Market

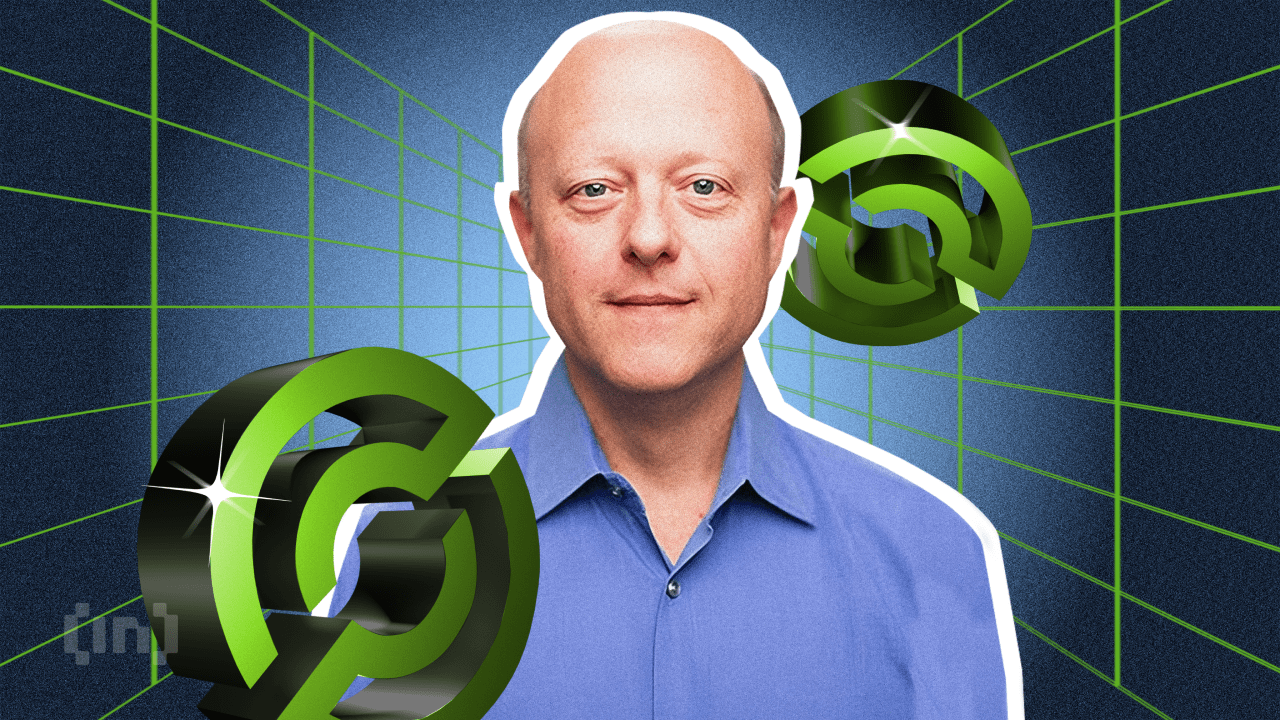

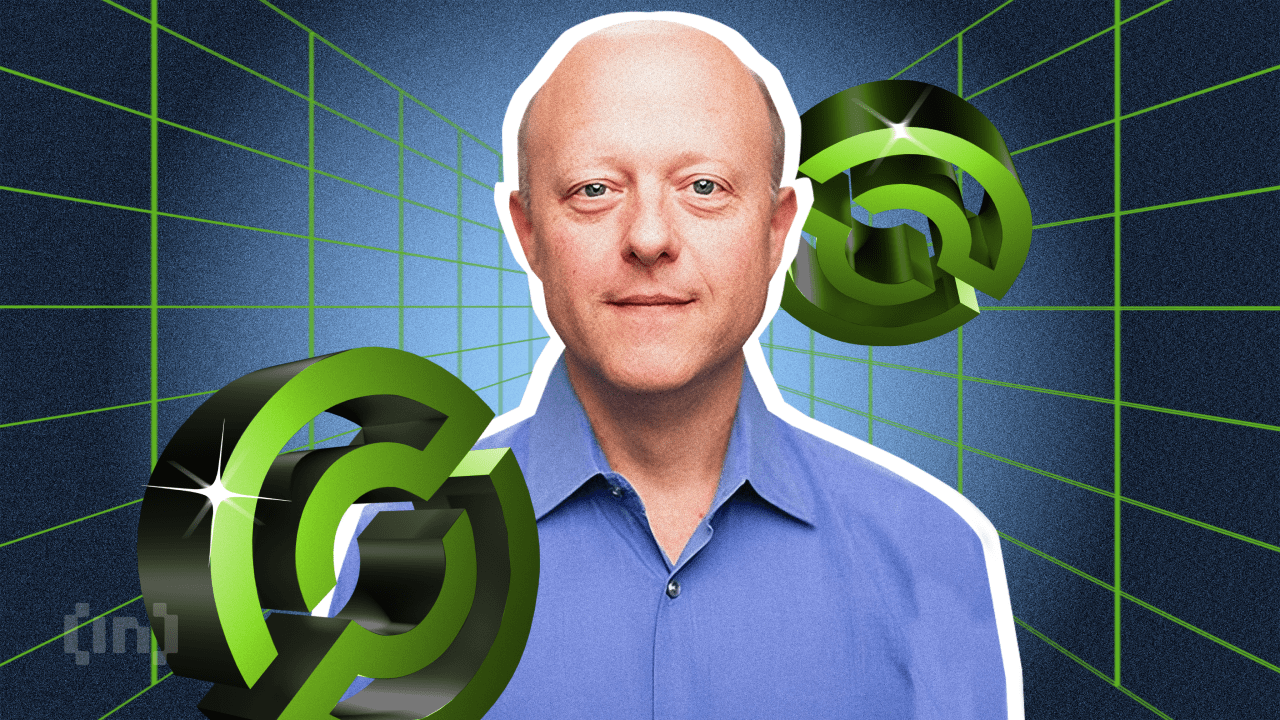

MiCA Propels Circle’s Euro Stablecoin, Says Jeremy Allaire

Circle co-founder and CEO Jeremy Allaire shilled USDC and EURC stablecoins in an interview on Monday. He anticipates more competition in the space as the EU’s regulatory framework toughens.

Under MiCA, stablecoin issuers must obtain authorization and be licensed by the relevant national authorities in the EU.

Circle Pioneers MiCA Compliance

Circle secured an Electronic Money Institution (EMI) license on Monday. This is a requirement for any issuer looking to offer dollar- and euro-pegged crypto tokens in the European Union (EU) under the Markets in Crypto Assets (MiCA) framework. It permits the firm to “onshore” its Euro-denominated EURC stablecoin to customers within the EU.

“Circle announces that USDC and EURC are now available under new EU stablecoin laws. Circle is the first global stablecoin issuer to be compliant with MiCA. Circle is now natively issuing both USDC and EURC to European customers effective July 1,” Allaire wrote.

Banks and EMIs can now issue and utilize Euro stablecoins as a core part of their products and services.

Read more: What Is Markets in Crypto-Assets (MiCA)? Everything You Need To Know

In a separate report, Allaire highlighted that compliance is the firm’s competitive advantage. He underscored Circle EURC stablecoin and USD Coin’s commitment to regulations stipulated by the MiCA framework.

“The day that MiCA came into law, we announced our Euro stablecoin EURC. We also announced our intention to make our stablecoins fully compliant with MiCA and we are very committed to that path. This is because legal electronic money in the form of Euro or dollar that runs on blockchains is a huge opportunity,” Allaire said in an interview.

Allaire cites two factors that embolden Circle: MiCA’s promotion of a pro-Euro digital asset environment and the firm’s strong compliance track record. This, in his opinion, positions the EURC to become much bigger as regulations in Europe allow Euro stablecoins to be part of a growth-bound financial system.

Why Tether’s USDT is in the Sidelines

The assertion comes after crypto exchanges delisted Euro-denominated stablecoins in their resolve to achieve MiCA compliance. Among them, Bitstamp revealed that the Euro Tether (EURT) stablecoin was delisted, joining the likes of Binance, Kraken, OKX, and Uphold, which also shed EURT.

Tether, the issuer of USDT stablecoin, indicated that it does not currently aim to comply with MiCA, which explains why it is subject to restrictions or cancellation on exchanges. Tether CEO Paolo Ardoino is against MiCA’s expectation of 60% of backing in bank cash, citing “bank failure risk.”

“Stablecoins should be able to keep 100% of reserves in treasury bills, rather than exposing themselves to bank failures by keeping big chunks of reserves in uninsured cash deposits. In case of bank failure, securities return to the legitimate owner,” Ardoino wrote in April.

For Tether, this could be another brick in the regulatory wall, shoving it to the sidelines over time as regulation in stablecoins gathers pace around the world.

Nevertheless, the landmark development sets the stage for increased adoption of Euro digital currency in the form of Euro stablecoins. With a clear set of guidelines for Euro digital currency issuance and operations, the new framework will promote a highly competitive market.

Allaire agrees with this speculation, saying that he anticipates more competition. In his opinion, new regulations that streamline the industry tend to attract more competition. Binance CEO Richard Teng lauded Circle in a post, calling for more players in the space.

“USDC becoming a MiCA-compliant e-money token (EMT) marks a positive step forward for the crypto ecosystem in the EEA region. We are hopeful that there’ll be more MiCA-compliant EMTs soon,” Teng wrote.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

With the MiCA regulations in effect, firms will be held more accountable. Their risk and compliance management, banking infrastructure, and assurances from major public audit firms will also be under more scrutiny.

The oversight, promoting regulatory clarity and transparency, will inspire increased customer confidence because of improved consumer protection. For new players looking to join the space, however, entry barriers will likely be higher as the MiCA framework aims to achieve its mandate — to protect consumers and investors, ensure financial stability, and foster innovation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Derivatives Get a Boost from US CFTC

The US Commodities Futures Trading Commission (CFTC) scrapped a key directive that had previously signaled increased scrutiny for digital asset derivatives.

This decision indicates a friendlier regulatory climate for digital assets in the US, given the Trump administration’s pro-crypto stance.

CFTC Loosens Oversight for Crypto Derivatives

The CFTC withdrew Staff Advisory No. 23-07 and No. 18-14 by its Division of Clearing and Risk (DCR).

The former, issued in May 2023, focused on the risks of clearing digital assets. Meanwhile, the latter targeted virtual currency derivatives listings.

Upon establishment, both directives hinted at the singling out of crypto products for tougher oversight.

However, both have now been deemed unnecessary, effective immediately, amid the commodities’ regulator’s push toward regulatory consistency.

The decision indicates a shift to treating digital asset derivatives like those on Ethereum (ETH) as traditional finance (TradFi) products.

“As stated in today’s withdrawal letter, DCR determined to withdraw the advisory to ensure that it does not suggest that its regulatory treatment of digital asset derivatives will vary from its treatment of other products,” the CFTC explained.

This move will eliminate the perceived distinctions between digital asset derivatives and TradFi instruments.

It also paves the way for enhanced market participation, which will facilitate broader involvement from financial institutions in the digital asset derivatives market. This could lead to increased liquidity and market maturity.

Nevertheless, the advisory warned derivatives clearing organizations (DCOs) to prepare for risk assessments specific to digital products’ unique characteristics.

Therefore, while it reflects the CFTC’s commitment to promoting innovation, it also suggests the intention to maintain strong financial oversight.

Meanwhile, this decision comes only weeks after the Office of the Comptroller of the Currency (OCC) allowed US banks to offer crypto and stablecoin services without prior approval.

However, the OCC had articulated that despite lifting the approval requirement, banks must maintain strong risk management controls akin to those required for traditional banking operations.

“The OCC expects banks to have the same strong risk management controls in place to support novel bank activities as they do for traditional ones,” said Rodney E. Hood, the acting Comptroller of the Currency.

Therefore, the CFTC’s move to eliminate regulatory bias for crypto derivatives marks a major divide in US policy. On the one hand, the CFTC seeks to scrap the distinction between crypto derivatives and TradFi instruments.

On the other hand, the FDIC (Federal Deposit Insurance Corporation) and OCC want banks to maintain risk management controls similar to those required for traditional banking operations despite providing crypto and stablecoin services.

Notwithstanding, these efforts mirror a growing trend among US financial regulators to lower barriers and foster responsible innovation in the crypto industry.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Falls 12% in a Week as Network Activity Declines

XRP is under heavy selling pressure, down more than 5% in the last 24 hours and over 12% in the past seven days. The recent downturn has been accompanied by increasingly bearish technical indicators, including a sharp spike in trend strength and a collapse in on-chain activity.

With price momentum weakening and user engagement dropping, concerns are mounting over XRP’s ability to hold key support levels. Unless sentiment shifts quickly, the path of least resistance appears to remain to the downside.

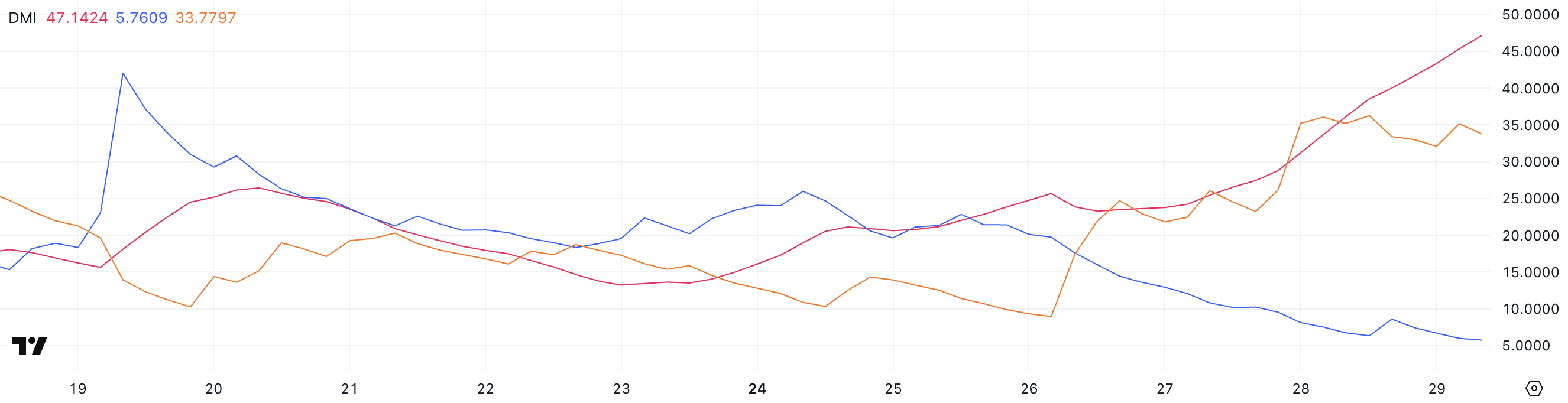

DMI Chart Shows The Current Downtrend Is Very Strong

XRP’s Directional Movement Index (DMI) is currently flashing strong bearish signals, with the Average Directional Index (ADX) surging to 47.14 from 25.43 just a day ago.

The ADX measures the strength of a trend, regardless of its direction, and values above 25 generally indicate that a trend is gaining momentum.

A reading above 40—like XRP’s current level—suggests a very strong trend is in play. Given that XRP is currently in a downtrend, this rising ADX points to intensifying bearish momentum and a market leaning heavily toward further declines.

Digging deeper into the DMI components, the +DI, which tracks upward price pressure, has dropped sharply from 20.13 to 5.76. Meanwhile, the -DI, which tracks downward price pressure, has surged from 8.97 to 33.77.

This stark divergence reinforces the bearish trend, indicating that sellers are aggressively taking control while buyer strength fades.

With ADX confirming the strength of this move and directional indicators tilting heavily to the downside, XRP’s price could remain under pressure in the short term unless a significant reversal in sentiment occurs.

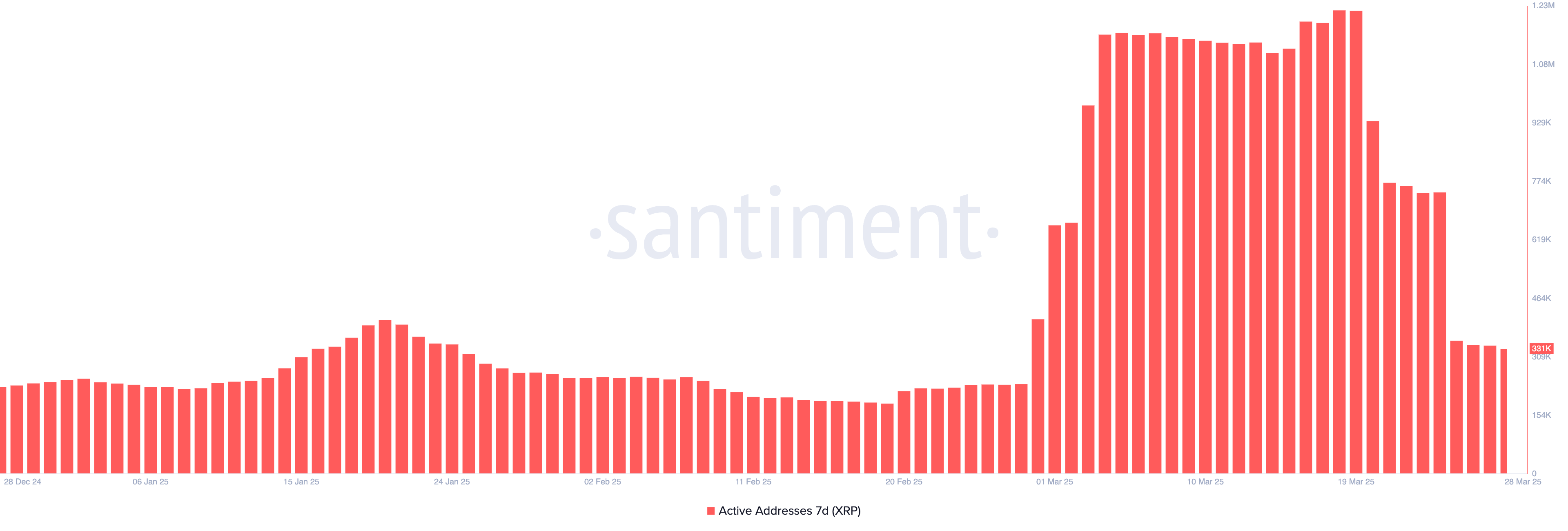

XRP Active Addresses Are Heavily Down

XRP’s 7-day active addresses have seen a sharp decline over the past week, following a recent surge to new all-time highs. On March 19, the metric peaked at 1.22 million, signaling strong network activity and user engagement.

However, since then, it has plummeted to just 331,000—a drop of over 70%. This sudden fall suggests that interest in transacting on the XRP has cooled off significantly in a short span of time.

Tracking active addresses is a key way to gauge on-chain activity and overall network health. A rising number of active addresses typically reflects growing user participation, increased demand, and potential investor interest—factors that can support price strength.

Conversely, a sharp decline like the one XRP is currently experiencing can point to weakening momentum and fading interest, which could put additional pressure on price.

Unless user activity begins to rebound, this drop in network engagement may continue to weigh on XRP’s short-term outlook.

XRP Could Drop Below $2 Soon

XRP’s Exponential Moving Average (EMA) lines are currently signaling a strong downtrend, with the short-term EMAs positioned below the longer-term ones—a classic bearish alignment.

This setup indicates that recent price momentum is weaker than the longer-term average, often seen during sustained corrections. If this downtrend continues, XRP could retest the support level at $1.90.

A break below that could open the door to a deeper drop toward $1.77 in April.

However, if market sentiment shifts and XRP price manages to reverse course, the first key level to watch is the resistance at $2.22.

A successful breakout above this point could trigger renewed bullish momentum, potentially driving the price up to $2.47.

If that level also gets breached, XRP could push further to test the $2.59 mark.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

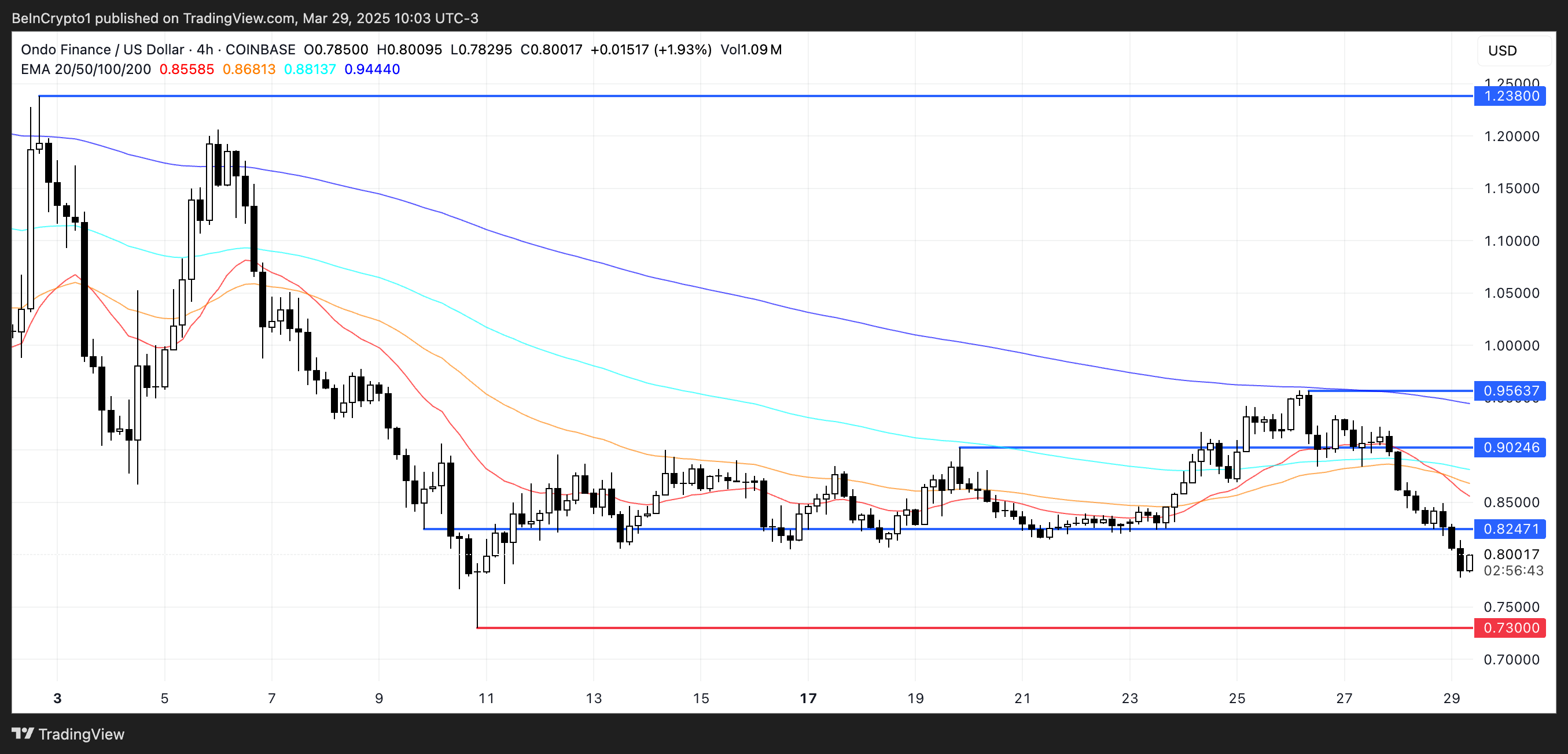

ONDO Whales Retreat as Price Risks Dropping Below $0.70

ONDO is facing notable downside pressure. It has been down over 5% in the last 24 hours and corrected more than 19% over the past 30 days. With its market cap now sitting around $2.5 billion, the coin is way below competitors like Chainlink and Mantra in terms of market cap.

Recent technical indicators and whale behavior suggest that the current weakness may not be over, despite a slight recovery in momentum.

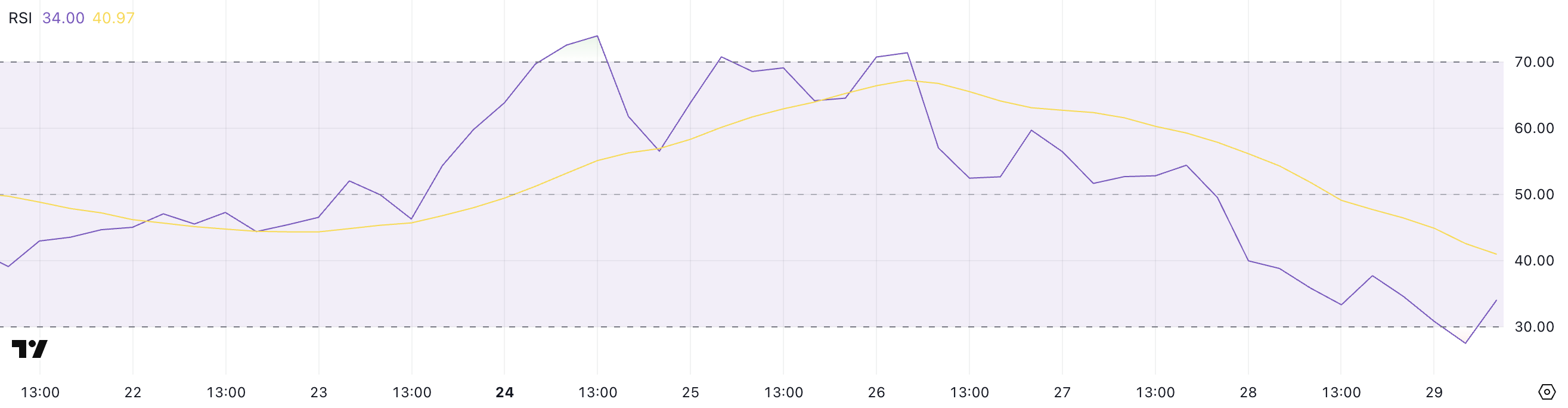

ONDO RSI Is Recovering From Oversold Levels

ONDO’s Relative Strength Index (RSI) is currently sitting at 34 after rebounding slightly from an earlier dip to 27.5. Just two days ago, the RSI was at 54.39, indicating how quickly momentum has shifted.

The RSI is a momentum oscillator that measures the speed and magnitude of recent price changes. It ranges from 0 to 100.

Readings below 30 are typically considered oversold, suggesting the asset may be undervalued and due for a bounce, while readings above 70 are viewed as overbought, indicating potential for a pullback.

With ONDO’s RSI now at 34, it has technically exited oversold territory but remains near the lower end of the scale. This suggests that while the sharpest selling pressure may have eased, the market is still fragile ,and sentiment remains cautious.

If the RSI continues to recover and climbs above 40 or 50, it could signal a shift toward more bullish momentum.

However, if selling resumes and RSI falls back below 30, it would indicate renewed downside risk and potential for further price declines.

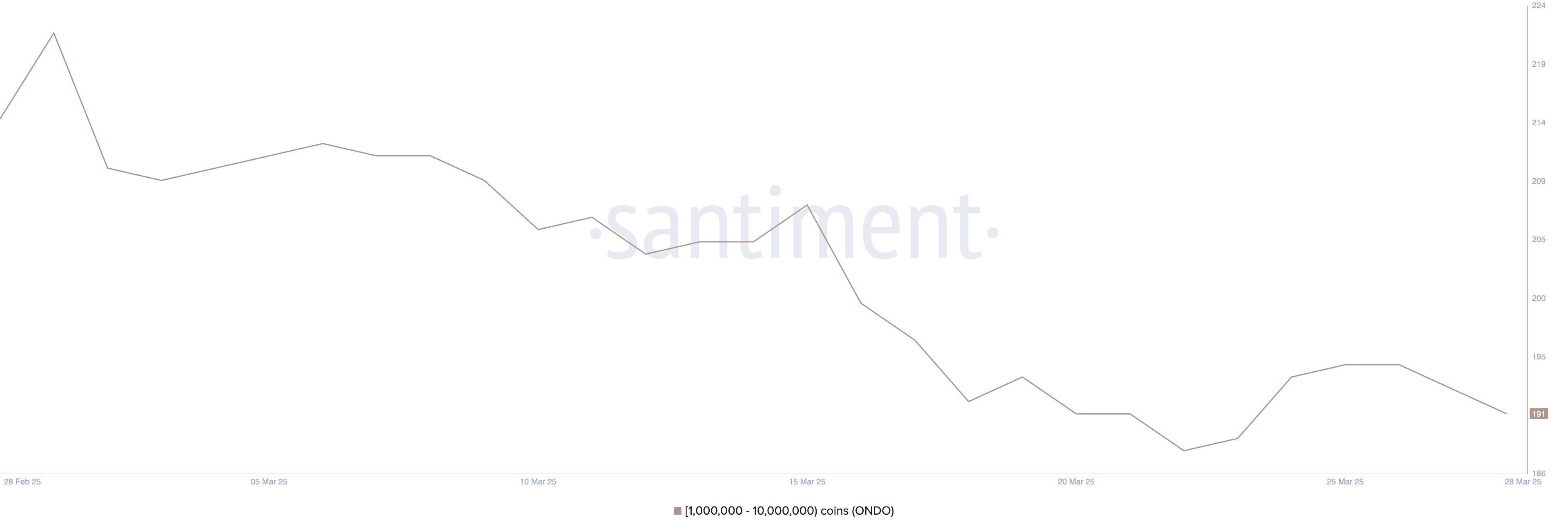

Whales Recently Stopped Their Accumulation

The number of ONDO whales—addresses holding between 1 million and 10 million ONDO—fluctuated in late March, initially increasing from 188 to 195 between March 22 and March 26 before declining to 191 in recent days.

This whale activity pattern is significant as these large holders often influence market sentiment and price movements, with their accumulation or distribution phases potentially foreshadowing broader market trends.

Tracking whale addresses provides valuable insights into how influential investors are positioning themselves, which can help predict potential price action.

The failure of Whale addresses to maintain the breakout above 195 and the subsequent return to 191 could signal bearish sentiment among larger investors.

This retreat might indicate that whales are taking profits or reducing exposure, which could create downward price pressure on ONDO in the short term.

When large holders begin to reduce their positions after a period of accumulation, it often precedes price corrections, suggesting that ONDO may experience resistance in maintaining upward momentum until whale confidence returns and accumulation resumes.

Will ONDO Fall Below $0.70 For The First Time Since November?

ONDO’s Exponential Moving Average (EMA) lines are currently aligned in a bearish formation, suggesting the ongoing downtrend may persist. If this weakness continues, ONDO could drop to test the key support level at $0.73.

A break below that would be significant, potentially sending the price under $0.70 for the first time since November 2024.

The token has been struggling to keep pace with other Real World Asset (RWA) coins like Mantra, and this underperformance adds further pressure to ONDO’s short-term outlook.

However, if sentiment shifts and ONDO manages to reverse its trend, the first key level to watch is the resistance at $0.82.

A breakout above this level could trigger a broader recovery, with price targets at $0.90 and $0.95.

If the RWA sector as a whole regains momentum, ONDO could even rise above the $1 mark and aim for the next major resistance at $1.23.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market16 hours ago

Market16 hours agoVitalik Buterin Promotes Ethereum Layer 2 Roadmap

-

Altcoin16 hours ago

Altcoin16 hours agoExpert Predicts Listing Date For WLFI’s USD1 Stablecoin, Here’s When

-

Market15 hours ago

Market15 hours agoGRASS Jumps 30% in a Week, More Gains Ahead?

-

Bitcoin21 hours ago

Bitcoin21 hours agoEl Salvador’s Nayib Bukele Open to White House Visit

-

Altcoin20 hours ago

Altcoin20 hours agoDid XRP Price Just Hit $21K? Live TV Display Error Goes Viral

-

Altcoin14 hours ago

Altcoin14 hours agoPepe Coin Whale Sells 150 Billion Tokens, Price Fall Ahead?

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum Breakdown, Analyst Eyes $1,130–$1,200 Price Target

-

Market13 hours ago

Market13 hours agoXRP Falls 12% in a Week as Network Activity Declines