Market

CertiK Auditor Criticized for Kraken’s $3 Million Loss

After the reported $3 million loss from Kraken exchange’s treasury, smart contract auditor CertiK has revealed an association with the incident.

The trading platform tried to recover the funds immediately but resorted to law enforcement, citing a case of extortion.

CertiK Shares Perspective on Kraken’s Loss

Kraken exchange’s recent $3 million bug attack has been linked to smart contract auditing firm CertiK, which confirmed the association. They discovered a series of critical vulnerabilities that could potentially lead to hundreds of millions of dollars in losses.

Following the discovery, the researchers took the initiative to explore the vulnerability, with three questions driving their research.

- Can a malicious actor fabricate a deposit transaction to a Kraken account?

- Can a malicious actor withdraw fabricated funds?

- What risk controls and asset protection might trigger from a large withdrawal request?

Read more: Kraken Review 2024: Security and Features

According to CertiK, the trading platform failed all the tests, which led it to conclude that Kraken’s “defense in-depth system is compromised on multiple fronts.”

“According to our testing result: The Kraken exchange failed all these tests, indicating that Kraken’s defense in-depth-system is compromised on multiple fronts. Millions of dollars can be deposited to ANY Kraken account. A huge amount of fabricated crypto (worth more than 1M+ USD) can be withdrawn from the account and converted into valid cryptos. Worse yet, no alerts were triggered during the multi-day testing period. Kraken only responded and locked the test accounts days after we officially reported the incident,” read the report as highlighted in a post.

CertiK presented these findings to Kraken Exchange, whose security team classified them as “critical,” the most serious classification level at the trading platform. Unfortunately, it all culminated in a case that required the involvement of law enforcement.

“Kraken’s security operation team threatened individual CertiK employees to repay a mismatched amount of crypto in an unreasonable time even without providing repayment addresses. The verbal consensus reached during our meeting was not confirmed afterward. Ultimately, they publicly accused us of theft and even directly threatened our employees, which is completely unacceptable,” CertiK told BeInCrypto.

CertiK has urged Kraken to cease the threats against their persona, which is termed “Whitehat hackers.” The smart contract auditor has shared all testing deposit transactions. They added that they moved all funds to an accessible account with Kraken.

Auditor Being Judged For $3 Million Bug-Attack

Despite CertiK’s efforts to shed light on the matter, the crypto community has criticized the researchers, calling them out for malpractice. One user observes that “the sentiment around this story would have been more positive if resolved friendly with Kraken and posted about it after.”

Developer Uttam Singh’s summary of the event ridiculed several aspects that make the case tilt further against CertiK. He highlights the fact that the researchers performed multiple transactions and that they waited five days before disclosure.

According to Cyvers CTO Meir Dolev, a Certik-associated address created a contract on the Coinbase Layer-2 network Base on May 24. This cast doubt on Certik’s claim that the vulnerability was discovered on June 5. Reportedly, the address is also testing OKX and Coinbase to see if there is the same vulnerability as Kraken.

Read more: Top 5 Flaws in Crypto Security and How To Avoid Them

Based on the community reaction, the general sentiment is that the action was not a Whitehat security research, with social media engagement citing on-chain evidence. Nevertheless, this did not derail CertiK’s Series B3 financing round, which garnered a stark $88 million.

Among the leaders in the funding round are Insight Partners, Tiger Global, and Advent International. Goldman Sachs, Sequoia, and Lightspeed Venture Partners also participated. Noteworthy, it marked CertiK’s fourth round of capital raised in nine months, totaling $230 million.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

3 altcoins that could go ballistic if Bitcoin (BTC) crosses $120,000 mark

Some altcoins are setting themselves up to profit from the positive wave as the crypto market prepares for Bitcoin’s possible breakout above the $120,000 mark. Rexas Finance (RXS), SUI, and Solana (SOL) are being hailed by some industry insiders as particularly outstanding performers and ready to go ballistic during the anticipated Bitcoin rally.

Rexas Finance (RXS): The future of real-world asset tokenization

Rexas Finance provides creative ideas for real-world asset (RWA) tokenization. By letting users tokenize real estate, artwork, and other highly valuable assets, Rexas Finance is changing the crypto scene. The initiative has enormous market potential since the real estate sector alone is valued at around $379.7 trillion.

Rexas Finance attracts retail and institutional investors by lowering transaction costs, improving liquidity, and raising transparency. Rexas Finance, in Stage 6 of its presale, has raised $9.5 million with 166 million tokens sold as of writing, indicating 81.74% completion. In this stage, the token price is $0.080; from its initial $0.03 price two months ago, this shows an impressive 166% increase.

It will list on three tier-1 exchanges at $0.20 post-presale, providing a wider global reach and more potential for gains. Rexas Finance recently received a Certik audit, which is a sign of security and trustworthiness in blockchain initiatives, improving investor confidence. Furthermore, its inclusion on CoinGecko and CoinMarketCap improves visibility and accessibility.

The ongoing $1 million giveaway, which offers 20 winners $50,000 in RXS apiece, has piqued investor interest. Based on projections for RXS, price appreciation seems to be strong as adoption rises. Some analysts believe Rexas Finance, with features such as AI integration, DeFi utilities, and yield optimization, could be poised to go ballistic if Bitcoin rallies above $120,000.

SUI: Consistently Hitting new all-time highs

Rising 105% in the past two weeks, SUI is among the top-performing altcoins in the current bull run. As of writing, SUI trades at $3.72, just below its all-time high of $3.94, which it attained last weekend.

Reflecting increased investor demand and confidence, its Open Interest (OI) has lately topped $826 million. The Chaikin Money Flow (CMF) indicator of the token indicates significant inflows, highlighting its positive trend. With a constant tendency to new all-time highs, SUI’s upward trajectory exactly matches market expectations of a possible surge. Driven by its excellent foundations and growing market visibility, SUI is expected to rise sharply if Bitcoin crosses $120,000.

Solana (SOL): Poised for a new all-time high?

Riding a surge of positive momentum, Solana broke past the $240 barrier twice in the current bull run. SOL trading at $246.89 as of writing has increased 59.9% over the past month. With analysts predicting a surge to $600 or more, its market capitalization of $115 billion ranks it among the top four leading cryptocurrencies, recently flipping Binance Coin.

Technical indicators supporting this optimistic view include a declining triangle breakout and a cup-and-handle pattern. Solana-based decentralized exchanges (DEXs), which account for 33.59% of DEX trade activity as of November, support its bullishness even more. So, Solana might see significant inflows if Bitcoin crosses the $120,000 mark, increasing its price to new highs.

Conclusion

Rexas Finance, SUI, and Solana could be ready to go ballistic if Bitcoin surges past $120,000. Each altcoin has unique qualities and solid foundations that guarantee a place of strength in the next positive market phase. Although SUI and Solana present interesting development chances, Rexas Finance distinguishes itself with its innovative RWA tokenizing, unparalleled presale expansion, and rich possibilities.

For more information about Rexas Finance (RXS) visit the links below:

Website: https://rexas.com

Win $1 Million Giveaway: https://bit.ly/Rexas1M

Whitepaper: https://rexas.com/rexas-whitepaper.pdf

Twitter/X: https://x.com/rexasfinance

Telegram: https://t.me/rexasfinance

Market

Cardano Whales Accumulation Hits $55 Million: $1 Target Soon?

On November 20, crypto whales offloaded significant amounts of Cardano (ADA), disrupting its bullish momentum. However, the narrative shifted today as the Cardano whales’ accumulation has taken center stage.

This renewed buying activity suggests that ADA’s price might regain its bullish momentum toward $1. But does the data support this bullish outlook?

Cardano Key Investors Change Their Stance

According to IntoTheBlock, Cardano’s large holders’ netflow has surged to 67.51 million ADA, signaling a significant shift in sentiment among crypto whales. The netflow represents the difference between the amount of ADA purchased and sold by large holders over a specific period.

When netflow increases, it indicates that whales are buying more than they are selling. Typically, this is a bullish signal. Conversely, a drop in netflow suggests more selling by whales, which is generally regarded as bearish.

In this case, the recent netflow increase, valued at approximately $55 million, aligns with ADA’s 11% price surge over the last 24 hours. Thus, this Cardano whales accumulation suggests that ADA may be poised for further gains, with the recent uptick serving as a potential foundation for a higher value.

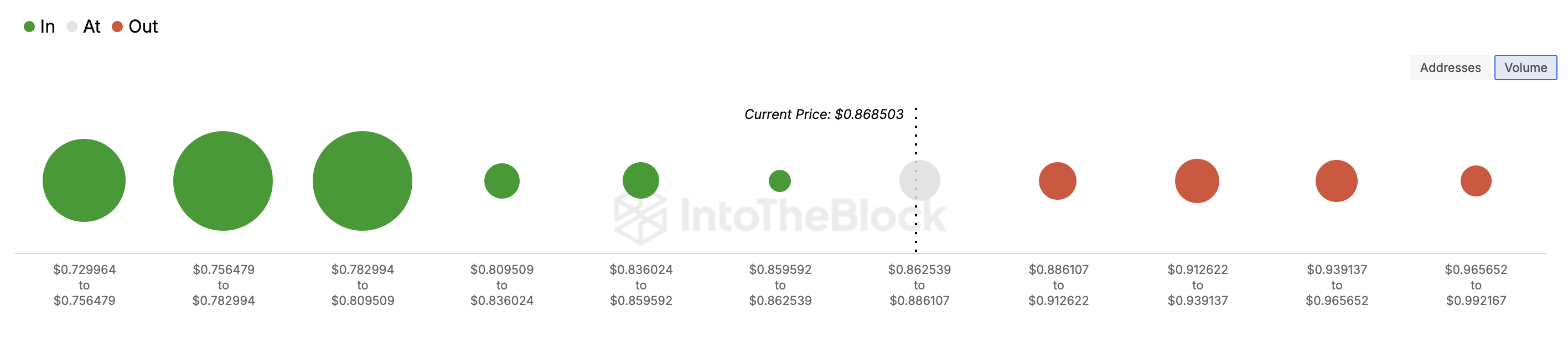

Furthermore, the In/Out of Money Around Price (IOMAP) indicator provides further support for this bullish outlook. For context, the IOMAP analyzes token clusters based on three groups: holders who purchased below the current price (in the money), above the current price (out of the money), and those at breakeven.

This metric is essential for identifying potential support and resistance zones. Specifically, if there is a higher number of tokens “in the money, ” it signifies solid support, as many holders are at a profit and less likely to sell, potentially driving the price higher.

On the other hand, a higher “out of the money,” volume points to resistance, as holders might sell to recover losses, putting downward pressure on the price.

Currently, ADA’s IOMAP shows strong support levels outweighing resistance zones, reinforcing the potential for its price to climb further.

ADA Price Prediction: Move Toward $1 Almost Valid

On the daily chart, ADA’s price has risen above the key Exponential Moving Averages (EMAs). Specifically, the 20-day EMA (blue) and 50 EMA (yellow) are below Cardano’s price. When the price is above the indicator, the trend is bullish.

On the other hand, if the price is below the indicator, the trend is bearish. Therefore, it appears that, with the current trend, ADA could rise higher than $0.87. If this happens, the altcoin might rally toward the $1 mark.

However, if Cardano whales decide to sell and book profits, this prediction might not come to pass. Instead, the price could drop to $0.68.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Approaches $100K: The Countdown Is On

Bitcoin price is rising steadily above the $95,000 zone. BTC is showing positive signs and might soon hit the $100,000 milestone level.

- Bitcoin started a fresh increase above the $95,000 zone.

- The price is trading above $95,000 and the 100 hourly Simple moving average.

- There is a key bullish trend line forming with support at $95,200 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could continue to rise if it clears the $100,000 resistance zone.

Bitcoin Price Sets Another ATH

Bitcoin price remained supported above the $92,000 level. BTC formed a base and started a fresh increase above the $95,000 level. It cleared the $96,500 level and traded to a new high at $98,999 before there was a pullback.

There was a move below the $98,000 level. However, the price remained stable above the 23.6% Fib retracement level of the upward move from the $91,500 swing low to the $98,990 high. There is also a key bullish trend line forming with support at $95,200 on the hourly chart of the BTC/USD pair.

The trend line is close to the 50% Fib retracement level of the upward move from the $91,500 swing low to the $98,990 high. Bitcoin price is now trading above $96,000 and the 100 hourly Simple moving average.

On the upside, the price could face resistance near the $98,880 level. The first key resistance is near the $99,000 level. A clear move above the $99,000 resistance might send the price higher. The next key resistance could be $100,000.

A close above the $100,000 resistance might initiate more gains. In the stated case, the price could rise and test the $102,000 resistance level. Any more gains might send the price toward the $104,500 resistance level.

Downside Correction In BTC?

If Bitcoin fails to rise above the $100,000 resistance zone, it could start a downside correction. Immediate support on the downside is near the $98,000 level.

The first major support is near the $96,800 level. The next support is now near the $95,500 zone and the trend line. Any more losses might send the price toward the $92,000 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $96,800, followed by $95,500.

Major Resistance Levels – $99,000, and $100,000.

-

Altcoin24 hours ago

Altcoin24 hours agoSui Network Back Online After 2-Hour Outage, Price Slips

-

Altcoin23 hours ago

Altcoin23 hours agoDogecoin Whale Accumulation Sparks Optimism, DOGE To Rally 9000% Ahead?

-

Bitcoin21 hours ago

Bitcoin21 hours agoMarathon Digital Raises $1B to Expand Bitcoin Holdings

-

Regulation15 hours ago

Regulation15 hours agoUK to unveil crypto and stablecoin regulatory framework early next year

-

Market21 hours ago

Market21 hours agoETH/BTC Ratio Plummets to 42-Month Low Amid Bitcoin Surge

-

Market18 hours ago

Market18 hours agoWhy SUI Network Outage Did Not Cause a Price Crash

-

Market22 hours ago

Market22 hours agoBitcoin Cash (BCH) Price Up, Leads Daily Gains

-

Market17 hours ago

Market17 hours agoCardano (ADA) Price Hits 41% Weekly Growth, $1 Target in Sight