Market

Polkadot (DOT) Bearish Trends Amid Declining Interest

Polkadot (DOT) faces bearish price trends with nearly a 50% decline from the local high of $12.

Analyzing Key Indicators Such as Total Open Interest and Social Dominance.

Technical Analysis of Polkadot

The price of DOT has once again rejected the Ichimoku Cloud and is currently testing the Ichimoku Baseline in red, which aligns with the lower boundary of the Ichimoku Cloud. The trading price stands at $6.45.

The RSI trend indicates a downward movement, with the 14-day simple moving average (SMA) of the RSI reflecting this bearish momentum. Recently, the RSI has been trending towards the oversold territory, nearing the critical level of 30. This downward trend points to increasing selling pressure and potential further declines in price if the RSI falls below 30.

The 4-hour chart highlights crucial resistance and support zones. The price recently fell below the 4-hour Ichimoku Cloud, indicating a bearish trend in this timeframe. The $6.23 price level has emerged as significant support.

Read More: What Is Polkadot (DOT)?

If DOT drops below this support level, it could signal a continuation of the bearish trend. Conversely, if the price climbs above the Ichimoku Cloud and the red baseline of the 4-hour Ichimoku Cloud, it could suggest a trend reversal and a potential shift to a bullish outlook.

DOT Total Open Interest: Understanding the Bearish Trends

From June 1 to June 13, the total open interest in USD for DOT across all exchanges showed a notable decline. Open interest was relatively higher on June 1 but began a downward trend, indicating reduced trading activity and interest.

By June 13, open interest had decreased significantly, suggesting potential market uncertainty or a reduction in speculative positions. This trend aligns with the broader price action observed during the same period, indicating a bearish sentiment among traders.

The correlation between Polkadot’s price and total open interest in USD from May 14 to June 14, 2024, is approximately 0.44. This positive correlation suggests a relationship between these two variables. Indicating that as open interest increases, Polkadot’s price tends to rise as well.

This relationship highlights that growing market participation and investment interest in Polkadot often accompanies an upward movement in its price. However, the correlation is not strong, implying that other factors significantly influence Polkadot’s price movements.

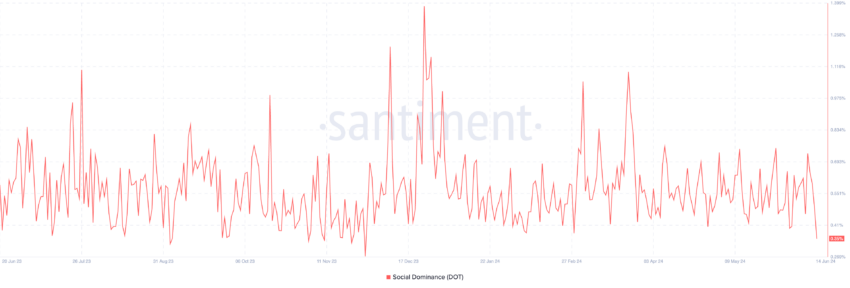

Social dominance peaked at 0.7537 on May 27, a 64.56% increase from 0.4579 on May 14. This rise indicates heightened community interest and engagement. Social interest sharply declined by 53.92% to 0.3474 by June 13.

This aligns with the price drop and suggests waning social media activity or interest in DOT.

Read More: 5 Best Polkadot (DOT) Wallets To Consider In 2024

Polkadot is approaching a critical support level at $6.23. If the price breaks below this level, it could signal a continuation of the bearish trend. Conversely, if the price reverts and moves above the 4-hour Ichimoku Cloud, it might indicate a potential shift in outlook.

The social dominance clearly highlights the current bearish trend that Polkadot is facing, reflecting a noticeable decline in interest from social media users regarding cryptocurrency.

Technical analysis highlights that a confirmed bullish trend will require the price to enter the daily Ichimoku Cloud and break above the daily Ichimoku Baseline.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Can Ethereum’s Utility Make a Comeback Against Bitcoin?

Ethereum (ETH) is still a leader in decentralized finance (DeFi) and smart contract applications, but it’s at a crossroads. The community has questioned Ethereum’s relevance in the shifting crypto industry, putting the altcoin’s future under intense scrutiny.

Mainstream narratives paint a dark picture of Ethereum’s developer exodus and underperformance.

Is Ethereum Getting Left Behind?

Critics reflect how Bitcoin’s ideological and political dominance, particularly after President Donald Trump’s pro-crypto stance, overshadowed Ethereum’s early promise of a global, decentralized computer.

Ethereum’s price downturn — down 44% in 2025 — is being driven by the exodus of developers, and network activity dropping 17% last year.

In contrast, Solana has spiked with an 83% uptick in developer engagement, partly driven by its adoption of meme coins and fast transaction speeds.

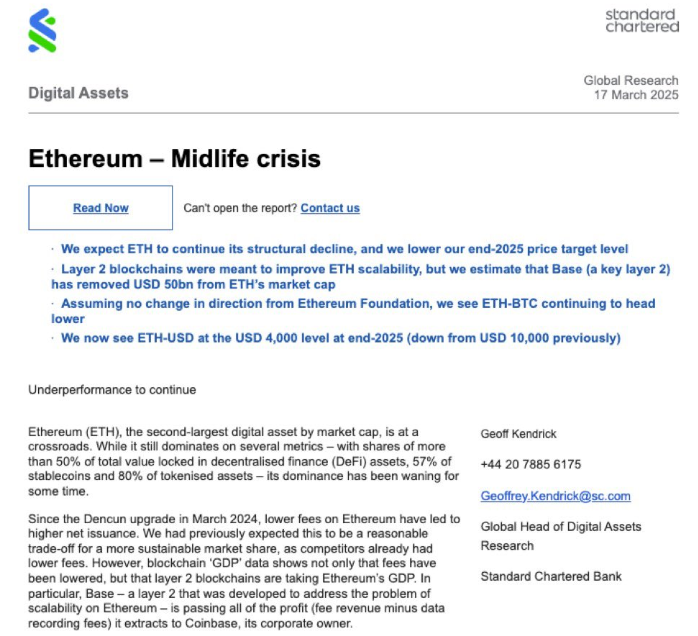

Standard Chartered analysts also cut their end-of-year Ether price forecast by 60%, based on what they told clients was Ethereum’s “identity crisis” and unclear direction forward.

Ethereum’s co-founder, Vitalik Buterin, acknowledged the growing criticism but rejected demands for quick fixes.

He reiterated Ethereum’s trajectory hinges on “long-term value” and real-world utility, not short-term speculation or political power.

“The only thing that can move Ethereum forward at this point is things that give long term value in a way where you can clearly see that the value is coming from a thing that is actually sustainable — like actual use for people,” Bloomberg reported citing Buterin.

Grassroots Push: Ethereum’s Loyalists See Opportunity

Despite growing critics, Ethereum’s most diehard supporters remain undeterred. They view the pessimism around the largest altcoin by market cap metrics as an inflection point for a turnaround.

“This is a bottom signal. Mainstream media almost always get the timing wrong,” a user on X remarked.

Ethereum Layer-2 (L2) solutions continue to dominate chain activity, while real-world asset (RWA) growth on Ethereum looks “exponential,” the user added.

Other users also reacted to the Bloomberg article, which renewed bullishness.

“Was starting to feel bearish but this post has me all bulled up again,” one added in a post.

These responses, among others, speak to Ethereum’s strong community, which has tended to shine in the face of adversity and innovation.

There is no political spectacle for Ethereum, unlike Bitcoin, with growth hinging on scalability and real-world use.

Recently, Buterin outlined a roadmap to Ethereum’s L2 ecosystem, calling for funding of open-source development to guarantee continued progress.

His vision is already coming to fruition as projects like Celo successfully transition to Ethereum layer-2 solutions. As BeInCrypto reported, Celo completed the migration after 20 months of testing, which aimed to improve scalability and transaction efficiency.

Adoption of Ethereum’s L2 scaling solutions, such as Arbitrum, Optimism, and Polygon, has also increased.

This aligns with Buterin’s perspective that sustainable blockchain growth comes from strengthened infrastructures, not hype-driven narratives.

These moves indicate that while speculation on Ethereum may be declining, long-term technological adoption could pick up the slack.

Can the Pectra Upgrade Flip the Narrative?

Likewise, Ethereum managed to overcome challenges through significant upgrades. Against that backdrop, its soon-to-be-released Pectra Upgrade could be revolutionary.

Though delays have frustrated some in the community, the upgrade is anticipated to offer improved security, transaction efficiency, and developer-friendly tools.

Ethereum’s continued commitment to innovation and ongoing testnet trials may be the perfect catalyst for reclaiming its DeFi throne. The network’s dominance in decentralized finance (DeFi) and NFT (non-fungible tokens) ecosystems proves particularly resilient.

Indeed, meme coins and speculative trading have shifted to faster chains such as Solana.

That said, when it comes to high-value applications, Ethereum is still at the heart of it all — from decentralized exchanges (DEXs) to institutional-grade financial products.

The question now, however, is whether Ethereum’s focus on real-world adoption can preserve and outlast Bitcoin’s dominance in the halls of political and financial attention.

With the Pectra upgrade on the horizon and a community loyal to the chain’s dominance in the ecosystem, Ethereum may soon show again that its greatest strength lies not in the hype but in resilience and innovation.

Despite community optimism, Ethereum’s price is down by 2.22% in the last 24 hours. BeInCrypto data shows ETH was trading for $1,842 as of this writing.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Derivatives Get a Boost from US CFTC

The US Commodities Futures Trading Commission (CFTC) scrapped a key directive that had previously signaled increased scrutiny for digital asset derivatives.

This decision indicates a friendlier regulatory climate for digital assets in the US, given the Trump administration’s pro-crypto stance.

CFTC Loosens Oversight for Crypto Derivatives

The CFTC withdrew Staff Advisory No. 23-07 and No. 18-14 by its Division of Clearing and Risk (DCR).

The former, issued in May 2023, focused on the risks of clearing digital assets. Meanwhile, the latter targeted virtual currency derivatives listings.

Upon establishment, both directives hinted at the singling out of crypto products for tougher oversight.

However, both have now been deemed unnecessary, effective immediately, amid the commodities’ regulator’s push toward regulatory consistency.

The decision indicates a shift to treating digital asset derivatives like those on Ethereum (ETH) as traditional finance (TradFi) products.

“As stated in today’s withdrawal letter, DCR determined to withdraw the advisory to ensure that it does not suggest that its regulatory treatment of digital asset derivatives will vary from its treatment of other products,” the CFTC explained.

This move will eliminate the perceived distinctions between digital asset derivatives and TradFi instruments.

It also paves the way for enhanced market participation, which will facilitate broader involvement from financial institutions in the digital asset derivatives market. This could lead to increased liquidity and market maturity.

Nevertheless, the advisory warned derivatives clearing organizations (DCOs) to prepare for risk assessments specific to digital products’ unique characteristics.

Therefore, while it reflects the CFTC’s commitment to promoting innovation, it also suggests the intention to maintain strong financial oversight.

Meanwhile, this decision comes only weeks after the Office of the Comptroller of the Currency (OCC) allowed US banks to offer crypto and stablecoin services without prior approval.

However, the OCC had articulated that despite lifting the approval requirement, banks must maintain strong risk management controls akin to those required for traditional banking operations.

“The OCC expects banks to have the same strong risk management controls in place to support novel bank activities as they do for traditional ones,” said Rodney E. Hood, the acting Comptroller of the Currency.

Therefore, the CFTC’s move to eliminate regulatory bias for crypto derivatives marks a major divide in US policy. On the one hand, the CFTC seeks to scrap the distinction between crypto derivatives and TradFi instruments.

On the other hand, the FDIC (Federal Deposit Insurance Corporation) and OCC want banks to maintain risk management controls similar to those required for traditional banking operations despite providing crypto and stablecoin services.

Notwithstanding, these efforts mirror a growing trend among US financial regulators to lower barriers and foster responsible innovation in the crypto industry.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Falls 12% in a Week as Network Activity Declines

XRP is under heavy selling pressure, down more than 5% in the last 24 hours and over 12% in the past seven days. The recent downturn has been accompanied by increasingly bearish technical indicators, including a sharp spike in trend strength and a collapse in on-chain activity.

With price momentum weakening and user engagement dropping, concerns are mounting over XRP’s ability to hold key support levels. Unless sentiment shifts quickly, the path of least resistance appears to remain to the downside.

DMI Chart Shows The Current Downtrend Is Very Strong

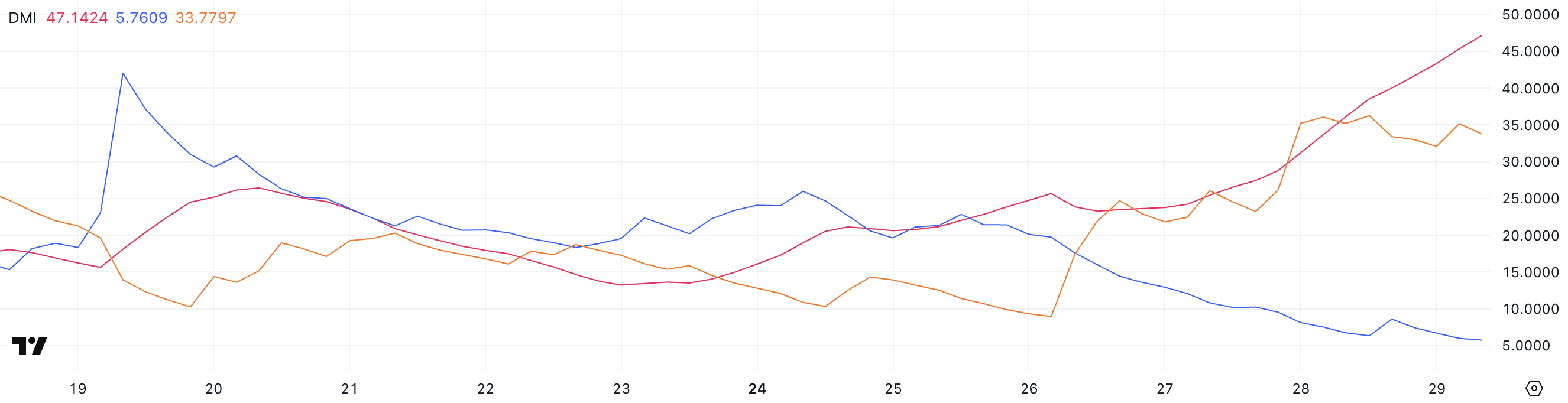

XRP’s Directional Movement Index (DMI) is currently flashing strong bearish signals, with the Average Directional Index (ADX) surging to 47.14 from 25.43 just a day ago.

The ADX measures the strength of a trend, regardless of its direction, and values above 25 generally indicate that a trend is gaining momentum.

A reading above 40—like XRP’s current level—suggests a very strong trend is in play. Given that XRP is currently in a downtrend, this rising ADX points to intensifying bearish momentum and a market leaning heavily toward further declines.

Digging deeper into the DMI components, the +DI, which tracks upward price pressure, has dropped sharply from 20.13 to 5.76. Meanwhile, the -DI, which tracks downward price pressure, has surged from 8.97 to 33.77.

This stark divergence reinforces the bearish trend, indicating that sellers are aggressively taking control while buyer strength fades.

With ADX confirming the strength of this move and directional indicators tilting heavily to the downside, XRP’s price could remain under pressure in the short term unless a significant reversal in sentiment occurs.

XRP Active Addresses Are Heavily Down

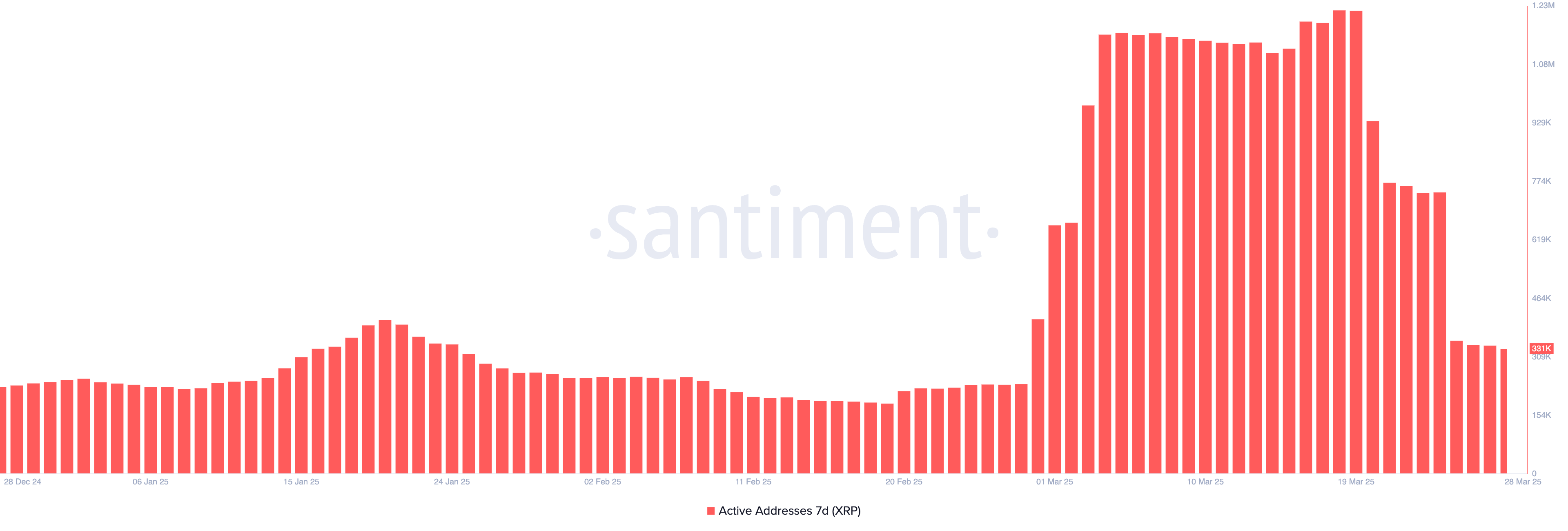

XRP’s 7-day active addresses have seen a sharp decline over the past week, following a recent surge to new all-time highs. On March 19, the metric peaked at 1.22 million, signaling strong network activity and user engagement.

However, since then, it has plummeted to just 331,000—a drop of over 70%. This sudden fall suggests that interest in transacting on the XRP has cooled off significantly in a short span of time.

Tracking active addresses is a key way to gauge on-chain activity and overall network health. A rising number of active addresses typically reflects growing user participation, increased demand, and potential investor interest—factors that can support price strength.

Conversely, a sharp decline like the one XRP is currently experiencing can point to weakening momentum and fading interest, which could put additional pressure on price.

Unless user activity begins to rebound, this drop in network engagement may continue to weigh on XRP’s short-term outlook.

XRP Could Drop Below $2 Soon

XRP’s Exponential Moving Average (EMA) lines are currently signaling a strong downtrend, with the short-term EMAs positioned below the longer-term ones—a classic bearish alignment.

This setup indicates that recent price momentum is weaker than the longer-term average, often seen during sustained corrections. If this downtrend continues, XRP could retest the support level at $1.90.

A break below that could open the door to a deeper drop toward $1.77 in April.

However, if market sentiment shifts and XRP price manages to reverse course, the first key level to watch is the resistance at $2.22.

A successful breakout above this point could trigger renewed bullish momentum, potentially driving the price up to $2.47.

If that level also gets breached, XRP could push further to test the $2.59 mark.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin20 hours ago

Altcoin20 hours agoDid XRP Price Just Hit $21K? Live TV Display Error Goes Viral

-

Altcoin14 hours ago

Altcoin14 hours agoPepe Coin Whale Sells 150 Billion Tokens, Price Fall Ahead?

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum Breakdown, Analyst Eyes $1,130–$1,200 Price Target

-

Market13 hours ago

Market13 hours agoXRP Falls 12% in a Week as Network Activity Declines

-

Bitcoin20 hours ago

Bitcoin20 hours agoBitcoin Price Could Surge To $95,000 — But Analyst Sounds ‘Bull Trap’ Alarm

-

Market19 hours ago

Market19 hours agoDark Web Criminals Are Selling Binance and Gemini User Data

-

Market16 hours ago

Market16 hours agoVitalik Buterin Promotes Ethereum Layer 2 Roadmap

-

Altcoin16 hours ago

Altcoin16 hours agoExpert Predicts Listing Date For WLFI’s USD1 Stablecoin, Here’s When