Market

Crypto Investments Outflows Hit $600 Million Last Week

Crypto investments outflows increased last week to record thresholds last seen in March. The turnout came as a reaction to the Federal Open Market Committee (FOMC) meeting.

The upside potential for the Bitcoin price remains limited as investors’ risk appetite drops.

Crypto Investments Outflows Hit $600 Million

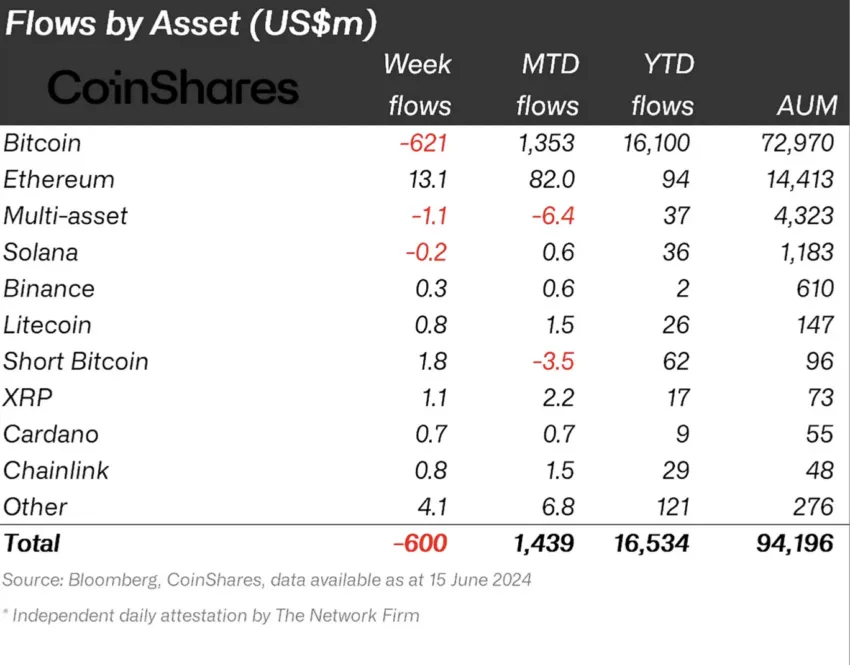

Digital asset investment products saw outflows of $600 million last week, levels last seen on March 22, according to a CoinShares report. Bitcoin accounted for most of the negative flows with $621 million in outflows. Conversely, altcoins like Ethereum (ETH) and Ripple (XRP) recorded net positive inflows, with $13 million and $1 million respectively.

“These outflows and recent price sell-off saw total assets under management (AuM) fall from above $100bn to $94bn over the week. The outflows were entirely focused on Bitcoin, seeing $621m outflows; the bearishness also prompted $1.8m inflows into short-bitcoin,” CoinShares analysts reported.

CoinShares analysts attribute the negative flows to the US Federal Reserve taking a “more hawkish-than-expected” stance in last week’s FOMC meeting. After cheering the softer US Consumer Price Index (CPI) print on June 12, which allowed digital assets to recoup some losses, tables turned ultra-fast as the Fed put out hopes of a more accommodative policy in the near term.

Read more: Crypto vs. Stocks: Where To Invest Your Money in 2024

The Fed’s updated dot plot suggested one rate cut for the year, down from three in its previous version. For the layperson, the prospect of fewer rate cuts is negative for cryptocurrencies. The FOMC meetings are crucial events where key decisions on the interest rate at which banks lend to each other and monetary policy are made.

From a regional perspective, the US saw the most outflows, reaching $565 million. However, Canada, Switzerland, and Sweden also recorded net negatives, with their respective outflows reaching $15 million, $24 million, and $15 million, respectively.

Ethereum Among Altcoins With Positive Flows

As indicated, Ethereum managed up to $13 million in positive flows, sidestepping the negative outlook in the BTC market. Sentiment in the Ethereum market remains bullish amid speculation that ETH spot ETFs will launch soon. Bloomberg analyst Eric Balchunas expects the financial instrument to launch on July 2.

“UPDATE: we are moving up our over/under date for the launch of spot Ether ETF to July 2nd, hearing the Staff sent issuers comments on S-1s today, and they’re pretty light, nothing major, asking for them back in a week. Decent chance they work to declare them effective the next week and get it off their plate bf holiday weekend. Anything possible but this is our best guess as of now,” noted Balchunas.

Balchunas’ optimism came after US Securities and Exchange Commission (SEC) Chair Gary Gensler confirmed that ETH spot ETFs would launch “over the course of this summer.”

Read more: Ethereum ETF Explained: What It Is and How It Works

In a Senate hearing last week, Gensler highlighted that the 19b-4 forms approved in May were from the stock exchanges expected to list the ETFs. He also indicated that the registration process for issuers was still underway. Nevertheless, Gensler hoped the issuers would conclude them within the summer.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

WisdomTree Europe Launches XRP ETP

ETF issuer WisdomTree’s European division just announced a new ETP based on XRP. This product is currently available in four EU countries, which has led XRP’s price to jump slightly.

ETPs are a common issuer strategy to earn revenue without ETF approval, but Europe will not necessarily approve one even if the US does so.

WisdomTree’s XRP ETP

WisdomTree, one of the Bitcoin ETF issuers in the US, announced that its European branch is offering an exchange-traded product (ETP) based on XRP. This new product is currently available in Germany, Switzerland, France, and the Netherlands. A growing number of issuers have filed for an XRP ETF, but WisdomTree is taking a slightly different tack.

“The WisdomTree Physical XRP ETP offers a simple, secure, and low-cost way to gain exposure to XRP, one of the largest cryptocurrencies by market capitalization. Backed 100% by XRP, XRPW is the lowest-priced XRP ETP in Europe, providing direct spot price exposure,” the announcement claimed.

The possibility of an official XRP ETF is growing with the current bull market, and Ripple CEO Brad Garlinghouse considers it “inevitable.” Still, it hasn’t happened yet, and ETP offerings allow issuers to somewhat address customers’ requirements. BitWise, which has also filed for an XRP ETF in the US, recently acquired a European ETP issuer to enter the same market.

WisdomTree, however, is no stranger to this market strategy. In May this year, it won approval to offer ETPs based on Bitcoin and Ethereum to British investors.

The UK has not yet approved a full ETF for either of these assets, but WisdomTree still gained market access. Even a fraction of the XRP market could also prove lucrative; the asset’s value spiked today.

WisdomTree Europe’s strategy page does not describe any further actions upon full approval. Even if the US approves an XRP ETF under the SEC’s new leadership, that won’t necessarily benefit WisdomTree’s European branch. For now, these ETPs built on XRP will have to suffice for this market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Rallies 10% and Targets More Upside

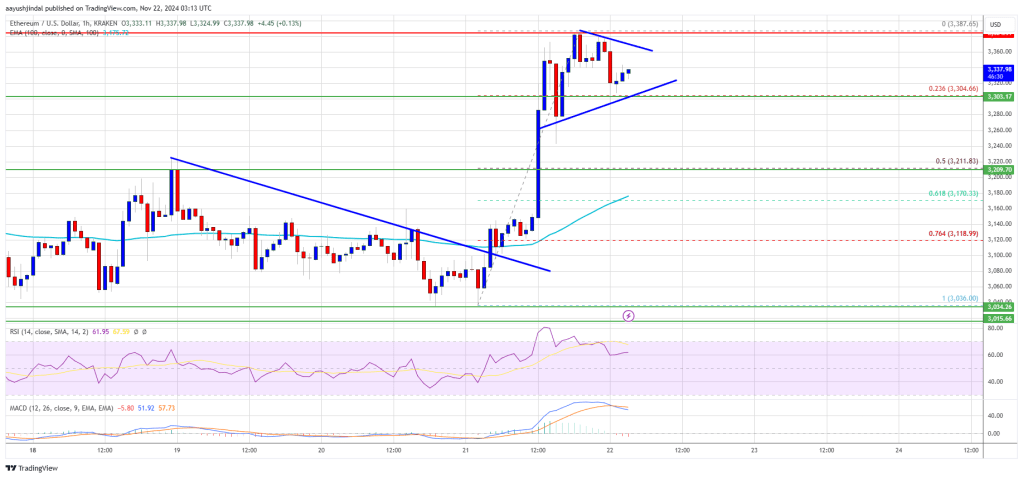

Ethereum price started a fresh increase above the $3,220 zone. ETH is rising and aiming for more gains above the $3,350 resistance.

- Ethereum started a fresh increase above the $3,220 and $3,300 levels.

- The price is trading above $3,250 and the 100-hourly Simple Moving Average.

- There is a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could gain bullish momentum if it clears the $3,385 resistance zone.

Ethereum Price Regains Traction

Ethereum price remained supported above $3,000 and started a fresh increase like Bitcoin. ETH gained pace for a move above the $3,150 and $3,220 resistance levels.

The bulls pumped the price above the $3,300 level. It gained over 10% and traded as high as $3,387. It is now consolidating gains above the 23.6% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high.

Ethereum price is now trading above $3,220 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,350 level. There is also a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD.

The first major resistance is near the $3,385 level. The main resistance is now forming near $3,420. A clear move above the $3,420 resistance might send the price toward the $3,550 resistance. An upside break above the $3,550 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,650 resistance zone or even $3,880.

Another Decline In ETH?

If Ethereum fails to clear the $3,350 resistance, it could start another decline. Initial support on the downside is near the $3,300 level. The first major support sits near the $3,250 zone.

A clear move below the $3,250 support might push the price toward $3,220 or the 50% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high. Any more losses might send the price toward the $3,150 support level in the near term. The next key support sits at $3,050.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,250

Major Resistance Level – $3,385

Market

Rallies 10% and Targets More Upside

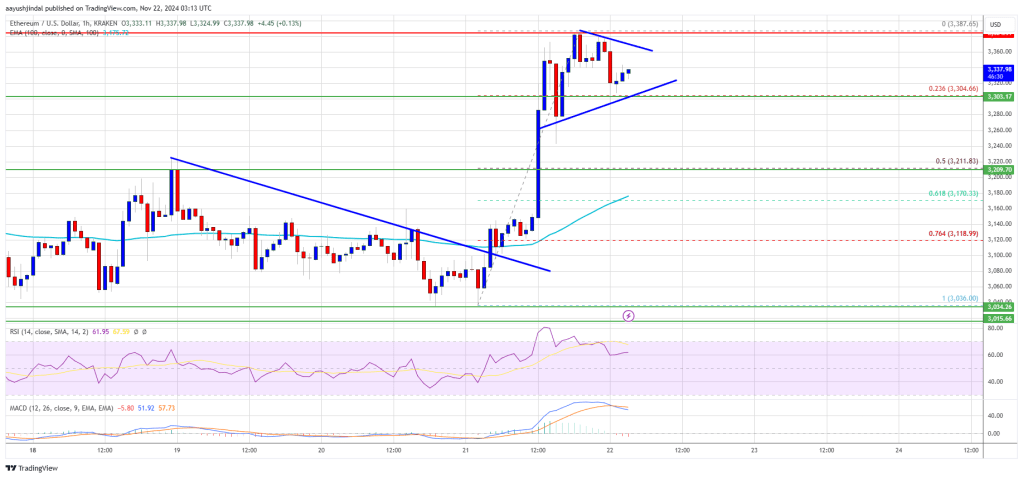

Ethereum price started a fresh increase above the $3,220 zone. ETH is rising and aiming for more gains above the $3,350 resistance.

- Ethereum started a fresh increase above the $3,220 and $3,300 levels.

- The price is trading above $3,250 and the 100-hourly Simple Moving Average.

- There is a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could gain bullish momentum if it clears the $3,385 resistance zone.

Ethereum Price Regains Traction

Ethereum price remained supported above $3,000 and started a fresh increase like Bitcoin. ETH gained pace for a move above the $3,150 and $3,220 resistance levels.

The bulls pumped the price above the $3,300 level. It gained over 10% and traded as high as $3,387. It is now consolidating gains above the 23.6% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high.

Ethereum price is now trading above $3,220 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,350 level. There is also a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD.

The first major resistance is near the $3,385 level. The main resistance is now forming near $3,420. A clear move above the $3,420 resistance might send the price toward the $3,550 resistance. An upside break above the $3,550 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,650 resistance zone or even $3,880.

Another Decline In ETH?

If Ethereum fails to clear the $3,350 resistance, it could start another decline. Initial support on the downside is near the $3,300 level. The first major support sits near the $3,250 zone.

A clear move below the $3,250 support might push the price toward $3,220 or the 50% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high. Any more losses might send the price toward the $3,150 support level in the near term. The next key support sits at $3,050.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,250

Major Resistance Level – $3,385

-

Ethereum23 hours ago

Ethereum23 hours agoFundraising platform JustGiving accepts over 60 cryptocurrencies including Bitcoin, Ethereum

-

Market19 hours ago

Market19 hours agoSouth Korea Unveils North Korea’s Role in Upbit Hack

-

Market23 hours ago

Market23 hours agoCardano’s Hoskinson Wants Brian Armstrong for US Crypto-Czar

-

Altcoin17 hours ago

Altcoin17 hours agoSui Network Back Online After 2-Hour Outage, Price Slips

-

Market22 hours ago

Market22 hours agoLitecoin (LTC) at a Crossroads: Can It Rebound and Rally?

-

Altcoin16 hours ago

Altcoin16 hours agoDogecoin Whale Accumulation Sparks Optimism, DOGE To Rally 9000% Ahead?

-

Altcoin21 hours ago

Altcoin21 hours agoWhy FLOKI Price Hits 6-Month Peak With 5% Surge?

-

Bitcoin14 hours ago

Bitcoin14 hours agoMarathon Digital Raises $1B to Expand Bitcoin Holdings