Altcoin

Aevo Unveils The Debut Of AZUR Pre-Launch Contract, What’s Next?

In the ever-evolving landscape of blockchain technology and decentralized finance, Aevo emerges as a trailblazer with the introduction of its AZUR Pre-Launch Contract. Aevo, renowned for its innovative solutions in the blockchain industry, has captured the attention of enthusiasts and experts alike with this latest unveiling.

The AZUR Pre-Launch Contract stands as a testament to Aevo’s commitment to pushing the boundaries of decentralized finance, offering a new paradigm for pre-launch initiatives. As the crypto community eagerly anticipates the unfolding of this milestone, it’s imperative to delve into the intricacies of this development and explore the implications it holds for the future of decentralized finance.

Introduction to AZUR Pre-Launch Contract

At the core of Aevo’s groundbreaking offering lies the AZUR Pre-Launch Contract, a revolutionary mechanism designed to redefine pre-launch trading in the blockchain sphere. As the world’s first high-performance decentralized options exchange, Aevo provides users with an Over-the-Counter (OTC) service for pre-market trading of $AZUR tokens. This innovative approach empowers buyers and sellers to engage in transactions at desired prices and liquidity levels before the official launch of $AZUR.

The recent announcement of the AZUR Pre-Launch contract on the X platform has generated significant excitement within the crypto community. With the opportunity to trade $AZUR tokens ahead of the highly-anticipated Azuro token launch, users can now access a new avenue for participating in the burgeoning decentralized finance ecosystem.

With a maximum supply of 1 billion $AZUR tokens, Aevo further enhances the appeal by integrating $AZUR into its Airdrops program, fostering greater engagement and participation among users. For those eager to explore the possibilities of pre-market trading, Aevo provides a seamless experience through its platform, inviting users to embark on a journey of innovation and opportunity.

Also Read: Solana Set For v1.18.15 Mainnet Upgrade, SOL Price Rally to $250 Ahead?

Aevo’s Market Analysis and Community Speculation

As the crypto market reacts to Aevo’s latest development, market analysts and enthusiasts alike are closely monitoring the implications for Aevo’s native token, AEVO. At present, the price of Aevo (AEVO) stands at $0.761, accompanied by a 24-hour trading volume of $58,947,712.82. Despite a recent -3.87% price decline in the last 24 hours and a -23.85% price decline over the past 7 days, Aevo remains a focal point of discussion within the crypto community.

With a circulating supply of 840 million AEVO tokens, Aevo commands a market cap of $638,266,057, underscoring its position as a prominent player in the blockchain industry. Amidst market fluctuations and speculative activity, Paxton, an Alt trader, offers insights into the potential trajectory of AEVO’s price action.

According to Paxton’s analysis, AEVO appears to be “catching its breath” following a token unlock sprint, signaling a momentary pause amidst a larger journey. Paxton’s optimistic outlook suggests that the current dip may present an opportune moment for investors, with bullish sentiments eyeing price targets of $1.9 and even $3.6 as the next milestones on Aevo’s upward trajectory.

Also Read: How Bitcoin Will Benefit From End Of US-Saudi Petrodollar Deal

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

DOGE Price To Hit $2.4 As Elon Musk Shares New Update On D.O.G.E.

DOGE price eyes a potential breakout ahead, with top experts echoing a similar sentiment for the dog-themed meme coin. For context, in a recent X post, Real Vision CEO and Founder Raoul Pal said that Dogecoin is likely gearing up for a rally ahead. In addition, this development also comes as Elon Musk has shared new developments to enhance the efficacy of the Department of Government Efficiency (D.O.G.E.)

DOGE Price Rallies As Elon Musk Prioritizes D.O.G.E. Efficacy

DOGE price continued its run towards the north on Friday, further highlighting the growing confidence of the investors towards the top meme coins. Amid this, Real Vision founder Raoul Pal, a prominent figure in the crypto world, predicts a potential rally for Dogecoin ahead, saying that it is in the “Great Banana Rotation” along with SUI. In a recent X post, Pal stated:

I think next in the Great Banana Rotation is $SUI and $DOGE and probably that token that you hold too.

Meanwhile, Pal previously explained the Banana Zone, emphasizing the importance of core allocations in top-tier assets like BTC, ETH, and SOL. He advises investors to keep 90% of their portfolio in solid assets like BTC and top altcoins while allowing 10% for riskier plays like meme coins.

However, Pal warns against overtrading and leverage, stressing the need to protect investments. With Pal’s prediction, DOGE holders are optimistic about the meme coin’s future performance.

Elon Musk Outlines D.O.G.E. Plan

In addition, the DOGE price rally also comes as Elon Musk has prioritized enhancing the efficacy of the Department of Government Efficiency (D.O.G.E.). Notably, Donald Trump appointed Elon Musk and Vivek Ramaswamy to lead the D.O.G.E., which has sparked optimism in the market.

Besides, the department’s short form also resembles the Dogecoin ticker, which has also sparked a rally in the crypto’s price. Additionally, Musk has been a vocal supporter of the meme coin, as evidenced by his previous social media comments, which have also caught the eyes of the traders.

Now, Musk and Ramaswamy have outlined plans to increase the efficacy of the department. According to a recent WSJ report, they have planned to end the remote work culture at the federal office, in an effort to trim the government spending. The two entrepreneurs said that ending the remote work culture would cause a mass resignation, which would aid them in achieving their goal of establishing a small but efficient government.

Dogecoin To Hit $2.4?

DOGE price today was up more than 2% and exchanged hands at $0.3941, while its one-day trading volume was near the flatline at $8.60 billion. Notably, the token has touched a 24-hour high of $0.3996, and CoinGlass data showed that Dogecoin Futures Open Interest rose nearly 9%, indicating strong market confidence.

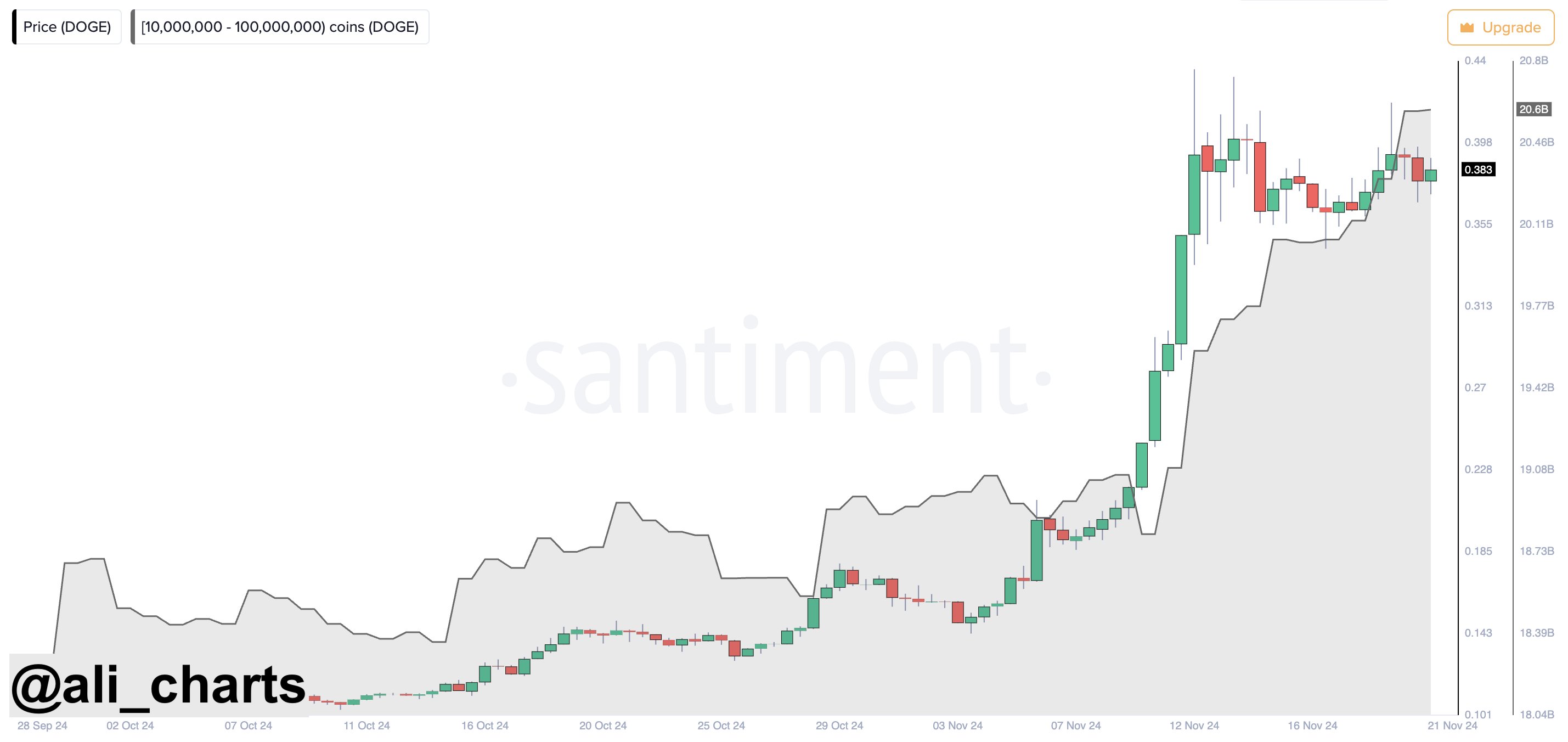

Besides, recent on-chain metrics and other market trends also indicate that Dogecoin is poised to continue its parabolic run ahead alongside SHIB and other meme coins. Amid this, a popular crypto market analyst, Ali Martinez has shared a bullish forecast for DOGE price.

Meanwhile, Martinez has recently highlighted the growing Dogecoin whale activity, which indicates that the crypto is poised to rally ahead. His X post showed that whales have bagged more than 550 million DOGE over the last week, valued at around $214.5 million.

In addition, the analyst has shared a DOGE price chart, which showed that the crypto is likely to hit $2.40 in the coming days. Besides, he also predicted that once the meme coin hits the $2.40 target, the next target for the crypto will be $18, sparking market optimism.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Deribit To Integrate Ethena USDe As Crypto Margin Collateral

The largest crypto derivatives exchange Deribit on Friday said it will integrate Ethena’s synthetic dollar USDe as margin collateral. It will enable users to earn rewards for holding USDe and use it as derivatives margin collateral in cross-collateral pool.

Ethena and Deribit Partners to Launch USDe as Rewarding Margin Collateral

Deribit, the leading crypto options and futures exchange, plans to integrate Ethena’s USDe as margin collateral. The exchange revealed that the goal is to include USDe in its cross-collateral pool as of early January. However, it still awaits regulatory approval from the authorities

“We are excited to announce the upcoming integration of USDe as rewarding margin collateral on Deribit” said Ethena Labs.

All users can earn rewards for holding USDe. Also, it can be used as derivatives margin collateral in a cross collateral pool. USDe as margin collateral is currently available on Bybit, Bitget and Gate crypto exchanges. Users can use USDe as a part of single or multi-exchange derivatives strategies, while earning rewards by holding the synthetic dollar.

Guy Young, founder of Ethena Labs, said: “This integration of USDe within the cross collateral pool at unlocks completely new structured product use cases not previously possible on CEXs with vanilla stablecoin collateral.”

Young expects this will become one of the most important venues for USDe use cases as Deribit holds 85% of market share within the options space. Also, he believes the USDe integration on the derivatives exchange will attract both TradFi and crypto-native trading firms.

ENA Price Rockets 20%

Amid Deribit’s USDe integration news, ENA price skyrocketed more than 20% in the past 24 hours. The price currently trades at $0.62, with a 24-hour low and high of $0.516 and $0.620, respectively. Furthermore, the trading volume has shot up by 78% in the last 24 hours, indicating a rise in interest among traders.

Last month, Ethena proposed adding Solana and its liquid staked variants (BNSOL and bbSOL) as reserve assets for backing USDe. Recently, the company integrated sUSDe into Aave to enable billions of borrowing and APY of up to 30%.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

3 Reasons Why Secret Network (SCRT) Price Skyrockets 50% Today

Secret Network (SCRT) saw a remarkable 50% price rise today, driven by three key developments. The network’s inclusion in NVIDIA Inception, a program supporting innovative tech startups, signals growing confidence in its privacy-focused solutions.

Additionally, Binance’s SCRT perpetual contracts launch with high leverage has boosted market activity. Coupled with a dramatic rise in open interest across major exchanges, these factors are fueling increased investor interest and pushing SCRT to new highs.

Secret Network Joins NVIDIA Inception

Secret Network joined NVIDIA Inception, a program designed to support tech startups advancing AI and blockchain innovations. This collaboration provides the platform with access to AI training, expert resources, and venture networks, boosting its development capabilities.

The partnership enhances Secret Network’s Decentralized Confidential Computing (DeCC) solutions, enabling new privacy tools for Web3 applications. Lisa Loud, Executive Director, emphasized that this initiative will revolutionize how sensitive data is handled in blockchain environments.

Binance Launches SCRT Perpetual Contracts

Binance, one of the world’s top cryptocurrency exchanges, introduced USD-margined Secret Network perpetual contracts with up to 75x leverage. The listing on Binance had an immediate effect, with SCRT’s price soaring 55% as Binance extended its support. This surge highlights growing investor interest, raising questions about whether the rally will be sustained.

Moreover, this move boosts liquidity and builds investor confidence, enhancing Secret’s appeal in the market. As trading activity intensifies on Binance, SCRT adoption continues to grow.

Open Interest Jumps 1300%, Fueling SCRT Price Surge

Secret Network (SCRT) saw an impressive 1300% increase in open interest over the past 24 hours, according to Coinglass data, signaling heightened market activity. On Binance, open interest surged by over 905%, with other major exchanges like Bitget and Kraken also showing significant interest. This surge in demand has propelled SCRT’s price to new highs.

Moreover, SCRT is currently trading at $0.4765, up 50% in the last 24 hours and 134% over the past week. With a 24-hour low of $0.3313 and a high of $0.5488, along with a market cap of $138 million and $107 million in volume, the coin shows strong potential for continued growth.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Regulation19 hours ago

Regulation19 hours agoUK to unveil crypto and stablecoin regulatory framework early next year

-

Market21 hours ago

Market21 hours agoWhy SUI Network Outage Did Not Cause a Price Crash

-

Market20 hours ago

Market20 hours agoCardano (ADA) Price Hits 41% Weekly Growth, $1 Target in Sight

-

Market18 hours ago

Market18 hours agoTrump Media Files Trademark for Crypto Platform TruthFi

-

Market23 hours ago

Market23 hours agoSEC Moves Toward Solana ETF Approval Amid Pro-Crypto Shift

-

Market16 hours ago

Market16 hours agoGOAT Price Sees Slower Growth After Reaching $1B Market Cap

-

Market22 hours ago

Market22 hours agoAptos Partners with Circle and Stripe to Revitalize Network

-

Altcoin16 hours ago

Dogecoin Code Appears In CyberTruck And Model 3 Website, Will Tesla Accept DOGE Payments For Cars Soon?

✓ Share: