Market

Blood In The Water? Ethereum Whales Circle As Price Drops

Ethereum (ETH), the world’s second-largest cryptocurrency by market capitalization, has created a perplexing scenario for investors recently. Despite a noticeable decline in its price, on-chain data reveals that large investors, often referred to as “whales,” are accumulating ETH. This could signal a potential buying opportunity, though technical indicators suggest a weakening uptrend, leaving Ethereum’s near-term future uncertain.

Related Reading: Solana Searching For Direction: Will SOL Break Free Or Fall Flat?

Ethereum Whales See Opportunity In Price Dip

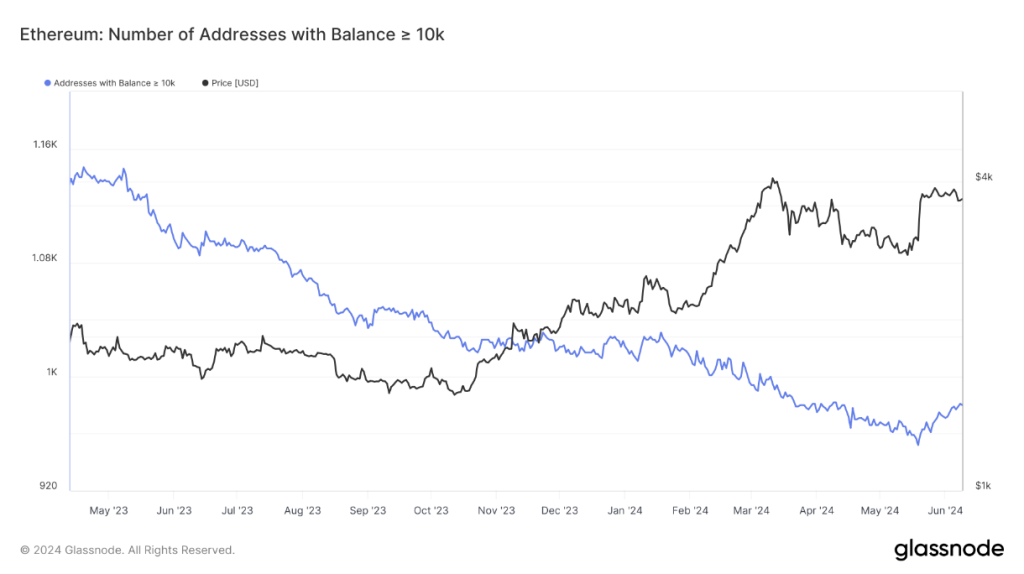

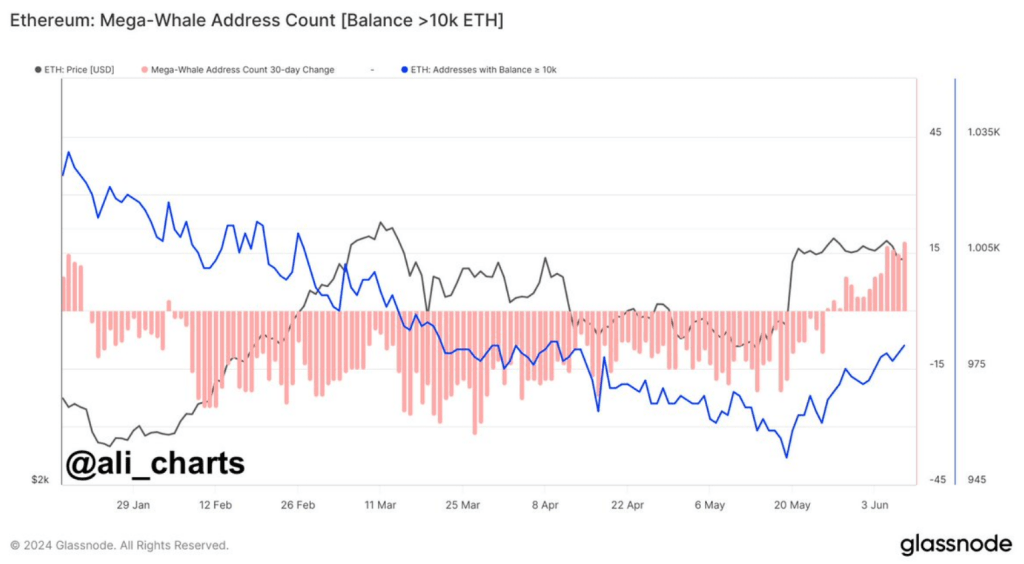

In recent analysis by NewsBTC, it was revealed that wallets holding over 10,000 ETH have been steadily acquiring more tokens since the end of May. This period of accumulation, based on Glassnode data, coincides with a drop in Ethereum’s price from around $3,074 to its current price of $3,670. The significant increase in holdings by these large investors suggests that they see the current price decline as an attractive entry point, anticipating a future price rise.

Adding to the bullish sentiment, CryptoQuant’s Netflow data for Ethereum has shown a dominance of negative flows in recent weeks. This means more ETH is leaving exchanges than entering them, a traditional indicator that investors are holding onto their ETH rather than selling it. This behavior can reduce the available supply on the market, potentially pushing prices up in the long run.

Related Reading: $2 Billion Crypto Funds Flow Into Market On Rate Cut Buzz

Technical Indicators Raise Red Flags

Despite the optimistic signs from whale accumulation and exchange outflows, technical indicators paint a less rosy picture. Ethereum has been trading in a narrow range around $3,600 for the past three days, showing a slight decline of approximately 0.8% today. While the Relative Strength Index (RSI) remains above 50, indicating a slight uptrend, it is currently on a downward trajectory. If this trend continues and the RSI falls below the neutral line, it could suggest a potential price dip.

The number of #Ethereum addresses holding 10,000+ $ETH has increased by 3% in the last three weeks, signaling an important spike in buying pressure! pic.twitter.com/7qq5HgGP37

— Ali (@ali_charts) June 9, 2024

The RSI’s downward movement indicates weakening momentum, which, if not reversed, might lead to further declines in Ethereum’s price. This bearish technical outlook contrasts sharply with the positive on-chain data, creating a complex situation for investors trying to predict the market’s next move.

Market Awaits A Significant Catalyst

The near-term future of Ethereum appears to hinge on the emergence of a significant catalyst. Broader market sentiment could play a crucial role, with a positive shift potentially reigniting the uptrend. Additionally, upcoming news or developments specific to the Ethereum network could also serve as a catalyst for price movement. Successful upgrades or increased adoption of decentralized applications (dApps) built on the Ethereum blockchain could trigger renewed investor interest and drive prices higher.

Featured image from Harbor Breeze Cruises, chart from TradingView

Market

WisdomTree Europe Launches XRP ETP

ETF issuer WisdomTree’s European division just announced a new ETP based on XRP. This product is currently available in four EU countries, which has led XRP’s price to jump slightly.

ETPs are a common issuer strategy to earn revenue without ETF approval, but Europe will not necessarily approve one even if the US does so.

WisdomTree’s XRP ETP

WisdomTree, one of the Bitcoin ETF issuers in the US, announced that its European branch is offering an exchange-traded product (ETP) based on XRP. This new product is currently available in Germany, Switzerland, France, and the Netherlands. A growing number of issuers have filed for an XRP ETF, but WisdomTree is taking a slightly different tack.

“The WisdomTree Physical XRP ETP offers a simple, secure, and low-cost way to gain exposure to XRP, one of the largest cryptocurrencies by market capitalization. Backed 100% by XRP, XRPW is the lowest-priced XRP ETP in Europe, providing direct spot price exposure,” the announcement claimed.

The possibility of an official XRP ETF is growing with the current bull market, and Ripple CEO Brad Garlinghouse considers it “inevitable.” Still, it hasn’t happened yet, and ETP offerings allow issuers to somewhat address customers’ requirements. BitWise, which has also filed for an XRP ETF in the US, recently acquired a European ETP issuer to enter the same market.

WisdomTree, however, is no stranger to this market strategy. In May this year, it won approval to offer ETPs based on Bitcoin and Ethereum to British investors.

The UK has not yet approved a full ETF for either of these assets, but WisdomTree still gained market access. Even a fraction of the XRP market could also prove lucrative; the asset’s value spiked today.

WisdomTree Europe’s strategy page does not describe any further actions upon full approval. Even if the US approves an XRP ETF under the SEC’s new leadership, that won’t necessarily benefit WisdomTree’s European branch. For now, these ETPs built on XRP will have to suffice for this market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Rallies 10% and Targets More Upside

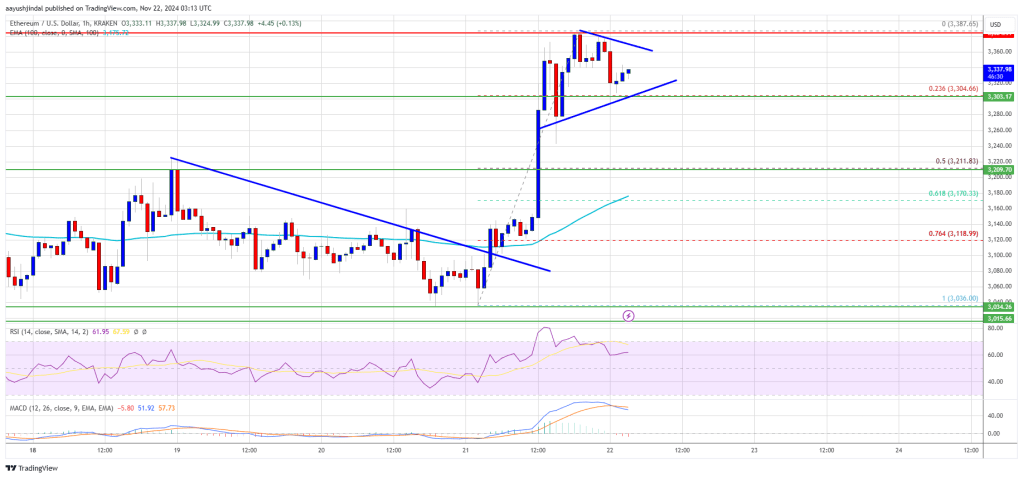

Ethereum price started a fresh increase above the $3,220 zone. ETH is rising and aiming for more gains above the $3,350 resistance.

- Ethereum started a fresh increase above the $3,220 and $3,300 levels.

- The price is trading above $3,250 and the 100-hourly Simple Moving Average.

- There is a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could gain bullish momentum if it clears the $3,385 resistance zone.

Ethereum Price Regains Traction

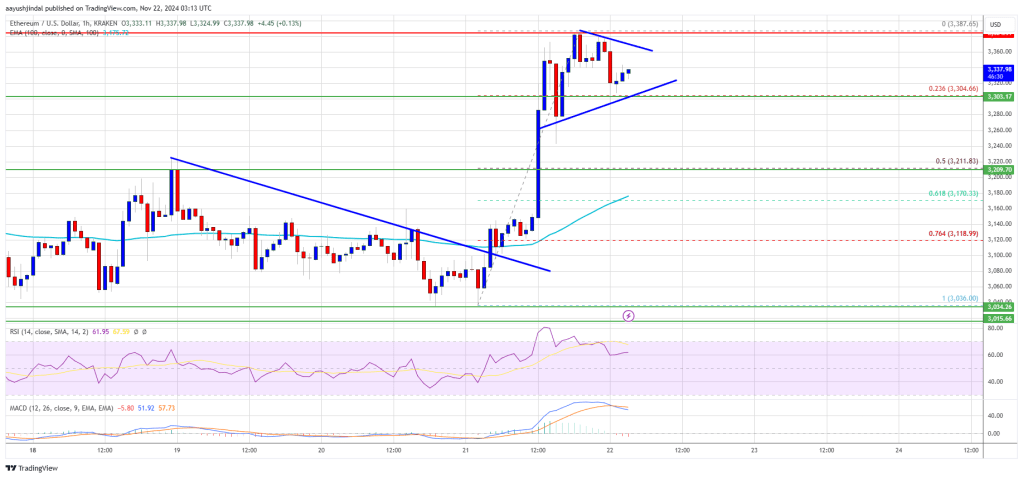

Ethereum price remained supported above $3,000 and started a fresh increase like Bitcoin. ETH gained pace for a move above the $3,150 and $3,220 resistance levels.

The bulls pumped the price above the $3,300 level. It gained over 10% and traded as high as $3,387. It is now consolidating gains above the 23.6% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high.

Ethereum price is now trading above $3,220 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,350 level. There is also a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD.

The first major resistance is near the $3,385 level. The main resistance is now forming near $3,420. A clear move above the $3,420 resistance might send the price toward the $3,550 resistance. An upside break above the $3,550 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,650 resistance zone or even $3,880.

Another Decline In ETH?

If Ethereum fails to clear the $3,350 resistance, it could start another decline. Initial support on the downside is near the $3,300 level. The first major support sits near the $3,250 zone.

A clear move below the $3,250 support might push the price toward $3,220 or the 50% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high. Any more losses might send the price toward the $3,150 support level in the near term. The next key support sits at $3,050.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,250

Major Resistance Level – $3,385

Market

Rallies 10% and Targets More Upside

Ethereum price started a fresh increase above the $3,220 zone. ETH is rising and aiming for more gains above the $3,350 resistance.

- Ethereum started a fresh increase above the $3,220 and $3,300 levels.

- The price is trading above $3,250 and the 100-hourly Simple Moving Average.

- There is a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could gain bullish momentum if it clears the $3,385 resistance zone.

Ethereum Price Regains Traction

Ethereum price remained supported above $3,000 and started a fresh increase like Bitcoin. ETH gained pace for a move above the $3,150 and $3,220 resistance levels.

The bulls pumped the price above the $3,300 level. It gained over 10% and traded as high as $3,387. It is now consolidating gains above the 23.6% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high.

Ethereum price is now trading above $3,220 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,350 level. There is also a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD.

The first major resistance is near the $3,385 level. The main resistance is now forming near $3,420. A clear move above the $3,420 resistance might send the price toward the $3,550 resistance. An upside break above the $3,550 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,650 resistance zone or even $3,880.

Another Decline In ETH?

If Ethereum fails to clear the $3,350 resistance, it could start another decline. Initial support on the downside is near the $3,300 level. The first major support sits near the $3,250 zone.

A clear move below the $3,250 support might push the price toward $3,220 or the 50% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high. Any more losses might send the price toward the $3,150 support level in the near term. The next key support sits at $3,050.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,250

Major Resistance Level – $3,385

-

Ethereum23 hours ago

Ethereum23 hours agoFundraising platform JustGiving accepts over 60 cryptocurrencies including Bitcoin, Ethereum

-

Market24 hours ago

Market24 hours agoCardano’s Hoskinson Wants Brian Armstrong for US Crypto-Czar

-

Market19 hours ago

Market19 hours agoSouth Korea Unveils North Korea’s Role in Upbit Hack

-

Market14 hours ago

Market14 hours agoETH/BTC Ratio Plummets to 42-Month Low Amid Bitcoin Surge

-

Altcoin17 hours ago

Altcoin17 hours agoSui Network Back Online After 2-Hour Outage, Price Slips

-

Market22 hours ago

Market22 hours agoLitecoin (LTC) at a Crossroads: Can It Rebound and Rally?

-

Altcoin16 hours ago

Altcoin16 hours agoDogecoin Whale Accumulation Sparks Optimism, DOGE To Rally 9000% Ahead?

-

Altcoin21 hours ago

Altcoin21 hours agoWhy FLOKI Price Hits 6-Month Peak With 5% Surge?