Market

Jason Derulo Faces Backlash Over Meme Coin Collapse

Pop icon Jason Derulo is embroiled in controversy after promoting a meme coin that plummeted shortly after its release.

Known for his electrifying musical performances, Derulo’s entry into the risky meme coin market has ignited debate over celebrity involvement in potentially dubious financial endorsements. The repercussions of these episodes extend beyond monetary losses, risking damage to the involved celebrities’ reputations and eroding trust in the cryptocurrency market overall.

Sahil Arora Attempts 3 Celebrities’ Meme Coin Launch

Recently, Derulo used his platform on X, previously Twitter, to announce the launch of the meme coin, JASON, to his 3.5 million followers. Regrettably, the coin’s value nosedived by more than 72% minutes later, leading to widespread dismay among investors and fans.

Derulo quickly pointed fingers at Sahil Arora, a figure previously linked to cryptocurrency scandals. In a reactionary move, Derulo declared his commitment to rectifying the situation.

Read more: Crypto Scam Projects: How To Spot Fake Tokens

“Damn Sahil got me! That’s ok, that’s motivation to take this all the way! I just bought $20,000 worth. In this for my fans for the long haul, going to do everything in my power to send this sh*t to the moon,” Derulo stated on X.

He reinforced his intentions in an apology video, vowing to make the meme coin’s recovery his “life’s goal.”

Despite Derulo’s proactive stance, skepticism persists. Influential voices in the crypto community, such as SlumDOGE Millionaire and prominent on-chain detective ZachXBT, have cast doubt on his innocence.

“Bro made $1 million off his rug and put $20,000 back in the chart lol. You’re not stupid or new to crypto Jason, you know exactly what was happening, don’t play dumb now,” SlumDOGE Millionaire said.

Currently, the liquidity of the JASON meme coin is perilously low at approximately $211,000, with around 3,190 holders. This pattern mirrors other high-profile crypto scams, where initial excitement leads to significant financial losses for ordinary investors.

This incident is not isolated. Arora has launched several other celebrity-associated meme coins. Yesterday, he hinted that he has been on a call with the American rapper Tyga to launch his meme coin.

However, unlike Derulo, Tyga has yet to discuss or promote any crypto token directly on his social media platforms. This silence raises questions about his involvement’s legitimacy and potential impact if confirmed.

Similarly, Arora has also teased a Ronaldinho Gaúcho meme coin. This happened after an X post from Gaúcho:

Time for crypto to go mainstream, who’s with me?” Gaúcho asked his 21.5 million followers.

However, the Brazilian footballer – Gaúcho did not explicitly promote the meme coin. Yet, Arora’s quick share of a contract address following Ronaldinho’s post added him to the list of celebrities speculated to be endorsing meme coins.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

The rapid depreciation of these coins post-launch poses a recurring concern, drawing the attention of the investing public and regulators.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Dives Below $2—Is This the Start of a Bigger Breakdown?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

How Privacy Coins Are Outperforming in 2025’s Crypto Chaos

In a year marked by market turbulence and mounting geopolitical tensions, privacy coins have emerged as the best-performing sector in the cryptocurrency space.

Analysts and privacy advocates argue this is no coincidence. In fact, some believe the outperformance signals the early stages of a larger shift in global financial dynamics.

Why Privacy Coins Are the Top Performers in a Fear-Driven Market

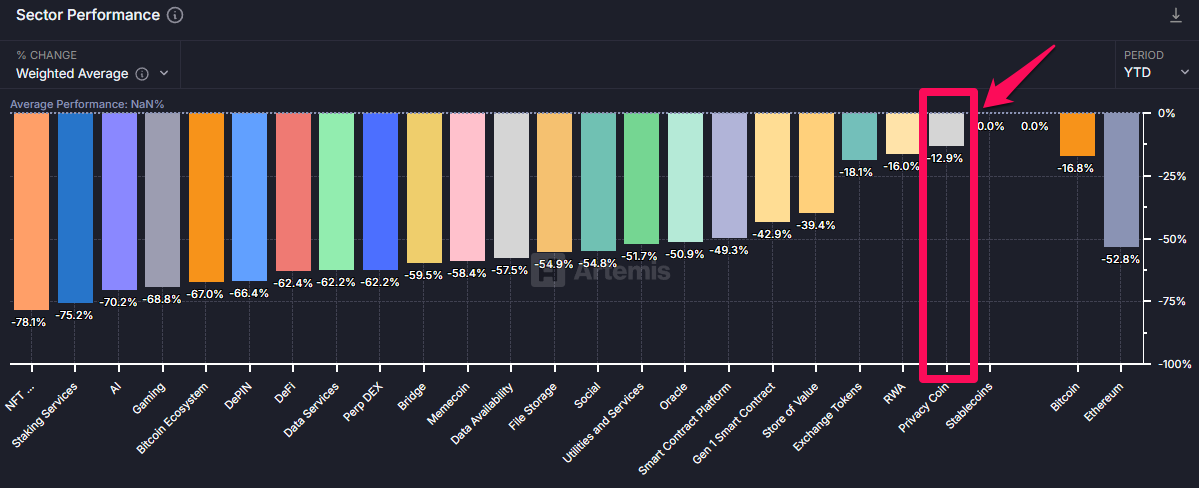

According to the latest data from Artemis, privacy-focused cryptocurrencies have dropped 12.9% since the start of the year, the smallest drop among all crypto sectors.

In comparison, Bitcoin (BTC) has seen a 16.8% decline. In addition, Ethereum (ETH) has also depreciated 52.8% year-to-date (YTD).

BeInCrypto data showed that over the past month, top privacy coins have fared well in comparison to BTC. Monero (XMR) has dipped 8.1%. Notably, Zcash (ZEC) has seen a modest rise of 9.1%. Nonetheless, with Bitcoin, the losses are slightly higher. Over the past month, the largest cryptocurrency has shed 9.8% of its gains.

In fact, privacy coins have also outperformed the broader cryptocurrency market in the past 24 hours. The privacy sector has seen a 7.0% decline, while the global crypto market has dropped 8.3%.

Patrick Scott, Head of Growth at DefiLlama, attributed this outperformance to broader macroeconomic shifts in a recent post on X (formerly Twitter).

“Privacy coins were the best-performing crypto sector during the crash. This isn’t about hype. It’s macro,” he wrote.

Scott pointed out that countries are becoming more economically isolated due to increasing tariffs and potential capital controls. He argued that privacy coins’ ability to resist censorship and operate privately would make them more important, shifting from being just a “narrative” to a practical necessity.

“The outperformance isn’t random. It’s an early reaction to a shifting global regime and the breakdown of the post-WW2 international order,” Scott remarked.

Meanwhile, many industry leaders echo a similar sentiment. Vikrant Sharma, Founder and CEO of Cake Investments, expressed strong support for privacy-focused solutions.

“I am a maxi.. a privacy maxi. That’s why I support privacy coins and tools like XMR, Zano, silent payments, and pay join for BTC, LTC-MWB, and yes, I think Zcash is fine too,” he posted.

Others, like Mike Adams, the founder of Brighteon, also stressed the importance of privacy in transactions.

“Use privacy crypto, folks. Monero, Zano, Firo… not BTC, which is completely transparency and has zero privacy,” stated Adams.

In addition to these factors, the demand for privacy coins is being fueled by their growing use in illegal activities. A recent report from BeInCrypto highlighted the dominance of privacy coins in illicit transactions, where they are preferred for their ability to conceal transaction details.

While Bitcoin and stablecoins are still used in such activities, privacy coins like Monero are gaining traction due to their superior anonymity features.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana (SOL) Freefall—Can It Hold Above The $100 Danger Zone?

Solana started a fresh decline below the $112 support zone. SOL price is now consolidating and might struggle to stay above the $100 support zone.

- SOL price started a fresh decline below $112 support zone against the US Dollar.

- The price is now trading below $105 and the 100-hourly simple moving average.

- There was a break below a key contracting triangle with support at $118 on the hourly chart of the SOL/USD pair (data source from Kraken).

- The pair could accelerate lower if there is a break below the $100 support zone.

Solana Price Dips Over 15%

Solana price started a fresh decline below the $122 and $115 levels, like Bitcoin and Ethereum. SOL even declined below the $112 support level to enter a bearish zone.

There was a break below a key contracting triangle with support at $118 on the hourly chart of the SOL/USD pair. The price declined over 15% and traded close to the $102 level. A low was formed at $102 and the price recently started a consolidation phase.

The current price action is still very bearish below 23.6% Fib retracement level of the downward move from the $121 swing high to the $102 low. Solana is now trading below $105 and the 100-hourly simple moving average.

On the upside, the price is facing resistance near the $105 level. The next major resistance is near the $112 level or the 50% Fib retracement level of the downward move from the $121 swing high to the $102 low. The main resistance could be $116.

A successful close above the $116 resistance zone could set the pace for another steady increase. The next key resistance is $120. Any more gains might send the price toward the $125 level.

Another Decline in SOL?

If SOL fails to rise above the $105 resistance, it could start another decline. Initial support on the downside is near the $102 zone. The first major support is near the $100 level.

A break below the $100 level might send the price toward the $92 zone. If there is a close below the $92 support, the price could decline toward the $84 support in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is gaining pace in the bearish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is below the 50 level.

Major Support Levels – $102 and $100.

Major Resistance Levels – $105 and $112.

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Whale Activity Fades Since Late February – Details

-

Market22 hours ago

Market22 hours agoXRP High Stakes Setup: Analyst Warns Of Sharp Move To $17 Or $0.65

-

Altcoin24 hours ago

Altcoin24 hours agoHas The Dogecoin Price Bottomed Out? Analyst Points Out ‘Critical Decision Zone’

-

Market20 hours ago

Market20 hours agoHBAR Could Avoid $30 Million Liquidation Thanks to Death Cross

-

Bitcoin15 hours ago

Bitcoin15 hours agoUS Macro Setup To Favour New Bitcoin ATH In The Long Run

-

Bitcoin23 hours ago

Bitcoin23 hours agoBitcoin Traders’ Realized Losses Reach FTX Crash Levels — What’s Happening?

-

Market21 hours ago

Market21 hours agoSEC Reconsiders Howey Test Use in Crypto Oversight

-

Bitcoin20 hours ago

Bitcoin20 hours agoAltseason Dead On Arrival? Data Shows Bitcoin Outperforming All Categories