Market

French Startup Mistral AI Hits $6 Billion with $640 Million Raise

Paris-based artificial intelligence startup Mistral AI has raised €600 million (approximately $640 million) in funding, bringing its valuation to $6 billion.

This new funding round marks the largest for a startup developing large-scale general-purpose AI models outside of Silicon Valley. It also provides the French startup with additional resources to compete with Silicon Valley’s leading AI companies.

Mistral AI Triples Valuation with New $640 Million Raise

A recent report reveals Mistral’s latest funding consists of €468 million ($502 million) in equity and €132 million ($141 million) in debt. Existing backers General Catalyst and Lightspeed Venture Partners are among the biggest investors in Mistral’s new Series B funding round. Arthur Mensch, the co-founder and CEO of Mistral AI, expressed his gratitude for this funding round.

“We are grateful to our new and existing investors for their continued confidence and support for our global expansion. This will accelerate our roadmap as we continue to bring frontier AI into everyone’s hands,” he wrote.

Read more: AI in Finance: Top 8 Artificial Intelligence Use Cases for 2024

Devendra Chaplot, a researcher at Mistral AI, also echoes Mensch’s enthusiasm for this funding.

“With a $640 million raise at a $6 billion+ valuation, Mistral AI has grown ~3x in valuation since December and ~25x in the last 12 months!” Chaplot stated.

Meta and Google’s DeepMind alumni co-founded Mistral AI in April 2023. The company aims to create foundational models rivaling today’s best-performing models. These include OpenAI’s GPT-4, Anthropic’s Claude 3, and Meta’s Llama 3.

Mistral AI has released several models, such as Mistral 7B, Mistral 8x7B, and Mistral 8x22B. The company offers these under an open-source Apache 2.0 license. This license allows unrestricted use and reproduction, provided there’s proper attribution.

The company’s most advanced offerings, like Mistral Large, are proprietary. They are intended to be repackaged as API-first products. Companies can use Mistral Large through an API that they’ll have to pay for according to their usage.

The company also offers a free chat assistant called Le Chat. Meanwhile, Codestral, its first generative AI model for coding, has a restrictive license.

In June 2023, Mistral AI secured €105 million ($113 million) from a founding round led by Lightspeed Venture Partners. This achievement is particularly noteworthy, considering the funding was secured shortly after the company’s launch. Jean-Nöel Barrot, the former minister in charge of digital transition and telecommunications in France, acknowledged Mistral AI’s achievement.

“Congratulations to the startup Mistral AI which raises €105 million only one month after its creation: a record!” Barrot said.

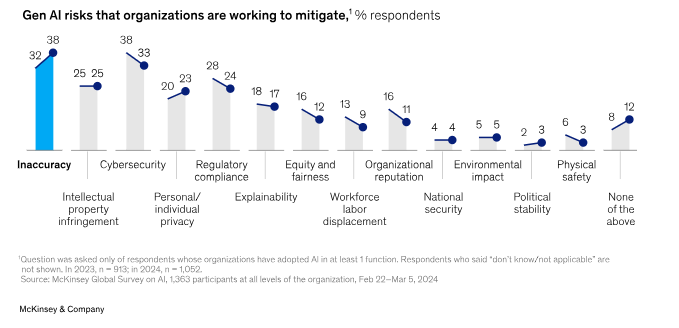

Investors Bullish on AI Growth Despite Recognized Risks

Investors’ confidence in generative AI startups like Mistral AI is plausible. A recent survey from McKinsey shows that 67% of the respondents expect their organizations to invest more in AI over the next three years.

Despite the potential, the survey noted that while businesses begin to see the benefits of generative AI, they also recognize the diverse risks associated with the technology. These can range from data management risks such as data privacy, bias, or intellectual property (IP) infringement to model management risks, which tend to focus on inaccurate output or lack of explainability.

Read more: How Will Artificial Intelligence (AI) Transform Crypto?

However, KPMG experts believe blockchain technology could solve companies’ challenges in safeguarding their IP and avoiding infringement. Blockchain technology could offer a secure and immutable way to track and manage IP, ensuring attribution and potential royalties for reused content and reducing the risk of IP misappropriation.

For instance, a company could store its IP as non-fungible tokens (NFTs) with embedded smart contracts on a blockchain, specifying the terms of use for generative AI. This approach could help prevent unauthorized use of proprietary data and ensure proper credit or compensation. Ultimately, it can help companies leverage artificial intelligence’s benefits while mitigating risks associated with IP protection and legal challenges.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pi Network Roadmap Frustrates Users Over Missing Timeline

Pi Network released its Mainnet Migration Roadmap today. The roadmap lays out a three‑phase plan to move tens of millions of Pioneers who are still waiting to be moved to the open network. It also introduces new rewards, such as referral bonuses.

However, unlike most project roadmaps, Pi network didn’t provide any estimated date or timeline. This lack of clarification has frustrated early adopters who still await key rewards and clarity on rollout pacing.

Pi Network’s Three‑Phase Migration Plan

According to the roadmap, Pi Network will first complete initial migrations for Pioneers already in the queue. This batch covers verified base mining rewards, Security Circle contributions, lockup commitments, utility‑app usage rewards, and confirmed Node rewards for some operators.

After clearing the first wave, the team will tackle second migrations, adding all referral mining bonuses linked to KYC‑verified team members. Pi says these referral rewards will follow once the current queue finishes.

Finally, the network will move into ongoing periodic migrations—potentially monthly or quarterly—to process any remaining bonuses and rewards.

The cadence “is to be determined,” the roadmap notes.

Community Concerns and Critical Gaps

A thorough observation reveals several gaps and potential concerns in the roadmap.

For one, the plan never discloses how many Pioneers remain in the queue or the network’s daily migration capacity. Without those figures, users can’t predict when their own migration will occur.

Node operators report that some “confirmed Node rewards” have landed, but criteria for qualification remain opaque. Early node runners worry they may miss out without clear benchmarks.

Many Pioneers say they have tapped their claim buttons daily since migration opened yet still lack basic mining rewards. They question whether those base rewards and deferred referral bonuses will ever arrive in phase two.

Also, the roadmap admits the UI’s “Transferable Balance” underestimates actual migrated amounts to save resources. Users fear this pessimistic display could erode trust if their true balances remain hidden.

“I thought we were mining all of these PI coins this whole time? I thought the security circles were the Consensus Mechanism. It kinda seems to me like there isn’t a blockchain, and never was one. What kind of “Blockchain protocol” would “Require” all tokens to be minted at genesis?” one community member wrote.

Crucially, Pi offers no audit or error‑resolution process for users who spot mismatches in their historical mining data.

Given six years of complex records, occasional disputes seem inevitable, but the roadmap remains silent on redress.

All migrations hinge on KYC completion, yet the team omits any scaling targets or timelines for identity verification. A bottleneck here could stall every subsequent phase.

The schedule also ignores how major token unlock events—such as the roughly 108.9 million PI tokens due to release this month—will align with migration waves.

Finally, some Pioneers challenge the project’s foundational narrative. They note that Pi’s statement “all tokens were minted at genesis” contradicts six years of “mining.”

This raises doubts about whether Pi ever operated on a true blockchain protocol.

In the past month, PI price has dipped by over 45%. To sustain momentum and community trust, the team must now supply concrete timelines, transparent criteria, and clear audit paths for its Mainnet migration.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

MEME Rallies 73%, BONE Follows

The meme coin market is experiencing a surge in investor interest, helping certain tokens recover from their all-time lows (ATLs). Memecoin (MEME) is one such token that has avoided a new ATL and also posted a significant 73% rise.

BeInCrypto has analyzed two other meme coins that have performed well over the past day, making them important tokens to watch.

Memecoin (MEME)

- Launch Date – November 2023

- Total Circulating Supply – 43.11 Billion MEME

- Maximum Supply – 69 Billion MEME

- Fully Diluted Valuation (FDV) – $135.37 Million

MEME had a rough week, hitting a new all-time low at $0.00137. However, the altcoin rebounded sharply, rising by 38% in the last 24 hours to trade at $0.00196. This surge marks a significant recovery, driven by renewed interest in meme coins.

The recent surge in MEME’s price was fueled by a sudden spike in interest for joke tokens, driving a 73% intraday high. To maintain its gains, MEME must successfully breach and flip the $0.00228 resistance into support, a critical level for sustaining its upward momentum.

If MEME experiences profit-taking from investors, it could reverse course and drop back down to the all-time low of $0.00137. A decline through this level would invalidate the bullish outlook and signal further challenges for the meme coin.

Bone ShibaSwap (BONE)

- Launch Date – July 2021

- Total Circulating Supply – 249.89 Million BONE

- Maximum Supply – 250 Million BONE

- Fully Diluted Valuation (FDV) – $71.67 Million

BONE posted an impressive 18.5% rise over the last 24 hours, trading at $0.285. The altcoin is currently under the key resistance of $0.295. Given the recent momentum, it seems poised to breach this level, signaling a potential upward trajectory for the token in the near future.

Flipping the $0.295 resistance into support would open the door for BONE to target its next major resistance at $0.348. A sustained push above this level could drive further bullish sentiment, propelling the token toward even higher price levels.

However, if BONE fails to breach $0.295, the bullish momentum could fade. A decline from this point could send the meme coin back towards $0.232, invalidating the optimistic outlook. Such a reversal would likely create caution among investors, delaying potential upward movement.

- Launch Date – April 2024

- Total Circulating Supply – 999.96 Million BAN

- Maximum Supply – 1 Billion BAN

- Fully Diluted Valuation (FDV) – $40.54 Million

BAN, a small-cap token, has caught the attention of investors, rising nearly 25% in the last 24 hours to trade at $0.040. This surge highlights the growing interest in the meme coin market, with BAN standing out despite its smaller market capitalization.

Inspired by the infamous banana taped to a wall, BAN gained significant fame after being purchased by Tron’s founder, Justin Sun, for $6.2 million last year. If the token continues its upward momentum, it could breach the $0.045 barrier and potentially flip it into support, securing its gains.

However, failing to break through the $0.045 resistance could lead to a drop back to $0.032. If this occurs, it would invalidate the bullish outlook and erase the recent gains, putting investors on alert for further price declines.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

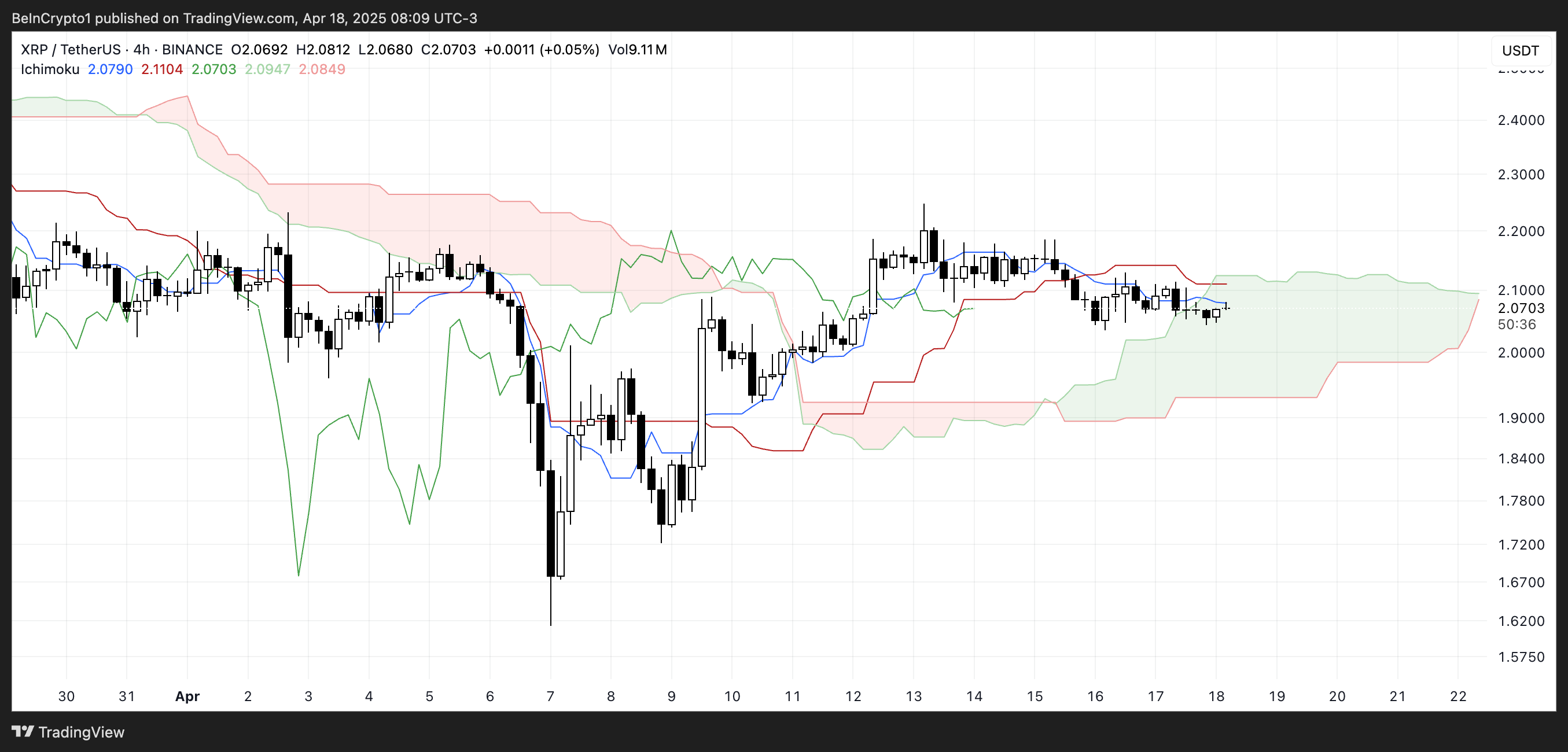

XRP Volume Plunges 20% Amid Market Uncertainty

XRP is currently showing signs of indecision, trading sideways with limited momentum as traders await a clearer signal. Over the past 24 hours, XRP’s trading volume has dropped by 20.37%, now sitting at $2.4 billion—a decline that reflects cooling interest in the short term.

Technical indicators like the RSI and Ichimoku Cloud suggest a neutral trend, with no strong bullish or bearish dominance in play. Price action remains confined between key support and resistance levels, leaving the next breakout direction still uncertain.

Neutral RSI Reading Suggests Caution for XRP Traders

XRP’s Relative Strength Index (RSI) is currently sitting at 46.82, signaling neutral momentum in the market. This neutral zone has persisted since April 7, with no significant shifts into either overbought or oversold territory.

Notably, the RSI was at 57.30 just three days ago, indicating that XRP has experienced a recent decline in buying pressure.

The drop suggests cooling interest or a possible shift in sentiment among traders, as the asset now hovers closer to the midpoint of the RSI scale.

The RSI is a momentum oscillator that measures the speed and magnitude of recent price changes, typically on a scale from 0 to 100.

Readings above 70 often suggest an asset is overbought and could be due for a pullback, while readings below 30 indicate it may be oversold and potentially poised for a bounce. With XRP now at 46.82, the asset is neither overbought nor oversold, implying indecision in the market.

This level, combined with the recent dip from 57.30, may signal growing caution or weakening bullish momentum. It could potentially point to a consolidation phase or slight downward pressure in the short term unless buyers re-enter with conviction.

Ichimoku Indicators Show Indecision in XRP’s Price Action

XRP is currently trading inside the Ichimoku Cloud, reflecting a state of indecision or consolidation.

The Tenkan-sen (blue line) and Kijun-sen (red line) are flat and closely aligned, suggesting weak momentum and a lack of short-term trend direction.

The Senkou Span A and B (the cloud boundaries) are relatively flat as well, which typically indicates that the market is in equilibrium without strong pressure from either buyers or sellers.

The Ichimoku Cloud, or Kumo, helps visualize support, resistance, and trend direction at a glance. When the price is above the cloud, the trend is considered bullish; below it, bearish.

Inside the cloud, as XRP currently is, the trend is neutral, and volatility often contracts. The flatness of the cloud’s leading edges implies a consolidation phase, and the fact that price is not breaking clearly above or below the cloud reinforces the idea of market uncertainty.

For now, the lack of a decisive breakout suggests XRP could remain range-bound until a stronger trend develops.

$2.03 Support and $2.09 Resistance Hold the Key to XRP’s Next Move

XRP price is currently trading within a narrow consolidation range, with key support at $2.03 and resistance at $2.09.

The price action has been relatively muted, but the EMA lines are starting to show signs of potential weakness, as a death cross—where the short-term EMA crosses below the long-term EMA—appears to be forming.

If this bearish crossover confirms and XRP breaks below the $2.03 support, a move down to $1.96 becomes increasingly likely.

A strong continuation of the downtrend could trigger a steeper drop. It could potentially drive the price as low as $1.61 if selling pressure accelerates.

However, there’s still a bullish scenario on the table. If buyers manage to push XRP above the $2.09 resistance, it could open the door for a retest of the $2.17 and $2.35 levels.

This would indicate renewed strength and a shift in momentum in favor of the bulls. Should the rally gain traction beyond these levels, XRP could make a run toward $2.50, marking a significant recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum Investors Suffer More Losses Than Bitcoin Amid Ongoing Market Turmoil

-

Altcoin23 hours ago

Altcoin23 hours agoDogecoin Price Breakout in view as Analyst Predicts $5.6 high

-

Ethereum16 hours ago

Ethereum16 hours agoEthereum Fee Plunges To 5-Year Low—Is This A Bottom Signal?

-

Altcoin22 hours ago

Altcoin22 hours agoTron Founder Justin Sun Reveals Plan To HODL Ethereum Despite Price Drop

-

Market19 hours ago

Market19 hours agoEthereum Price Fights for Momentum—Traders Watch Key Resistance

-

Altcoin19 hours ago

Altcoin19 hours agoExpert Predicts Pi Network Price Volatility After Shady Activity On Banxa

-

Market17 hours ago

Market17 hours agoIs XRP’s Low Price Part of Ripple’s Long-Term Growth Strategy?

-

Market23 hours ago

Market23 hours agoHedera Struggles Under $0.17 Despite Strong Support