Bitcoin

How Institutional Adoption Could Push Bitcoin Over $400,000

Bitcoin’s allure is growing as investors increasingly recognize its unique traits. The spot Bitcoin exchange-traded funds (ETFs) simplify the process for investors, potentially leading to a significant increase in Bitcoin’s price.

The Motley Fool analysts highlight that the approval of Bitcoin ETFs is a major step in cryptocurrency acceptance. They believe this could drive Bitcoin’s price to $400,000 or even $1 million.

Bitcoin’s Path to $400,000 and Beyond

The ETFs allow retail investors to bypass complex crypto exchanges and digital wallets, making Bitcoin more accessible.

However, the potential for substantial growth lies with institutional investors entering the Bitcoin market. These include pension funds, retirement plans, and hedge funds, which manage vast sums of money. Previously deterred by the complexities of digital assets, these institutions can now incorporate Bitcoin into their portfolios with ease, thanks to ETFs.

Read more: Bitcoin Price Prediction 2024/2025/2030

As of now, about 700 professional investment firms have invested around $5 billion in these ETFs. Leading investors include Millennium Management, which has allocated about 3% of its $64 billion portfolio to Bitcoin ETFs. Others, such as Morgan Stanley and Bracebridge Capital, along with the State of Wisconsin Investment Board, are also significant participants.

Despite this growth, institutional investors still represent only about 10% of the total ETF ownership. This figure is increasing, indicating a rising institutional interest that could significantly boost demand for Bitcoin. Institutional investors often conduct extensive due diligence before diversifying into new assets like Bitcoin.

“Yet, after conducting their research, I think they will all likely arrive at the same conclusion: Bitcoin’s inherent characteristics make it a necessity in portfolios. Eventually, widespread adoption among institutional investors will occur, leading to a tsunami of capital flowing in,” a Motley Fool analyst said.

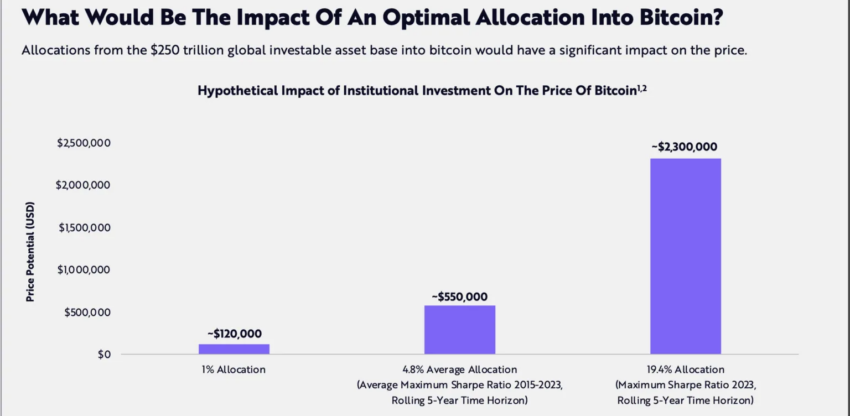

This shift in investment isn’t just about increasing Bitcoin ownership; it involves strategic financial planning. With the vast sums managed by these institutions, even a small allocation to Bitcoin could have a major impact. If institutions allocate 5% of the $129 trillion assets they manage to Bitcoin, its market cap could exceed $7 trillion, pushing its price beyond $400,000.

Some analysts believe a 5% allocation might be too conservative. ARK Invest suggests an optimal portfolio could include up to 19% Bitcoin for the best risk-adjusted returns.

Read more: 7 Best Crypto Exchanges in the USA for Bitcoin (BTC) Trading

Their recommendation is based on a rolling 5-year analysis, which supports a higher allocation to maximize portfolio performance.

As investment strategies evolve, Bitcoin’s role in future financial portfolios appears increasingly significant. Observing the benefits reaped by their peers, more institutions might feel compelled to increase their Bitcoin investments.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Price And Satoshimeter: Analyst Says $100,000 Is Far From The Peak

The Bitcoin price rally towards the $100,000 mark is the talk of the crypto industry. Notably, the Bitcoin price has reached new all-time highs for four consecutive days on the path to this $100,000 price level, with the latest being an intraday high of $99,645 in the past 24 hours.

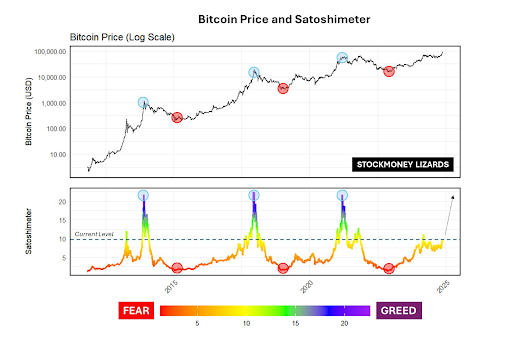

Interestingly, the ongoing bullish sentiment suggests this rally is far from over. According to one crypto (Stockmoney Lizards), Bitcoin is still in the middle of its projected peak this cycle, and the current pump is just one phase of a larger upward trajectory.

Satoshimeter Says Bitcoin Price Still Has A Long Way To Go

The Satoshimeter is a technical analysis tool developed by Stockmoney Lizards. The Satoshimeter uses on-chain data to monitor Bitcoin’s market cycles and has been relatively good in predicting market peaks and lows. For instance, readings around 1.6 typically mark the low points of bear markets, as seen in years like 2011, 2015, 2019, and 2022. On the other hand, the peaks of bull markets are highlighted by readings above 20 on the Satoshimeter.

The Bitcoin price rally has witnessed a notable surge since the beginning of the year and is showing no signs of stopping anytime soon. Particularly, the Bitcoin price is up by 163% in the past 12 months, according to Coinmarketcap data. Despite Bitcoin’s ongoing rally, the Satoshimeter currently sits in a mid-range area, suggesting that the cryptocurrency has substantial room for growth before reaching a cycle peak.

Stockmoney Lizards emphasized that while the recent price surge might see short-term corrections, these are part of a healthy market trajectory. This implies that the Bitcoin price could see periodic pullbacks as it consolidates gains, but the Bitcoin price at $100,000 is definitely not the peak for this cycle.

Long Road Ahead For BTC Price

A final break above $100,000 would undoubtedly be a major milestone for the Bitcoin price history. However, the current market sentiment suggests it would only be the first step of many milestones to hit this bull cycle. For instance, crypto analyst Stockmoney Lizards projected in another analysis that the Bitcoin price is about to enter a second parabolic run that would see it surging past the $120,000 price mark by April 2025.

Although this price target is very bullish, it pales in comparison to projections from other crypto analysts. PlanB, the creator of the popular Stock-to-Flow (S2F) model, has put forth an even more ambitious target. He suggests that Bitcoin could reach trade for as high as $1,000,000 by December 2025. Despite these ambitious targets, caution is warranted, particularly as Bitcoin appears to be approaching an overheated zone on the MVRV ratio indicator.

At the time of writing, Bitcoin is trading at $98,550.

Featured image created with Dall.E, chart from Tradingview.com

Bitcoin

Bitcoin Price To $100,000? Here’s What To Expect If BTC Makes History

Following the events of the past week, it is more of a matter of “when” rather than of “if” the Bitcoin price will hit a historic six-figure value. The crypto commentary channels and waves have been largely occupied with the premier cryptocurrency potentially reaching $100,000 over the last few weeks.

A six-figure value for BTC is not only an impressive milestone for the entire crypto industry but also one that comes with “unfavorable” events such as liquidations for short traders. Here is an on-chain insight into “what next” if the Bitcoin price climbs above $100,000.

What’s Next For BTC’s Price After $100,000?

In a recent report, blockchain analytics firm Glassnode shared an insight into the on-chain performance of the premier cryptocurrency since starting its latest rally. While the $100,000 price mark seems inevitable, the blockchain firm expects Bitcoin price to lose some of its momentum after crossing the target.

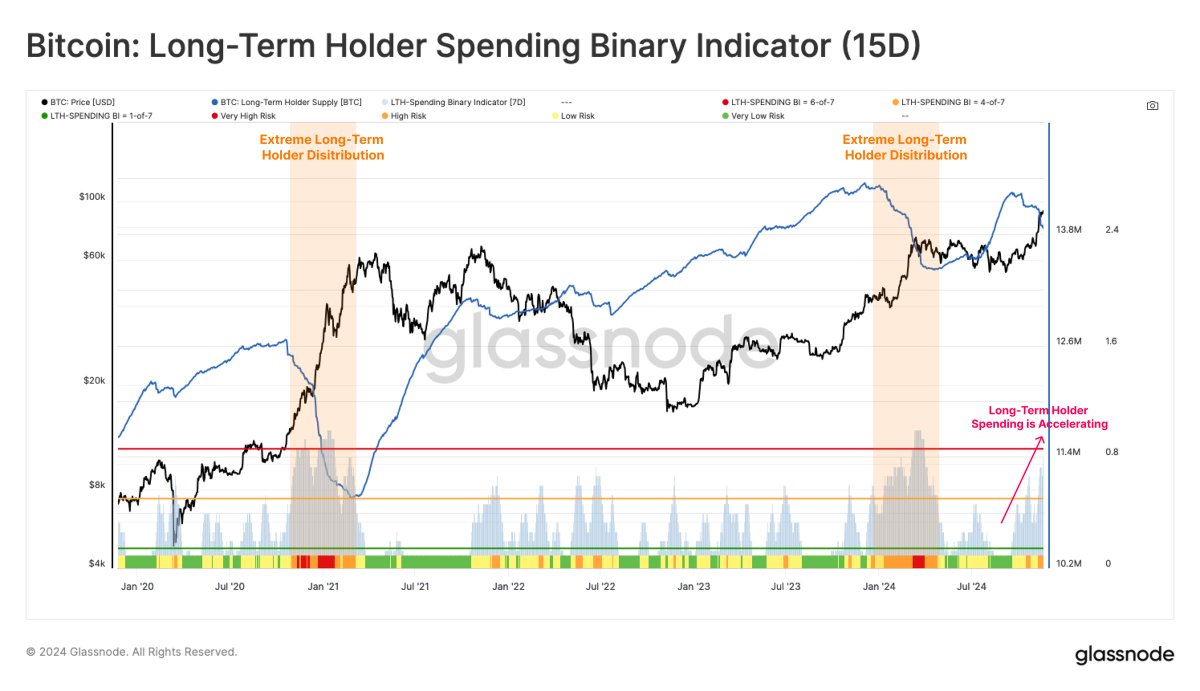

One of the rationales behind this projection lies in the recent behavior of an investor cohort known as the Long-term holders (LTH). According to Glassnode, the long-term holders are beginning to offload their assets for profits and may be waiting to sell more coins as the price action continues to grow strong.

Source: Glassnode/X

Based on data from the LTH Spending Binary Indicator, which tracks the intensity of the sell-side pressure of the long-term holders, these major investors have been increasingly distributing their assets. This Spending Binary metric shows that the LTH balance has declined on 11 of the last 15 days.

While the demand from institutional investors, specifically via the US spot exchange-traded funds (ETFs), has absorbed 90% of the sell-side pressure from long-term investors, Glassnode noted that the spending pressure of this investor cohort has begun to outpace ETF net inflows in recent days. This pattern was also noticed earlier in February 2024.

According to Glassnode, if the sell-side pressure continues to outpace the ETF demand, it could result in short-term price volatility or lead to price consolidation. The on-chain firm said:

However, since 13 November, LTH sell-side pressure has begun to outpace ETF net inflows, echoing a pattern observed in late February 2024, where the imbalance between supply and demand led to increased market volatility, and consolidation.

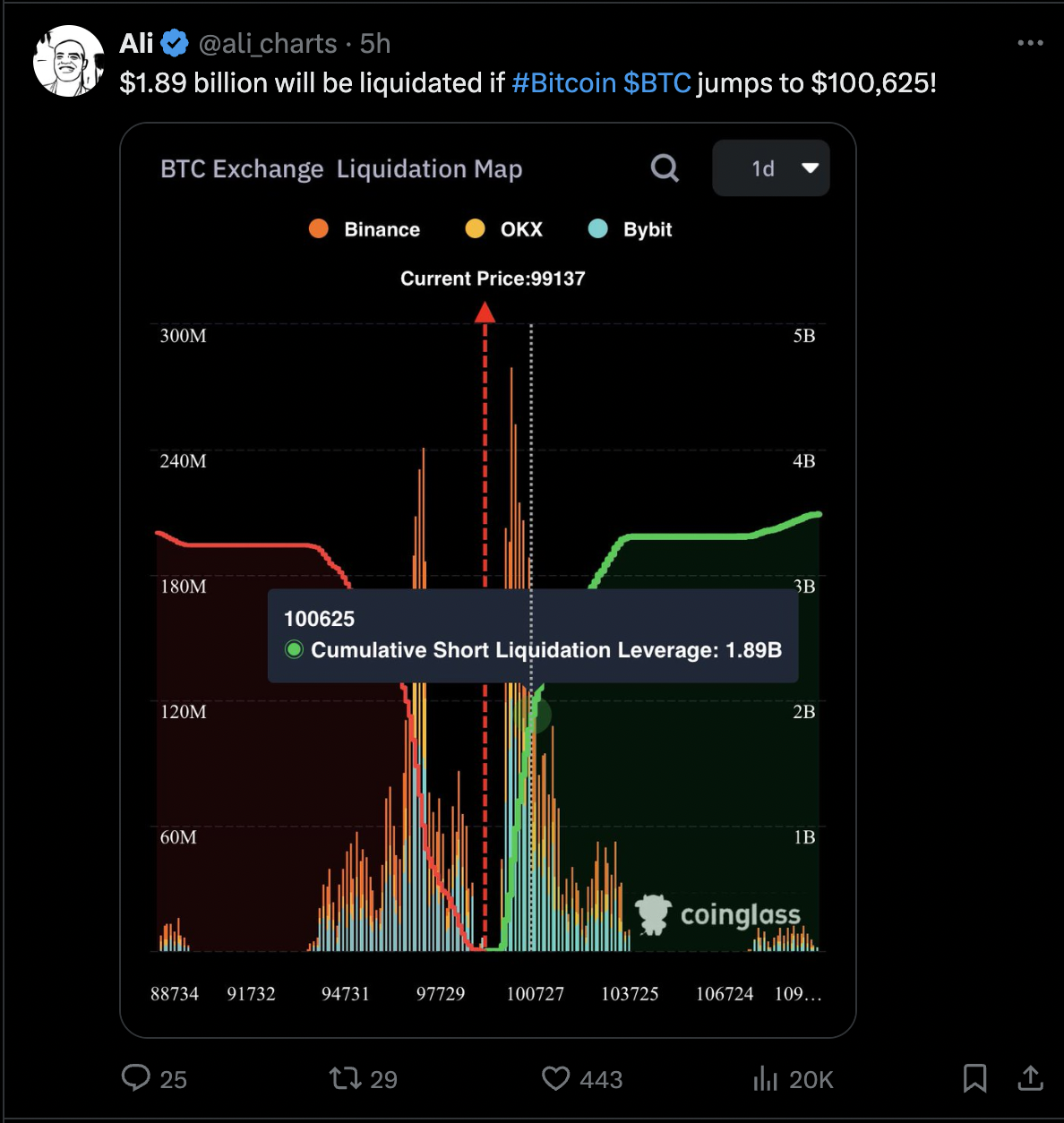

$1.89 Billion To Be Liquidated If Bitcoin Price Crosses This Level

In a November 22 post on X, prominent crypto analyst Ali Martinez sounded a warning to the Bitcoin bears. According to data from CoinGlass, a massive $1.89 billion looks set for liquidation if the Bitcoin price hits $100,625.

Source: Ali_charts/X

As of this writing, the premier cryptocurrency is valued at $99,424, reflecting a 1.4% price increase in the past day. Data from CoinGecko shows that the Bitcoin price has been on a much more impressive run on the weekly timeframe, surging by nearly 10% in the past seven days.

The price of Bitcoin on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Bitcoin

Bitcoin’s Put-to-Call Ratio Tops 1.0: Bearish Signs Ahead?

Crypto markets will witness $3.42 billion in Bitcoin and Ethereum options contracts expire today. The massive expiration could cause a short-term price impact, particularly as markets wait expectantly for Bitcoin to tag $100,000.

With Bitcoin options valued at $2.86 billion and Ethereum at $561.66 million, traders are bracing for potential volatility.

Unlike Ethereum, Traders Bet On Bitcoin Price Pullback

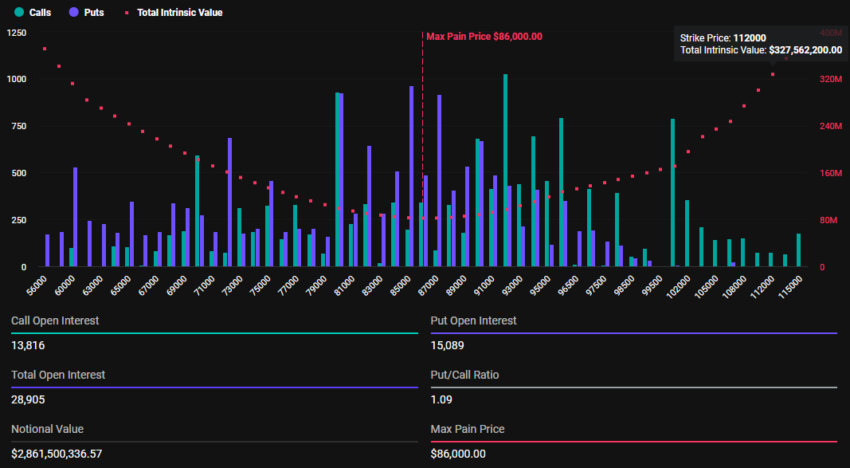

There has been a significant increase in Bitcoin (BTC) and Ethereum (ETH) contracts due for expiry today compared to last week. According to Deribit data, 28,905 Bitcoin options contracts will expire on Friday with a put-to-call ratio of 1.09 and a maximum pain point of $86,000.

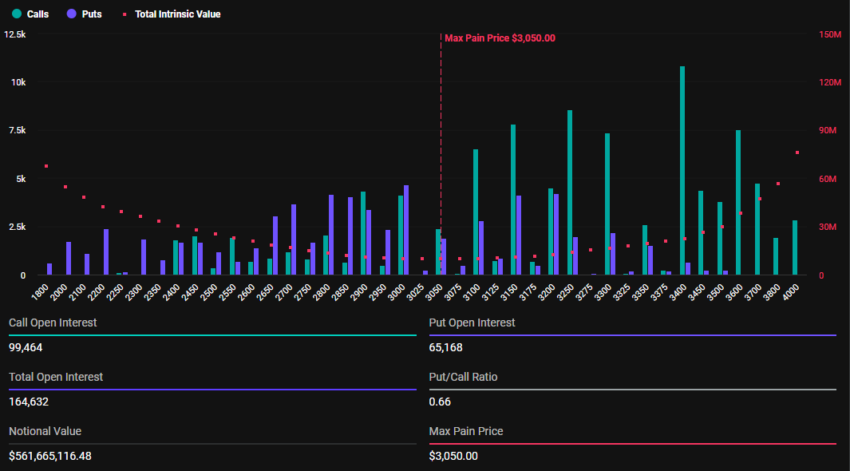

On the other hand, 164,687 Ethereum contracts are due for expiry today, with a put-to-call ratio of 0.66 and a maximum pain point of $3,050.

Bitcoin’s Put-to-call ratio stands above 1, indicating a generally bearish sentiment despite BTC’s whales and long-term holders fueling its recent growth. In comparison, Ethereum counterparts have a put-to-call ratio of 0.66, reflecting a generally bullish market outlook.

The put-to-call ratio gauges market sentiment. Put options represent bets on price declines, whereas call options point to bets on price increases.

When this ratio is above 1, it suggests a lack of optimism in the market, with more traders betting on price decreases. On the other hand, a put-to-call ratio below 1 suggests optimism in the market, and more traders are betting on price increases.

Bitcoin’s Put-to-Call Ratio, Implications for BTC

As options near expiration, traders are betting on BTC prices dropping and ETH prices rising. According to the Max Pain Theory in options trading, BTC and ETH could each pull toward their maximum pain points (strike prices) of $86,000 and $3,050, respectively. Here, the largest number of contracts — both calls and puts — would expire worthless.

Notably, price pressure for both assets will ease after Deribit settles contracts at 08:00 UTC today. At the time of writing, however, BTC was trading for $98,876, whereas ETH was exchanging hands for $3,389. Meanwhile, in line with put-to-call ratios, analysts at Greeks.live anticipate an extended move north for ETH and say BTC is at the cusp of a correction.

“With about 8% of positions expiring this week, the big rally in Ethereum has led to a significant increase in ETH major term options IV [implied volatility], while BTC major term options IV has remained relatively stable. The market sentiment remains extremely optimistic at this point,” Greeks.live analysts said.

The analysts also note that while Bitcoin risks a correction, the generalized market rally keeps this potential pullback at bay. They ascribe the positive sentiment in the market to significant capital inflows into ETFs (exchange-traded funds), specifically BlackRock’s IBIT options, which started to trade only recently alongside a strongly driven spot bull market.

Nevertheless, with today’s high-volume expiration, traders should anticipate fluctuations in Bitcoin and Ethereum prices that could shape their short-term trends.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market16 hours ago

Market16 hours agoTrump Taps Pro-Crypto Scott Bessent for Treasury Secretary Role

-

Altcoin16 hours ago

Altcoin16 hours agoTerra Luna Classic Community Discord On Proposal Amid LUNC Price Rally

-

Market15 hours ago

Market15 hours agoArtificial Intelligence Coins on the Rise: TFUEL, ZIG, and AKT

-

Altcoin15 hours ago

Altcoin15 hours agoAlameda Research Dumping Polygon (POL) Amid Price Spike, What’s Next?

-

Market23 hours ago

Market23 hours agoADA Sights More Growth After Breaking $0.8119

-

Altcoin23 hours ago

Altcoin23 hours agoBTC at $98K, HBAR Surges 25% and XLM rises 55%

-

Altcoin20 hours ago

Altcoin20 hours agoRipple CEO Shares Bullish News With XRP Army As Trump Names Treasury Secretary

-

Altcoin17 hours ago

Altcoin17 hours agoArthur Hayes Shills Another Solana Meme Coin, Price Rallies