Market

PEPE Price Consolidates: Where to Next?

Ready to uncover the secrets behind PEPE’s recent rollercoaster ride?

Dive into this analysis to learn what key indicators are revealing about the market’s next move and gain actionable insights to stay ahead of the game.

PEPE Daily Chart Analysis

The PEPE/USDT daily chart shows that the price has surged remarkably, moving from about 0.000009 to 0.000017 in late May. Now, it seems to be stabilizing around 0.000014.

The Ichimoku Cloud’s baseline, marked in red, is sitting around 0.000012, which could be a significant support level. If the price dips below this line, we might see a shift in market sentiment.

The two exponential moving averages (EMAs) at 0.00000871 and 0.00000623 are trending upward, suggesting that the bullish momentum could continue. As long as the price stays above these EMAs, there’s potential for further appreciation.

However, if the price falls below the Ichimoku Cloud baseline and the EMAs start to flatten or decline, it could indicate a change in market sentiment towards a bearish trend.

Read More: Pepe: A Comprehensive Guide to What It Is and How It Works

It’s important to watch the 0.000012 support level closely. If the price bounces off this level, it might be a good entry point for buying.

Analyzing PEPE on the 4-Hour Chart

Let’s examine PEPE/USDT on the 4-hour chart, focusing on key indicators: the Ichimoku Cloud baseline (in red), the 100-day Exponential Moving Average (EMA) in blue, and the 200-day EMA in green. We’ll also examine the current price action and what it might mean for the market.

First off, PEPE has had quite a ride recently. The price skyrocketed, then pulled back significantly. Even with this correction, it’s still trading above crucial support levels, suggesting there’s still a lot of interest and potential for further gains.

Currently, PEPE is trading inside the Ichimoku Cloud on the 4-hour chart, nestled between the baseline at 0.00001484 and the 100 EMA. This is a pivotal area. If the price can push above the baseline, it could break out of the cloud to the upside – a very bullish signal. Think of the baseline as a gateway: crossing it could ignite another rally.

Read More: Pepe (PEPE) Price Prediction 2024/2025/2030

The price is currently wedged between the 100 EMA (0.00001390) and the 200 EMA (0.00001218). If it dips below the 100 EMA, we might see it exit the cloud to the downside, which would be a bearish signal and could reverse the current bullish trend.

The 200 EMA would become the key support level to watch in this case. Picture the 100 EMA as a guardrail; if the price falls through it, the 200 EMA serves as the safety net below.

Trading within the Ichimoku Cloud generally indicates a period of consolidation or indecision. PEPE’s current position suggests the market is at a critical juncture. Exiting the cloud from the upside would confirm a bullish continuation while dropping out from the bottom could shift sentiment to bearish.

Strategic Recommendations

For Short-term Traders: Focus on the 4-hour chart. A breakout above the Ichimoku Cloud baseline or a drop below the 100 EMA will guide your trading strategy.

For Long-term Investors, the daily chart provides a broader perspective. Monitoring the EMAs and the 0.000012 support level will help them make informed decisions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance and the SEC File for Pause in Lawsuit

The SEC and Binance filed a joint motion to pause their lawsuit for 60 days. They requested a prior pause 60 days ago and have “been in productive discussions” since then.

Both parties have asked for more time to finalize an agreement and consider all the relevant policy implications. In the main, however, it’s a substantially similar agreement to the one between the SEC and Ripple yesterday.

Binance and SEC Discussing a Settlement

The SEC has been dropping a lot of its most prominent enforcement actions lately, such as its lawsuit against Ripple. Still, despite this progress, a few outstanding cases remain.

The SEC has been ending lawsuits against prominent exchanges like Coinbase and Kraken, and now it’s preparing to drop one against Binance:

“Pursuant to the Court’s February 13, 2025 Minute Order, Plaintiff Securities and Exchange Commission and Defendants Binance Holdings Limited… and Changpeng Zhao submit this joint status report and jointly move to continue to stay this case for a period of 60 additional days,” a motion filed today read.

Binance is the world’s largest crypto exchange, and it has been engaged in this fight since 2023. The SEC sued Binance in June of that year, alleging that it committed a few serious crimes.

In addition to violating securities laws, the Commission also claims that Binance deliberately lied to regulators. This caused serious problems for its business, prompting a lengthy battle.

The SEC, however, is under new management now. Paul Atkins is the Commission’s new Chair, and he’s prioritized friendly crypto regulation.

Before his confirmation, the SEC, under Acting Chair Mark Uyeda, filed a joint request with Binance to pause the lawsuit 60 days ago, and they’re asking for another extension.

Today’s filing is slightly shorter than the previous one, but it suggests that real progress has been made. It claims that Binance and the SEC “have been in productive discussions” concerning the Crypto Task Force and broader policy implications of a settlement. However, they still need more time to fully consider a resolution.

This agreement is similar to the one filed yesterday. Specifically, the Commission also requested a 60-day pause in a cross-appeal from Ripple, attempting to tie up loose ends without wasting the court’s resources.

There are a few subtle differences, but Binance’s filing with the SEC attempts to meet the same basic goals.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Whales Are Buying These Altcoins Post Tariffs Pause

Crypto whales are making bold moves following Donald Trump’s 90-day tariff pause, with Ethereum (ETH), Mantra (OM), and Onyxcoin (XCN) drawing significant accumulation.

ETH whales pushed holdings to their highest level since September 2023, while OM holders are quietly increasing exposure amid the growing real-world asset narrative. XCN, meanwhile, saw a sharp spike in whale activity alongside a 50% price surge in just 24 hours.

Ethereum (ETH)

The broader crypto market rallied after Donald Trump announced a 90-day pause on tariffs—excluding China—boosting investor sentiment across risk assets.

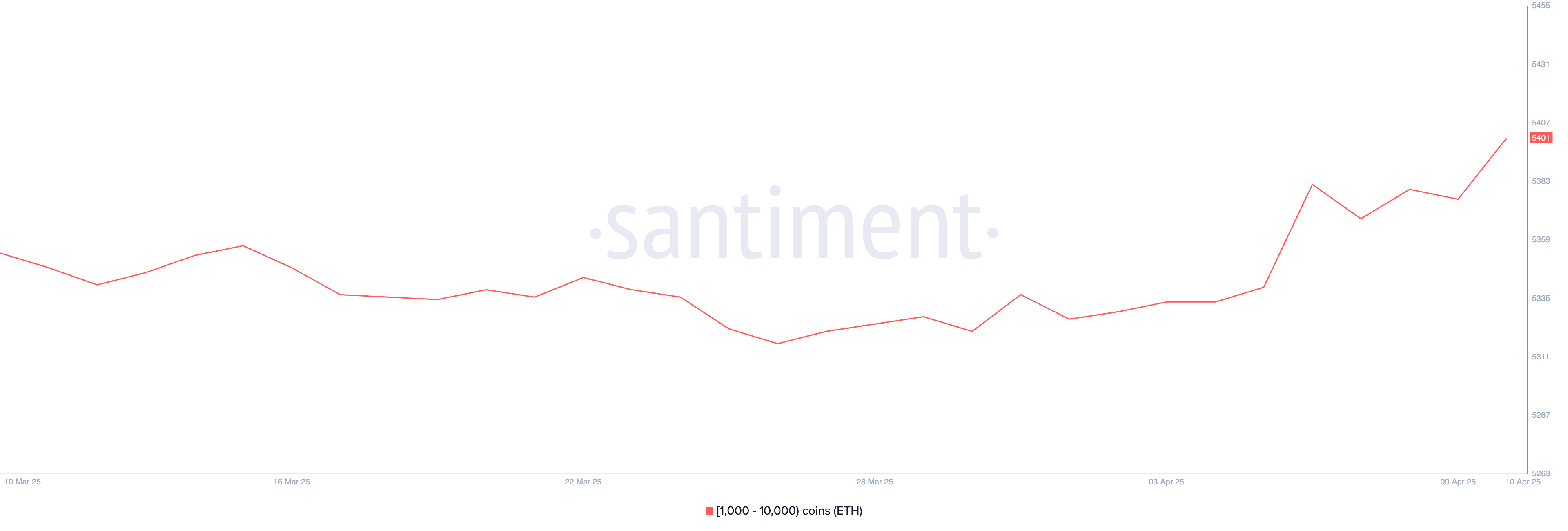

Ethereum followed suit, with on-chain data showing a rise in crypto whales activity; the number of addresses holding between 1,000 and 10,000 ETH climbed from 5,376 to 5,417 between April 9 and 10, reaching its highest level since September 2023.

If Ethereum can maintain this renewed momentum, it may test key resistance levels at $1,749 and potentially rally further toward $1,954 and $2,104. However, macroeconomic uncertainty still looms.

A sentiment reversal could see Ethereum price retesting the $1,412 support zone. If that level fails, a deeper decline toward $1,200—or even $1,000—is possible.

Some analysts have gone as far as comparing Ethereum’s decline to Nokia’s historical collapse, warning of long-term structural weakness.

Mantra (OM)

Real-world assets (RWAs) on the blockchain have hit a new all-time high, surpassing $20 billion in total value, reinforcing their growing importance as a crypto narrative and sector.

Binance Research also highlighted that RWA tokens have shown more resilience than Bitcoin during tariff-related volatility, further boosting confidence in the sector.

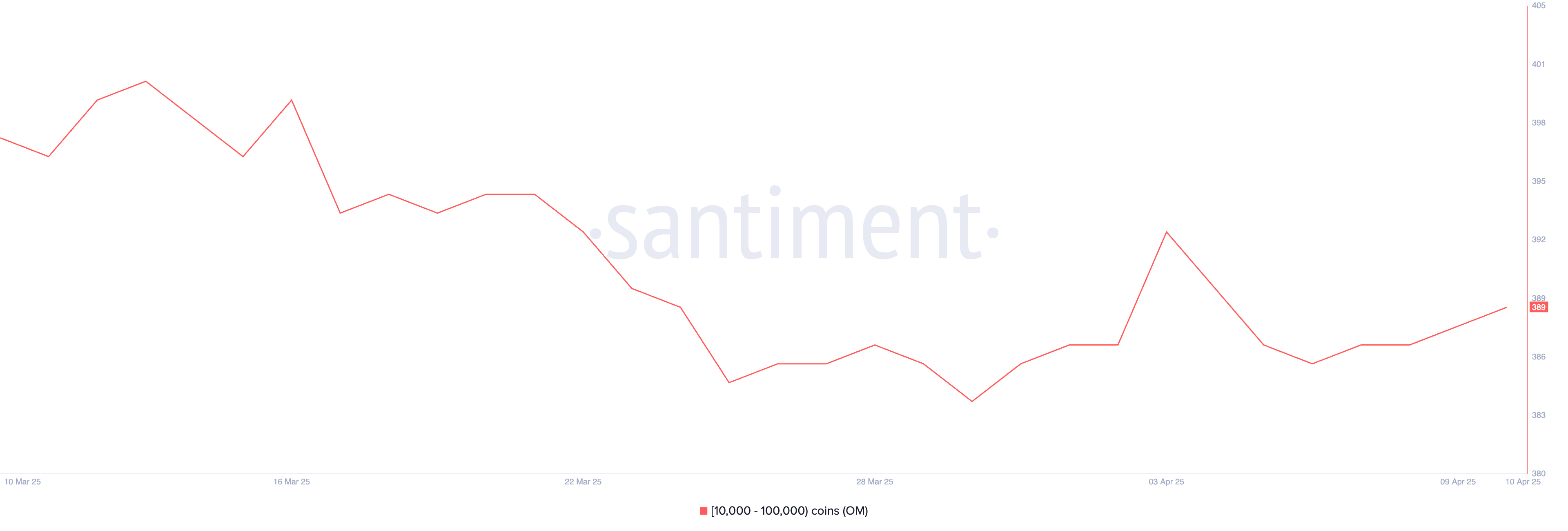

With the RWA narrative gaining traction, OM could see significant upside. Between April 6 and April 10, the number of OM whale addresses holding between 10,000 and 100,000 tokens rose from 386 to 389, signaling quiet accumulation.

If OM breaks past the resistance levels at $6.51 and $6.85, it could climb above $7. However, if the momentum fades, a correction could push the token down to $6.11, with further downside risk toward $5.68.

Onyxcoin (XCN)

Onyxcoin (XCN) has surged over 50% in the past 24 hours, breaking above the $0.02 mark as whale accumulation intensifies.

Between April 7 and April 10, the number of addresses holding between 1 million and 10 million XCN rose from 503 to 532, signaling renewed interest from large holders.

If this strong bullish momentum continues, XCN could rally toward resistance levels at $0.026, $0.033, and even $0.040. However, given the rapid price increase in a short timeframe, a correction may follow.

In that case, XCN could retest support at $0.020, with potential downside extending to $0.014 if selling pressure accelerates.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Flashes Symmetrical Triangle From 2017, A Repeat Could Send It as Flying To $30

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The XRP price may be gearing up for a historic breakout as a long-term Symmetric Triangle pattern from 2017 resurfaces on the charts. If history repeats and a similar explosive move follows, a crypto analyst predicts XRP could skyrocket to an eye-popping $30.

XRP Price Triangle Pattern Signals Breakout Above $30

A new technical analysis by Egrag Crypto, a crypto analyst on X (formerly Twitter), has stirred excitement among XRP supporters, suggesting that the digital asset may be on the brink of a historic price surge and that XRP could jump from its current market value of $2 to reach $30 soon.

Related Reading

While this figure may seem rather ambitious, Egrag Crypto has identified a massive Symmetrical Triangle formation on XRP’s monthly chart. Interestingly, the analyst has revealed that this pattern is strikingly similar to one that preceded XRP’s legendary 2,600% rally in the 2017 bull market.

In the 2017-2018 bull market, XRP had surged to an all-time high of $3.84 in just months. Now, after years of tightening price action within a giant Symmetrical Triangle, the altcoin appears to be breaking out once again, and this time, the analyst predicts that the upside could be even more explosive.

According to Egrag Crypto’s chart, if the asset mirrors its previous 2,600% triangle breakout, it could soar from the breakout zone around $1.20 to as high as $32.36. Notably, XRP’s Symmetrical Triangle formation is a classic consolidation pattern that usually results in a bullish surge in the direction of the prevailing trend.

Currently, XRP’s all-time high is $3.84. A potential surge to $32.36 would represent a whopping 741.6% increase, propelling its price to a level far exceeding its historical peak.

Bullish Pennants Strengthen Symmetrical Triangle Forecast

Egrag Crypto’s bullish forecast for XRP is supported by a textbook diagram comparing bullish pennants and symmetrical triangles, both of which point to double target zones once a breakout occurs. The pattern suggests that once the altcoin escapes its multi-year consolidation, the analyst’s projected rally may play out in three stages: an initial pump, followed by a retracement, and a second explosive move.

Related Reading

The XRP price chart shows a lower target, around $3.52, which aligns with the 1.0 Fibonacci retracement level. This indicates that the token could see a temporary rebound to 3.52, followed by a short-term pullback to the triangle breakout point at $1.20, before ultimately bouncing toward the projected $32.36 target.

Notably, this movement aligns with XRP’s current market structure, where it has maintained long-term support and is now showing signs of upward momentum. While historical price patterns offer insights into potential moves, the predicted rise to $32.36 is uncertain, given the magnitude of such a rise.

Featured image from Adobe Stock, chart from Tradingview.com

-

Market19 hours ago

Market19 hours agoPresident Trump Signs First-Ever Crypto Bill into Law

-

Market18 hours ago

Market18 hours agoXRP Price Ready to Run? Bulls Eyes Fresh Gains Amid Bullish Setup

-

Altcoin20 hours ago

Altcoin20 hours agoXRP Price Risks 40% Drop to $1.20 If It Doesn’t Regain This Level

-

Altcoin18 hours ago

Altcoin18 hours agoBNB Chain Completes Lorentz Testnet Hardforks; Here’s The Timeline For Mainnet

-

Market20 hours ago

Market20 hours agoEthereum Price Cools Off—Can Bulls Stay in Control or Is Momentum Fading?

-

Market13 hours ago

Market13 hours agoHBAR Buyers Fuel Surge with Golden Cross, Suggesting Upside

-

Bitcoin17 hours ago

Bitcoin17 hours agoOver $2.5 Billion in Bitcoin and Ethereum Options Expire Today

-

Market12 hours ago

Market12 hours agoChina Raises Tariffs on US to 125%, Crypto Markets Steady