Market

Miles Deutscher’s Best Altcoins After Bullish Market Signal

Crypto analyst Miles Deutscher highlighted a significant bullish movement in Bitcoin, driving speculation about the best altcoins to watch. He noted Bitcoin’s impressive rise to over $71,000, marking a potentially pivotal moment for the crypto market. This surge comes amidst the highest daily inflows ever recorded for Bitcoin spot exchange-traded funds (ETFs) since, indicating strong institutional demand.

Deutscher emphasized that Bitcoin’s performance could have a ripple effect on altcoins, as positive market sentiment often spills over into other digital assets. He shared insights on key altcoins that could benefit from this bullish momentum.

Ethereum (ETH):

Ethereum remains a top contender in the altcoin market. Deutscher pointed out that the anticipation around a spot Ethereum ETF could drive significant interest and investment.

“If Bitcoin is signaling strong institutional demand, it’s only logical that a fraction of this demand will also apply to Ethereum,” he said.

Ethereum’s role as the leading blockchain for decentralized applications (dApps) and smart contracts positions it as a critical player in the crypto ecosystem.

The potential approval of an Ethereum ETF would provide institutional investors easier access to Ethereum, likely driving up its price. Furthermore, the ongoing developments aim to improve scalability, security, and energy efficiency, adding to its long-term appeal.

Binance Coin (BNB):

Binance Coin, the native token of the Binance ecosystem, is another altcoin that Deutscher believes has strong potential. BNB has shown resilience, making new all-time highs and breaking major levels on the weekly chart. Deutscher suggested that BNB’s high market cap might not lead to exponential gains but still represents a solid trade.

BNB is integral to the Binance Smart Chain (BSC), a blockchain network that supports smart contracts and decentralized applications. BSC has gained popularity due to its lower transaction fees and faster processing times than Ethereum. As more projects are developed on BSC, the demand for BNB is likely to increase, further boosting its value.

Floki (FLOKI):

Deutscher identified Floki as a meme coin with substantial upside potential. He compared its current breakout to the price action of Pepe, noting similar patterns that could signal a 20% or more increase.

Meme coins like Floki often experience rapid price movements driven by social media hype and community engagement. While inherently risky, these coins can offer significant short-term gains for those who time their investments well.

“The Floki and Pepe charts are mirroring each other right now,” he observed.

Deutscher suggested that Floki could follow Pepe’s upward trajectory. Still, Investors should be cautious and consider the volatile nature of meme coins while making investment decisions.

PancakeSwap (CAKE):

PancakeSwap’s CAKE token is another altcoin Deutscher is monitoring closely. He noted that CAKE is starting to reclaim major support levels and break through significant moving averages. As the DeFi sector grows, platforms like PancakeSwap are becoming increasingly important.

“If BNB continues its upward trend, CAKE could also benefit as the primary DEX token within the Binance Smart Chain ecosystem,” Deutscher explained.

PancakeSwap is the leading decentralized exchange (DEX) on the Binance Smart Chain, allowing users to trade tokens without a centralized intermediary. Investors should look for signs of sustained upward movement and consider CAKE’s potential as a key player in the DeFi space.

Ondo Finance (ONO):

Ondo Finance is highlighted as a key player in the real-world asset (RWA) sector. With ongoing bullish price action and significant market interest, ONDO stands out.

Real-world asset tokenization involves creating digital tokens representing ownership of physical assets, such as real estate or commodities. This process can increase liquidity and accessibility for these assets.

Deutscher emphasized ONDO’s strong performance and potential for further gains, especially as the market continues recognizing the value of asset tokenization and staking. Integrating traditional financial assets with blockchain technology is a growing trend, and Ondo Finance could capitalize on this movement.

Strategic Insights and Market Sentiment

Deutscher’s analysis is rooted in the broader market dynamics, including institutional inflows and improving sentiment. He pointed out that the current bullish sentiment is driven by Bitcoin’s performance and strategic moves from major financial players like BlackRock and Citadel.

These institutions are pushing the tokenization narrative, which could further boost interest in altcoins associated with RWAs.

He also urged investors to remain vigilant and informed about market trends, especially given the potential for significant movements in response to ETF approvals and other macroeconomic factors. “Your goal is to outperform the market,” Deutscher advised, highlighting the importance of staying ahead of trends and making informed investment decisions.

Read more: 10 Best Altcoin Exchanges In 2024

In conclusion, Miles Deutscher’s insights provide a comprehensive guide for crypto investors looking to capitalize on the current bullish trend. By focusing on strategic altcoins like Ethereum, Binance Coin, Floki Inu, PancakeSwap, and Ondo Finance, investors can position themselves to benefit from the ongoing positive market sentiment and institutional interest.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Exploring Hottest New Coins: FINE, CHILLGUY, and CHILLFAM

New coins such as FINE, launched three days ago, have seen their market cap reach $2.5 million. CHILLGUY, driven by TikTok hype, has amassed 120,000 holders and achieved $129 million in daily trading volume.

CHILLFAM, following in CHILLGUY’s footsteps, has quickly reached a $10 million market cap with a 300% price surge, showing the potential for continued interest in these emerging tokens.

This Is Fine (FINE)

FINE, launched on Pumpfun just three days ago and now graduated into Raydium, is attempting to capitalize on the growing trend of coins paired with animated video.

As of this writing, the coin boasts over 26,000 holders and a market cap of $2.5 million. However, it has experienced a steep decline, dropping more than 50%. If FINE can stabilize after this sharp drop, it may present an attractive entry point for traders eyeing a potential recovery.

FINE’s RSI is 35, indicating that it is approaching the oversold zone. This suggests that selling pressure may be reaching an extreme, potentially setting the stage for a reversal or bounce if buying interest returns. However, the current bearish momentum highlights the need for caution before expecting a recovery.

Just a chill guy (CHILLGUY)

CHILLGUY, a Solana-based meme coin that gained popularity through TikTok, has quickly risen to prominence in less than a week. The coin’s rapid adoption is evident in its impressive metrics, boasting over 120,000 holders and amassing 112,000 transactions per day.

The coin’s daily trading volume has surpassed $129 million, showcasing substantial market activity and strong interest from traders. This level of engagement highlights CHILLGUY’s potential to sustain its momentum if the hype continues to drive liquidity and participation.

CHILLGUY’s RSI sits at 52.3, indicating a neutral zone where neither buyers nor sellers have a dominant edge. This balanced sentiment suggests the market is stabilizing after initial volatility, leaving room for the token to move in either direction depending on future market activity and demand.

Chill Family (CHILLFAM)

CHILLFAM, inspired by the success of CHILLGUY, was launched just two days ago. With nearly 58,000 holders and a daily trading volume of $55 million, the token is gaining traction among meme coins enthusiasts on Solana.

Currently boasting a $10 million market cap, CHILLFAM has surged almost 300% in 24 hours, highlighting strong early interest. If it can maintain this momentum and sustain its $10 million market cap, the coin could potentially aim for $15 million or even $20 million.

CHILLFAM’s RSI is at 43, suggesting that the token is in a slightly bearish to neutral zone. This level indicates that the recent rally may be cooling off, providing a period of consolidation. If buying interest returns, it could reignite bullish momentum and push CHILLFAM toward higher valuations.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP To Hit $40 In 3 Months But On This Condition – Analyst

XRP remains one of the crypto market’s current trailblazers rising by 23.21% in the past 24 hours. Over the last two weeks, the prominent altcoin has recorded a 154% price gain establishing itself as the sixth-largest cryptocurrency with a market cap of $89.82 billion. With this current momentum and the crypto bull season still in its early stages, analysts remain highly bullish on XRP’s potential to reach lofty price levels.

Can XRP Repeat 2017 Historical Price Movement?

In an X post on November 22, an analyst with the username CryptoBull stated that XRP could trade at $40 over the next three months if the token mirrors its first prominent price surge from 2017.

Data from CoinMarketCap shows that XRP rose $0.006 to a market peak of $0.33 in early 2017, representing a 5,400% gain. Considering its recent price rally, the altcoin may be gathering momentum to reproduce such price movement in a highly anticipated crypto bull run, especially considering recent happenings.

Most notably, popular anti-crypto Securities and Exchange Commission Chairman Gary Gensler recently announced his intentions to resign on January 20, a move largely behind the current bullish sentiment among XRP investors considering the Commission’s long-lasting regulatory battle with Ripple. In fact, Gensler’s decision to leave the SEC has been described as the “best thing” for Ripple, which holds significant weight for XRP’s future.

Gensler’s resignation coincides with the inauguration of pro-crypto incoming US President-Elect Donald Trump who has promised to introduce a more friendly approach to digital asset regulation in the US. Aside from XRP finally being free from the regulatory scrutiny of the SEC, the potential introduction of a spot ETF under Trump’s pro-crypto regime also contributes to bullish sentiments on the altcoin’s profitability.

According to CryptoBull, if XRP follows its price explosion from early 2017, the token is expected to hit a price target of $1.96 in November, $6.30 in December, and $40 in January.

Price Resistance Levels In XRP’s Dream Surge

While XRP presents much potential for a high price target, CryptoBull predicts the token to face significant resistance at the $1.96 price region. If buying pressure proves sufficient to move past this level, the analyst expects XRP to confront another resistance at $3.84 which represents the token’s current all-time high price.

Considering the current robust bullish sentiments in the market, the altcoin is likely to move past these highlighted resistance levels. However, the token’s Relative Strength Index remains far in the overbought zone (91.73) indicating significant potential for a price pullback.

At the time of writing, XRP continues to trade at $1.78 reflecting a 79.57% gain in the past week. Meanwhile, the token’s daily trading volume is up by 103.57% and valued at $20.29 billion.

Featured image from Trackinsight, chart from Tradingview

Market

Kraken Eyes Token Expansion as Trump Promises Crypto Support

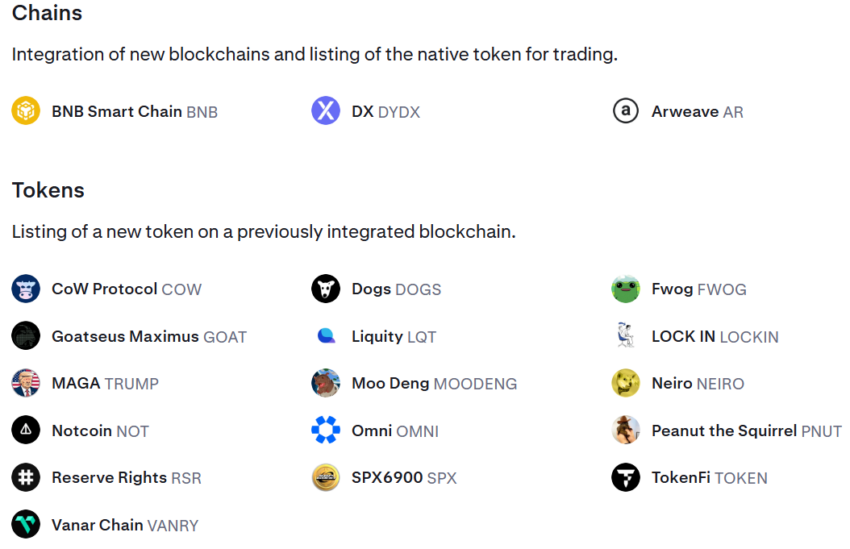

Kraken, one of the leading cryptocurrency exchanges, has announced plans to list 19 new tokens, including a range of popular meme coins, and to integrate three additional blockchains.

This development has sparked optimism across the crypto industry, with many anticipating a more favorable environment for token listings under the incoming Trump administration.

Kraken Plans to List 19 Tokens and Integrate 3 Blockchains

According to its recently published tradeable asset roadmap, Kraken will add the Binance Smart Chain, dYdX, and Arweave blockchains to its platform. Each integration will include support for the native tokens of these networks.

“Kraken lists BNB,” Binance founder Changpeng Zhao stated.

In addition to these three, Kraken plans to list 16 other tokens, primarily meme coins. Some of the notable additions include FWOG, TRUMP, NEIRO, DOGS, GOAT, PNUT, MOODENG, and COW, alongside eight others. These tokens belong to blockchains already integrated into Kraken’s ecosystem.

However, the exchange clarified that listing plans are not guaranteed. Funding and trading for these tokens will only begin after an official announcement through Kraken Pro’s account on X. The company warned that Depositing tokens prematurely could result in losses.

Kraken’s planned token expansion comes at a time when the exchange is navigating legal challenges. The US Securities and Exchange Commission (SEC) has accused Kraken of operating an unregistered securities exchange and offering staking services in violation of federal laws. The exchange has been actively defending itself against these allegations.

Despite regulatory hurdles, crypto industry stakeholders are optimistic that the incoming administration will ease restrictions on token listings. Many believe President-elect Trump’s pro-crypto stance could pave the way for a more supportive regulatory environment. Expectations include a clear regulatory framework, the potential establishment of a Bitcoin reserve, and a departure from the SEC’s regulation-by-enforcement approach.

Already, major US exchanges are capitalizing on the growing market optimism to expand their token listings. Coinbase recently listed PEPE and FLOKI, leveraging the ongoing meme coin trend.

Similarly, Robinhood expanded its offerings by adding tokens that the SEC previously described as securities — XRP, Cardano, and Solana. These moves reflect a broader effort by exchanges to capture market momentum and cater to diverse investor interests.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market21 hours ago

Market21 hours agoADA Sights More Growth After Breaking $0.8119

-

Altcoin21 hours ago

Altcoin21 hours agoBTC at $98K, HBAR Surges 25% and XLM rises 55%

-

Altcoin15 hours ago

Altcoin15 hours agoArthur Hayes Shills Another Solana Meme Coin, Price Rallies

-

Market14 hours ago

Market14 hours agoTrump Taps Pro-Crypto Scott Bessent for Treasury Secretary Role

-

Altcoin14 hours ago

Altcoin14 hours agoTerra Luna Classic Community Discord On Proposal Amid LUNC Price Rally

-

Ethereum24 hours ago

Ethereum24 hours agoMassive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

-

Market13 hours ago

Market13 hours agoArtificial Intelligence Coins on the Rise: TFUEL, ZIG, and AKT

-

Altcoin13 hours ago

Altcoin13 hours agoAlameda Research Dumping Polygon (POL) Amid Price Spike, What’s Next?