Market

XRP Exhibiting Unusual On-Chain Behavior, How Will This Affect Price?

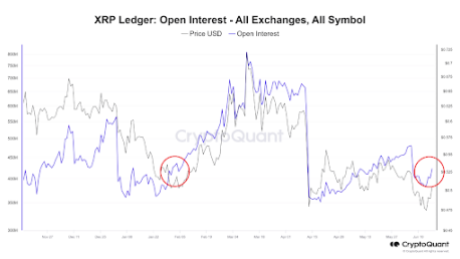

Data shows XRP is currently exhibiting an interesting on-chain behavior amidst a broader market uncertainty. This unusual behavior was highlighted by CryptoQuant, a crypto on-chain analytics company. The peculiar behavior is noteworthy because it is associated with a growing open interest in XRP in comparison to other cryptocurrencies, suggesting XRP is primed for a major price move.

XRP Open Interest Surges

According to CryptoQuant data initially noted by an analyst associated with the analytics platform, recent news involving the SEC and Ripple, XRP’s parent company, has seen the open interest for XRP resuming an uptrend.

Related Reading

As per the CryptoQuant chart below, the open interest, which has generally been in an uptrend since April 15, recently took a hit in the first week of June and started to decline concurrently with a fall in the price of XRP. However, the open interest has now rebounded and has resumed its uptrend.

Interestingly, this increase is more significant than that of other cryptocurrencies, considering many crypto prices have struggled in the past week. The rising open interest also relays the current sentiment among XRP investors, as it indicates that investors are opening more positions in anticipation of an increase in the price of XRP.

How Will This Affect Price?

Open interest refers to the total number of outstanding derivative contracts that haven’t been settled. Climbing open interest often signals more money flowing into the market. This is evident in the chart above, as increases in open interest have mostly been registered with a corresponding increase in the price of XRP.

Furthermore, open interest is considered a leading indicator for many savvy investors. When it soars, it signals that new money is flowing into the market as traders open new positions. This increased activity and liquidity can foreshadow where an asset’s price might be headed next. Regardless of the direction in which the price heads, one outcome is nearly guaranteed: more volatility.

Related Reading

At the time of writing, XRP is trading at $0.486 and has increased by 1.44% in the past seven days. Despite this meager increase, it’s interesting to note that XRP is currently the only asset among the top 20 largest cryptocurrencies still in the green zone in the past week. Adding to the bullish outlook is the strong trading volume over the past few days.

According to data from Santiment, some traders are still bearish on XRP despite the fact that it is currently outperforming many other assets. XRP is also traders shorting to counter the bulls. However, as Santiment noted, this is a good sign for patient bulls, as the shorting activity can act as ‘rocket fuel’ for continued price rises when they eventually become liquidated.

Featured image created with Dall.E, chart from Tradingview.com

Market

Binance Managed 94% of All Crypto Airdrops and Staking Rewards

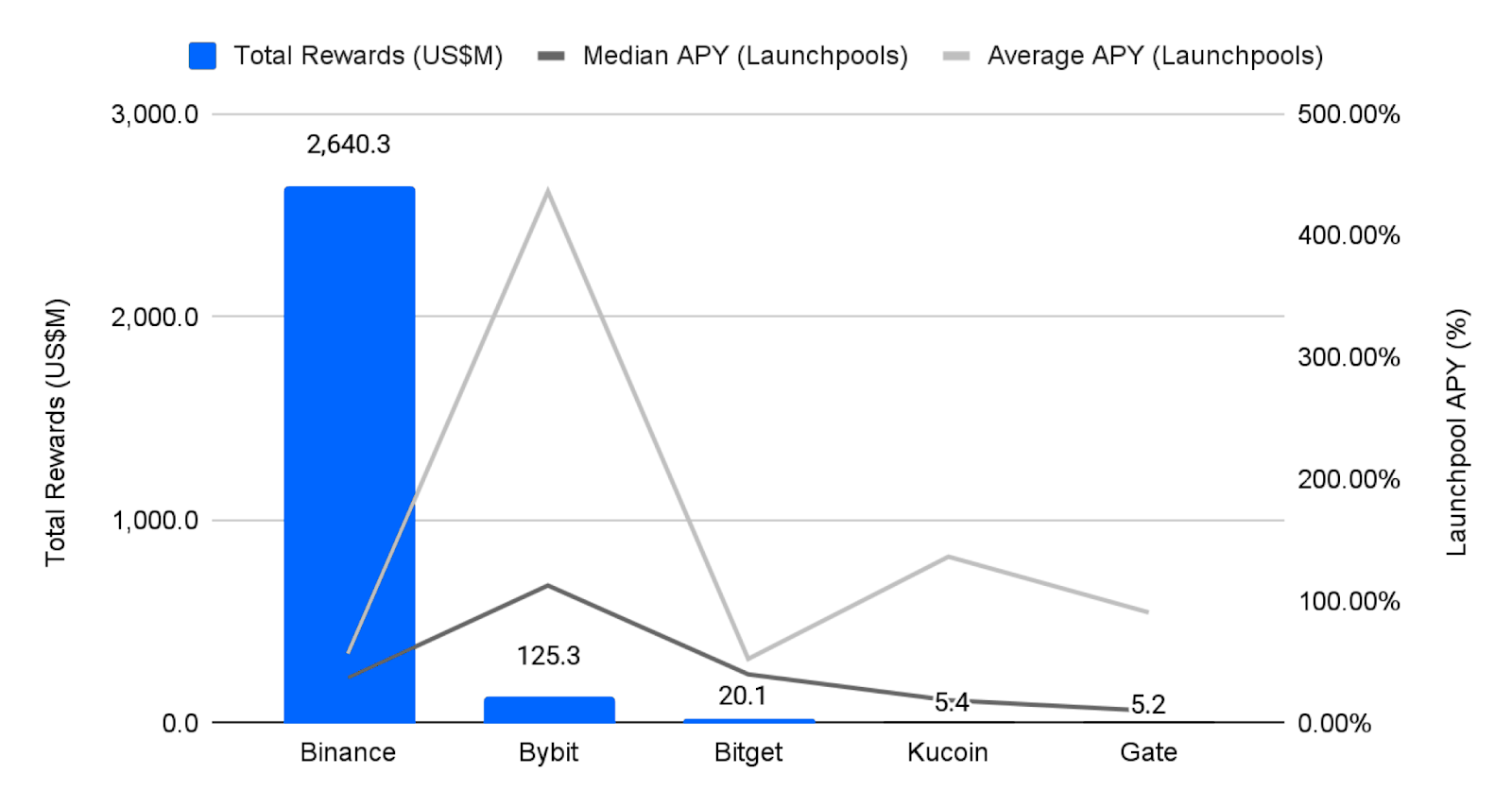

A new report shows that Binance almost has a monopoly in the CEX market in terms of crypto airdrop distribution and staking rewards. In 2024, the exchange received $2.6 billion of a total of $2.7 billion in rewards, amounting to 94% of the entire market segment.

In an exclusive press release shared with BeInCrypto, Binance also revealed that it’s making substantial changes to its airdrop services to improve user experience and make participation easier.

Binance Leads the Market in Crypto Airdrops

Binance, the world’s largest crypto exchange, has become the go-to platform for airdrops and staking rewards. It launched the HODLer airdrop program less than a year ago, providing many new projects with a comprehensive platform to reward early adopters.

In the past year, the exchange has become synonymous with the latest airdrops, as most users are accessing their rewards through the platform.

Based on this impressive performance in the airdrop sector, Binance has substantially upgraded a few of its services. The platform has revamped its Launchpool and BNB Earn pages, making it easier for users to both track and participate in airdrops.

“With these upgrades, we’re making it easier than ever for users to unlock the full potential of BNB and participate in high-quality token launches. The redesigned Binance Launchpool and BNB pages reflect our commitment to user education, simplicity, and maximizing rewards,” said Jeff Li, VP of Product at Binance.

The updated BNB page will give Binance users key benefits, such as real-time information on airdrops across its platforms, including Launchpool, Megadrop, and HODLer Airdrops.

Users will also see features like trading fee discounts, VIP perks, and a historical rewards section. These improvements are designed to help the firm maintain its significant dominance while continuing to focus on integrity.

Hopefully, these improvements will allow the firm to maintain its significant dominance while maintaining its usual integrity. Last month, Binance Research identified some systemic problems with airdrops in general, and the exchange seems particularly concerned with its reputation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pi Network Price Falls To Record New Low Amid Weak Inflows

Pi Network (PI) has experienced a significant downtrend recently, with price declines that have left many holders facing losses.

The altcoin has failed to break free from this negative momentum, and the market conditions continue to worsen. As a result, investors are losing confidence, and the price may continue to drop further.

Pi Network Continues To Suffer

The Chaikin Money Flow (CMF) continues to show bearish signs, remaining well below the zero line. This indicates that the network is suffering from outflows, meaning that investors are moving their funds out of Pi Network. Despite a bullish start, Pi failed to sustain interest, leading many holders to sell off their positions.

The outflow trend is concerning for investors, as the lack of positive momentum suggests a prolonged downtrend. The market sentiment remains bearish, with sellers outweighing buyers. As the CMF stays in the negative zone, it signals that Pi Network’s price could struggle to find stability in the short term.

The Ichimoku Cloud, a widely used technical indicator, is hovering well above the candlesticks, signaling that the bearish trend is gaining strength. This indicates that there is little upward momentum in the market, and Pi Network is likely to face more downward pressure.

Additionally, broader market conditions are still negative, which suggests that Pi Network may fail to recover in the immediate future. With bearish technical indicators and a lack of support from investors, the outlook for Pi Network remains grim for now.

PI Price Hits A New Low

Pi Network is currently priced at $0.61, having formed a new all-time low of $0.60 after dropping by nearly 14% over the last 24 hours. The altcoin continues to struggle under the weight of negative sentiment and is not showing signs of reversal in the near term.

Based on the ongoing outflows and bearish technical indicators, Pi Network will likely continue its decline. It could fall further to $0.50, potentially forming new all-time lows. The current market conditions suggest that recovery is unlikely without a significant shift in sentiment.

However, if Pi Network can bounce off the $0.60 level, it might regain some support and climb back to $0.87. This would help recover some of the recent losses and potentially give the altcoin another chance at a bullish move. But, without a strong catalyst, it may struggle to break through the resistance levels.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

TRUMP Token Hits Record Low Due To Liberation Day Tariffs

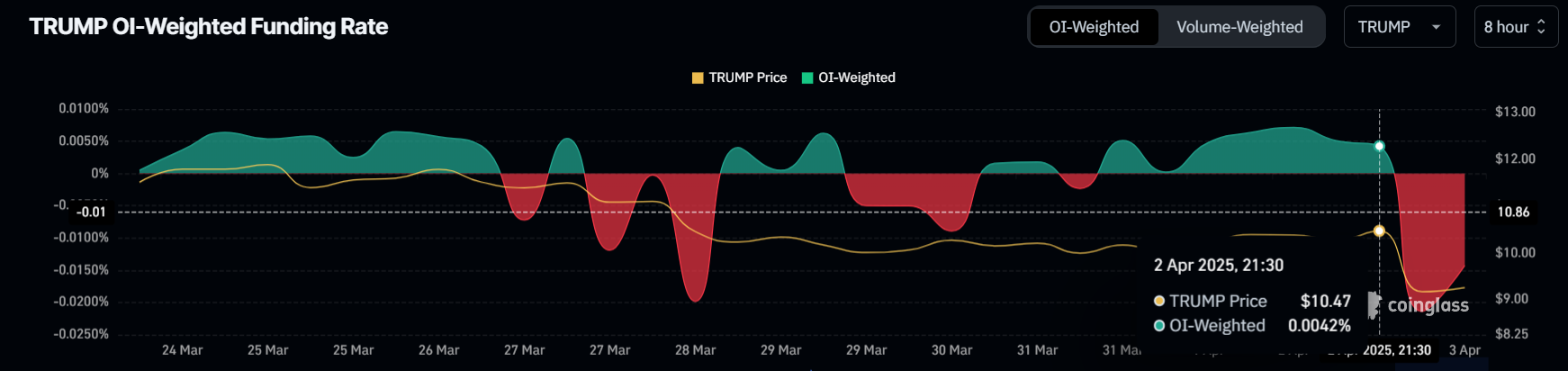

TRUMP token has faced a significant downturn, failing to recover after a recent decline. The altcoin’s price has been further pressured by the announcement of US President Donald Trump’s Liberation Day Tariffs.

As a result, bearish sentiment has grown, leading traders to capitalize on the negative market conditions.

Trump’s Announcement Took A Toll

The funding rate for TRUMP turned negative over the last 24 hours, signaling increased bearish activity. Traders are shifting to short contracts, betting that the price will decline further. This shift in sentiment follows the announcement of the tariffs, which, despite being a policy move, had a negative impact on TRUMP’s price.

This negative market reaction highlights traders’ skepticism about the future prospects of TRUMP. While the tariff announcement was meant to stimulate market reactions, it instead spurred fear, driving a wave of sell-offs.

Looking at the broader momentum, technical indicators such as the Relative Strength Index (RSI) reveal that TRUMP is far from recovering its recent losses. The RSI remains firmly in the bearish zone, well below the neutral 50.0 mark. With no signs of reversal or bullish momentum, the token is likely to continue facing declines in the short term.

The oversold conditions are not yet reached either, indicating there is still room for further declines. With the RSI not showing any substantial recovery signals, the current downtrend could persist until market sentiment shifts or a new catalyst sparks renewed interest in the token.

TRUMP Price Suffers

TRUMP’s price hit a new all-time low of $8.97 before recovering slightly to $9.29. Over the last 24 hours, the token has seen a 10% decline. This drop has added to its month-long 45% slide, as the token lost crucial support levels, including $12.57 and $10.29.

The ongoing bearish trend suggests that TRUMP could continue to slide, with the next key support around $8.00. If the broader market conditions remain weak and the bearish sentiment continues to dominate, the price could dip further, reaching new lows before any potential recovery.

However, if TRUMP manages to reclaim $10.29 as support, it could mark the beginning of a recovery attempt. Successfully breaching $12.57 could invalidate the current bearish outlook and signal a potential rally, but this would require a significant shift in investor sentiment and market conditions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin24 hours ago

Altcoin24 hours agoHere’s Why This Analyst Believes XRP Price Could Surge 44x

-

Altcoin23 hours ago

Altcoin23 hours agoHow Will Elon Musk Leaving DOGE Impact Dogecoin Price?

-

Ethereum21 hours ago

Ethereum21 hours agoWhy A Massive Drop To $1,400 Could Rock The Underperformer

-

Ethereum23 hours ago

Ethereum23 hours agoWhales Dump 760,000 Ethereum in Two Weeks — Is More Selling Ahead?

-

Altcoin20 hours ago

Altcoin20 hours agoFirst Digital Trust Denies Justin Sun’s Allegations, Claims Full Solvency

-

Altcoin21 hours ago

Altcoin21 hours agoWill Cardano Price Bounce Back to $0.70 or Crash to $0.60?

-

Market13 hours ago

Market13 hours agoXRP Price Under Pressure—New Lows Signal More Trouble Ahead

-

Altcoin13 hours ago

Altcoin13 hours agoAnalyst Forecasts 250% Dogecoin Price Rally If This Level Holds