Market

Will Polygon (MATIC) Price Manage to Escape This Curse?

Polygon (MATIC) price is struggling to break above a critical resistance that has left the altcoin stuck within two limits.

To make this worse, the investors are not too keen on HODLing either, as they are likely opting to offset their losses.

Polygon Investors Are Pulling Back?

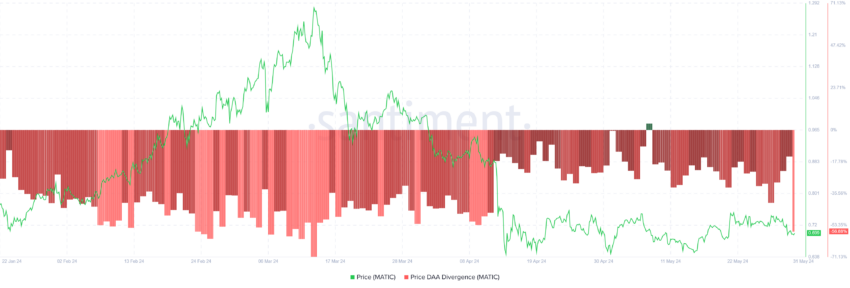

MATIC price could be taking a dip, owing to the asset’s holders’ actions. In the last few days, the lack of increase in price has resulted in the investors noting a sell sign flashing across the network.

This is visible in the price daily active addresses (DAA) divergence. This is a phenomenon where the price of a cryptocurrency and the number of its daily active addresses move in opposite directions. This divergence can indicate potential overvaluation or undervaluation of the asset.

In the case of MATIC though, both price and participation are declining. This results in the network flashing a sell signal which the retail investors could follow.

As is the whales are following this path evident in their recent dumping. The addresses holding between 1 million and 10 million MATIC tokens have sold off more than 23 million MATIC. This $17 million worth of supply sold in the span of four days has brought their holdings to 913 million MATIC.

This group of investors is known to be highly influential on the price as their actions lead to the price. When these whales buy, the price tends to go up, and when they sell, MATIC takes a dip.

Read More: How To Buy Polygon (MATIC) and Everything You Need To Know

Thus, their selling could likely translate to a decline in the altcoin’s value.

MATIC Price Prediction: Decline May Continue

MATIC price has been consolidated for the past month within the limits of $0.75 and $0.64. These two price points have been tested multiple times as both resistance and support, respectively.

The aforementioned conditions highlight similar potential outcome since the investors are not particularly bullish. The altcoin could drop back to $0.64 from the current trading price of $0.69.

Read More: Polygon (MATIC) Price Prediction 2024/2025/2030

Should MATIC price break out or break down, the neutral bearish thesis would be invalidated. A breakout would send the altcoin rising towards $0.80, while a fall below $0.64 will result in a drop to $0.60.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP and Bitcoin Briefly Rallies After Rumors of 90-Day Tariff Pause

The brief rumor of a 90-day pause from Trump’s tariffs caused the markets to rally significantly. However, the White House squashed these rumors, fueling further crashes.

This highlights a genuine desperation in the markets as traders try to regain some bullish momentum and prevent a recession.

Trump Tariff Fakeout

The threat of Trump’s tariffs is closer than ever, and it’s causing a “Black Monday” event in the crypto markets. Bitcoin dipped below $80,000, and over $1 billion was liquidated from crypto.

However, one of the President’s advisors, Kevin Hassett, suggested this morning that he might be having second thoughts:

“Would Trump consider a 90-day pause in tariffs?’ ‘I think the president is gonna decide what the president is gonna decide … even if you think there will be some negative effect from the trade side, that’s still a small share of GDP,’” Hassett said in an interview.

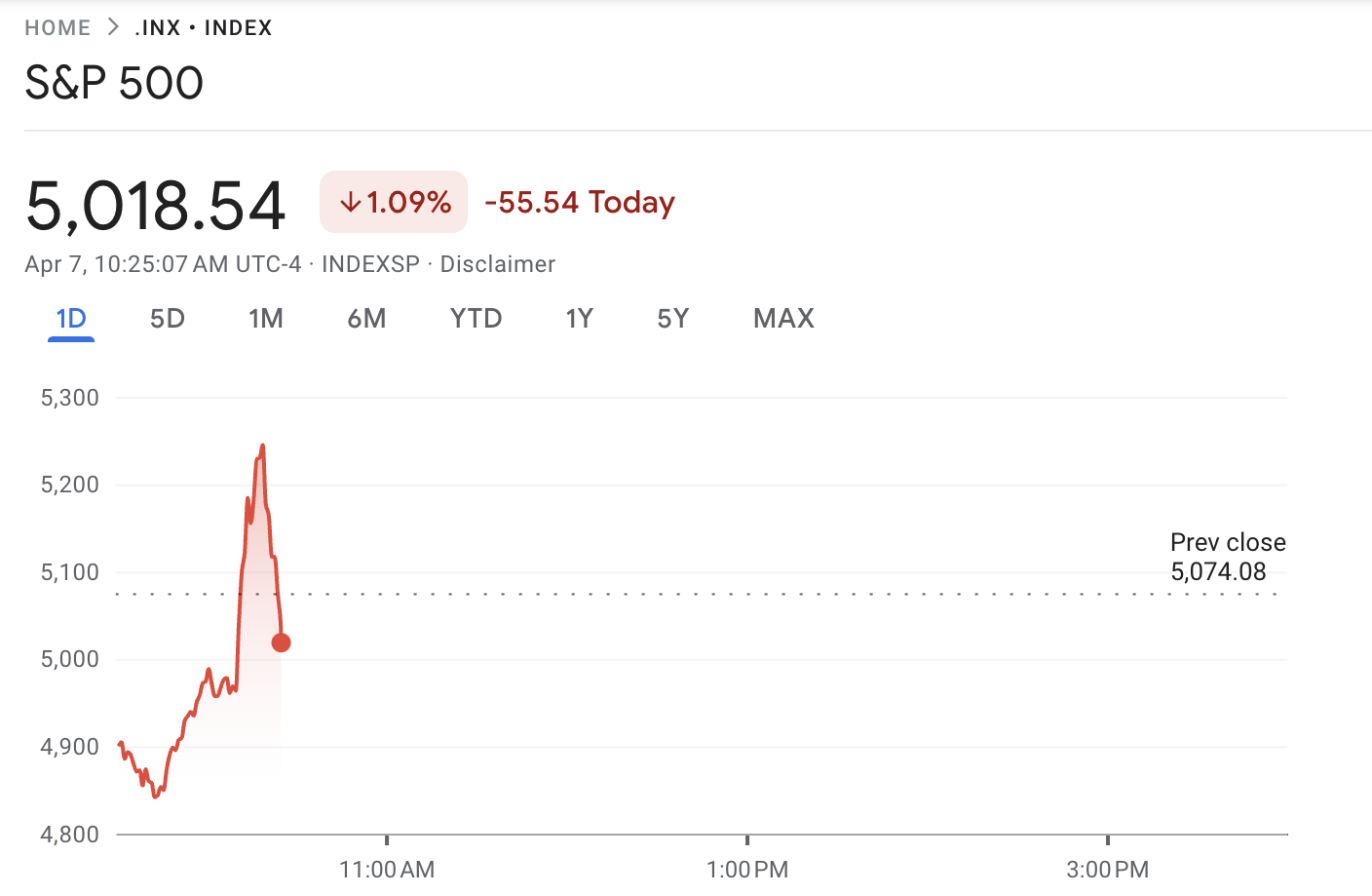

This news quickly began recirculating, claiming that Trump was seriously considering a 90-day pause in tariffs. This created a huge rally in traditional markets, with the S&P 500 shooting up 6% in seconds. This rally turned on a dime to a certain extent, falling again quickly.

Following the rumor, XRP rallied nearly 10% to hit $2, while Bitcoin rebounded back to $80,000. Both assets have declined again due to the lack of credibility of the news. Overall, the volatility has been extremely chaotic in the crypto market today.

In his interview, Hassett did not make any firm commitments that Trump is considering pausing tariffs. His response focused mostly on ongoing negotiations and assertions that the tariffs would have a limited impact.

Shortly afterward, the White House officially denied any knowledge of a 90-day pause. They are still set to begin in two days.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance Founder CZ Joins Pakistan Crypto Council as Advisor

Changpeng ‘CZ’ Zhao, the founder of Binance, has reportedly taken on a new role as Strategic Advisor to the Pakistan Crypto Council.

Pakistan’s local media suggests that the appointment was confirmed during a meeting held in Islamabad with top government officials.

CZ Joins Pakistan Crypto Council

The Finance Minister, Senator Muhammad Aurangzeb, reportedly led the session. Other attendees included the heads of Pakistan’s key financial and regulatory bodies—the Securities and Exchange Commission and the State Bank—and senior officials from the law and IT ministries.

According to the reports, Zhao also met separately with Pakistan’s Prime Minister and Deputy Prime Minister to discuss digital asset policy and blockchain adoption.

His involvement with Pakistan follows a recent agreement with the Kyrgyz Republic. There, he is advising on Web3 infrastructure and blockchain education.

Kyrgyzstan has also launched the A7A5 stablecoin, pegged to the Russian ruble. Both Kyrgyzstan and Pakistan are looking to develop their financial ecosystem around crypto to attract industry interest in the regions.

Meanwhile, CZ continues to engage with multiple governments on crypto regulation. He has been focused on building secure frameworks and enabling digital finance ecosystems.

BeInCrypto has contacted Binance about the reports and whether the company is involved in the initiative.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum (ETH) Tanks to March 2023 Levels as ETH/BTC Ratio Plummets to 5-Year Low

The value of the leading altcoin, Ethereum, has plunged to its lowest point since March 2023, signaling a steep decline in market confidence. This has happened amid the broader market’s downturn, which was exacerbated by Donald Trump’s Liberation Day.

Compounding the bearish sentiment, the ETH/BTC ratio has now dropped to a five-year low, indicating that Bitcoin is gaining relative strength against Ethereum.

ETH/BTC Ratio Hits 5-Year Low as Traders Flee

ETH’s price decline has pushed the ETH/BTC ratio to a five-year low of 0.019. This ratio measures ETH’s relative value compared to BTC. When it rises, it indicates that ETH is outperforming BTC, either because the altcoin’s price is growing faster or the king coin’s price is falling.

Conversely, a decline like this suggests that the leading coin, BTC, is gaining strength relative to the top altcoin, ETH. It suggests that traders are moving capital into BTC, seeing it as a safer or more profitable investment at the moment despite its own price troubles.

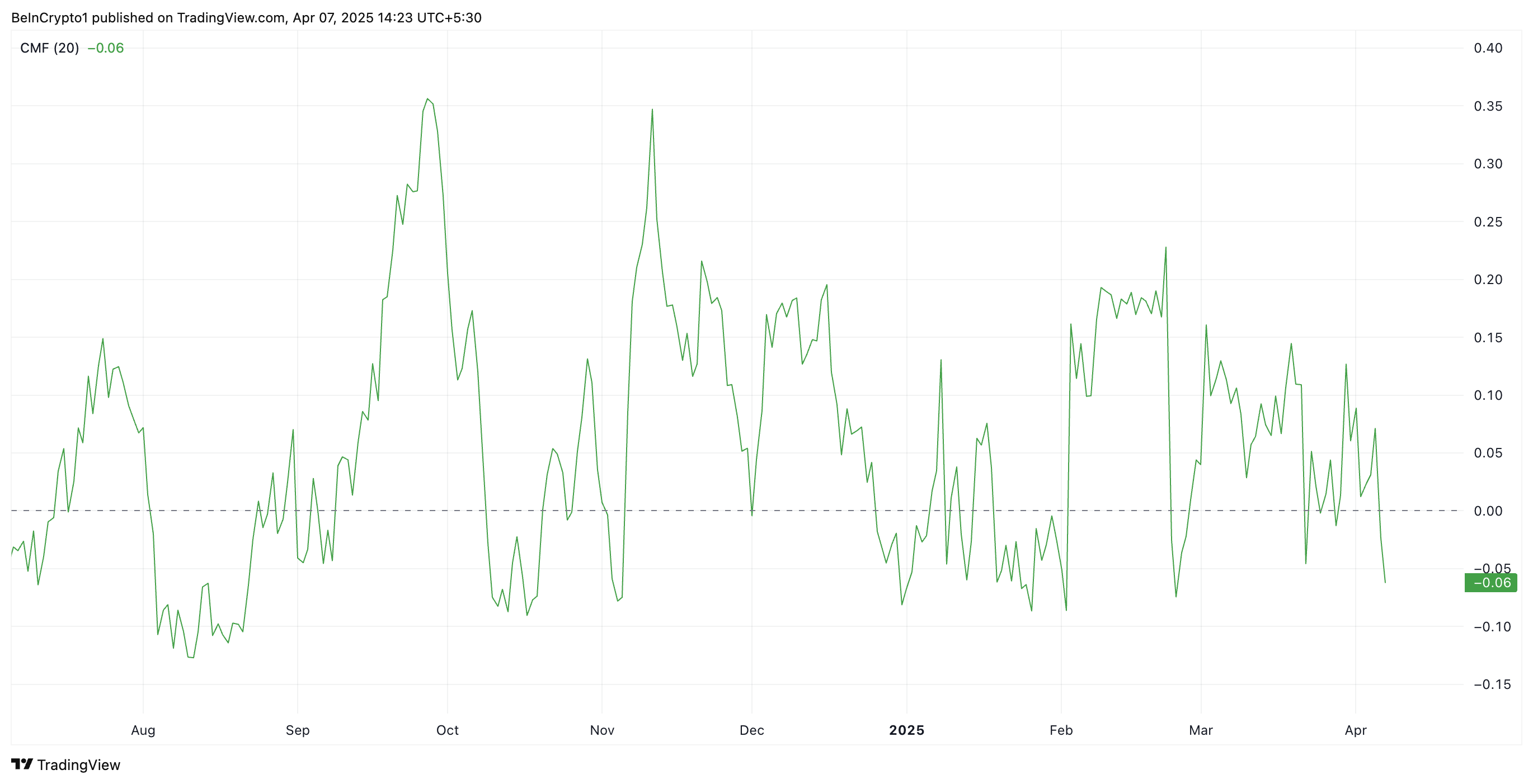

Further, on the daily chart, ETH’s negative Chaikin Money Flow (CMF) confirms the coin’s plummeting demand. At press time, it is at -0.07.

The CMF indicator measures the volume-weighted accumulation and distribution of an asset over a set period, helping gauge buying and selling pressure. When its value falls below zero like this, it indicates that selling pressure is dominating.

ETH’s CMF readings suggest that more traders are distributing (selling) the coin than accumulating it. This reflects weakening demand and is a bearish signal for the asset’s price momentum.

ETH Flashes Oversold Signal: Is a Bounce Back on the Horizon?

ETH’s Relative Strength Index (RSI), observed on a one-day chart, shows that the altcoin is currently oversold. At press time, the momentum indicator is in a downtrend at 25.62.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 25.62, ETH’s RSI signals that the coin is deeply oversold. This presents a buying opportunity, as such lows are usually followed by a price rebound.

If this happens, ETH’s price could regain and climb back above $1,589. If this support level strengthens, it could propel ETH’s value to $1,904.

However, this rebound is not guaranteed. If ETH bears maintain dominance and selloffs continue, the coin could extend its decline and fall toward $1,197.

The post Ethereum (ETH) Tanks to March 2023 Levels as ETH/BTC Ratio Plummets to 5-Year Low appeared first on BeInCrypto.

-

Altcoin21 hours ago

Altcoin21 hours agoExpert Reveals Decentralized Strategy To Stabilize Pi Network Price

-

Bitcoin23 hours ago

Bitcoin23 hours agoUS Macro Setup To Favour New Bitcoin ATH In The Long Run

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Lags Behind Bitcoin In Q1 Performance Amid Market Downturn – Details

-

Market20 hours ago

Market20 hours agoBitcoin Price Drops Below $80,000 Amid Heavy Weekend Selloff

-

Ethereum18 hours ago

Ethereum18 hours agoEthereum Supply On Exchanges Plummets – Is A Supply Squeeze Coming?

-

Market24 hours ago

Market24 hours agoKey Solana Holders’ 6-Month High Accumulation Signal Price Rise

-

Market23 hours ago

Market23 hours ago3 Token Unlocks for This Week: AXS, JTO, XAV

-

Market7 hours ago

Market7 hours agoEthereum Price Tanks Hard—Can It Survive the $1,500 Test?