Market

The Rise of Liquid Staking on Solana: Key Insights

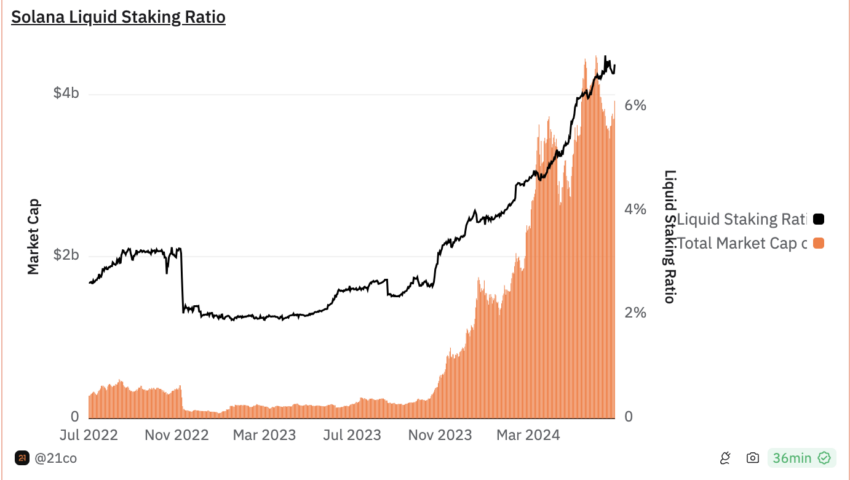

Solana, the fifth-largest crypto asset by market size and the third-largest proof-of-stake (POS) network, saw its liquid staking ratio rise by 1.76% quarter-over-quarter.

According to DefiLlama, over $54 billion worth of crypto assets are staked across liquid staking platforms. Liquid staking, unlike traditional staking, lets users earn extra yield and retain liquidity with a derivative token for DeFi.

The Rise of Liquid Staking on Solana

Data from Dune Analytics shows over 23 million SOL, valued at over $3.6 billion, staked on liquid staking platforms. Solana has a higher staking ratio than Ethereum, around 60%, but only 6% of staked SOL is in liquid staking. This indicates untapped potential in Solana’s liquid staking sector, as well as potential growth opportunities.

Read more: What Is Liquid Staking in Crypto?

Solana’s two-day unbonding period, shorter than many other blockchains, might also impact the popularity of liquid staking. Konstantin Boyko-Romanovsky, founder and CEO of Allnodes, explains how this can be an advantage over other blockchains like Polkadot or Ethereum.

“Since Solana’s unbonding period is only two days, liquid staking might not be as popular as blockchains with unbonding periods of 2-3 weeks. In the context of staking, the unbonding period is when staked assets are unlocked and available for use after a user decides to unstake them,” Boyko-Romanovsky, told BeInCrypto.

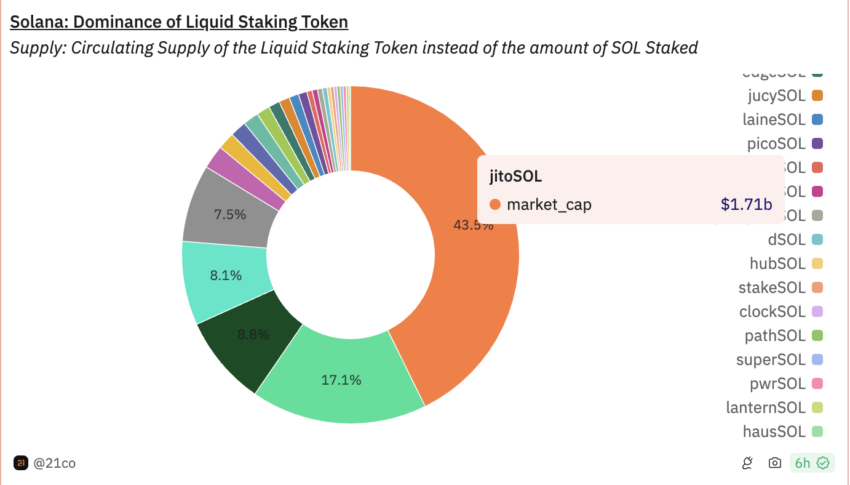

Platforms like Sanctum and Jito Labs are also driving the liquid staking boom on Solana. According to researcher and analyst Tom Wan, Sanctum lowered the barrier of entry and is helping projects build their own liquid staking tokens (LSTs) and scale.

Jito currently has about 91,000 Solana investors staking on the platform, with an APR of over 8% and over 10.6 million SOL staked.

“Sanctum is able to take the torch. The launch of INF, Sanctum Router, and Sanctum Reserve, has lowered the barrier to entry, buklding foundation of a Cambrain explosion of the liquid staking sector on Solana,” Wan shared in a post.

Boyko-Romanosvky also highlights the influence emerging trends like re-staking can have on liquid staking’s growth in Solana.

“Emerging technologies like re-staking can potentially influence the development and adoption of liquid staking on Solana and similar blockchains. By providing continuous liquidity, increasing yield opportunities, and offering greater flexibility, re-staking can enhance the attractiveness of liquid staking even on platforms with short unbonding periods like Solana. However, ensuring the security and reliability of these technologies, alongside effective market and liquidity management, will be crucial for their success and widespread adoption,” Boyko-Romanosvky shared.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

As liquid staking continues to grow in popularity, Solana could benefit from increased user participation and enhanced network security. So far, two major filings for a Solana ETF have been made in the US. If liquid staking popularity continues to grow, it can give Solana a competitive advantage and attract investment firms.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana Hits New All-Time High After 3 Years

On Friday, Solana (SOL) soared to a new all-time high (ATH), now trading at approximately $261. This breakthrough surpasses its previous peak set in November 2021.

Solana’s rise to a new ATH marks an increase of over 32 times from its lows recorded in December 2022.

Solana Hits All-Time High as Gary Gensler Plans Resignation

Solana’s path to this new high has been anything but smooth. After reaching its previous high in 2021, the platform faced a downturn in 2022 amid a broader crypto bear market, further exacerbated by technical issues and network downtimes.

The collapse of FTX in November 2022 pushed Solana’s price down to around $8.

However, Solana has since made a remarkable recovery, increasing more than 32-fold from its low. Now, Solana enthusiasts believe that SOL could eventually outpace Ethereum (ETH) in market capitalization.

“Solana has been at an all-time high by market cap for a while actually. Now, we’re finally in price discovery. The flippening is coming,” Birch, the founder of PathCrypto, said.

The surge in Solana’s market value coincides with the news of SEC Chairman Gary Gensler’s planned resignation, slated for January 20, 2025, as Donald Trump assumes office.

Known for his strict regulatory stance on cryptocurrencies, Gensler’s departure signals a potential shift toward a more crypto-friendly administration. Consequently, this political change is stoking speculations about the approval of a Solana exchange-traded fund (ETF). According to Fox Business journalist Eleanor Terrett, the SEC has begun engaging with issuers to explore the possibility of a Solana ETF.

“Talks between SEC staff and issuers looking to launch a Solana spot ETF are “progressing” with the SEC now engaging on S-1 applications. Recent engagement from staff, coupled with the incoming pro-crypto administration, is sparking a renewed sense of optimism that a Solana ETF could be approved sometime in 2025,” Terrett claimed.

Previous efforts to launch a Solana ETF were stalled by regulatory roadblocks, often stopping early in the process. However, the changing political environment and the SEC’s increased openness have reignited hopes within the crypto community. Recent filings for a Solana ETF by Canary Capital and BitWise reflect a growing interest and anticipation for regulatory approval.

Despite these encouraging developments, the odds of a Solana ETF approval in 2024 remain low, with Polymarket estimates placing it at around 4%.

Meanwhile, the crypto community is also closely watching Bitcoin as it approaches the highly anticipated $100,000 mark. On Friday, Bitcoin recorded a new high of about $99,300. This milestone is viewed as a pivotal moment for Bitcoin and could impact other cryptocurrencies, including Solana.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price 25% Rally: Breaking Barriers and Surpassing Odds

XRP price rallied above the $1.15 and $1.20 resistance levels. The price is up over 25% and might rise further above the $1.420 resistance.

- XRP price started a fresh surge above the $1.20 resistance level.

- The price is now trading above $1.250 and the 100-hourly Simple Moving Average.

- There was a break above a key bearish trend line with resistance at $1.1400 on the hourly chart of the XRP/USD pair (data source from Kraken).

- The pair is up over 25% and it seems like the bulls are not done yet.

XRP Price Eyes Steady Increase

XRP price formed a base above $1.050 and started a fresh increase. There was a move above the $1.150 and $1.20 resistance levels. It even pumped above the $1.25 level, beating Ethereum and Bitcoin in the past two sessions.

There was also a break above a key bearish trend line with resistance at $1.1400 on the hourly chart of the XRP/USD pair. A high was formed at $1.4161 and the price is now consolidating gains. It is trading above the 23.6% Fib retracement level of the upward move from the $1.0649 swing low to the $1.4161 high.

The price is now trading above $1.30 and the 100-hourly Simple Moving Average. On the upside, the price might face resistance near the $1.400 level. The first major resistance is near the $1.420 level. The next key resistance could be $1.450.

A clear move above the $1.450 resistance might send the price toward the $1.50 resistance. Any more gains might send the price toward the $1.550 resistance or even $1.620 in the near term. The next major hurdle for the bulls might be $1.750 or $1.80.

Are Dips Supported?

If XRP fails to clear the $1.420 resistance zone, it could start a downside correction. Initial support on the downside is near the $1.3350 level. The next major support is near the $1.2850 level.

If there is a downside break and a close below the $1.2850 level, the price might continue to decline toward the $1.240 support or the 50% Fib retracement level of the upward move from the $1.0649 swing low to the $1.4161 high in the near term. The next major support sits near the $1.20 zone.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now above the 50 level.

Major Support Levels – $1.3350 and $1.2850.

Major Resistance Levels – $1.4000 and $1.4200.

Market

WisdomTree Europe Launches XRP ETP

ETF issuer WisdomTree’s European division just announced a new ETP based on XRP. This product is currently available in four EU countries, which has led XRP’s price to jump slightly.

ETPs are a common issuer strategy to earn revenue without ETF approval, but Europe will not necessarily approve one even if the US does so.

WisdomTree’s XRP ETP

WisdomTree, one of the Bitcoin ETF issuers in the US, announced that its European branch is offering an exchange-traded product (ETP) based on XRP. This new product is currently available in Germany, Switzerland, France, and the Netherlands. A growing number of issuers have filed for an XRP ETF, but WisdomTree is taking a slightly different tack.

“The WisdomTree Physical XRP ETP offers a simple, secure, and low-cost way to gain exposure to XRP, one of the largest cryptocurrencies by market capitalization. Backed 100% by XRP, XRPW is the lowest-priced XRP ETP in Europe, providing direct spot price exposure,” the announcement claimed.

The possibility of an official XRP ETF is growing with the current bull market, and Ripple CEO Brad Garlinghouse considers it “inevitable.” Still, it hasn’t happened yet, and ETP offerings allow issuers to somewhat address customers’ requirements. BitWise, which has also filed for an XRP ETF in the US, recently acquired a European ETP issuer to enter the same market.

WisdomTree, however, is no stranger to this market strategy. In May this year, it won approval to offer ETPs based on Bitcoin and Ethereum to British investors.

The UK has not yet approved a full ETF for either of these assets, but WisdomTree still gained market access. Even a fraction of the XRP market could also prove lucrative; the asset’s value spiked today.

WisdomTree Europe’s strategy page does not describe any further actions upon full approval. Even if the US approves an XRP ETF under the SEC’s new leadership, that won’t necessarily benefit WisdomTree’s European branch. For now, these ETPs built on XRP will have to suffice for this market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market21 hours ago

Market21 hours agoSouth Korea Unveils North Korea’s Role in Upbit Hack

-

Altcoin23 hours ago

Altcoin23 hours agoWhy FLOKI Price Hits 6-Month Peak With 5% Surge?

-

Bitcoin16 hours ago

Bitcoin16 hours agoMarathon Digital Raises $1B to Expand Bitcoin Holdings

-

Market16 hours ago

Market16 hours agoETH/BTC Ratio Plummets to 42-Month Low Amid Bitcoin Surge

-

Market15 hours ago

Market15 hours agoSEC Moves Toward Solana ETF Approval Amid Pro-Crypto Shift

-

Altcoin19 hours ago

Altcoin19 hours agoSui Network Back Online After 2-Hour Outage, Price Slips

-

Altcoin18 hours ago

Altcoin18 hours agoDogecoin Whale Accumulation Sparks Optimism, DOGE To Rally 9000% Ahead?

-

Regulation11 hours ago

Regulation11 hours agoUK to unveil crypto and stablecoin regulatory framework early next year