Altcoin

Why Bitcoin, ETH, DOGE, SHIB Prices Are Falling Today?

Crypto Market Selloff: The digital asset sector has noted a sharp decline today, with the overall market retreating nearly 3% today in the last 24 hours. Meanwhile, the recent slump in the major cryptos like Bitcoin, Ethereum, DOGE, BNB, LINK, and others, has sparked discussions in the market over the potential reasons.

So, let’s take a look at the possible reasons that have fueled the recent crypto market selloff.

Potential Reasons Behind The Recent Crypto Market Selloff

A series of factors could have triggered the recent crypto market selloff today. Here we explore the top reasons that might have impacted the sentiment of the broader crypto market.

Bitcoin ETF Outflow Fuels Concern

The U.S. Spot Bitcoin ETF has reversed its track after noting inflows for five straight days through July 1. Over the last five days, the U.S. Bitcoin ETF has recorded the highest influx of $129.5 million on July 1. This move has fueled the market sentiment over regaining the confidence of the institutional interests towards the flagship crypto.

However, the overall scenario took a different turn on July 2, with U.S. Spot Bitcoin ETFs recording an outflow of $13.7 million. Despite inflows of $14.1 million and $5.4 million from BlackRock IBIT and Fidelity’s FBTC, the outflux of $32.4 million from GrayScale has allayed the gains.

This move might have once again weighed on the investors’ sentiment, who are still seeking clarity on the market momentum. The recent outflux after a five-day winning streak also indicates that the institutions are taking a pause before making further bets in the sector.

Friday Options Expiry

The Bitcoin ETF outflow has triggered volatility in BTC, potentially impacting the broader crypto market. Apart from that, the massive upcoming options expiry also seems to have impacted the risk-bet appetite of the investors.

Notably, the recent crypto market selloff could be primarily attributed to the upcoming expiration of significant BTC and ETH options. Data from Deribit reveals that BTC options with a notional value exceeding $1.04 billion and a put/call ratio of 0.80 are set to expire on Friday, July 5, with a maximum pain price of $63,000.

Similarly, ETH options worth $479.30 million, with a put/call ratio of 0.38 and a max pain price of $3,450, will also expire. The impending expiries are creating uncertainty and influencing market behavior, as traders adjust their positions ahead of the deadline.

Also Read: Ripple and Coinbase Use Binance Win to Contest SEC Claims

Ethereum ETF Launch Delay

The crypto market was highly anticipating the Spot Ethereum ETF approval by the U.S. SEC this week. However, a potential delay might have sparked concerns among the investors.

Meanwhile, looking at the latest market trends, ETF Store president Nate Geraci said that the U.S. Spot Ethereum ETF might launch on July 15. Besides, Bloomberg also hinted at a mid-July launch for the Ether ETF to go live in the U.S.

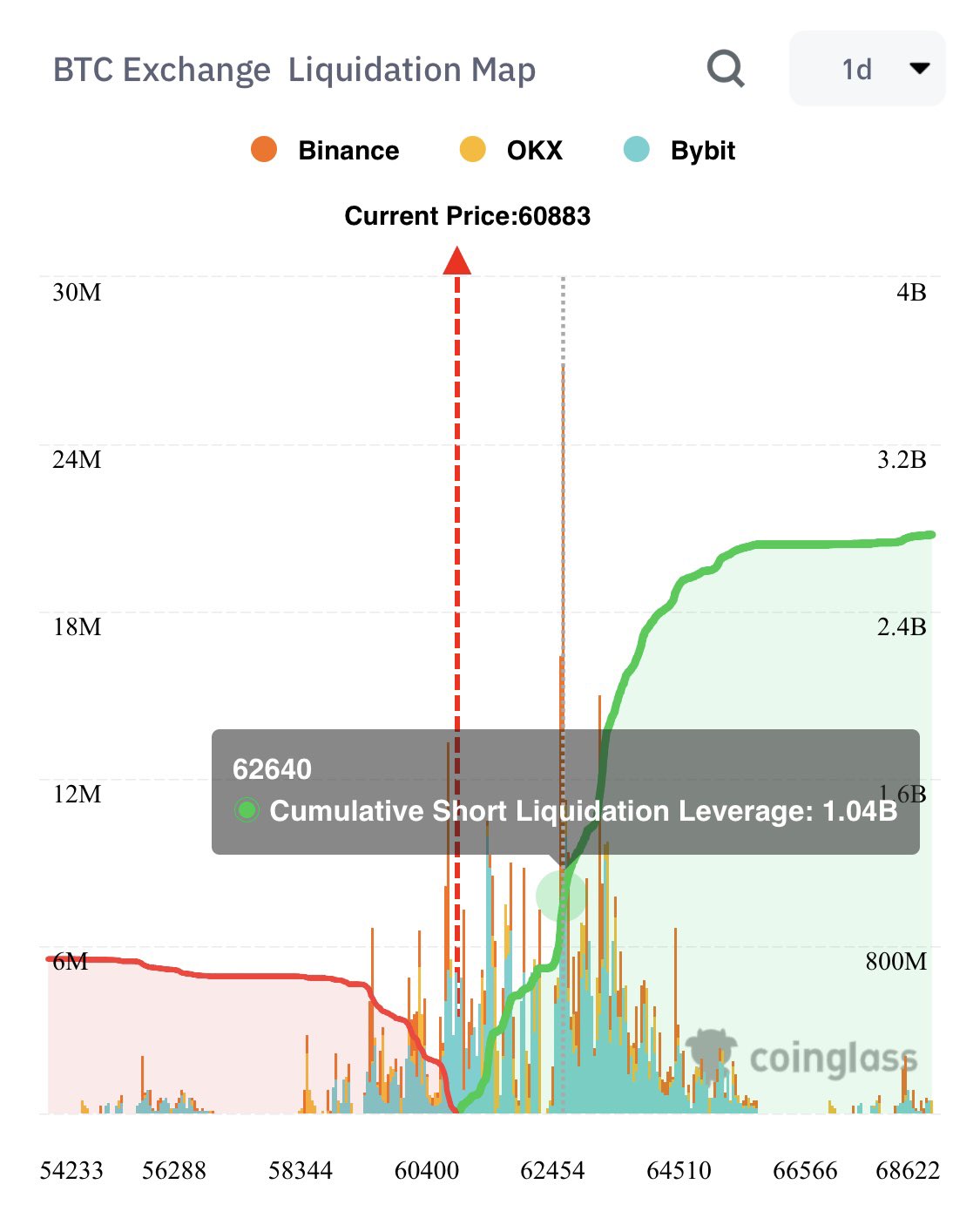

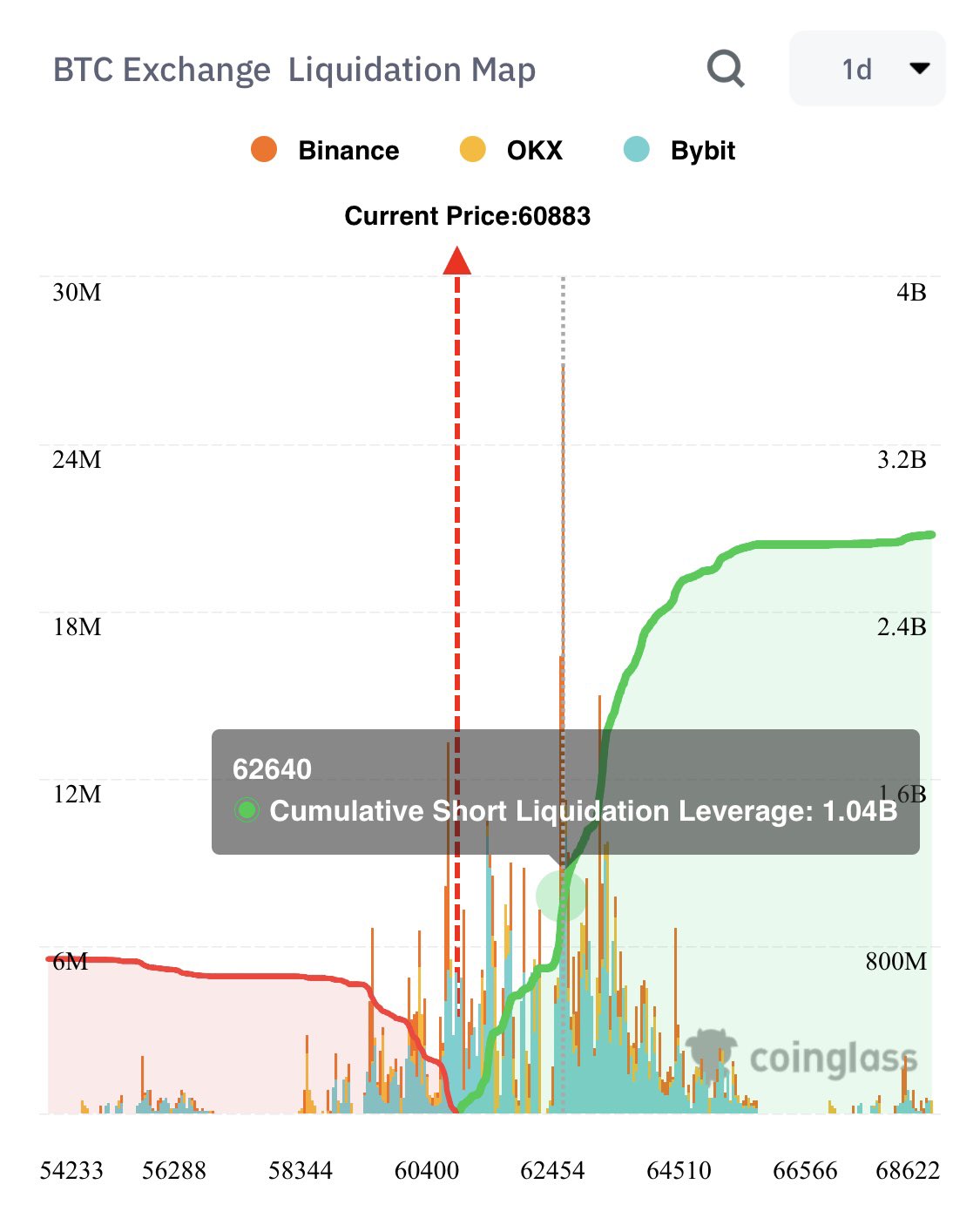

Crypto Market Faces Over $120M Liquidation

The recent selloff in the crypto market has caused a liquidation of $123.62 million over the last 24 hours, CoinGlass data showed. In the same timeframe, around 45,000 traders were liquidated with the largest single liquidation taking place on OKX – ETH-USDT-SWAP worth $3.36 million.

Bitcoin faces liquidation of $34.74 million, while Ethereum’s liquidation stood at $32.87 million. However, despite the recent crypto market selloff, some analysts are still optimistic about the future performance of the market. Given the declining value and anticipation over Ethereum ETF approval this month, the crypto market might witness robust gains in the coming days.

However, with Bitcoin price currently crossing the brief $61,000 mark, the risk still prevails in the market. In a recent analysis, popular crypto market expert Ali Martinez warned of over $1 billion liquidation if BTC hits the $62,600 mark.

As of writing, Ethereum price dropped nearly 3% in the last 24 hours, while Dogecoin price fell 1.3%. Simultaneously, the BNB price noted a slump of 2.5% to $566.23, and Shiba Inu price slipped 1.34% to $0.00001695.

Also, CoinGlass data showed that Bitcoin Futures Open Interest (OI) fell about 4% from yesterday, while Ethereum OI slipped about 1.4%. This data also highlights the gloomy sentiment dominating the crypto market.

Also Read: Genesis Digital Is Considering Going Public Via IPO In US

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

XRP Price to $27? Expert Predicts Exact Timeline for the Next Massive Surge

Crypto expert Egrag Crypto has again predicted that the XRP price could rally to as high as $27. The analyst has also revealed the exact timeline for when the altcoin could record this massive price surge.

Expert Reveals Time For XRP Price To Hit $27

In an X post, Egrag Crypto asserted that the XRP price can hit $27 in 60 days. The expert remarked that historical patterns indicate that the altcoin can reach this target within this timeframe.

Based on this price prediction, XRP could reach this $27 target by June, marking a 1,250% gain for Ripple’s native crypto. The expert’s accompanying chart showed that he was alluding to the 2017 bull run as to why the altcoin could record such a parabolic rally.

In 2017, XRP recorded a historic gain of over 60,000% as it rallied to its current all-time high (ATH) of $3.8 the following year. As such, based on history, a 1,250% increase is nothing for the altcoin.

In the meantime, the XRP price still boasts a bearish outlook thanks to the sentiment in the broader crypto market. As CoinGape reported, Ripple’s coin could drop to the next major support levels at $1.79 and $1.56 if it fails to hold above $2.03.

Decision Time For The Altcoin

In an X post, crypto analyst CasiTrades stated that it is decision time for the XRP price. She noted that the altcoin is showing strength with a bounce right back to the first key test at $2.17. She added that this is the resistance level she wants to see flip into support, as it might be the “most important price of the week.”

The analyst stated that XRP must reclaim this level to build momentum. She added that the $2 level remains a valid target if the $2.17 level rejects. Meanwhile, CasiTrades revealed that $2.70, $3.05, and $3.80 are the major resistance zones once the upward trend is confirmed.

The analyst also mentioned that the XRP price is now fully inside the Fibonacci Time Zone 3, which spans most of April. She affirmed that this is the breakout window market participants have been preparing for and that all signs point to a macro wave.

CasiTrades affirmed that the structure is clean. The RSI divergence has confirmed the bottom, while the subwaves are aligning well with the larger targets. If the next leg pushes XRP back above $2.17 with momentum, she claimed that market participants may finally see obvious signs of Wave 3. Interestingly, the analyst added that if the altcoin clears $2.70 this week, it may break the $1,000 price extension.

For now, investors may remain cautious, especially seeing how XRP fell after the PMI and JOLTS data release earlier today. Donald Trump is also set to announce reciprocal tariffs tomorrow, which could spark a massive price crash.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Binance Update Sparks 50% Decline For Solana Meme Coin ACT: Details

A recent Binance update has triggered massive liquidations while sending Solana memecoin ACT into a steep correction. At first, pundits blamed market maker Wintermute for the jarring declines but Binance’s update to leverage and margin tiers appears to be the culprit.

Several Altcoins on Binance Suffer Massive Corrections

According to an X post, several altcoins listed on Binance took a major hit, dropping by double-digit percentages. The hardest hit of the lot was Solana memecoin ACT, experiencing a sudden drop of over 50% in 30 minutes.

Other altcoins including DEXE and DF equally recorded steep declines of 23% and 16% respectively in the same window. The price slump left traders scratching their heads but a consensus formed that sizable sell orders were behind the declines.

“The sudden dips were triggered by large sell orders executed in a short time frame, leading to a significant surge in spot trading volume,” said one pundit.

Others turned to market maker Wintermute as the trigger for the selloff. However, Wintermute CEO Evgeny Gaevoy denied responsibility while noting that the market maker reacted “post move.”

The decline comes amid a broader market recovery with several cryptocurrencies including Compound (COMP) gaining 70%.

What Triggered The 50% Decline For Solana Meme Coin

A Binance update on leverage and margin tiers on specific tokens like ACT triggered the massive declines. According to an April 1 announcement, the top exchange has updated the margin tiers of several perpetual contracts, noting that existing positions will be affected.

Following the move, one ACT whale got liquidated for $3.79 million at $0.1877, triggering a broad selloff. Former FTX community manager Benson Sun noted that traders had less than 3 hours to respond to the change, criticizing Binance for the move.

“Before changing the rules, Binance should have evaluated how many positions would be closed,” said Sun. “If there are market makers with large positions, they should have notified them in advance.”

Within hours of MUBARAK’s listing, the memecoin tumbled by 40% with Binance CEO Changpeng Zhao downplaying the impact of a listing on prices. Binance has drawn criticism in recent days following its exclusion of Pi Network from its Vote To List initiative.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

BTC, ETH, XRP, DOGE Fall Following Weak PMI, JOLTS Data

A crypto market crash looks imminent, with Bitcoin, Ethereum, XRP, and Dogecoin witnessing notable declines. This price crash happened following the release of weak manufacturing PMI and JOLTS data, which provides a bearish outlook for the market.

Crypto Market Crash: BTC, ETH, XRP, & DOGE Decline

CoinMarketCap data shows that a crypto market crash could be on the horizon, with the Bitcoin price sharply dropping below $83,000 from a daily high of around $84,400. Altcoins such as Ethereum, XRP, and DOGE also witnessed sharp declines.

This market crash occurred following the release of weak ISM manufacturing PMI and JOLTS data. The March PMI data dropped to 49, below expectations of 49.5 and lower than the 50 recorded in February.

The US JOLTS job openings for February came in at 7.568 million, below the expected 7.690 million and lower than the 7.762 million recorded in January. These data add to several macro fundamentals that paint a bearish outlook for the market.

This crypto market crash could persist, with China, Japan, and South Korea agreeing to respond to Donald Trump’s proposed tariffs. Trump is set to announce a number of reciprocal tariffs tomorrow, which could significantly harm the market as it sets off a trade war between the US and other nations.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market24 hours ago

Market24 hours agoBlackRock’s Larry Fink Thinks Crypto Could Harm The Dollar

-

Market23 hours ago

Market23 hours agoCoinbase Tries to Resume Lawsuit Against the FDIC

-

Altcoin23 hours ago

Altcoin23 hours agoCharles Hoskinson Reveals How Cardano Will Boost Bitcoin’s Adoption

-

Market22 hours ago

Market22 hours agoHedera (HBAR) Bears Dominate, HBAR Eyes Key $0.15 Level

-

Altcoin24 hours ago

Altcoin24 hours agoEthereum Bitcoin Ratio Drops to Record Low, What Next for ETH?

-

Market21 hours ago

Market21 hours agoThis is Why PumpSwap Brings Pump.fun To the Next Level

-

Market20 hours ago

Market20 hours agoCardano (ADA) Whales Hit 2-Year Low as Key Support Retested

-

Bitcoin9 hours ago

Bitcoin9 hours ago$500 Trillion Bitcoin? Saylor’s Bold Prediction Shakes the Market!

✓ Share: