Market

This Is How Meme Coin Snipers Are Making Millions

Meme coins stand out due to their viral nature and potential for substantial gains. Recently, the trading volumes of these coins have surged to new highs, capturing the attention of both skeptics and enthusiasts.

However, meme coin trading requires thorough research, strategic execution, and constant market monitoring.

Crypto Traders Share Meme Coin Trading Strategies

Experts like Mike Novogratz from Galaxy, a leading digital asset company, highlight the significance of meme coins, which now boast a market cap of over $54 billion.

“Meme coins – whether you’re a fan or not – have become a cornerstone of the crypto economy… In today’s market, they’re one of the most powerful narratives out there,” Novogratz said.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

Meme coins attract investors with their rapid profit opportunities. Atlas, a crypto analyst, explains that knowledgeable traders can achieve up to 100X returns with meme coins.

“Once you understand the basics of trading, you can start analyzing and buying tokens. A few clicks can make you a millionaire; just spend a little time,” he asserts.

Atlas shares several essential strategies for those keen on navigating this market. Initially, he advises evaluating the project’s social media footprint, especially on X (Twitter), which is crucial to studying sentiments. The absence of an X account often signals a project’s lack of credibility.

Furthermore, Atlas recommends tools like DEX Screener or DEXTools to assess the distribution of token holders. He warns that a high percentage of tokens held by creators can pose a crash risk. This analysis is critical as it helps eliminate potential scams.

Another tactic discussed is token sniping, which involves purchasing tokens as soon as liquidity is provided.

“Sniping is buying tokens at the moment liquidity is added to them, which can bring you an easy 100x increase in a short period,” Atlas explained.

Popular telegram bots such as BONKbot, SolTradingBot, and Unibot can facilitate meme coin sniping. When a new token pool appears, meme coin snipers act fast. They copy the contract, analyze it, and quickly purchase tokens through the aforementioned bots.

Read more: Unibot: A Comprehensive Guide to the Telegram Bot

However, Atlas emphasizes the importance of caution. He highlights the unpredictable nature of trading, where no one achieves a 100% success rate.

Moreover, Atlas suggests that traders should avoid getting distracted by numerous emerging projects and instead focus on established market leaders. As the meme coin sector is highly sensitive to the broader crypto trends, especially Bitcoin’s movements, maintaining vigilance on overall market conditions is crucial.

KingWilliam, another crypto trader, offers additional advice. He recommends monitoring new pairs on DEXScreener and emulating the strategies of top traders. Tools like AlphaTrace provide insights into successful strategies.

“The wallet should have a 60-70%+ win rate and $500-600,000+ in PnL,” KingWilliam suggested.

Lastly, the potential for scams is ever-present in the meme coin arena. Tools like RugCheck can help determine the likelihood of a project being a ‘rug pull,’ a scam where developers abandon a project and leave with investors’ funds.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana (SOL) Price Falls Below $100, Crashes To 14-Month Low

Solana (SOL) has faced significant price declines recently, falling below the $100 mark and reaching a 14-month low.

This drop is attributed to broader market bearishness, largely driven by ongoing trade tensions and fears of a financial crisis, often likened to the 1987 “Black Monday.” Despite these challenges, there is potential for SOL to stabilize and recover in the near future.

Solana Investors Stand Strong

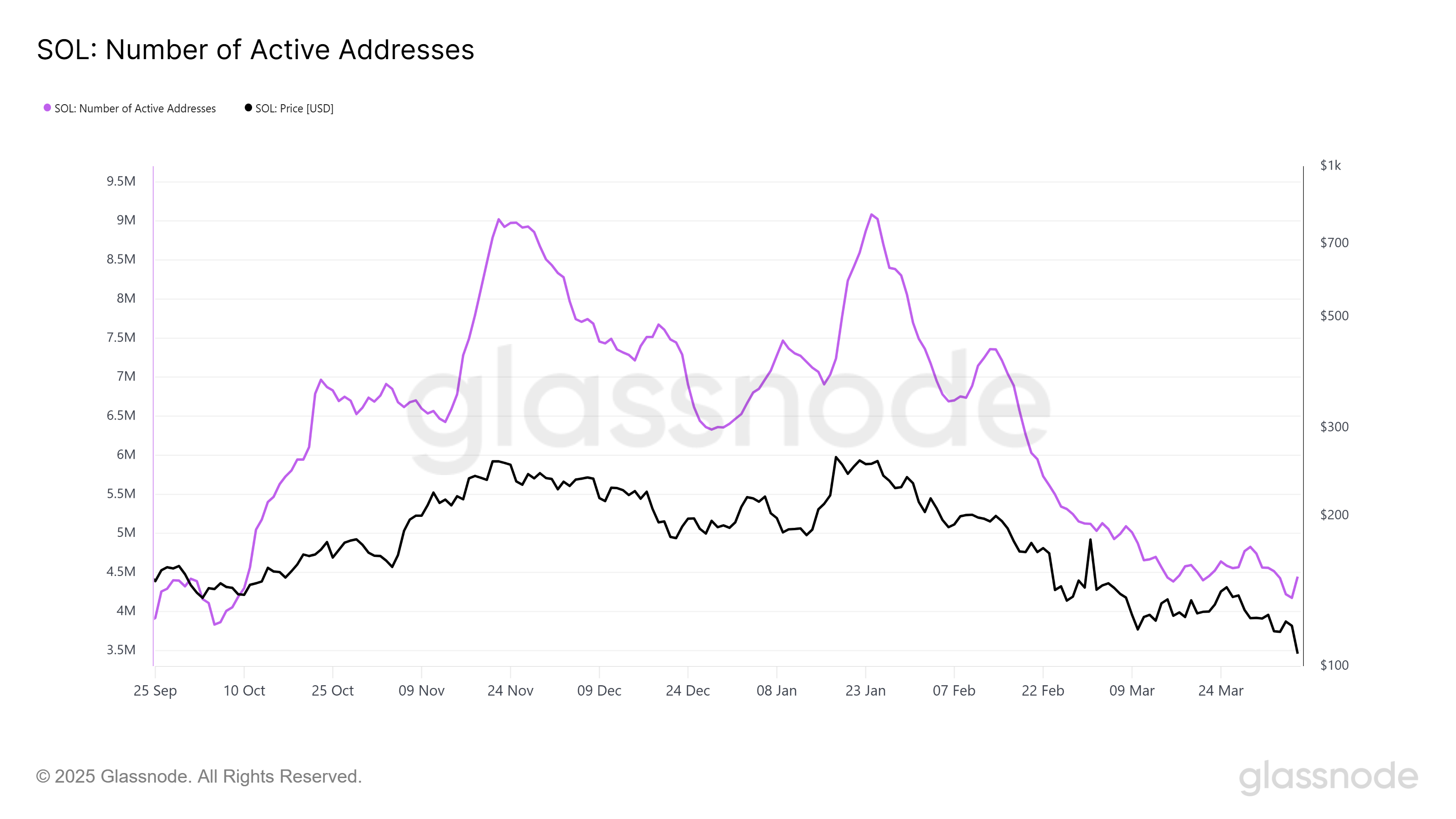

The number of active addresses on the Solana network has recently hit a 6-month low, with around 4.44 million addresses engaging on the platform. While the decline from January’s peak of 9 million addresses might seem concerning, it also indicates that investors are likely waiting for a strong recovery before being more active on the network.

Despite the price downturn, Solana’s loyal investor base continues to hold their positions, signaling potential support that could prevent further price declines. Solana’s investors remain hopeful for a rebound, particularly given the network’s history of bouncing back after downturns.

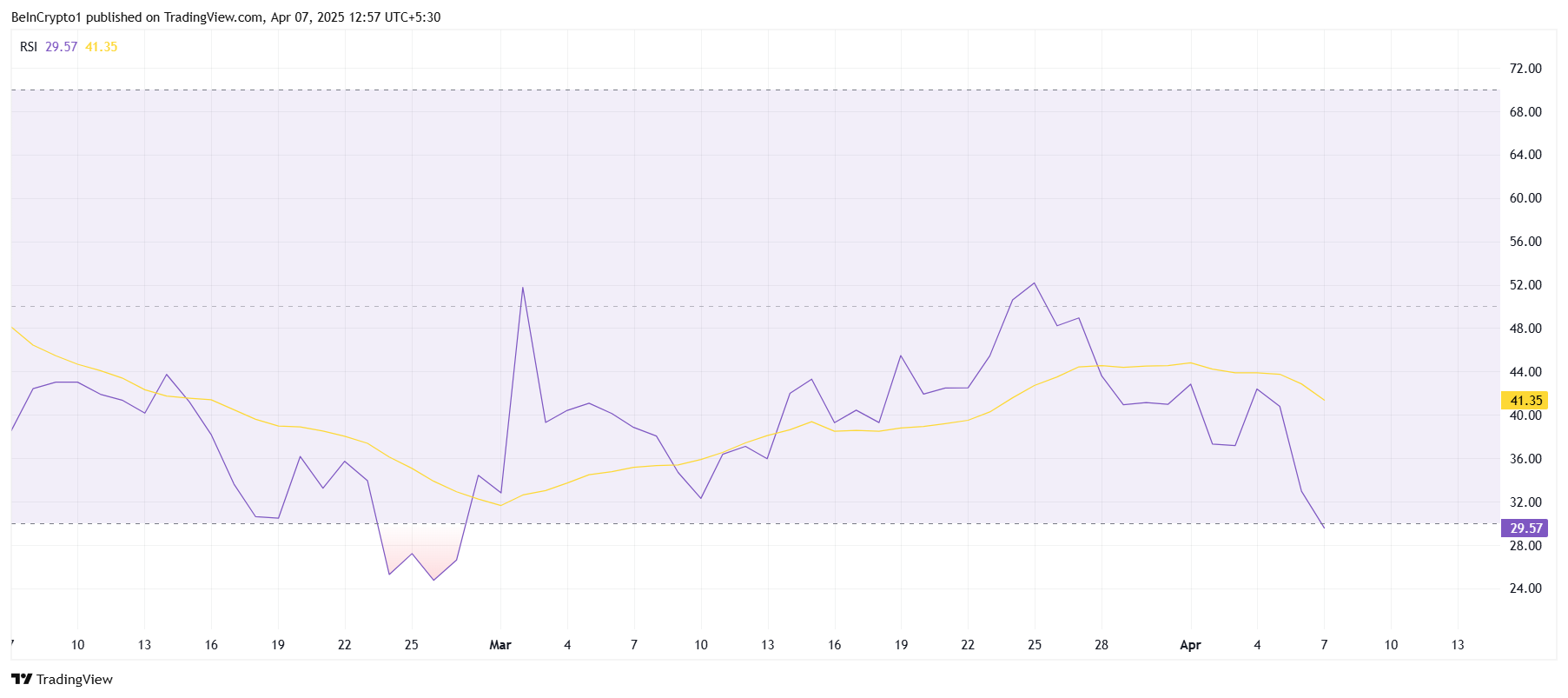

Looking at technical indicators, the Relative Strength Index (RSI) for Solana is currently sitting in the oversold zone, below the critical 30.0 mark. This suggests that the bearish momentum may be nearing its saturation point, with the potential for a reversal in the near future. Historically, when SOL has dipped into the oversold region, the price has rebounded.

The RSI reading suggests that the market may be poised for a short-term recovery if the broader market conditions stabilize. While the global financial climate remains uncertain, the RSI signals that Solana could be on the brink of a price rebound, provided the bearish forces start to subside.

SOL Price May Recover Soon

Solana’s price has dropped 20.8% during the intra-day trading session, reaching $97. The price fall below $100 marks a new low for the asset, driven by a surge in bearish sentiment across the market. As a result, many investors are watching closely to see if Solana can reclaim its previous support levels.

Despite the recent declines, Solana’s recovery potential remains strong. If the price manages to break above the $100 mark and hold it as support, the positive momentum could return. Investors are likely to capitalize on the current 14-month low, injecting new capital into the network and helping to stabilize the price.

However, if the broader market conditions fail to improve, Solana’s price may continue to struggle. A drop below the $90 support level would invalidate the bullish outlook and extend losses. As a result, SOL may face further downward pressure, especially if negative market trends persist.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Dives Below $2—Is This the Start of a Bigger Breakdown?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

How Privacy Coins Are Outperforming in 2025’s Crypto Chaos

In a year marked by market turbulence and mounting geopolitical tensions, privacy coins have emerged as the best-performing sector in the cryptocurrency space.

Analysts and privacy advocates argue this is no coincidence. In fact, some believe the outperformance signals the early stages of a larger shift in global financial dynamics.

Why Privacy Coins Are the Top Performers in a Fear-Driven Market

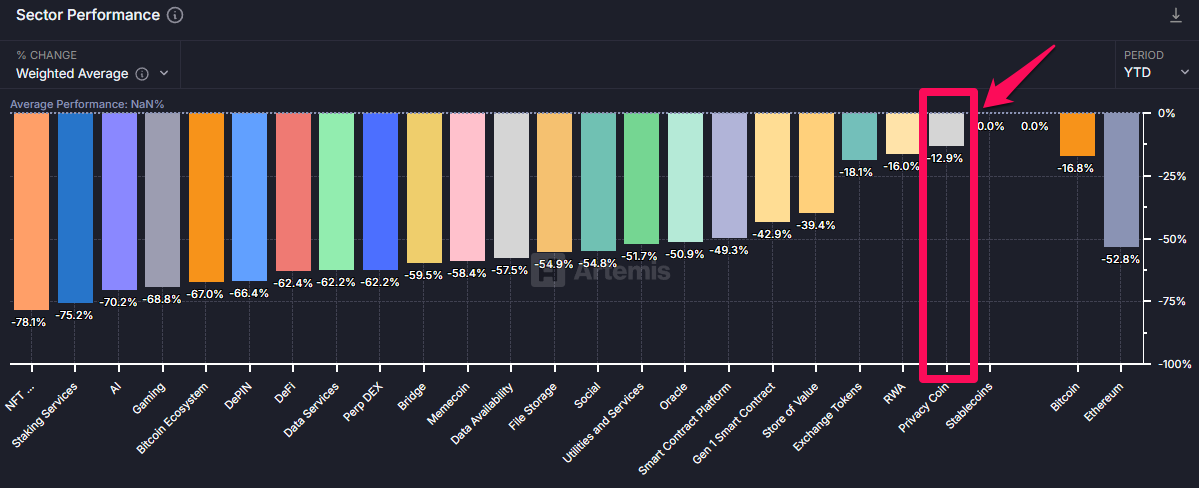

According to the latest data from Artemis, privacy-focused cryptocurrencies have dropped 12.9% since the start of the year, the smallest drop among all crypto sectors.

In comparison, Bitcoin (BTC) has seen a 16.8% decline. In addition, Ethereum (ETH) has also depreciated 52.8% year-to-date (YTD).

BeInCrypto data showed that over the past month, top privacy coins have fared well in comparison to BTC. Monero (XMR) has dipped 8.1%. Notably, Zcash (ZEC) has seen a modest rise of 9.1%. Nonetheless, with Bitcoin, the losses are slightly higher. Over the past month, the largest cryptocurrency has shed 9.8% of its gains.

In fact, privacy coins have also outperformed the broader cryptocurrency market in the past 24 hours. The privacy sector has seen a 7.0% decline, while the global crypto market has dropped 8.3%.

Patrick Scott, Head of Growth at DefiLlama, attributed this outperformance to broader macroeconomic shifts in a recent post on X (formerly Twitter).

“Privacy coins were the best-performing crypto sector during the crash. This isn’t about hype. It’s macro,” he wrote.

Scott pointed out that countries are becoming more economically isolated due to increasing tariffs and potential capital controls. He argued that privacy coins’ ability to resist censorship and operate privately would make them more important, shifting from being just a “narrative” to a practical necessity.

“The outperformance isn’t random. It’s an early reaction to a shifting global regime and the breakdown of the post-WW2 international order,” Scott remarked.

Meanwhile, many industry leaders echo a similar sentiment. Vikrant Sharma, Founder and CEO of Cake Investments, expressed strong support for privacy-focused solutions.

“I am a maxi.. a privacy maxi. That’s why I support privacy coins and tools like XMR, Zano, silent payments, and pay join for BTC, LTC-MWB, and yes, I think Zcash is fine too,” he posted.

Others, like Mike Adams, the founder of Brighteon, also stressed the importance of privacy in transactions.

“Use privacy crypto, folks. Monero, Zano, Firo… not BTC, which is completely transparency and has zero privacy,” stated Adams.

In addition to these factors, the demand for privacy coins is being fueled by their growing use in illegal activities. A recent report from BeInCrypto highlighted the dominance of privacy coins in illicit transactions, where they are preferred for their ability to conceal transaction details.

While Bitcoin and stablecoins are still used in such activities, privacy coins like Monero are gaining traction due to their superior anonymity features.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum Whale Activity Fades Since Late February – Details

-

Market23 hours ago

Market23 hours agoXRP High Stakes Setup: Analyst Warns Of Sharp Move To $17 Or $0.65

-

Market21 hours ago

Market21 hours agoHBAR Could Avoid $30 Million Liquidation Thanks to Death Cross

-

Market20 hours ago

Market20 hours agoConor McGregor’s Crypto Token REAL Tanks After Launch

-

Bitcoin16 hours ago

Bitcoin16 hours agoUS Macro Setup To Favour New Bitcoin ATH In The Long Run

-

Market22 hours ago

Market22 hours agoSEC Reconsiders Howey Test Use in Crypto Oversight

-

Bitcoin21 hours ago

Bitcoin21 hours agoAltseason Dead On Arrival? Data Shows Bitcoin Outperforming All Categories

-

Altcoin14 hours ago

Altcoin14 hours agoExpert Reveals Decentralized Strategy To Stabilize Pi Network Price