Market

Jesse Powell’s $1 Million Trump Donation Explained

Kraken‘s co-founder Jesse Powell said he donated $1 million to Donald Trump’s presidential campaign.

While the 45th president of the US has campaigned with a crypto banner in the past few months, cryptocurrency failing to feature in the Thursday night debate has left many disappointed.

Jesse Powell’s Pro-Crypto Move: $1 Million to Trump

Powell said that most of his $1 million donation to Trump’s presidential bid was in Ethereum (ETH). His support for Trump comes as crypto proponents advocate for the end of an anti-crypto era. The Kraken executive cited attacks by Senator Elizabeth Warren and Gary Gensler, chair of the US Securities and Exchange Commission (SEC).

“I am excited to join other leaders from our community to unite behind the only pro-crypto major party candidate in the 2024 Presidential election so the United States can continue to remain a leader in blockchain technology,” Powell wrote.

According to the Kraken executive, President Joe Biden’s administration has done nothing to curb “a campaign of unchecked regulation by enforcement.” This negligence has shrunk the competitiveness of the US, Powell said, compared to other major economies in the world which continue to advance clear rules for digital assets regulation.

The announcement came hours after the Thursday night debate between President Biden and his opponent, Trump. To the surprise and disappointment of the crypto community, the debate only focused on the economy, abortion, immigration, and foreign policy, leaving out cryptocurrency and digital assets in general. A poll by MicroStrategy founder and chairman Michael Saylor ahead of the debate highlights the dismay.

Coinbase exchange decried this oversight, acknowledging the huge population of crypto owners in the country. Per the US-based trading platform, this qualifies digital assets to feature in the conversation.

“The first Presidential Debate has just ended and crypto was not mentioned. With 52 million Americans and 19% of Georgians owning crypto, it’s time to make sure it’s part of the conversation going forward,” Coinbase remarked.

Other community members on X shared Coinbase’s sentiment, with the oversight provoking a sell-off among PolitiFi token holders. TRUMP, MAGA, BODEN, TREMP, and STRUMP tokens plummeted, some to double-digit extremes.

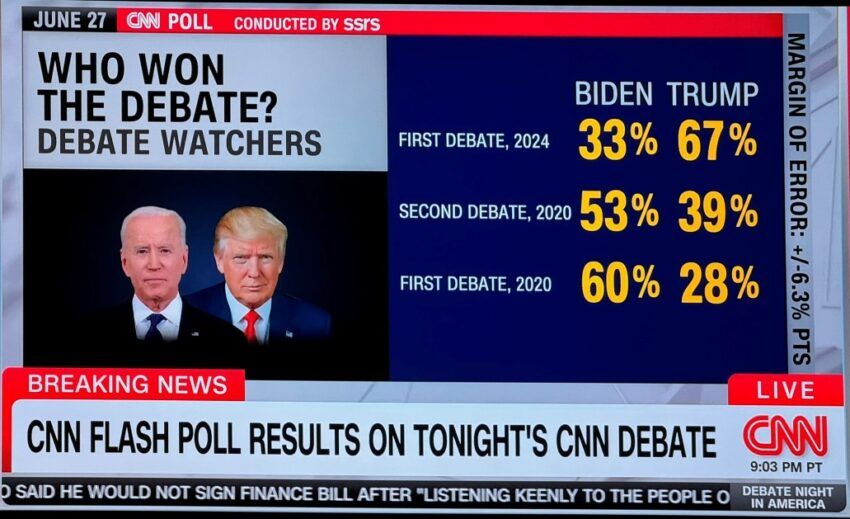

Notably, this was the first debate between the two presidential aspirants. Another is slated for September before the November elections. The general sentiment is that Trump won the first round, clocking 67% against 33% for Biden, according to CNN flash polls.

Also Read: Crypto Regulation: What Are the Benefits and Drawbacks?

Donations Soar as Crypto Lobbists Speak Out

Besides Powell, the Winklevoss twins had donated $2 million worth of Bitcoin to Trump’s campaign. Quantitative trading firm Jump Crypto also donated $10 million to the crypto-focused Super Political Action Committee (PAC) Fairshake, joining Coinbase in the pro-crypto campaign. With such big bucks from crypto lobbyists, speculation is that cryptocurrency could sway round two of the debates.

Read More: Who Are Cameron and Tyler Winklevoss? A Profile on the Brothers

With crypto proving to be fundamental in US politics in 2024, Jay Jacobs, Head of Thematic and Active ETFs at BlackRock, declared BTC a hedge against geopolitical and monetary risks. Jacobs reinforced Bitcoin’s growing importance and demand in an ever-growing financial landscape.

“Bitcoin is a nascent asset. It’s only one-tenth of the size of the gold market. Therefore, it has high volatility and behaves a bit differently than stocks and bonds. A lot of investors look at it as a potential hedge against geopolitical and monetary risks. Other investors look at it as a way to play future adoption of blockchain technology. In either case, investors must take a measured approach to Bitcoin, considering both the risks and the potential returns of the asset,” Jacob said in the video.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Rallies After Trump Pauses Tariff—Crypto Markets Cheer the Move

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started a fresh increase above the $80,000 zone. BTC is now consolidating gains and might correct some to test the $80,500 zone.

- Bitcoin started a fresh increase above the $80,000 zone.

- The price is trading above $80,500 and the 100 hourly Simple moving average.

- There was a break above a key bearish trend line with resistance at $78,800 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $83,500 zone.

Bitcoin Price Jumps Over 5%

Bitcoin price started a fresh increase from the $74,500 zone. BTC formed a base and gained pace for a move above the $78,500 and $80,000 resistance levels.

The bulls pumped the price above the $80,500 resistance. There was a break above a key bearish trend line with resistance at $78,800 on the hourly chart of the BTC/USD pair. The pair even cleared the $82,500 resistance zone. A high was formed at $83,548 and the price is now consolidating gains above the 23.6% Fib retracement level of the upward move from the $74,572 swing low to the $83,548 high.

Bitcoin price is now trading above $80,200 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $83,200 level. The first key resistance is near the $83,500 level.

The next key resistance could be $84,500. A close above the $84,500 resistance might send the price further higher. In the stated case, the price could rise and test the $85,800 resistance level. Any more gains might send the price toward the $88,000 level.

Are Dips Supported In BTC?

If Bitcoin fails to rise above the $83,500 resistance zone, it could start a downside correction. Immediate support on the downside is near the $81,400 level. The first major support is near the $80,500 level.

The next support is now near the $79,500 zone or the 50% Fib retracement level of the upward move from the $74,572 swing low to the $83,548 high. Any more losses might send the price toward the $78,000 support in the near term. The main support sits at $75,000.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $81,400, followed by $80,500.

Major Resistance Levels – $83,500 and $84,500.

Market

Top 3 Exchange Tokens to Keep An Eye For April 2025

Bitget (BGB), Cronos (CRO), and 1INCH are three of the top exchange tokens to watch in April 2025. BGB is down 4% this week after a massive rally in late 2024, while CRO has dropped nearly 10% amid broader market weakness tied to the tariff war.

1INCH has also fallen over 5%, impacted by Ethereum’s continued decline. Despite the pullbacks, each token has key catalysts ahead that could drive a reversal—or deepen the correction.

Bitget (BGB)

BGB token has drawn significant attention in recent months, rallying 434% between December 1 and December 27, 2024.

However, after reaching that peak, momentum began to cool, and the token is now down 12% over the last seven days. This pullback comes as traders reassess the token’s near-term potential following its explosive run.

Despite that correction, Bitget Token continues to be one of the biggest exchange tokens in the market, with a market cap of $4.8 billion.

In Q1 2025, Bitget burned 30 million BGB tokens, following a much larger 800 million burn in late 2024—cutting total supply by 40% in a move aimed at boosting long-term value through deflation. BGB has also expanded its utility, now supporting multi-chain gas fees and real-world payments, pushing its use cases beyond the Bitget ecosystem.

If the current correction reverses, Bitget Token could test resistance at $4.40, with a potential push to $4.69 if broken.

Conversely, if the selloff deepens, support around $3.72 could be tested, and a break below that would mark the token’s first drop beneath $3.70 since December 2024.

Cronos (CRO)

CRO, Crypto.com’s native token, is down nearly 22% over the past seven days, making it one of the worst performers among major exchange tokens this week.

The decline comes as broader crypto markets react sharply to the escalating tariff war, which has triggered a wave of risk-off sentiment across both traditional and digital assets.

Crypto.com had ambitious plans for 2025, including talk of a potential CRO ETF, but with market conditions deteriorating, the viability of these milestones remains uncertain.

Technically, Cronos’ EMA lines have formed two death crosses in recent days—a strong bearish signal. If the downtrend persists, CRO could fall to test support at $0.077, and if that level breaks, drop further to $0.073.

However, if market sentiment rebounds—especially if boosted by Crypto.com’s partnership with Trump Media—CRO could recover sharply, making it one of the most relevant exchange tokens in the market.

Key upside targets include $0.085, followed by $0.097, $0.108, and potentially $0.12 if bullish momentum strengthens.

1INCH

1INCH remains one of the most important DEX aggregators in the crypto space, even as it operates at a much smaller scale compared to rivals like Jupiter, which sees roughly five times more trading volume.

It also faces rising competition from newer players like CoWSwap, putting pressure on its dominance in the sector.

Despite its strong fundamentals and reputation, 1INCH has seen its token price drop more than 17% over the last seven days, bringing its market cap down to $221 million.

The ongoing downturn in the Ethereum ecosystem, with ETH now trading below $1,500 and at risk of dropping toward $1,000, has had a significant impact on aggregators like 1INCH.

If the correction deepens, 1INCH could test support near $0.148.

However, a rebound in Ethereum activity could quickly reverse the trend, potentially pushing 1INCH to retest resistance at $0.177 and, if broken, rally toward $0.198 and even $0.22.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana (SOL) Drops 4% as Selling Pressure Intensifies

Solana (SOL) has recovered over 12% today after Trump announced a 90-day pause on tariffs. Despite the significant recovery, technical indicators continue flashing bearish warnings. Key indicators like the RSI, BBTrend, and EMA lines all point to weakening momentum and a lack of buyer conviction. While oversold conditions have started to stabilize, the broader structure still leans slightly in favor of sellers.

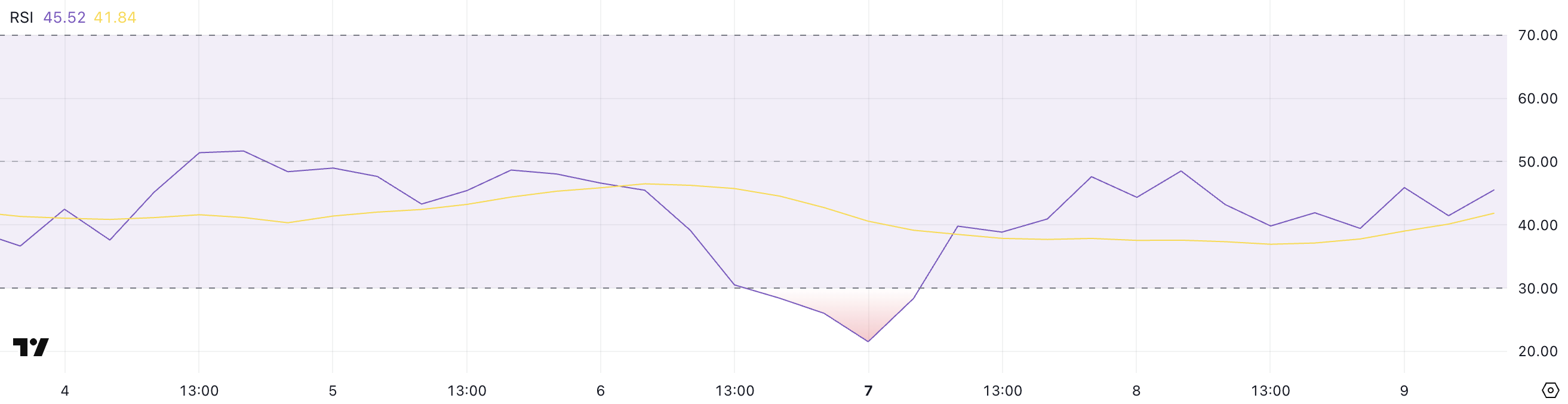

Solana RSI Shows The Lack Of Conviction Among Buyers

Solana’s Relative Strength Index (RSI) is currently sitting at 45.52, hovering in neutral territory but remaining below the midline of 50 for nearly two days.

This comes after the RSI briefly dipped to an oversold level of 21.53 two days ago, indicating that sellers had briefly dominated before demand began to stabilize.

The RSI’s slow climb back toward neutral suggests that while extreme selling pressure has eased, bullish momentum has not yet taken control.

The RSI is a momentum oscillator that measures the speed and magnitude of recent price movements. It typically ranges from 0 to 100.

Readings above 70 are generally interpreted as overbought, signaling the potential for a pullback, while readings below 30 suggest oversold conditions and potential for a rebound.

Solana’s RSI at 45.52 indicates that the asset is in a recovery phase but lacks conviction. If the RSI fails to cross above 50 soon, it could imply continued hesitation among buyers and the potential for sideways price action or even another leg lower.

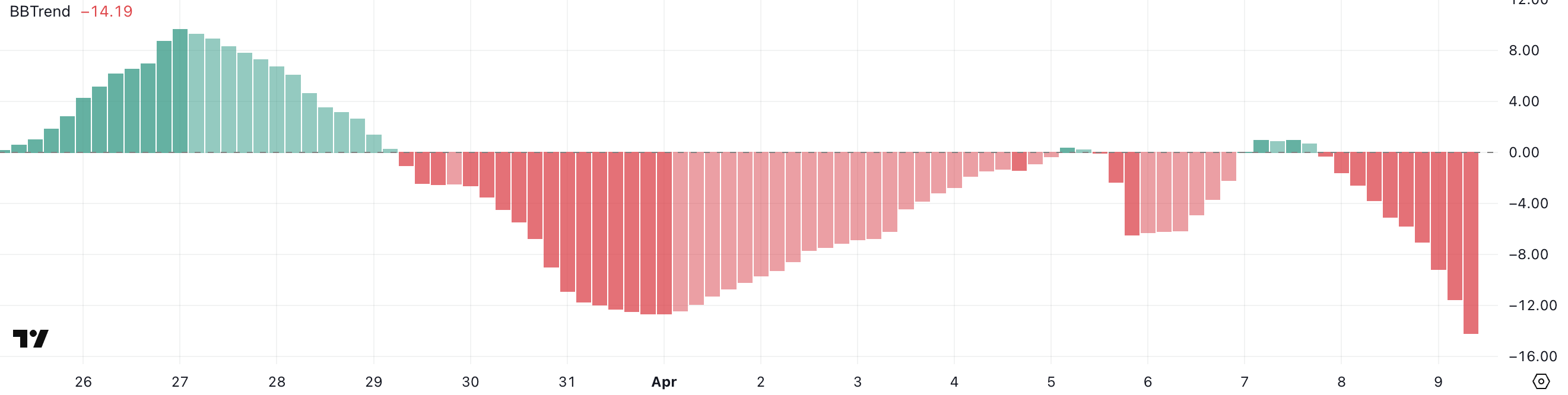

SOL BBTrend Has Reached Its Lowest Levels In Almost A Month

Solana’s BBTrend indicator is currently at -14.19, having turned negative since yesterday, and is at its lowest level since March 13—nearly a month ago.

This shift into deeper negative territory suggests that bearish momentum is building once again after a period of relative stability.

The return to these levels may indicate growing downside pressure, especially if follow-through selling continues in the short term.

The BBTrend (Bollinger Band Trend) is a volatility-based indicator that measures the strength and direction of a price trend using the distance between price and Bollinger Bands.

Positive BBTrend values generally reflect bullish momentum, while negative values signal bearish momentum. The deeper the reading into negative territory, the stronger the downward pressure is considered to be.

Solana’s BBTrend is now at -14.19, implying an intensifying bearish phase, which could mean further price declines unless sentiment or volume shifts quickly in favor of buyers.

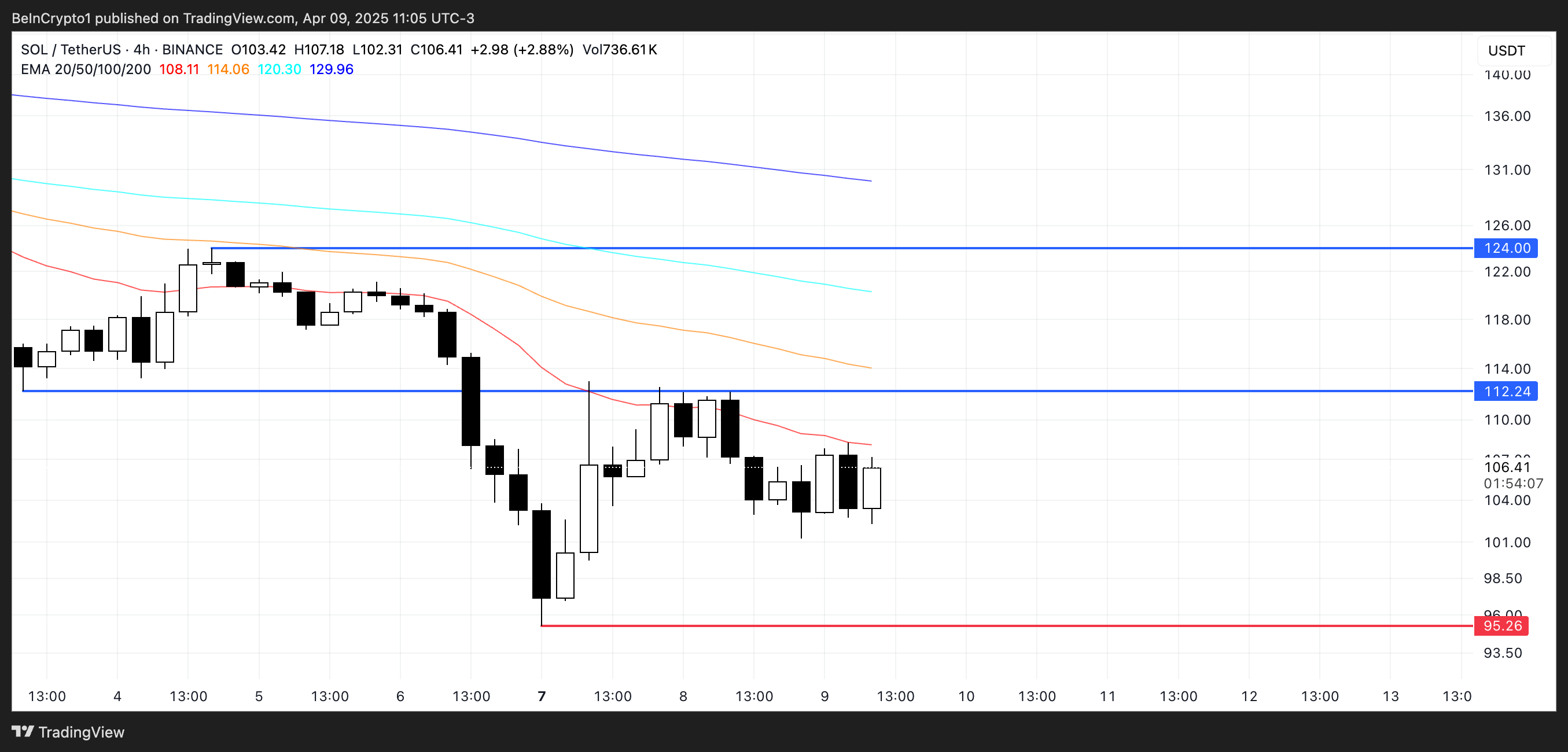

Will Solana Dip Below $100 Again In April?

Solana’s EMA setup continues to reflect a strong bearish structure, with short-term moving averages remaining well below long-term ones.

This alignment confirms that downward momentum is still in control, keeping sellers in a dominant position.

However, if Solana price manages to sustain the current strength and buying interest, it could test resistance at $120. A break above that level may open the path toward the next target at $134.

On the downside, if the current bearish trend persists, Solana could revisit support near $95, a level that has previously acted as a short-term floor.

Losing this level would be technically significant, potentially pushing SOL below $90—territory not seen since January 2024.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market19 hours ago

Market19 hours agoXRP Price Warning Signs Flash—Fresh Selloff May Be Around the Corner

-

Altcoin19 hours ago

Altcoin19 hours agoBinance To Delist These 7 Crypto Pairs Amid Market Turmoil, Are Prices At Risk?

-

Market23 hours ago

Market23 hours agoEthereum Price Hit Hard—10% Drop Sparks Selloff Fears

-

Bitcoin22 hours ago

Bitcoin22 hours agoHow Trump’s Tariffs Threaten Bitcoin Mining in the US

-

Altcoin22 hours ago

Altcoin22 hours agoShiba Inu Burn Rate Shoots Up 1500%, Can SHIB Price Recover After Bloodbath?

-

Market20 hours ago

Market20 hours agoJasmyCoin Surge Defies “Dead Cat Bounce” Fears

-

Bitcoin14 hours ago

Bitcoin14 hours agoWill the Corporate Bitcoin Accumulation Trend Continue in 2025?

-

Market14 hours ago

Market14 hours agoPaul Atkins SEC Confirmation Vote