Market

Riot Platforms Targets Bitfarms in Bold Takeover

Riot Platforms Inc. (RIOT) has aggressively entered the spotlight by securing a 9.25% stake in Bitfarms Ltd. (BITF). The company is now pushing forward with a public takeover bid for the Canadian Bitcoin miner, following Bitfarms’ refusal of a prior approach last month.

Riot’s concerns about Bitfarms’ corporate governance, heightened by recent management changes, underscore this move.

Riot Offers to Acquire Bitfarms at a 15% Premium

Riot has tabled an offer at $2.30 per share, combining cash and stock, valuing Bitfarms at about $950 million. In addition, Riot aims to reshape the governance of Bitfarms by proposing new directors at the forthcoming shareholders’ meeting.

However, on Friday, Bitfarms traded around $2. This means Riot has offered just a 15% premium. Danny Marques, a Merger and Acquisition advisor, believes the offer is disrespectful.

“As someone who’s advised on M&A deals, absolutely no one would entertain that offer unless you’re in a dire financial situation, which is not the case here. Riot clearly trying to test the waters and wet the beak. I wouldn’t be surprised if BITF entertains an offer in the $2.75-3.00 range,” Marques said.

Read more: Best Crypto Mining Stocks to Buy or Watch Now

This strategic move is timely, given the crypto sector’s recent shifts. The Bitcoin halving has dramatically cut miners’ rewards, leading to projections of significant revenue losses. Consequently, large mining entities are eyeing mergers and acquisitions as vital strategies to maintain economic viability.

The CEO of another mining firm – CleanSpark, recently noted that the industry might soon consolidate around four major players – Riot, Marathon Digital, CleanSpark, and Cipher Mining. This consolidation is seen as essential for leveraging collective resources and enhancing operational efficiencies among leading miners.

The potential integration of Riot and Bitfarms would forge the largest Bitcoin miner globally based on projected computing power and output. This significant boost in Riot’s Bitcoin production would solidify its position alongside other industry giants like Marathon Digital Holdings Inc. and CleanSpark Inc.

Following the news of the potential merger, the market has responded positively. On Tuesday, pre-markets, Bitfarms’ shares increased by 9.35%, trading at $2.21.

Not to mention, Bitfarms is concurrently dealing with internal challenges. The company recently terminated its interim CEO, Geoffrey Morphy, following his lawsuit against Bitfarms, which sought $27 million in damages for breach of contract. This turmoil within the management team likely influenced Riot’s acquisition efforts.

Riot initially made its takeover bid to Bitfarms’ board on April 22. The board rejected the proposal without significant discussion about a potential deal. Under Riot’s offer, Bitfarms shareholders would control approximately 17% of the merged company.

“While we have long respected Bitfarms’ business and management team, we are confident that Bitfarms’ shareholders will agree that this Proposal represents a significantly more attractive alternative for Bitfarms than its standalone trajectory,” Benjamin Yi, Executive Chairman of Riot, said.

Read more: Is Crypto Mining Profitable in 2024?

Moreover, Riot is scheduling a special meeting to appoint several new independent directors after Bitfarms’ annual meeting on May 31. This plan ensures a seamless transition and integration of both companies’ interests.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Analyst Reveals ‘Worst Case Scenario’ With Head And Shoulders Formation

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

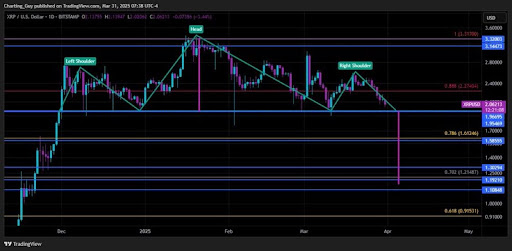

Recent XRP price action has sparked a new prediction from a crypto analyst, as a potential Head and Shoulders pattern emerges on the chart. The analyst warns that this technical formation could trigger a significant price correction for XRP, describing this downturn as the worst-case scenario.

Analyst Predicts XRP Price Crash To $1.15

The ‘Charting Guy,’ a pseudonymous crypto analyst on X (formerly Twitter), has unveiled a potential Head and Shoulder pattern formation on the XRP price chart. The analyst has shared insights into the implications of this technical pattern, projecting a potential crash in the XRP price.

Related Reading

As a well-known bearish reversal pattern, the formation of a Head and Shoulder in the XRP price chart suggests a potential shift from an uptrend to a downtrend. Typically, a Head and Shoulder pattern consists of three peaks: the Left Shoulder, Head, and Right Shoulder. However, the Charting Guy has confirmed that XRP’s current pattern formation consists of two right shoulders and one head. Due to this irregularity, the analyst has expressed doubt about the possibility of the pattern playing out.

If the Head and Shoulder pattern eventually takes shape, it could lead to a significant drop in the XRP price, potentially bringing it down to as low as $1.15. This price level aligns with a key Fibonacci Golden Pocket retracement zone between 0.618 – 0.786.

Notably, the analyst has described this projected price crash as the worst-case scenario for XRP. While he believes a bearish move is possible, the analyst is confident that XRP’s broader market structure is bullish.

Moreover, the Charting Guy argues that if XRP does decline to $1.15, it would likely serve as a healthy retracement in an overall bullish trend. He noted that XRP’s price has been holding the $2 level on daily closes, meaning its price action remains strong above support levels. This also indicates the possibility of an uptrend resumption that could yield higher highs and higher lows for XRP.

Key Support And Resistance Levels To Watch

The Charting Guy’s analysis of XRP’s potential Head and Shoulder pattern formation highlights several critical price levels to watch. Since XRP has consistently closed daily candles above $2, the analyst has determined this level as short-term support.

Related Reading

XRP has also been wicking during recent pullbacks in a crucial range between $1.7 and $1.9. As a result, the crypto analyst has revealed that he will be watching this area closely for a potential price bounce.

The Golden Pocket retracement zone, which represents the worst-case scenario for the XRP price, is between $1.15 and $1.30. If XRP experiences a deeper price correction, lower support levels have been marked from $1.19 to $0.91.

For its resistance levels, the Charting Guy has pinpointed $2.27 as a key price point. Additionally, $3.14 – $3.32 has been identified as an upper resistance range where XRP could rally if bullish momentum resumes.

Featured image from Medium, chart from Tradingview.com

Market

BeInCrypto US Morning Briefing: Standard Chartered and Bitcoin

Welcome to the US Morning Crypto Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to see how Standard Chartered sees early signs of institutional investors turning to Bitcoin as a hedge against equity market volatility, just as traders gear up for a potentially volatile week driven by tariff news. At the same time, Coinbase wraps up its worst quarter since the FTX collapse, and U.S. regulators inch closer to unified stablecoin legislation.

Standard Chartered Sees Signs of Bitcoin Starting to Be Used as Hedge Against Market Volatility

Geoff Kendrick, Head of Digital Assets Research at Standard Chartered, sees signs that institutional traders are starting to use Bitcoin as a hedge against equity market volatility.

In a recent exclusive interview with BeInCrypto, Kendrick highlighted that this trend is already underway, with investors seeking alternatives to traditional instruments. “This is happening already,” Kendrick stated. “Investors used to use FX, specifically AUD, for this purpose due to its highly liquid and positive correlation to stocks, but now I think Bitcoin is being used because it is also highly liquid and trades 24/7.”

Additionally, in an investor note from late March, Kendrick expanded on Bitcoin’s evolving role in investment portfolios, suggesting that over time, Bitcoin may serve multiple purposes—both as a hedge against traditional financial market fluctuations and as a proxy for tech stocks.

He pointed out signs that markets could anticipating a less severe tariff announcement from the U.S. on April 2. “Given this has been the worst quarter for the Nasdaq since Q2 2022, there should be a degree of portfolio rebalancing (buying) that needs to take place,” Kendrick added.

As of April 1, 2025, Bitcoin has shown resilience amid broader market uncertainties. The cryptocurrency is up approximately 3.32%, trading at $84,282. This uptick comes alongside an overall increase in the global cryptocurrency market capitalization. In contrast, U.S. stock futures, including Dow Futures, S&P 500 Futures, and Nasdaq Futures, are all trending lower in pre-market trading, reflecting investor caution ahead of the anticipated tariff announcements.

Bitcoin Options Heat Up Before Trump’s “Liberation Day”

FalconXCrypto Global Co-Head of Markets, Joshua Lim, noted that in anticipation of Wednesday’s Trump-tariff “Liberation Day,” crypto funds are actively purchasing Bitcoin options at two key strike prices: $75,000 on the downside to hedge against potential losses and $90,000 on the upside to capitalize on a price surge.

Lim highlighted that the options market is pricing in a potential 4% move in Bitcoin’s price during the event. “The implied event move embedded in Bitcoin options is around 4% for the 2 April event,” he told BeInCrypto.

He also pointed out that traders are likely to keep buying put options in the short term as a protective measure, maintaining a high options cost premium. “We believe the front of the options curve will hold its premium as traders continue to hedge their portfolios or replace spot positions with limited-loss option positions,” Lim added.

Additionally, he noted a 4-point increase in the VIX, signaling that investors expect heightened volatility in the coming days and are turning to options to manage risk or capitalize on price swings. “US equities are also showing a bid in options, with the front-month VIX up 4 points to 22v from last week,” he said.

Crypto Stocks Slide: Coinbase Suffers Worst Quarter Since FTX Collapse

Coinbase is closing out its roughest quarter since the FTX collapse, with its stock tumbling over 30% since January. While it dipped nearly 1% in early U.S. pre-market trading on Monday, the stock managed to claw back losses and is now up around 1%.

Other crypto-linked companies are also feeling the pressure. Galaxy Digital Holdings has dropped over 8% in pre-market trading, while mining firms Riot Platforms and Core Scientific are only barely staying afloat, each gaining less than 0.5%.

Meanwhile, CoreWeave, which pivoted from Bitcoin mining to AI infrastructure, is struggling after a disappointing IPO. Initially aiming for a $2.7 billion raise, the company had to settle for $1.5 billion, slashing its offer price from the $47–55 range to $40 per share. Since going public last Friday, its shares are down 6.8%, with a 7.3% drop recorded in the last 24 hours.

Byte-Sized Alpha

– Today’s JOLTS report, a key gauge of U.S. job openings, could sway Bitcoin—strong data may boost the dollar and hurt crypto, while a sharp decline could fuel rate-cut hopes and lift risk assets.

– Bitcoin is off to its worst quarterly start since 2018, dropping nearly 12% in Q1 2025—but growing whale accumulation, falling exchange supply, and signs of consolidation hint at a potential rebound ahead.

– Crypto scams are on the rise, with fake Gemini bankruptcy emails and a Coinbase employee breach fueling phishing attacks

– OKX has appointed former NYDFS Superintendent Linda Lacewell as Chief Legal Officer, a move aimed at bolstering its regulatory credibility as the exchange accelerates global expansion into regions like Europe and the UAE.

– A unified U.S. stablecoin regulation could soon become reality, as the STABLE and GENIUS Acts differ by only 20% and enjoy strong bipartisan support alongside SEC and CFTC involvement.

– A push for expanded crypto oversight is underway as incoming CFTC Chair Brian Quintenz meets with Senator Chuck Grassley to discuss regulating the crypto spot market.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

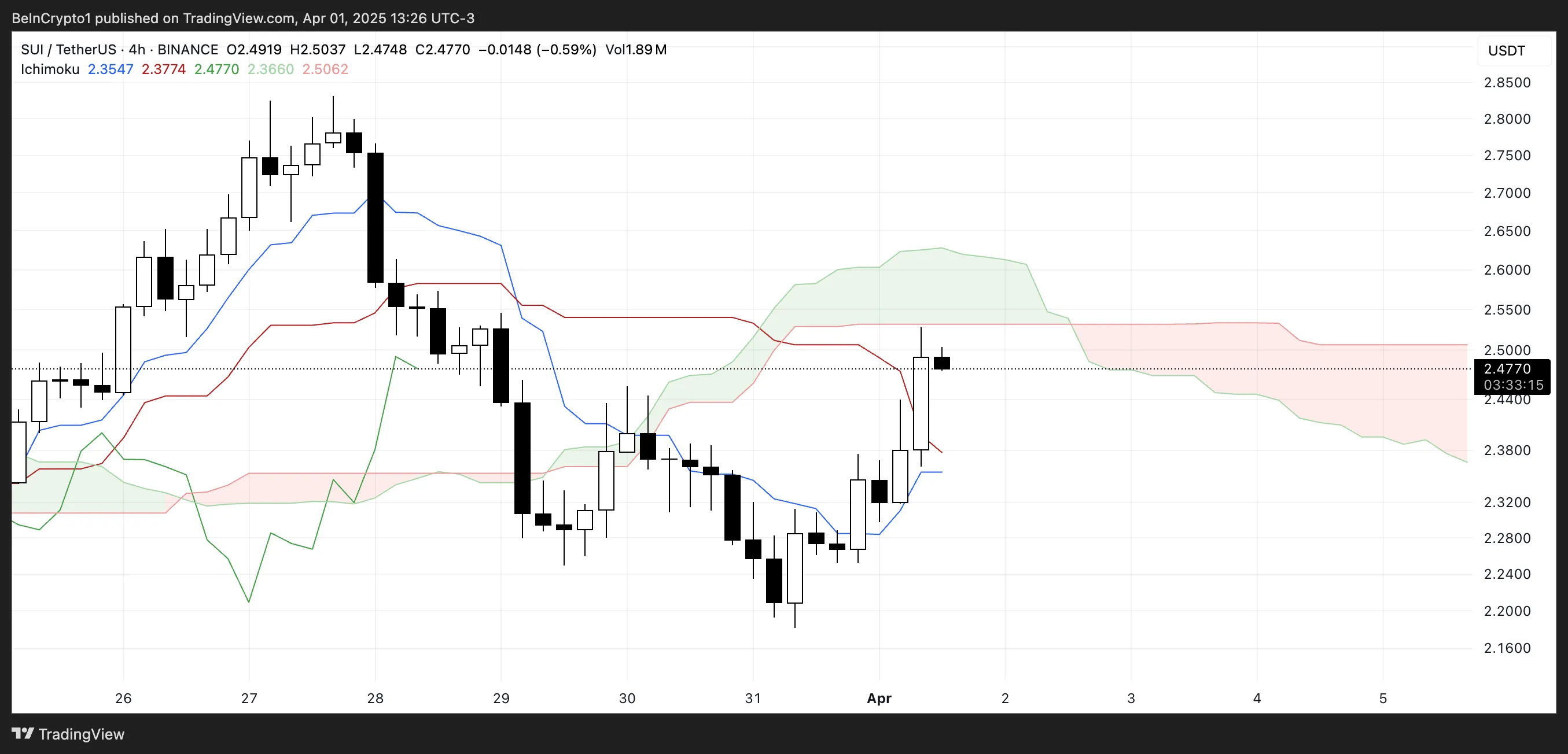

SUI Price Stalls After Major $147 Million Token Unlock

SUI enters a critical phase today as a $147 million token unlock threatens to inject selling pressure into a market already testing key resistance levels. Despite a sharp rebound in momentum—evident in the RSI’s surge from oversold territory—SUI failed to break above the crucial 60 mark, signaling buyer hesitation.

The Ichimoku Cloud shows price action pressing against the cloud’s edge, but lacking the conviction needed for a clear breakout. With a possible golden cross forming on the EMA lines, bulls still have a chance—if they can overcome resistance at $2.50 and avoid being dragged down by post-unlock volatility.

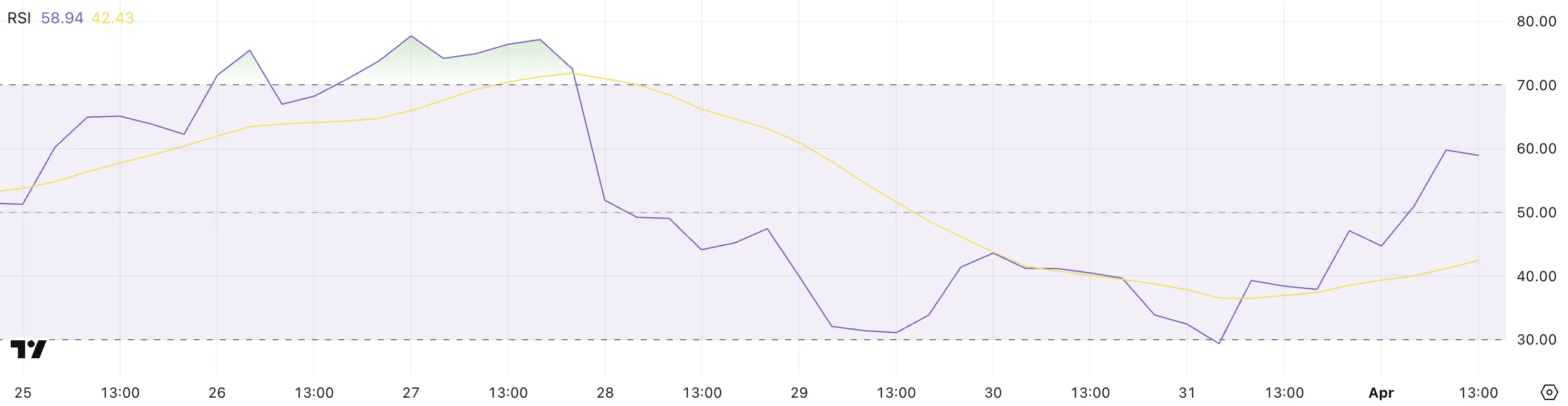

SUI RSI Surged Since Yesterday But Failed To Break Above 60

SUI’s Relative Strength Index (RSI) has jumped sharply to 58.94, up from 29.38 just a day ago, reflecting a strong shift in short-term momentum.

The RSI is a momentum oscillator that measures the speed and magnitude of recent price changes. It typically ranges from 0 to 100. Readings below 30 suggest an asset may be oversold, while levels above 70 indicate it may be overbought.

The rapid rise in SUI’s RSI suggests buyers have stepped in aggressively after a period of heavy selling.

However, despite the impressive rebound, SUI’s RSI briefly approached but failed to break above the 60 threshold earlier today.

This level often acts as a short-term resistance during recovery phases, and the rejection may indicate lingering hesitation among buyers or profit-taking after the surge.

While the RSI nearing 60 is encouraging, a decisive move above it would be needed to confirm a breakout. For now, SUI appears to be in a recovery mode. However, the inability to push past 60 highlights that bulls are not fully in control just yet.

Ichimoku Cloud Shows Lack Of Strong Upward Momentum

SUI blockchain Ichimoku Cloud chart shows a potential breakout attempt, as the price has surged upward and is now hovering right at the edge of the Kumo (cloud).

This movement suggests bullish momentum is trying to build. However, the resistance provided by the thick, red cloud ahead could make it difficult for SUI to sustain the uptrend without stronger confirmation.

The Tenkan-sen (blue line) is starting to rise and has crossed above the Kijun-sen (red line), which is a bullish signal. However, the price still needs to clearly break and hold above the cloud to flip the overall trend from bearish to bullish.

For now, the cloud remains bearish and flat, indicating possible resistance and a lack of strong upward conviction.

The current position suggests that SUI is at a key decision point—either break through the cloud to initiate a trend reversal or get rejected and slip back into the previous downtrend range.

If buyers can sustain the pressure and push the price above the upper cloud boundary, it could trigger a stronger rally. But without increased volume and broader market support, the price risks getting stuck in consolidation or turning back downward.

Will SUI Rise Back To $2.80?

SUI’s EMA lines are tightening and showing signs of a potential golden cross. That happens when a short-term moving average crosses above a longer-term one—a classic bullish signal that often precedes upward momentum.

However, the price is currently grappling with a key resistance near the $2.50 level.

If bulls manage to break through this level, it could open the path for a move toward $2.83.

That said, downside risks remain, particularly with today’s $147 million token unlock, which could introduce significant selling pressure. If that selling materializes, SUI price could fall back to test the support at $2.23.

A breakdown below that level would likely shift momentum back in favor of bears. This would expose deeper supports at $2.11 and $1.96.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoEthereum Price Faces a Tough Test—Can It Clear the Hurdle?

-

Bitcoin14 hours ago

Bitcoin14 hours ago$500 Trillion Bitcoin? Saylor’s Bold Prediction Shakes the Market!

-

Market21 hours ago

Market21 hours agoSolana (SOL) Holds Steady After Decline—Breakout or More Downside?

-

Ethereum20 hours ago

Ethereum20 hours ago$2,300 Emerges As The Most Crucial Resistance

-

Market20 hours ago

Market20 hours agoCFTC’s Crypto Market Overhaul Under New Chair Brian Quintenz

-

Altcoin12 hours ago

Altcoin12 hours agoWill XRP, SOL, ADA Make the List?

-

Altcoin20 hours ago

Altcoin20 hours agoA Make or Break Situation As Ripple Crypto Flirts Around $2

-

Market19 hours ago

Market19 hours agoXRP Bulls Fight Back—Is a Major Move Coming?