Market

Circle CEO Jeremy Allaire Praised Brasil Crypto Industry

Jeremy Allaire, CEO of Circle, the issuer of the USDC stablecoin, announced new partnerships with industry giants during his visit to Brazil.

Allaire noted that the adoption of cryptocurrencies and stablecoins is still in its early stages.

Circle Officially Enters Brazil, BTG Pactual Will Issue USDC

During his visit to Brazil, Circle’s chairman signed a partnership with BTG Pactual. This means one of Latin America’s largest investment banks will now offer USDC to the market through the local banking system.

“BTG will be our direct liquidity partner for the minting [registration within the blockchain] of USDC 24 hours a day, seven days a week. This means that on a retail and institutional level, companies and investors will be able to almost instantly issue and receive USDC in Brazil using the real in the local banking system,” Allaire said.

The executive with over two decades of experience stated that the partnership with BTG “represents a tremendous milestone.”

“We are still in the early stages and at the beginning of the wider use of digital dollars, we are at the beginning of the wider use of blockchain in the financial system,” he stated.

Read more: Top 12 Crypto Companies to Watch in 2024

Allaire told a small group of journalists in São Paulo that he is certainly excited to see wider adoption by end users. He expressed enthusiasm about the growing number of financial institutions, fintechs, and payment companies gaining access to this infrastructure in Brazil. While these partnerships are important, he noted that Brazil has a much larger overall number of financial institutions and fintechs.

“We want to grow this and I think now we have the real infrastructure, the financial infrastructure, we have the key partners that can really grow this. I think it’s really the beginning and it’s about enabling, you enable thousands of institutions here in Brazil to be able to use this infrastructure,” Circle CEO commented.

BTG CEO Roberto Sallouti stated during the Circle meeting that blockchain is likely the future path for the institutional and financial systems. Jeremy Allaire echoed this sentiment in his discussion with reporters. The CEO highlighted the success of the Central Bank’s PIX system, which now has over 160 million users. He noted that Brazil, with leaders like Roberto Campos Neto, has a progressive approach to advancing financial technology and initiatives like Drex.

“We are committed to making a positive impact on the Brazilian market and partnering with key stakeholders to enable companies to participate in the global economy more easily and efficiently. There are many powerful opportunities on the horizon when Brazil’s advanced fintech ecosystem converges with the world’s most accessible dollar platform,” Circle co-founder said.

Brazil Will Become a Major Crypto Player

Jeremy Allaire explained that Circle initially launched USDC in Singapore due to strong Asian demand. Nevertheless, he now sees Brazil as a major global player.

“People know that Asia is a huge hub for this activity, but when we look at other markets, we look at Brazil,” he stated.

According to Allaire, the proactive stance of Brazilian regulators, such as the Central Bank, has attracted Circle’s attention. Besides partnering with BTG, Circle has also teamed up with Nubank and Mercado Bitcoin.

When asked if the United States lags behind Brazil in digital currency adoption, Jeremy Allaire noted that the US has the largest financial system in the world and the most to lose from inaction. However, he also mentioned that the US government might prefer to wait “until things are more developed before taking the next steps.”

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

“This is a slow-moving trend. But at the same time, there has been a particular environment around fintech innovation. And I consider Circle to be one of them. They were built under an American regulatory regime, and so there has been a lot of progress,” Allaire noted.

Regarding the US presidential race, Jeremy Allaire mentioned Donald Trump, noting that the Republican candidate often supports cryptocurrencies. Circle CEO also pointed out that Trump opposes the digital dollar (CBDC).

“Regardless of who wins the presidential election in the United States, we’re going to see more constructive, bipartisan work to regulate the sector. There may be some differences of opinion here or there, but I think the general direction is, regardless, towards good regulation,” he concluded.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Volume Plunges 20% Amid Market Uncertainty

XRP is currently showing signs of indecision, trading sideways with limited momentum as traders await a clearer signal. Over the past 24 hours, XRP’s trading volume has dropped by 20.37%, now sitting at $2.4 billion—a decline that reflects cooling interest in the short term.

Technical indicators like the RSI and Ichimoku Cloud suggest a neutral trend, with no strong bullish or bearish dominance in play. Price action remains confined between key support and resistance levels, leaving the next breakout direction still uncertain.

Neutral RSI Reading Suggests Caution for XRP Traders

XRP’s Relative Strength Index (RSI) is currently sitting at 46.82, signaling neutral momentum in the market. This neutral zone has persisted since April 7, with no significant shifts into either overbought or oversold territory.

Notably, the RSI was at 57.30 just three days ago, indicating that XRP has experienced a recent decline in buying pressure.

The drop suggests cooling interest or a possible shift in sentiment among traders, as the asset now hovers closer to the midpoint of the RSI scale.

The RSI is a momentum oscillator that measures the speed and magnitude of recent price changes, typically on a scale from 0 to 100.

Readings above 70 often suggest an asset is overbought and could be due for a pullback, while readings below 30 indicate it may be oversold and potentially poised for a bounce. With XRP now at 46.82, the asset is neither overbought nor oversold, implying indecision in the market.

This level, combined with the recent dip from 57.30, may signal growing caution or weakening bullish momentum. It could potentially point to a consolidation phase or slight downward pressure in the short term unless buyers re-enter with conviction.

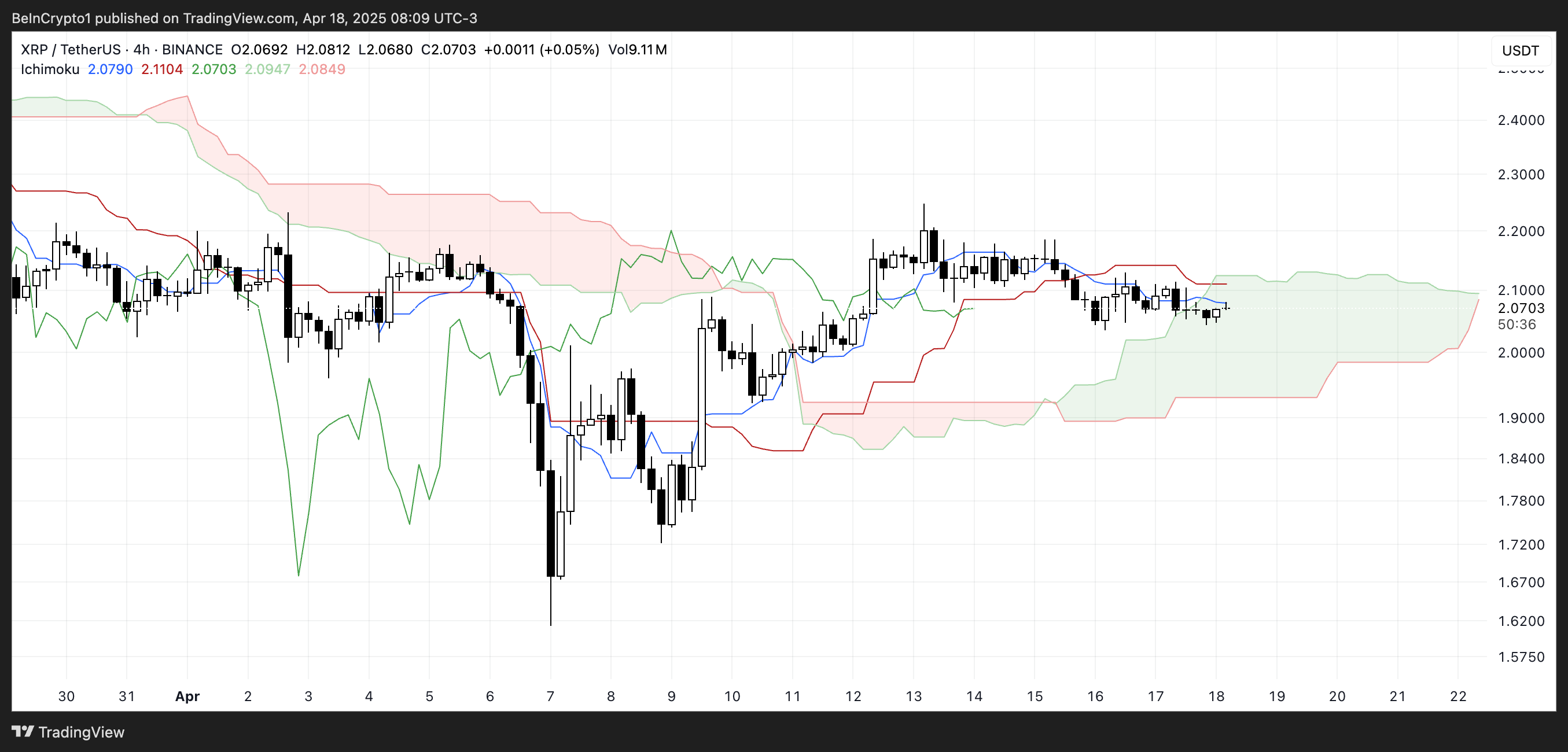

Ichimoku Indicators Show Indecision in XRP’s Price Action

XRP is currently trading inside the Ichimoku Cloud, reflecting a state of indecision or consolidation.

The Tenkan-sen (blue line) and Kijun-sen (red line) are flat and closely aligned, suggesting weak momentum and a lack of short-term trend direction.

The Senkou Span A and B (the cloud boundaries) are relatively flat as well, which typically indicates that the market is in equilibrium without strong pressure from either buyers or sellers.

The Ichimoku Cloud, or Kumo, helps visualize support, resistance, and trend direction at a glance. When the price is above the cloud, the trend is considered bullish; below it, bearish.

Inside the cloud, as XRP currently is, the trend is neutral, and volatility often contracts. The flatness of the cloud’s leading edges implies a consolidation phase, and the fact that price is not breaking clearly above or below the cloud reinforces the idea of market uncertainty.

For now, the lack of a decisive breakout suggests XRP could remain range-bound until a stronger trend develops.

$2.03 Support and $2.09 Resistance Hold the Key to XRP’s Next Move

XRP price is currently trading within a narrow consolidation range, with key support at $2.03 and resistance at $2.09.

The price action has been relatively muted, but the EMA lines are starting to show signs of potential weakness, as a death cross—where the short-term EMA crosses below the long-term EMA—appears to be forming.

If this bearish crossover confirms and XRP breaks below the $2.03 support, a move down to $1.96 becomes increasingly likely.

A strong continuation of the downtrend could trigger a steeper drop. It could potentially drive the price as low as $1.61 if selling pressure accelerates.

However, there’s still a bullish scenario on the table. If buyers manage to push XRP above the $2.09 resistance, it could open the door for a retest of the $2.17 and $2.35 levels.

This would indicate renewed strength and a shift in momentum in favor of the bulls. Should the rally gain traction beyond these levels, XRP could make a run toward $2.50, marking a significant recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BONK Symmetrical Triangle Squeeze: Is A Mega Breakout Imminent?

Bonk (BONK), one of the more energetic players in the meme coin space, is showing signs of a potentially explosive move as it coils tighter within a symmetrical triangle pattern. This classic chart formation, characterized by converging trendlines of lower highs and higher lows, often acts as a pressure booster for price action — the longer the squeeze, the more powerful the breakout tends to be.

The symmetrical triangle squeeze is a technical signal that often precedes sharp breakouts, and in BONK’s case, it couldn’t come at a more pivotal moment. With the broader meme coin market showing signs of strength and sentiment slowly shifting, a decisive move from this setup could define the next chapter for BONK. A breakout above the upper trendline might ignite fresh bullish momentum and open the door to new highs, while a break below support could trigger a sell-off toward lower key levels.

Bonk’s Recent Price Action: The Setup For A Big Move

According to a recent post by Whales_Crypto_Trading on X (formerly Twitter), Bonk is currently forming a symmetrical triangle pattern on the 1-hour chart. The price has just rebounded from the lower support trendline of the triangle, suggesting that buyers are stepping in to defend the structure and potentially build momentum for an upward breakout.

What makes this pattern particularly noteworthy is the potential upside. Whales_Crypto_Trading highlighted a profit target range of 70–80%, should BONK successfully break above the upper resistance trendline. With volatility tightening and volume starting to show signs of recovery, such a breakout could offer a substantial short-term trading opportunity.

However, traders are advised to keep a close eye on volume confirmation and key breakout levels to avoid possible fakeouts, as symmetrical triangles can break in either direction.

Will The Meme Coin Explode Or Fizzle Out?

Bonk’s symmetrical triangle pattern has reached a critical stage, raising speculations about whether the meme coin will break free with force or lose steam under pressure. The recent bounce off the support trendline suggests bullish interest is still alive, and if momentum continues to build, BONK could be gearing up for a powerful breakout, potentially delivering gains in the 70–80% range as projected by traders.

However, it’s important to remain cautious. Symmetrical triangles are neutral by nature, meaning a breakdown is still on the table if buyers fail to push through resistance. The next few candles on the 1-hour chart could provide key confirmation of BONK’s direction.

In the end, BONK is approaching a defining moment. Whether it explodes into a bullish run or fizzles out into another rejection will largely depend on volume, sentiment, and the strength of the breakout. Traders should stay alert, as a big move may be closer than it seems.

Market

BANK Token Surges 150% After Binance Futures Listing

Lorenzo Protocol’s native token, BANK, has recorded a 150% price surge within six hours of its official launch.

The token’s rapid climb follows its listing on multiple platforms, including Binance’s Alpha Market and the launch of a BANKUSDT perpetual contract on Binance Futures with up to 50x leverage.

What is the New BANK Token on Binance Futures?

The Token Generation Event (TGE) for BANK took place today, April 18, via Binance Wallet, in partnership with PancakeSwap. Lorenzo Protocol raised $200,000 through the sale of 42 million BANK tokens—2% of the total supply—priced at $0.0048 each.

The token is now trading on PancakeSwap, Bitget, and CoinEx. Following its debut, BANK reached a market cap of approximately $22 million.

BANK is the governance and utility token for Lorenzo Protocol, a DeFi platform focused on enhancing Bitcoin liquidity.

The protocol allows users to earn yield on BTC without giving up custody. It uses financial primitives like Liquid Principal Tokens (LPTs) and Yield-Accruing Tokens (YATs).

According to its claims, BANK holders can stake their tokens to receive veBANK, which provides governance rights and a share of future emissions.

Also, Lorenzo Protocol is built on a Cosmos-based Ethermint appchain. It enables BTC restaking and interoperability with Bitcoin’s Layer 1. The design supports on-chain issuance and settlement of BTC-backed assets.

The listing of the BANK/USDT perpetual contract on Binance Futures adds further momentum to the token. Binance Futures is a derivatives platform that allows users to trade perpetual contracts with high leverage.

Binance has historically preferred new tokens on the BNB chain for early futures trading. BANK’s sharp price increase and rapid market integration highlight strong early interest in Lorenzo Protocol’s approach to BTC-based DeFi infrastructure.

Currently, it’s far-fetched to project whether the exchange will list this newly launched token. However, Binance’s new community voting on token listing has offered positive hopes for small market cap projects.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum Investors Suffer More Losses Than Bitcoin Amid Ongoing Market Turmoil

-

Ethereum13 hours ago

Ethereum13 hours agoEthereum Fee Plunges To 5-Year Low—Is This A Bottom Signal?

-

Altcoin19 hours ago

Altcoin19 hours agoTron Founder Justin Sun Reveals Plan To HODL Ethereum Despite Price Drop

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum Whales Offload 143,000 ETH In One Week – More Selling Ahead?

-

Market16 hours ago

Market16 hours agoEthereum Price Fights for Momentum—Traders Watch Key Resistance

-

Market22 hours ago

Market22 hours agoCrypto Ignores ECB Rate Cuts, Highlighting EU’s Fading Influence

-

Altcoin16 hours ago

Altcoin16 hours agoExpert Predicts Pi Network Price Volatility After Shady Activity On Banxa

-

Market21 hours ago

Market21 hours agoBinance Leads One-Third of the CEX Market in Q1 2025