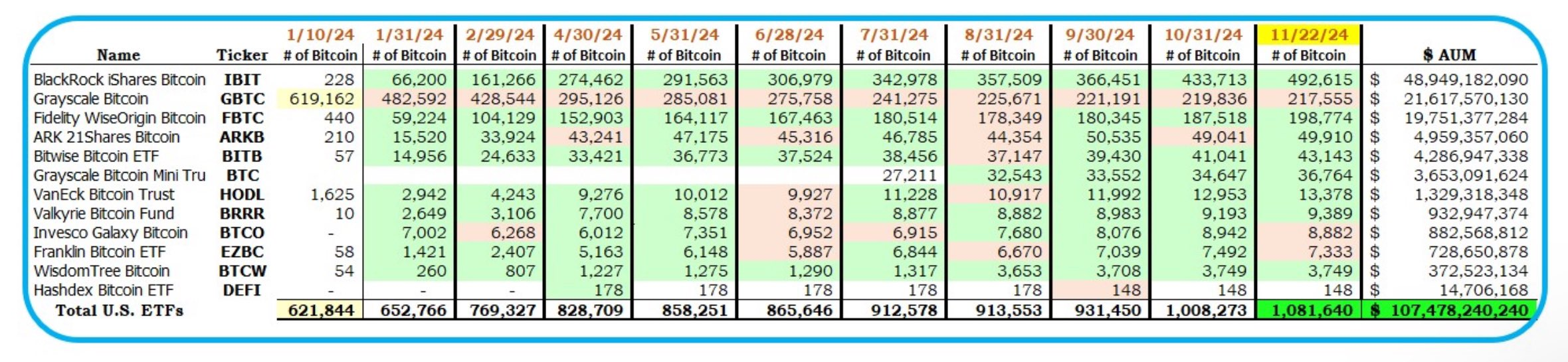

Since their launch in January, US spot Bitcoin ETFs have grown significantly. According to crypto analyst HODL15Capital, these funds now hold about 1.081 million Bitcoin, just below Nakamoto’s estimated 1.1 million.

Satoshi Nakamoto, the anonymous creator of Bitcoin, is believed to own approximately 5.68% of the total Bitcoin supply. These holdings, valued at over $100 billion, place Nakamoto among the world’s wealthiest individuals — if they are alive and a single person.

However, Bloomberg’s Senior ETF Analyst, Eric Balchunas, pointed out that ETFs are now 98% of the way to overtaking Nakamoto. He predicted that if the current pace of inflows continues, this could happen by Thanksgiving.

“US spot ETFs now 98% of way there to passing Satoshi as world’s biggest holder. My over/under date of Thanksgiving looking good. If next 3 days are like the past 3 days flow-wise it’s a done deal,” Balchunas stated.

SoSoValue data shows inflows into these ETFs grew by around 97% week-on-week to $3.3 billion over the last five trading days, with BlackRock’s iShares Bitcoin Trust (IBIT) contributing $2 billion. This surge coincides with the introduction of options trading for these products, which many believe is attracting more institutional investors.

Meanwhile, Bitcoin ETFs are also narrowing the gap with gold ETFs, which currently hold $120 billion in assets under management (AUM). According to Balchunas, Bitcoin ETFs manage $107 billion and could overtake gold ETFs by Christmas.

These bullish predictions reflect Bitcoin’s exceptional performance in 2024. The top cryptocurrency has surged nearly 160% since January, trading near the $100,000 landmark. In addition, its $1.91 trillion market capitalization now exceeds that of silver and major corporations like the state-owned oil company Saudi Aramco.

However, BTC still lags behind gold, which remains the world’s largest asset with a market capitalization of more than $18 billion.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin24 hours ago

Altcoin24 hours agoBTC Continues To Soar, Ripple’s XRP Bullish

-

Bitcoin18 hours ago

Bitcoin18 hours agoBitcoin Price Is Decoupling From Gold Again — What’s Happening?

-

Market21 hours ago

Market21 hours agoWhy a New Solana All-Time High May Be Near

-

Market16 hours ago

Market16 hours agoIs the XRP Price Decline Going To Continue?

-

Market15 hours ago

Market15 hours agoToken Unlocks to Watch Next Week: AVAX, ADA and More

-

Bitcoin14 hours ago

Bitcoin14 hours agoSenator’s Bold Proposal To Replenish US Reserves

-

Market13 hours ago

Market13 hours agoCan the SAND Token Price Rally Be Sustained?

-

Bitcoin12 hours ago

Bitcoin12 hours agoBitcoin Whales Remain Determined, $3.96 Billion Worth Of BTC Gobbled Up In 96 Hours