Market

Solana rolls out new features for trading Crypto on regular social media apps

- Solana rolled out the Blinks and Action feature, allowing users to buy crypto, tip vendors, and transact directly on the blockchain from regular websites and social media apps.

- The Solana Foundations says “Actions” will allow developers to integrate Solana ecosystem transactions into regular websites and apps.

The Solana Foundation, in collaboration with Dialect, an on-chain smart messaging protocol, built “Actions and Blinks” (also called “Actions”), a set of features that allow users to interact with the Solana blockchain directly from a website, popular social media applications, or QR code.

The feature aims to bring Solana closer to everyday users by allowing developers to integrate virtually all transactions into websites and applications that regular people already use.

Actions and blinks on Solana allow any website and application on the internet to be a distribution point for on-chain interactions – furthering the goal of mainstream adoption,” said Jon Wong, the Solana Foundation’s head of ecosystem engineering.

“From your X feed, you can buy an NFT, tip a creator, receive money, vote, stake, swap, and so much more,” says Chris Osborn, founder of Dialect.

Popular Solana wallets like Phantom and Backpack will immediately support the new features, while others can integrate by following the instructions in the chain’s developer documentation.

Applications like Telegram trading bots, which simplify the on-chain trading process, have been successful and serve as a reference for the viability of features that plug into Web2.

While Solana is not the first to roll out extended blockchain functionality on social media, it is the first to plug directly into Web2 social media.

Market

Solana Faces Resistance While ETH Sees DEX Volume Boost

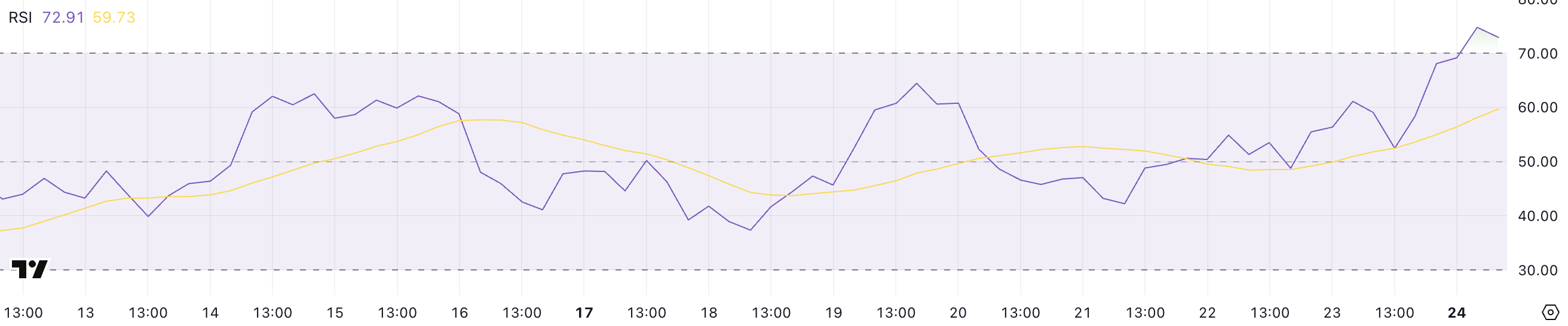

Solana (SOL) is attempting to recover from an almost 12% correction over the past seven days. The RSI has surged into overbought territory, suggesting strong bullish momentum. However, the BBTrend remains deeply negative—though it’s beginning to ease, hinting at potential stabilization.

Meanwhile, the EMA lines are setting up for a possible golden cross, signaling that a trend reversal could be forming if key resistance levels are broken. Still, with Ethereum overtaking Solana in DEX volume for the first time in six months and critical support levels not far below, SOL remains in a delicate position.

SOL RSI Is Now At Overbought Levels

Solana’s Relative Strength Index (RSI) has surged to 72.91, up sharply from 38.43 just a day ago—indicating a rapid shift in momentum from neutral to strongly bullish territory.

The RSI is a widely used momentum oscillator that measures the speed and magnitude of price movements on a scale from 0 to 100.

Readings above 70 typically suggest an asset is overbought and may be due for a pullback, while levels below 30 indicate oversold conditions and potential for a rebound.

With Solana’s RSI now above 70, the asset has officially entered overbought territory, reflecting intense buying pressure in the short term.

While this can sometimes precede a correction or consolidation, it can also signal the start of a breakout rally.

Traders should watch closely for signs of continuation or exhaustion. If momentum holds, Solana could push higher, but any stalling may trigger profit-taking and short-term volatility.

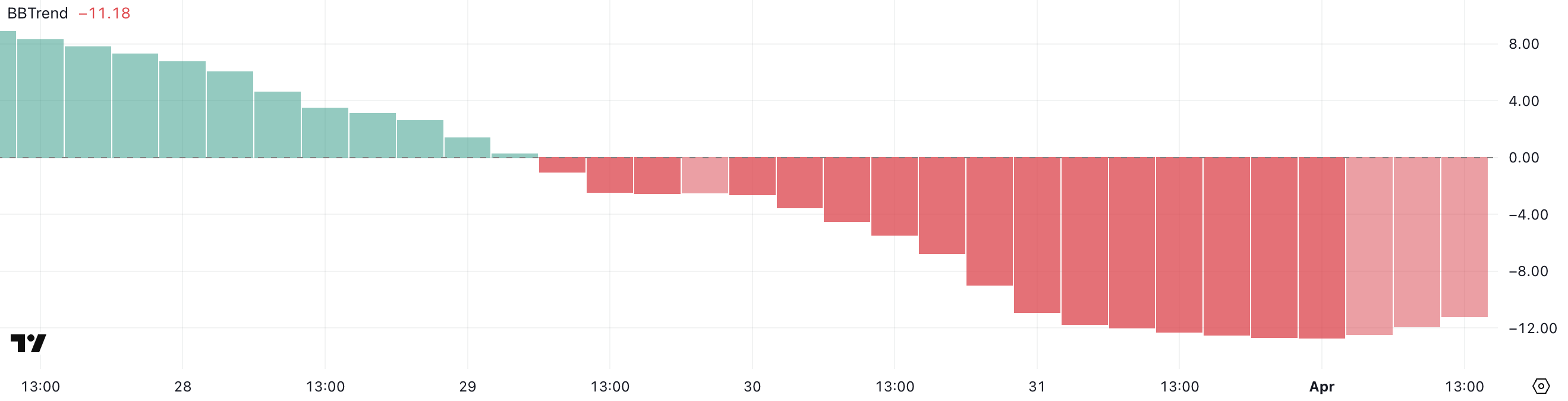

Solana BBTrend Is Decreasing, But Still Very Negative

Solana’s BBTrend indicator has climbed slightly to -11.18 after hitting a low of -12.68 earlier today. That suggests that the bearish momentum is starting to ease.

The BBTrend (Bollinger Band Trend) measures the strength and direction of a trend based on how price interacts with the Bollinger Bands.

Values below -10 typically indicate strong bearish pressure, while values above +10 reflect strong bullish momentum. A rising BBTrend from deep negative territory can be an early sign of a potential reversal or at least a slowdown in the downtrend.

With SOL’s BBTrend still in bearish territory but improving, the market may be attempting to stabilize after a period of intense selling.

However, broader ecosystem developments complicate the technical picture. For example, Ethereum recently surpassed Solana in DEX volume for the first time in six months.

While the easing BBTrend hints at recovery potential, Solana still needs a stronger confirmation to shift the trend fully in its favor. Until then, cautious optimism may be warranted, but the bears haven’t fully let go.

Solana Still Has Challenges Ahead

Solana’s EMA lines are showing signs of an impending golden cross. A golden cross occurs when a short-term moving average crosses above a long-term one. That’s often seen as a bullish signal that can mark the start of a sustained uptrend.

If this pattern is confirmed and buying momentum continues, Solana price could push up to test the resistance at $131.

A successful breakout above that level may open the door to further gains toward $136, and potentially even $147.

However, downside risks remain if buyers fail to hold recent gains.

If SOL pulls back and loses the key support at $124, it could trigger further selling pressure, pushing the price down to $120.

Should the downtrend gain strength from there, SOL might revisit deeper support levels around $112.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Hill Rejects Interest-Bearing Stablecoins Despite Armstrong’s Wish

Representative French Hill, who Chairs the House Committee on Financial Services, rejected requests to approve interest-bearing stablecoins. Coinbase CEO Brian Armstrong made a public appeal in support of this yesterday.

Hill has been a vocal supporter of new stablecoin regulations, and the crypto industry counted his Committee appointment as a victory.

French Hill Rejects Interest-Bearing Stablecoins

If there’s one topic that’s a top priority for US crypto policy, it’d be stablecoin regulations. Significant momentum is building behind pro-industry regulations, and President Trump claimed that stablecoins will play a role in dollar dominance. However, Representative French Hill pushed back on one request, saying he opposes interest-bearing stablecoins:

“I hear the point of view, but I don’t think that there’s consensus among the parties or the Houses [of Congress] on having a dollar-backed payment stablecoin pay interest to the holder of that stablecoin,” Hill told reporters earlier today.

Although Hill portrayed this position on stablecoins as a common-sense viewpoint, it represents a limit to the crypto industry’s political influence. When Hill was chosen to head the House Committee on Financial Services, crypto took it as a big win. Further, he’s been a visible presence in the fight for stablecoin regulation. So, what’s the problem?

Essentially, Coinbase CEO Brian Armstrong made an appeal to Hill and other legislators regarding interest-bearing stablecoins. Just yesterday, Armstrong called this policy a “win-win” and a huge opportunity to help consumers and the economy.

“US stablecoin legislation should allow consumers to earn interest on stablecoins. The government shouldn’t put it’s thumb on the scale to benefit one industry over another. Banks and crypto companies alike should both be allowed to, and incentivized to, share interest with consumers. This is consistent with a free market approach,” Armstrong claimed.

Since Armstrong made this public appeal yesterday, it’s remarkable that Hill rejected his vision of stablecoins so quickly. Ostensibly, Armstrong’s political influence has been on the rise, as he played a prominent role in Trump’s Crypto Summit, and the SEC dropped its suit against Coinbase.

It’s an important fact for the US crypto industry to learn: no matter how quickly its influence is growing, it’s still very new to most people. Earlier this year, a string of state-level Bitcoin Reserve proposals failed in Republican-controlled states. President Trump may support crypto, but his supporters have limits.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

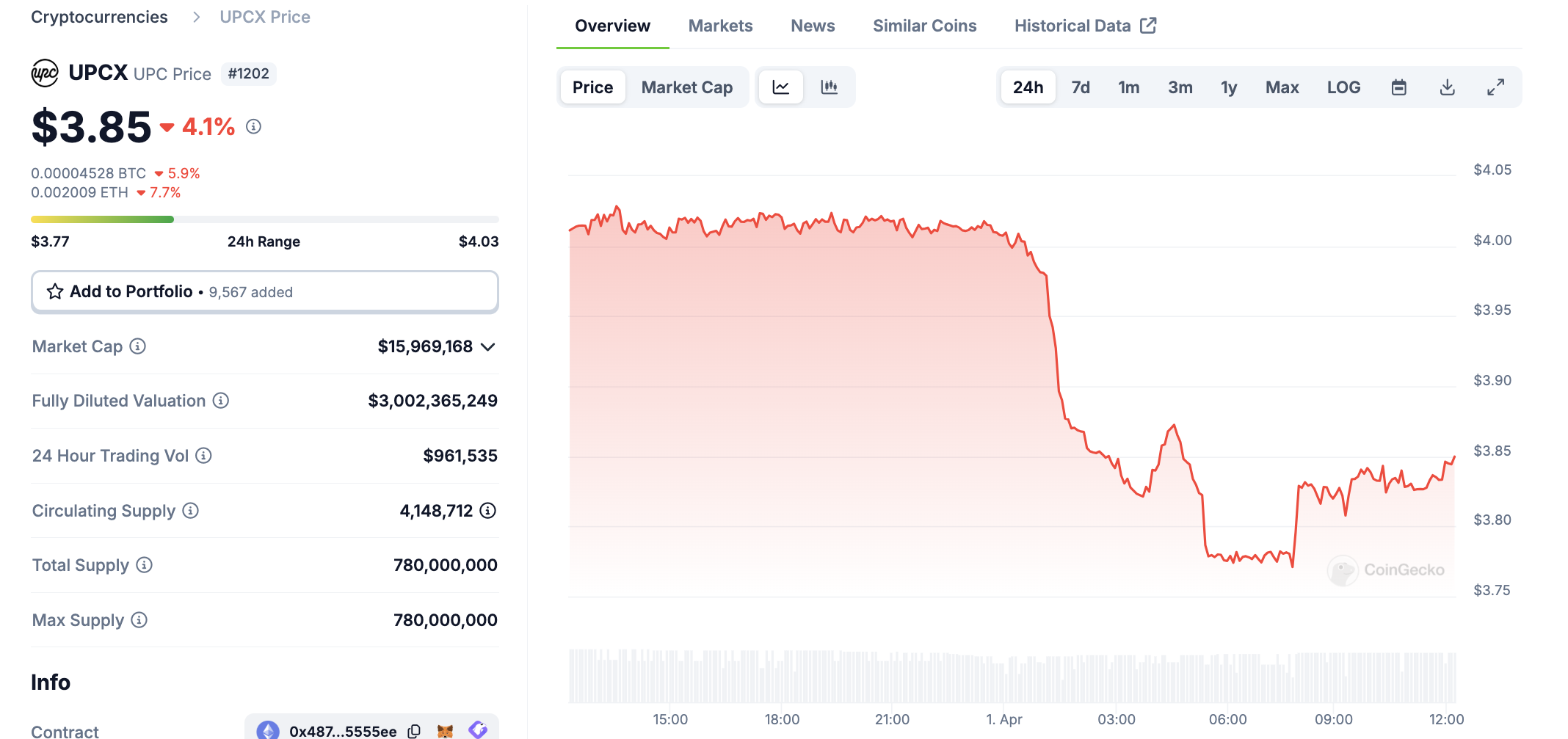

How Did UPCX Lose $70 Million in a UPC Hack?

UPCX suffered a major hack today, with 18.4 million UPC tokens stolen from its management accounts. This amounts to about $70 million dollars, and the price of UPC fell drastically.

The hackers stole more UPC than is currently circulating in the markets and haven’t offloaded any assets yet. It is unclear who did this or how they will be able to secure their gains in other assets.

UPCX Suffers Major Hack

Cyvers, a crypto security firm that has tracked and uncovered several major crimes, identified a serious hack this morning. Multiple suspicious transactions took place involving UPCX’s management account, and the firm acknowledged suspicious activity. UPCX didn’t go into great detail, only describing a few security measures, but Cyvers showed the extent of the hack:

“It appears that someone gained access to the address 0x4C….3583E, upgraded the ‘ProxyAdmin’ contract, and executed the ‘withdrawByAdmin’ function, resulting in the transfer of 18.4 million UPC (approximately $70 million) from three different management accounts,” Cyvers claimed via social media.

UPCX is an open-source crypto payment system, and this hack may represent a serious blow to the company. According to CoinGecko data, the hackers stole significantly more UPC tokens than are currently available, which is around 4 million. Naturally, this caused the price to drop significantly, in an immediate drop of over 4%:

Although a $70 million hack will certainly damage UPCX individually, it’s unclear if it will actually impact the broader market much. The largest hack in crypto history took place a little over a month ago, and the community is still assessing the fallout. Meanwhile, UPCX is comparatively tiny; less than 10,000 X users viewed its post admitting to the security breach.

Since the UPCX hack took place, the recipient account hasn’t moved any of its UPC tokens. Indeed, it may be difficult for the perpetrator to convert these assets into usable fiat in the first place. If the hackers stole nearly 5x the amount of UPC tokens in circulation, any attempt to liquidate them will crash UPC’s token price even further.

Ultimately, the UPCX hack is strange for several reasons. Despite a large dollar amount, it hasn’t attracted a huge amount of buzz or impacted the market outside UPC. Hopefully, further analysis will identify the perpetrators, and possibly freeze the assets. Otherwise, the threat of a future sale could hamper UPC’s recover for the foreseeable future.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoCoinbase Tries to Resume Lawsuit Against the FDIC

-

Altcoin23 hours ago

Altcoin23 hours agoCharles Hoskinson Reveals How Cardano Will Boost Bitcoin’s Adoption

-

Market22 hours ago

Market22 hours agoHedera (HBAR) Bears Dominate, HBAR Eyes Key $0.15 Level

-

Market21 hours ago

Market21 hours agoThis is Why PumpSwap Brings Pump.fun To the Next Level

-

Market20 hours ago

Market20 hours agoCardano (ADA) Whales Hit 2-Year Low as Key Support Retested

-

Bitcoin10 hours ago

Bitcoin10 hours agoBig Bitcoin Buy Coming? Saylor Drops a Hint as Strategy Shifts

-

Market19 hours ago

Market19 hours agoTop 3 Made in USA Coins to Watch In April

-

Market17 hours ago

Market17 hours agoEthereum Price Faces a Tough Test—Can It Clear the Hurdle?