Market

Iggy Azalea’s Mother Coin Scandal: $2 Million Insider Trading

Following Caitlyn Jenner’s controversial meme coin launch, Sahil Arora, the “middleman” accused of scamming Jenner and rapper Rich the Kid, has targeted Australian rapper Iggy Azalea.

Arora suggested his next celebrity collaboration for launching a meme coin would be with Azalea, utilizing Solana’s meme coin launchpad, pump.fun.

Inside Iggy Azalea’s Meme Coin Controversy

In his Telegram group, he shared an address and encouraged members to send Solana (SOL) to participate in a presale for a new token named IGGY. He initially opened the presale to 100 wallets but increased the limit to 700 and then to 1,000.

The presale wallet has amassed over $380,000 in cryptocurrency. However, investors claimed that they had yet to receive their tokens.

During its debut, IGGY showed a strong performance. According to data from DEX Screener, it quickly reached a market capitalization of approximately $3 million. Yet, at the time of writing, IGGY is now trading at $0.00003907, with the market capitalization slumped to $39,000.

Read more: Crypto Social Media Scams: How to Stay Safe

After Arora’s announcement, Azalea declared on her X (Twitter) account that she launched her own meme coin, Mother Iggy (MOTHER), with the token address. She clarified that she independently launched MOTHER, urging her followers not to trust false claims about her involvement with Arora.

“Don’t disappoint your mother. Also don’t believe the bullsh*t, fake screenshots, and all the rest. I know you all are smarter than that. No one is working with me. I can’t say it enough. Not true. Sahil, baby, take your L and go already,” Azalea stated in her post.

Compared to IGGY, MOTHER had a stronger debut. It reached a market capitalization of $18.2 million. DEX Screener data reveals that MOTHER is now trading at $0.008633, with its market capitalization halved to $9.2 million.

Azalea admitted in an X Space discussion that no one had “really onboarded” her to the crypto industry. She claimed her brother, Mathias ‘Matt’ Kelly, helped her launch the token.

“Matt just likes crypto and honestly, [he] just doesn’t shut up about any type of technology or new thing. Meme coin involves so much more sh*tposting and memeing and stuff that I really like, like that kind of culture of the internet,” she explained.

Furthermore, Azalea outlined her plans to build trust and integrity in the crypto community. She aims to distinguish herself from other controversial celebrity tokens.

“Every time they start rugging, I just want to burn some of mine because I’m a celebrity in the space, and I know I’m going to get hated on for being here. So I’m just going to burn some every time someone comes that’s a celebrity and it’s looking like it’s clearly a rug. I’m just gonna burn,” she affirmed.

Insider Trading Allegations Hit Iggy Azalea’s Meme Coin

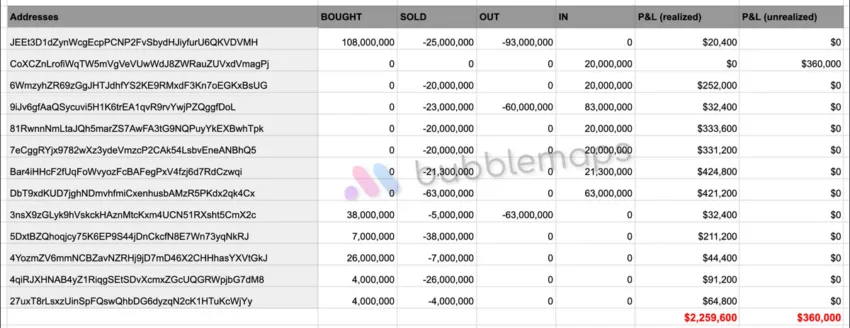

Despite Azalea’s efforts, blockchain data provider Bubblemaps discovered “huge insider activity” in the MOTHER meme coin. Insiders bought 20% of the supply at launch before Azalea announced and have since dumped tokens worth $2 million.

According to Bubblemaps, wallet address JEEt3D1dZynWcgEcpPCNP2FvSbydHJiyfurU6QKVDVMH bought 109 trillion MOTHER, equal to 10% of the supply. The wallet then splits those tokens into seven wallets.

“Out of these, 89 trillion tokens have been sold. Realized profit and loss: $1.4 million. Unrealized profit and loss: $400,000,” Bubblemaps noted.

The wallet sent SOL to highly profitable wallets that made significant returns on MOTHER. These include DbT9xdKUD7jghNDmvhfmiCxenhusbAMzR5PKdx2qk4Cx, 3nsX9zGLyk9hVskckHAznMtcKxm4UCN51RXsht5CmX2c, and 4YozmZV6mmNCBZavNZRHj9jD7mD46X2CHHhasYXVtGkJ. These wallets reportedly made approximately $800,000 by selling 8% of the token supply.

In addition to the discoveries made by Bubblemaps, when on-chain investigator Coffeezilla questioned Arora regarding the recent accusations made by Jenner, Azalea, and Rich the Kid, Arora confessed that the entire situation was “all orchestrated.” He further accused Rich the Kid of exploiting him for publicity by making false allegations of hacking and scams.

“This meta was started by me. They wouldn’t have clocked any of that if I didn’t back them up. Period,” Arora told Coffeezilla in an Instagram message.

Davido’s Meme Coin Exit Raises Eyebrows

In a related development, American-born Nigerian singer Davido launched a meme coin named after himself. On-chain tracker platform Lookonchain reported that Davido created the token on Wednesday using pump.fun. He received 7.5 SOL (approximately $1,275) as initial capital and spent 7 SOL ($1,190) to buy 203 million DAVIDO, equaling 20.3% of the total supply.

Several hours after creating and promoting the meme coin on his social media, Davido cashed out 121.88 million DAVIDO for 2,791 SOL, generating roughly $474,400. This transaction led to speculation that Davido made this token solely for pump and dump.

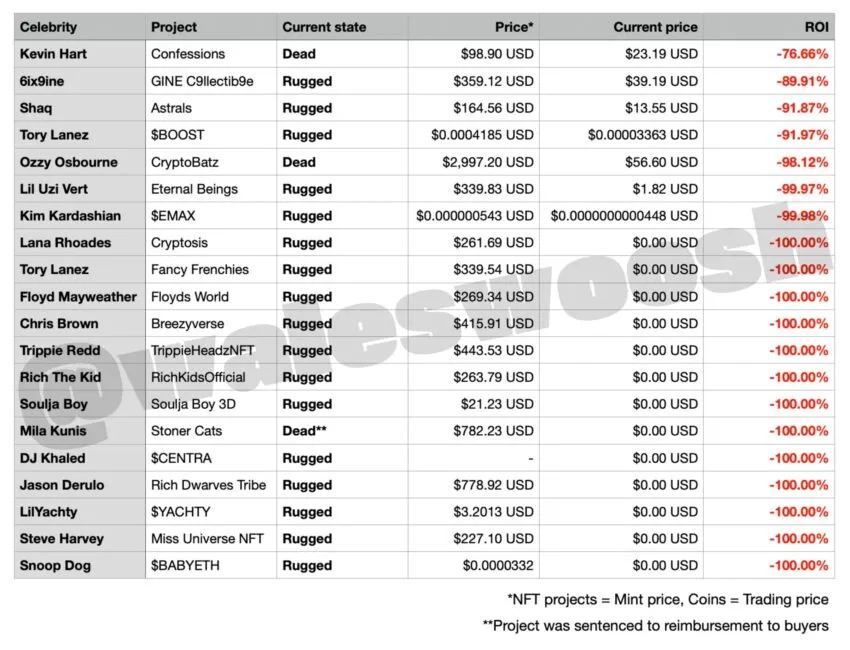

In response to the trend of celebrity meme coins, Wale Moca, a researcher at Azuki, examined past celebrity-owned and celebrity-promoted crypto projects. According to Moca, they all failed, with most being scams. This pattern raises concerns about the sustainability and integrity of such ventures.

“At the end of the day, these projects usually fail because the individuals behind them just don’t care. Either they get a bag for promoting and posting a video or their team coordinates a sale. In most cases, there is no real interest or plan for the project. […] I would be surprised if any of the celebrities that promoted them even know what’s going on,” Moca explained.

Read more: Crypto Scam Projects: How To Spot Fake Tokens

Regulatory bodies have previously taken action against misleading crypto promotions. In October 2022, the US Securities and Exchange Commission (SEC) charged Kim Kardashian for promoting EthereumMAX (EMAX) as crypto asset security without disclosing her financial compensation. Kardashian settled the charges by paying $1.26 million in penalties and cooperating with the ongoing investigation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Rallies 10% and Targets More Upside

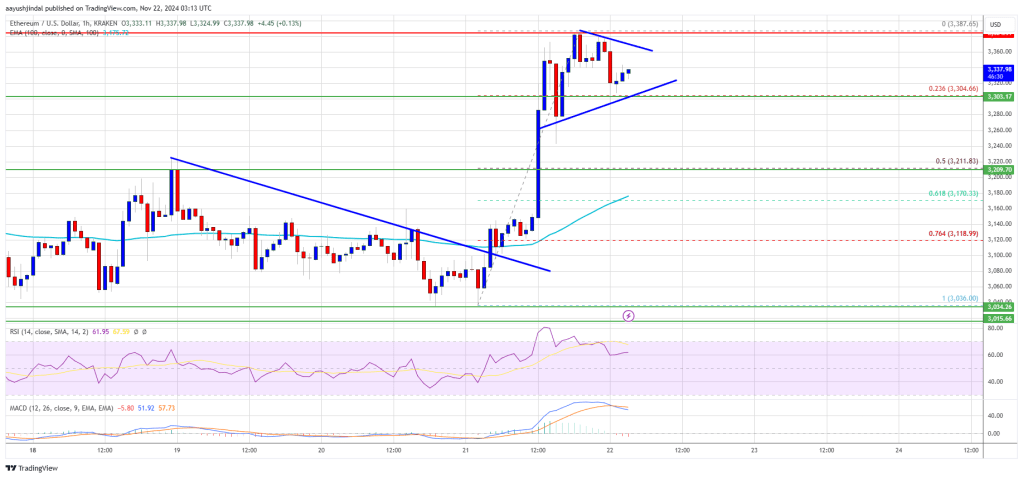

Ethereum price started a fresh increase above the $3,220 zone. ETH is rising and aiming for more gains above the $3,350 resistance.

- Ethereum started a fresh increase above the $3,220 and $3,300 levels.

- The price is trading above $3,250 and the 100-hourly Simple Moving Average.

- There is a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could gain bullish momentum if it clears the $3,385 resistance zone.

Ethereum Price Regains Traction

Ethereum price remained supported above $3,000 and started a fresh increase like Bitcoin. ETH gained pace for a move above the $3,150 and $3,220 resistance levels.

The bulls pumped the price above the $3,300 level. It gained over 10% and traded as high as $3,387. It is now consolidating gains above the 23.6% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high.

Ethereum price is now trading above $3,220 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,350 level. There is also a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD.

The first major resistance is near the $3,385 level. The main resistance is now forming near $3,420. A clear move above the $3,420 resistance might send the price toward the $3,550 resistance. An upside break above the $3,550 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,650 resistance zone or even $3,880.

Another Decline In ETH?

If Ethereum fails to clear the $3,350 resistance, it could start another decline. Initial support on the downside is near the $3,300 level. The first major support sits near the $3,250 zone.

A clear move below the $3,250 support might push the price toward $3,220 or the 50% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high. Any more losses might send the price toward the $3,150 support level in the near term. The next key support sits at $3,050.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,250

Major Resistance Level – $3,385

Market

Rallies 10% and Targets More Upside

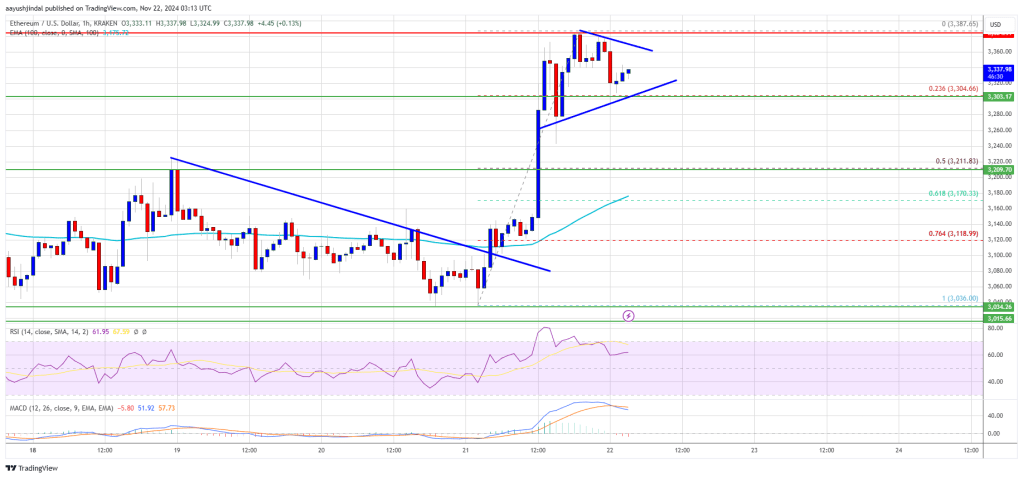

Ethereum price started a fresh increase above the $3,220 zone. ETH is rising and aiming for more gains above the $3,350 resistance.

- Ethereum started a fresh increase above the $3,220 and $3,300 levels.

- The price is trading above $3,250 and the 100-hourly Simple Moving Average.

- There is a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could gain bullish momentum if it clears the $3,385 resistance zone.

Ethereum Price Regains Traction

Ethereum price remained supported above $3,000 and started a fresh increase like Bitcoin. ETH gained pace for a move above the $3,150 and $3,220 resistance levels.

The bulls pumped the price above the $3,300 level. It gained over 10% and traded as high as $3,387. It is now consolidating gains above the 23.6% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high.

Ethereum price is now trading above $3,220 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,350 level. There is also a short-term contracting triangle forming with resistance at $3,360 on the hourly chart of ETH/USD.

The first major resistance is near the $3,385 level. The main resistance is now forming near $3,420. A clear move above the $3,420 resistance might send the price toward the $3,550 resistance. An upside break above the $3,550 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,650 resistance zone or even $3,880.

Another Decline In ETH?

If Ethereum fails to clear the $3,350 resistance, it could start another decline. Initial support on the downside is near the $3,300 level. The first major support sits near the $3,250 zone.

A clear move below the $3,250 support might push the price toward $3,220 or the 50% Fib retracement level of the recent move from the $3,036 swing low to the $3,387 high. Any more losses might send the price toward the $3,150 support level in the near term. The next key support sits at $3,050.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,250

Major Resistance Level – $3,385

Market

GOAT Price Sees Slower Growth After Reaching $1B Market Cap

GOAT price has skyrocketed 214.29% in one month, recently breaking into the $1 billion market cap and securing its place as the 10th largest meme coin. It now stands just ahead of MOG, which closely trails its position in the rankings.

However, recent indicators suggest that GOAT’s uptrend may be weakening, raising questions about whether it can sustain its rally or face a potential correction.

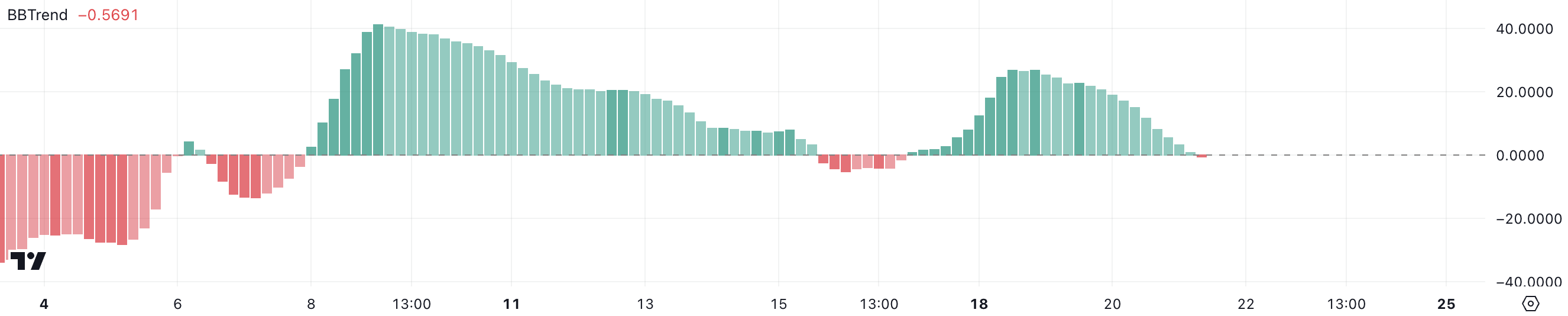

GOAT BBTrend Is Negative For The First Time In 4 Days

GOAT BBTrend has turned negative for the first time since November 17, now sitting at -0.54. This shift suggests that bearish momentum is beginning to take hold, with the asset’s recent upward trajectory starting to weaken potentially.

BBTrend measures the strength and direction of price trends using Bollinger Bands, with positive values indicating an uptrend and negative values signaling a downtrend. A negative BBTrend reflects increased downward pressure, which could indicate the start of a broader market shift.

GOAT has had an impressive November, gaining 61% and reaching a new all-time high on November 17.

However, the current negative BBTrend, if it persists and grows, could signal the potential for further bearish momentum.

GOAT Is In A Neutral Zone

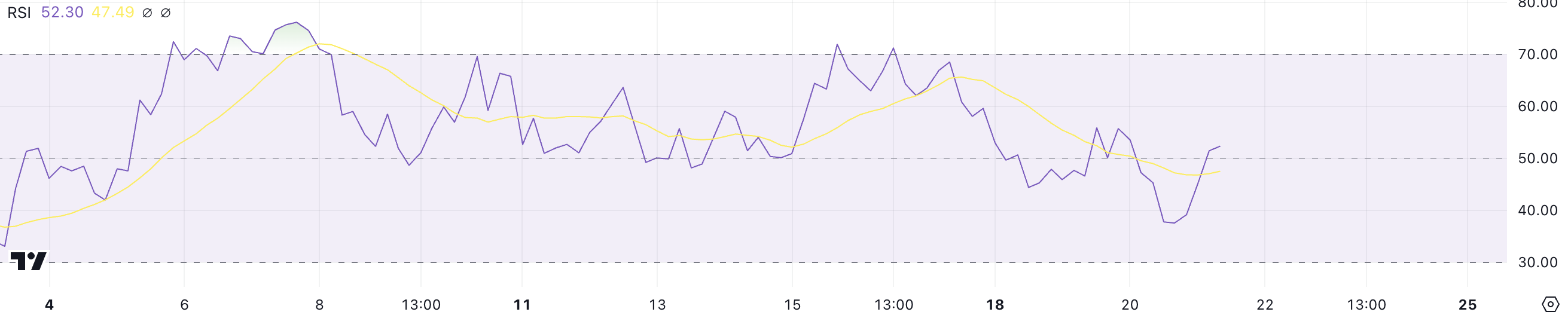

GOAT’s RSI has dropped to 52, down from over 70 a few days ago when it reached its all-time high. This decline indicates that buying momentum has cooled off, and the market has moved out of the overbought zone.

The drop suggests a shift toward a more neutral sentiment as traders consolidate gains and the strong bullish pressure seen earlier subsides.

RSI measures the strength and velocity of price changes, with values above 70 indicating overbought conditions and below 30 signaling oversold levels. At 52, GOAT’s RSI is in a neutral zone, neither signaling strong bullish nor bearish momentum.

This could mean the current uptrend is losing strength, and the price may consolidate or move sideways unless renewed buying pressure reignites upward momentum.

GOAT Price Prediction: A New Surge Until $1.50?

If GOAT current uptrend regains strength, it could retest its all-time high of $1.37, establishing its market cap above $1 billion, a fundamental threshold for being among the biggest meme coins in the market today.

Breaking above this level could pave the way for further gains, potentially reaching the next thresholds at $1.40 or even $1.50, signaling renewed bullish momentum and market confidence.

However, as shown by indicators like RSI and BBTrend, the uptrend may be losing steam. If a downtrend emerges, GOAT price could test its nearest support zones at $0.80 and $0.69.

Should these levels fail to hold, the price could fall further, potentially reaching $0.419, putting its position in the top 10 ranking of biggest meme coins at risk.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum21 hours ago

Ethereum21 hours agoFundraising platform JustGiving accepts over 60 cryptocurrencies including Bitcoin, Ethereum

-

Market18 hours ago

Market18 hours agoSouth Korea Unveils North Korea’s Role in Upbit Hack

-

Market22 hours ago

Market22 hours agoCardano’s Hoskinson Wants Brian Armstrong for US Crypto-Czar

-

Altcoin16 hours ago

Altcoin16 hours agoSui Network Back Online After 2-Hour Outage, Price Slips

-

Market21 hours ago

Market21 hours agoLitecoin (LTC) at a Crossroads: Can It Rebound and Rally?

-

Altcoin15 hours ago

Altcoin15 hours agoDogecoin Whale Accumulation Sparks Optimism, DOGE To Rally 9000% Ahead?

-

Altcoin20 hours ago

Altcoin20 hours agoWhy FLOKI Price Hits 6-Month Peak With 5% Surge?

-

Bitcoin13 hours ago

Bitcoin13 hours agoMarathon Digital Raises $1B to Expand Bitcoin Holdings