Market

Bitcoin Pharaoh Remains Jailed and More

BeInCrypto comprehensive Latam Crypto Roundup brings Latin America’s most important news and trends. With reporters in Brazil, Mexico, Argentina, and more, we cover the latest updates and insights from the region’s crypto scene.

This week’s roundup includes stories about Brazil’s Bitcoin Pharaoh, Botev Plovdiv FC’s move to El Salvador to issue tokenized shares, and more.

El Salvador and Russia Strengthen Economic Cooperation: Bitcoin Could Be on the Agenda

El Salvador and Russia unveiled plans for closer economic collaboration at the St. Petersburg International Economic Forum. Salvadoran Vice President Felix Ulloa proposed enhancing trade relations and establishing mutual embassies, potentially reshaping both nations’ economies.

Russia, facing sanctions from the US and the EU since its 2022 invasion of Ukraine, seeks new trade allies. Under President Nayib Bukele, El Salvador has cooled relations with the US while strengthening ties with China.

Geopolitically, an alliance with Russia could enhance El Salvador’s global standing, reducing its dependence on the United States and solidifying relations with emerging powers like China and Russia. Economically, El Salvador aims to balance its trade deficit with Russia, highlighted by Ulloa’s mention of a $16 million import from Russia in 2021 with no corresponding exports.

Read more: Top 3 Methods for Cross-Border Money Transfer Using Crypto

Technologically, El Salvador aspires to become a hub of innovation. Collaborations with Russian tech firms could support this ambition. Notably, Bitcoin’s role is crucial in this potential partnership. As the first country to adopt Bitcoin as legal tender, El Salvador’s digital asset laws and possibly creating a Bitcoin bank could facilitate trade with Russia, bypassing traditional fiat currencies controlled by central banks.

This economic cooperation could redefine El Salvador’s position on the global stage, offering new opportunities in trade, technology, and digital finance.

Brazilian ‘Pharaoh of Bitcoins’ to Remain in Prison After Supreme Court Ruling

The Federal Supreme Court (STF) upheld the imprisonment of Glaidson Acácio dos Santos, known as the “Pharaoh of Bitcoins,” on June 11. Santos, accused of running a cryptocurrency scam through Gas Consultoria, was arrested in 2021 during the Federal Police’s Operation Kryptos.

Santos’ defense requested habeas corpus, seeking to convert his imprisonment to house arrest due to alleged psychiatric issues and questioning the Federal Court’s jurisdiction. However, Justice Gilmar Mendes rejected the request. He acknowledged that pyramid schemes typically fall under state jurisdiction but noted that federal courts can intervene when cases involve crimes connected to the National Financial System.

Santos faces multiple charges, including financial pyramiding, fraudulent management, irregular securities issuance, unauthorized operations, and criminal organization. His scheme promised victims monthly returns of 10% on crypto-asset investments.

This decision follows the recent arrest of Cláudio Barbosa, another “Pharaoh of Bitcoins,” for running a pyramid scheme through Trust Investing. On the run since 2022, Barbosa allegedly caused a loss of R$4.1 billion to investors from over 80 countries.

Read more: 15 Most Common Crypto Scams To Look Out For

Bulgarian Soccer Club Botev Plovdiv to Issue Tokenized Shares in El Salvador

Bulgarian soccer club Botev Plovdiv FC has announced plans to transfer its cryptocurrency operations to El Salvador through Bitfinex Securities. The club adopted Bitcoin as a payment method in October 2023. It moved its operations to benefit from El Salvador’s tax incentives and favorable business environment, aiming to access new capital markets.

George Manolov, the club’s Bitcoin strategy leader, revealed that Botev Plovdiv established a financial entity in El Salvador to issue tokenized shares. This initiative allows investors to become co-owners of the club.

Read more: What is Tokenization on Blockchain?

“We want Bitcoin to be the main long-term financial strategy for our business. I am here because we want to do a token issuance from El Salvador to accumulate BTC, but also to allow our fans to be part of the process to become a recognized European club. We are working with Bitfinex Securities to democratize the shares, and the investment ticket will be very low. Anyone can become a co-owner,” Manolov explained.

Manolov discussed this new business model at a Bulgarian presentation and will share it at the BTC Prague forum. He explained that tokenization would enable efficient storage, transfer, and management of assets on Bitfinex Securities via the Liquid Network, a Bitcoin sidechain.

Brazil’s Largest Private Bank Expands Access to Bitcoin and Ethereum

Itaú Unibanco, Brazil’s largest private bank, has expanded its cryptocurrency offerings, allowing customers to trade Bitcoin and Ethereum through its digital platform, Íon. With assets exceeding R$2.7 trillion, the bank aims to make access to these top cryptocurrencies more straightforward and secure.

The initiative began gradually at the end of 2023, receiving positive client feedback. In internal surveys, over 90% of users rated their experience as good or great. With a minimum contribution of R$10, all active users on the Íon platform can now trade cryptocurrencies.

“We are very happy with the cryptoassets journey we are building with our customers. Opening trading to all Íon users reflects not only the evolution of our product but also of the entire market,” said Guto Antunes, head of Itaú Digital Assets. He stressed Itaú’s commitment to offering intuitive and secure crypto trading.

Itaú also aims to educate clients about the crypto market, ensuring they make informed investment decisions. This move aligns Itaú with other Brazilian institutions like BTG Pactual and Nubank, which already offer cryptocurrency exposure to their clients.

Read more: Crypto vs. Banking: Which Is a Smarter Choice?

El Salvador Overcame IMF Observations and Reaffirms Bitcoin Agenda

El Salvador’s Vice President Félix Ullóa has reaffirmed the country’s commitment to Bitcoin, aiming for economic liberation from central banks. Since enacting the Law of Digital Assets last year, the nation has embraced various tokens and cryptocurrencies.

Ullóa highlighted El Salvador’s pioneering role in admitting Bitcoin in exchange-traded funds (ETFs) ahead of the US He expressed confidence that Bitcoin could reach $100,000 by the end of 2024.

Despite initial criticism from the International Monetary Fund (IMF) and rating agencies, El Salvador has diversified its financing sources beyond traditional multilateral organizations. This strategy has bolstered the country’s credibility and attracted digital economy companies through a supportive regulatory framework.

Read more: Who Owns the Most Bitcoin in 2024?

El Salvador recently marked three years since adopting Bitcoin as a legal tender. The country has been purchasing one Bitcoin daily, accumulating up to 30 BTC monthly. These investments have yielded over $67 million in unrealized profits.

Notable investors like Cathie Wood, CEO of ARK Invest, believe President Bukele’s Bitcoin strategy could significantly boost the nation’s GDP over the next five years. Ullóa acknowledged that the IMF continues to monitor the Bitcoin Law, highlighting ongoing discussions about the associated risks and benefits.

As the Latin American crypto scene grows, these stories highlight the region’s increasing influence in the global market. From El Salvador’s Bitcoin plans to Brazilian banks’ crypto trading launch, LATAM is positioning itself as a key player in the tech world. Stay tuned for more updates and insights in next week’s roundup.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

HBAR Futures Traders Lead the Charge as Buying Pressure Grows

Hedera Foundation’s recent move to partner with Zoopto for a late-stage bid to acquire TikTok has sparked renewed investor interest in HBAR, driving a fresh wave of demand for the altcoin.

Market participants have grown increasingly bullish, with a notable uptick in long positions signaling growing confidence in HBAR’s future price performance.

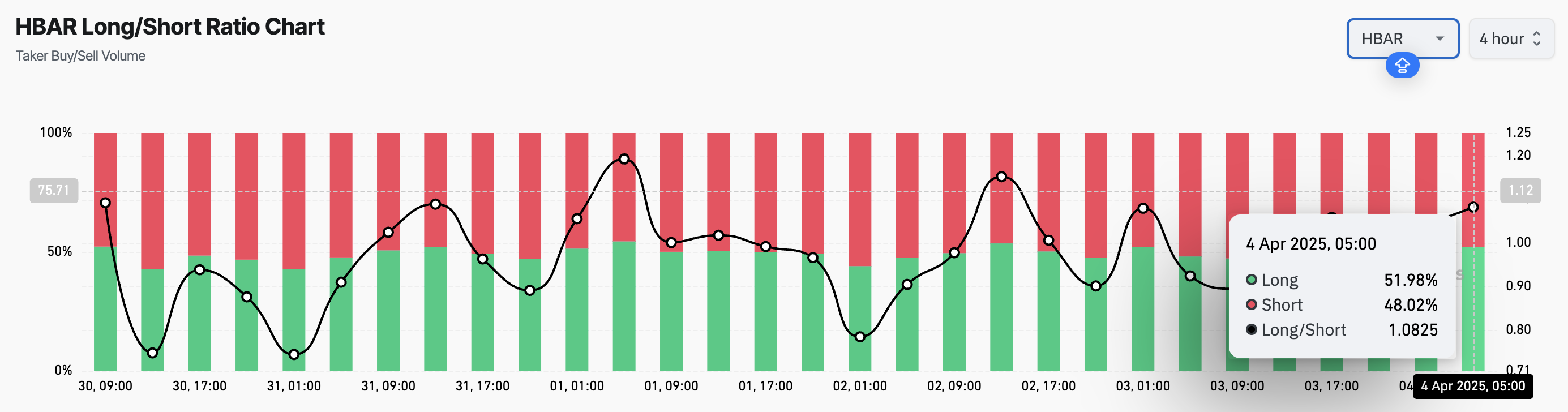

HBAR’s Futures Market Sees Bullish Spike

HBAR’s long/short ratio currently sits at a monthly high of 1.08. Over the past 24 hours, its value has climbed by 17%, reflecting the surge in demand for long positions among derivatives traders.

An asset’s long/short ratio compares the proportion of its long positions (bets on price increases) to short ones (bets on price declines) in the market.

When the long/short ratio is above one like this, more traders are holding long positions than short ones, indicating bullish market sentiment. This suggests that HBAR investors expect the asset’s price to rise, a trend that could drive buying activity and cause HBAR’s price to extend its rally.

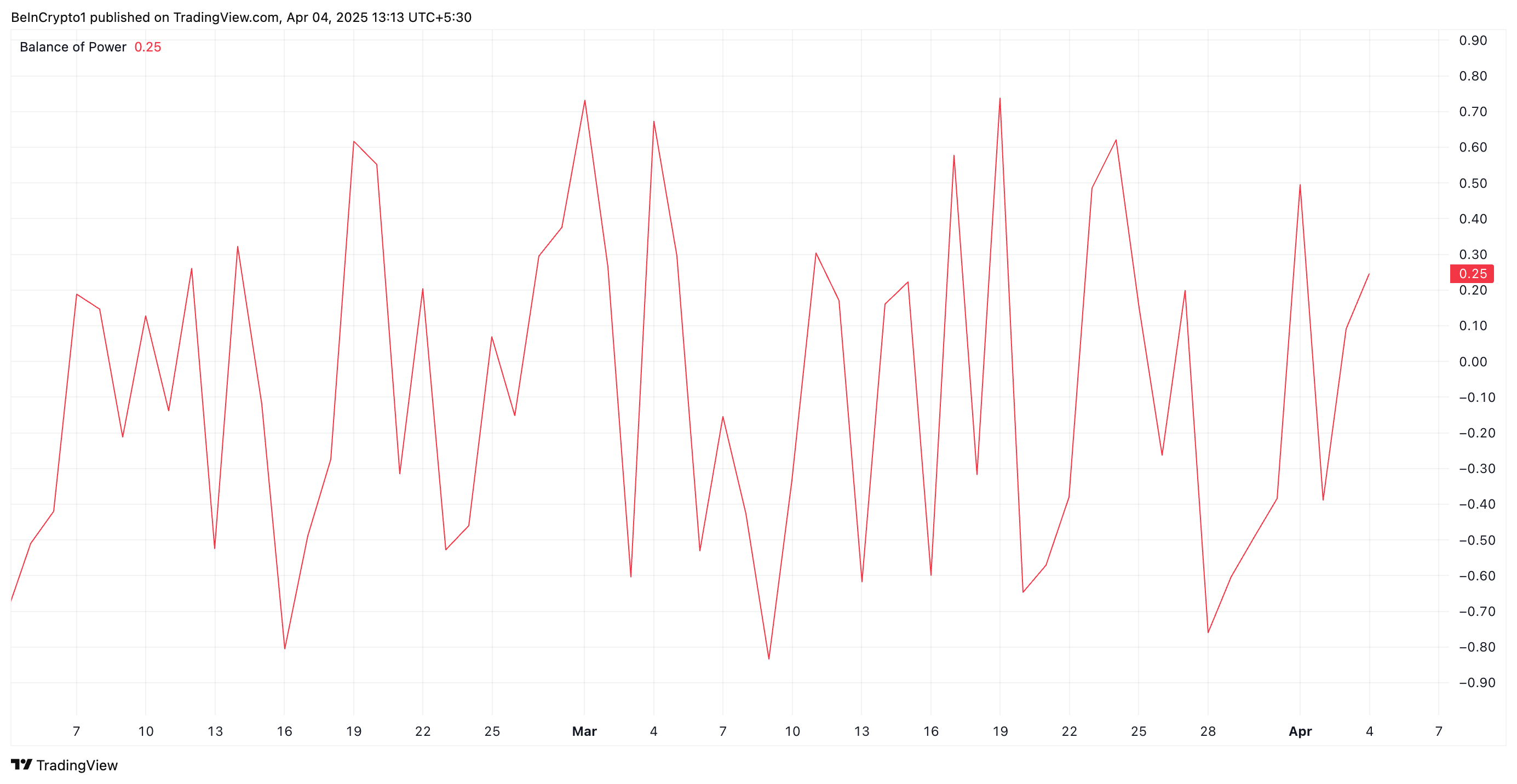

Further, the token’s Balance of Power (BoP) confirms this bullish outlook. At press time, this bullish indicator, which measures buying and selling pressure, is above zero at 0.25.

When an asset’s BoP is above zero, buying pressure is stronger than selling pressure, suggesting bullish momentum. This means HBAR buyers dominate price action, and are pushing its value higher.

HBAR Buyers Push Back After Hitting Multi-Month Low

During Thursday’s trading session, HBAR traded briefly at a four-month low of $0.153. However, with strengthening buying pressure, the altcoin appears to be correcting this downward trend.

If HBAR buyers consolidate their control, the token could flip the resistance at $0.169 into a support floor and climb toward $0.247.

However, a resurgence in profit-taking activity will invalidate this bullish projection. HBAR could resume its decline and fall to $0.129 in that scenario.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin is Far From a Bear Market But not Altcoins, Analysts Claim

Welcome to the US Morning Crypto Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to see how Bitcoin is holding firm above $79,000 despite a sharp equities sell-off. Markets are bracing for the March NFP report and rising recession risks. With Fed rate cuts on the table and ETF inflows staying strong, all eyes are on what’s next for macro and crypto markets.

Is Bitcoin in a Bear Market?

The highly anticipated March U.S. non-farm payrolls (NFP) report is due later today, and it’s expected to play a key role in shaping market sentiment heading into the weekend.

“With the key macro risk event now behind us, attention turns to tonight’s non-farm payroll report. Investors are bracing for signs of softness in the U.S. labour market. A weaker-than-expected print would bolster the case for further Fed rate cuts this year, as policymakers attempt to cushion a decelerating economy. At the time of writing, markets are pricing in four rate cuts in 2025—0.25 bps each in June, July, September and December,” QCP Capital analysts said.

Traditional markets are increasingly pricing in a recession, with equities retreating sharply—a 7% decline overall, including a 5% drop just yesterday. This broad de-risking environment helps explain the current pause in crypto inflows.

On the derivatives front, QCP adds:

“On the options front, the desk continues to observe elevated volatility in the short term, with more buyers of downside protection. This skew underscores the prevailing mood – uncertain and cautious.”

However, they also note that “with positioning now light and risk assets largely oversold, the stage may be set for a near-term bounce.”

Bitcoin remains resilient despite market volatility, holding above $79,000 with strong ETF inflows and signs of decoupling from stocks and altcoins. According to Nic Puckrin, crypto analyst, investor, and founder of The Coin Bureau: “Bitcoin is nowhere near a bear market at this stage. The future of many altcoins, however, is more questionable.”

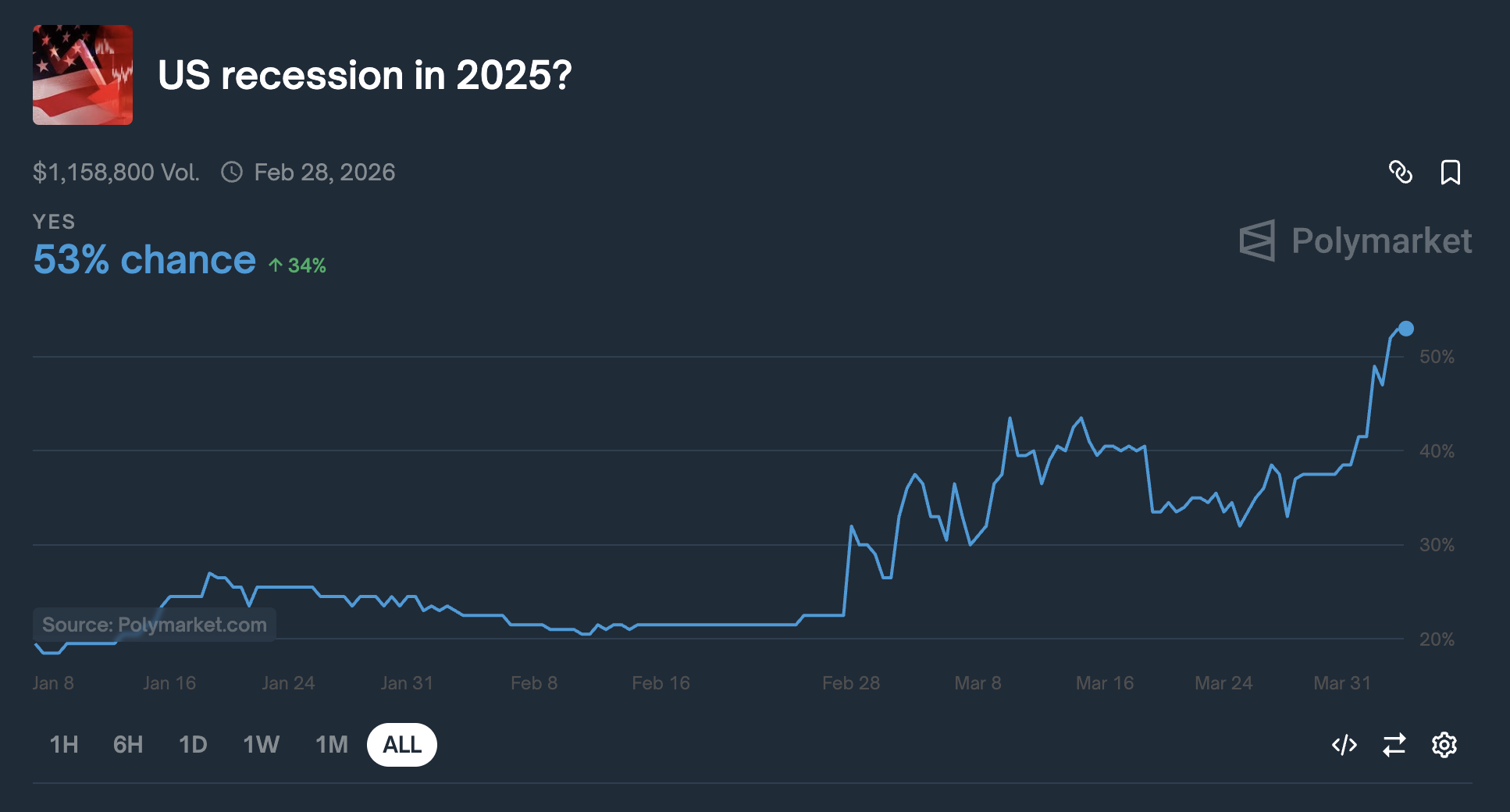

Chart of the Day

Chances of a US Recession in 2025 jumped above 50% for the first time, currently at 53%.

Byte-Sized Alpha

– Major ETF issuers are buying Bitcoin, with $220 million in inflows showing strong confidence despite volatility.

– Futures show bullish BTC sentiment, but options traders remain cautious, signaling mixed market outlook.

– Coinbase is launching XRP futures after Illinois lawsuit relief, signaling growing regulatory support for crypto.

– Despite Trump’s tariff-driven crash, analysts see potential for a Bitcoin rebound—though inflation may cap gains.

– The Anti-CBDC bill passed a key House vote, aiming to block Fed-issued digital currencies and protect privacy.

– Today at 11:25 AM, Fed Chair Jerome Powell will deliver a speech on the U.S. economic outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cardano Price Recovery Next As Whales Buy 230 Million ADA

Cardano has experienced a tough period, with the failed price recovery and declining market conditions. However, the recent buying behavior of whales and the potential for a price surge suggest a change in momentum.

If Cardano (ADA) can break through the $0.70 level, it could signal the end of the bearish sentiment.

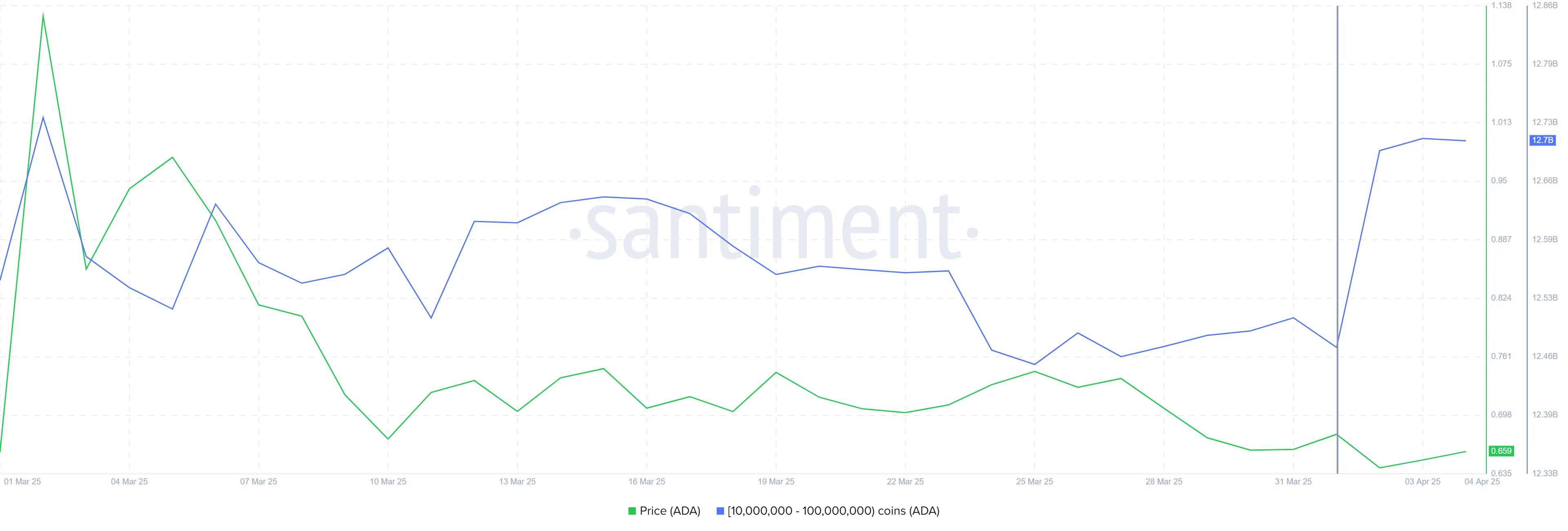

Cardano Whales Are Hopeful

Over the past 72 hours, whales holding between 10 million and 100 million ADA have accumulated over 230 million ADA, valued at over $150 million at current prices. This shift from selling and staying neutral to accumulation indicates a shift in sentiment, with whales optimistic about ADA’s potential for Q2 2025. Their recent activity signals confidence in the altcoin’s recovery despite the recent market struggles.

Whale accumulation is often a bullish indicator as these investors have significant influence over the market. The accumulation is crucial, as it provides the support needed for ADA to break through resistance levels.

The liquidation map for Cardano shows that approximately $15 million in short contracts will expire as soon as ADA rises above the $0.70 level. This presents a key opportunity for the altcoin. Short-sellers may be forced to close their positions, which could lead to a short squeeze and drive the price higher.

Potential liquidation of short positions may create upward pressure, preventing further declines and allowing ADA to recover. The combination of whale accumulation and the looming liquidation of short contracts could provide Cardano with the momentum it needs to break free from its recent downtrend.

Can ADA Price Breach $0.70?

At the time of writing, Cardano’s price is at $0.65, holding above the crucial $0.62 support level. The altcoin has struggled in recent weeks, but the whale-buying activity offers hope for recovery. A breach of the $0.70 barrier could lead to further upward movement.

Should ADA successfully break through $0.70, it could gain the necessary momentum to continue its recovery. Flipping $0.77 into support would provide an additional boost, positioning Cardano to regain recent losses and possibly challenge higher resistance levels.

However, if Cardano fails to breach $0.70, the price may return to the $0.62 support level. Losing this support would invalidate the bullish outlook and send ADA to a lower level of $0.58, extending the ongoing decline.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoBinance Managed 94% of All Crypto Airdrops and Staking Rewards

-

Market19 hours ago

Market19 hours agoWormhole (W) Jumps 10%—But Is a Pullback Coming?

-

Altcoin19 hours ago

Altcoin19 hours agoAltcoin Season Still In Sight Even As Ethereum Struggles To Gain Upward Momentum

-

Market23 hours ago

Market23 hours agoPi Network Price Falls To Record New Low Amid Weak Inflows

-

Regulation21 hours ago

Regulation21 hours agoUS SEC Acknowledges Fidelity’s Filing for Solana ETF

-

Market21 hours ago

Market21 hours agoXRP Battle Between Bulls And Bears Hinges On $1.97 – What To Expect

-

Market20 hours ago

Market20 hours agoRipple Shifts $1B in XRP Amid Growing Bearish Pressure

-

Market18 hours ago

Market18 hours agoBinance’s CZ is Helping Kyrgyzstan Become A Crypto Hub