Market

SEC Greenlights 8 Ethereum ETFs

In a landmark decision, the U.S. SEC has approved eight spot Ethereum ETFs, including those from BlackRock and Fidelity.

This approval follows the first spot in Bitcoin ETFs, marking another milestone in the cryptocurrency market.

SEC Approves 8 Ethereum ETFs

The SEC has given the green light to the 19b-4 forms for these ETFs. However, issuers still need approval for their S-1 registration statements, a process that might take weeks or months. Bloomberg ETF analyst James Seyffart noted that this process has historically taken over three months.

Read more: Ethereum ETF Explained: What It Is and How It Works

The SEC’s approval was unexpected due to the lack of prior interaction with the ETF issuers. The SEC’s sudden request for the 19b-4 forms has sparked speculation about the reasons for this shift. Some insiders suggest political pressure might have influenced this decision.

A bipartisan group of lawmakers urged the SEC to approve these ETFs, arguing that the Bitcoin ETF approval set a precedent for Ethereum. As news of the potential approval spread, the discount on Grayscale Ethereum Trust shares shrank from -24% to -6%.

Since the Bitcoin ETF approval, these funds have amassed an additional 207,000 bitcoins, worth approximately $14 billion. However, Bloomberg ETF analyst Eric Balchunas estimated that Ethereum ETFs might gather 10 to 15% of Bitcoin ETFs’ assets, translating to $5 to $8 billion.

“For any normal launch in the first couple of years, that’s pretty good,” Balchunas remarked.

In response to the news of the approval, ETH is now trading at $3,870.55, up +3.77%. Additionally, stakeholders have expressed their expectations for further industry growth following this announcement. Sergey Nazarov, co-founder of Chainlink, commented on the Ethereum ETF approval:

“The Ethereum ETF approval is a second large step forward for the crypto industry. It proves that the capital markets are now getting involved in the crypto industry in earnest for some of their largest user bases and most widely used products,” Nazarov said.

He also pointed out the significance of assets utilizing smart contracts being officially approved by the SEC.

“One of the most important aspects of this ETF approval is the spotlight it places on the potential of smart contracts and decentralized applications (dApps), which are critical use cases for Ethereum. In our daily work with global banks, asset managers, and financial market infrastructures, we continue to observe increasing interest in smart contracts, the adoption of blockchain technology, and a growing interest in cryptocurrencies as a legitimate asset class,” Nazarov added.

The approval of these Ethereum ETFs signifies a pivotal moment for the cryptocurrency sector, opening doors for increased investment and setting a precedent for future digital asset regulation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Altcoins GOAT, SUI, POPCAT Face Post-Peak Declines

Altcoins like GOAT, SUI, and POPCAT have faced notable shifts in momentum following their recent peaks. GOAT, which hit an all-time high of $1.37, has declined 25.42% over the past week, falling out of the top 10 meme coin rankings.

SUI, after reaching $3.94, has dropped 7.56%, slipping below a $10 billion market cap and trailing behind altcoins like Bitcoin Cash and Chainlink. Meanwhile, POPCAT has seen a sharp 21.00% decline from its $2.08 high, signaling potential further corrections as bearish technical patterns emerge.

GOAT

GOAT price has seen a significant decline, dropping 25.42% in the past week and falling below its $1 billion market cap. After reaching an all-time high of $1.37 on November 17, the altcoin’s momentum has cooled.

Once ranked among the top 10 meme coins by market cap, it is now 12th, losing places to MOG and MEW.

If bullish momentum returns, GOAT could test resistance at $1.23, potentially surpassing its previous high of $1.37. However, EMA lines indicate a prevailing downtrend.

Should this continue, the coin might test support at $0.69, and if that level fails to hold, prices could fall as low as $0.419.

SUI

SUI hit its all-time high of $3.94 on November 17 but has since entered a downward trend, falling 7.56% over the past week.

The altcoin recently dropped below a $10 billion market cap, slipping behind other rising altcoins like Bitcoin Cash (BCH) and Chainlink (LINK). The coin recently faced a two-hour outage, but its price didn’t fall as much as many expected, staying above $3.

EMA lines suggest SUI is in a downtrend, with short-term lines nearing a bearish cross below long-term ones. If this continues, SUI could test support at $3.09, with a potential drop to $2.2 if the lower level fails to hold.

However, renewed bullish momentum could see SUI challenge its all-time high of $3.94 and possibly test $4, pushing its market cap to $11.5 billion for the first time.

POPCAT

POPCAT reached an all-time high of $2.08 roughly one week ago but has since seen a sharp decline, falling 21.00% in the last seven days.

This drop has been accompanied by bearish signals, with its shortest-term EMA lines crossing below the longest ones, forming a death cross. This technical pattern suggests growing selling pressure and potential for further downside.

If the correction continues, POPCAT could test support at $1.17, with a possibility of falling as low as $0.9 if the lower support fails.

However, a reversal in momentum could see POPCAT rise to test $1.82, and if this resistance is broken, it may return to the $2 mark, potentially setting a new all-time high.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cardano (ADA) Price Faces Critical Levels After 193% Surge

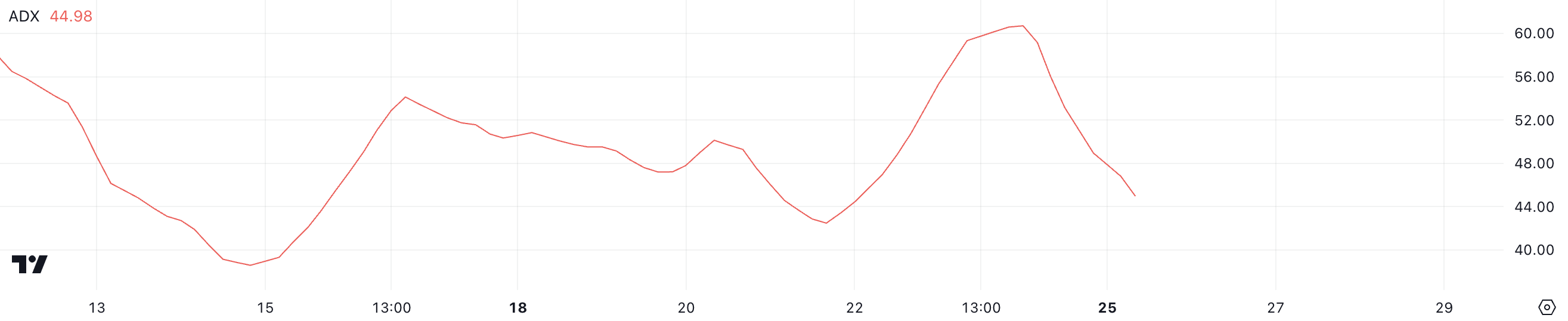

Cardano (ADA) price climbed 193.65% over the last 30 days and 37.82% in the past week. Despite this impressive rally, indicators suggest that ADA’s uptrend may be losing steam. The ADX, which measures trend strength, has dropped from over 60 to nearly 45, signaling weakening momentum even as the uptrend remains intact.

With whale accumulation stabilizing and prices approaching key EMA levels, ADA faces a critical moment that could lead to either a test of its highest price since 2021 or a potential 48% correction if bearish pressure grows.

ADA Uptrend Appears to Be Losing Steam

Cardano ADX currently sits at nearly 45, having declined from over 60 just a few days ago. The ADX, or Average Directional Index, measures the strength of a trend, with values above 25 indicating a significant trend and values above 40 suggesting a very strong one.

Although an ADX of 45 still reflects strong momentum, the drop from 60 signals a weakening in the trend’s intensity, even if the direction remains unchanged.

Currently, ADA is in an uptrend, supported by its directional indicators. The decline in ADX suggests that while the uptrend remains strong, the bullish momentum has begun to lose some of its strength. If the ADX continues to drop, it could indicate that the current uptrend may flatten or reverse if selling pressure grows.

However, with an ADX still well above 25, the trend remains meaningful, and Cardano price is likely to retain its bullish bias for the near term unless further weakening occurs.

Cardano Whales Stopped Accumulating

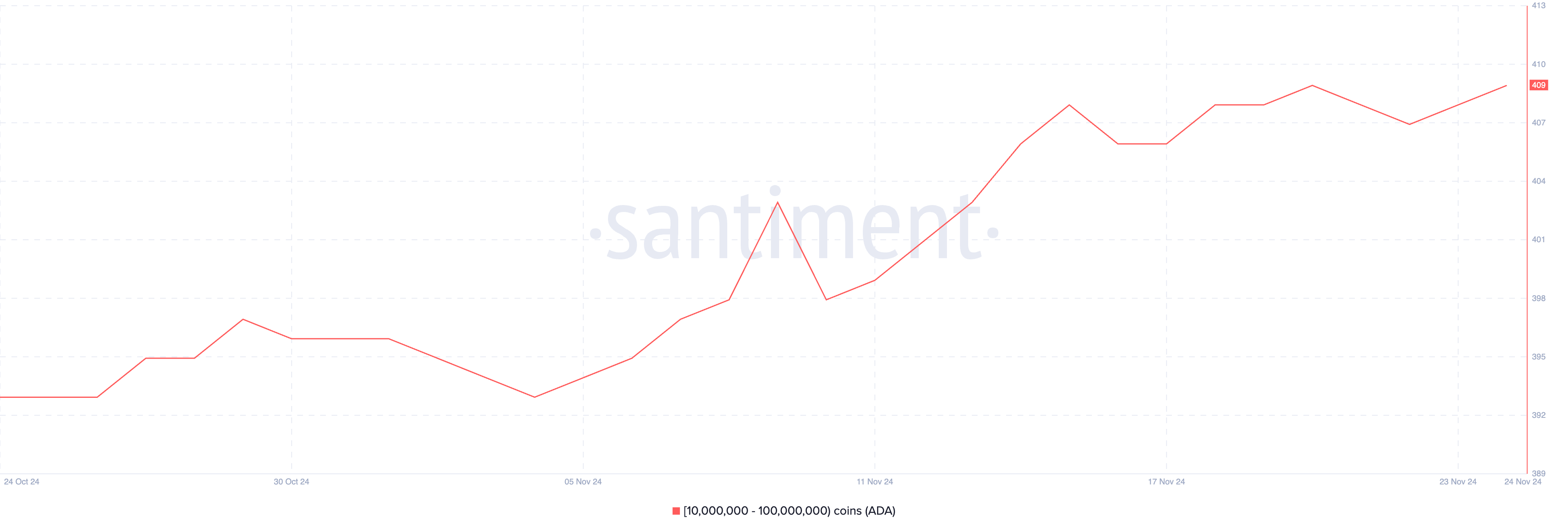

Whales began accumulating Cardano heavily starting November 10, with the number of wallets holding between 10,000,000 and 100,000,000 ADA increasing from 398 to 408 by November 15. Tracking whale activity is crucial because these large holders often have the power to influence market trends significantly.

Their buying behavior can indicate growing confidence in the asset and potentially fuel price surges, while their selling may trigger downward pressure.

Since November 15, the number of these whale wallets has stabilized, hovering between 407 and 409. This consistent accumulation suggests that whales are holding onto their positions, reflecting a neutral to bullish sentiment.

If whales maintain their holdings without significant additions or reductions, ADA price may experience less volatility, with the market awaiting new catalysts for the next directional move.

ADA Price Prediction: Highest Price Since 2021 Or a Strong Correction?

Cardano EMA lines continue to reflect a bullish setup, with short-term lines positioned above long-term ones. However, the current price is no longer significantly above the short-term EMA lines, indicating that the bullish momentum has weakened.

This proximity suggests that the uptrend is losing strength, and the ADA price is approaching a critical point where it could either rebound or dip below these lines, signaling a potential trend shift.

If the uptrend regains strength, ADA price could test levels above $1.155, potentially reaching $1.16, its highest price since March 2021. However, as indicated by the declining ADX, the current uptrend is losing intensity, increasing the likelihood of a reversal.

Should the trend turn bearish, ADA’s closest support lies at $0.519, which would represent a significant 48% correction from current levels.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

How Bitcoin Realized Profits May Impact BTC Price

Since November 21, Bitcoin (BTC) has hovered near the $100,000 mark but hasn’t hit it, with BeInCrypto attributing this to increased realized profits.

Recent data shows that profit-taking activity has slowed. What does this mean for Bitcoin’s price?

Bitcoin Holders Step Back from Booking Gains

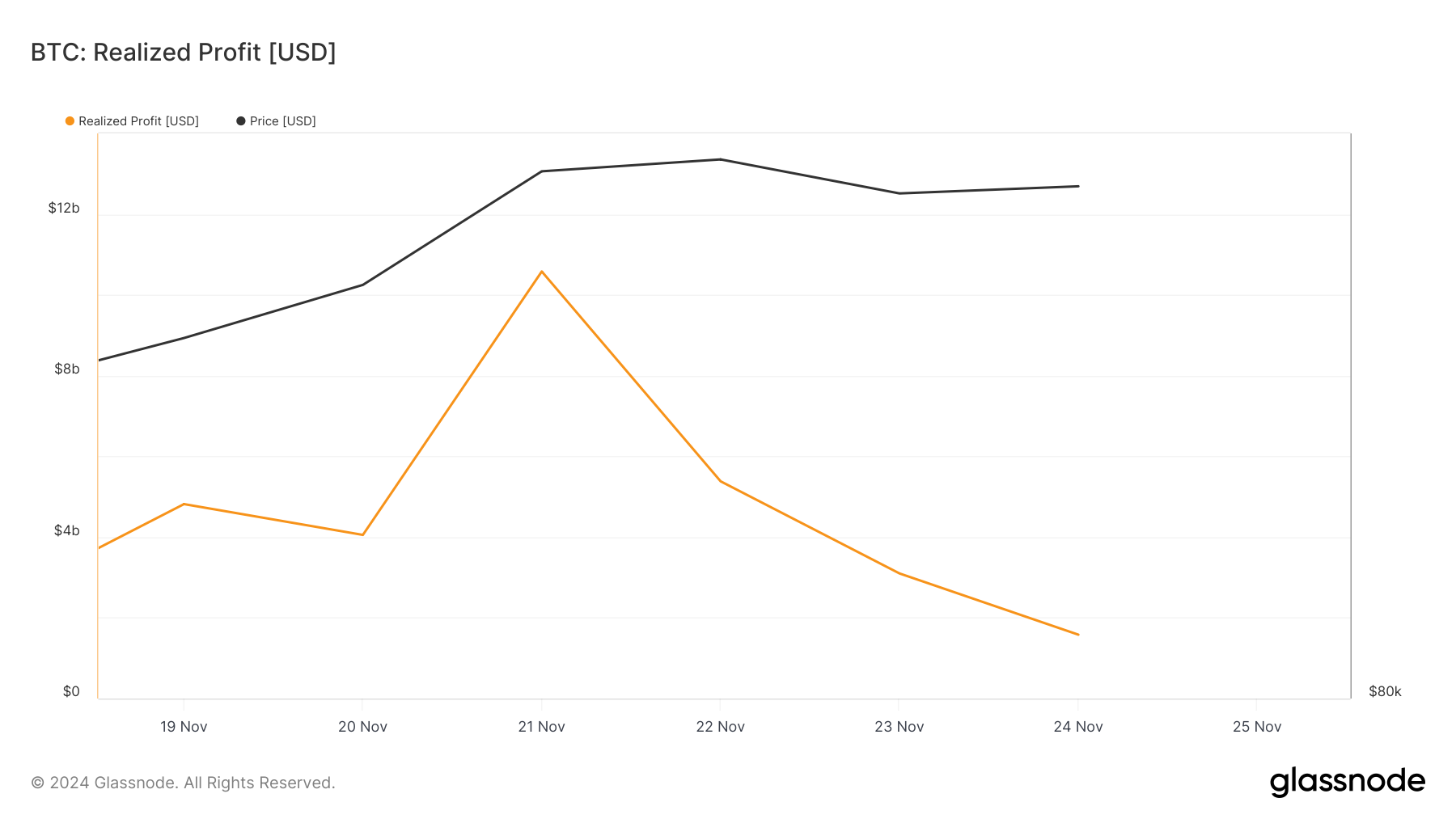

Data from Glassnode shows that Bitcoin realized profits surged to $10.58 million on Thursday, November 21. However, as of this writing, the value has dropped to $1.58 million, a $9 million difference.

As the name implies, realized profit is the value of coins sold after their price has increased. Therefore, when this metric rises, it becomes challenging for the cryptocurrency’s price to continue its rally.

However, since the realized profit has dropped, most BTC holders have halted selling in large volumes. If this trend continues, Bitcoin’s price could bounce and probably rise to the $100,000 milestone.

This sentiment is further supported by the Coins Holding Time metric, which tracks how long a cryptocurrency has been held without being transacted or sold.

When the Coins Holding Time decreases, it means holders of a particular crypto are selling. If this continues, the trend becomes bearish. However, over the last seven days, BTC Coins Holding Time has increased by 65%.

This increment reinforces the bias by the Bitcoin realized profit that selling pressure has decreased. Interestingly, IT Tech, an analyst on CryptoQuant, agrees with the thesis that Bitcoin might continue to climb.

“The green bars showing STH selling in profit have yet to reach levels seen during the previous $72,400 peak. This suggests that profit-taking pressure hasn’t peaked, leaving room for further upward movement in price,” IT Tech said.

BTC Price Prediction: $102, 500 Seems Close

On the daily chart, BTC continues to trade within an ascending channel, suggesting that it has the potential to climb higher.

BeInCrypto also observed that the Supetrend indicator has remained bullish. The Supertrend is a technical indicator used to spot the direction in which an asset moves.

If the red part of the indicator is above the price, the trend is downward, and the price can decrease. However, since the green area is below the price, the value might rise above $99,780. If that were the case, Bitcoin’s price might climb to $102,500.

On the other hand, if Bitcoin realized profits surge again, this might not happen. Instead, the value could decline to $84,466.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin7 hours ago

Altcoin7 hours agoWhy Is Ethereum Up Today? Will It Hit $10,000?

-

Market22 hours ago

Market22 hours agoBitcoin ETFs Could Overtake Gold ETFs by End of The Year

-

Market15 hours ago

Market15 hours agoEthereum Price Poised for Gains: $3,600 Within Reach?

-

Altcoin15 hours ago

Altcoin15 hours agoBTC and Major Altcoins Pullback, SAND Soars 60%

-

Altcoin13 hours ago

Altcoin13 hours agoSuper Pepe Coin Whale Sells 130B PEPE, Shifts Focus To EIGEN

-

Market12 hours ago

Market12 hours agoHarmful Livestreams Prompt Ban Calls

-

Market24 hours ago

Market24 hours agoWhy Ethereum Price May Fall Under $3,000

-

Bitcoin23 hours ago

Bitcoin23 hours agoBitcoin Bull Saylor Hints at Expanding MicroStrategy’s Holdings