Market

Extends Losses Amid Increased Selling Pressure

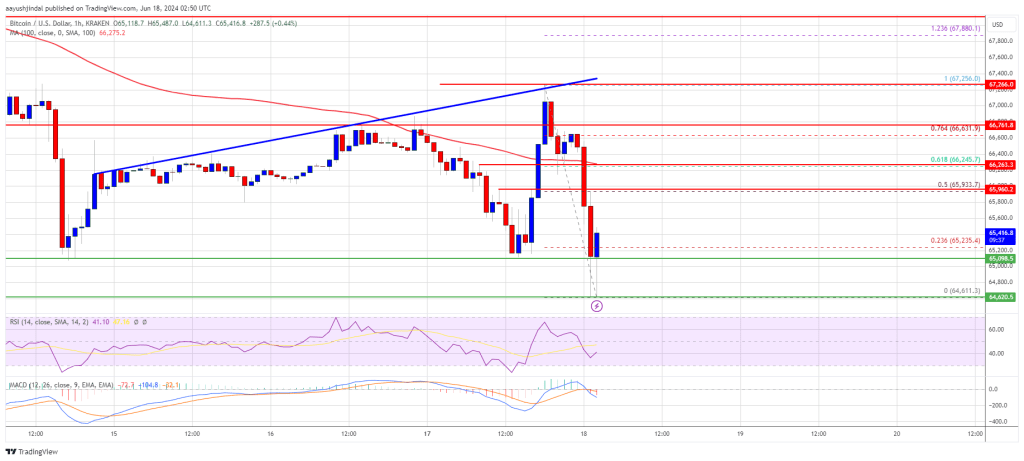

Bitcoin price extended its losses and traded below the $65,000 level. BTC is showing bearish signs and might extend losses below the $64,600 level.

- Bitcoin remained in a bearish zone and traded below $65,000.

- The price is trading below $66,000 and the 100 hourly Simple moving average.

- There is a connecting trend line forming with resistance at $67,500 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could continue to move down and even trade below the $64,500 support zone.

Bitcoin Price Extends Its Decline

Bitcoin price struggled to recover above the $66,500 resistance zone. BTC remained in a bearish zone and started a fresh decline from the $67,256 high. There was a move below the $66,500 level.

There was a clear move below the $65,500 and $65,000 support levels. Finally, the price tested $64,600. A low was formed at $64,611 and the price is now consolidating losses. There was a minor increase above the $65,000 level. The price climbed above the 23.6% Fib retracement level of the downward move from the $67,256 swing high to the $64,611 low.

Bitcoin is now trading below $66,000 and the 100 hourly Simple moving average. There is also a connecting trend line forming with resistance at $67,500 on the hourly chart of the BTC/USD pair.

On the upside, the price is facing resistance near the $66,000 level or the 50% Fib retracement level of the downward move from the $67,256 swing high to the $64,611 low. The first major resistance could be $66,250. The next key resistance could be $66,500.

A clear move above the $66,500 resistance might start a decent increase and send the price higher. In the stated case, the price could rise and test the $67,500 resistance. Any more gains might send BTC toward the $68,500 resistance in the near term.

More Losses In BTC?

If Bitcoin fails to climb above the $66,000 resistance zone, it could continue to move down. Immediate support on the downside is near the $65,000 level.

The first major support is $64,600. The next support is now forming near $64,500. Any more losses might send the price toward the $63,200 support zone in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $65,000, followed by $64,500.

Major Resistance Levels – $66,000, and $66,500.

Market

Dogecoin (DOGE) Shows Renewed Energy: Rally Incoming?

Dogecoin is consolidating gains above the $0.380 resistance against the US Dollar. DOGE is holding gains and eyeing more upsides above $0.400.

- DOGE price started a fresh increase above the $0.3750 resistance level.

- The price is trading above the $0.3800 level and the 100-hourly simple moving average.

- There was a break above a short-term contracting triangle with resistance at $0.390 on the hourly chart of the DOGE/USD pair (data source from Kraken).

- The price could continue to rally if it clears the $0.400 and $0.4080 resistance levels.

Dogecoin Price Eyes More Upsides

Dogecoin price remained supported above the $0.350 level and recently started a fresh increase like Bitcoin and Ethereum. DOGE was able to clear the $0.3650 and $0.3750 resistance levels.

The price climbed above the 50% Fib retracement level of the downward move from the $0.4208 swing high to the $0.3652 low. Besides, there was a break above a short-term contracting triangle with resistance at $0.390 on the hourly chart of the DOGE/USD pair.

Dogecoin price is now trading above the $0.3750 level and the 100-hourly simple moving average. Immediate resistance on the upside is near the $0.3950 level or the 61.8% Fib retracement level of the downward move from the $0.4208 swing high to the $0.3652 low.

The first major resistance for the bulls could be near the $0.400 level. The next major resistance is near the $0.4080 level. A close above the $0.4080 resistance might send the price toward the $0.4200 resistance. Any more gains might send the price toward the $0.4500 level. The next major stop for the bulls might be $0.500.

Are Dips Supported In DOGE?

If DOGE’s price fails to climb above the $0.400 level, it could start a downside correction. Initial support on the downside is near the $0.3850 level. The next major support is near the $0.3750 level.

The main support sits at $0.3550. If there is a downside break below the $0.3550 support, the price could decline further. In the stated case, the price might decline toward the $0.3200 level or even $0.300 in the near term.

Technical Indicators

Hourly MACD – The MACD for DOGE/USD is now gaining momentum in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for DOGE/USD is now above the 50 level.

Major Support Levels – $0.3850 and $0.3750.

Major Resistance Levels – $0.4000 and $0.4200.

Market

Solana Hits New All-Time High After 3 Years

On Friday, Solana (SOL) soared to a new all-time high (ATH), now trading at approximately $261. This breakthrough surpasses its previous peak set in November 2021.

Solana’s rise to a new ATH marks an increase of over 32 times from its lows recorded in December 2022.

Solana Hits All-Time High as Gary Gensler Plans Resignation

Solana’s path to this new high has been anything but smooth. After reaching its previous high in 2021, the platform faced a downturn in 2022 amid a broader crypto bear market, further exacerbated by technical issues and network downtimes.

The collapse of FTX in November 2022 pushed Solana’s price down to around $8.

However, Solana has since made a remarkable recovery, increasing more than 32-fold from its low. Now, Solana enthusiasts believe that SOL could eventually outpace Ethereum (ETH) in market capitalization.

“Solana has been at an all-time high by market cap for a while actually. Now, we’re finally in price discovery. The flippening is coming,” Birch, the founder of PathCrypto, said.

The surge in Solana’s market value coincides with the news of SEC Chairman Gary Gensler’s planned resignation, slated for January 20, 2025, as Donald Trump assumes office.

Known for his strict regulatory stance on cryptocurrencies, Gensler’s departure signals a potential shift toward a more crypto-friendly administration. Consequently, this political change is stoking speculations about the approval of a Solana exchange-traded fund (ETF). According to Fox Business journalist Eleanor Terrett, the SEC has begun engaging with issuers to explore the possibility of a Solana ETF.

“Talks between SEC staff and issuers looking to launch a Solana spot ETF are “progressing” with the SEC now engaging on S-1 applications. Recent engagement from staff, coupled with the incoming pro-crypto administration, is sparking a renewed sense of optimism that a Solana ETF could be approved sometime in 2025,” Terrett claimed.

Previous efforts to launch a Solana ETF were stalled by regulatory roadblocks, often stopping early in the process. However, the changing political environment and the SEC’s increased openness have reignited hopes within the crypto community. Recent filings for a Solana ETF by Canary Capital and BitWise reflect a growing interest and anticipation for regulatory approval.

Despite these encouraging developments, the odds of a Solana ETF approval in 2024 remain low, with Polymarket estimates placing it at around 4%.

Meanwhile, the crypto community is also closely watching Bitcoin as it approaches the highly anticipated $100,000 mark. On Friday, Bitcoin recorded a new high of about $99,300. This milestone is viewed as a pivotal moment for Bitcoin and could impact other cryptocurrencies, including Solana.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price 25% Rally: Breaking Barriers and Surpassing Odds

XRP price rallied above the $1.15 and $1.20 resistance levels. The price is up over 25% and might rise further above the $1.420 resistance.

- XRP price started a fresh surge above the $1.20 resistance level.

- The price is now trading above $1.250 and the 100-hourly Simple Moving Average.

- There was a break above a key bearish trend line with resistance at $1.1400 on the hourly chart of the XRP/USD pair (data source from Kraken).

- The pair is up over 25% and it seems like the bulls are not done yet.

XRP Price Eyes Steady Increase

XRP price formed a base above $1.050 and started a fresh increase. There was a move above the $1.150 and $1.20 resistance levels. It even pumped above the $1.25 level, beating Ethereum and Bitcoin in the past two sessions.

There was also a break above a key bearish trend line with resistance at $1.1400 on the hourly chart of the XRP/USD pair. A high was formed at $1.4161 and the price is now consolidating gains. It is trading above the 23.6% Fib retracement level of the upward move from the $1.0649 swing low to the $1.4161 high.

The price is now trading above $1.30 and the 100-hourly Simple Moving Average. On the upside, the price might face resistance near the $1.400 level. The first major resistance is near the $1.420 level. The next key resistance could be $1.450.

A clear move above the $1.450 resistance might send the price toward the $1.50 resistance. Any more gains might send the price toward the $1.550 resistance or even $1.620 in the near term. The next major hurdle for the bulls might be $1.750 or $1.80.

Are Dips Supported?

If XRP fails to clear the $1.420 resistance zone, it could start a downside correction. Initial support on the downside is near the $1.3350 level. The next major support is near the $1.2850 level.

If there is a downside break and a close below the $1.2850 level, the price might continue to decline toward the $1.240 support or the 50% Fib retracement level of the upward move from the $1.0649 swing low to the $1.4161 high in the near term. The next major support sits near the $1.20 zone.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now above the 50 level.

Major Support Levels – $1.3350 and $1.2850.

Major Resistance Levels – $1.4000 and $1.4200.

-

Market22 hours ago

Market22 hours agoSouth Korea Unveils North Korea’s Role in Upbit Hack

-

Bitcoin17 hours ago

Bitcoin17 hours agoMarathon Digital Raises $1B to Expand Bitcoin Holdings

-

Regulation12 hours ago

Regulation12 hours agoUK to unveil crypto and stablecoin regulatory framework early next year

-

Market17 hours ago

Market17 hours agoETH/BTC Ratio Plummets to 42-Month Low Amid Bitcoin Surge

-

Market16 hours ago

Market16 hours agoSEC Moves Toward Solana ETF Approval Amid Pro-Crypto Shift

-

Altcoin20 hours ago

Altcoin20 hours agoSui Network Back Online After 2-Hour Outage, Price Slips

-

Altcoin19 hours ago

Altcoin19 hours agoDogecoin Whale Accumulation Sparks Optimism, DOGE To Rally 9000% Ahead?

-

Altcoin22 hours ago

Altcoin22 hours agoVitalik Buterin, Coinbase’s Jesse Pollack Buy Super Anon (ANON) Tokens On Base