Market

Ethereum Founder to Sell $37 Million in ETH Before ETF Decision

Recent significant Ethereum (ETH) transfers to cryptocurrency exchanges have caught the market’s attention. This move has raised speculation about potential profit-taking, portfolio rebalancing, or market speculation.

These developments coincide with the US Securities and Exchange Commission (SEC) nearing a decision on the Vaneck Ethereum exchange-traded fund (ETF), which has heightened expectations within the industry.

Investors Transfer ETH to Exchanges

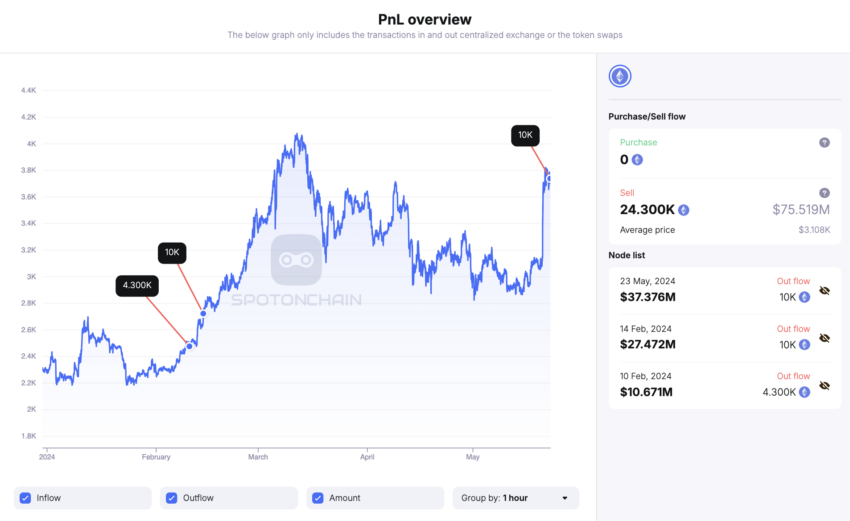

Jeffrey Wilke, one of the founders of Ethereum, has transferred 10,000 ETH, worth around $37.38 million, to the cryptocurrency exchange Kraken. While the motive behind such a significant transfer is unclear, a few hypotheses can be derived from it.

- Profit Taking: Wilke may be selling off his tokens to realize profits. This could be due to achieving his desired return on investment or anticipating a potential downturn in the market.

- Rebalancing Portfolios: Wilke might be rebalancing his portfolios by selling some tokens and buying others. This could be based on changes in market conditions, project developments, or his investment strategy.

- Market Speculation: Wilke might be speculating on short-term price movements or taking advantage of arbitrage opportunities between different cryptocurrency exchanges.

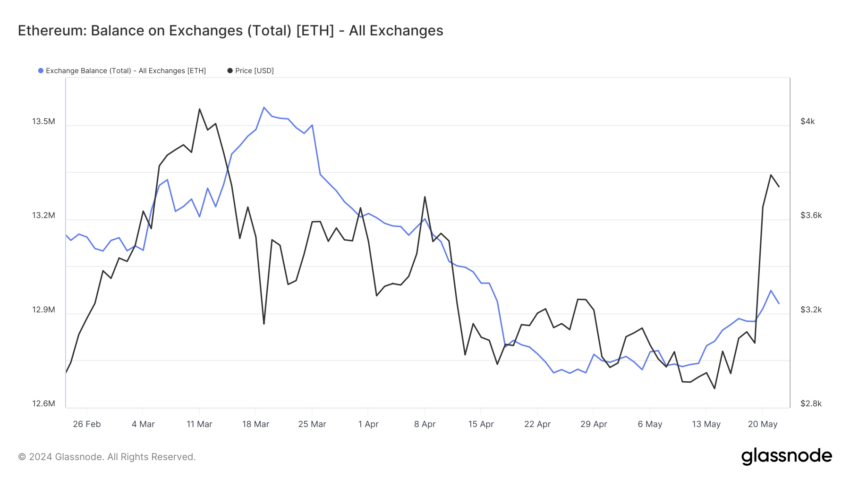

Whether Wilke aims to book profits, rebalance his portfolio, or speculate on the market, he appears not the only one. Looking at Ethereum’s balance on exchanges reveals a spike in the tokens available to sell.

- Balance on Exchanges: This refers to the total amount of Ethereum held in cryptocurrency exchange wallets.

Over the last two weeks, more than 242,000 ETH have moved to cryptocurrency exchange wallets. This indicates increased trading activity on exchanges that can contribute to price volatility.

Ethereum ETF Approval Looms

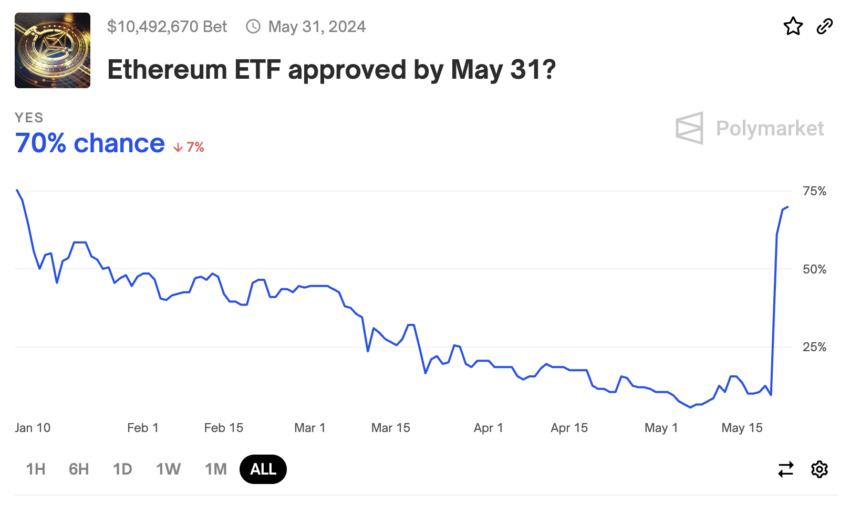

The timing of these transfers is notable, as it aligns with today’s SEC final ruling regarding the Vaneck Ethereum ETF. Interestingly, on May 20, the SEC requested Nasdaq, CBOE, and NYSE to refine their applications for listing spot Ethereum ETFs, hinting at a potential approval of these filings.

In response to this regulatory development, Eric Balchunas and James Seyffart, ETF analysts at Bloomberg Intelligence, remarked that the likelihood of approval has substantially increased, shifting from only 25% to a considerable 75%.

“Hearing chatter this afternoon that the SEC could be doing a 180 on this increasingly political issue, so now everyone is scrambling. But again, we cap it at 75% until we see more, e.g., filing updates,” Balchunas wrote.

Read more: Ethereum ETF Explained: What It Is and How It Works

Similarly, Polymarket, a decentralized prediction market platform that allows users to place bets on world events, shows a significant increase in approval odds, which have risen from 10% to 70% over the past 72 hours.

Warning Signal for Traders

Although industry leaders like Anthony Pompliano see the Ethereum ETF approval as an “approval of the entire industry” and as “the last dam to be broken,” traders must be cautious. The increasing ETH deposits to cryptocurrency exchange wallets hint at the possibility of a sell-off or a spike in profit-taking.

Meanwhile, the Tom DeMark (TD) Sequential indicator presents a sell signal on Ethereum’s daily chart.

- TD Sequential Indicator: This is a technical analysis tool used to identify potential market trend exhaustion points and upcoming price reversals.

- Setup Phase: This involves counting a series of nine consecutive price bars, where each bar closes higher (for an uptrend) or lower (for a downtrend) than the bar four periods earlier.

- Countdown Phase: Following the setup phase, a countdown begins where a series of thirteen additional price bars are counted if they close lower (in a downtrend) or higher (in an uptrend) than the close two bars earlier.

The current green nine candlestick on the daily chart suggests that a spike in selling pressure could see Ethereum retrace for one to four daily candlesticks or even start a new downward countdown phase before the uptrend resumes.

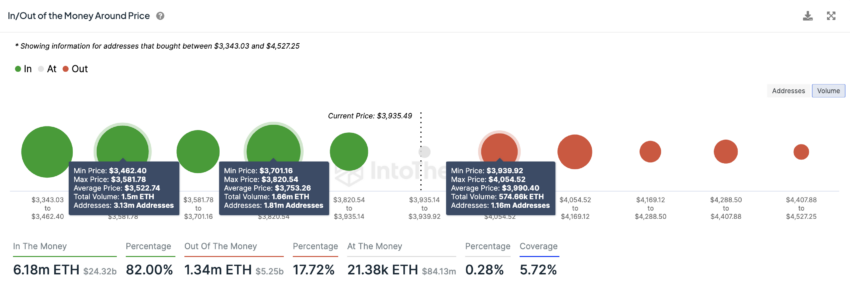

Despite the bearish signals seen from an on-chain and technical perspective, the In/Out of the Money Around Price (IOMAP) indicator suggests that Ethereum is above significant areas of support that could hold in the event of a correction.

- IOMAP: This metric helps analyze and visualize the distribution of holders’ positions relative to the current price. It helps understand the potential support and resistance levels based on the number of addresses holding a particular cryptocurrency at different price levels.

- In the Money: Refers to addresses that acquired the cryptocurrency at a price lower than the current market price, indicating potential support levels as holders are likely to sell at a profit.

- Out of the Money: Refers to addresses that acquired the cryptocurrency at a price higher than the current market price, indicating potential resistance levels as holders might want to break even or minimize losses.

Based on the IOMAP, over 1.81 million addresses bought around 1.66 million ETH between $3,820 and $3,700. This demand zone could keep Ethereum’s price at bay amid increasing selling pressure. But if it fails to hold, the next key area of support is between $3,580 and $3,462, where 3.13 million addresses purchased over 1.50 million ETH.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

On the other hand, the most important resistance barrier for Ethereum is between $3,940 and $4,054. Here, over 1.16 million addresses had previously purchased around 574,660 ETH.

If Ethereum overcomes this hurdle and prints a daily candlestick close above $4,170, the bearish outlook will be invalidated. This could result in a new upward countdown phase toward $5,000.

Summary and Conclusions

Ethereum co-founder Jeffrey Wilke’s recent transfer of 10,000 ETH to Kraken is indicative of broader market activities, where investors are moving significant amounts of ETH to exchanges. This trend aligns with increased trading activity, suggesting potential profit-taking, portfolio rebalancing, or market speculation among Ethereum holders. The balance of ETH on exchanges has spiked, indicating a potential rise in market volatility.

This market movement comes at a critical time, as the SEC is about to make a final ruling on Vaneck’s Ethereum ETF. Analysts have noted a substantial increase in the likelihood of approval, which has surged from 25% to 75%. Such regulatory developments are seen as a positive signal for the broader cryptocurrency market, potentially paving the way for further institutional investment.

Read more: How to Buy Ethereum (ETH) and Everything You Need to Know

Despite technical indicators suggesting a possible short-term bearish trend, the IOMAP indicator shows strong support levels for Ethereum. This suggests that while there may be short-term corrections, the underlying demand for Ethereum remains robust. Long-term holders appear confident, continuing to accumulate ETH, which bodes well for its future price stability and growth.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Approaches $100K: The Countdown Is On

Bitcoin price is rising steadily above the $95,000 zone. BTC is showing positive signs and might soon hit the $100,000 milestone level.

- Bitcoin started a fresh increase above the $95,000 zone.

- The price is trading above $95,000 and the 100 hourly Simple moving average.

- There is a key bullish trend line forming with support at $95,200 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could continue to rise if it clears the $100,000 resistance zone.

Bitcoin Price Sets Another ATH

Bitcoin price remained supported above the $92,000 level. BTC formed a base and started a fresh increase above the $95,000 level. It cleared the $96,500 level and traded to a new high at $98,999 before there was a pullback.

There was a move below the $98,000 level. However, the price remained stable above the 23.6% Fib retracement level of the upward move from the $91,500 swing low to the $98,990 high. There is also a key bullish trend line forming with support at $95,200 on the hourly chart of the BTC/USD pair.

The trend line is close to the 50% Fib retracement level of the upward move from the $91,500 swing low to the $98,990 high. Bitcoin price is now trading above $96,000 and the 100 hourly Simple moving average.

On the upside, the price could face resistance near the $98,880 level. The first key resistance is near the $99,000 level. A clear move above the $99,000 resistance might send the price higher. The next key resistance could be $100,000.

A close above the $100,000 resistance might initiate more gains. In the stated case, the price could rise and test the $102,000 resistance level. Any more gains might send the price toward the $104,500 resistance level.

Downside Correction In BTC?

If Bitcoin fails to rise above the $100,000 resistance zone, it could start a downside correction. Immediate support on the downside is near the $98,000 level.

The first major support is near the $96,800 level. The next support is now near the $95,500 zone and the trend line. Any more losses might send the price toward the $92,000 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $96,800, followed by $95,500.

Major Resistance Levels – $99,000, and $100,000.

Market

This Is Why XRP Price Rallied By 25% and Could Soon Hit $2

Ripple’s (XRP) price rallied by 25% in the last 24 hours following Gary Gensler’s announcement that he would resign as the US Securities and Exchange Commission (SEC) chair on January 20, 2025.

This development comes as a relief to the popular “XRP Army,” which has had to deal with suppressed price action due to the Gensler-led SEC’s nonstop petitions against Ripple. But that is not all that happened.

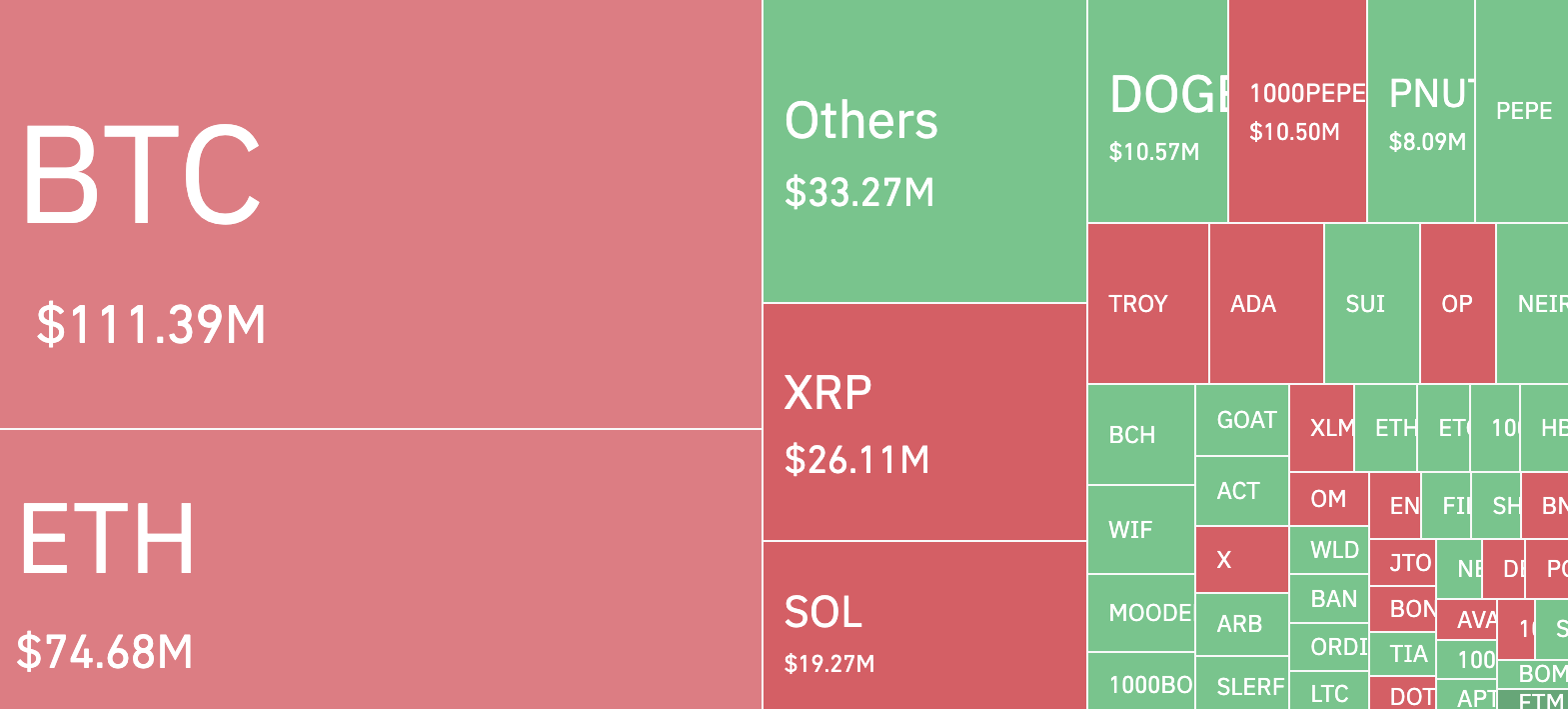

Ripple Bears Face Notable Liquidation Following Gensler’s Notification

Gensler’s announcement appears to be a positive development for the broader crypto market. But XRP holders seemed to benefit the most. This was particularly significant given the unresolved Ripple-SEC legal issues that have persisted throughout the SEC Chair’s tenure.

As a result, it came as no surprise that XRP price rallied and outpaced those of any other cryptocurrency in the top 10. Furthermore, the development triggered liquidations totaling $26.11 million over the last 24 hours.

Liquidation occurs when a trader fails to meet the margin requirements for a leveraged position. This forces the exchange to sell off their assets to prevent further losses. In XRP’s case, the liquidation primarily resulted in a short squeeze.

A short squeeze happens when a large number of short positions (traders betting on price declines) are forced to close, driving the price higher as they rush back to buy back the asset.

At press time, XRP trades at $1.40 and currently has a market cap of $80.64 billion. With Gensler almost gone, crypto lawyer John Deaton noted that XRP price gains could be higher, and the market cap could climb to $100 billion.

“XRP soon will achieve a $100B market cap. Times are changing,” Deaton wrote on X.

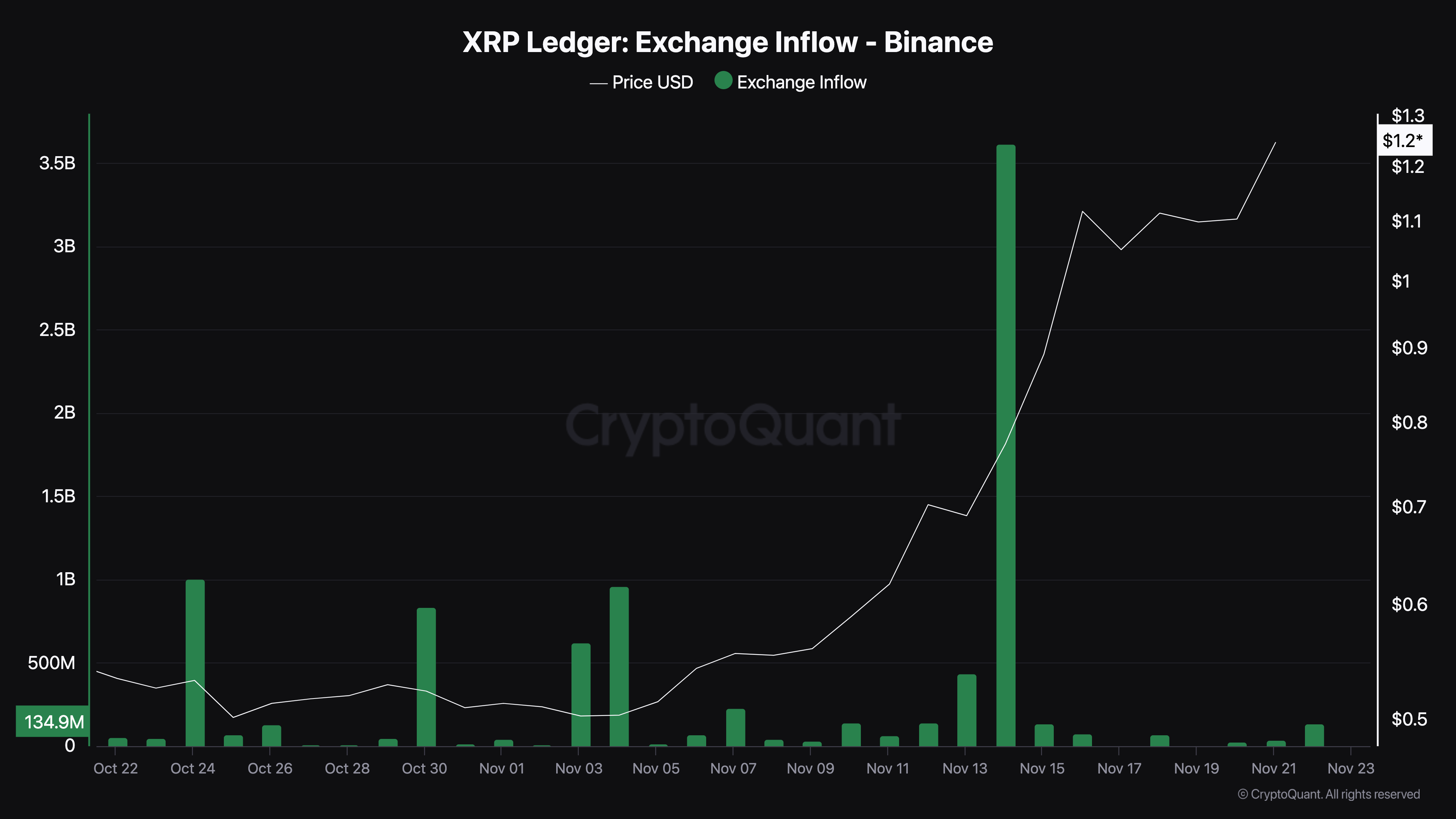

Meanwhile, CryptoQuant data shows that the total number of XRP sent into exchange has significantly decreased. Typically, high values indicate increased selling pressure in the spot market. This is because it suggests that more assets are being offloaded, potentially driving prices lower.

However, since it is low, XRP holders are refraining from selling. If this remains the case, the token’s value could rise higher than $1.40.

XRP Price Prediction: $2 Coming?

According to the 4-hour chart, XRP has been trading within a range of $1.04 to $1.17 since November 18. This sideways movement has resulted in the formation of a bull flag — a bullish chart pattern that signals potential upward momentum.

The bull flag begins with a sharp price surge, forming the flagpole, driven by significant buying pressure that outpaces sellers. This is followed by a consolidation phase, where the price retraces slightly and moves within parallel trendlines, creating the flag structure.

Yesterday, XRP broke out of this pattern, signaling that bulls have seized control of the market. If this momentum persists, XRP’s price could surpass $1.50, potentially approaching the $2 threshold.

However, this bullish scenario hinges on market behavior. If holders decide to secure profits, selling pressure could push XRP’s price below $1, erasing recent gains.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Dogecoin (DOGE) Shows Renewed Energy: Rally Incoming?

Dogecoin is consolidating gains above the $0.380 resistance against the US Dollar. DOGE is holding gains and eyeing more upsides above $0.400.

- DOGE price started a fresh increase above the $0.3750 resistance level.

- The price is trading above the $0.3800 level and the 100-hourly simple moving average.

- There was a break above a short-term contracting triangle with resistance at $0.390 on the hourly chart of the DOGE/USD pair (data source from Kraken).

- The price could continue to rally if it clears the $0.400 and $0.4080 resistance levels.

Dogecoin Price Eyes More Upsides

Dogecoin price remained supported above the $0.350 level and recently started a fresh increase like Bitcoin and Ethereum. DOGE was able to clear the $0.3650 and $0.3750 resistance levels.

The price climbed above the 50% Fib retracement level of the downward move from the $0.4208 swing high to the $0.3652 low. Besides, there was a break above a short-term contracting triangle with resistance at $0.390 on the hourly chart of the DOGE/USD pair.

Dogecoin price is now trading above the $0.3750 level and the 100-hourly simple moving average. Immediate resistance on the upside is near the $0.3950 level or the 61.8% Fib retracement level of the downward move from the $0.4208 swing high to the $0.3652 low.

The first major resistance for the bulls could be near the $0.400 level. The next major resistance is near the $0.4080 level. A close above the $0.4080 resistance might send the price toward the $0.4200 resistance. Any more gains might send the price toward the $0.4500 level. The next major stop for the bulls might be $0.500.

Are Dips Supported In DOGE?

If DOGE’s price fails to climb above the $0.400 level, it could start a downside correction. Initial support on the downside is near the $0.3850 level. The next major support is near the $0.3750 level.

The main support sits at $0.3550. If there is a downside break below the $0.3550 support, the price could decline further. In the stated case, the price might decline toward the $0.3200 level or even $0.300 in the near term.

Technical Indicators

Hourly MACD – The MACD for DOGE/USD is now gaining momentum in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for DOGE/USD is now above the 50 level.

Major Support Levels – $0.3850 and $0.3750.

Major Resistance Levels – $0.4000 and $0.4200.

-

Market24 hours ago

Market24 hours agoSouth Korea Unveils North Korea’s Role in Upbit Hack

-

Bitcoin19 hours ago

Bitcoin19 hours agoMarathon Digital Raises $1B to Expand Bitcoin Holdings

-

Regulation13 hours ago

Regulation13 hours agoUK to unveil crypto and stablecoin regulatory framework early next year

-

Market19 hours ago

Market19 hours agoETH/BTC Ratio Plummets to 42-Month Low Amid Bitcoin Surge

-

Altcoin22 hours ago

Altcoin22 hours agoSui Network Back Online After 2-Hour Outage, Price Slips

-

Altcoin21 hours ago

Altcoin21 hours agoDogecoin Whale Accumulation Sparks Optimism, DOGE To Rally 9000% Ahead?

-

Altcoin24 hours ago

Altcoin24 hours agoVitalik Buterin, Coinbase’s Jesse Pollack Buy Super Anon (ANON) Tokens On Base

-

Altcoin19 hours ago

Altcoin19 hours ago5 Key Indicators To Watch For Ethereum Price Rally To $10K