Market

The AI-Powered Trading Bot Anyone Can Use

Editorial Note: The following content does not reflect the views or opinions of BeInCrypto. It is provided for informational purposes only and should not be interpreted as financial advice. Please conduct your own research before making any investment decisions.

The market for cryptocurrencies is certainly full of potential, and at the same time, it can be quite overwhelming as well. Especially for a new entrant, the trends might just be a bit too much changing, coupled with technical jargon.

But what if there was a way to make crypto trading a reality for everybody just by making the process simple? Meet AlgosOne: an AI-driven platform that automates the analysis process and executes successful trades so people of any experience level can confidently partake in the crypto market.

The AlgosOne AI works with a high-power blend of algorithms, including machine and deep learning, to analyze large-scale market data. These include historical patterns, price movements in real-time, news events, and even sentiment on social media.

After studying all the critical areas, AlgosOne points out potentially profitable situations that human traders may fail to notice or analyze due to their limited information-handling abilities. Fueled by state-of-the-art algorithms and a large GPT-4 model that can support up to 500 pages of data within a few minutes, AlgosOne never rests and is always on the lookout for successful trades for you automatically.

Moreover, AlgosOne is not just about stating where trends lie. It goes a step further in customizing a trading strategy to fit what you specifically require. During the registration process, you define your risk settings and investment goals.

That information is then used in defining a customized trading strategy that sees to it that trades are in your comfort zone and toward your financial goals. This way, it is not just throwing in trades but following a data-driven approach optimized for your success.

AlgosOne does it all, from catching emerging trends to predicting a market upsurge: it does all this with unsurpassed accuracy. The testament to the trades the AlgosOne AI suggests is the remarkable 80% success rate that it offers. To see this trading success rate yourself, AlgosOne lets you try out its platform through a 14-day risk-free trial.

AlgosOne’s AI doesn’t operate with a one-size-fits-all approach. It recognizes that different investors have varying levels of experience, risk tolerance, and trading goals. To cater to this

diversity, AlgosOne offers three distinct trading methods, each designed to empower you on your path to success:

- Fully Automated Trading

Ideal for newbies or for anybody who simply does not feel like spending hours reading the market and always wants to capture the perfect trading opportunities. In this, the AI is constantly on the lookout for a successful trade, and as soon as it finds one, it executes the trade. The user will only receive a notification of the trade, and that’s it.

One check that the AI runs before executing a trade is the verification of your selected risk settings. If you select low in the risk settings, then the AI will go for low-leveraged 1x or 2x trades. However, if your risk settings are set high, then the AI will go for 50x, 75x, and even 100x leveraged trades. Holistically, this process allows you to just sit back, relax, and watch your portfolio grow without having to keep an eye on the market from time to time.

- 1-Click Approval Trades

The 1-Click Approval Trades technique is meant for those who are looking to balance automation with control. AlgosOne AI scans the markets, identifies where there is potential for a trade, and then highlights this for you by clearly stating the entry and exit points.

You can approve the trade with just one click if it suits your strategy, or just decline in case you like waiting for a better opportunity to present itself. It empowers you to use the power of AI to make informed decisions while still being in control of your trades.

- Trading Bank Trades

Looking to supercharge your returns? AlgosOne’s innovative Trading Bank Trades are designed to maximize your profits. This feature utilizes referral credits, which you can earn by referring friends to the platform. These credits are then used to execute additional automated trades on top of your daily tier limit. You can find your daily limits in the detailed table below by clicking here.

AlgosOne has recently introduced its innovative approach to wealth accumulation through its savings accounts.

The key to AlgosOne savings accounts lies in their hands-off approach to investing The magic secret about AlgosOne savings accounts is that they are hands-off investments. No more waiting for signals from discord groups and manually putting in those trades or regrets of missing out on golden opportunities.

With AlgosOne’s savings account, all your profits will be used for even more trades and they will keep on compounding with every trade. The withdrawal time is about 12 to 36 months, so you can have an impressive and sizable investment portfolio.

But maybe the most compelling feature of AlgosOne Savings Accounts is their unwavering commitment to long-term growth. First of all, they are registered with the EU to ensure the reliability and security of the platform.

Secondly, they have established the AlgosOne Reserve Fund for anyone who suffers losses due to any error or hacking attack. Lastly, the upcoming Algosone is going to launch its own token, which will further strengthen the whole community and project for long-term success.

For a limited time, you can try out AlgosOne yourself through a two-week risk-free trial!

AlgosOne isn’t just about making trading easier. It is going to tokenize its AI and the users have the possibility to own part of the AI core. With the tokenization of the platform, it is going to bring the AI ownership to its users.Here’s how the AlgosOne token empowers you:

- Let your tokens work for you! AlgosOne plans to distribute regular dividends from its profits to token holders. This means you can earn a steady stream of passive income simply by holding onto your tokens. (Note: The specific frequency of these dividends is not publicly available yet. Be sure to check the AlgosOne website for the latest information.)

- The AlgosOne token has a limited supply. With increasing value across different sale stages (pre-sale, public rounds), the token might hold the potential for significant growth.

Visit the AlgosOne website today to learn more about the AI app that is advancing constantly. You can use the 14-day free trial and see how the AI works.

Disclaimer

This article is sponsored content and does not represent the views or opinions of BeInCrypto. While we adhere to the Trust Project guidelines for unbiased and transparent reporting, this content is created by a third party and is intended for promotional purposes. Readers are advised to verify information independently and consult with a professional before making decisions based on this sponsored content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Trump’s Surprise Move Sends ETH Up 15%

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price started a fresh increase above the $1,600 zone. ETH is now up nearly 15% and might attempt a move above the $1,680 zone.

- Ethereum started a decent increase above the $1,550 and $1,600 levels.

- The price is trading above $1,550 and the 100-hourly Simple Moving Average.

- There was a break above a key bearish trend line with resistance at $1,470 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair tested the $1,680 resistance zone and might correct some gains.

Ethereum Price Jumps Over 12%

Ethereum price formed a base above $1,380 and started a fresh increase, like Bitcoin. ETH gained pace for a move above the $1,450 and $1,500 resistance levels.

The bulls even pumped the price above the $1,550 zone. There was a break above a key bearish trend line with resistance at $1,470 on the hourly chart of ETH/USD. The pair even cleared the $1,620 resistance zone. A high was formed at $1,687 and the price is now consolidating gains above the 23.6% Fib retracement level of the upward move from the $1,384 swing low to the $1,687 high.

Ethereum price is now trading above $1,550 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $1,650 level.

The next key resistance is near the $1,680 level. The first major resistance is near the $1,720 level. A clear move above the $1,720 resistance might send the price toward the $1,750 resistance. An upside break above the $1,750 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $1,850 resistance zone or even $1,880 in the near term.

Are Dips Limited In ETH?

If Ethereum fails to clear the $1,650 resistance, it could start a downside correction. Initial support on the downside is near the $1,615 level. The first major support sits near the $1,580 zone.

A clear move below the $1,580 support might push the price toward the $1,535 support and the 50% Fib retracement level of the upward move from the $1,384 swing low to the $1,687 high. Any more losses might send the price toward the $1,480 support level in the near term. The next key support sits at $1,420.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $1,535

Major Resistance Level – $1,650

Market

Solana Price Attempts Recovery, Nears $120, But Needs A Push

Solana (SOL) has experienced significant volatility recently, with a marked decline following its failure to breach the $150 mark.

Over the last few days, Solana has struggled to break through certain resistance levels that have been affected by broader market trends. However, investor optimism appears to be driving recent price movements as SOL nears $120.

Solana Gains Support

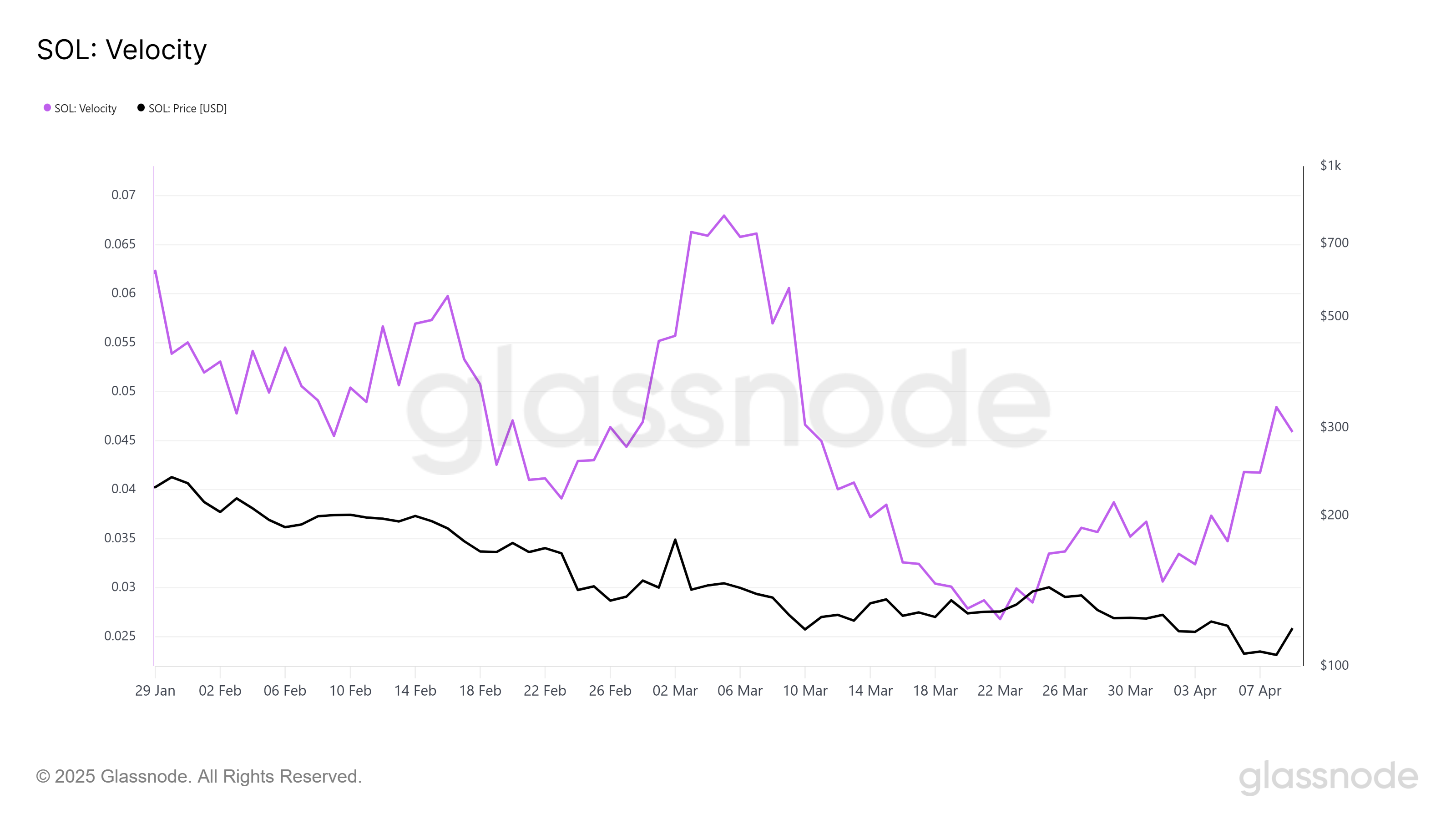

One of the indicators showing promise for Solana’s recovery is its velocity, which measures the pace at which tokens are being circulated. The velocity has reached a monthly high, signaling that the transaction of supply is accelerating.

Amidst recovering price, there’s a noticeable increase in the velocity at which tokens are being transacted, highlighting greater demand. Velocity and price tend to move in tandem. Typically, when both price and velocity rise together, it’s considered a bullish signal — a trend currently seen with Solana.

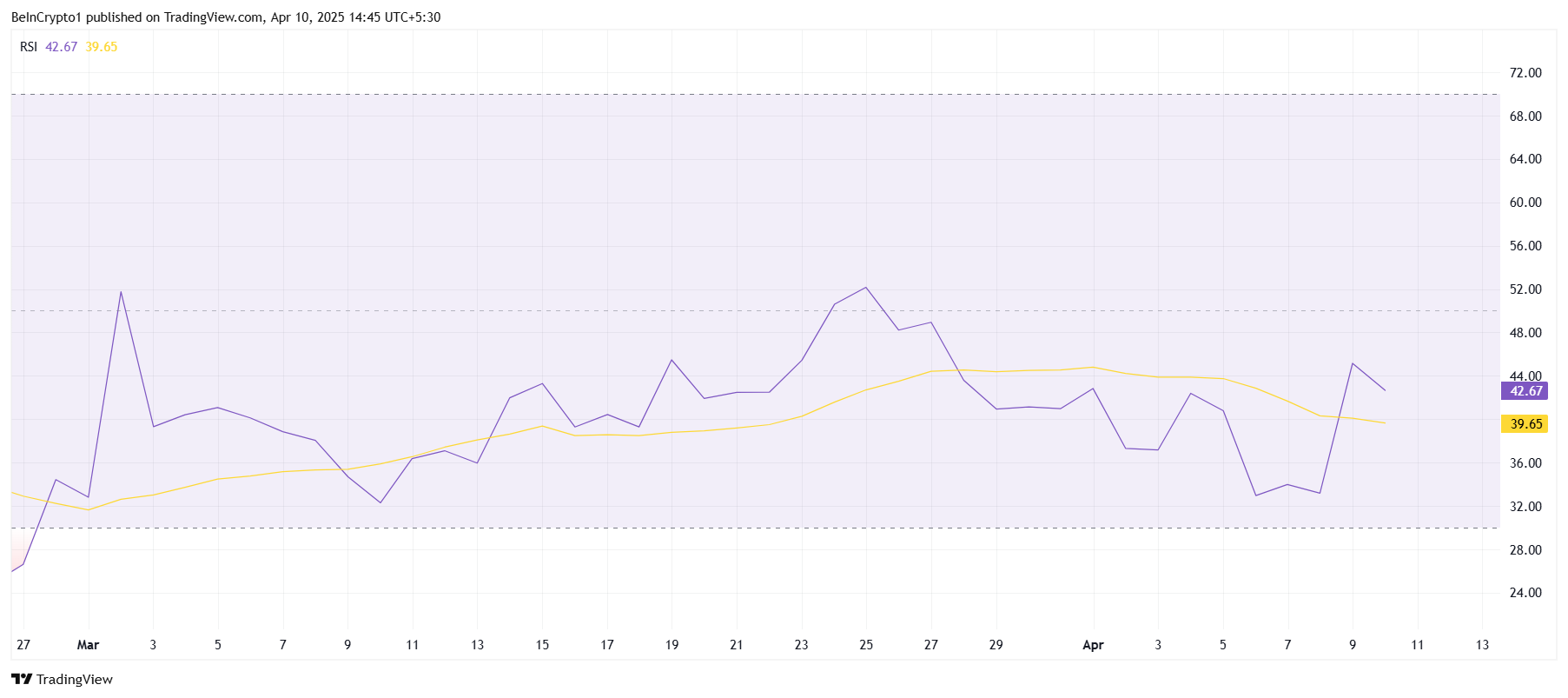

However, despite the favorable signs from the velocity, Solana’s macro momentum remains relatively weak. The Relative Strength Index (RSI) is still stuck in the bearish zone, under the neutral 50.0 mark.

While the broader market has seen some rallies, Solana’s RSI indicates a lack of significant buying momentum. This suggests that while some positive movement is occurring, broader macroeconomic factors may still be playing a limiting role.

The persistent bearish sentiment reflected in the RSI implies that Solana’s recovery may face continued challenges. Despite occasional price bounces, the altcoin has not yet experienced enough momentum to break free from the bearish pressure.

SOL Price Attempts Recovery

Solana’s price has risen by 8.2% in the past 24 hours, trading at $114. While it is showing signs of recovery, the altcoin remains under the key psychological price of $120. Beyond it lies a crucial resistance of $123, which has proven challenging in recent days.

If the bullish momentum continues, Solana could rise past $120 and aim for $123. Securing it as support would likely lead to further gains, pushing Solana toward the $135 mark. Investor confidence and continued supply distribution could support this upward movement.

However, if Solana fails to breach the $123 resistance, the price may retreat toward $105 or even lower. A drop below $105 could signal a deeper decline, with the altcoin potentially heading toward the $100 mark. This would invalidate the recent bullish outlook, extending the correction phase for Solana.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Eyes $2.0 Breakout—Can It Hold and Ignite a Bullish Surge?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

-

Altcoin21 hours ago

Altcoin21 hours agoNFT Drama Ends For Shaquille O’Neal With Hefty $11 Million Settlement

-

Altcoin20 hours ago

Altcoin20 hours agoIs Dogecoin Price Levels About To Bounce Back?

-

Bitcoin17 hours ago

Bitcoin17 hours agoMicroStrategy Bitcoin Dump Rumors Circulate After SEC Filing

-

Market19 hours ago

Market19 hours agoFBI Ran Dark Web Money Laundering to Track Crypto Criminals

-

Market17 hours ago

Market17 hours agoXRP Primed for a Comeback as Key Technical Signal Hints at Explosive Move

-

Market15 hours ago

Market15 hours agoSolana (SOL) Drops 4% as Selling Pressure Intensifies

-

Market20 hours ago

Market20 hours agoWeb3 Projects Adjust to Market Chaos

-

Altcoin15 hours ago

Altcoin15 hours agoArgentina Opens LIBRA Investigation, Top Officials May Be Implicated