Market

Avalanche (AVAX) Price Marks $30 as Next Target, Data Suggests

Three days ago, BeInCrypto reported that bears planned to push the Avalanche (AVAX) price to $25. While the token’s price fell in that direction, recent data suggests it may soon rebound.

The cryptocurrency’s value has fallen by 12.31% in the last seven days while trading at $27.72. Here are the potential targets for the coming days.

Avalanche Holders Plan to HODL

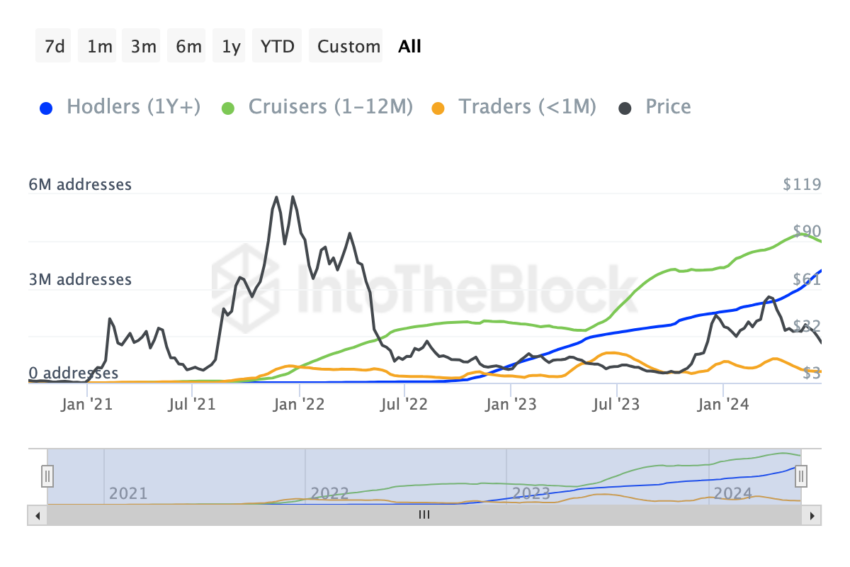

Firstly, we analyzed the Addresses by Time Held, as provided by IntoTheBlock.

- Addresses by Time Held: This metric is divided into Holders, Cruisers, and Traders. Holders are those who have held a token for at least a year. Cruisers are those who have held the token between one to 12 months. Lastly, traders are those who made purchases within the last 30 days.

As of this writing, the number of Cruisers, also called swing traders, decreased in the last 30 days. Short-term speculators also towed a similar path.

However, addresses holding AVAX for at least a year increased by 16.12% within the same period. Historically, when the number of holders decreases, it means that the bull market is reaching its last stages.

Read More: How to Add Avalanche (AVAX) to MetaMask: A Step-by-Step Guide

Past cycles, including 2013, 2017, and 2021, show evidence of this. However, an increase in the number of Avalanche holders when the price of a cryptocurrency has gone through a correction is a bullish sign.

Furthermore, if sustained, AVAX may begin to take steps to erase some of its losses. The addresses by holdings also show evidence of a possible price increase.

- Addresses by Holdings: It groups addresses based on the number of tokens owned and tells if more market participants are buying more or if existing addresses are selling.

At press time, the number of addresses holding 100,000 to 10 million AVAX increased. An increasing number of holders with large amounts of tokens is a positive sign of the price. As such, AVAX may resist further downside and begin to climb.

AVAX Price Prediction: Challenges Appear Despite Bullish Potential

As seen below, Avalanche’s price has bounced after falling to $26.47 earlier. While it remains sandwiched below $30, bulls seem ready to curb the tenacious downswing. The Relative Strength Index (RSI) shows proof of this attempt.

- Relative Strength Index (RSI): This technical oscillator shows whether a cryptocurrency’s momentum is bullish or bearish. It can also spot overbought (readings above 70) and oversold (readings below 30) points.

On June 18, AVAX dropped to the oversold region. But at 32.07, the RSI reveals that little drops of buying pressure are starting to appear. If bulls sustain this momentum, AVAX’s price may jump to $30.95. In a highly bullish scenario, the token’s value can reach $33.20.

However, the Ichimoku Cloud indicator shows that AVAX may experience a stumbling block in the attempt. If this happens, the bullish price prediction will be invalidated.

Ichimoku Cloud: It consists of five moving averages, which help to identify the trend direction. As a result, it spots resistance and support regions.

If the price denoted by the candles moves about the cloud, it is an uptrend. But if the cloud is above the price, it is a downtrend. Looking at the AVAX/USD daily chart above, we observe that the cloud was below the price in March.

Read More: How to Buy Avalanche (AVAX) and Everything You Need to Know

Consequently, this drove AVAX to $60.66 at that time. However, as of this writing, it is the other way around. By the look of things, AVAX’s price can increase. However, if buying pressure is not intense, it may not surpass $31.98. This may force a rejection to $26.60

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price 25% Rally: Breaking Barriers and Surpassing Odds

XRP price rallied above the $1.15 and $1.20 resistance levels. The price is up over 25% and might rise further above the $1.420 resistance.

- XRP price started a fresh surge above the $1.20 resistance level.

- The price is now trading above $1.250 and the 100-hourly Simple Moving Average.

- There was a break above a key bearish trend line with resistance at $1.1400 on the hourly chart of the XRP/USD pair (data source from Kraken).

- The pair is up over 25% and it seems like the bulls are not done yet.

XRP Price Eyes Steady Increase

XRP price formed a base above $1.050 and started a fresh increase. There was a move above the $1.150 and $1.20 resistance levels. It even pumped above the $1.25 level, beating Ethereum and Bitcoin in the past two sessions.

There was also a break above a key bearish trend line with resistance at $1.1400 on the hourly chart of the XRP/USD pair. A high was formed at $1.4161 and the price is now consolidating gains. It is trading above the 23.6% Fib retracement level of the upward move from the $1.0649 swing low to the $1.4161 high.

The price is now trading above $1.30 and the 100-hourly Simple Moving Average. On the upside, the price might face resistance near the $1.400 level. The first major resistance is near the $1.420 level. The next key resistance could be $1.450.

A clear move above the $1.450 resistance might send the price toward the $1.50 resistance. Any more gains might send the price toward the $1.550 resistance or even $1.620 in the near term. The next major hurdle for the bulls might be $1.750 or $1.80.

Are Dips Supported?

If XRP fails to clear the $1.420 resistance zone, it could start a downside correction. Initial support on the downside is near the $1.3350 level. The next major support is near the $1.2850 level.

If there is a downside break and a close below the $1.2850 level, the price might continue to decline toward the $1.240 support or the 50% Fib retracement level of the upward move from the $1.0649 swing low to the $1.4161 high in the near term. The next major support sits near the $1.20 zone.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now above the 50 level.

Major Support Levels – $1.3350 and $1.2850.

Major Resistance Levels – $1.4000 and $1.4200.

Market

WisdomTree Europe Launches XRP ETP

ETF issuer WisdomTree’s European division just announced a new ETP based on XRP. This product is currently available in four EU countries, which has led XRP’s price to jump slightly.

ETPs are a common issuer strategy to earn revenue without ETF approval, but Europe will not necessarily approve one even if the US does so.

WisdomTree’s XRP ETP

WisdomTree, one of the Bitcoin ETF issuers in the US, announced that its European branch is offering an exchange-traded product (ETP) based on XRP. This new product is currently available in Germany, Switzerland, France, and the Netherlands. A growing number of issuers have filed for an XRP ETF, but WisdomTree is taking a slightly different tack.

“The WisdomTree Physical XRP ETP offers a simple, secure, and low-cost way to gain exposure to XRP, one of the largest cryptocurrencies by market capitalization. Backed 100% by XRP, XRPW is the lowest-priced XRP ETP in Europe, providing direct spot price exposure,” the announcement claimed.

The possibility of an official XRP ETF is growing with the current bull market, and Ripple CEO Brad Garlinghouse considers it “inevitable.” Still, it hasn’t happened yet, and ETP offerings allow issuers to somewhat address customers’ requirements. BitWise, which has also filed for an XRP ETF in the US, recently acquired a European ETP issuer to enter the same market.

WisdomTree, however, is no stranger to this market strategy. In May this year, it won approval to offer ETPs based on Bitcoin and Ethereum to British investors.

The UK has not yet approved a full ETF for either of these assets, but WisdomTree still gained market access. Even a fraction of the XRP market could also prove lucrative; the asset’s value spiked today.

WisdomTree Europe’s strategy page does not describe any further actions upon full approval. Even if the US approves an XRP ETF under the SEC’s new leadership, that won’t necessarily benefit WisdomTree’s European branch. For now, these ETPs built on XRP will have to suffice for this market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Rallies 10% and Targets More Upside

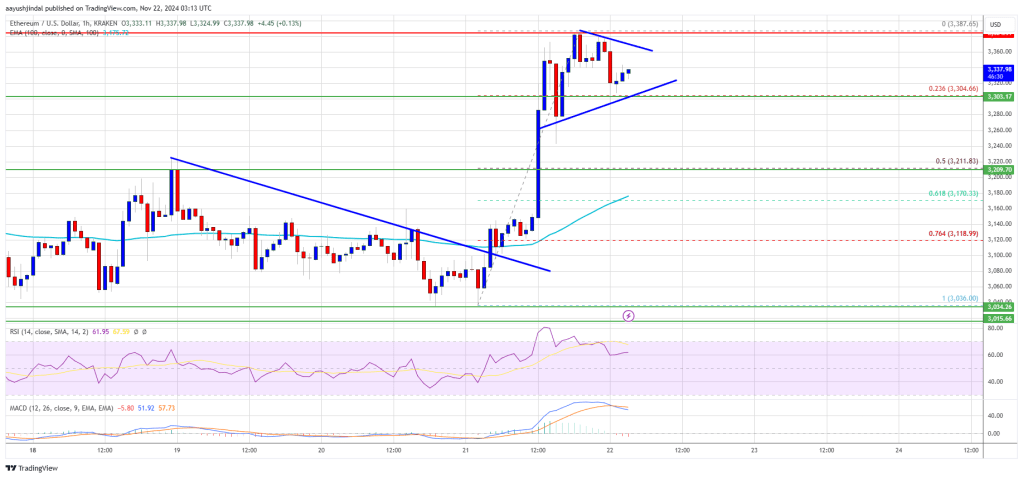

Ethereum price started a fresh increase above the $3,220 zone. ETH is rising and aiming for more gains above the $3,350 resistance.

- Ethereum started a fresh increase above the $3,220 and $3,300 levels.

- The price is trading above $3,250 and the 100-hourly Simple Moving Average.

- There is a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could gain bullish momentum if it clears the $3,385 resistance zone.

Ethereum Price Regains Traction

Ethereum price remained supported above $3,000 and started a fresh increase like Bitcoin. ETH gained pace for a move above the $3,150 and $3,220 resistance levels.

The bulls pumped the price above the $3,300 level. It gained over 10% and traded as high as $3,387. It is now consolidating gains above the 23.6% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high.

Ethereum price is now trading above $3,220 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,350 level. There is also a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD.

The first major resistance is near the $3,385 level. The main resistance is now forming near $3,420. A clear move above the $3,420 resistance might send the price toward the $3,550 resistance. An upside break above the $3,550 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,650 resistance zone or even $3,880.

Another Decline In ETH?

If Ethereum fails to clear the $3,350 resistance, it could start another decline. Initial support on the downside is near the $3,300 level. The first major support sits near the $3,250 zone.

A clear move below the $3,250 support might push the price toward $3,220 or the 50% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high. Any more losses might send the price toward the $3,150 support level in the near term. The next key support sits at $3,050.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,250

Major Resistance Level – $3,385

-

Ethereum24 hours ago

Ethereum24 hours agoFundraising platform JustGiving accepts over 60 cryptocurrencies including Bitcoin, Ethereum

-

Market20 hours ago

Market20 hours agoSouth Korea Unveils North Korea’s Role in Upbit Hack

-

Bitcoin15 hours ago

Bitcoin15 hours agoMarathon Digital Raises $1B to Expand Bitcoin Holdings

-

Market15 hours ago

Market15 hours agoETH/BTC Ratio Plummets to 42-Month Low Amid Bitcoin Surge

-

Market23 hours ago

Market23 hours agoLitecoin (LTC) at a Crossroads: Can It Rebound and Rally?

-

Altcoin22 hours ago

Altcoin22 hours agoWhy FLOKI Price Hits 6-Month Peak With 5% Surge?

-

Altcoin20 hours ago

Altcoin20 hours agoVitalik Buterin, Coinbase’s Jesse Pollack Buy Super Anon (ANON) Tokens On Base

-

Altcoin15 hours ago

Altcoin15 hours ago5 Key Indicators To Watch For Ethereum Price Rally To $10K