Market

Swiss Regilator Close Crypto-Friendly FlowBank SA

Crypto-linked bank FlowBank SA shut down on Thursday, June 13, with Switzerland’s financial regulator citing bankruptcy.

Among other reasons, the regulator revealed well-founded concerns about the bank’s financial health.

Switzerland’s FlowBank Shuts Down

The Swiss Financial Market Supervisory Authority (FINMA) has closed the crypto-linked bank FlowBank SA, citing financial reasons. According to the report, the lender does not have enough capital to continue operating as a bank. FINMA expresses serious concerns about FlowBank’s minimum capital requirements and indicates that the bank is “over-indebted,” making restructuring potentially impossible.

“FINMA established in the last week that FlowBank SA no longer has sufficient capital for its operations as a bank. The minimum capital requirements, which must be met at all times, have been significantly and seriously breached,” said the report.

Reportedly, FINMA has had FlowBank on its watchlist since 2021 amid serious breaches of supervisory regulations. The bank fell short of capital requirements and did not meet organization and risk management thresholds. With this, FINMA had drawn extensive measures that FlowBank would have to follow to restore compliance.

FINMA also brought in an independent auditor to monitor its implementation. Nevertheless, findings of inadequacies in the bank’s compliance further worsened the situation, including breaches of the capital ratio. The report also cites another engagement between FINMA and FlowBank in June 2023, where the regulator appointed an overseer over the bank’s activities to probe its compliance failures.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

The findings revealed that FlowBank SA repeatedly violated capital requirements and exhibited multiple organizational deficiencies. These issues, along with recent developments, led to the regulator’s decision to dissolve the bank after a week. Ultimately, FlowBank SA and its management bodies failed to sustainably restore compliance with the capital requirements within the required timeframe.

“The bank also entered into numerous higher-risk business relationships and processed large transactions without properly investigating the background of these business relationships and transactions,” FINMA noted.

At the time of writing, FlowBank was unavailable for comment. The company has already deactivated its official X account.

Letter To FlowBank Customers

FlowBank acknowledged the dissolution in a letter to its clients, highlighting the revocation of its license as bank and securities. Nevertheless, FINMA assures FlowBank customers that deposits up to 100,000 Swiss francs (nearly $111,710) are protected. Refunds will happen within seven working days, where Swiss law firm Walder Wyss AG oversees the bankruptcy liquidation process.

Unfortunately, the fate of customers’ crypto deposits remains unclear, entirely in Walder Wyss’s hands. According to the FINMA, the liquidator is tasked with determining whether cryptocurrencies will be treated as “claims on the bank.” Otherwise, they would pass as custody assets and, therefore, securities in the bankruptcy process to be repaid.

“FINMA’s primary aim is to protect depositors. In a first step the liquidator will therefore repay deposits up to CHF 100,000 (privileged deposits) to the clients concerned as quickly as possible. According to current calculations, the privileged deposits can be repaid in full out of the bank’s available funds. Therefore, we do not expect the Swiss banks’ deposit insurance scheme (esisuisse) to be involved. Client custody accounts will also be segregated from the estate and repaid,” the regulator stated.

Read More: What Is Markets in Crypto-Assets (MiCA)? Everything You Need To Know

The Swiss regulator’s action is unsurprising, given Switzerland’s reputation as one of the most crypto-friendly European countries. Several Swiss banks, including AMINA (SEBA), Maerki Baumann, and Swissquote, support operations with digital assets. Shutting down a platform that fails to meet operating criteria aims to prevent an outcome similar to the FTX implosion rather than acting against crypto.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Approaches Resistance—Will It Smash Through?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price started a recovery wave above the $1,850 level. ETH is now consolidating and facing key hurdles near the $1,920 level.

- Ethereum started a recovery wave above $1,820 and $1,850 levels.

- The price is trading above $1,860 and the 100-hourly Simple Moving Average.

- There is a connecting bullish trend line forming with support at $1,860 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair must clear the $1,900 and $1,920 resistance levels to start a decent increase.

Ethereum Price Starts Recovery

Ethereum price managed to stay above the $1,750 support zone and started a recovery wave, like Bitcoin. ETH was able to climb above the $1,820 and $1,850 resistance levels.

The bulls even pushed the price above the $1,880 resistance zone. There was a move above the 50% Fib retracement level of the downward wave from the $2,032 swing high to the $1,767 low. However, the bears are active near the $1,920 zone.

Ethereum price is now trading above $1,850 and the 100-hourly Simple Moving Average. There is also a connecting bullish trend line forming with support at $1,860 on the hourly chart of ETH/USD.

On the upside, the price seems to be facing hurdles near the $1,900 level. The next key resistance is near the $1,920 level and the 61.8% Fib retracement level of the downward wave from the $2,032 swing high to the $1,767 low.

The first major resistance is near the $1,970 level. A clear move above the $1,970 resistance might send the price toward the $2,020 resistance. An upside break above the $2,020 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,050 resistance zone or even $2,120 in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $1,920 resistance, it could start another decline. Initial support on the downside is near the $1,860 level and the trend line. The first major support sits near the $1,845 zone.

A clear move below the $1,845 support might push the price toward the $1,800 support. Any more losses might send the price toward the $1,765 support level in the near term. The next key support sits at $1,710.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $1,860

Major Resistance Level – $1,920

Market

Bitcoin Price Bounces Back—Can It Finally Break Resistance?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started a recovery wave above the $83,500 zone. BTC is now consolidating and might struggle to settle above the $85,500 zone.

- Bitcoin started a decent recovery wave above the $83,500 zone.

- The price is trading above $83,000 and the 100 hourly Simple moving average.

- There is a connecting bullish trend line forming with support at $84,500 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it stays above the $83,500 zone.

Bitcoin Price Starts Recovery

Bitcoin price managed to stay above the $82,000 support zone. BTC formed a base and recently started a decent recovery wave above the $82,500 resistance zone.

The bulls were able to push the price above the $83,500 and $84,200 resistance levels. The price even climbed above the $85,000 resistance. A high was formed at $85,487 and the price is now consolidating gains above the 23.6% Fib retracement level of the upward move from the $81,320 swing low to the $85,487 high.

Bitcoin price is now trading above $83,500 and the 100 hourly Simple moving average. There is also a connecting bullish trend line forming with support at $84,550 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $85,200 level. The first key resistance is near the $85,500 level. The next key resistance could be $85,850. A close above the $85,850 resistance might send the price further higher. In the stated case, the price could rise and test the $86,650 resistance level. Any more gains might send the price toward the $88,000 level or even $88,500.

Another Decline In BTC?

If Bitcoin fails to rise above the $85,500 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $84,500 level and the trend line. The first major support is near the $83,500 level and the 50% Fib retracement level of the upward move from the $81,320 swing low to the $85,487 high.

The next support is now near the $82,850 zone. Any more losses might send the price toward the $82,000 support in the near term. The main support sits at $80,500.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $84,500, followed by $83,500.

Major Resistance Levels – $85,200 and $85,500.

Market

Analyst Reveals ‘Worst Case Scenario’ With Head And Shoulders Formation

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

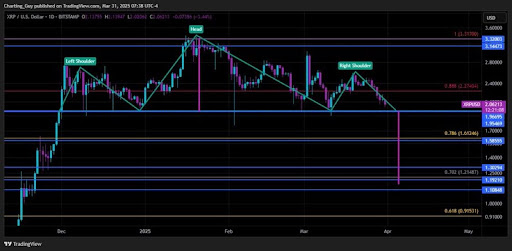

Recent XRP price action has sparked a new prediction from a crypto analyst, as a potential Head and Shoulders pattern emerges on the chart. The analyst warns that this technical formation could trigger a significant price correction for XRP, describing this downturn as the worst-case scenario.

Analyst Predicts XRP Price Crash To $1.15

The ‘Charting Guy,’ a pseudonymous crypto analyst on X (formerly Twitter), has unveiled a potential Head and Shoulder pattern formation on the XRP price chart. The analyst has shared insights into the implications of this technical pattern, projecting a potential crash in the XRP price.

Related Reading

As a well-known bearish reversal pattern, the formation of a Head and Shoulder in the XRP price chart suggests a potential shift from an uptrend to a downtrend. Typically, a Head and Shoulder pattern consists of three peaks: the Left Shoulder, Head, and Right Shoulder. However, the Charting Guy has confirmed that XRP’s current pattern formation consists of two right shoulders and one head. Due to this irregularity, the analyst has expressed doubt about the possibility of the pattern playing out.

If the Head and Shoulder pattern eventually takes shape, it could lead to a significant drop in the XRP price, potentially bringing it down to as low as $1.15. This price level aligns with a key Fibonacci Golden Pocket retracement zone between 0.618 – 0.786.

Notably, the analyst has described this projected price crash as the worst-case scenario for XRP. While he believes a bearish move is possible, the analyst is confident that XRP’s broader market structure is bullish.

Moreover, the Charting Guy argues that if XRP does decline to $1.15, it would likely serve as a healthy retracement in an overall bullish trend. He noted that XRP’s price has been holding the $2 level on daily closes, meaning its price action remains strong above support levels. This also indicates the possibility of an uptrend resumption that could yield higher highs and higher lows for XRP.

Key Support And Resistance Levels To Watch

The Charting Guy’s analysis of XRP’s potential Head and Shoulder pattern formation highlights several critical price levels to watch. Since XRP has consistently closed daily candles above $2, the analyst has determined this level as short-term support.

Related Reading

XRP has also been wicking during recent pullbacks in a crucial range between $1.7 and $1.9. As a result, the crypto analyst has revealed that he will be watching this area closely for a potential price bounce.

The Golden Pocket retracement zone, which represents the worst-case scenario for the XRP price, is between $1.15 and $1.30. If XRP experiences a deeper price correction, lower support levels have been marked from $1.19 to $0.91.

For its resistance levels, the Charting Guy has pinpointed $2.27 as a key price point. Additionally, $3.14 – $3.32 has been identified as an upper resistance range where XRP could rally if bullish momentum resumes.

Featured image from Medium, chart from Tradingview.com

-

Ethereum23 hours ago

Ethereum23 hours ago$2,300 Emerges As The Most Crucial Resistance

-

Market22 hours ago

Market22 hours agoCFTC’s Crypto Market Overhaul Under New Chair Brian Quintenz

-

Altcoin22 hours ago

Altcoin22 hours agoA Make or Break Situation As Ripple Crypto Flirts Around $2

-

Market19 hours ago

Market19 hours agoBitcoin Price Battles Key Hurdles—Is a Breakout Still Possible?

-

Bitcoin17 hours ago

Bitcoin17 hours ago$500 Trillion Bitcoin? Saylor’s Bold Prediction Shakes the Market!

-

Market23 hours ago

Market23 hours agoSolana (SOL) Holds Steady After Decline—Breakout or More Downside?

-

Altcoin15 hours ago

Altcoin15 hours agoWill XRP, SOL, ADA Make the List?

-

Market21 hours ago

Market21 hours agoXRP Bulls Fight Back—Is a Major Move Coming?