Market

Why Coinbase Faces Growth Challenges Amid Crypto Maturity

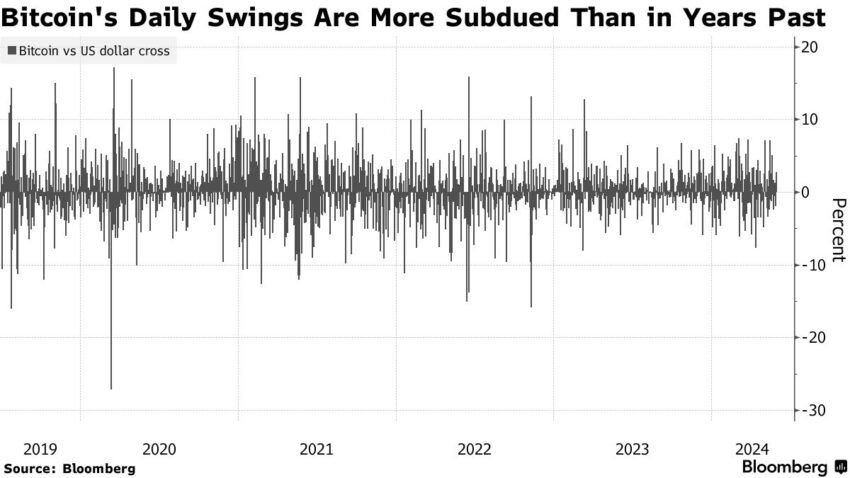

The extreme market volatility that once attracted speculative investors is diminishing in the crypto ecosystem. This change significantly impacts exchanges like Coinbase (COIN), which thrived during periods of high fluctuation.

Despite surpassing financial forecasts for the first quarter of 2024, Coinbase reported a trading volume of $56 billion. This figure starkly contrasts with the $177 billion peak in late 2021.

How Coinbase Navigates Diminishing Trading Volume

According to a Bloomberg report, citing research from CCData, the average volatility for digital currencies has decreased to 57% this year from about 79% in 2021. This reduction indicates a stabilizing market, which, while less appealing to high-risk traders, promises more sustainable growth.

Coinbase’s CFO – Alesia Haas, highlighted this new stability at a JPMorgan conference.

“Volatility looks much more mature in this cycle than it did in 2021. Volatility of Bitcoin, volatility of Ethereum start to come, what I call, on the grid,” Haas said.

Furthermore, spot Bitcoin exchange-traded funds (ETFs) have brought more structured market inflows. As a result, Bitcoin hit a new all-time high of around $73,000 in March 2024.

Consequently, Bobby Zagotta, CEO of Bitstamp USA, suggests that the market retains some volatility. However, he believes the magnitude of price movements will likely be less extreme than in past cycles.

“The market is more mature today and is less likely to have wild swings. It will still be volatile, and there will still be upward momentum on Bitcoin and crypto prices, but I don’t think it’ll be as explosive up and down as prior cycles,” Zagotta said.

Read more: Coinbase Review 2024: The Best Crypto Exchange for Beginners?

Due to this, Coinbase’s financials, while strong, still lag behind the 2021 peak. The company’s future performance is closely tied to the duration of the current bull market and its ability to maintain significant market share, which has slightly decreased since the beginning of 2023.

In addition to these internal challenges, Coinbase has faced technical issues, including several outages this year. These incidents have temporarily barred users from trading during critical times, underscoring the need for improved platform stability to maintain trader confidence.

Financially, Coinbase is diversifying its revenue sources. The company has established itself as a major custodian for US spot Bitcoin ETFs and is poised to hold a similar position for upcoming Ethereum ETFs.

Its involvement in the Base network is expected to become a significant revenue stream. According to Owen Lau, an analyst from Oppenheimer & Co., this diversification should lead to more stable and predictable earnings.

“Coinbase revenue could become even more predictable. It means that they could command a higher earnings multiple,” Lau said.

From a technical analysis standpoint, COIN stock has demonstrated notable activity this year. After reaching a local high of $283 on March 25, 2024, the stock entered a consolidation phase, fluctuating between $236 and $197. On May 24, the COIN stock broke out of this range, converting the $236 level from resistance to support.

Read more: 5 Best Web3 Stocks To Invest in 2024

Currently, the COIN stock is testing this new support level. If it holds, there could be a potential rally of up to 20% as the stock aims to retest the March highs.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Market

10 Altcoins at Risk of Binance Delisting

On April 3, Binance announced that it would add a new set of tokens to its monitoring list. These tokens are under closer scrutiny and may face delisting following the upcoming review period.

This move follows the exchange’s aims to increase transparency while offering more clarity regarding the risk levels associated with different cryptocurrencies.

10 Altcoins in Danger of Binance Delisting

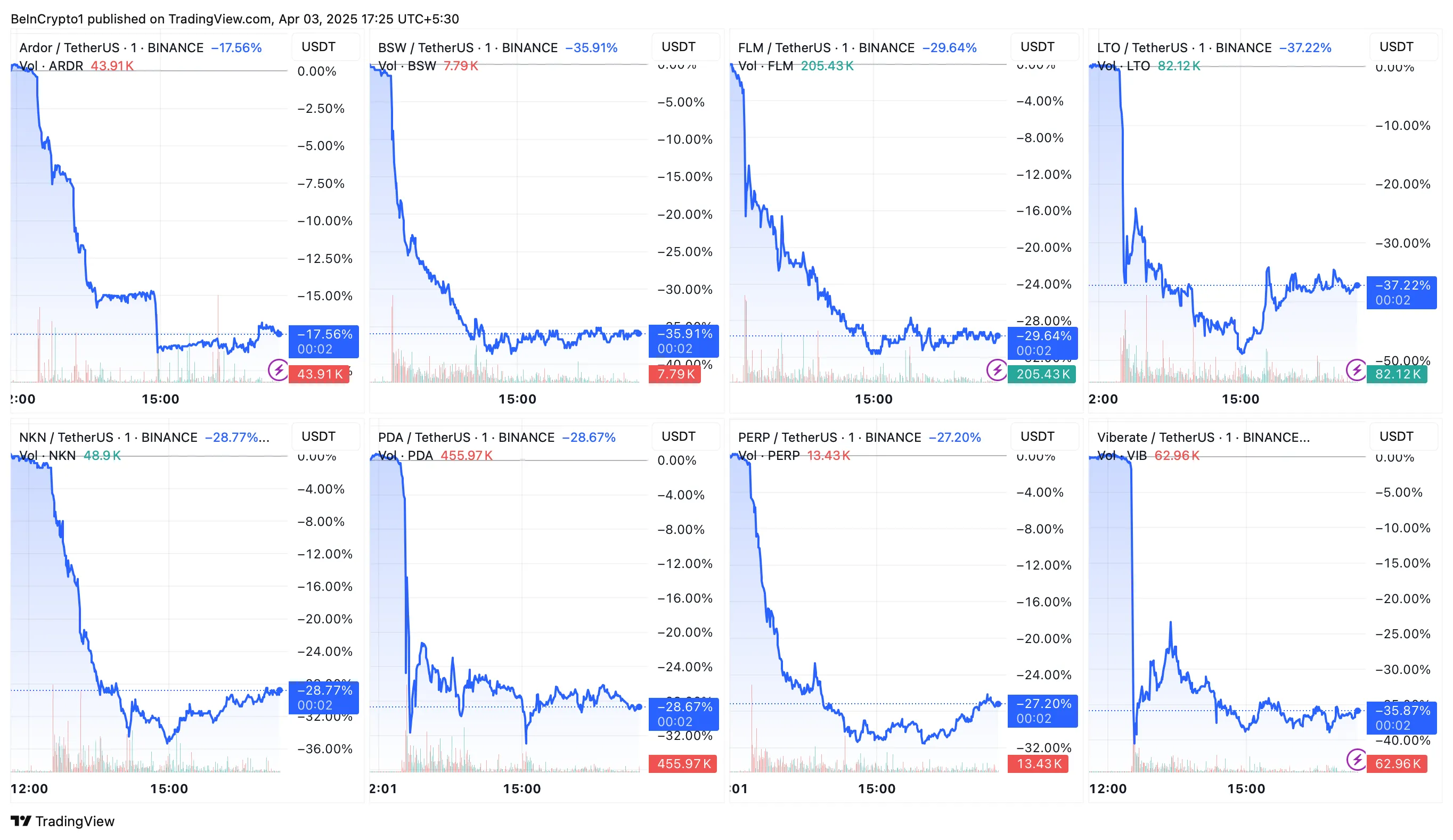

As part of this update, the following tokens will be added to the Monitoring Tag list: Ardor (ARDR), Biswap (BSW), Flamingo (FLM), LTO Network (LTO), NKN (NKN), PlayDapp (PDA), Perpetual Protocol (PERP), Viberate (VIB), Voxies (VOXEL) and Wing Finance (WING).

Tokens added to the Monitoring Tag exhibit notably higher volatility and risk compared to other listed tokens. Binance will closely monitor these tokens, with regular reviews to assess their compliance with the platform’s listing criteria.

“Tokens with the Monitoring Tag are at risk of no longer meeting our listing criteria and being delisted from the platform,” Binance said.

Following the announcement, the prices of the mentioned altcoins plummeted by double-digits.

In addition to the new Monitoring Tag additions, Binance will also remove the Seed Tag from Jupiter (JUP), Starknet (STRK), and Toncoin (TON).

Tokens marked with the Seed Tag are those that are still in their early stages of development and have not yet met Binance’s full listing criteria. The removal of the Seed Tag indicates a change in the status of these projects. This suggests that they no longer fit the initial criteria for such a label.

Tokens with the Monitoring Tag or Seed Tag come with inherent risks. Binance ensures that users are well-informed before trading them. To access trading for these tokens, users must pass a risk awareness quiz every 90 days.

The quiz makes sure that users understand the potential risks associated with trading higher-risk tokens. Binance will also display a risk warning banner for these tokens on its Spot and Margin platforms.

Binance will continue to conduct periodic reviews of tokens with the Monitoring Tag and Seed Tag. During these reviews, several factors are taken into account. This includes the project team’s commitment, development activity, token liquidity, and community engagement.

The latest development follows a similar announcement from Binance in March. The exchange routinely delists tokens that fail to keep up with its criteria.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

HBAR Foundation Eyes TikTok, Price Rally To $0.20 Possible

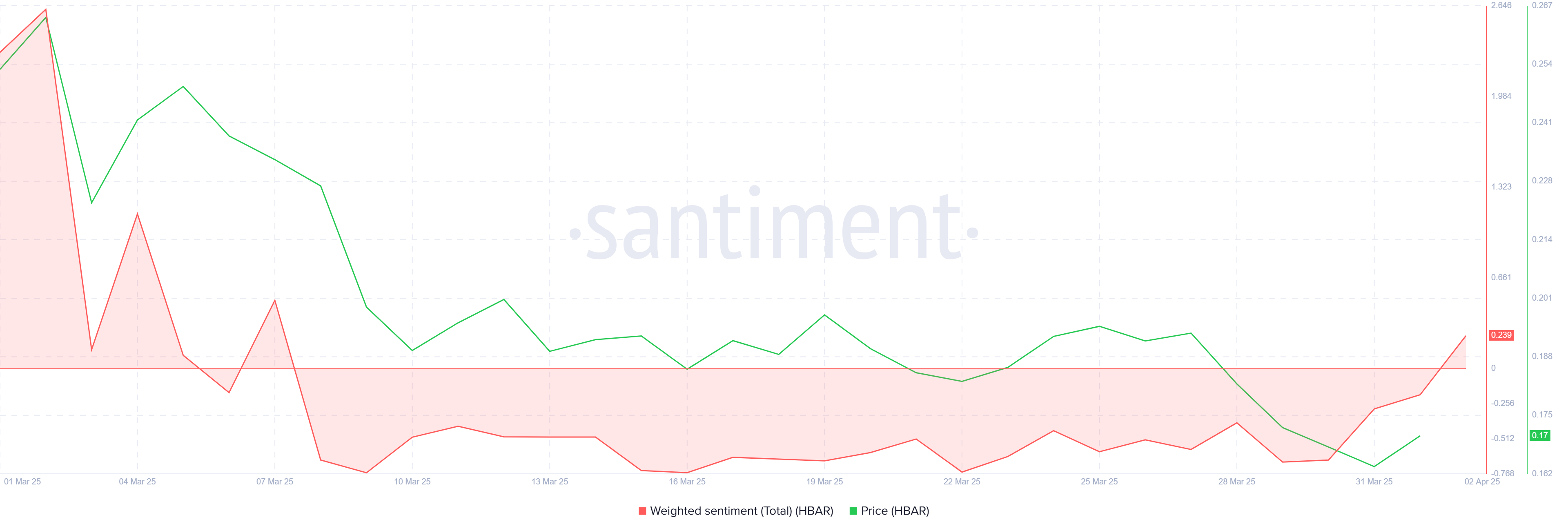

Hedera (HBAR) has faced a downtrend recently, with the crypto asset’s price failing to maintain support at $0.200. This failure to establish a solid base has led to a pullback.

However, key developments within the Hedera ecosystem and shifting investor sentiment could spark a potential price rally in the coming days.

HBAR Foundation Eyes TikTok

After nearly a month of bearish sentiment, investors are beginning to shift their stance towards bullishness. The Hedera Foundation’s recent move to team up with Zoopto for a late-stage bid to acquire TikTok has played a pivotal role in this shift. If the acquisition is approved, the partnership could expose HBAR to a massive audience due to TikTok’s extensive user base, potentially driving up demand and mainstream adoption.

The prospect of this collaboration has reignited interest among investors, sparking optimism about Hedera’s future growth potential. With TikTok’s wide-reaching influence, the strategic partnership could offer Hedera an edge in the competitive crypto market, encouraging further accumulation of HBAR tokens.

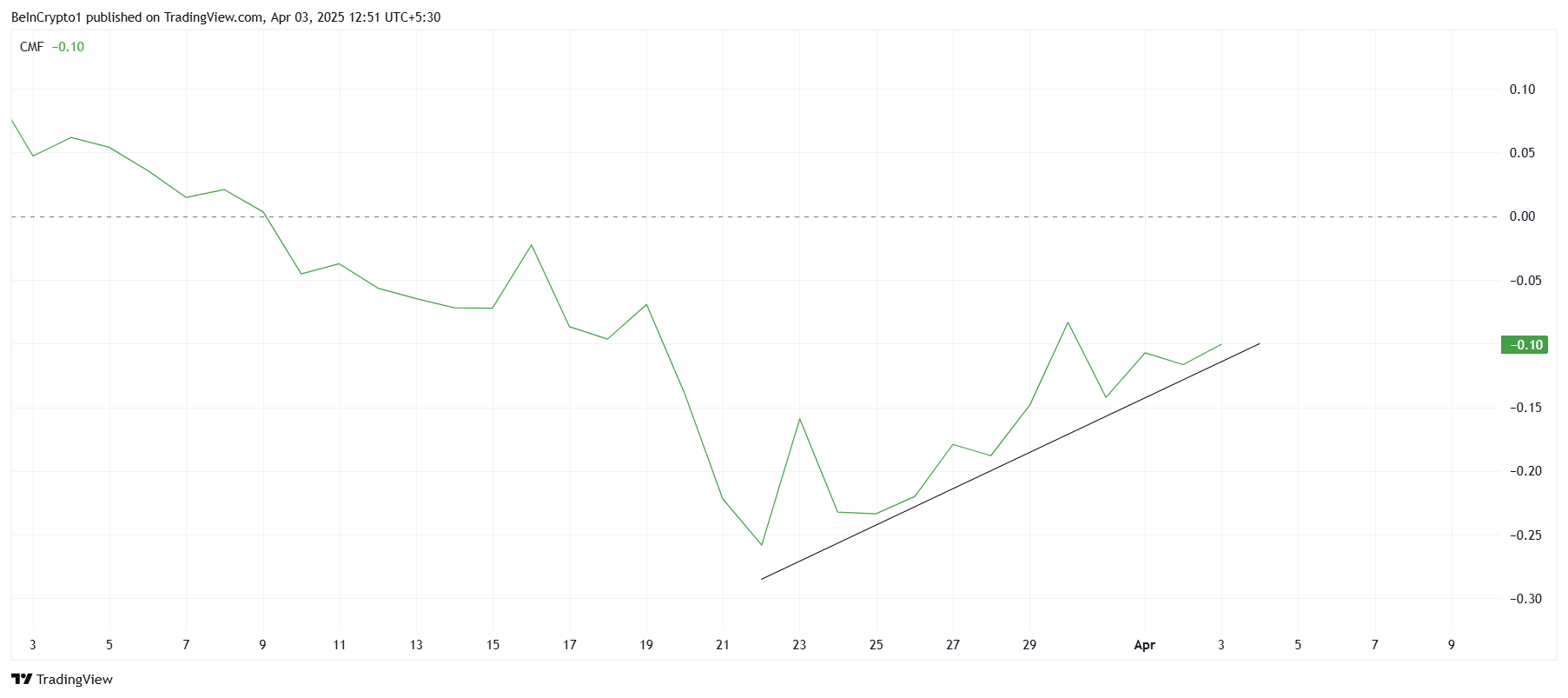

On the technical front, the Chaikin Money Flow (CMF) indicator is showing signs of recovery. The CMF has started to tick upwards, signaling a potential increase in inflows. While it hasn’t yet crossed above the zero line, the growing positive momentum indicates that more capital could be entering the market. Continued inflows could provide the necessary push for HBAR to break through key resistance levels.

The increase in capital flow suggests a strengthening of investor confidence. However, for a sustained rally, more substantial buying pressure will be required to move HBAR above its current price point. If this trend continues, HBAR may see a rise in both investor interest and market value in the near future.

HBAR Price Finds Support

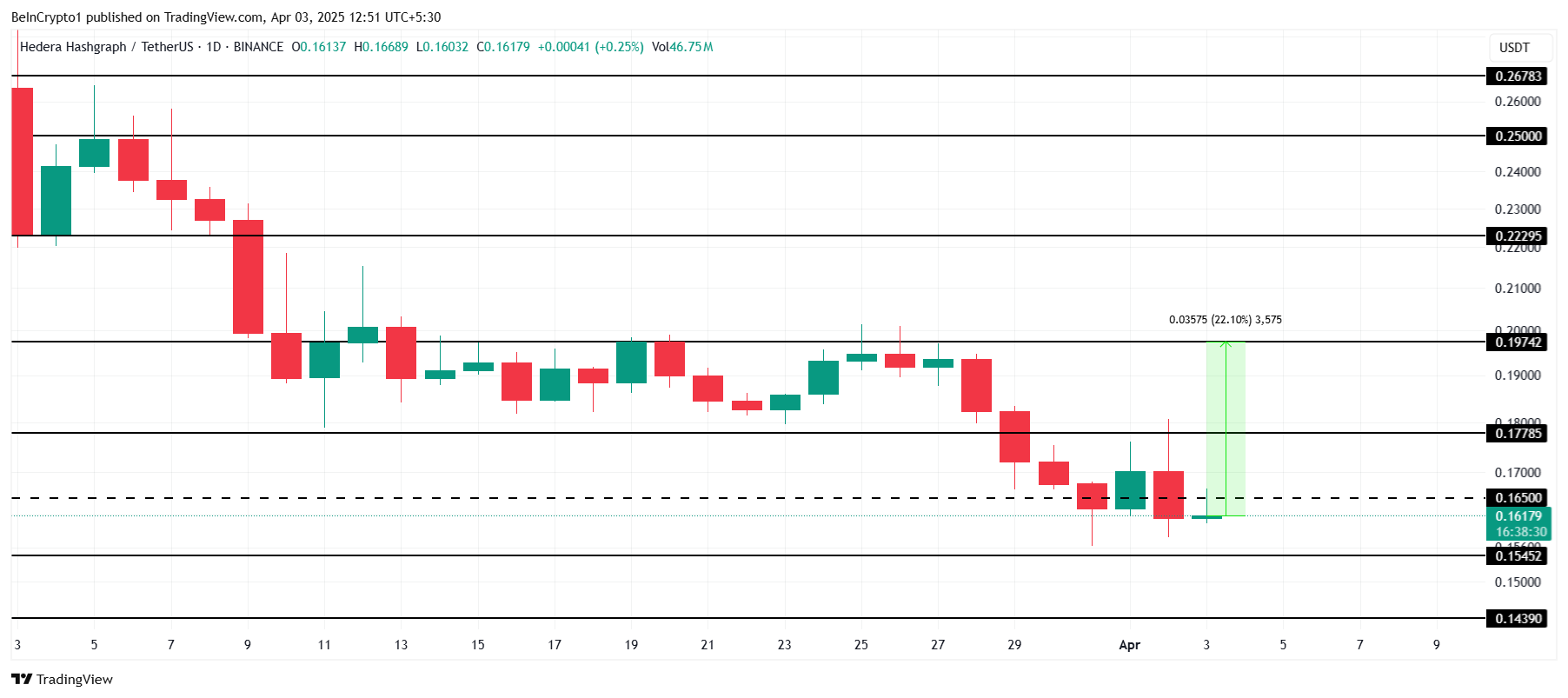

Currently, HBAR is priced at $0.161, just under the key resistance level of $0.165. The next significant resistance lies at $0.197, which has acted as a barrier to HBAR’s price recovery. With a 22% gap between the current price and this resistance, overcoming this hurdle could pave the way for a move toward $0.200.

Given the positive developments surrounding Hedera, it is plausible that HBAR could move toward these resistance levels. If the token can breach $0.165 and then $0.177, the path to $0.197 becomes much clearer. This would mark a critical point for HBAR as it seeks to regain lost ground.

However, if investors decide to take profits and sell before further upward movement, HBAR could fail to breach the $0.177 resistance. Such a scenario could push the price back down towards $0.154 or $0.143, invalidating the bullish outlook and prolonging the consolidation phase.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

IP Token Price Surges, but Weak Demand Hints at Reversal

Story’s IP is today’s top-performing asset. Its price has surged 5% to trade at $$4.37 at press time, defying the broader market’s lackluster performance.

However, despite the price uptick, the weakening demand for the altcoin raises concerns about its rally’s sustainability.

IP Price Rises, But Falling Volume Signals Weak Buying Momentum

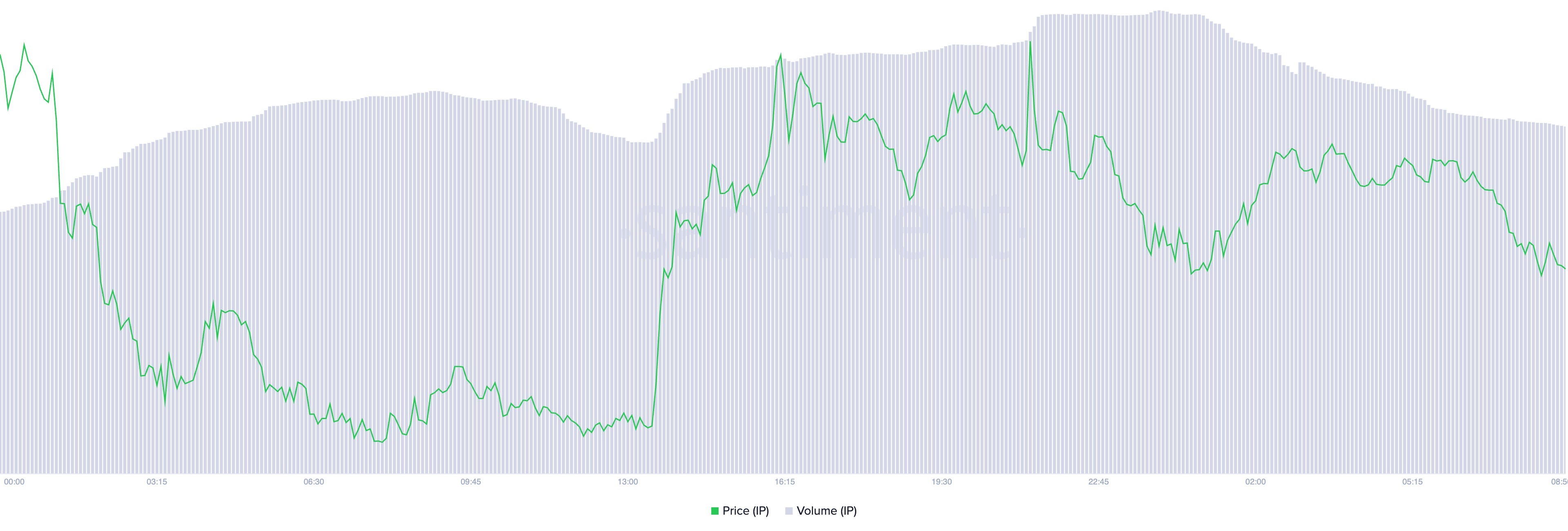

IP’s daily trading volume has plummeted by 7% over the past 24 hours despite the token’s price surge. This forms a negative divergence that hints at the likelihood of a price correction.

A negative divergence emerges when an asset’s price rises while trading volume falls. It suggests weak buying momentum and a lack of strong market participation.

This indicates that the IP rally may not be sustainable, as fewer traders are backing its upward move. Without sufficient volume to reinforce the price increase, the altcoin is at risk of a potential reversal or correction.

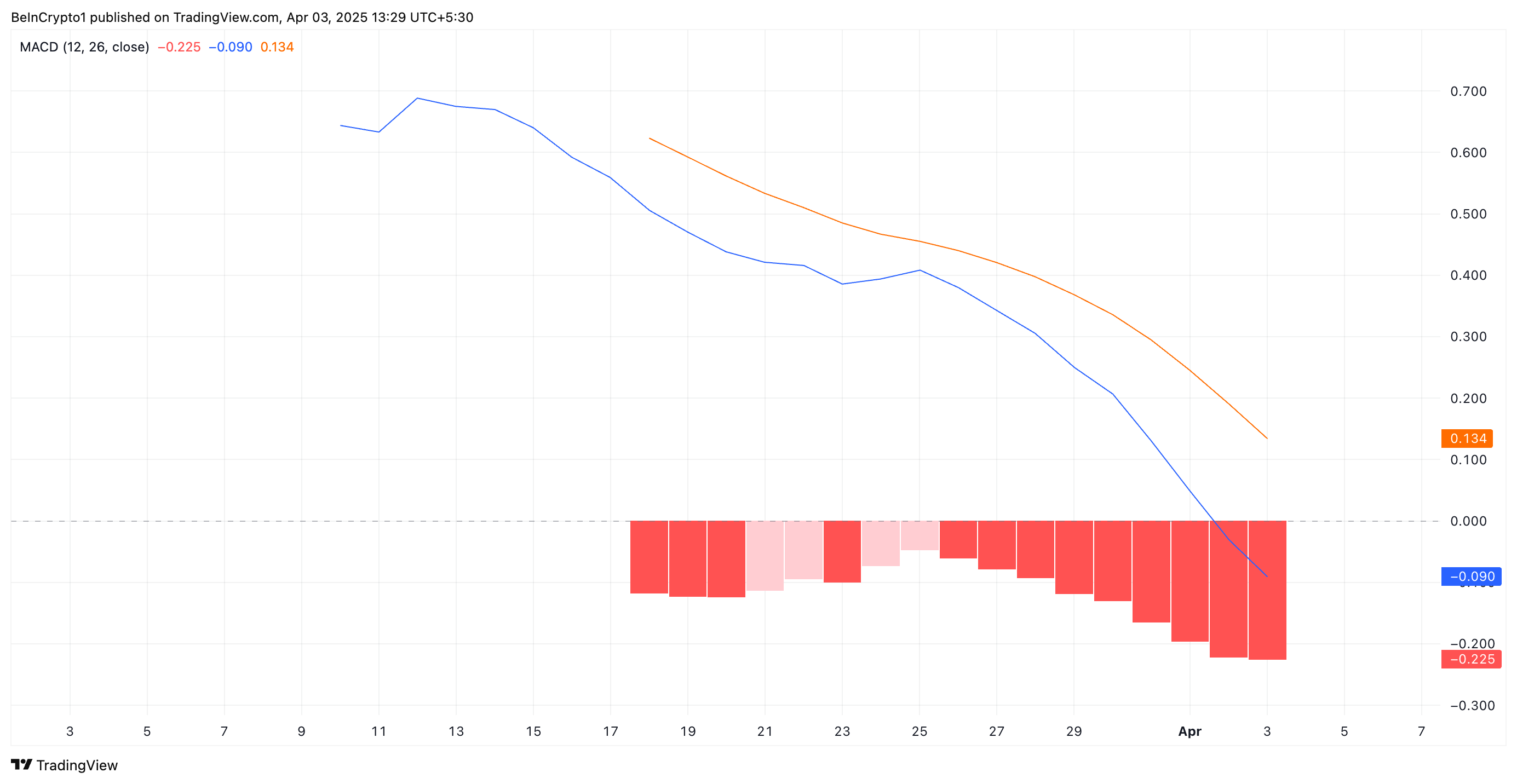

Further, IP’s Moving Average Convergence Divergence (MACD) setup supports this bearish outlook. As of this writing, the token’s MACD line (blue) rests below its signal line (orange), reflecting the selling pressure among IP spot market participants.

The MACD indicator measures an asset’s trend direction and momentum by comparing two moving averages of an asset’s price. When the MACD line is below the signal line, it indicates bearish momentum, suggesting a potential downtrend or continued selling pressure.

If this trend persists, IP’s recent 5% price surge may lose steam, increasing the likelihood of a short-term correction.

IP’s Bearish Structure Remains Intact – How Low Can It Go?

On the daily chart, IP has traded within a descending parallel channel since March 25. This bearish pattern emerges when an asset’s price moves within two downward-sloping parallel trendlines, indicating a consistent pattern of lower highs and lower lows.

This pattern confirm’s IP prevailing downtrend, suggesting continued bearish pressure unless a breakout above resistance occurs.

If the downtrend strengthens, IP’s price could break below the lower trend line of the descending parallel channel and fall to $3.68.

On the other hand, if the altcoin witnesses a spike in new demand, it could break above the bearish channel and rally toward $5.18.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin24 hours ago

Bitcoin24 hours agoLummis Confirms Treasury Probes Direct Buys

-

Altcoin18 hours ago

Altcoin18 hours agoHere’s Why This Analyst Believes XRP Price Could Surge 44x

-

Regulation22 hours ago

Regulation22 hours agoKraken Obtains Restricted Dealer Registration in Canada

-

Altcoin14 hours ago

Altcoin14 hours agoFirst Digital Trust Denies Justin Sun’s Allegations, Claims Full Solvency

-

Altcoin17 hours ago

Altcoin17 hours agoHow Will Elon Musk Leaving DOGE Impact Dogecoin Price?

-

Ethereum16 hours ago

Ethereum16 hours agoWhy A Massive Drop To $1,400 Could Rock The Underperformer

-

Altcoin15 hours ago

Altcoin15 hours agoWill Cardano Price Bounce Back to $0.70 or Crash to $0.60?

-

Market7 hours ago

Market7 hours agoXRP Price Under Pressure—New Lows Signal More Trouble Ahead