Market

ZKsync Airdrop Controversy: ZK Nation Speaks Out

Matter Labs’ announcement of the first ZKsync airdrop, slated for June 17, has stirred significant controversy within the crypto market.

The airdrop will distribute 17.5% of ZKsync’s native token, but the exclusion of several key ecosystem participants has sparked outrage.

ZK Nation Breaks Down ZKsync Airdrop Issues

Prominent projects built on the Ethereum Layer-2 ZKsync Era, such as the NFT marketplace Element, have expressed their discontent. For instance, Element, which accounted for nearly 70% of ZKsync Era’s total trading volume up to June 12, voiced its frustration on social media.

“As the largest NFT marketplace on ZKsync, we didn’t receive any airdrops, is this a joke?,” Element wrote.

Similar sentiments were echoed by ZKApe, an NFT development platform that generated $15 million in gas fees for ZKsync, and DMail, a decentralized messaging platform. DMail labeled its exclusion as “unbelievable,” given its high user engagement and transaction activity.

In response, ZK Nation released a detailed blog post explaining the eligibility criteria and rationale behind the crypto airdrop allocations.

The post clarified that wallets qualified for the ZKsync airdrop through two primary categories: users (89%) and contributors (11%). Users needed to bridge crypto-assets to ZKsync Era and meet one of seven eligibility criteria. Meanwhile, contributors were recognized for their developmental and community efforts.

ZK Nation emphasized that the allocation aimed to reward long-term, organic users rather than opportunistic participants. The blog outlined that transaction volume alone did not impact allocation size. Instead, a combination of eligibility criteria, time-weighted average balance (TWAB), and bonus multipliers determined the allocations.

For example, early Ethereum adopters and holders of top ZKsync native NFTs received allocation multipliers.

“A wallet’s history across chains can reveal a lot about its owner. Real users tend to be more risk-on, especially when they feel part of a community. They spend time exploring, trying out new protocols, and holding onto speculative assets. On the flip side, bots and opportunists play it safe, putting in minimal effort while trying to blend in and extract value,” ZK Nation wrote.

The blog also addressed specific grievances. Some users who met several eligibility criteria but received smaller allocations may have held lower balances over time or lacked qualifying multipliers. Additionally, ZKsync Lite users needed to bridge assets to ZKsync Era to qualify, a step that some overlooked.

Read more: Best Upcoming Airdrops in 2024

The controversy highlights the issues with fair crypto airdrop distributions and the challenges of balancing recognition and reward. As the airdrop date approaches, the community scrutinizes the criteria and outcomes, seeking transparency and fairness from Matter Labs.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ripple Highlights UK’s Potential to Become Global Crypto Hub

Blockchain firm Ripple has called on UK policymakers to seize the moment and position the country as a global leader in digital assets.

Matthew Osborne, Policy director of Ripple Europe, revealed that panelists at Ripple’s recent London Policy Summit stated that the country has the right mix of financial expertise, infrastructure, and international reputation to lead this evolving sector.

UK Has ‘Second-Mover Advantage’

In a blog post, Osborne pointed out that one of the key takeaways from the summit was that the UK holds a “second-mover advantage” in the race for crypto regulation.

According to the post, the UK can adopt a more balanced and innovation-friendly regulatory framework by observing the early efforts of jurisdictions like the EU, Singapore, and Hong Kong.

They believe that this approach could ensure consumer protection while encouraging responsible growth across the sector.

“There is a huge opportunity for digital assets in the UK. With growing consensus that blockchain technology will transform financial markets, the UK already boasts a globally leading, competitive financial services center. And with particular strengths in FX, capital markets, insurance and professional services, the UK has all the building blocks to be a global leader in digital assets,” Osborne wrote.

The panelists furthered that these clear rules will improve institutional confidence, raise industry standards, and lower systemic risks. However, they also warned that the window to act is quickly closing.

“The window of opportunity is narrowing, and one clear theme that emerged from industry participants is the need to provide regulatory clarity with greater pace and urgency,” the blockchain firm noted.

The need for urgency stems from projections that digital assets could represent up to 10% of global capital markets by 2030, potentially holding a combined value of $4 to $5 trillion.

Osborne stressed that the UK must act boldly and collaboratively to remove unnecessary legal obstacles and create an innovation-friendly environment.

Meanwhile, another pressing concern the panelists highlighted was the lack of clarity around stablecoins.

Stablecoins are digital tokens pegged to fiat currencies like the US dollar and are essential to the broader crypto economy. As they are increasingly used for trading, payments, and settlements, stablecoins have become the backbone of the digital asset ecosystem.

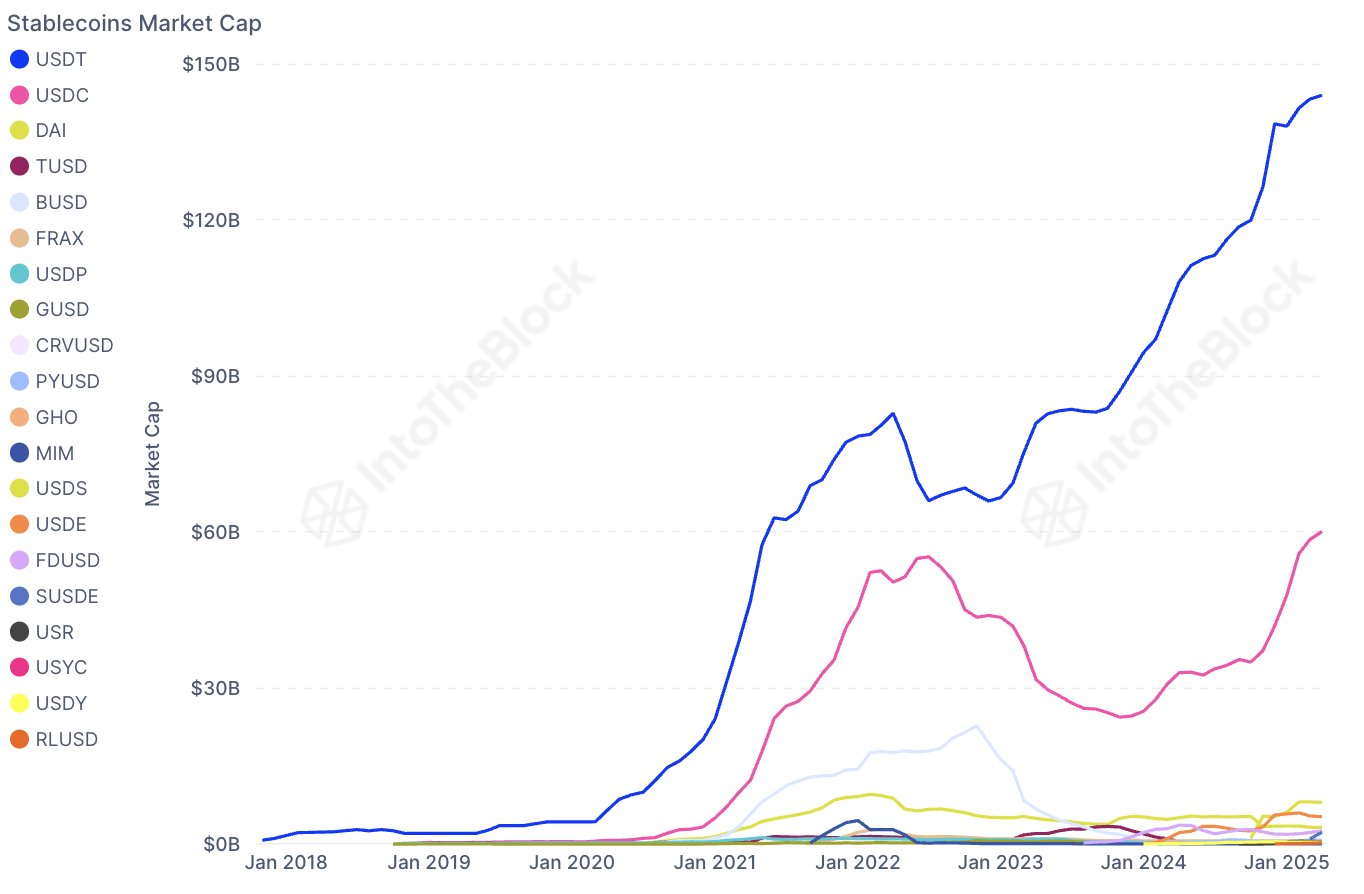

With a current market valuation exceeding $230 billion, stablecoins are expected to grow further as adoption increases.

Considering this, there are calls for the Financial Conduct Authority (FCA) to fast-track its stablecoin framework. The panelists emphasized the need for policies that support both domestically issued and foreign stablecoins operating within the UK.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Celestia (TIA) Price’s 30% Crash Prolonging Could Bring Recovery

Celestia (TIA) has recently experienced a significant drawdown, losing nearly 30% of its value in the past two weeks. This decline has been attributed to the broader bearish market conditions, which caused panic among investors.

As a result, many TIA holders decided to pull their funds, adding to the downward pressure on the price.

Celestia Holders Opt To Back Out

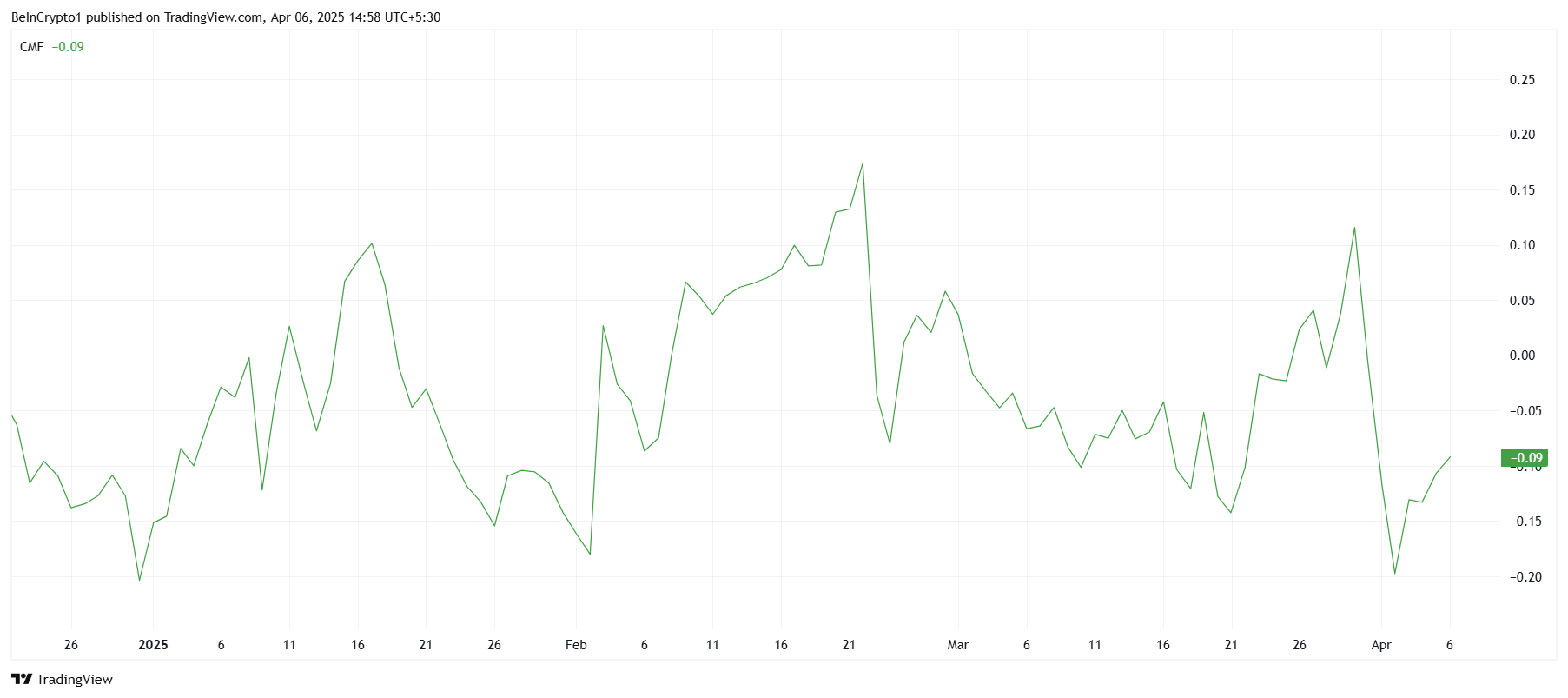

The Chaikin Money Flow (CMF) indicator has shown significant outflows from Celestia, marking the largest selling activity since the beginning of 2025. This reflects the growing fear among investors after the 30% price correction.

However, despite the negative sentiment, there has been an uptick in the CMF recently, indicating that some new investors are beginning to see value in the low prices. These inflows could potentially help stabilize the price and set the stage for a recovery.

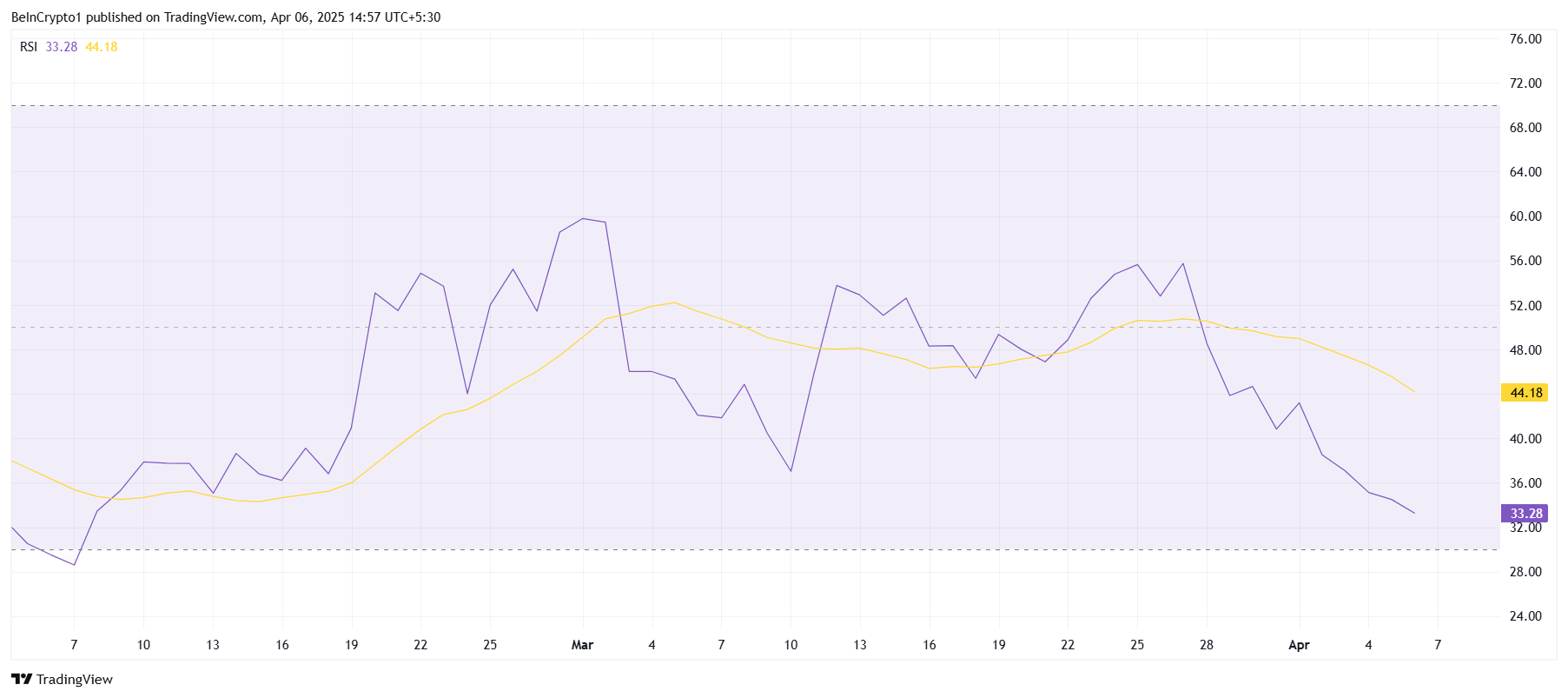

The Relative Strength Index (RSI) for Celestia shows that cryptocurrency is currently on a bearish trend. Stuck below the neutral line at 50.0, the RSI is moving closer to the oversold threshold of 30.0. Historically, when an asset reaches this level, it is considered a signal for a potential reversal, as selling typically slows, and accumulation begins.

If the RSI falls below 30, it could trigger buying interest, as many traders may view the low prices as an opportunity to enter the market.

The current state of the RSI suggests that while bearish momentum is still strong, the conditions are ripe for a reversal. If the selling pressure wanes and buyers begin to step in, Celestia’s price could find support and begin an upward move.

TIA Price Could Be Looking At Recovery

Celestia is currently priced at $2.62, reflecting a nearly 30% decline over the past two weeks. It is holding just above the critical support level of $2.53. If the market sentiment improves and the RSI hits the oversold zone, there is potential for a recovery.

The influx of new investors could provide the momentum needed to drive the price higher.

A successful bounce from the $2.53 support level could see Celestia pushing through $2.73 and heading towards $2.99. This would signal the beginning of a recovery rally and possibly set the stage for further price appreciation as market conditions improve.

However, if Celestia fails to hold the $2.53 support, it could trigger a further decline towards $2.27. This would invalidate the bullish outlook, prolonging the downtrend and extending investors’ losses.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Conor McGregor’s Crypto Token REAL Tanks After Launch

Conor McGregor, the former UFC champion, has entered the crypto scene with the launch of a new memecoin dubbed REAL.

Despite the star power behind it, REAL is off to a sluggish start, struggling to attract investor interest in a memecoin market that is still reeling from recent scandals.

Conor McGregor’s REAL Token Raises Just $218,000

Announced on April 5, McGregor unveiled his plans to disrupt the digital asset space, claiming he had already changed the fight, whiskey, and stout industries.

“I changed the FIGHT game. I changed the WHISKEY game. I changed the STOUT game. Now it’s time to change the CRYPTO game. This is just the beginning. This is REAL,” McGregor announced on X.

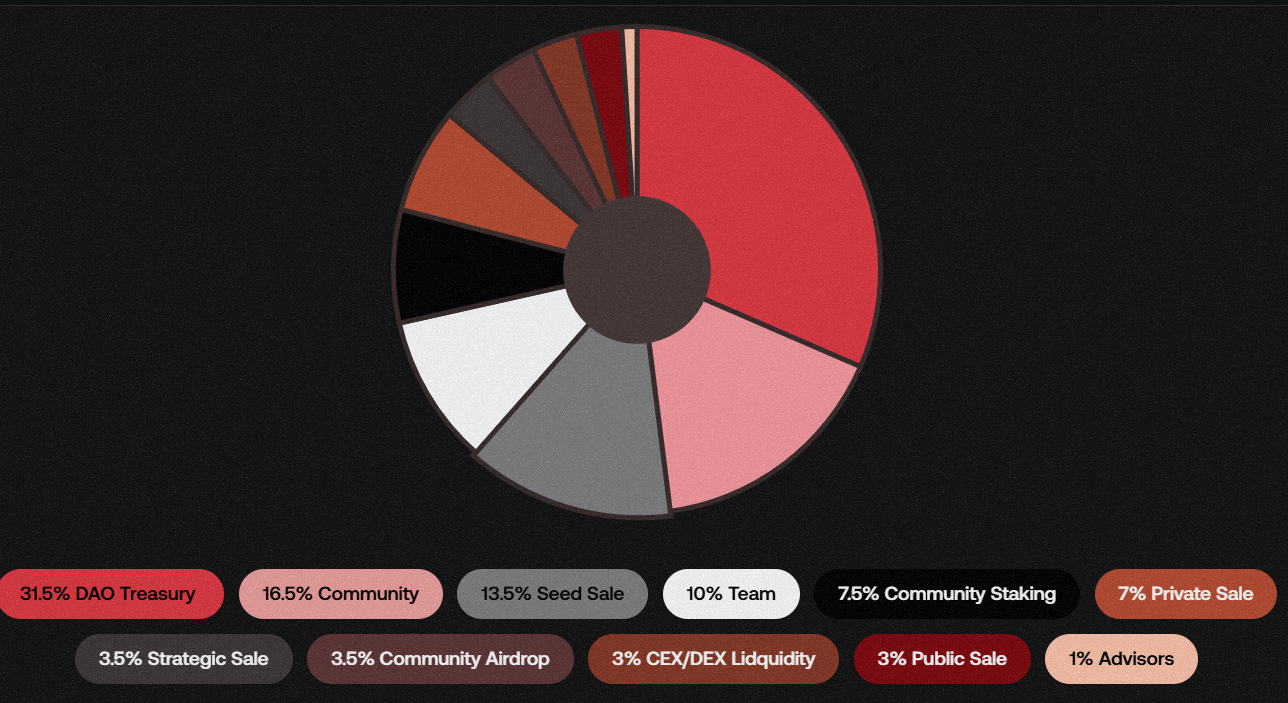

His latest move involves a partnership with Real World Gaming DAO to launch REAL. The token promises staking rewards and governance rights through a decentralized autonomous organization.

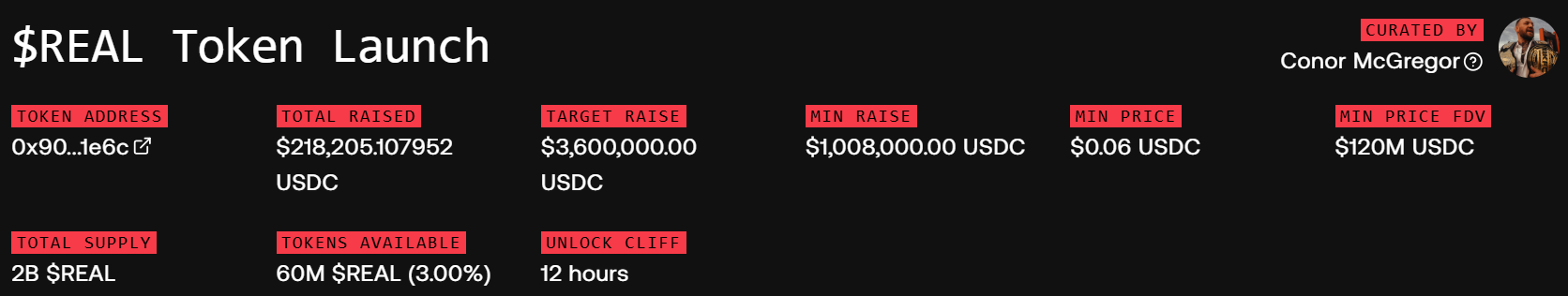

According to the project’s website, the team opted for a sealed-bid auction model to launch the token, aiming to prevent bot manipulation and create fairer pricing.

Under this system, participants submitted bids using USDC. Successful bidders would receive REAL tokens based on a clearing price, while those who didn’t meet the mark would be refunded.

“The auction will be open for 28 hours, after which a single clearing price will be determined. Tokens will be locked for 12 hours after auction close to facilitate a snipe-free deployment of on-chain liquidity. Proceeds from the auction will seed this pool and fund the DAO treasury,” the project added.

However, the community’s response to the project has been underwhelming. The team aimed to raise $3.6 million, with a minimum threshold of $1 million. As of press time, the auction has raised just $218,000, far below expectations.

Several issues appear to be fueling investor hesitation. Critics have called out the token’s short unlock window, warning that it creates ideal conditions for rapid sell-offs.

Others raised concerns about the project’s use of third-party logos on its site, hinting at misleading promotional tactics.

Moreover, community feedback about the project has also been overwhelmingly negative. Many users labeled the tokenomics as flawed and accused the team of focusing on short-term hype rather than sustainable value.

“If you’re buying REAL token, prepare to get dumped on. The tokenomics are absolute trash, and the unlock cliff is only 12 hours. You’re essentially giving your money away if you buy this token,” Crypto Rug Muncher wrote.

Meanwhile, the dismal launch reflects broader exhaustion in the meme coin sector, which has been rattled by recent scandals involving other celebrity-backed tokens.

Tokens tied to Donald Trump and Melania, for instance, have seen sharp declines that have caused investors significant losses.

“Celebrity coins like McGregor’s REAL and Trumps’ are toxic for crypto! Driven by hype, they lack utility, $Trump crashed 81%, $Melania 92%. These [tokens] hurt investors and crypto’s reputation. We need utility tokens for real value and growth,” Maragkos Petros, the founder of MetadudesX said on social media platform X.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin23 hours ago

Altcoin23 hours agoExpert Calls On Pi Network To Burn Tokens To Revive Pi Coin Price

-

Bitcoin24 hours ago

Bitcoin24 hours agoArthur Hayes Sees Tariff War Pushing Bitcoin Toward $1 Million

-

Market23 hours ago

Market23 hours agoDogecoin Faces $200 Million Liquidation If It Slips To This Price

-

Ethereum23 hours ago

Ethereum23 hours agoCrypto Analyst Who Called Ethereum Price Dump Says ETH Is Now Undervalued, Time To Buy?

-

Market21 hours ago

Market21 hours agoIMX Price Nears All-Time Low After 30 Million Token Sell-Off

-

Market22 hours ago

Market22 hours agoSEC’s Guidance Raises Questions About Tether’s USDT

-

Market20 hours ago

Market20 hours agoKey Levels To Watch For Potential Breakout

-

Market19 hours ago

Market19 hours agoSolana Altcoin Saros Rallies 1000% Since March, Hits New High