Bitcoin

$500 Million in Bitcoin Open Interest Erased After US Jobs Report

The recent US jobs report has significantly impacted the cryptocurrency market, wiping out over $500 million in Bitcoin open interest.

This drastic market movement comes after mixed signals from the latest employment data.

US Jobs Report Slashes Bitcoin Open Interest

The US Bureau of Labor Statistics reported that May saw an increase in hiring by 272,000 in the establishment survey. However, the household survey indicated a drop in employment and a rise in unemployment, which climbed to 4.0% — the highest since January 2022.

Average weekly hours remained steady at 34.3, which often aligns with a soft economy. Additionally, average hourly earnings rose by 0.4% in May, marking a 4.1% increase from a year earlier.

Private sector hiring averaged just over 200,000 new jobs per month over the last three to six months, a notable increase from the 155,000 jobs seen at the end of the previous year. The index of aggregate weekly payrolls for private-sector workers, which combines hiring, wages, and hours, was up 5.4% over the last 12 months. This is a decline from the 6%-6.5% range observed a year ago, bringing it closer to 2018’s highs for the 2009-2020 cycle.

Following the report’s release, Bitcoin’s price saw a 2% correction, dropping from $72,144 to $70,668. This sudden price movement triggered significant liquidations.

“Over $500 million of Bitcoin open interest wiped out within minutes. Shorts and longs were liquidated,” IT Tech noted.

The job report’s mixed signals have caused significant market fluctuations. While an increase in hiring suggests economic strength, the rise in unemployment and steady weekly hours indicate underlying weaknesses.

The reaction from the crypto market reflects its sensitivity to macroeconomic indicators but could soon revert.

“Unemployment just hit the highest level since COVID, and markets whipsawed down. Often, the first move on these announcements is the wrong one. Time will tell. But it for sure looks like unemployment has bottomed now, which suggests US liquidity will need to rise and rise soon. Rate cuts incoming,” Charles Edwards, founder at Capriole Investments, commented.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

As investors digest the implications of the latest jobs report, Bitcoin and other digital assets will likely remain volatile.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Why Bitcoin Seasoned Investors Are Accumulating — Analyst Evaluates BTC’s Current Phase

The cryptocurrency market has not had a clear direction in 2025, reflecting the uncertain condition of the digital asset industry. Bitcoin, the world’s largest cryptocurrency by market capitalization, is currently 24% away from its record-high price of $108,786 reached in January 2025.

With the premier cryptocurrency steadily drifting away from its all-time high, there have been questions about what phase of the cycle the market is currently in. Interestingly, recent on-chain data offers some insight into the current state of the Bitcoin market and the reaction of the participants.

Are Seasoned BTC Investors Anticipating A Price Surge?

In a Quicktake post on the CryptoQuant platform, analyst Axel Adler Jr. shared an analysis of the current Bitcoin cycle, offering insight into the behavior of an important group of investors. According to the online pundit, seasoned BTC players are back to accumulating the flagship cryptocurrency.

Adler Jr. revealed that the experienced BTC investors have been involved in four phases of accumulation (January 2023, October 2023, October 2024, March 2025) in the current cycle. On the flip side, the selling activity of these market participants has reached four distinct peaks, including January 2024, April 2024, July 2024, and January 2025.

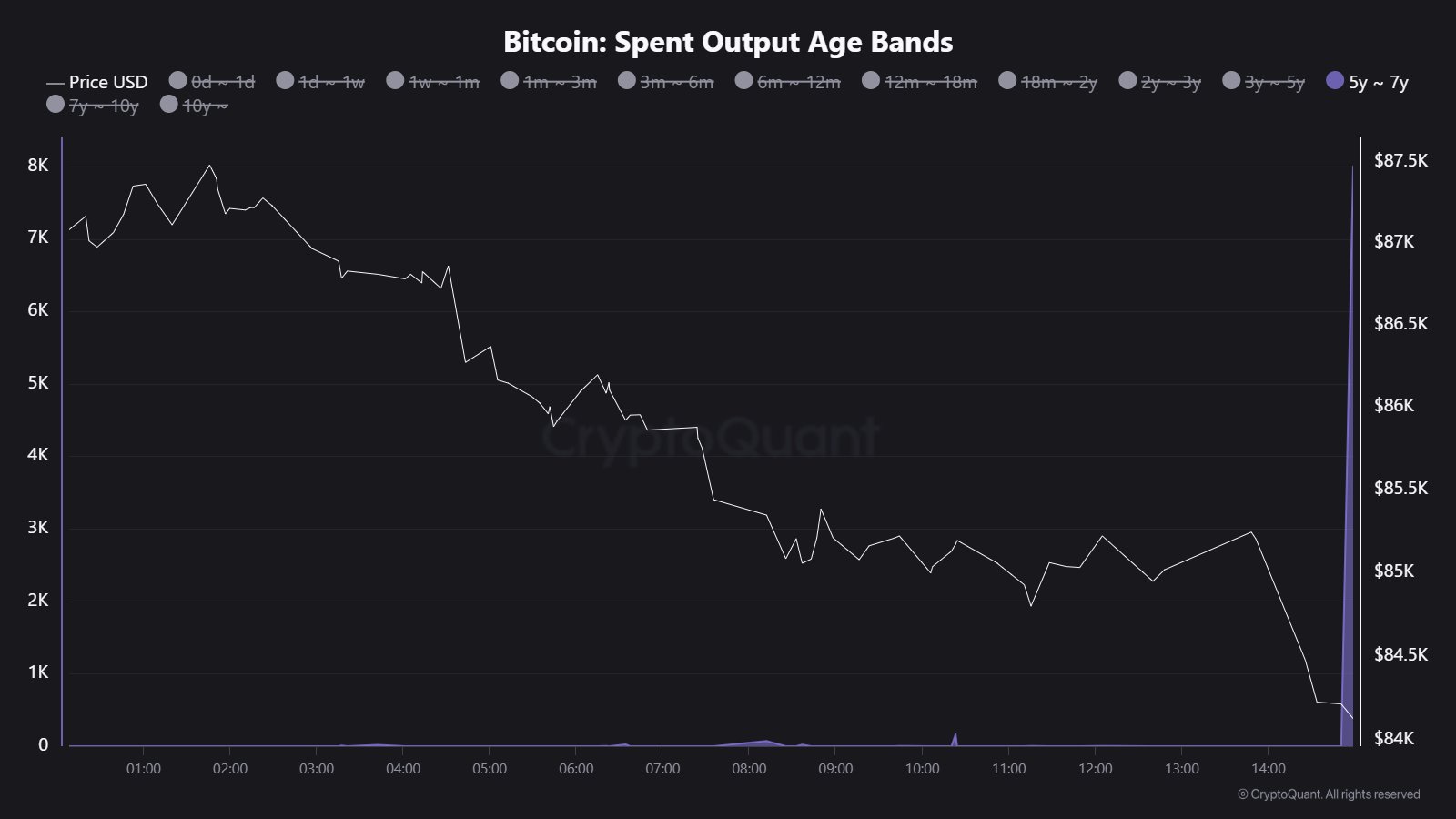

The relevant on-chain indicator here is the Value Days Destroyed (VDD) metric, which tracks the spending behaviour of long-term investors. The chart below shows that the VDD metric has been steadily declining since the start of 2025.

Source: CryptoQuant

Using the chart as a basis, Adler Jr. mentioned that three major features define the current phase of the Bitcoin cycle. Firstly, the seasoned investors, who were actively distributing their BTC at local peaks, have now shifted their strategy toward holding and accumulating their coins.

Additionally, the Value Days Destroyed metric suggests an absence of significant selling pressure, which means that the experienced traders are skeptical about profit at the current Bitcoin price. Moreover, periods of low VDD values have historically preceded significant upward price movements, as investors accumulate in anticipation of a price surge.

Ultimately, this positive shift in the behavior of seasoned Bitcoin holders suggests that there might be room for further price growth for Bitcoin in the medium term.

Bitcoin Price At A Glance

As of this writing, the price of BTC sits at around $83,200, with an over 2% decline in the past 24 hours. According to data from CoinGecko, the flagship cryptocurrency is also down by about 2% on the weekly timeframe.

BTC price reclaims $83,000 level on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image created by DALL-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

8,000 Dormant Bitcoin Suddenly Move: What’s Next For The Market?

Popular CryptoQuant analyst Maartunn reports that 8,000 Bitcoin (BTC) which have been dormant for five to seven years have been moved suddenly, adding to current bearish concerns in the crypto. This development comes after a rather adventurous week as BTC prices struggled to break above $89,000, following an initial steady bullish climb, before succumbing to heavy selling pressures driven by US President Donald Trump’s hawkish tariff policy.

$674 Million In Old BTC Transfers In Single Block – Cause For Alarm?

The Spent Output Age Bands is a crucial metric to measure how long Bitcoin tokens remain inactive before moving. According to Maartuun in an X post, this metric has recently revealed that 8,000 BTC worth $674 million that was last transferred between 2018 and 2020 have been moved recently in a single block drawing significant market attention.

This transfer follows a string of recent activations of dormant Bitcoin stashes. On March 24, a 14-year inactive Bitcoin wallet suddenly moved 100 Bitcoin valued at $8.5 million. Meanwhile, in early March, six ancient Bitcoin wallets also transferred nearly 250 BTC worth $22 million.

Notably, the most recent transaction reported by Maartuun is of far larger size with potentially strong implications for an uncertain Bitcoin market. Generally, a movement of such a large amount of BTC from long-term dormancy is usually interpreted as a signal for incoming selling pressure leading to major price corrections.

However, there are other potential non-bearish motives behind such transactions such as internal wallet shuffling by institutional investors or large holders as well as a cold storage reorganization. Currently, the owners of the new wallets receiving the 8000 is unknown thus reducing the potential of a bearish reaction from BTC holders.

Bitcoin Price Overview

In the last day, Bitcoin prices declined by 4.00% after the US Government announced intentions to impose a 25% tariff on auto imports and goods from China, Mexico, and Canada starting from April 3. This marks the latest negative reaction of the crypto market to President Trump’s international trade policies following similar incidents in early February and mid-March.

These measures by the Donald Trump administration are flaming fears of a potential economic slowdown which could further push high-risk assets such as BTC out of investors’ portfolios leading to a further downside.

At press time, Bitcoin currently trades at $83,693 reflecting a decline of 0.72% and 2.53% in the last seven and 30 days respectively. Meanwhile, the asset’s daily trading volume is up by 19.38% and is valued at $31.58 billion. The BTC market cap now stands at $1.66 trillion and still represents a dominant 61.1% of the total crypto market.

BTC trading at $83,727 on the daily chart | Source: BTCUSDT chart on Tradingview.com

Bitcoin

Bitcoin Price Could Surge To $95,000 — But Analyst Sounds ‘Bull Trap’ Alarm

The Bitcoin price seemed to be breaking out of its consolidation range early on in the week, rising to as high as $88,500 on Monday, March 24. However, the flagship cryptocurrency appears to be back to ground zero, retracing to around $84,000 on Friday, March 28.

This recent price correction came following the release of inflation data in the United States. With the latest inflation data suggesting delayed rate cuts by the US Federal Reserve, risk assets — including cryptocurrencies — experienced significant downward pressure to close the week.

Here’s How BTC Price Could Fall To $62,000

The story gets a little grim for the world’s largest cryptocurrency after popular crypto analyst Crypto Capo put forward a bearish projection for the Bitcoin price in their latest post on the X platform. According to the crypto trader, the price of BTC could be on its way to a new low in this cycle.

Crypto Capo highlighted in their analysis of the BTC 12-hour chart that the $84,000 – $85,000 is pivotal for the premier cryptocurrency’s future trajectory. The online pundit noted that the Bitcoin price action could go one of two ways over the next few weeks.

In the first scenario, Crypto Capo expects the price of Bitcoin to enjoy a short-lived bullish burst to within the $95,000 – $100,000 range. This initial price run-up would be a bull trap for investors, according to the analyst. For context, a bull trap is a pattern that lures long traders (bulls) into the market by an initial upward surge followed by a quick reversal.

Fittingly, Crypto Capo predicts that Bitcoin will experience a capitulation event that will see its value plummet to the next main support. As seen in the chart below, this next major support lies within the $62,000 – $69,000 bracket, containing the April and November all-time high prices.

Source: @CryptoCapo_ on X

In the alternate scenario, Crypto Capo highlighted how the first bull trap idea could be invalidated. According to the trader, if the Bitcoin price successfully closes beneath the $84,000 – $85,000 range, it could fall to the $62,000 – $69,000 bracket.

Bitcoin Price At A Glance

As of this writing, the price of Bitcoin is moving around the $83,300 level, reflecting a 3% decline in the past 24 hours. This single correction event has wiped out the premier coin’s early-week profit, with CoinGecko data showing no significant gain or loss in the last seven days.

The price of BTC slides beneath $84,000 on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image created by DALL-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Bitcoin20 hours ago

Bitcoin20 hours agoBitcoin Price Could Surge To $95,000 — But Analyst Sounds ‘Bull Trap’ Alarm

-

Market20 hours ago

Market20 hours agoDark Web Criminals Are Selling Binance and Gemini User Data

-

Market17 hours ago

Market17 hours agoVitalik Buterin Promotes Ethereum Layer 2 Roadmap

-

Altcoin16 hours ago

Altcoin16 hours agoExpert Predicts Listing Date For WLFI’s USD1 Stablecoin, Here’s When

-

Market16 hours ago

Market16 hours agoGRASS Jumps 30% in a Week, More Gains Ahead?

-

Bitcoin21 hours ago

Bitcoin21 hours agoEl Salvador’s Nayib Bukele Open to White House Visit

-

Altcoin20 hours ago

Altcoin20 hours agoDid XRP Price Just Hit $21K? Live TV Display Error Goes Viral

-

Altcoin14 hours ago

Altcoin14 hours agoPepe Coin Whale Sells 150 Billion Tokens, Price Fall Ahead?