Bitcoin

Binance CEO Predicts Bitcoin Rally Above $80,000, But What Will Drive It?

Binance Chief Executive Officer (CEO), Richard Teng has made a bullish prediction for Bitcoin, the world’s largest cryptocurrency. Despite BTC’s recent downward trend, Teng foresees the cryptocurrency hitting $80,000 in this market cycle, citing the influence of Spot Bitcoin ETFs and Spot Ethereum ETFs as potential drivers.

Bitcoin Predicted To Hit $80,000 In 2024

In a recent interview on the YouTube channel, Bankless, Teng shared his 2024 prediction for Bitcoin, foreseeing major gains ahead for the pioneer cryptocurrency.

The Binance CEO disclosed that in 2023, he had initially predicted BTC would hit an all-time high of $80,000. However, with the significant market changes brought about by the approval and launch of Spot Bitcoin ETFs, he now anticipates Bitcoin surpassing $80,000 before the end of the year.

Teng’s BTC outlook for 2025 is even more impressive than his 2024 price prediction. He predicted that 2025 would be an incredibly bullish year, highlighting key drivers like improvements in macroeconomic factors and more favorable environments for the cryptocurrency industry.

For 2024, the Binance CEO highlighted several factors that could drive Bitcoin towards his predicted price target. He discussed a high potential for the Federal Reserve (FED) to cut down rates before the end of 2024. Additionally, he pinpointed the influx of capital into Spot Bitcoin ETFs and the recent approval of Ethereum Spot ETFs.

Basing his previous predictions of BTC on its historical performance after each halving event, Teng expressed surprise that the pioneer cryptocurrency had risen to new all-time highs above $73,000 before its halving event on April 20. He acknowledged his oversight, as he had expected BTC to reach a new all-time high at least six months after its halving event.

Due to the massive success of the Spot Bitcoin ETF launch and the billions of capital flowing into the market, Teng has changed his previous predictions, declaring that BTC’s price would surge significantly higher than his base prediction from the end of last year. Although the Binance CEO refrained from giving an exact predictive value for Bitcoin’s price, he emphasized Standard Chartered’s bullish prediction of the cryptocurrency earlier this year, which saw BTC potentially hitting $200,000 or even as high as $250,000 by 2025.

Update On BTC’s Current Price

Despite the hype surrounding the upcoming launch of Spot Ethereum ETFs and the significant inflows into Spot Bitcoin ETFs, the price of BTC has remained slightly below expected levels. The cryptocurrency is currently trading at $65,649, reflecting a 2.54% decline over the past week, according to CoinMarketCap.

While its trading volume remains relatively high, recording a 108.35% increase in its 24-hour trading volume, its price has plummeted by 2.47% over the past month. Popular Crypto analyst, Ali Martinez has highlighted the negative impacts a continuous downtrend would have on BTC’s value. Martinez revealed that Bitcoin needs to climb back above $66,254 to avoid spiraling down to new lows at $61,000.

Featured image created with Dall.E, chart from Tradingview.com

Bitcoin

US Economic Events Impacting Bitcoin and Crypto Sentiment

This week, three US economic events will be on crypto traders’ and investors’ watchlists. The interest comes amid the continued influence of US macroeconomic data on Bitcoin (BTC) and crypto prices in 2024, after drying up last year.

Meanwhile, Bitcoin remains just shy of the $100,000 psychological level, hovering above $98,000 after retracting to the $95,000 range over the weekend.

Minutes of Fed’s November FOMC Meeting

All eyes will be on the Federal Reserve (Fed) on Tuesday, November 26, for the minutes of the November 6 FOMC (Federal Open Market Committee) meeting. Traders and investors will be watching to see if the FOMC minutes shed some more light on how the policymakers assessed the economy leading up to the November meeting.

The minutes may also show at least some discussion about possible economic implications following the US election outcome. They will come after policymakers voted to cut interest rates by 25 basis points (bps), following an initial 50 bps reduction in September. Investors will be looking for any clues on whether the pace of rate cuts could drop from here.

Meanwhile, data continues to suggest the US economy is holding up well. Still, fears abound that President-elect Donald Trump’s proposed policies may be inflationary, potentially reducing the need for lower rates.

“Experts say Donald Trump’s election victory could shift interest rate policy in the US as his promised policies risk higher inflation…Tradition tells us that that increase in tariffs will increase inflation in the US,” The Canadian Press reported, citing Sheila Block, an economist with the Canadian Centre for Policy Alternatives.

One way the FOMC minutes could affect Bitcoin and crypto is through their impact on the overall market sentiment. Any dovish or hawkish tones in the minutes can influence market expectations and lead to changes in investor behavior.

Initial Jobless Claims

Another key US economic event this week is the release of initial jobless claims on Wednesday, November 27. Labor market weakness was a concern through the summer and fall, with rising jobless claims, an increased unemployment rate, and slower monthly job gains. This data influenced the Federal Reserve’s decision to cut interest rates by half a percentage point in September.

However, since then, labor market data has come in better than expected, with the unemployment rate falling from a peak of 4.3% to 4.1%. The previous initial jobless claims data came in at 213,000 for the week ending November 16, below the estimate of 220,000, which was a good sign.

“US initial jobless claims fell by 6,000 to 213,000 last week, the lowest since April. The labor market is strong,” the publisher of the Lead-Lag Report noted.

Weekly unemployment claims have been steadily decreasing after reaching a peak in over a year this past October. While initial jobless claims are falling, the rise in continuing claims indicates that employers are striving to retain workers. However, those who lose their jobs are facing challenges in securing new employment.

“Initial jobless claims remain very slow but continuing claims hit a three-year high. This reinforces that employers aren’t actively laying workers off, but they aren’t hiring, either,” Sevens Report commented.

For now, things appear to be okay on the labor side of the Federal Reserve’s dual mandate. If the trend continues, it would suggest that economic hardship is reversing and that the labor market is gaining strength. This could lead to increased consumer spending and investment in traditional assets like Bitcoin and crypto.

US PCE Inflation

Crypto market participants will also watch Wednesday’s October US PCE (Personal Consumption Expenditures) inflation data, as this is the Fed’s preferred gauge. The November PCE index on Wednesday is also a good watch. The data will show whether inflation continued to slow in November.

“Expectations: Monthly PCE expected to rise by 0.2% Annual PCE expected at 2.3% Core PCE monthly increase at 0.3% Core PCE annual increase at 2.8%,” data on MarketWatch shows.

Rising PCE figures often raise concerns about higher inflation levels in the economy. If PCE inflation exceeds expectations, it could weaken the US dollar as investors anticipate potential monetary policy actions, such as interest rate hikes. A weaker dollar tends to benefit Bitcoin and other cryptocurrencies, which often show an inverse correlation with the USD.

In such scenarios, investors may turn to alternative assets like Bitcoin as a hedge against inflation. Cryptocurrencies are frequently seen as a store of value, similar to gold, during periods of inflationary pressure.

Currently, the Federal Reserve remains optimistic that inflation is nearing its 2% target. Policymakers have maintained interest rates at historically high levels to combat the inflation surges of the past two years. In this context, traders and investors are closely monitoring price data for positive signs that could prompt the Fed to begin easing interest rates.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Bull Saylor Hints at Expanding MicroStrategy’s Holdings

Michael Saylor, co-founder of MicroStrategy, has hinted at the possibility of additional Bitcoin purchases.

In a November 24 post on X (formerly Twitter), Saylor teased the company’s plans following its successful $3 billion fundraising round on November 22.

MicroStrategy’s $3 Billion Raise Could Fuel New Bitcoin Purchases

The Bitcoin bull mentioned that MicroStrategy’s portfolio tracker, SaylorTracker, “needs more green dots.” These markers symbolize the company’s each Bitcoin acquisition, fueling speculation about another significant purchase.

Saylor’s recent hints echo his previous two Sunday posts, which preceded announcements of large-scale Bitcoin acquisitions. During this period, MicroStrategy added approximately 80,000 BTC to its holdings, worth over $6 billion at the time.

Meanwhile, the recent $3 billion funding — raised through the issuance of convertible debt — could be instrumental in financing these new acquisitions. The convertible notes, sold privately to institutional investors under US securities laws, will mature on December 1, 2029. These notes carry a 55% premium and an implied strike price of $672 per share of MicroStrategy’s Class A common stock.

Market observers noted that this fundraiser aligns with MicroStrategy’s ambitious “21/21” initiative, which aims to raise $42 billion over three years through a mix of equity and fixed-income instruments.

The company remains the largest Bitcoin-holding public entity, with 331,200 BTC valued at over $32.7 billion. According to Saylor, MicroStrategy’s treasury operations have delivered a year-to-date Bitcoin yield of 41.8%, generating a net benefit of around 79,130 BTC, or roughly 246 BTC daily, without the operational costs associated with mining.

Additionally, this strategy has also bolstered MicroStrategy’s stock performance. MSTR shares have surged over 515% since the start of the year, making it one of the most actively traded stocks in the US.

Saylor emphasized that MicroStrategy’s operations are driven by its Bitcoin holdings, which are optimized through strategic financial tools like ATM offerings, enabling the company to reduce risk and volatility while enhancing shareholder value.

“MicroStrategy is powered by its Bitcoin treasury operations. We sell volatility through our ATM offerings, strip BTC risk, volatility, and performance from our fixed-income securities, and transfer that performance to our MSTR equity holders,” he stated.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

$100K Bitcoin Is Only The Beginning, VanEck Targets $180K

Recent gains in Bitcoin are owed in part to changes in the political environment, particularly in the US. Incoming US President Donald Trump is backing cryptocurrencies, sparking renewed market optimism among investors.

From reforms in regulatory structures to a proposal for a national Bitcoin reserve, the policies he enforces provide Bitcoin an exceptional outlet for growth in an increasingly open and friendly new landscape. These changes places the US in a strategic position as the world’s leader in crypto innovation while giving a fertile ground for Bitcoin to continue growing.

Crypto On The Rise

These possible changes have been well taken by market participants, who have seen the highest market dominance of BTC at 59%. A bill being worked out may permit state-chartered banks to mint stablecoins without seeking prior approval from the Federal Reserve, putting the US in a very commanding position in the race to dominate financial innovation. Furthermore, proposals to deregulate the energy industry may favor crypto mining, which will place the US in a better position in the global race for blockchain.

🧐 Bitcoin’s flirtation with $100K continues as crypto’s top market cap has now reached an ATH of $99,850. As its price continues to hit round numbers and fulfill limit sell orders, it is widely being perceived as only a matter of time. pic.twitter.com/Qb1LTznuij

— Santiment (@santimentfeed) November 22, 2024

Historic Rally: BTC Approaching $100K

Bitcoin is trading at nearly $99,850 and is on the verge of the long-awaited $100,000 milestone. Similar to other bull runs, including the one witnessed after the elections in 2020, when the price of Bitcoin nearly doubled in a matter of a few months, some believe institutional interest coupled with friendly economic conditions and increased on-chain activity are the drivers of this phenomenal appreciation of the price of Bitcoin.

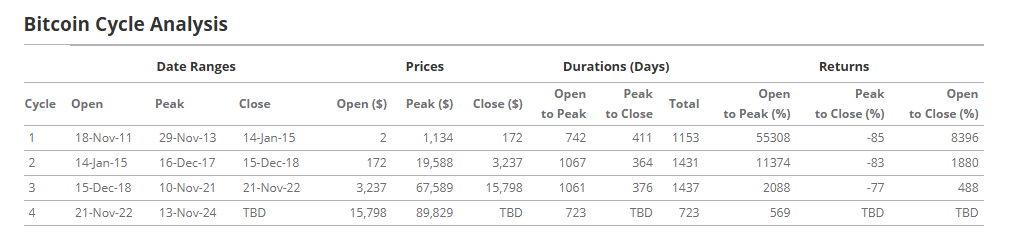

Source: VanEck

According to VanEck’s latest report, Bitcoin still is in its early stages of the rally, and there is minimal technical resistance in its way. With investor enthusiasm building, growing calls for the alpha coin to be adopted as a strategic reserve, and with a supportive US government, this rally appears well-positioned to continue. Experts are optimistic that Bitcoin is going to push forward and hit new highs.

The Future Of Bitcoin: Cautious Optimism

Analysts, while acknowledging that momentum is strong, point out that the market may run too hot, and early signs in the development are a rise in funding rates and increased unrealized profits. However, even from this stage, long-term prospects appear bright given strong institutional demand, solid on-chain metrics, and supportive regulatory changes, according to the forecast of $180,000 by VanEck for Bitcoin in the current cycle.

While historical data may indicate the crypto asset’s growth is decelerating as the markets mature, the cryptocurrency still shows hopeful prospects in the near term. So far, this rally displays the confidence of investors and has incrementally acquired recognition regarding Bitcoin’s role in a changed financial sector.

Featured image from CNBC, chart from TradingView

-

Bitcoin22 hours ago

Bitcoin22 hours agoSenator’s Bold Proposal To Replenish US Reserves

-

Market21 hours ago

Market21 hours agoCan the SAND Token Price Rally Be Sustained?

-

Bitcoin20 hours ago

Bitcoin20 hours agoBitcoin Whales Remain Determined, $3.96 Billion Worth Of BTC Gobbled Up In 96 Hours

-

Altcoin8 hours ago

Altcoin8 hours agoSuper Pepe Coin Whale Sells 130B PEPE, Shifts Focus To EIGEN

-

Market20 hours ago

Market20 hours agoCantor Fitzgerald Deepens Tether Ties With 5% Stake Acquisition

-

Market7 hours ago

Market7 hours agoHarmful Livestreams Prompt Ban Calls

-

Bitcoin17 hours ago

Bitcoin17 hours agoBitcoin Bull Saylor Hints at Expanding MicroStrategy’s Holdings

-

Market16 hours ago

Market16 hours agoBitcoin ETFs Could Overtake Gold ETFs by End of The Year