NFT

Why Are NFTs Bad? The Problem And Legal Issues

Why Are NFTs Bad? This pressing question underscores today’s heated discussions around Non-Fungible Tokens (NFTs). Despite the buzz, many investors are left grappling with unsellable NFTs, questioning their value and security. This article cuts through the noise to examine the critical issues and legal challenges surrounding NFTs.

We navigate the complex NFT laws, dissect the reasons behind the unsellable nature of some digital assets, and address the underlying problems fueling the skepticism. With focused insights, we aim to shed light on the darker aspects of NFTs to answer the question: are NFTs bad?

Why Are NFTs Bad?

The question “Why are NFTs bad?” resonates in the digital world, particularly among those cautious about the rapidly evolving blockchain technology. NFTs, or Non-Fungible Tokens, have garnered attention for their unique ability to represent ownership of digital assets. However, beneath the surface of this innovative technology lies a web of concerns that have led many to question their overall value and impact.

Understanding NFTs: A Brief Overview

NFTs are digital tokens that represent ownership of unique items, using blockchain technology to certify authenticity and ownership. Each NFT stands out as distinct, unlike cryptocurrencies such as Bitcoin or Ethereum, which are fungible and allow for one-to-one exchanges. They can represent anything digital, such as art, music, or even tweets.

NFTs derive their uniqueness from granting a feeling of exclusivity and ownership over digital assets, which have traditionally been easily replicated and distributed. By tokenizing these assets on a blockchain, NFTs create a digital scarcity and a verifiable way to claim ownership.

However, the rise of NFTs has not been without controversy. Their detractors point to several key issues: technical issues questioning the longevity of NFTs, the potential for market manipulation, and the creation of a speculative bubble where the value of digital assets is highly uncertain. Furthermore, the legal landscape surrounding NFTs is still evolving, with questions about copyright and ownership rights at the forefront.

Exploring The Main Question: Why Are NFTs Bad?

While NFTs have their benefits, the growing concerns cannot be overlooked. The main question, “Why are NFTs bad?” stems from several critical issues associated with their use and functionality.

Technical Challenges And Longevity Concerns

The appeal of NFTs on blockchains such as Ethereum is diminished by various technical challenges, raising questions about their long-term viability and dependability as digital assets. Here are some technical reasons for “why are NFTs bad”:

- Off-Blockchain Asset Storage: Most NFTs, especially on Ethereum, link to digital assets like images stored off the blockchain due to Ethereum’s size and cost constraints. These assets are often hosted on platforms like IPFS (InterPlanetary File System), not directly on the blockchain.

- External URL Vulnerability: The use of external storage like IPFS raises questions about the longevity and accessibility of the linked digital assets. The potential obsolescence of these platforms poses a risk to the permanence of NFTs.

- Blockchain-Specific Uniqueness: The uniqueness of an NFT is limited to its native blockchain, like Ethereum. The same asset can be tokenized on different blockchains, challenging the notion of uniqueness.

- Duplicate NFT References: NFTs can reference the same digital asset via HTTP links, leading to multiple NFTs for a single asset within the same blockchain, contrary to their non-fungible nature.

Market Manipulation And Speculative Bubble

The NFT market is not just a platform for digital creativity but also a hotbed for speculation and potential market manipulation, raising significant concerns. Following are some market-related reasons for “why are NFTs bad”:

- Speculative Investments: NFTs have become symbols of speculative investment, with prices often driven by hype rather than intrinsic value. High-profile sales, like that of Beeple’s artwork, have attracted a wave of investors looking to capitalize on potential market booms. This speculation can inflate prices artificially, creating a bubble where the value of NFTs is grossly overestimated.

- Risk Of Market Manipulation: The NFT marketplace is vulnerable to manipulation due to its relatively unregulated nature and the opacity of transactions. There have been instances where artists or sellers artificially inflate the value of an NFT by purchasing their own assets through third parties. This tactic creates a false impression of high demand and value, luring unsuspecting buyers into overpaying.

- Impact Of Celebrity Endorsements: The involvement of celebrities and influencers in promoting NFTs further fuels the speculative bubble. Their endorsements can lead to rapid spikes in prices and interest, often without a sustainable basis. While celebrity involvement has brought mainstream attention to NFTs, it also raises questions about the genuine value and long-term viability of these assets.

- Volatility And Unsustainability: High volatility marks the NFT market, featuring significant fluctuations in value. This instability renders NFT investments risky, especially for individuals not deeply familiar with the digital asset landscape.

Legal Ambiguity

The burgeoning world of NFTs is mired in legal ambiguities, making it a complex landscape to navigate for creators, collectors, and investors alike. Below are some legal reasons for “why are NFTs bad”:

Unclear Copyright And Ownership Rights:

One of the fundamental legal challenges with NFTs is the ambiguity surrounding copyright and ownership rights. Purchasing an NFT often grants the buyer ownership of a unique token, but not necessarily the copyright of the underlying digital asset. This distinction can lead to confusion and disputes over what buyers are actually entitled to when they acquire an NFT.

Varying International Laws:

The legal recognition of NFTs varies significantly across different jurisdictions. While some countries may have specific regulations governing digital assets, others lack clear guidelines. This inconsistency presents challenges, particularly in cases involving cross-border transactions or disputes.

Smart Contract Complexities:

NFTs operate on smart contracts—self-executing contracts with the terms of the agreement directly written into code. However, the legal status of these contracts is not always clear. Issues arise when smart contracts, which are immutable once deployed, contain errors or do not align with legal standards. Rectifying these issues can be complicated and may require litigation.

Regulatory Uncertainty:

The regulatory landscape for NFTs is still in its infancy. Financial regulators in various countries are grappling with how to classify NFTs—whether as securities, commodities, or a completely new asset class. This lack of regulatory clarity adds to the uncertainty, particularly regarding compliance with existing financial laws and anti-money laundering (AML) requirements.

Liability And Consumer Protection:

The decentralized nature of NFT marketplaces often leaves consumers with limited recourse in cases of fraud, theft, or disputes. In such scenarios, the issue of liability remains mostly unresolved, and consumer protection mechanisms are not as strong as those in traditional financial markets.

NFT Pros And Cons

The world of Non-Fungible Tokens (NFTs) presents a mixed bag of advantages and drawbacks. Understanding these pros and cons is essential for anyone looking to engage with NFTs, whether as creators, collectors, or investors.

Pros Of NFTs:

- Digital Ownership And Provenance: NFTs provide a clear proof of ownership and provenance for digital assets. They enable artists and creators to monetize digital works, which were previously easy to replicate and difficult to sell as unique pieces.

- Market Expansion For Artists: NFTs have opened up new markets for digital artists and creators, allowing them to reach a global audience. This democratization of art sales has empowered artists, especially those outside the traditional gallery system.

- Innovation And Creativity: The NFT space encourages innovation and creativity, particularly in digital art and multimedia. It has sparked new forms of artistic expression and collaboration.

- Collectibility And Investment: For collectors, NFTs offer a new avenue for investment in digital art and collectibles. The unique nature of NFTs makes them appealing as collectible items.

Cons Of NFTs:

- Technical Issues: On blockchains like Ethereum, NFTs present several technical issues, questioning their longevity. Being aware of these issues is crucial.

- Market Volatility And Speculation: The NFT market is highly volatile, with values fluctuating dramatically. This instability, coupled with speculative investments, poses risks for buyers and sellers.

- Intellectual Property Issues: The legal ambiguity around copyright and ownership rights in NFTs creates complications for intellectual property law. Buyers might not fully understand what rights they are acquiring, leading to potential legal disputes.

- Accessibility And Inclusivity Issues: Despite their potential for democratizing art, NFTs also pose challenges in terms of accessibility and inclusivity. The technical and financial barriers to entry can be high, limiting participation to a more tech-savvy and financially capable audience.

The Dark Side: Unsellable NFTs And Market Risks

The world of NFTs is not just about innovation and lucrative opportunities. There’s a darker side to this market, characterized by the phenomenon of unsellable NFTs and significant market risks that raise critical questions about the overall safety and soundness of investing in these digital assets. This adds another layer to the question “why are NFTs bad.”

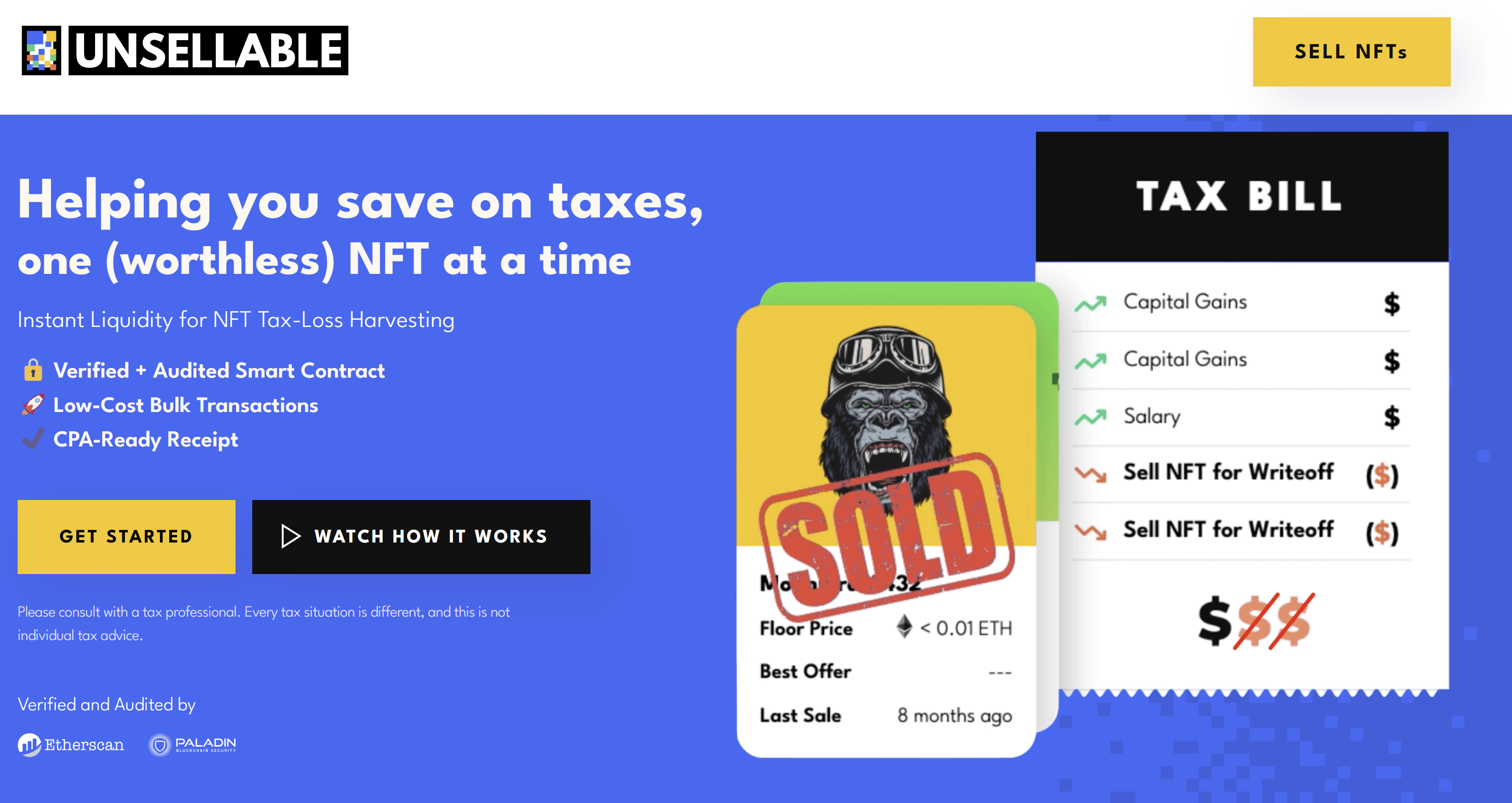

The Reality Of Unsellable NFTs

While NFTs have been sold for staggering amounts, the reality is that not all NFTs find buyers, leading to a growing concern over unsellable NFTs. Several factors contribute to this situation:

- Market Saturation: As more creators and investors flood into the NFT space, the market is becoming increasingly saturated. This saturation makes it harder for individual NFTs to stand out, reducing their likelihood of being sold.

- Speculative Nature: Many NFTs are bought for speculative purposes, with the hope of reselling for a profit. When the speculation bubble bursts, or if the hype dies down, the value of these NFTs can plummet, making them difficult to sell.

- Lack Of Intrinsic Value: Some NFTs may lack intrinsic artistic or collectible value, being created solely for the purpose of capitalizing on the trend. These NFTs may struggle to find a market.

- Liquidity Issues: The NFT market is not as liquid as other investment markets. Selling an NFT, especially at a desired price point, can be challenging and time-consuming.

Platforms like Unsellable specialize in purchasing these low-value NFTs for tax write-off purposes.

Are NFTs Bad?

The question “Are NFTs bad?” is complex. NFTs themselves are a neutral technology with potential for positive use, such as supporting artists and creating unique digital experiences. However, the issues of market saturation, speculative bubbles, and technical concerns add a negative aspect to this technology. The answer largely depends on how NFTs are used and the awareness of the buyers and sellers about the risks involved.

Are NFTs Safe?

The safety of investing in NFTs is a matter of perspective and depends on various factors:

- Technical Issues: NFTs on Ethereum face several problems that investors should be aware of.

- Market Volatility: The high volatility of the NFT market can lead to significant financial risks for investors.

- Legal and Technical Risks: As discussed earlier, there are legal ambiguities and technical challenges associated with NFTs, which can impact their long-term viability.

- Scams And Fraud: The NFT space, like any emerging market, is susceptible to NFT scams and fraudulent activities, which can pose risks to less experienced investors.

NFT Laws: Legal Challenges

Navigating the complex legal landscape of NFTs poses a challenge, given that these digital assets intersect various aspects of law in ways that are still evolving and being defined. The dynamic and rapidly evolving nature of NFTs has left lawmakers and stakeholders working to catch up with the legal implications which adds another argument to the question “why are NFTs bad”.

NFT Laws Decoded

The application of existing laws to NFTs is a challenging task, primarily because NFTs are a novel concept that doesn’t fit neatly into traditional legal categories. Intellectual property rights are at the forefront of legal concerns. When someone purchases an NFT, they acquire a token that represents ownership, but the extent of this ownership is often misunderstood. It rarely includes the right to reproduce or distribute the underlying digital asset, leading to potential legal disputes over copyright infringement and ownership rights.

Consumer protection laws are also critical in the NFT marketplace. These laws are designed to protect buyers from deceptive practices. However, the decentralized and often anonymous nature of blockchain transactions makes the enforcement of such laws challenging. The risk of fraud and misrepresentation is high, and buyers may find themselves with limited recourse in cases of dispute.

The classification of NFTs under financial regulations is another area of legal ambiguity. The structure and nature of certain NFTs might classify them as securities. For example, the US Securities and Exchange Commission charged Stoner Cats 2 for conducting an “unregistered offering of crypto asset securities,” depending on their specific characteristics. This categorization subjects them to stringent regulatory requirements, including registration and disclosure obligations under securities laws. However, the lack of clear guidance from regulatory bodies creates uncertainty for NFT issuers and investors.

NFT Legal Issues: A Detailed Analysis

Legal issues in the NFT space are diverse and multifaceted. Copyright and ownership disputes are common, particularly as the lines between digital ownership and copyright ownership are blurred. These disputes often involve multiple parties, including artists, digital platforms, and collectors, each with differing interpretations of their legal rights.

Smart contracts, which are the backbone of NFT transactions, present their own set of legal challenges. While these contracts are designed to be self-executing and immutable, they are not immune to legal scrutiny. Disputes can arise when the terms encoded in smart contracts conflict with statutory laws or when there are errors in the code. The resolution of such disputes often requires litigation, which can be complex and costly.

Taxation of NFT transactions is an emerging area of legal concern. The tax implications for buying, selling, or creating NFTs are not straightforward, and tax authorities are still determining how to apply existing tax laws to these transactions. This uncertainty complicates financial planning for participants in the NFT market and raises the risk of unintended tax liabilities.

The Evolving Landscape Of NFT Legality

As the NFT market continues to grow, so does the legal framework that surrounds it. Governments and regulatory bodies worldwide are beginning to recognize the need for specific regulations that address the unique aspects of NFTs. These emerging regulations aim to provide clarity and stability to the market, but they also bring new compliance challenges.

The global nature of NFT transactions adds another layer of complexity. NFTs are often bought and sold across international borders, bringing into play different legal jurisdictions and regulatory standards. Harmonizing these diverse legal systems is a daunting task and one that is critical for the development of a cohesive global NFT marketplace.

Legal cases involving NFTs are increasingly making their way through courts, setting important precedents that will influence future legal interpretations and regulations. These cases cover a range of issues, from copyright disputes to the enforceability of smart contracts, and their outcomes will have significant implications for the NFT industry.

In conclusion, the legal challenges surrounding NFTs are as dynamic and multifaceted as the technology itself. From intellectual property concerns to regulatory compliance, the legal aspects of NFTs require careful navigation. As the market evolves, so too will the laws and regulations that govern it, shaping the future of this innovative digital asset class.

The Problem With NFTs

The world of Non-Fungible Tokens (NFTs) is marked not only by innovation and opportunity but also by significant problems that raise concerns and contribute to the question, “Why are NFTs bad?”.

Analyzing More Of The Problem With NFTs

A closer look reveals several underlying problems with NFTs:

- Perceived Value Vs. Real Value: A core problem with NFTs is the disconnect between their perceived and real value. The worth of many NFTs is often driven by hype and speculation rather than tangible artistic or utilitarian value. This discrepancy can lead to a volatile market where prices do not reflect the true value of the underlying digital asset.

- Cultural And Ethical Concerns: The NFT craze has raised cultural and ethical questions. It challenges traditional notions of art ownership and creation, potentially commodifying artistic expression in unprecedented ways.

- Impact On Artistic Integrity: For artists, the lure of NFTs can sometimes lead to a compromise in artistic integrity. The pressure to create content that is more likely to sell in the NFT market can influence artistic decisions, potentially leading to a homogenization of digital art.

- Accessibility And Digital Divide: The NFT ecosystem tends to favor those with access to specific technological resources and knowledge. This digital divide excludes a large segment of potential creators and collectors, particularly those from underprivileged backgrounds or regions with limited access to advanced technology.

Blockchain Legal Issues

Earlier discussions have addressed the legal challenges of blockchain, the underlying technology of NFTs, but further exploration reveals additional nuances worth considering:

- Data Privacy Concerns: Blockchain’s transparency and immutability, while strengths, also raise data privacy concerns. Once on the blockchain, information becomes almost impossible to remove, potentially leading to privacy issues, especially with personal data involved.

- Smart Contract Liabilities: Smart contracts are prone to coding errors or unforeseen legal implications. These liabilities can lead to complex legal scenarios where the responsibilities and liabilities of parties in a blockchain transaction are unclear or disputed.

- Cross-Border Enforcement: Enforcing legal decisions across borders is a significant challenge in blockchain transactions. When a dispute arises, the international and decentralized nature of blockchain makes it difficult to enforce judgments or legal actions.

- Emerging Legal Frameworks: As governments and regulatory bodies start to catch up with blockchain technology, new legal frameworks are emerging. These frameworks aim to address the unique challenges posed by blockchain but also create a shifting legal landscape that can be difficult for participants to navigate.

In conclusion, the problems with NFTs extend beyond simple technical or market issues, encompassing broader cultural, ethical, and legal challenges. As the NFT space matures, addressing these multifaceted problems will be crucial for its sustainable and responsible growth.

FAQ: Why Are NFTs Bad?

This FAQ section aims to succinctly address some key questions surrounding NFTs, especially everything about the questions “why are NFTs bad?”

Why Are NFTs Bad?

Critics often target NFTs for their environmental impact, market volatility, and legal uncertainties. Concerns also include the potential for exacerbating the digital divide. The perspective on whether NFTs are “bad” varies based on individual viewpoints and contexts.

NFT Laws: What Investors Should Know?

Investors should note that the legal framework around NFTs is evolving. Key considerations include copyright and financial regulations, as well as the market’s inherent volatility and potential legal risks.

Are NFTs Unsellable?

Not all NFTs are unsellable, but market saturation and fluctuating values can affect their salability. The speculative nature of the market adds to the uncertainty regarding the sale and value of NFTs.

Are NFTs Bad?

Whether NFTs are “bad” is subjective. While they offer innovative digital asset ownership, their environmental costs, potential for market manipulation, and legal challenges are significant drawbacks.

What Is The Problem With NFTs?

The main issues with NFTs include environmental concerns, market instability, accessibility challenges, and legal ambiguities, highlighting the need for sustainable practices and clear regulations.

What’s The Problem With NFTs?

NFTs face environmental, economic, legal, and ethical challenges, including energy consumption, market fluctuation, and impacts on artistic and cultural values.

Are NFTs Legal?

NFTs are legal, but they operate in a complex regulatory landscape that varies across regions. The legality involves considerations around transactional frameworks and compliance with existing laws.

Featured image from Shutterstock

NFT

Free Web3

Web3 Liberation from Postmodernism’s Stranglehold: The Art Renaissance

By VESA

Postmodernism isn’t just an art issue—it’s everywhere. This single, pervasive philosophy has seeped into big tech, corporations, legislation, media, and nearly every major institution, often strangling genuine creativity, diversity of thought, and depth. For comparison, there are around 200 other philosophies, 4,300 religions, the male perspective, homemaker moms, the working class, the diminishing middle class, the scientific paradigm, and much more that are left out of gallery circles simply because they don’t fit the dominant narrative, which paradoxically claims to be the one that’s repressed. It’s really a luxury belief for the modern aristocracy—a tool for control—and the Marxist roots always emerge when pressure is applied.

Postmodernism’s defining trait is deconstruction, pulling apart concepts and ideals without ever offering a cohesive path forward. It’s a circular maze that keeps doubling back on itself, producing increasingly bizarre conclusions to solve the very problems it creates. Real solutions lie in expanding the field of view beyond this single frame, embracing a diversity of philosophies, religions, and perspectives that have grounded humanity for millennia. The real power of Web3 lies in its ability to do just that: to break art and culture out of this one-note narrative, empowering creators and thinkers alike to explore beyond the limits imposed by postmodernism.

This is what we missed in the first run of NFT’s importing the same postmodern experts from the realm we were trying to break free from. That and some better tech solutions for sustainable art, as some of the falling platforms have showed.

We first had a true avant-garde scene, which was then quickly eroded by the millions upon millions showered on end-stage postmodern expressions, championed by people who either (a) didn’t realize how tired it all was or (b) were heavily financially and ideologically incentivized to support it.

Funny, not funny

Funny, not funny

It turns out that holding contempt for ideas and their significance means that, time and again, the working class ends up being ruled by them. While I understand why this is amusing to some, I see how many are now disillusioned, as the humanities have been overtaken by a single, monolithic ideology. Similarly, the U.S. intelligentsia’s “flyover states” disdain is now facing a reckoning with the MAGA hat in a very different way after 40 years of indulging in postmodern ideas and scorn. The underbelly of the speech in A Bug’s Life is surfacing, too.

You can’t only summarise postmodernism to be woke and Marxist, but you aren’t far off. In case you want to hear the foundations, Steven Hicks has a brilliant analysis and summary of it. You might have to spend 3hrs to save your life & community to get it, so it’s not that long, really ⚡️

Part I – Philosophy foundations

Part II – Relevance now

For five long decades, postmodernism has held art in a chokehold, enforcing its narrow, often cynical, view of reality. Art became a reflection of society’s fragmentation, alienation, and obsession with irony—what I call the “postmodern monolithic rule.” While postmodernism initially sought to challenge established norms, it has since become the new establishment, dictating an increasingly restrictive narrative. The art world under postmodernism has marginalised genuine exploration, profound beauty, and universal human truths.

This is where Web3 steps in, not just as a technological shift but as a liberation front for artistic expression. That was the point. Not just monetising what ever, but to actually set culture free. Web3 allows artists to break out from the centralised grip of traditional galleries and critics, unleashing a decentralized platform where new ideas can flourish – however this means the scene has to support that, instead of the next duck tape banana or drooling ape AI pic.

Through NFTs and blockchain, creators can finally bypass the gatekeepers, reaching audiences directly and letting their art speak unfiltered. It’s the anti-postmodern era we’ve been waiting for—one that values authenticity, courage, and depth over calculated irony and shallow critique. The freedom to explore and create in as vast a way as the internet has already guided us to be for the past twenty years.

What is the Garden of Earthly Delights by Hieronymus Bosch. From paradise to hell, the lesson path is clear in the end stage. These aren’t just imaginative nightmares. They’re warnings about human nature — and what a world without religion is like. Feel familiar a bit? The twet link will explain it further.

Outside the restrictive frame of postmodernism lies a rich expanse of artistic traditions and narratives that we’ve been missing out on. Imagine a return to the timeless pursuits of beauty, harmony, and spirituality, merged with the advancements of digital technology. Art that celebrates connection, transcendence, and human potential. Web3 offers the tools to bring these visions to life, and artists are now free to explore themes of mythology, futurism, abstraction, and even divinity—all without needing to conform to a single ideology. This isn’t just art for art’s sake; it’s art for humanity’s sake, and it’s been a long time coming.

Authenticity as an Artist: From Cave Paintings to the Metaverse

Art isn’t a recent trend—it’s a core aspect of the human journey that dates back to our ancestors painting on cave walls. In today’s world, however, many artists find themselves constrained by expectations to follow specific trends, often losing their authenticity along the way. True artistry isn’t about following popular movements or creating what’s fashionable. It’s about tapping into a lineage of creativity that spans thousands of years, one that includes everything from the first tribal carvings to the masterworks of the Renaissance, all the way to the digital landscapes of the metaverse.

Why did Graham Hancock’s Ancient Apocalypse suddenly get attacked as racist, with Hancock himself labeled a white supremacist, despite his thirty-year marriage to a woman of color and his long-standing praise of ancient cultures worldwide throughout his journalistic career? You guessed it—postmodernism, as the series collapses the narrative. I’ll write more on that later.

Why did Graham Hancock’s Ancient Apocalypse suddenly get attacked as racist, with Hancock himself labeled a white supremacist, despite his thirty-year marriage to a woman of color and his long-standing praise of ancient cultures worldwide throughout his journalistic career? You guessed it—postmodernism, as the series collapses the narrative. I’ll write more on that later.

Inside the art world, for the most part, you might hear of Mayan culture and traditions, but not the parts that contradict postmodern ideas.

Inside the art world, for the most part, you might hear of Mayan culture and traditions, but not the parts that contradict postmodern ideas.

Being an authentic artist means immersing yourself in this vast ocean of history and expression, drawing inspiration from the past and future alike. The beauty of Web3 is that it allows artists to travel across these realms without restriction. The blockchain and NFTs don’t just democratize art; they create a space where we can explore new forms of expression while staying grounded in the wisdom of our creative ancestors. The metaverse, for instance, offers the opportunity to merge the digital with the timeless, creating interactive experiences that honor the depth and spirituality of older art forms while pushing the boundaries of what’s possible.

When you explore the richness of art history, you find yourself standing on the shoulders of giants. Authentic art doesn’t mimic or simply react—it builds bridges. It’s about discovering your voice in this vast chorus and using every tool available, whether it’s oil on canvas, sculpture, or VR. Web3 and the metaverse make this journey even more exhilarating, providing artists with a canvas as expansive as their imaginations. True artists dig deep, break molds, and remind us that art is not bound by time or technology but by a timeless quest for truth.

Imagine the uproar, the fuss and emotional outbursts if there was to be a grand unveiling of an openly conservative gallery?

Imagine the uproar, the fuss and emotional outbursts if there was to be a grand unveiling of an openly conservative gallery?

The Heretical Idea: Curate Your Own Galleries Outside the Establishment

Here’s a heretical idea for cultural curators and artists: Forget trying to break into the art world if you don’t feel represented. Start your own galleries, curate your own shows, and let Web3 be your platform for sharing art on your own terms. It’s cheap to start an online gallery.

Web3 has made this entirely possible. With decentralized platforms, artists can sidestep traditional gatekeepers, reach global audiences, and create communities that appreciate and support their work. Curating your own gallery isn’t just an act of defiance; it’s a celebration of creative freedom. Imagine artists coming together to form collectives that highlight unique styles, new voices, and daring themes that the conventional art world might consider “too much.” With NFTs and blockchain, you have the tools to bring these exhibitions to life without relying on anyone else’s approval.

Curating your own gallery in the Web3 space doesn’t just disrupt the old system; it builds a new one based on collaboration, innovation, and authenticity. This is where real artistic diversity can thrive, unbound by the constraints of a single ideology. Artists can create galleries that reflect their own vision, themes, and messages—whether that’s surrealism, futurism, spiritual exploration, or socio-political commentary. The freedom to shape your own narrative is the most powerful tool artists have, and Web3 is the key to unlocking it. It’s time to stop waiting for permission and start creating spaces that embody the true spirit of art: raw, fearless, and unfiltered.

TDR

Notice that all these artists and collectors below are doing this poll by not making their views public. I’ve been standing up for this, in the free speech spirit, since I came in from 2017, and was put in the web3 Western culture jail for it (mostly) since. Here is an earlier article to prove it.

so, have your postmodernism, it’s fine, I’m not trying to take your voice away from you, but actually deliver on the inclusion promise so everyone can come to play. The virtual is for everyone, not just one dominant ideology that leaves out most of the world.

As for the cover image, I have my reservations about Trump, even if there’s a potential Web3 landslide against the pro-censorship camp led by figures like Kamala. My concerns are less pronounced with Elon Musk, Ron Paul, RFK, Tulsi Gabbard, and increasingly JD Vance after listening to him on Rogan. While most visual artists sat this one out—even in Web3—the comedians have shifted the landscape, outpacing us 6-0 in terms of relevance.

The thing is, even if Trump is guilty of a lot, he and his team of “X-men mutants” have become voices for Bitcoin, free speech, opposition to big pharma, and perhaps even psychedelics, squirrels, and the like. For the first time in my life, a political campaign is actually addressing ideas that interest me. Of course, as I am not a US citizen, you don’t have to worry about my vote even if you absolutely hate everything I just wrote. None the less, this election will greatly influence my life, and it is addressed in the web3 citizen of the world spirit.

Let that sink in,

VESA

Crypto Artist, Speaker, Consultant, Writer

All links to physical, NFTs, and more below

NFT

Magic Eden Expands To Arbitrum With New Gaming NFT Collection

Magic Eden will soon be minting Ubisoft’s upcoming 10,000-piece NFT collection on the Ethereum scaling network Arbitrum to give holders early access to the new game.

Minted on the Ethereum layer-2 scaling network Arbitrum, the new Niji Warrior ID NFTs unlock early access to the top-down shooter, enable participation in the game’s governance model and track player progress.

Magic Eden, Ubisoft Team Up for Captain Laserhawk NFT Launch

According to the official press release, this deal marks Arbitrum’s addition to the Magic Eden NFT marketplace, which had already supported projects from Solana, Bitcoin, Ethereum, Polygon, and Base in the past.

Among the top NFT marketplaces, Magic Eden will be instrumental in serving up distribution and management of NFTs for Captain Laserhawk: The G.A.M.E. It is a leading force in cross-chain compatibility and backs projects with innovative gameplay, further building influence in Web3 gaming.

With the partnership, Magic Eden injects several years of experience in NFT ecosystems into this new agreement with Ubisoft and Arbitrum, offering players a secure and user-friendly way to manage digital assets. The deal also heats up gaming experiences and solidifies the status of Magic Eden as one of the leading driving forces in the fast-changing NFT gaming sector.

The partnership also points toward the modern trend in the adoption of layer-2 solutions for NFT projects, all-inclusive of better scalability and interoperability within the Ethereum ecosystem. Such infrastructure will enable smoother and easier gaming, reaching a wider audience both for game developers and gamers alike.

The name of the game is Captain Laserhawk: The G.A.M.E., and it’s set in a dystopian world inspired by Netflix’s series Captain Laserhawk. The title will also feature various iconic characters from other Ubisoft franchises.

Ubisoft’s Captain Laserhawk: The G.A.M.E. was described at the time as “a transmedia experience” on the foundation of Arbitrum. Holders will be granted Web3 governance over determining the narrative for the game. The game itself comes along with an imminent mint for their Niji Warrior ID NFTs.

Ubisoft maintains that one of the main benefits with NFTs is that holders will have extraordinary voting rights over major governance decisions and, in fact, give the community the power to shape the future of the game.

Ubisoft’s NFTs Coming Soon: Only 10,000 Will Exist

These NFTs are play-to-earn, unlocking rewards for a unique opportunity to be fully involved in the active creation of new content, thus transforming players into co-creators of game development.

This move signifies one of the most major steps Ubisoft has ever taken towards including blockchain and NFTs in gaming. An initiative of this nature by Ubisoft precisely fits into the company’s vision: to offer more immersive experiences through decentralized platforms and increase player engagement.

This new Magic Eden-Ubisoft partnership comes off the heels of a closed beta, which was held in August. Still, hardly any footage has surfaced online because participants reportedly had NDAs. These were preventing them from sharing any details about the game. From the few clips that managed to find their way onto Twitter, the game looks colorful and quick-paced. There are also plenty of tight choke points around which players fight it out.

However, the highly-coveted collection of 10,000 NFTs will be minted in the coming weeks. At the same time, many future minters have secured spots for participation in the beta and completed challenges in Discord. The ID mint represents the final milestone on the road map before the game launches, meaning Captain Laserhawk: The G.A.M.E. is not very far away.

The title represents Ubisoft’s second major blockchain game after its partnership with Magic Eden, aside from Champions Tactics: Grimoria Chronicles. The latter is on the Oasys network but has also similarly minted NFTs on Ethereum. Recently, Champions Tactics conducted a sort of “technical beta” testing ahead of its public launch, which is expected very soon.

The publisher known for titles like Assassin’s Creed and Just Dance has been developing and investing in the crypto space for years. In late 2021, they launched in-game NFTs for their Ghost Recon: Breakpoint game on the Tezos blockchain.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

NFT

Digital Chamber Supports New NFT Legislation Amid Gary Gensler Criticism

The introduction of the New Frontiers in Technology Act (NFT Act) by Congressman Timmons has garnered support from Digital Chamber. This legislative effort marks the first direct address by the US Congress towards the regulatory treatment of non-fungible tokens (NFTs). This is a pivotal moment for the digital asset industry amidst ongoing legal challenges.

Digital Chamber Supports New NFT Act

Following the recent introduction of the NFT Act, Digital Chamber has quickly aligned itself in favor of the proposed legislation. Digital Chamber praised Congressman Timmons’ leadership for spearheading this critical initiative, which seeks to clarify the classification of NFTs amidst increasing legal scrutiny of digital assets.

The Act addresses a variety of use cases for NFTs, ensuring they are treated as consumer goods rather than financial products. This distinction could influence the future regulatory landscape for NFTs.

Additionally, The NFT Act lays a foundational definition of non-fungible tokens and provides protections for what it describes as “covered” NFTs. These include digital works of art, collectibles, and other forms of intellectual property, distinguishing them from financial instruments.

Concurrently, the Act mandates that the Comptroller General of the United States conduct a study on non-fungible digital assets. This study aims to assess the evolving landscape and implications of NFTs.

The legislative clarity will be a step toward safeguarding creators and consumers from the regulatory actions that have recently targeted the industry.

NFT Legal Challenges and Regulatory Scrutiny

The need for the New Frontiers in Technology Act has been underscored by a series of high-profile legal challenges facing the industry. Companies like Dapper Labs and DraftKings have faced lawsuits, with OpenSea receiving a Wells notice from the SEC, signaling potential securities violations.

Additionally, the SEC’s recent actions against Flyfish Club for unregistered NFT sales have provoked criticism from within the agency itself, with Commissioners Peirce and Uyeda dissenting from the decision. They argue that such tokens should not automatically be classified as securities based on their potential for resale at higher values.

The broader digital asset community, including Digital Chamber, has voiced concerns over SEC Chair Gary Gensler’s aggressive regulatory stance. More so, Digital Chamber founder, Perianne Boring, expressed her dissatisfaction with Gary stating,

“SEC Chair Gary Gensler’s unlawful crackdown on #crypto has pushed the industry back by a decade.”

In addition, these accusations of unlawful crackdowns on the crypto and NFT sectors by the SEC chair have led many to speculate about Gensler’s dismissal. Incidents like the recent amendment of original complaint against Binance, further fuel debates over the need for clearer guidelines.

Moreover, these developments come amid reports that all five SEC commissioners will testify before the House Financial Services Committee, an event not seen since 2019. The hearing may include discussions on ETH’s classification as a security.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Ethereum23 hours ago

Ethereum23 hours agoFundraising platform JustGiving accepts over 60 cryptocurrencies including Bitcoin, Ethereum

-

Market19 hours ago

Market19 hours agoSouth Korea Unveils North Korea’s Role in Upbit Hack

-

Market24 hours ago

Market24 hours agoCardano’s Hoskinson Wants Brian Armstrong for US Crypto-Czar

-

Altcoin17 hours ago

Altcoin17 hours agoSui Network Back Online After 2-Hour Outage, Price Slips

-

Market22 hours ago

Market22 hours agoLitecoin (LTC) at a Crossroads: Can It Rebound and Rally?

-

Altcoin16 hours ago

Altcoin16 hours agoDogecoin Whale Accumulation Sparks Optimism, DOGE To Rally 9000% Ahead?

-

Altcoin21 hours ago

Altcoin21 hours agoWhy FLOKI Price Hits 6-Month Peak With 5% Surge?

-

Bitcoin14 hours ago

Bitcoin14 hours agoMarathon Digital Raises $1B to Expand Bitcoin Holdings

✓ Share: