Market

MATIC Price Tests 8-Month Support As Polygon Unveils New Governance Hub

Polygon’s native token, MATIC, has experienced a notable disparity compared to the broader cryptocurrency market. Unlike the top cryptocurrencies that have posted double-digit gains year-to-date, MATIC has failed to post positive performance across all time frames since the 2021 bull run.

Adding to the concern, MATIC’s price has recorded losses amounting to 16.5% over the past seven days. This downward trend has prompted the token to test a crucial macro support level, raising questions about its future trajectory.

Amid these developments, Polygon has announced a strategic partnership with Aragon, a developer of decentralized autonomous organizations, to introduce a “governance hub” for the Polygon community.

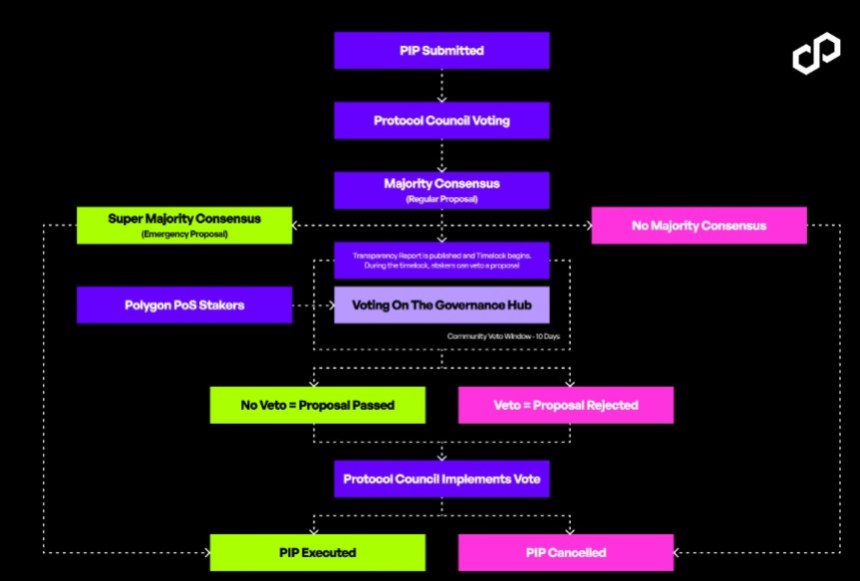

Simplified Governance Hub For Polygon?

According to a recent blog post by the Layer 2 solution protocol, the governance hub is “designed to empower” users and builders, allowing them to influence the core development of Polygon’s technology. The hub will reportedly be developed in phases in collaboration with Aragon to ensure that community feedback is incorporated to create a decentralized platform that aligns with community values.

Related Reading

The governance hub will feature a unified interface for “two essential pillars” of Polygon’s governance: protocol and system smart contract governance.

The hub seeks to increase transparency and encourage greater community participation in protocol governance. As for system smart contract governance, it introduces an upgraded framework that prioritizes structured decision-making processes while maintaining transparency and safety.

In addition, Aragon will leverage its expertise to build the Polygon Governance Hub using Aragon OSx. This tool enables the construction of customized on-chain governance solutions that can be adapted over time through a modular plugin-based architecture. Polygon stated in its announcement:

Polygon, and all related network architecture, needs flexible, transparent, and future-proof governance mechanisms and tooling. The Polygon Governance Hub is central to achieving this.

MATIC Market Capitalization Drops Dramatically

Despite the developers’ focus on community governance within the Polygon ecosystem, key metrics indicate a consistent decline in the MATIC token’s price over the past year.

For instance, the token’s market capitalization has experienced a significant drop, plummeting nearly 50% in just three months. In March, it was valued at $9.9 billion, whereas it is currently valued at $5.6 billion. This decline suggests a potential capital shift towards other large-cap tokens or profit-taking activities.

Furthermore, MATIC’s trading volume has also seen a notable decrease of approximately 18% in the past 24 hours, according to CoinGecko data. The trading volume now stands at a mere $293 million. Moreover, MATIC has witnessed a substantial 80% decline from its all-time high of $2.92 in December 2021.

Related Reading

Presently, the token faces a critical test at an 8-month support level, as depicted in the MATIC/USD daily chart below, with its current trading price at $0.5982. Should the price continue to decline without a significant catalyst to drive an upward trend and price recovery, attention should be paid to the next support level at $0.5700.

The future trajectory of the MATIC price remains uncertain, and it remains to be seen whether further downside movement is in store or if a bounce at the current support level will materialize, offering potential opportunities for bullish investors.

Featured image from DALL-E, chart from TradingView.com

Market

Top 3 Made in USA Coins to Watch In April

Made in USA coins continue to try a rebound, with Solana (SOL), RENDER, and Jupiter (JUP) standing out as key names to watch in April. Despite recent price corrections, each of these tokens plays a major role in high-growth areas like DeFi, AI, and blockchain infrastructure.

Solana has seen its price dip, but ecosystem activity remains strong; RENDER is riding the wave of AI demand despite market turbulence; and Jupiter is showing solid usage metrics even as its token struggles. Here’s a closer look at the technical and fundamental setups for each of these standout U.S.-based projects.

Solana (SOL)

Solana has faced a notable price correction over the past week, with its value dropping nearly 13%. If this bearish momentum continues, the token could be on track to retest the critical support level at $120.

A breakdown below that could see SOL sliding further toward the $112 mark.

Despite the recent downturn, Solana remains one of the most relevant Made in USA coins and continues to show impressive usage metrics. PumpFun, for example, generated nearly $9 million in revenue over the past 24 hours, second only to Tether.

After a short period when BNB led the DEX volume race, Solana seems to be regaining traction—its decentralized exchange volume has surged by 128% in just seven days, reaching $18 billion and surpassing both Ethereum and BNB.

If this recovery in momentum persists, SOL could target a move toward the $131 resistance level. A successful breakout there could open the door to further gains toward $136 and potentially $147.

RENDER

RENDER, one of the most prominent U.S.-based cryptocurrencies with a focus on artificial intelligence, has seen its price decline nearly 11% over the past seven days.

This drop reflects the broader correction that has impacted many AI-related tokens in recent months.

However, new developments in the AI infrastructure space may provide a catalyst for a potential rebound, especially as the limitations of centralized systems become clear.

If bullish momentum returns to the AI sector, RENDER could look to challenge the resistance at $3.47, and a successful breakout might open the door for a rally toward $4.21.

However, if the current correction deepens, the token could fall to test the $3.14 support level. A breakdown there may trigger further losses, potentially dragging RENDER down to $2.83 or even $2.52—its lowest level in recent weeks.

Jupiter (JUP)

Despite Solana’s recent struggles, Jupiter—its leading DEX aggregator—is demonstrating impressive strength in terms of activity.

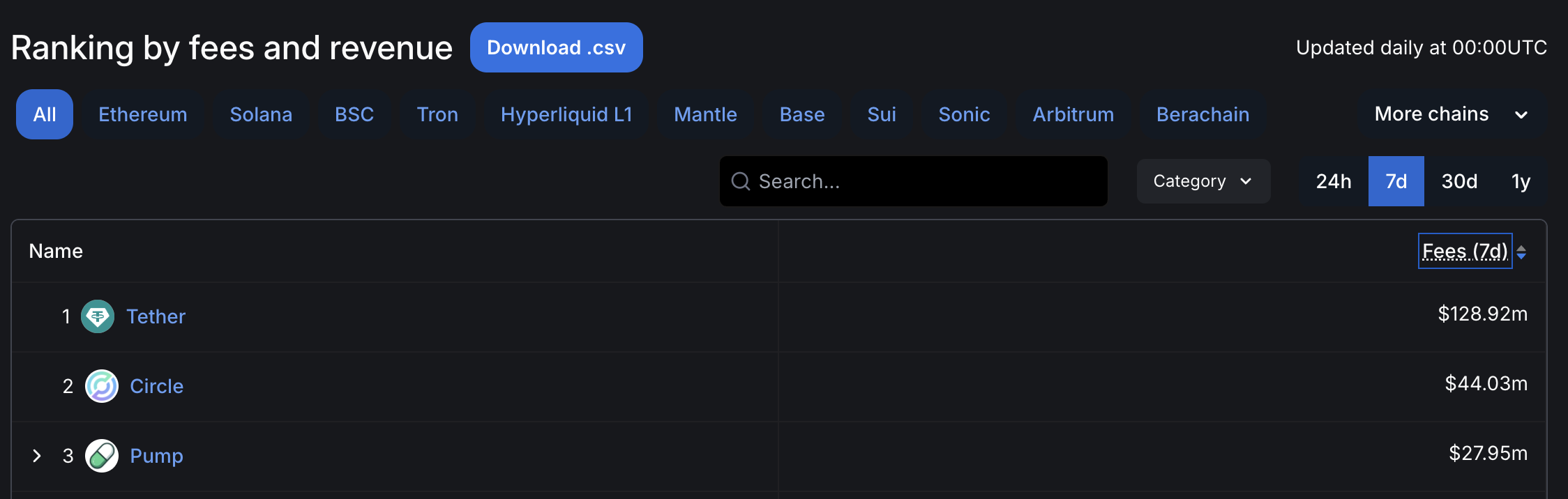

In the last 24 hours, Jupiter ranked as the fourth-highest protocol in crypto by fee generation, collecting nearly $2.5 million.

Only Tether, PumpFun, and Circle managed to outperform it, highlighting the platform’s growing relevance within the Solana ecosystem even during periods of broader market weakness.

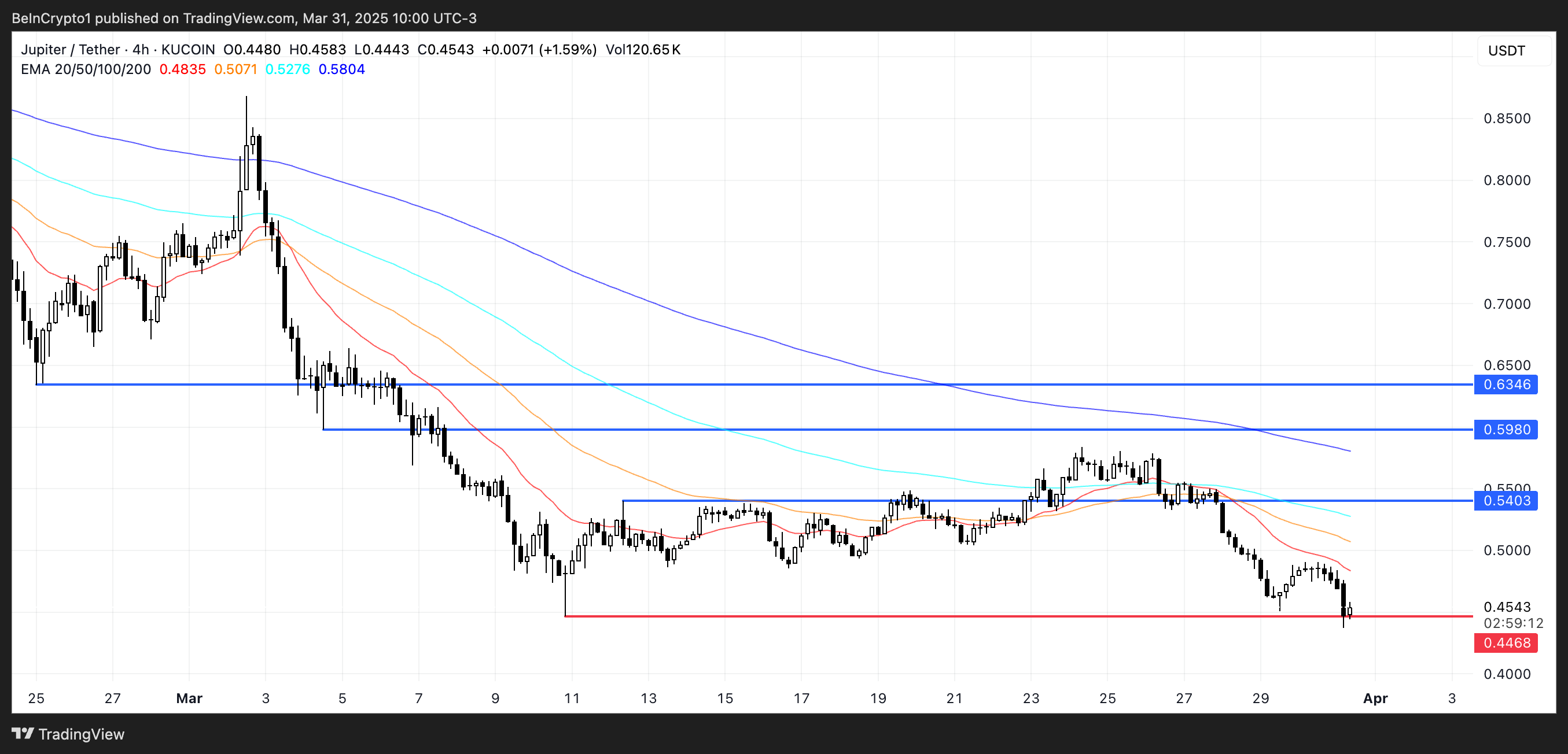

However, JUP, Jupiter’s native token, hasn’t mirrored this positive momentum. Its price has dropped over 21% in the past week, being one of the worst performers among the biggest Made in USA coins. It has remained below the $0.65 mark for three consecutive weeks.

With JUP now hovering dangerously close to a key support at $0.44, a breakdown could see the token dip below $0.40 for the first time ever.

Still, if market sentiment shifts and momentum returns, JUP could begin climbing again—first testing resistance at $0.54, then potentially moving toward $0.598 and even $0.63 if bullish pressure intensifies.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cardano (ADA) Whales Hit 2-Year Low as Key Support Retested

Cardano (ADA) is facing mounting pressure as its price corrects by 10% over the past seven days, continuing a broader downtrend that has kept it trading below the $1 mark for nearly a month. With technical indicators flashing warning signs and large holders exiting their positions, concerns around ADA’s short-term stability are growing.

The recent rejection at higher resistance levels and a strong directional trend signal suggest that bearish momentum is far from over. As the $0.64 support level is tested once again, ADA’s next move could determine whether a rebound is possible—or if further downside is ahead.

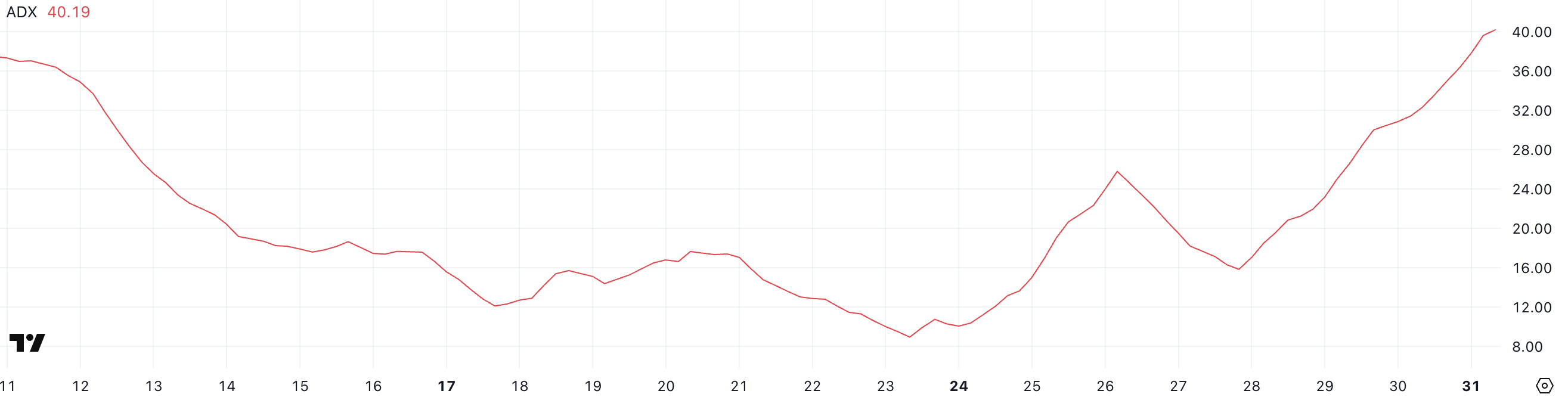

Cardano ADX Shows The Downtrend Is Very Strong

Cardano’s Average Directional Index (ADX) is currently at 40.19, rising sharply from 15.83 just four days ago. This steep increase suggests a rapid strengthening in the trend’s momentum.

Given that ADA is currently in a downtrend, the rising ADX indicates that bearish momentum is intensifying and the current downward move is gaining traction.

The ADX is a trend strength indicator that measures how strong a trend is, regardless of its direction. It ranges from 0 to 100, with readings below 20 typically indicating a weak or non-existent trend, while values above 25 suggest a strong trend is in place.

Cardano’s ADX climbing above 40 confirms that the current downtrend is active and becoming stronger. If this trend continues, it may point to further downside pressure unless a shift in momentum begins to build from the bulls.

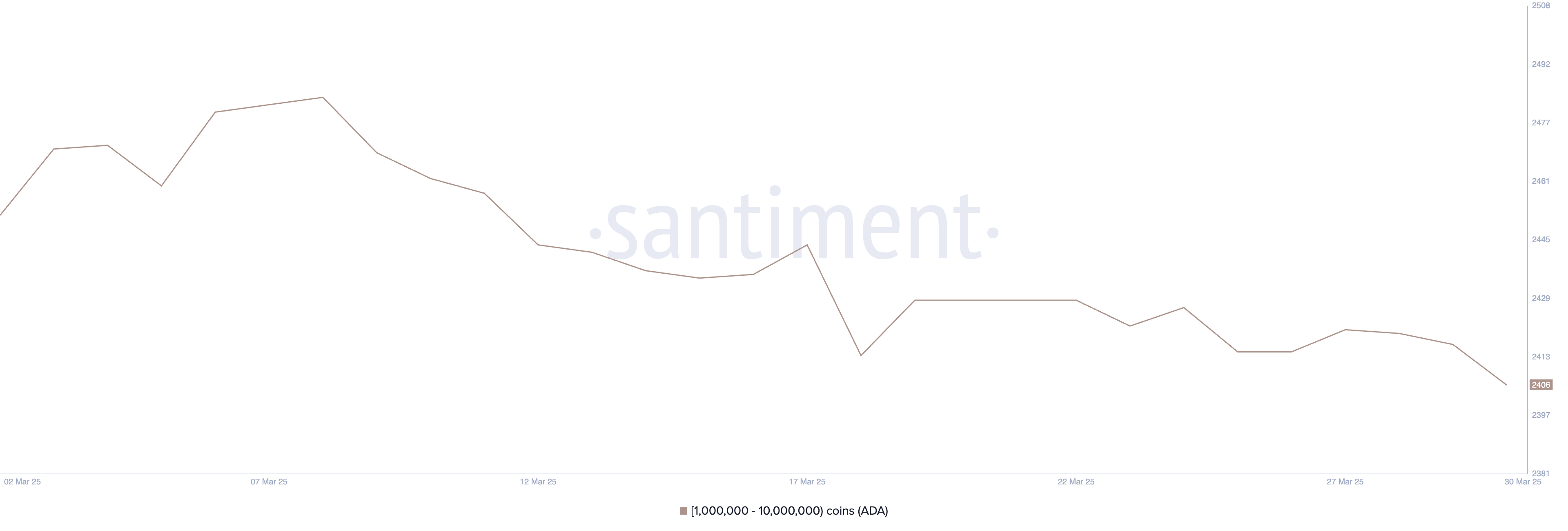

ADA Whales Dropped To Their Lowest Level Since February 2023

The number of Cardano whales—wallets holding between 1 million and 10 million ADA—has dropped to 2,406, down from 2,421 just four days ago.

This decline brings the whale count to its lowest level since February 2023, marking a potentially meaningful shift in large-holder behavior. These movements are worth paying attention to, as changes in whale holdings often precede broader market trends.

Tracking whales is important because these large holders can significantly influence price action through their buying or selling decisions. A decline in whale numbers can signal reduced confidence or capital rotation into other assets.

In Cardano’s case, the drop suggests that some major players may be exiting or reducing exposure, which could add downward pressure to ADA’s price.

If this trend continues, it could weaken investor sentiment and make it harder for ADA to recover in the short term.

Can Cardano Sustain The $0.64 Support Again?

Cardano price recently tested the support level at $0.64 and managed to hold, showing that buyers are still defending that zone. This support has become a key line in the sand for ADA’s short-term outlook.

If the current downtrend is reversed and bullish momentum picks up, the next upside target would be the resistance at $0.69. A breakout above that level could open the door for a push toward $0.77.

Should the rally continue with strength, ADA could aim for $1.02—marking a return above the $1 level for the first time since early March.

However, the $0.64 support remains a critical level to watch. If Cardano tests it again and fails to hold, it could indicate weakening buyer conviction.

A breakdown below $0.64 would likely send ADA toward the next support at $0.58. This would confirm a continuation of the downtrend and possibly trigger further selling pressure.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

This is Why PumpSwap Brings Pump.fun To the Next Level

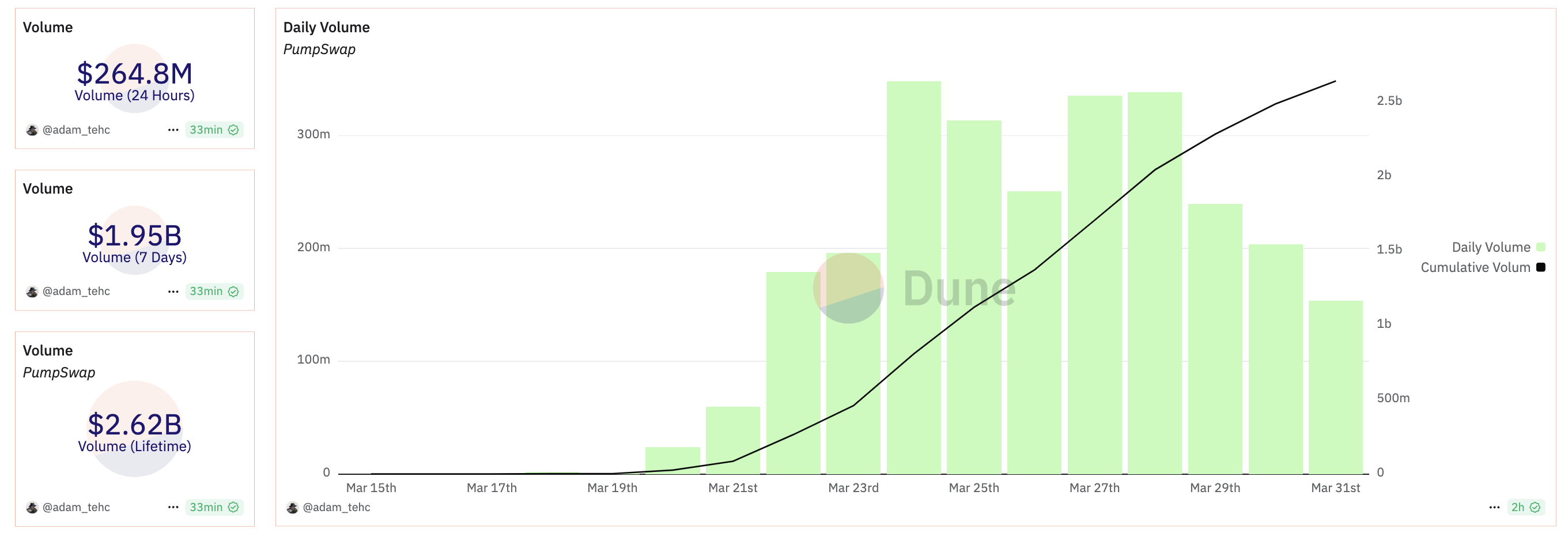

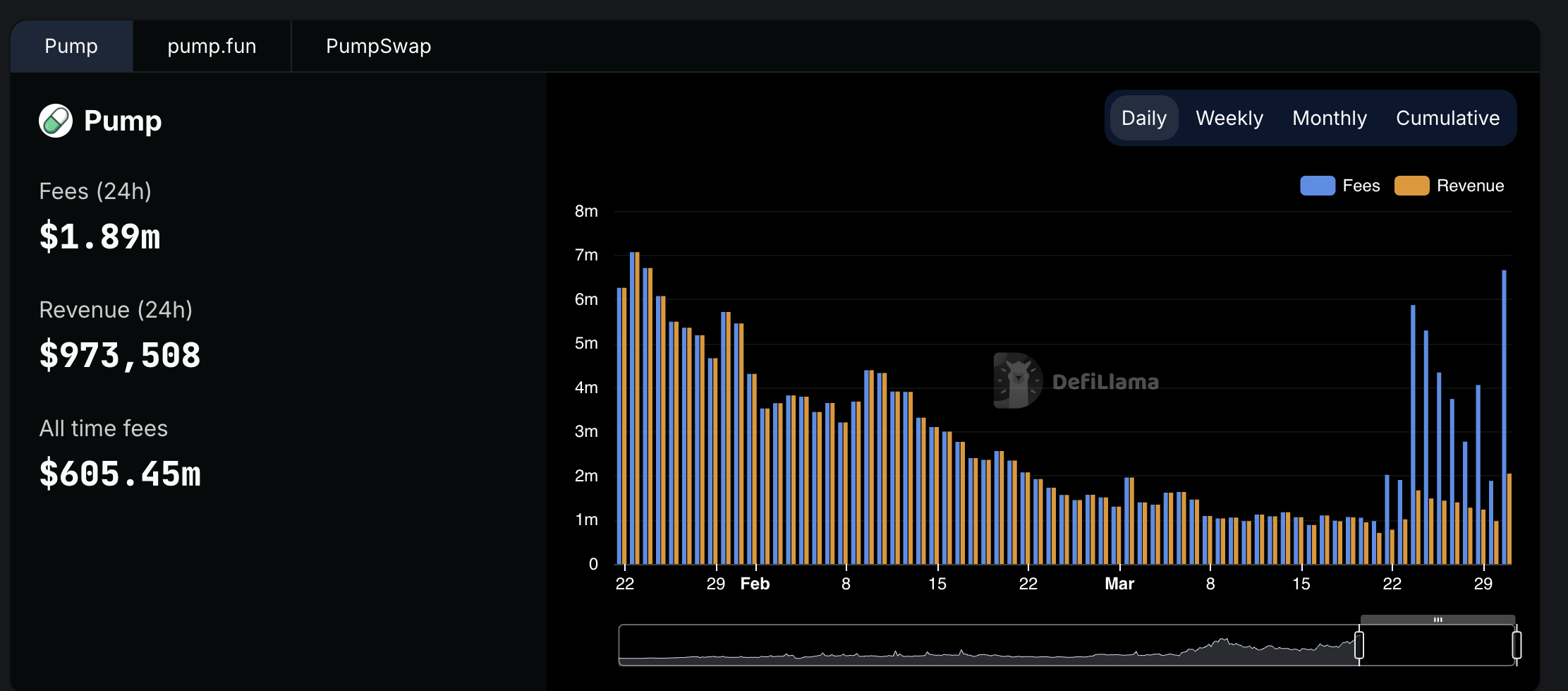

Since launching PumpSwap, token launchpad Pump.fun has resumed its position as a top-level protocol by fees and revenue. It saw over $2.62 billion in volume in less than two weeks, signifying high market interest.

Nonetheless, the meme coin sector as a whole has been more volatile than usual lately. PumpSwap is an attractive new option, but it still needs to stand the test of time.

Pump.fun Surges with PumpSwap

Pump.fun, a prominent meme coin creation platform, recently suffered some difficulties in the market. Facing lawsuits and criticism from the industry, the platform’s revenue had been declining in 2025. However, since launching PumpSwap, Pump.fun’s income has rebounded, making it one of the largest protocols by fees and revenue.

PumpSwap is a decentralized exchange on Solana’s blockchain, and it has grown very quickly since its launch less than two weeks ago. It has already managed over $2.62 billion in trade volume, although its daily volume fell over the weekend. Pump.fun’s cofounder spoke highly about PumpSwap, calling it a “crucial step that will help grow the ecosystem.”

Pump.fun’s overall revenues were declining before it launched PumpSwap, and they have since jumped back up. However, it’s important to not overstate the new exchange’s success. The exchange’s total fees collected have skyrocketed compared to Pump.fun, but the actual revenue growth has been comparatively small.

Still, these low fees also have significant advantages. Demand seems to be drying up in the meme coin sector, but Pump.fun faces stiff competition in the form of firms like Raydium, using low fees as a competitive edge. It has also promised things like revenue sharing with token creators to promote ecosystem growth.

Ultimately, the meme coin market as a whole is full of uncertainty. PumpSwap has been able to keep Pump.fun competitive as a top-level platform in this space, giving it a welcome reprieve. The real challenge will come in determining long-term viability.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoBitcoin Bears Tighten Grip—Where’s the Next Support?

-

Market9 hours ago

Market9 hours agoTrump Family Gets Most WLFI Revenue, Causing Corruption Fears

-

Market22 hours ago

Market22 hours agoEthereum Price Weakens—Can Bulls Prevent a Major Breakdown?

-

Market19 hours ago

Market19 hours agoBitcoin Price Nears $80,000; Fuels Death Cross Potential

-

Market15 hours ago

Market15 hours agoStrategic Move for Trump Family in Crypto

-

Market10 hours ago

Market10 hours agoBNB Breaks Below $605 As Bullish Momentum Fades – What’s Next?

-

Market14 hours ago

Market14 hours agoTop Crypto Airdrops to Watch in the First Week of April

-

Altcoin14 hours ago

Altcoin14 hours ago$33 Million Inflows Signal Market Bounce