Market

Crypto Exchange Plans $321 Million Fundraise After Hack

Japanese crypto exchange DMM Bitcoin has announced a 50 billion yen ($321 million) fundraising plan. The funds will be used to purchase Bitcoin to compensate customers affected by the recent hack.

DMM Bitcoin operates under the umbrella of DMM.com, an enterprise active in several sectors, including entertainment, technology, and renewable energy. It is led by CEO Keishi Kameyama.

Japanese Regulators Demand Investigation Into DMM Bitcoin Hack

On Wednesday, DMM Bitcoin shared details of its fundraising strategy. The company aims to raise funds from its group companies through a 48 billion yen (~ $ $307.8 million) capital increase and 2 billion yen (~ $ $12.8 million) in subordinated debt.

This financial maneuver is designed to minimize any potential impact on the Bitcoin (BTC) market while acquiring crypto assets.

“It’s difficult for outsiders to pass judgment on the exchange’s plan to raise funds since it involves other companies that also belong to the broader DMM.com Group,” Yuya Hasegawa said.

Read more: Crypto Project Security: A Guide to Early Threat Detection

The unauthorized outflow involved 4,502.9 Bitcoin. Based on the current market price of nearly $71,000, this incident is the seventh-largest crypto theft recorded, according to blockchain analytics firm Chainalysis. This loss highlights persistent security vulnerabilities within digital asset exchanges and intensifies concerns over their security frameworks.

Reacting swiftly, Japan’s Financial Services Agency has called for an in-depth examination into the origins of the breach and the strategy for compensating affected customers. Finance Minister Shunichi Suzuki has also underscored the government’s dedication to bolstering security measures to thwart future incidents.

This breach is not an isolated incident in Japan’s crypto industry but part of a larger pattern of significant hacks, with earlier episodes including the Mt. Gox collapse in 2014 and the CoinCheck breach in 2018. In an interview with BeInCrypto, Mati Greenspan, CEO of Quantum Economics, reflected on the recurring security issues in the Japanese crypto sector.

“The first was Mt. Gox in 2014 and then CoinCheck in 2028. You’d think by now people would learn not to leave their crypto on these centralized exchanges. Both of the previous hacks effectively halted crypto adoption in Japan for quite a while. I suspect this time will be no different as people often learn the wrong lesson from these type of things,” Greenspan told BeInCrypto.

Despite the grim circumstances, the overall crypto sector shows signs of resilience and adjustment. Data from 2024 reveals a 20% decrease in losses due to crypto-related crimes compared to the previous year.

Read more: Top Crypto Bankruptcies: What You Need To Know

Specifically, May 2024 saw a 12% decline in such incidents compared to May 2023.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Optimism (OP) Price Shows Strong Uptrend, Eyes $3 Resistance

Optimism (OP) price has surged 43.40% in the last seven days, showcasing strong bullish momentum in the market. The uptrend is supported by rising trend strength, with the ADX confirming growing momentum and EMA lines showing a bullish setup.

Despite the rally, a declining trend in daily active addresses suggests caution, as it may indicate reduced network activity and potential pressure on OP’s price. Whether OP can sustain this momentum to test resistance at $3 or face a deeper correction depends on the strength of buyer interest in the coming days.

OP Current Uptrend Is Strong

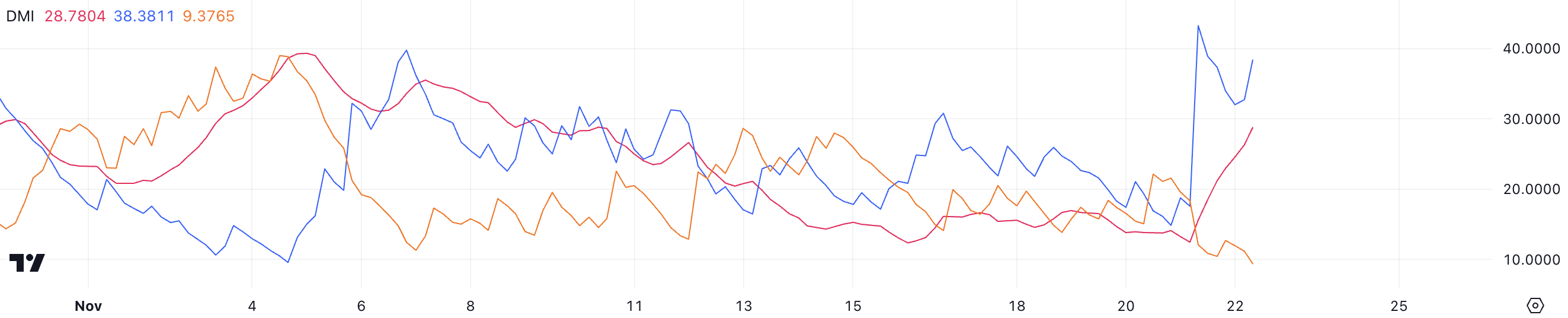

Optimism currently has an ADX of 28.7, a significant surge from below 15 just a day ago. The sharp rise in ADX indicates that the strength of OP’s current trend is increasing fast, signaling growing momentum behind the price movement.

The ADX measures trend strength, with values above 25 indicating a strong trend and below 20 suggesting a weak or nonexistent trend. At 28.7, OP’s ADX confirms that its uptrend is gaining traction and could sustain further upward momentum if this strength persists.

The positive directional index (D+) is at 38.8, while the negative directional index (D-) is at 9.37, showing that bullish pressure far outweighs bearish activity. This large gap between D+ and D- reflects strong buyer dominance, reinforcing the uptrend.

The combination of a rising ADX and a high D+ suggests that OP’s price could continue climbing as long as market conditions remain favorable and buying pressure persists.

OP Daily Active Addresses Bring An Important Signal

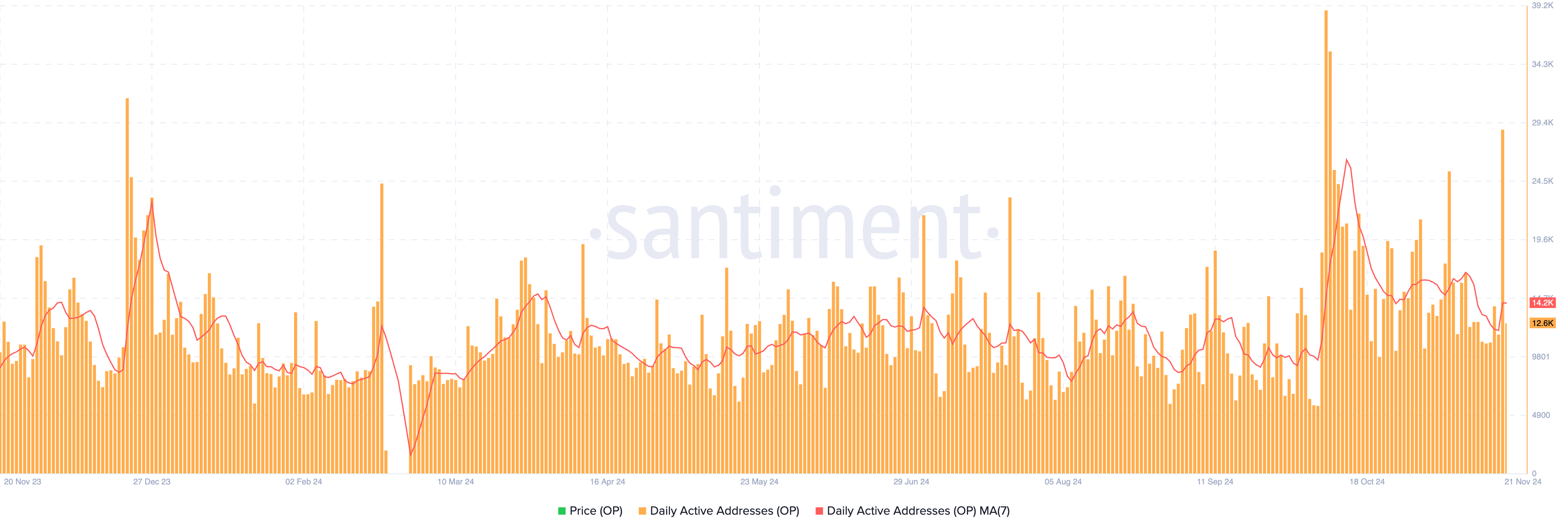

OP 7-day moving average of daily active addresses was 14,200 as of November 21.

This metric reflects the number of unique wallet interactions with the network, which indicates continued strong activity but is down from the yearly peak of 26,300 on October 13.

Daily active addresses are a crucial metric because they provide insights into network usage and overall demand. A decreasing trend in this metric may signal waning interest or reduced activity on the network, which could translate into lower buying pressure for OP.

If the trend continues to decline, it may exert downward pressure on OP price as market enthusiasm fades. However, a reversal in this metric could reignite bullish sentiment and support future price growth.

Optimism Price Prediction: Can OP Reach $3 In November?

If Optimism price maintains its uptrend, it could test the next resistance levels at $2.55 and potentially $3.04. Breaking above $3.04 could pave the way for OP price to challenge $3.41, its highest price since April.

This bullish scenario is supported by the EMA lines, which show a favorable setup with short-term lines positioned above the long-term ones, indicating strong momentum.

However, if the trend reverses, OP price could face significant downward pressure, with the next supports at $1.82 and $1.53.

If these levels fail to hold, the price could drop further to $1.06, representing a steep 51% correction.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Sui Partners with Franklin Templeton for Blockchain Development

Sui, a Layer-1 network, announced a new partnership with investment firm Franklin Templeton. This partnership includes capital investment in Sui and support for the firm’s blockchain development.

Despite a few vague details, the exact nature of the working relationship between the two companies remains unclear.

Sui Partners Franklin Templeton

Sui, the prominent Layer-1 blockchain, recently partnered with investment firm Franklin Templeton. This partnership will prioritize supporting a developer ecosystem rather than focusing directly on SUI development. The firm claimed Franklin Templeton has been supporting blockchain projects since 2018, and its CEO has espoused blockchain technology.

“Franklin Templeton Digital Assets has previously invested in the Sui ecosystem, and this new partnership will provide further benefit by seeking value creation opportunities to allow Sui builders to deploy novel technology onchain,” Sui claimed in a social media post.

As of yet, the firm has publicly revealed very few exact details about the partnership’s planned blockchain developments. Instead, the firm discussed several of its existing projects that attracted Franklin Templeton’s attention: its DeFi central limit order book, a decentralized mobile carrier, and an MPC network.

Still, this information does provide a few clues about the investment firm’s intentions. Earlier this year, Franklin Templeton explored DePin projects, considering them a possible lucrative development area. The firm has also been investing heavily in tokenization. It may help Sui by supporting its blockchain developers in these areas, especially DePin.

Sui, for its part, is performing quite well lately. It recently went on a remarkable bull run, climbing 74% in one month before hitting an all-time high on November 20. Yesterday, its blockchain stopped producing blocks for nearly two hours, but its token price remained impressively steady. These fundamentals could make Sui an attractive partner for Franklin Templeton.

Franklin Templeton has not yet made any direct announcements about this partnership. Sui additionally posted a more developed press release, but it did not have substantially different information than the talking points in its main announcement. Suffice it to say that Franklin Templeton is investing in Sui blockchain development.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Altcoins Trending Today — November 22: MYTH, MAD, MODE

Several altcoins are trending today for various reasons. CoinGecko data shows that all these cryptocurrencies share one thing in common: their prices have risen in the last 24 hours.

This notable hike could be linked to broader market recovery. That said, the top three altcoins trending today are Mythos (MYTH), MAD (MAD), and Mode (MODE).

Mythos (MYTH)

Mythos tops the list of trending altcoins today, specifically due to its 45% price increase in the last seven days. As a project built on the Ethereum blockchain, MYTH’s price also increased due to the rise in ETH’s value.

As of this writing, MYTH’s price is $0.27 but has encountered resistance around the same area. However, the Awesome Oscillator (AO), which measures momentum, shows that the sentiment around the altcoin remains bullish.

In this scenario, MYTH’s price is likely to bounce toward $0.32. However, if momentum turns bearish and the AO reading drops to the negative area, this might not happen. Should that be the case, the altcoin’s value might decline to $0.21.

MAD (MAD)

Another crypto among the altcoins trending today is MAD, a meme coin built on the Solana blockchain. MAD is trending because its value has spiked by 85% in the last 24 hours and over 600% within the last seven days.

This rise in price could be linked to a surge in buying pressure. From a technical point of view, despite the hike, the Bull Bear Power (BBP), which measures the strength of buyers compared to sellers, reveals that bulls are still in control.

If this continues, MAD’s price could rise to $0.00010. However, if cryptocurrency holders decide to sell in large volumes, this might not happen. Instead, the altcoin’s value could sink to $0.000045.

Mode (MODE)

Like yesterday, Mode is also one of the trending altcoins today. Unlike its price action on November 21, MODE’s price has increased 26.50% in the last 24 hours.

Between August and the first few days of this month, MODE’s price traded within a descending triangle. This bearish pattern ensures that the altcoin value failed to notch a significant hike.

However, at press time, it broke out, as BeInCrypto had predicted earlier. With the current price movement, MODE is likely to raise $0.022 in the short term. But in a scenario where selling pressure rises, that might not happen. Instead, it might drop to $0.012.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation21 hours ago

Regulation21 hours agoUK to unveil crypto and stablecoin regulatory framework early next year

-

Market21 hours ago

Market21 hours agoTrump Media Files Trademark for Crypto Platform TruthFi

-

Market19 hours ago

Market19 hours agoGOAT Price Sees Slower Growth After Reaching $1B Market Cap

-

Altcoin19 hours ago

Dogecoin Code Appears In CyberTruck And Model 3 Website, Will Tesla Accept DOGE Payments For Cars Soon?

-

Market24 hours ago

Market24 hours agoWhy SUI Network Outage Did Not Cause a Price Crash

-

Market23 hours ago

Market23 hours agoCardano (ADA) Price Hits 41% Weekly Growth, $1 Target in Sight

-

Market22 hours ago

Market22 hours agoBanana Gun Rises After Justin Sun’s $6.2 Million Art Purchase

-

Market14 hours ago

Market14 hours agoWisdomTree Europe Launches XRP ETP