Bitcoin

Swiss University Unveils Pioneering Business Course

The hallowed halls of academia are embracing the digital age, with the Zurich University of Applied Sciences in Business Administration (HWZ) announcing a one-of-its-kind Bitcoin course.

Launching in March 2025, this program promises to be the first of its kind in Europe, offering a comprehensive exploration of Bitcoin for business professionals. However, the hefty price tag of the course has left some members of the cryptocurrency community feeling more like spectators at a “fiat faucet failure” than potential enrollees.

Bitcoin Course Costs A Fortune

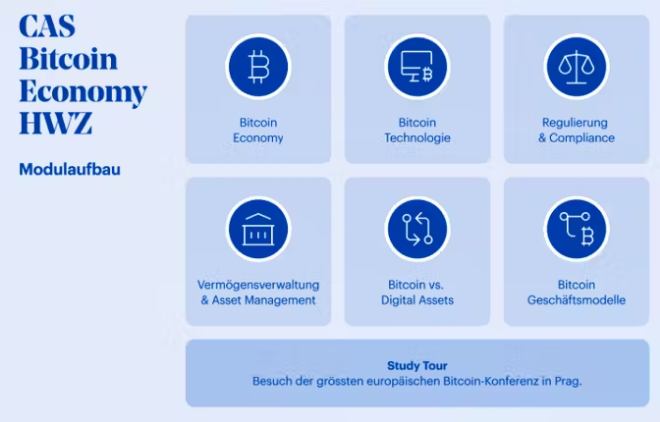

HWZ’s brainchild caters specifically to individuals seeking to integrate crypto into their business models. Spanning 16 days and carrying a price tag of 9,950 francs (which is almost $11,000), the course offers a crash course in all things Bitcoin.

Participants can expect to explore the economic principles that underpin the world’s first cryptocurrency, analyze its impact on traditional finance, and dissect the technical aspects of blockchain technology, the backbone of Bitcoin.

Recognizing the complexities surrounding cryptocurrency, the curriculum also examines the ever-evolving regulatory landscape of cryptocurrency, equipping participants with the knowledge to navigate compliance hurdles. But the course doesn’t stop there. It also guides participants through wealth management strategies specifically tailored for BTC, a valuable asset class known for its volatility.

Bitcoin Vs. Altcoins: A Comparative Analysis

To help students differentiate Bitcoin from the sea of other digital assets, the program includes a comparative analysis of altcoins. This in-depth exploration equips participants with a clear understanding of what makes Bitcoin the “granddaddy” of cryptocurrencies and how it stacks up against its younger counterparts.

BTCUSD trading at $68,686 on the 24-hour chart: TradingView.com

From Theory To Practice: Business Models For The Future?

The final leg of the course bridges the gap between theory and practice. Here, participants get a chance to explore the exciting world of business models and opportunities enabled by Bitcoin. By the course’s end, graduates will be equipped with the knowledge and tools to leverage Bitcoin’s potential for innovation and disruption within their organizations.

Crypto Community Questions Value Proposition

While HWZ boasts the program’s uniqueness, the hefty price tag has caused some ripples of discontent within the Bitcoin community. Many online commentators expressed skepticism, suggesting that the cost would be better invested directly in Bitcoin itself, with the remaining funds used for self-directed learning through online resources and forums.

Is This A Gateway For Broader Adoption?

Despite the initial resistance from some Bitcoin enthusiasts, the university’s initiative signifies a growing recognition of cryptocurrency’s influence on the business world. The course’s existence could pave the way for the development of further educational programs, fostering a new generation of professionals equipped to navigate the complexities of the digital asset landscape.

Bitcoin course, anyone?

Featured image from The Balance, chart from TradingView

Bitcoin

Why Bitcoin Is Gaining Appeal Amid Falling US Treasury Yields

The US 10-year Treasury yield has fallen below 4% for the first time since October.

This signals a potential shift in Federal Reserve (Fed) policy, sparking renewed interest in Bitcoin (BTC) and other risk assets.

Treasury Yields and Bitcoin: A Risk-On Rotation?

As highlighted by financial markets aggregator Barchart, this decline reflects growing economic uncertainty. Specifically, it suggests rising recession fears and increasing speculation that the Fed may pivot to rate cuts sooner than expected.

A drop in Treasury yields reduces the attractiveness of traditional safe-haven assets like bonds, often encouraging investors to seek higher returns elsewhere.

Historically, Bitcoin and altcoins have benefitted from such shifts, as declining real yields increase liquidity and risk appetite. Crypto analyst Dan Gambardello emphasized this connection. He noted that lower yields are bullish for Bitcoin, aligning with expectations that a dovish Fed will drive liquidity into riskier assets.

“The irony is that when yields fall, there’s less reason to sit in “safe” bonds— And ultimately more reason to chase returns in risk assets like BTC and alts. This is why you see risk-on bulls get excited when 10-year yields begin falling,” he stated.

Additionally, BitMEX founder and former CEO Arthur Hayes pointed out that the 2-year Treasury yield sharply declined after the new tariffs were introduced. He said this reinforced the market’s expectation of imminent Fed rate cuts.

“We need Fed easing, the 2yr treasury yield dumped after Tariff announcement because the market is telling us the Fed will be cutting soon and possibly restarting QE to counter -ve economic impact,” Hayes shared on X (Twitter).

Hayes previously projected that Bitcoin could surge as high as $250,000 if quantitative easing (QE) returns in response to economic downturns.

The Trump Factor: Tariffs and Market Volatility

Further, analysts have tied the yield drop to economic uncertainty triggered by Trump’s aggressive tariff strategy. As Gambardello noted, these tariffs have spurred a flight to safety, pushing bond prices higher and lowering yields.

This trend aligns with Trump’s broader economic approach of weakening the dollar and lowering interest rates, which historically benefit Bitcoin. During his first term, Trump frequently desired a weaker dollar and lower interest rates to boost exports and economic growth. He also pressured the Fed to cut rates multiple times.

Another analyst, Kristoffer Kepin, highlighted that the M2 money supply is growing. This reinforces expectations of increased liquidity entering the market further. This influx of capital could flow into Bitcoin and altcoins as investors seek alternative stores of value amid economic turbulence.

Despite Bitcoin’s potential upside, Goldman Sachs has recommended gold and the Japanese yen as preferred hedges against US recession risks. Specifically, the bank cited its historical performance in risk-off environments.

“The yen offers investors the best currency hedge should the chances of a US recession increase,” Bloomberg reported, citing Kamakshya Trivedi, head of global foreign exchange, interest rates, and emerging market strategy at Goldman Sachs.

The bank expressed the same sentiment toward gold, raising its forecast as investors buy the yellow metal. Similarly, a Bank of America (BofA) survey showed that 58% of fund managers prefer gold as a trade war haven, while only 3% back Bitcoin.

Meanwhile, JPMorgan has raised its global recession probability to 60%. Likewise, the multinational banking and financial services company attributed the increased risk to the economic shock from tariffs announced on Liberation Day.

“These policies, if sustained, would likely push the US and possibly global economy into recession this year,” wrote head of global economic research Bruce Kasman in a note late Thursday.

However, Kasman acknowledged that while a scenario where the rest of the world muddles through a US recession is possible, it is less likely than a global downturn.

As Treasury yields continue to fall and economic uncertainty mounts, the Fed becomes a key watch for investors for signs of a policy shift.

If rate cuts and liquidity injections materialize, Bitcoin could see substantial gains, particularly as traditional assets undergo re-pricing. However, as experts caution, short-term volatility remains a key risk factor amidst these market shifts.

BeInCrypto data shows Bitcoin was trading for $82,993 as of this writing, up by a modest 1.42% in the last 24 hours.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Drops as China Escalates Trade War With 34% Tariff on US

On April 4, 2025, China responded to the latest US tariff imposition by imposing an additional 34% tariff on all goods imported from the US. This escalates the already tense trade war between the two largest economies in the world.

Bitcoin dropped 3% within hours of the announcement, briefly falling below $82,000. This latest development has caused concern among investors, analysts, and participants in the cryptocurrency sector about its potential impact.

Bitcoin Investors Worry About The Escalating Trade War

According to Xinhua News Agency, China will impose a 34% tariff on all products imported from the US starting April 10. Xinhua reported that the US’s “Reciprocal Tariff” violated WTO rules, severely damaging the legal and legitimate rights of WTO members and undermining the multilateral trade system and the international trade order based on rules.

“This is a typical act of unilateral hegemony that harms the stability of the global economic and trade order. China firmly opposes this,” The spokesperson for the Ministry of Commerce said in an interview about China’s lawsuit against the US’s “Reciprocal Tariff” at the WTO.

Previously, President Trump had imposed a 34% tariff on China in addition to the 20% tariffs already imposed in two phases. This means a total of 54% tariffs were applied to China.

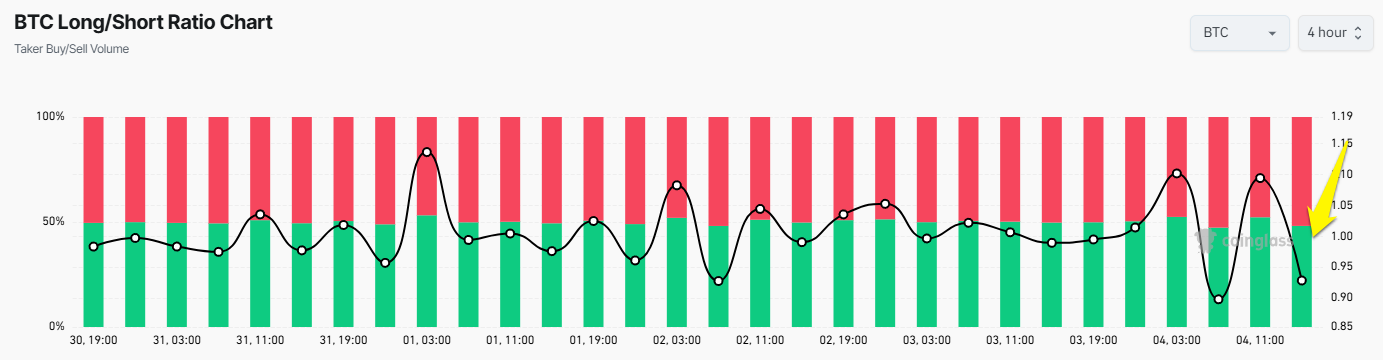

News from China has caused concern among crypto investors. On April 4, Bitcoin’s price dropped from $84,600 to $82,000, a 3% decrease.

At the same time, following the news, the Long/Short ratio of Bitcoin dropped below 1, indicating a growing sentiment for short-selling, which has become dominant in the market.

Both Bitcoin and other markets have been affected. The S&P 500 fell from 5,260 points to 5,250 points, while the Dow Jones Industrial Average dropped from 41,100 points to 40,500 points. China’s actions have raised concerns about the potential escalation of the global trade war.

“The ‘Third World War’ of the trade war has begun,” The Kobeissi Letter commented.

What Will Happen to Bitcoin When The US-China Trade War Escalates?

This cryptocurrency, often praised as a hedge against economic instability, tends to behave like a risky asset during sudden uncertain periods. Historical patterns support this reaction—during the US-China trade war in 2018-2019, Bitcoin experienced significant sell-offs as tariffs escalated, only recovering when the narrative of value preservation took precedence.

A significant portion of the global cryptocurrency hardware supply chain comes from China, where companies like Bitmain dominate the production of ASIC mining machines—important devices for Bitcoin mining.

With the US now facing a 34% tariff on technology imports from China, the cost of importing these mining machines is expected to rise dramatically. Bitcoin miners in the US, already facing high energy costs and competitive pressure on hashrate, may see their profits shrink further.

However, the long-term outlook for Bitcoin may not be as bleak as the initial market reaction. Some analysts suggest that prolonged trade wars and economic friction could enhance Bitcoin’s appeal as a decentralized asset unaffected by government intervention. If tariffs lead to inflation or weaken fiat currencies like the USD, investors may turn to cryptocurrencies as a safe haven.

“It’s not gold, and it’s not the yen. Instead, Bitcoin is emerging as a risk-dynamic asset – one that doesn’t crumble like high-growth stocks but also doesn’t attract the same flight-to-safety flows as traditional safe havens,” Nexo Dispatch Editor Stella Zlatarev told BeInCrypto.

This sentiment aligns with research indicating that instability often causes initial price drops but can pave the way for growth as acceptance increases.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Fresh $36M Bitcoin Transfer By Bhutan Sparks Speculation—Dump Alert?

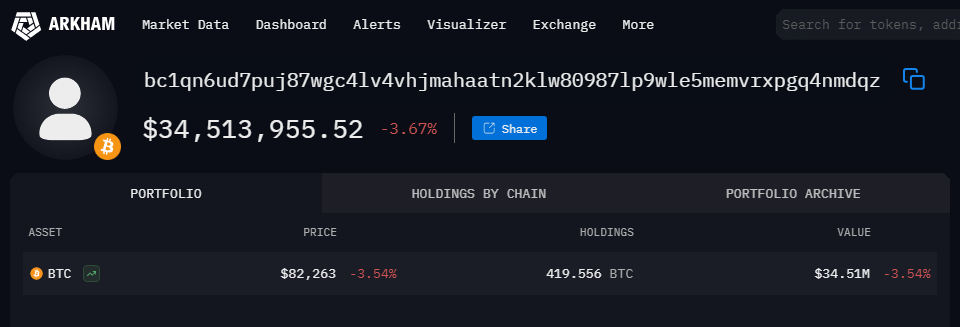

A series of Bitcoin transfers from wallets linked to the Bhutanese government has caught the attention of cryptocurrency watchers. According to blockchain data from Arkham, addresses tied to Druk Holdings, the commercial arm of Bhutan’s government, moved 419.5 Bitcoin worth approximately $34.51 million to an unidentified address on April 2.

Government Wallets Transfer Large Sum To New Address

Based on reports from Arkham, a blockchain analytics platform, two separate wallets believed to belong to the Bhutanese government participated in the transfer. The main Bitcoin holding wallet sent 377.8 BTC ($32.11 million) to a new address identified only as “bc1qn6.” A second wallet, labeled “34oXLr,” contributed an additional 41.7 BTC ($3.5 million) to the same destination.

Source: Arkham

The funds remain in the new wallet at the time of this report. This movement follows a larger transfer last week when the government reportedly shifted 1,664 BTC ($144.57 million) to several different addresses.

Bhutan Maintains Significant Crypto Holdings

The Royal Government of Bhutan owns significant Bitcoin holdings, despite recent sales. Bhutan, based on Bitcoin Treasuries data, owns 13,029 BTC at a value of $1,061,269,247. This puts the nation fourth in total Bitcoin owned among countries, just behind El Salvador.

Source: Bitcoin Treasuries

The landlocked Buddhist-majority country has emerged as an offbeat contributor to the cryptocurrency world. Bhutan reportedly mines Bitcoin by leveraging its abundant hydroelectric resources. This most recent stockpile of cryptocurrency constitutes a sizable portion of the total economy — 31% of the country’s gross domestic product (GDP), estimated at nearly $3 billion.

Market Response Following The News

The cryptocurrency market appears unaffected by Bhutan’s Bitcoin movements. According to price data, Bitcoin recovered from a low of $81,014 to reach $82,005 before slightly pulling back. This represents a 2.5% rebound within a day.

The leading cryptocurrency traded at $82,401 at the time of the report, showing a nearly 1% increase over 24 hours. If this upward trend continues, Bitcoin could achieve its third consecutive positive daily close for the first time since early January.

While Bhutan has been selling off its Bitcoin for profit, the United States is seeking to stop all sales of their balance and even expand it. Interestingly, US President Donald Trump signed an executive order last month to establish a strategic Bitcoin reserve for the nation. In the meantime, senator Cynthia Lummis has filed the Bitcoin Act, seeking to acquire 1 million BTC for the nation.

Featured image from AD, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Market24 hours ago

Market24 hours agoBinance Managed 94% of All Crypto Airdrops and Staking Rewards

-

Regulation22 hours ago

Regulation22 hours agoUS SEC Acknowledges Fidelity’s Filing for Solana ETF

-

Market21 hours ago

Market21 hours agoWormhole (W) Jumps 10%—But Is a Pullback Coming?

-

Altcoin21 hours ago

Altcoin21 hours agoAltcoin Season Still In Sight Even As Ethereum Struggles To Gain Upward Momentum

-

Market23 hours ago

Market23 hours agoXRP Battle Between Bulls And Bears Hinges On $1.97 – What To Expect

-

Market22 hours ago

Market22 hours agoRipple Shifts $1B in XRP Amid Growing Bearish Pressure

-

Market20 hours ago

Market20 hours agoBinance’s CZ is Helping Kyrgyzstan Become A Crypto Hub

-

Altcoin20 hours ago

Altcoin20 hours agoHere’s Why Is Shiba Inu Price Crashing Daily?