Regulation

Ripple Crypto Super PAC Donation Overshadows Proposed $10M SEC Fine

In a bold move, Ripple Labs made a massive donation to reaffirm. determination to reshape the regulatory landscape for crypto in the U.S. The blockchain payments company has announced a substantial $25 million donation to Fairshake, a crypto super Pollitical Action Committee. Moreover, this contribution exceeds Ripple’s proposed $10 million penalty to be paid to the Securities and Exchange Commission (SEC) in the ongoing legal battle.

Ripple Makes Major Donation To Fairshake

Ripple’s decision to inject significant funds into political advocacy comes amid a broader industry-led effort to amplify crypto voices ahead of the November elections. With the crypto industry poised at a pivotal moment in its maturation, stakeholders are intensifying their efforts to influence policymakers and secure favorable regulatory frameworks.

Brad Garlinghouse, the CEO of Ripple, emphasized the industry’s determination not to remain silent in the face of regulatory bumps. “Ripple will not – and the crypto industry should not – keep quiet while unelected regulators actively seek to impede innovation and economic growth,” stated the Ripple CEO, according to Fox Business.

The escalating tension between the SEC and the crypto industry has strained relations. It started with Gary Gensler, the SEC Chairman, spearheading a series of lawsuits against major players. The industry contends that the overambitious regulator has been unfairly targeting them. However, the SEC maintains its position on enforcing compliance with securities laws.

Recent developments suggest a shifting landscape in Washington’s perception of the crypto industry. These include bipartisan support for friendly legislation, Financial Innovation and Technology for the 21st Century Act (FIT21). Moreover, the overturning of a controversial SEC rule, SAB 121, bagged significant attention.

Even GOP presidential front-runner Donald Trump has signaled his willingness to embrace digital assets, offering hope to crypto enthusiasts. Additionally, the SEC approved eight Spot Ethereum ETFs, potentially influenced by the Biden administration’s shift in crypto stance.

Hence, the role of super PACs, such as Fairshake, in shaping electoral outcomes cannot be understated. Fairshake’s substantial financial backing has influenced key elections, tipping the scales in favor of crypto-friendly candidates. Moreover, the defeat of anti-crypto Congresswoman Katie Porter in California serves as a testament to the efficacy of such political maneuvering.

Also Read: Ripple CTO Defends Joe Biden’s Gag Order Plea In Trump Trial

About XRP Vs SEC Lawsuit

The battle between Ripple and the SEC has been protracted and contentious, stretching over three years. At the heart of the dispute lies the SEC’s allegation that Ripple knowingly violated U.S. securities laws by selling its cryptocurrency XRP without proper registration.

Meanwhile, Ripple’s opposition to the SEC’s motion for remedies and entry of final judgment underscores the company’s steadfast stance against what it perceives as regulatory overreach. Earlier this month, Ripple Labs denied paying the $2 billion fine imposed by the SEC. The firm noted that it will not pay more than $10 million in penalty, opposing the exorbitant fine proposed by the SEC.

Stuart Alderoty, Ripple’s Chief Legal Officer, expressed confidence in the judicial process. In addition, he highlighted the absence of allegations of recklessness or fraud in the SEC’s case. the time, he stated “Our opposition to the SEC’s request for $2B in penalties for legacy institutional sales is now public… the SEC’s ask is just more evidence of its ongoing intimidation against all of crypto in the U.S.”

Also Read: XRP Lawyer Hints At SEC Corruption In Hinman Ethereum Case

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Regulation

US SEC Drops Charges Against Hawk Tuah Girl Hailey Welch

Hawk Tuah girl Hailey Welch, known for her association with the controversial $HAWK token, has been cleared of any wrongdoing after a lengthy investigation by the U.S. Securities and Exchange Commission (SEC). The SEC has decided not to press charges against Welch in connection with the rapid rise and subsequent collapse of the meme-based cryptocurrency.

US SEC Investigation Into Hawk Tuah Girl Concludes Without Charges

The SEC had launched an investigation into the $HAWK token after its dramatic price drop. The token, which was linked to Welch’s viral persona, initially saw a market cap surge to $490 million before crashing by over 90%. Investors who were impacted by the crash filed a lawsuit against those behind the project, alleging that the coin had been promoted and sold without proper registration.

Hawk Tuah girl Hailey Welch, who cooperated fully with the investigation, expressed relief after the SEC’s decision. “For the past few months, I’ve been cooperating with all the authorities and attorneys, and finally, that work is complete,” Welch told TMZ.

Her attorney, James Sallah, confirmed that the SEC had closed the case without any findings against her, adding that there would be no monetary sanctions or restrictions on Welch’s future involvement in cryptocurrency or securities.

This Is A Developing News, Please Check Back For More

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Regulation

Sonic Labs To Abandon Plans For Algorithmic USD Stablecoin, Here’s Why

Barely a week after hinting at launching an algorithmic USD stablecoin, Sonic Labs is shuttering its plans. Sonic Labs co-founder Andre Cronje revealed that incoming stablecoin regulation in the US contributes to the change of stance.

Sonic Labs Makes U-Turn Over Algorithmic USD Stablecoin

In mid-March, Sonic Labs disclosed plans for a yield-generating algorithmic stablecoin for its blockchain. However, new developments in the US regulatory landscape are forcing the company to ditch its algorithmic stablecoin ambitions.

Sonic Labs co-founder Andre Cronje confirmed the change in direction via an X post following the release of the full draft of the STABLE Act by Congress for clearer oversight. According to the text, lawmakers are pushing for a two-year moratorium on algorithmic stablecoin, souring Sonic Labs plans.

Unlike mainstream stablecoins backed by fiat or other commodities, algorithmic stablecoins rely on smart contracts to maintain their peg. The 2022 implosion of Terra’s ecosystem following the de-pegging of its TerraUSD (UST) algorithmic stablecoin stunned regulators.

“We will no longer be releasing a USD-based algorithmic stablecoin,” said Cronje.

In a light-hearted note, community members teased potential strategies for Sonic Labs to sidestep incoming stablecoin regulation. Apart from the loophole of launching the algorithmic stablecoin before the regulation goes live, Cronje teased an algorithmic dirham that will be denominated in USD.

Industry Players Are Bracing For New Stablecoin Regulations

Stablecoin issuers are steeling themselves for incoming stablecoin regulations in the US. While the GENIUS Act and STABLE Act continue to inch forward, there are common denominators in both bills.

For starters, there is the requirement for equivalent reserves at a 1:1 ratio with both bills steering clear of algorithmic stablecoins. The White House is favoring the GENIUS Act over the STABLE Act as lobbyists rally to stifle the possibility of a Conference Committee.

Authorities are targeting stablecoin regulation to reach Trump in two months as issuers jostle for position. Tether, Circle, and Ripple are staking their claims to lead the US government’s ambitions to rely on stablecoins to maintain the dollar’s dominance.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Regulation

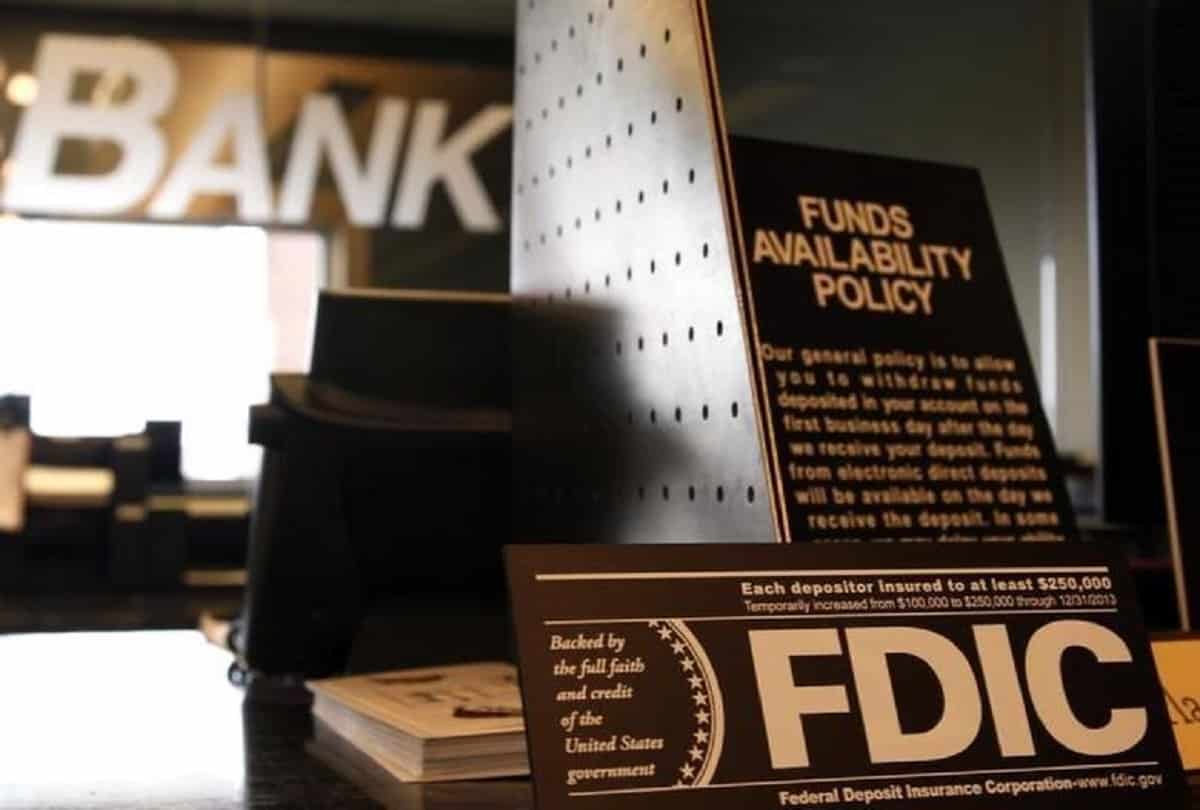

FDIC Revises Crypto Guidelines Allowing Banks To Enter Digital Assets

The Federal Deposit Insurance Corporation (FDIC) has updated its guidelines, enabling banks to engage in cryptocurrency-related activities without seeking prior approval. This new policy shift signals a change in the FDIC’s approach to the growing role of digital assets in the banking sector.

New FDIC Guidelines on Crypto-Related Activities

The FDIC has issued a new Financial Institution Letter (FIL-7-2025), which provides updated guidance for banks looking to engage in cryptocurrency activities. The new guidance rescinds the previous policy set out in FIL-16-2022, which required banks to notify the FDIC before engaging in such activities.

Under the new rules, banks can now participate in permissible crypto-related activities without waiting for FDIC approval, as long as they manage the risks appropriately.

This change is seen as a shift in the FDIC’s stance, following the agency’s earlier stance that required prior approval for crypto engagements. FDIC Acting Chairman Travis Hill expressed that this new approach aims to establish a more consistent framework for banks to explore and adopt emerging technologies like crypto-assets and blockchain.

“With today’s action, the FDIC is turning the page on the flawed approach of the past three years,” said Hill in a statement.

This Is A Developing News, Please Check Back For More

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Altcoin20 hours ago

Altcoin20 hours agoDogecoin Price Set To Reach $1 As Once In A Year Buy Opportunity Returns

-

Regulation15 hours ago

Regulation15 hours agoUS SEC Drops Charges Against Hawk Tuah Girl Hailey Welch

-

Market23 hours ago

Market23 hours agoCoinbase to Rival Binance With BNB Perpetual Futures

-

Market22 hours ago

Market22 hours agoSatLayer CEO Luke Xie Talks Bitcoin Restaking and DeFi’s Future

-

Altcoin22 hours ago

Altcoin22 hours agoBlessing or Curse for the Crypto Market?

-

Market21 hours ago

Market21 hours agoHedera Falls 4% as Bears Dominate: What’s Next for HBAR?

-

Regulation17 hours ago

Regulation17 hours agoFDIC Revises Crypto Guidelines Allowing Banks To Enter Digital Assets

-

Altcoin21 hours ago

Altcoin21 hours agoWhy the US SEC Is Delaying the Ripple Case?

✓ Share: