Market

5 Meme Coins to Monitor in July 2024: Top Picks

Only a few cryptocurrencies can boast of outperforming meme coins this cycle. Despite their long-standing dominance, these tokens may not take the backseat anytime soon.

Furthermore, investors will be looking to allocate some of their capital to these cryptos in the new month. Here are BeInCrypto’s top meme coins to watch in July.

MAGA Hat (MAGA) Looks Up to Trump’s Campaign

MAGA, the crypto launched in honor of U.S. presidential candidate Donald Trump, tops the list, and the reason is not far-fetched. Elections in the country are scheduled to be held in November, and on Thursday, June 27, the first round of debate took place.

Launched some months back as one of Trump’s Make America Great Again narrative meme coins, MAGA reached a market cap of $263 million in the last week of May.

However, as of this writing, that value has decreased to $161 million, largely due to profit-taking. Since its launch, MAGA’s price has increased by an incredible 5,034%.

Technical analysis from the 4-hour chart reveals that the value may be higher in July. At press time, MAGA changes hands at $0.00032. The 4-hour chart also examines indicators, including the Moving Average Convergence Divergence (MACD) and Supertrend.

The Supertrend assists traders in identifying market trends and spot buy and sell signals. The MACD, on the other hand, checks whether a trend is bullish or bearish by subtracting the 26-day EMA from the 12-day EMA.

At press time, the green part of the Supertrend is below MAGA’s price ‚ specifically at $0.00029. This implies a buy signal for the meme coin. With the red region not anywhere close, MAGA may reach $0.00038 in the short term.

However, the MACD remains negative, indicating that momentum is becoming bearish. If this is the case, the meme coin may retrace to $0.00025. But buyers may take advantage of the discount. Consequently, this could lead MAGA’s price toward $0.00042 before July ends.

Jeo Boden’s (BODEN) Decline Could Be a Chance

Following the MAGA meme coins closely is BODEN. The reason for this inclusion is as clear as the day, especially as political tension in the U.S. heightens. Max Jones, founder of Memepad, explains this in a recent statement.

“PolitiFi memecoins are a major reflection of the industry’s public image as they relate to the ongoing election campaigns in the US.” Jones notes.

On June 27, BODEN’s price was $0.13, a 12% decrease from June 26. However, the meme coin continued to tank after the first public debate, with the price plunging to $0.080.

Furthermore, the 4-hour chart shows that BODEN is close to its bottom due to the descending triangle formed on the 4-hour chart.

This pattern is characterized by a series of lower highs and a flat trend line that acts as support. If demand is low in this instance, the bearish pattern may continue. The Awesome Oscillator measures momentum and supports a move down to $0.060.

However, if bulls defend this region, BODEN’s price can recover and possibly retest $0.15 in July.

Read More: What Are Meme Coins?

Frog-Themed Pepe (PEPE) Eyes Gains

PEPE is one of the top meme coins built on Ethereum. Because of the imminent spot Ethereum ETF launch, it will be one to watch in July.

At press time, PEPE trades at $0.000012. However, the price is above 20 EMA (blue), which is the average price of the cryptocurrency over the past 20 trading days. As long as PEPE does not drop below this price, the token will not undergo a correction.

Furthermore, the Relative Strength Index (RSI), which measures momentum, is rising. If this continues, PEPE can retest $0.000015 in July. However, rejection of the forecast may send the value down to $0.000011.

POPCAT Price Slips But Can It Rebound?

A notable inclusion is POPCAT, one of the top meme coins on the Solana blockchain. In the last 24 hours, POPCAT’s price has increased by 16.58%. The Bollinger Bands (BB) on the 4-hour chart shows that the token is experiencing high volatility.

Apart from volatility, the BB also shows if a cryptocurrency is overbought or oversold. When the upper band of the indicator touches the price, it is oversold. Conversely, if the lower band taps the price, it is oversold.

Previously, the upper band tapped POPCAT at $0.60, indicating that the token was oversold. Later, the retrace happened, and as of this writing, it trades at $0.54. The Relative Strength Index (RSI), whose reading was initially over 70.00, indicated the same.

By the looks of things, POPCAT may reverse to $0.49 as bullish momentum drops. It can also decline to $0.42 if many holders book profits.

If this happens, it may provide another buying opportunity for traders. In addition, the token may replicate its recent performance in July. Should this be the case, the POPCAT price may attempt to reach $0.67.

Dogwifhat (WIF) Moves Toward Resurgence

In April, predictions went round, expecting WIF to reach $5. But after hitting an all-time high of

$4.84, the meme coin went through a correction phase that plunged the price to $1.59 on June 23.

However, the cryptocurrency’s value has increased by 3.51% in the last 24 hours. Trading at $2.106, the Money Flow Index (MFI) shows that capital has begun to flow back into the WIF market.

This rise in the reading is a sign of buying pressure. If sustained, the price of WIF may not revisit its all-time high, but targets between $2.47, $2.98, and $3.35 look plausible in July.

Another factor that can propel the price is the optimism regarding the recent Solana ETF application, especially as WIF is the top meme coin on the blockchain.

Read More: How to Buy Solana Meme Coins: A Step-by-Step Guide

In conclusion, there are other meme coins to look forward to. One of them is BOBBY, named after Robert Kennedy Jr., another candidate vying for U.S. presidency.

BOBBY’s market capitalization, at $87.36 million, is much lower than BODEN and MAGA’s. Meanwhile, Max Jones adds that the token is in the mix.

‘“As the campaign heats up, these memecoins may serve as a popularity check among the respective candidates. While it remains unknown which of these memecoins will stand the test of time, they currently serve as an uncommon litmus test for Trump, Biden, and RKF.” The Memepad founder says.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

WisdomTree Europe Launches XRP ETP

ETF issuer WisdomTree’s European division just announced a new ETP based on XRP. This product is currently available in four EU countries, which has led XRP’s price to jump slightly.

ETPs are a common issuer strategy to earn revenue without ETF approval, but Europe will not necessarily approve one even if the US does so.

WisdomTree’s XRP ETP

WisdomTree, one of the Bitcoin ETF issuers in the US, announced that its European branch is offering an exchange-traded product (ETP) based on XRP. This new product is currently available in Germany, Switzerland, France, and the Netherlands. A growing number of issuers have filed for an XRP ETF, but WisdomTree is taking a slightly different tack.

“The WisdomTree Physical XRP ETP offers a simple, secure, and low-cost way to gain exposure to XRP, one of the largest cryptocurrencies by market capitalization. Backed 100% by XRP, XRPW is the lowest-priced XRP ETP in Europe, providing direct spot price exposure,” the announcement claimed.

The possibility of an official XRP ETF is growing with the current bull market, and Ripple CEO Brad Garlinghouse considers it “inevitable.” Still, it hasn’t happened yet, and ETP offerings allow issuers to somewhat address customers’ requirements. BitWise, which has also filed for an XRP ETF in the US, recently acquired a European ETP issuer to enter the same market.

WisdomTree, however, is no stranger to this market strategy. In May this year, it won approval to offer ETPs based on Bitcoin and Ethereum to British investors.

The UK has not yet approved a full ETF for either of these assets, but WisdomTree still gained market access. Even a fraction of the XRP market could also prove lucrative; the asset’s value spiked today.

WisdomTree Europe’s strategy page does not describe any further actions upon full approval. Even if the US approves an XRP ETF under the SEC’s new leadership, that won’t necessarily benefit WisdomTree’s European branch. For now, these ETPs built on XRP will have to suffice for this market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Rallies 10% and Targets More Upside

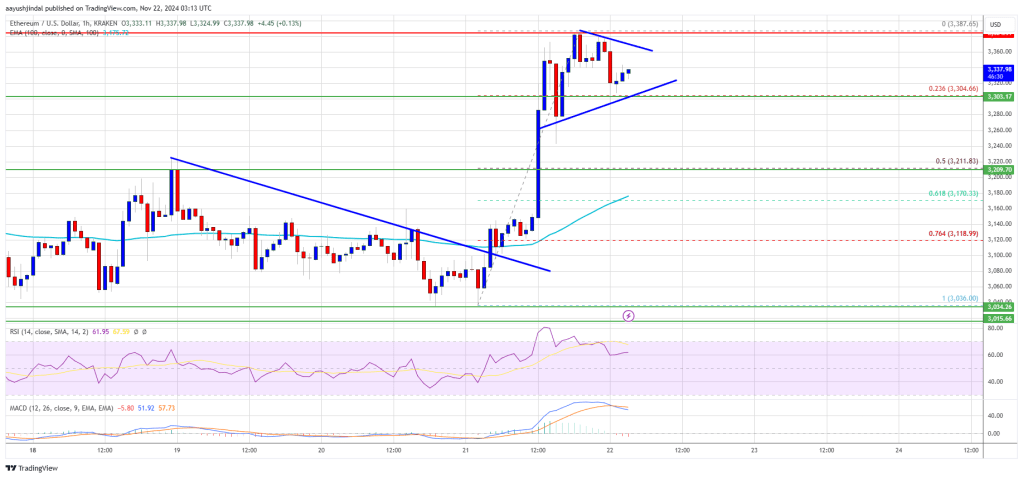

Ethereum price started a fresh increase above the $3,220 zone. ETH is rising and aiming for more gains above the $3,350 resistance.

- Ethereum started a fresh increase above the $3,220 and $3,300 levels.

- The price is trading above $3,250 and the 100-hourly Simple Moving Average.

- There is a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could gain bullish momentum if it clears the $3,385 resistance zone.

Ethereum Price Regains Traction

Ethereum price remained supported above $3,000 and started a fresh increase like Bitcoin. ETH gained pace for a move above the $3,150 and $3,220 resistance levels.

The bulls pumped the price above the $3,300 level. It gained over 10% and traded as high as $3,387. It is now consolidating gains above the 23.6% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high.

Ethereum price is now trading above $3,220 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,350 level. There is also a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD.

The first major resistance is near the $3,385 level. The main resistance is now forming near $3,420. A clear move above the $3,420 resistance might send the price toward the $3,550 resistance. An upside break above the $3,550 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,650 resistance zone or even $3,880.

Another Decline In ETH?

If Ethereum fails to clear the $3,350 resistance, it could start another decline. Initial support on the downside is near the $3,300 level. The first major support sits near the $3,250 zone.

A clear move below the $3,250 support might push the price toward $3,220 or the 50% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high. Any more losses might send the price toward the $3,150 support level in the near term. The next key support sits at $3,050.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,250

Major Resistance Level – $3,385

Market

Rallies 10% and Targets More Upside

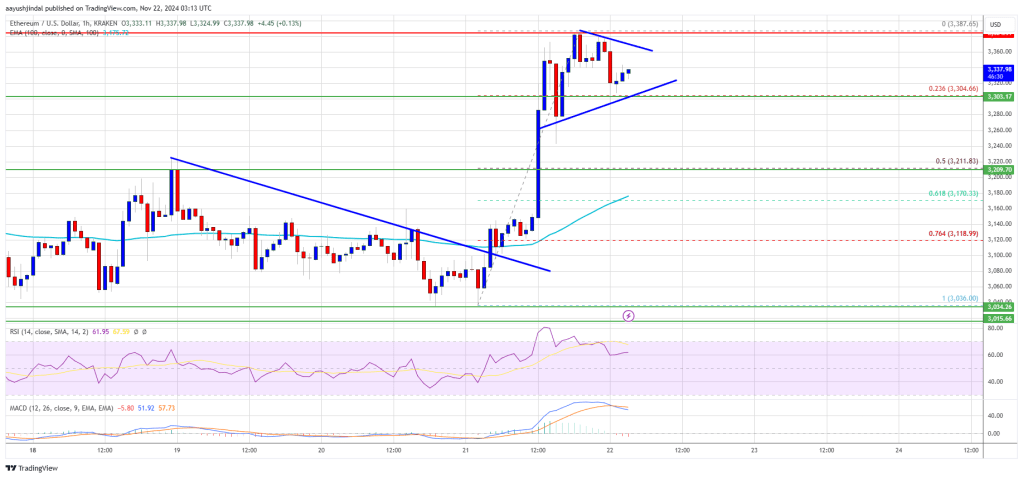

Ethereum price started a fresh increase above the $3,220 zone. ETH is rising and aiming for more gains above the $3,350 resistance.

- Ethereum started a fresh increase above the $3,220 and $3,300 levels.

- The price is trading above $3,250 and the 100-hourly Simple Moving Average.

- There is a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could gain bullish momentum if it clears the $3,385 resistance zone.

Ethereum Price Regains Traction

Ethereum price remained supported above $3,000 and started a fresh increase like Bitcoin. ETH gained pace for a move above the $3,150 and $3,220 resistance levels.

The bulls pumped the price above the $3,300 level. It gained over 10% and traded as high as $3,387. It is now consolidating gains above the 23.6% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high.

Ethereum price is now trading above $3,220 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,350 level. There is also a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD.

The first major resistance is near the $3,385 level. The main resistance is now forming near $3,420. A clear move above the $3,420 resistance might send the price toward the $3,550 resistance. An upside break above the $3,550 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,650 resistance zone or even $3,880.

Another Decline In ETH?

If Ethereum fails to clear the $3,350 resistance, it could start another decline. Initial support on the downside is near the $3,300 level. The first major support sits near the $3,250 zone.

A clear move below the $3,250 support might push the price toward $3,220 or the 50% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high. Any more losses might send the price toward the $3,150 support level in the near term. The next key support sits at $3,050.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,250

Major Resistance Level – $3,385

-

Ethereum22 hours ago

Ethereum22 hours agoFundraising platform JustGiving accepts over 60 cryptocurrencies including Bitcoin, Ethereum

-

Market19 hours ago

Market19 hours agoSouth Korea Unveils North Korea’s Role in Upbit Hack

-

Market23 hours ago

Market23 hours agoCardano’s Hoskinson Wants Brian Armstrong for US Crypto-Czar

-

Altcoin16 hours ago

Altcoin16 hours agoDogecoin Whale Accumulation Sparks Optimism, DOGE To Rally 9000% Ahead?

-

Altcoin21 hours ago

Altcoin21 hours agoWhy FLOKI Price Hits 6-Month Peak With 5% Surge?

-

Bitcoin14 hours ago

Bitcoin14 hours agoMarathon Digital Raises $1B to Expand Bitcoin Holdings

-

Market14 hours ago

Market14 hours agoETH/BTC Ratio Plummets to 42-Month Low Amid Bitcoin Surge

-

Altcoin24 hours ago

Altcoin24 hours agoSHIB Burn Rate Surges 2200%, Shiba Inu Eyes Parabolic Rally Ahead?