Market

ZK Listing and Top Crypto News Impacting Market This Week

This week, some major news has captured the attention of crypto investors and enthusiasts alike.

These developments are expected to substantially impact the crypto market, marking an exciting time for decentralized finance (DeFi) and blockchain technology.

zkSync Token Airdrop and Exchange Listings

ZK Nation, the Ethereum layer-2 network zkSync governance system, has announced that eligible users can claim their ZK token airdrops on June 17 at 07:00 UTC. The ZK token, introduced on June 11, is zkSync’s native asset.

The token allows holders to propose and vote on protocol upgrades and pay for network fees using zkSync’s native account abstraction. Additionally, the community can evolve ZK through governance-driven protocol upgrades to introduce staking and other functionalities.

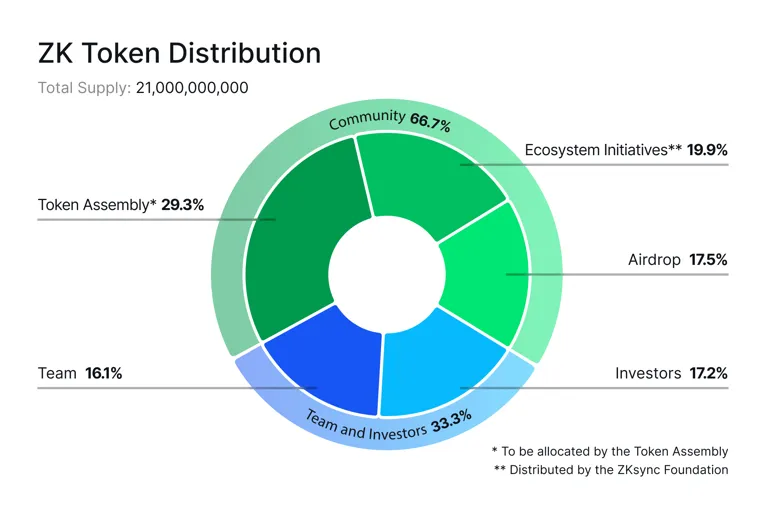

The total supply of ZK tokens is 21 billion, with 17.5% allocated for airdrops. Major exchanges, including Binance, HTX (Huobi), and KuCoin, will list ZK on June 17.

Read more: What Is zkSync?

Renzo Users Anticipate Key Withdrawal Dates

Users of the liquid staking token (LRT) Renzo (ezETH) are poised to request withdrawals on June 17 or 18. Lucas Kozinski, co-founder of Renzo, announced on Discord that the team is finalizing audit results for their projects.

Users can request withdrawals after the EigenLayer custody period ends on either expected date. This development is crucial for Renzo’s liquidity and user confidence. It also marks a significant milestone for the protocol.

Synthetix’s V3 Deployment on Arbitrum

On June 15, derivatives liquidity protocol Synthetix announced via X (Twitter) that its V3 will be live on Arbitrum (ARB) next week. However, the Synthetix team did not specify the exact date of this launch.

Synthetix’s deployment plan on Arbitrum was initially introduced on March 12 through an improvement proposal called SIP-367. On March 31, Synthetix Governance approved this proposal, paving the way for this significant upgrade.

Implementing the core V3 system will allow Synthetix to establish the core contracts on Arbitrum, enabling users to LP various collateral types like USDC, DAI, Ethereum (ETH), and ARB while minting an Arbitrum-native stablecoin against their collateral. The Synthetix Perpetual market will be paused upon initial deployment, with no tradable markets.

Rocket Pool’s Houston Upgrade: What to Expect

Rocket Pool (RPL), a liquid staking platform on the Ethereum network, will implement their Houston upgrade on June 17. According to its official announcement, the Houston upgrade aims to remove reliance on third-party systems by introducing a fully on-chain DAO to govern the protocol, known as the Protocol DAO (pDAO). The pDAO, run by RPL governance, comprises node operators directly participating in the protocol and invested in its success.

The upgrade will also introduce new features, allowing for building more integrations and platforms on the protocol. These features include the ability to stake ETH on behalf of a node and a new RPL withdrawal address feature. Additionally, the feature allows one party to supply the ETH for staking and another to provide the RPL without giving custody to the node operator.

Binance and Nigeria’s Legal Proceedings

Nigeria’s Federal Inland Revenue Service (FIRS) has dropped its tax charges against Binance executives Tigran Gambaryan and Nadeem Anjarwalla. This decision makes Binance becoming the sole defendant in this lawsuit.

However, Gambaryan and Anjarwalla remained named in a money-laundering case brought by Nigeria’s Economic and Financial Crimes Commission. The official statement reveals that the next hearing of this case will be on June 19.

LayerZero’s Upcoming Token Distribution

LayerZero Labs, the entity behind the interoperability protocol LayerZero, recently introduced the LayerZero Foundation. The Foundation’s first tweet, featuring the date “06.20.2024,” has sparked speculation about a major announcement related to its upcoming token.

On June 14, Bryan Pellegrino, CEO of LayerZero, shared details about the approximate distribution of LayerZero’s native token, ZRO, on Twitter. Pellegrino outlined that 23.8% of the supply would go directly to the community and builders, with 8.5% distributed on day one.

“The majority of the remainder will be given over the next 36 months with additional retroactive distribution every 12 months, along with some forward-looking [request for proposals] RFPs for builders,” Pellegrino added.

This distribution strategy aims to engage the community actively and support the development of LayerZero’s ecosystem. Pellegrino further provided detailed simulations of the token distribution to ensure fair and broad participation.

Read more: LayerZero Explained: A Guide to the Interoperability Protocol

SpaceID and Other Major Token Unlocks

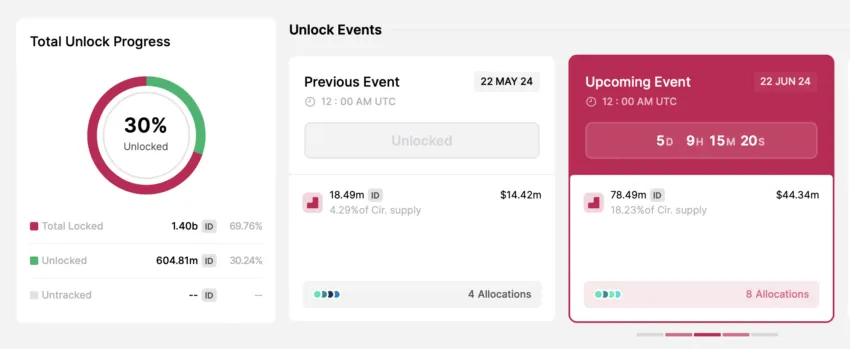

Space ID, a universal decentralized identity protocol, will unlock over 78 million of its native token, ID, on June 22 at 00:00 UTC. These tokens, valued at approximately $44.34 million, will be allocated to the Space ID Foundation and several sale-round participants. This unlock represents 18.23% of the token’s circulating supply.

Another noteworthy token unlock event is Pixel (PIXEL), which will unlock 54.38 million PIXEL, worth $19.66 million, on June 19 at 10:00 UTC. Read this article for detailed information on major crypto token unlocks this week.

Crypto investors and traders will closely watch this week’s events, as they have the potential to shape market sentiment and spur innovation in the industry.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Justin Sun Claims First Digital Trust Fraud Exceeds Impact of FTX

TRON founder Justin Sun is intensifying his accusations against First Digital Trust (FDT), the issuer of the FDUSD stablecoin, who he claims embezzled $500 million of its clients’ funds.

In an April 5 post on X, Sun compared FDT to the now-defunct FTX exchange, claiming the FDT case is “ten times worse.” FTX filed for bankruptcy in November 2022 after a bank run revealed an $8 billion shortfall in its assets.

Justin Sun Compares First Digital Trust to FTX

Sun argued that while FTX misused user funds, the exchange at least maintained an internal system that portrayed the activity as pledged loans.

He explained that FTX used assets like FTT, SRM, and MAPS tokens as collateral in transactions that, on the surface, had some structure. In contrast, Sun claims First Digital Trust outright stole funds without user consent or any internal pledge mechanism.

“FDT simply siphoned off $456m from TUSD’s custodial funds without client authorization or knowledge, and booked as loans to a dubious third party Dubai company without any collaterals,” Sun claimed.

The Tron founder further asserted that the now-convicted FTX founder Sam Bankman-Fried (SBF) indeed misused funds. However, Sun noted much of that capital went into investments in reputable firms such as Robinhood and AI company Anthropic.

On the other hand, Sun alleged that FDT diverted user assets into private entities for personal gain without any meaningful investment.

Sun also took aim at FDT CEO Vincent Chok Zhuo, criticizing his apparent indifference following the exposure of the alleged misconduct.

According to him, Chok has shown no intention of taking responsibility. This contrasts with SBF, who took steps to recover user assets and cooperated with authorities.

“Vincent Chok has acted deceptively and maliciously, pretending nothing happened when exposed,” Sun stated.

Considering this development, the TRON founder urged Hong Kong authorities to take swift action. He called for a response similar to that of US regulators during the FTX collapse.

Sun emphasized that Hong Kong’s reputation as a global financial hub is at risk and called for immediate enforcement to prevent further damage.

“Hong Kong must act like its US counterparts—swiftly, decisively, and effectively. We cannot allow the fraudsters continue its pyramid scheme against the public,” the crypto entrepreneur concluded.

To support investigations, Sun has launched a $50 million bounty program aimed at exposing the alleged misconduct. He also met with Hong Kong lawmaker Johnny Wu to discuss potential regulatory action.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

3 Token Unlocks for This Week: AXS, JTO, XAV

Token unlocks play a pivotal role in the crypto market, impacting liquidity, price volatility, and investor sentiment. They are events in crypto where locked coins or tokens are released and become available for trading in the open market.

This week, three major projects—Axie Infinity (AXS), Jito Labs (JTO), and Xave (XAV)—will release previously locked tokens into circulation. Here’s what you need to know and watch for.

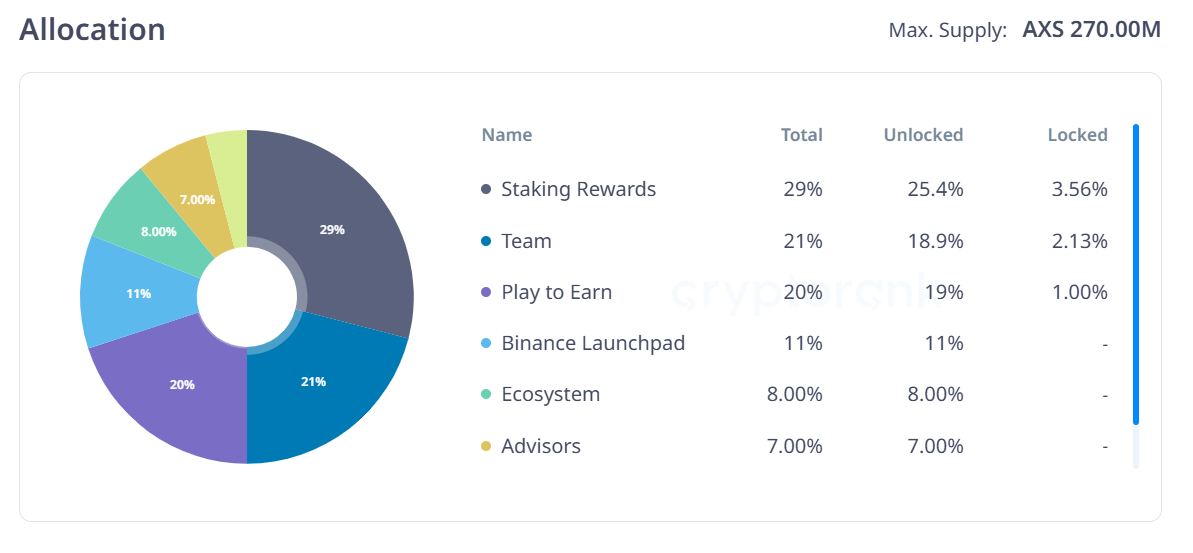

1. Axie Infinity (AXS)

- Unlock Date: April 12

- Number of Tokens to be Unlocked: 10.72 Million AXS (3.97% of Total Supply)

- Current Circulating Supply: 160.159 Million AXS

- Total supply: 270 Million AXS

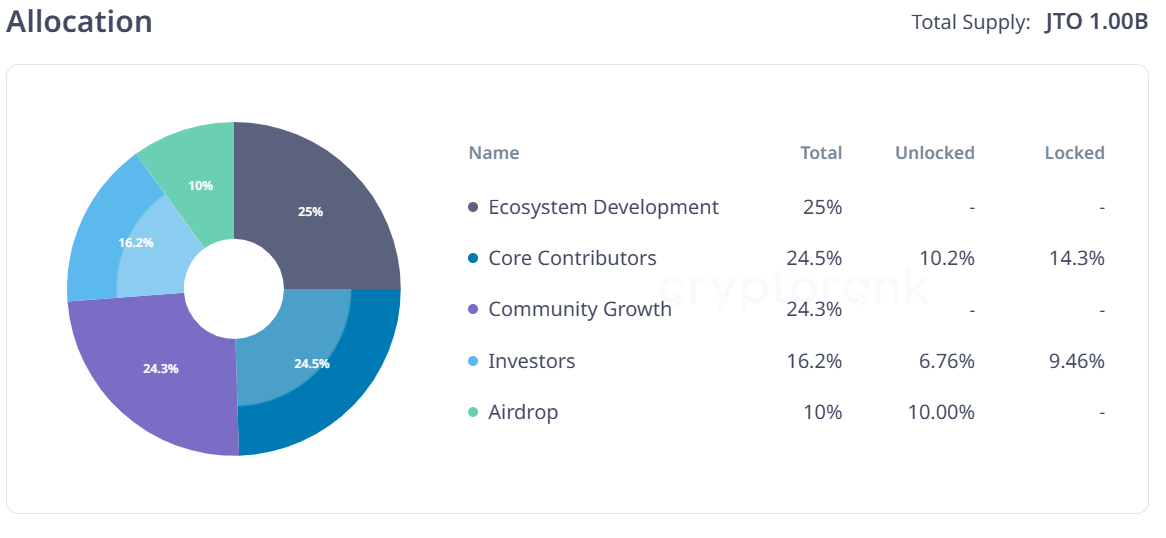

- Unlock Date: April 7

- Number of Tokens to be Unlocked: 11.31 Million JTO (1.13% of Total Supply)

- Current Circulating Supply: 313.37 Million JTO

- Total supply: 1 Billion JTO

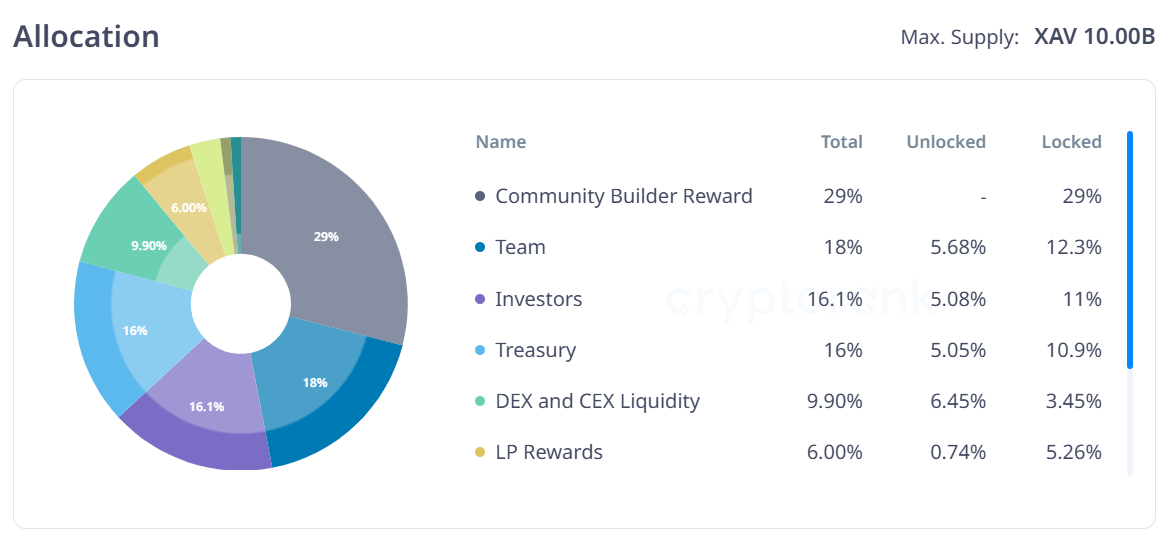

- Unlock Date: April 11

- Number of Tokens to be Unlocked: 313.29 Million XAV (3.13% of Total Supply)

- Total supply: 10 Billion XAV

Axie Infinity is a blockchain-based game featuring digital creatures called Axies, often compared to Pokémon. This pet-centric game combines elements of blockchain, NFTs, and ERC-20 tokens, offering players the chance to collect, battle, and trade unique creatures in a virtual world.

The April 12 unlock will consist of 10.72 million AXS tokens valued at about $29 million. Axie Infinity will award the majority of these tokens for staking rewards and for the team.

2. Jito Labs (JTO)

Jito is a liquid staking service on Solana that distributes MEV rewards to holders. On April 7, Jito will unlock 11.3 million tokens which is currently worth around $20 million.

The project will allocate the majority of the unlocked tokens for ecosystem development, core contributors, and community growth. Additionally, it will allocate 10% of the tokens for airdrops.

3. Xave (XAV)

Xave is a DeFi platform that focus on decentralized foreign exchange (FX) markets. It enhances stablecoin liquidity through an automated market maker (AMM) model.

On April 11, the network will unlock over 313 million XAV tokens, which constitutes just over 3% of the total supply. Xave will largely focus distribution to the team, investors, and treasury.

Other prominent token unlocks that investors can look out for this week include Delysium (AGI), Parcl (PRCL) and Circular Protocol (CIRX).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Key Solana Holders’ 6-Month High Accumulation Signal Price Rise

Solana (SOL) has struggled to gain momentum over the past couple of weeks, and its price has failed to recover significantly.

Despite this, the altcoin has seen signs of stabilization, with long-term holders (LTHs) showing increasing support. This shift could indicate a potential price rise, provided the current trend holds.

Solana Investors Move To Accumulate

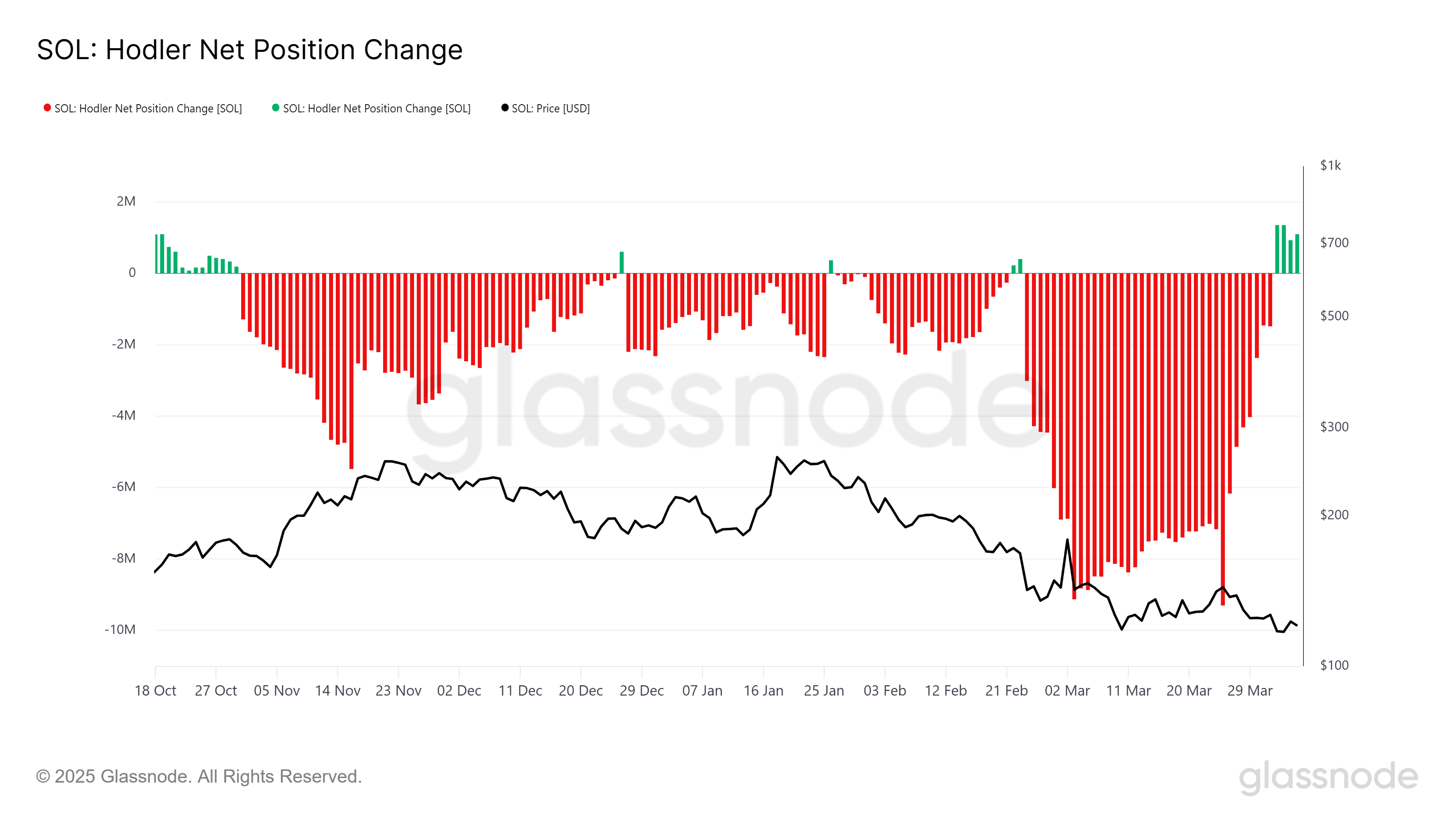

The HODLer Net Position Change for Solana has been positive for the past four days, with consistent green bars indicating that LTHs are accumulating more SOL. This is the longest streak of accumulation in over six months, signaling confidence from long-term investors.

As these investors continue to add to their positions, Solana could build a solid foundation for a price rebound.

LTHs tend to significantly influence Solana’s price, as their holdings reflect longer-term confidence in the cryptocurrency. If this trend continues, the growing support from LTHs could provide the necessary backing to help Solana break through key resistance levels.

However, despite the support from LTHs, Solana’s overall market sentiment is still mixed.

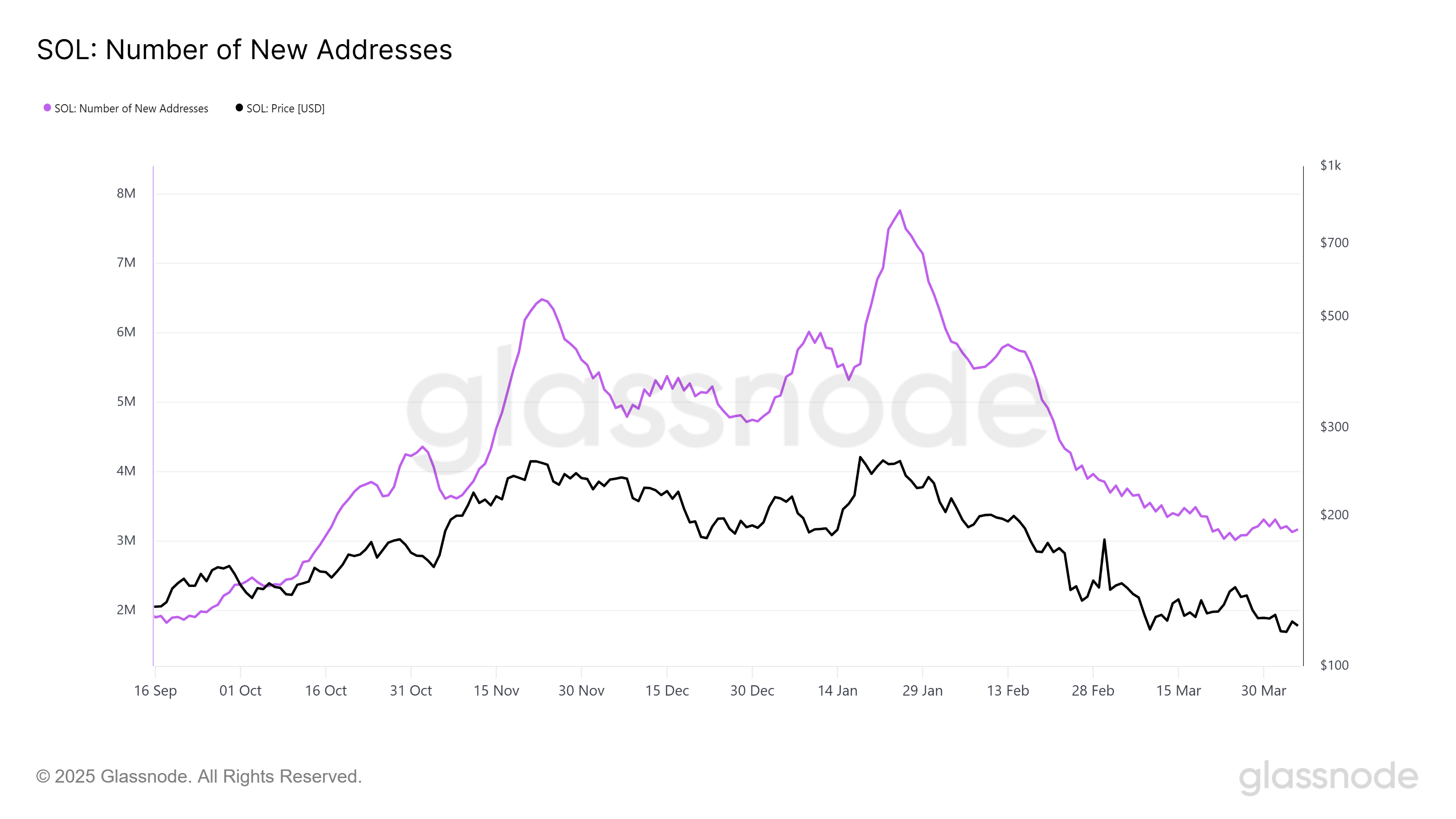

New addresses, an important metric for investor interest, have recently hit a six-month low. This indicates that fewer new investors are entering the market, reflecting a lack of optimism for a recovery in the short term. The last time new address activity was this low was in October, suggesting that investor confidence is currently subdued.

The drop in new addresses could signal caution among potential buyers, affecting the altcoin’s overall momentum. While LTHs continue to accumulate, the lack of fresh interest from new investors could delay any significant upward movement for Solana.

SOL Price Vulnerable To Correction

Solana is currently trading at $119, holding just above the crucial support level of $118. While the altcoin is attempting to make its way to $135, mixed market sentiments suggest it may struggle to break through this resistance.

The price could consolidate between $118 and $135 as it builds enough momentum for a potential rally.

If Solana manages to bounce back, it may continue to trade within this range, allowing time for the market to stabilize and support further price appreciation. Consolidation could help SOL gather strength before another attempt to breach the $135 level.

However, if the price falls below $118, it could signal a shift in momentum, invalidating the bullish-neutral outlook. A drop below this support level would likely lead to further declines, potentially taking Solana down to $109, which would extend investors’ losses.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoSolana Altcoin Saros Rallies 1000% Since March, Hits New High

-

Altcoin19 hours ago

Altcoin19 hours agoWhat’s Next for ADA Price?

-

Market23 hours ago

Market23 hours agoKey Levels To Watch For Potential Breakout

-

Bitcoin19 hours ago

Bitcoin19 hours agoBitcoin Indicator Signals Momentum Building – Capital Inflows Surge 350% In 2 Weeks

-

Bitcoin17 hours ago

Bitcoin17 hours agoBitcoin (BTC) To Take Off In June, Analyst Pins Market Target At $175,000

-

Ethereum9 hours ago

Ethereum9 hours agoEthereum Whale Activity Fades Since Late February – Details

-

Altcoin18 hours ago

Altcoin18 hours agoXRP’s Open Interest Surges Above $3 Billion, Will Price Follow?

-

Altcoin17 hours ago

Altcoin17 hours agoEthereum Price Threatens Decline To $1600 After Breakdown From Symmetrical Triangle